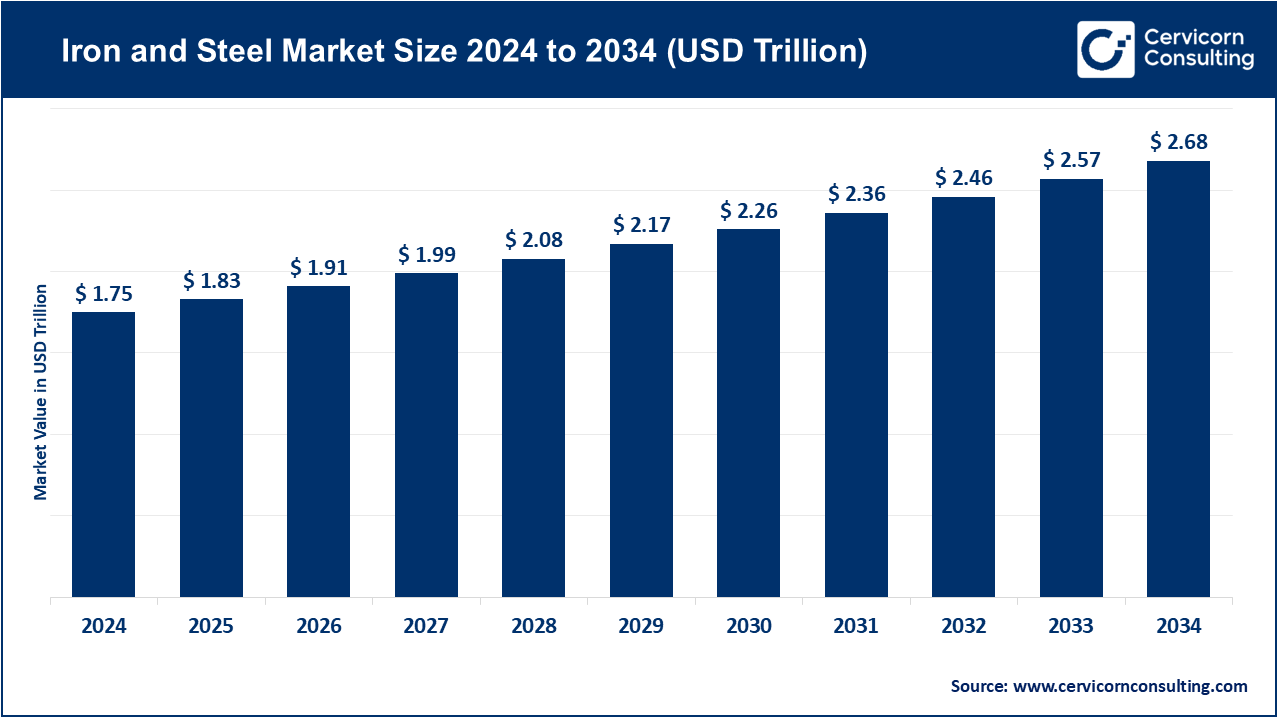

The global iron and steel market size was estimated at USD 1.75 trillion in 2024 and is expected to surpass around USD 2.68 trillion by 2034, growing at a compound annual growth rate (CAGR) of 4.8% over the forecast period from 2025 to 2034. The iron and steel market is experiencing intense growth due to the fast industrialization, urbanization, and the increasing demand by the automotive, energy, and chemical industries. Automation, AI-powered production systems, and digital twin are all increasingly used to make the industry more efficient in its operations, optimize quality, and minimize carbon emissions. To achieve sustainability and energy transition, governments in the world are encouraging biofuel projects, funding new technologies in producing ethanol, and implementing practices in the circular economy.

Meanwhile, intelligent production and ionic monitoring systems are assisting manufacturers to streamline energy consumption, maintain uniform quality, and reduce wastage. The firms are heavily investing in the production of low-carbon ethanol, second-generation biofuels, and use of renewable feedstock to fulfill the changing environmental regulations. New value chains of clean energy and carbon neutrality based on collaborations between energy producers, automakers, and biofuel companies are also being established. Consequently, the iron and steel market is becoming a long-term growth and digitally-enhanced, sustainable and innovation-driven ecosystem by gradually replacing the traditional biofuel segment.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.83 Trillion |

| Estimated Market Size in 2034 | USD 2.68 Trillion |

| Projected CAGR 2025 to 2034 | 4.80% |

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Production Method, Form, Application, Region |

| Key Companies | China Baowu Steel Group, ArcelorMittal, Ansteel Group, Nippon Steel Corporation, HBIS Group, Shagang Group, Jianlong Group, POSCO Holdings, Shougang Group, Tata Steel Group, Delong Steel, JSW Steel Limited, Hunan Steel Group, JFE Steel Corporation, Jingye Group |

The iron and steel market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

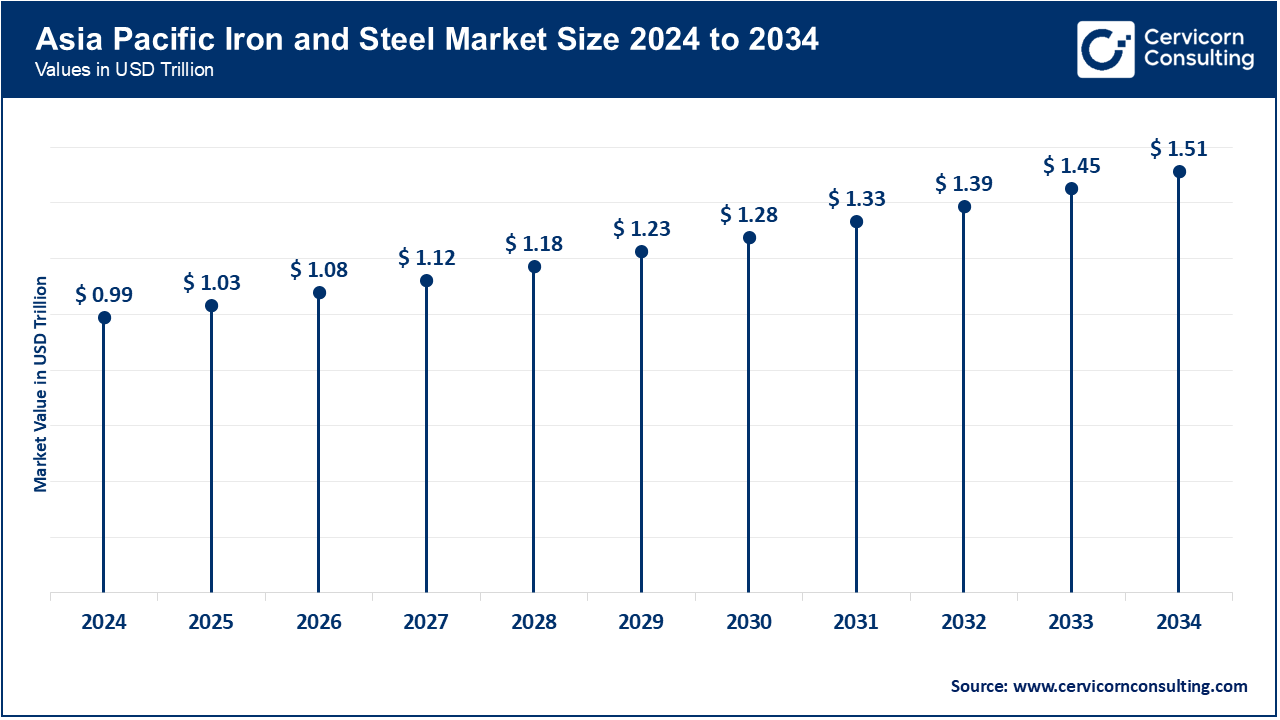

The Asia-Pacific is at high rate of growth due to rapid urbanization, industrialization, and development of infrastructures. The biggest producers and consumers are china, India, Japan and South Korea which make more than 60% of the global steel demand in the year 2025. Large-scale construction and energy projects are the priorities of China, whereas high-value automotive and industrial steel are in the forefront in South Korea and Japan. The infrastructure boom in India such as smart cities, railways and wind energy projects is creating huge demands. The growth in industrialization and growth in manufacturing of steel is also rapidly growing in the southeast Asian countries of Indonesia, Vietnam, and Thailand. The area has an advantage of raw materials, labor force, and rapidly growing investment in green steel technologies, which serve as a foundation of its strong status as a decisive point of growth.

The North America driving the market because of its highly developed industrial infrastructure, embracing technologies, and well-organized manufacturing ecosystems. The U.S. and Canada have great steel manufacturers, combined supply chains, and state of the art fabrication plants, which provide stable production and distribution. It has high venture capital funding on sustainable steel technology, such as hydrogen-based production and carbon capture projects. North American steelmakers also are the first to embrace AI-based process optimization, smart furnaces, and automated quality control systems, which enhances efficiency and lower emissions. The market is also enhanced by government policies and incentives on low-carbon technologies. The presence of strategic alliance among manufacturers, construction firms, and automotive OEMs strengthens the leadership of the region in the supply of enterprise grade steel.

One of the major markets is Europe due to strict environmental laws, sustainability, and technological advancement. The leaders of the green steel adoption in the region are Germany, Italy, France, and the U.K., which invest in hydrogen-based production and electric arc furnace (EAF) development. The European market is focusing on the carbon minimization, energy conservation, and lifecycle of the steel products. High-strength and lightweight, and corrosion-resistant steels are being developed in advanced R&D centers to be used in automotive and aerospace as well as infrastructure. European steelmakers work with the renewable energy suppliers to lower carbon footprints and establish digital tracking systems. The emphasis on the green and developing technologies makes Europe a leader in sustainable steel production.

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 14.50% |

| Europe | 24.80% |

| Asia-Pacific | 56.50% |

| LAMEA | 4.20% |

The increasing activities of infrastructure, urbanization and increase in industrial activities have made LAMEA market. The dominant Latin American producers are Brazil, Mexico and Argentina, whose construction, automotive and energy industries are putting more demands. Middle East, especially the UAE and Saudi Arabia are making huge investments in infrastructure projects and sustainable steel production, such as EAF and green hydrogen projects. The localized steel production and community-based industrial project are increasing in Africa, especially in South Africa, Nigeria, and Kenya, to fulfill the local demand. International relationships, modernization, and the adoption of effective production methods are making LAMEA become a prospective growth region in the world of iron and steel despite its struggles with such challenges as lack of infrastructure and regulatory loopholes.

Carbon Steel: Carbon steel is the most common material because it is economical, strong and is applicable in numerous construction and automobile companies. By 2025 the world produced 1.2 billion tons of carbon steel in its production which supplied more than 60% of all steel. New products such as high-strength low-alloy carbon steel are on the rise to address the automotive lightweighting and infrastructure durability requirements. The content is progressively incorporating intelligent production systems and AI-controlled quality management systems to improve consistency and minimize wastage. The major players are concentrating on reduction of carbon emission technologies at affordable rates. There is a fast growing use of carbon steel in both industrial and residential projects on emerging economies especially in the Asia-Pacific region.

Alloy Steel: Alloy steels that are reinforced with such elements as chromium, nickel and vanadium, are needed in specialized applications that are necessitated by corrosion resistance and durability. Alloy steel was required to increase by 8% YoY in 2025 in the industrial machinery and defense markets due to infrastructure development and modernization. Manufactures are concerned with the production methods of low-carbon alloys to catch up with the sustainability goals. Germany, Japan and the U.S. are major players in high performance alloy steel R & D of automotive and aerospace. Alloy steel offers a solution to high value industrial segments, by virtue of its combination of cost-efficiency and performance.

Stainless Steel: Stainless steel is preferred due to its resistance to corrosion and beauty, and is important to the construction field, consumer goods, and the food processing industry. By the middle of 2025, the production of stainless steel had reached a value of 38 billion and this was backed by the increase in demand in Asia-Pacific and North America. Surface finishing and scrap stainless steel recycling is enhancing sustainability. It has major uses in architectural panels, medical equipment and kitchen appliances. The introduction of digital monitoring within the production plants promotes uniformity of quality. The further development is likely to be caused by the increasing urbanization and the increasing levels of consumer standards.

Tool Steel: Tool steels are made hard and wear resistant, used in precision in machines and dies. The demand of tool steel globally in 2025 is estimated at 12 billion and major consumption centers in Europe and Japan. There are also developments of advanced tool steel grades to be used in high-speed machining and additive manufacturing. The manufacturers are embracing efficiency in energy use through the use of electric arc furnaces that are environmentally friendly and automation to ensure quality and save on cost. The tool steels are also applied more in the renewable energy applications such as in wind turbines. The constant innovation makes tool steel a key to the efficiency of industrial manufacturing.

Blast Furnace -Basic Oxygen Furnace (BF-BOF) Route: This is the conventional route that still controls the larger portion of steel production in the world with more than 70 percent. Although it has high energy usage, BF -BOF is recommended in uniform steel grades with high volume. In 2025, global steel production by BF-BOFs would amount to about 450 billion. Businesses are incorporating technology of carbon capture and hydrogen injection in order to lower emissions. It is a popular route still in China and Europe where it has the greatest demand due to the large-scale infrastructure and automotive needs. AI-based monitoring systems are leading to efficiency improvements

Electric Arc Furnace (EAF) Route: EAF steelmaking is becoming prominent as it is both flexible and less carbon-intensive. As of 2025, about 35 percent of the world steel production is brought by EAF, which has an estimated value of $220 billion. The technique involves scrap steel and electricity, which is ideal in the initiative of circular economy. Plants of EAF are being spread in North America and Europe where the supply of green energy is large. Two such innovations are furnaces that are powered by renewable energy sources and intelligent energy management tools to save money. EAF also facilitates production of special steels such as stainless and alloy steels.

Market Share, By Production Method, 2024 (%)

| Production Method | Revenue Share, 2024 (%) |

| Blast Furnace–Basic Oxygen Furnace (BF–BOF) Route | 55.40% |

| Electric Arc Furnace (EAF) Route | 28.10% |

| Direct Reduced Iron (DRI) Route | 10.50% |

| Hydrogen-Based Steelmaking | 6% |

Direct Reduced Iron (DRI) Route: DRI production, which uses natural gas or hydrogen to reduce iron ore, is becoming a low-emission substitute to BF-BOF. By 2025, the DRI capacity had hit 35 billion, primarily in India and Middle East. Business enterprises are seeking the use of hydrogen-based DRI as a way of realizing close-to-zero emissions. DRI is very compatible with EAF production in order to have flexible and sustainable steelmaking. It is also a way of minimizing the use of coking coal and enhances energy efficiency. Carbon credits and subsidies are some of the measures that governments encourage the use of DRIs.

Hydrogen-Based Steelmaking: Hydrogen-based steelmaking leads the way in decarbonization of the steel industry. Europe and Japan have pilot plants that are projected to produce up to $15 20 billion by the year 2030. The process substitutes carbon with green hydrogen, which will reduce the number of CO2 emissions greatly. By 2025, some projects in Germany and Sweden are operating with plans of more projects in India and the Middle East. The production with hydrogen corresponds to the international net-zero efforts and ESG needs. It is the most long-term sustainable mode of production which is capital intensive.

Semi-Finished (Billets, Blooms, Slabs): The semi-finished steel is the foundation of the steel production worldwide as it is consumed as raw material to finished products. The semi-finished steel production will reach an estimate of 320 billion in 2025 with China, India, and Japan as the leading. Advancements in technology such as constant casting and automatic quality checks have made the process of production more efficient and less wasteful. Long products such as rods, beams and rails are mostly made of semi-finished steel. The industry is diverted to energy saving furnaces and scrap incorporation in an attempt to reduce carbon footprints. The product enables the company to have a long time demand in construction, automotive and machinery industries due to their versatility.

Market Share, By Form, 2024 (%)

| Form | Revenue Share, 2024 (%) |

| Semi-Finished | 38.20% |

| Finished | 61.80% |

Finished (Sheets, Bars, Rods, Plates, Pipes): Most of the market revenue is on finished steel products of which sheets, bars, rods, plates, and pipes will constitute the bulk considered at an estimate of 450 billion in 2025. Automobile, appliance, and infrastructure markets are predominantly covered by sheet steel, whereas energy, oil, and gas markets need plates and pipes. New advanced methods of processing, such as galvanization, coating, and precision rolling, are being incorporated along with the AI-guided quality control. The emergence of smart infrastructure development and renewable energy plants is stimulating the increase in the demand of finished steel. Localised production centers are being embraced by companies to reduce logistic expenses. Final products also have the advantage of recycling with environmental friendliness and optimization of energy.

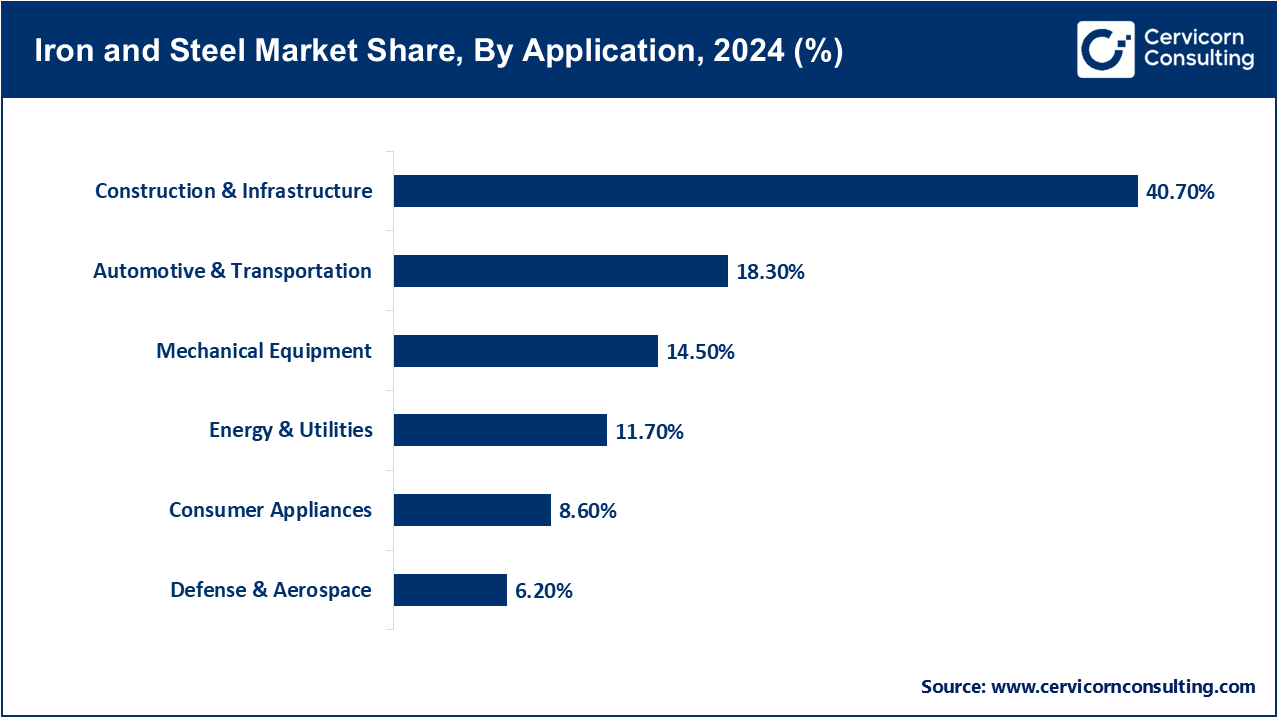

Construction and Infrastructure: The largest consumer of iron and steel is the construction industry which consumes more than 300 billion of the total steel demand and the total steel demand in the world in 2025. The requirements of high-strength, long-life steel are being fueled by the processes of urbanization, smart city projects and renewable energy projects. The use of innovations to high-strength concrete-reinforcing bars and corrosion-resistant structural steel are being embraced all over the world. Bridges, highways, and housing work in India, Southeast Asia, and Africa are drawing heavy investment by governments and are adding to the demand. Robotization in steel fabrication, and artificial intelligence project planning is enhancing cost-effectiveness. The steel industry is a leading construction segment in the world economy.

Automotive & Transportation: Transportation and automotive uses up approximately 150 billion steel each year with a bias towards lightweight and high-strength alloys. EVs are driving the requirements of both sophisticated grades of carbon steel and alloy steel, especially battery cases and chassis. In 2025, the world production of EV increased by 22% and the automakers began to work towards sustainable steel production and EAF-based production. The automotive OEMs are cooperating with steelmakers to make custom solutions that have low environmental impact. Railways and commercial vehicles are also the main users of pipes, tubes as well as sheet steel. Digital quality checking is an assurance of standards in safety and durability.

Mechanical Equipment: Machinery and industrial equipment, steel will be worth $75 billion in 2025. Alloy and tool steels: Alloy and tool steels are essential in high precision production such as turbines, presses and heavy machinery. In the emerging economies, demand is increasing because of the fast industrialization and automation initiatives. To optimize production, companies are using predictive maintenance based on AI and IoT-enabled quality control. Additive manufacturing of tool steels is also being developed, which allows cost-effective and complicated components. The manufacturing of industrial equipment is a sector where low-carbon steel grades are becoming hugely popular among manufacturers in a bid to meet the ESG requirements.

Energy & Utilities: There is energy sector which will demand plates, pipes and tubular steel, adding up to 60 billion dollars in 2025. Corrosion-resistant steel is very important in infrastructure of renewable energy, including wind turbines, solar mounts, and hydrogen pipelines. Another important contributor is oil, gas and power transmission industries. Organizations are using digital surveillance to monitor structural integrity and durability. Energy projects are becoming increasingly green with the increasing compliance requirements of the project with regard to ESG. The industry will grow faster as the world decarbonizes and the energy infrastructure is developed on the basis of hydrogen.

Defense & Aerospace: It is estimated that steel will be needed in defense and aerospace applications worth up to 40 billion dollars in 2025. Military vehicles, aircraft, and naval ships are made of high-strength alloy steels and specialty tool steels. These applications rely on advanced manufacturing methods, such as precision forging, CNC machining, and additive manufacturing. The involvement of governments in indigenous defense production is generating local steel demand. To enhance fuel efficiency and durability, lightweight, corrosion-resistant and high-performance steels have been given priority. Smart steel tracking with blockchain and IoT asset management is also being integrated into the segment.

Consumer Appliances: Consumer appliances steel is worth $35 billion by 2025. Fridges, wash, oven, and kitchenware are dominated by stainless steel sheets as they resist corrosion and are also good looking. The use of smart home appliances is creating a demand of precision-processed steels. Producers are capitalizing on intelligent quality control production lines. Green and recycled steel are on the increase to act in accordance to sustainability. Appliance steel continues to experience the greatest growth market in the Asia-Pacific region mainly in China and India. The market is also being supported by the consumer preference of durable and energy efficient appliances.

Market Segmentation

By Type

By Production Method

By Form

By Application

By Region