Commercial Vehicle Market Size and Growth 2025 to 2034

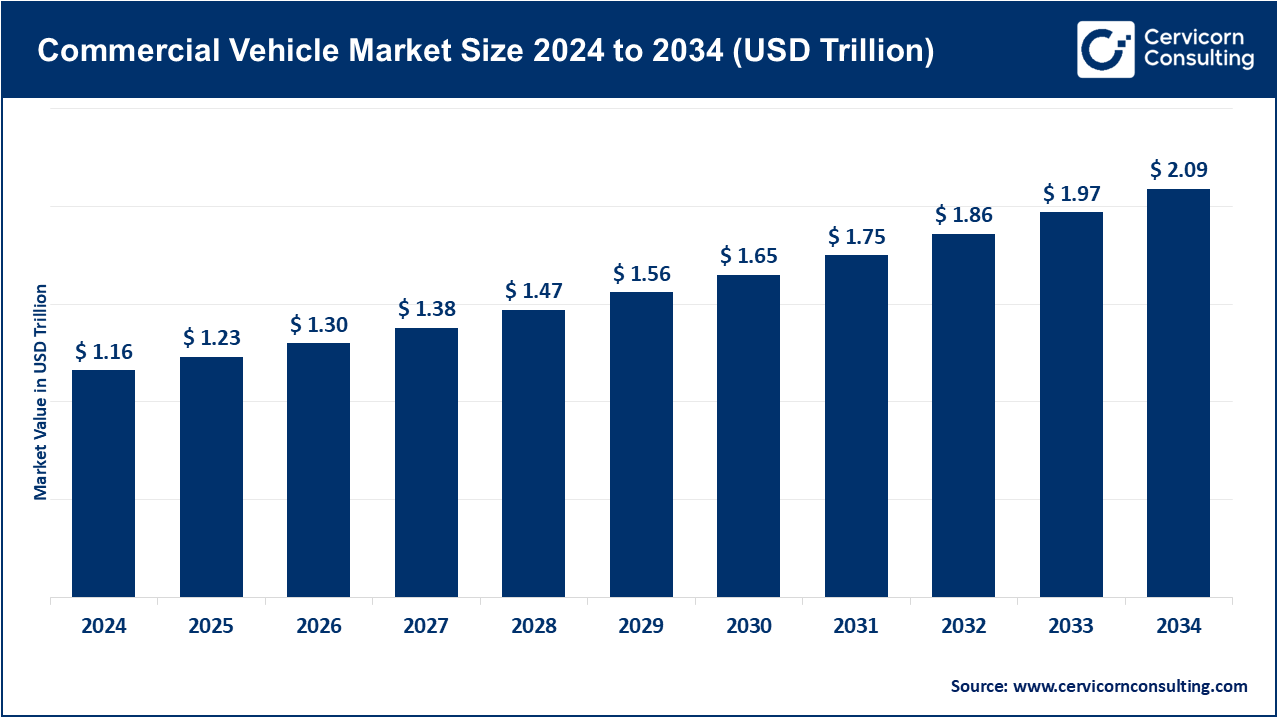

The global commercial vehicle market size was valued at USD 1.16 trillion in 2024 and is expected to hit around USD 2.09 trillion by 2034, growing at a compound annual growth rate (CAGR) of 6.02% over the forecast period from 2025 to 2034. The commercial vehicle industry is changing quickly due to new technology and customer needs. Major manufacturers are focusing on creating better vehicle features, especially in connectivity, self-driving technology, and alternative engines. The increasing disposable income in both emerging and established nations, along with ongoing infrastructure expansion, is expected to positively impact market growth. The heightened awareness of environmentally friendly transportation options has encouraged commercial vehicle producers to create vehicles with lower carbon emissions. Manufacturers are focused on innovating vehicle designs, minimizing load factors and dimensions, and tailoring vehicles to comply with weight regulations.

In 2024, Asia-Oceania led worldwide motor vehicle manufacturing with 54.9 million units, accounting for more than half of total output. Europe produced 17.2 million units, closely behind America's 19.2 million. With 1.2 million units, Africa—apart from Egypt—contributed a rather small amount. The continuous dominance of Asia-Oceania is reflected in this distribution, especially because of important manufacturing nations like China, Japan, and South Korea, which are home to some of the biggest automakers in the world.

Motor Vehicle Production by Region, 2024

| Region |

Units |

| Europe |

172,31,668 |

| America |

191,87,421 |

| Asia-Oceania |

549,07,849 |

| Africa (Excluding Egypt) |

11,77,400 |

Commercial Vehicle Market Report Highlights

- By Region, North America region accounted for highest revenue share of 56.3% in 2024.

- By Fuel Type, the internal combustion (IC) engine segment has accounted for a highest revenue share of around 83% in 2024.

- By Fuel Type, the electric vehicle segment hit fastest growth, especially in commercial settings, is mainly due to government programs that encourage the use of electric vehicles in all sectors.

- By End User, the logistics segment has captured revenue share of 28% in 2024. Increased spending on transportation to make it more accessible and affordable is a key factor driving this growth.

- By End User, the industrial segment is projected to grow at a rate of 3.76% from 2025 to 2034.

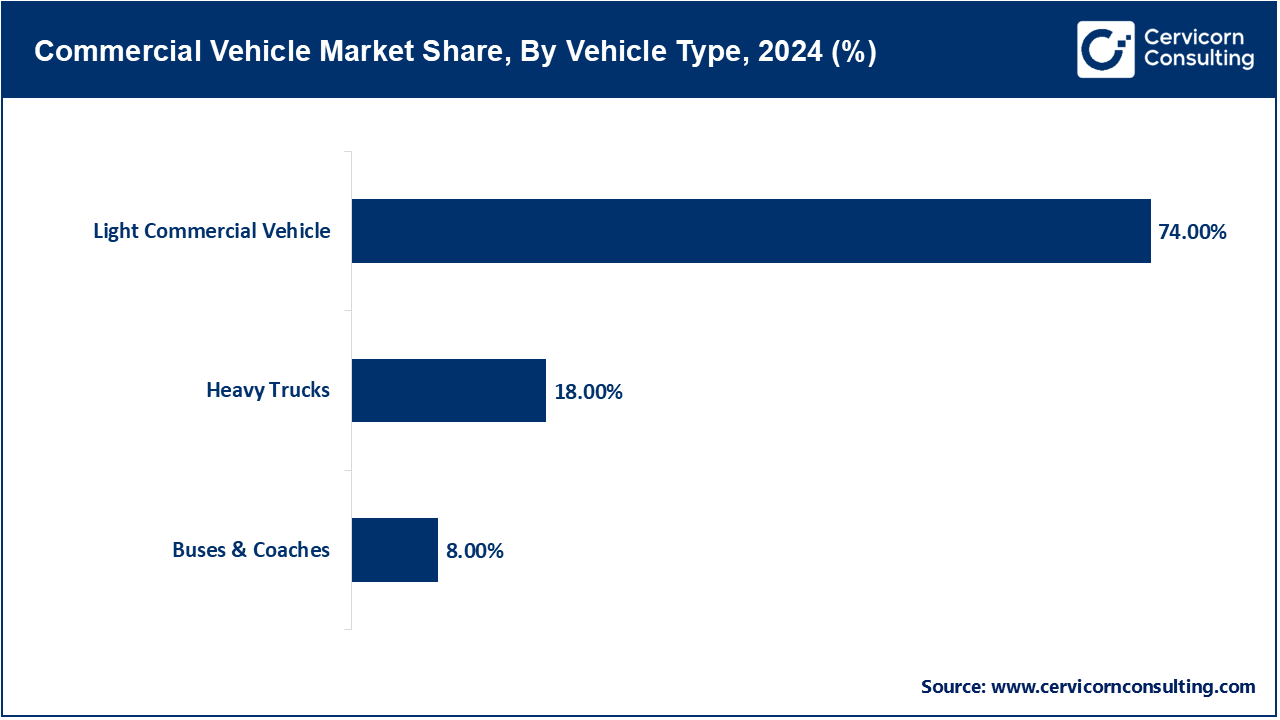

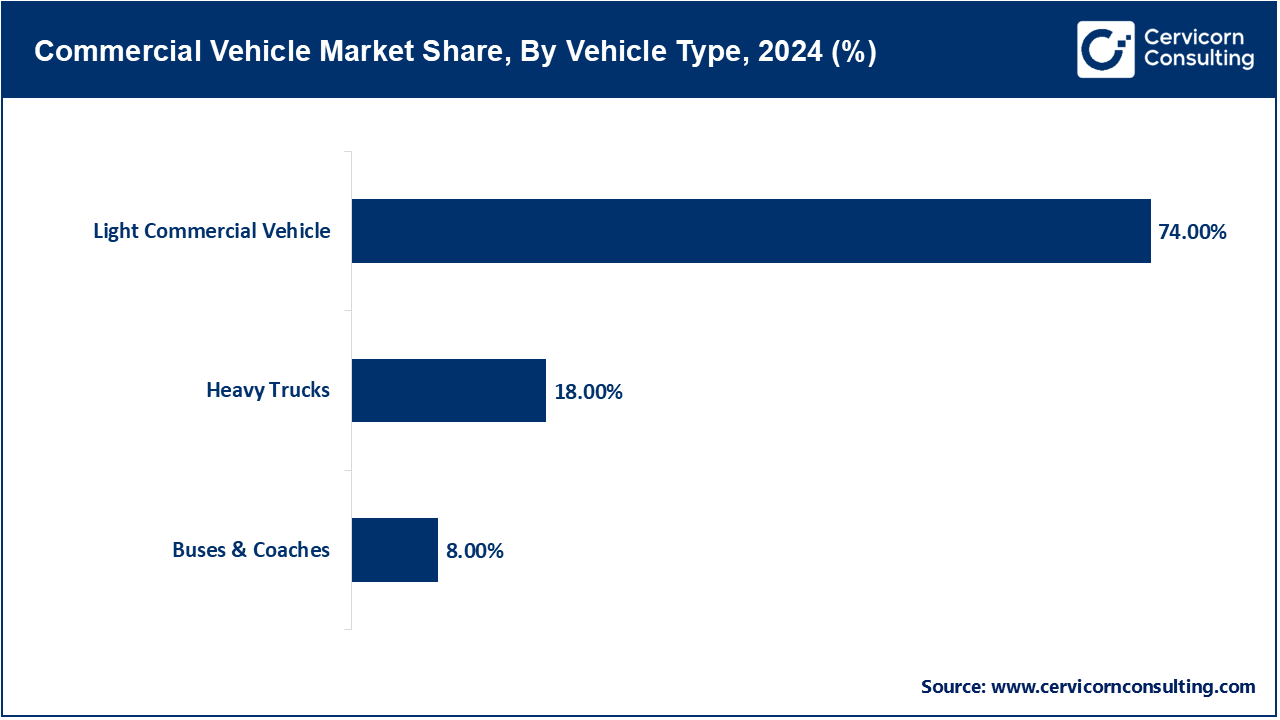

- By Vehicle Type, the light commercial vehicle segment holding about 74% of the market share in 2024. Their popularity results from their versatility and widespread use in various industries, especially in last-mile delivery, construction, and small business operations.

Commercial Vehicle Market Growth Factors

- Electrification of the vehicles: Around the world, the increasing air pollution resulting from emissions produced by traditional vehicles is contributing to environmental challenges. This situation has prompted manufacturing companies to transition to sustainable energy sources. Various regions' public transportation systems are implementing electrification for freight vehicles to support zero-emission transport, helping to maintain a clean and breathable environment for the community. Additionally, original equipment manufacturers (OEMs) are striving to lower battery costs to promote the widespread adoption of electric vehicles. Furthermore, electric vehicles are becoming increasingly popular in the global market due to their numerous advantages, including extended battery life, greater range, energy efficiency, and advancements in electronic technology.

- Advancements in Infrastructure and Industrialization: The worldwide market for commercial vehicles is growing, driven by advancements in infrastructure and industrial growth in multiple regions. The International Monetary Fund (IMF) estimates that global investment in infrastructure will hit USD 3.7 trillion annually by 2035. As nations continue to allocate funds towards infrastructure projects such as road building, highway upgrades, and urban development, the need for commercial vehicles increases. These vehicles play a crucial role in moving construction materials, equipment, and personnel to work sites, thereby aiding the development of infrastructure projects.

Commercial Vehicle Market Trends

- Adoption of Advanced Technologies: The adoption of advanced driving assistance systems (ADAS)—including lane departure warning systems, driver drowsiness detection systems, driver monitoring systems, and blind spot detection systems—contributes positively to market growth. Additionally, connectivity and telematics are significantly transforming operations, prompting manufacturers to equip vehicles with various connected services that enhance safety and prevent unauthorized access, thereby reducing mishandling and wear and tear on freight vehicles. This trend is expected to facilitate market expansion in the coming years.

- Strategic partnerships and collaborations: Strategic alliances and collaborations are transforming the landscape of commercial vehicle development, especially in the areas of electric and autonomous vehicle technologies. In May 2023, Toyota and Suzuki unveiled a major partnership to jointly create new mini electric vans and battery electric vehicle platforms, highlighting the industry's dedication to electric mobility solutions. These collaborations reach beyond traditional car manufacturers to encompass tech companies, charging infrastructure providers, and battery manufacturers, fostering a more cohesive and effective ecosystem for the development and deployment of commercial vehicles.

Commercial Vehicle Market Dynamics

Market Drivers

- Sustainability and Environmental Responsibility: The commercial vehicle industry is embracing a vital transformation, placing sustainability and environmental responsibility at the forefront of its agenda. Manufacturers are making substantial investments in clean technologies and innovative practices to drive this change. A prime example is the groundbreaking partnership between BYD and Castrosua in May 2023, which resulted in the launch of custom-designed, fully electromechanical buses that represent a leap forward in eco-friendly transport solutions. Additionally, the industry's dedication to a sustainable future is highlighted through significant investments in renewable energy for manufacturing facilities and the development of recyclable materials for vehicle components. As these advancements unfold, the direction of the commercial vehicle sector will be profoundly influenced by this commitment to sustainability and technological innovation, ultimately benefiting both businesses and the environment.

- E-Commerce Boom Boosts Commercial Vehicle Sales: The explosive growth of the e-commerce sector is a major catalyst for the commercial vehicles market. As online shopping becomes increasingly popular, the demand for efficient and timely delivery services is more critical than ever. This surge in e-commerce activity creates an urgent need for a greater number of delivery vans, trucks, and other commercial vehicles to satisfy customer expectations for swift and reliable deliveries. Companies are actively expanding their logistics and distribution networks, which drives up the procurement of commercial vehicles. Furthermore, advancements in last-mile delivery solutions and the expansion of logistics services into rural and remote areas significantly enhance this demand, making it essential for businesses to invest now and stay ahead in a competitive marketplace.

Market Restraints

- High Operating Costs: A major problem in the commercial vehicle sector is the high costs that companies have to pay. Trucks and buses need a lot of money for fuel, maintenance, and insurance, which can be a heavy financial load. Fuel prices can change a lot, which affects budgets and profits. Also, these vehicles usually need more maintenance because they are used so much, leading to frequent repairs and new parts. For small and medium-sized companies, these costs can be too much, making it hard for them to buy new or better vehicles. Because of this, high operating costs are a big barrier that slows down market growth and makes it hard for new companies to start their own vehicle fleets.

- Complexity in Operating Advanced Systems: Operating advanced systems presents unique complexities - advanced driver assistance technologies like adaptive cruise control, driver monitoring, park assist, drowsiness detection, blind spot monitoring, and automated emergency braking incorporate sensors, cameras, radars, mapping tools, and various software. These sophisticated systems introduce numerous technical difficulties and challenges. Since these systems rely on batteries, their continuous power consumption can result in battery issues, and dependence on these systems may pose calculated risks of malfunctions and failures. Additionally, the electronic components within these systems can fail and deliver inaccurate information. Furthermore, the heightened risk of cyber security threats and the difficulties drivers encounter while using these systems may jeopardize the safety of both the vehicle and its occupants. Any functional errors, whether accidental or intentional, in these advanced features can pose serious and life-threatening risks for users. Hence, the complicated mechanisms, significant maintenance and replacement costs associated with these systems, and a shortage of skilled professionals are likely to hinder growth in the global commercial vehicle market.

Market Opportunities

- Reduce distribution costs and professionalize revenue management: To make the most of their dealer networks, OEMs should take a flexible approach. They can create facilities that offer different services instead of forcing all locations to follow the same model. This means some sites can focus on sales, while others can specialize in workshops or provide test drives. OEMs can also improve efficiency by updating their networks and reducing in-person interactions in favor of online engagement throughout the customer journey. By using remote or inside sales teams, they can lower physical costs and better meet changing consumer preferences. Centralizing tasks that were once spread across individual dealers helps companies bundle services. This leads to significant savings in inventory management and marketing. By making this shift, OEMs can achieve greater success and better customer satisfaction.

- Increasing incorporation of telematics and fleet management solutions: More companies are using telematics and fleet management systems, which is helping the market grow. These technologies give fleet operators real-time information about vehicle performance, location, driver behavior, and maintenance needs. This information helps them improve operations, reduce downtime, and increase fleet efficiency. Driving is also safer with telematics and fleet management technologies. They assist with route planning, promote routine maintenance, and monitor driver behavior. These solutions are growing essential as businesses prioritize safety and regulatory compliance. Additionally, the commercial vehicle industry is expanding as a result of the integration of telematics with sustainability initiatives. Telematics makes operations more economical and environmentally friendly by improving route planning, lowering emissions, and using less fuel.

Market Challenges

- Economic Uncertainty: Economic uncertainty is a major challenge in the commercial vehicle sector. Changes in the economy can greatly affect how many cargo trucks and pickup trucks businesses want to buy. During a recession, companies often spend less money, which can lead them to postpone buying new trucks or buses. When the economy is doing well, businesses are more willing to invest in new vehicles to grow. Additionally, rising fuel prices add to this uncertainty. If fuel prices suddenly increase, transportation costs go up. This may cause businesses to rethink their vehicle choices and consider more fuel-efficient options like mini trucks. Understanding these factors can help businesses make smarter decisions.

- Regulatory Compliance: The commercial vehicle industry has strict rules. Governments set these rules to ensure safety, limit emissions, and establish operating standards for vehicles like cargo trucks and buses. Although these regulations help protect the environment and keep people safe, they can also create challenges for manufacturers and operators. For example, new emissions standards often require companies to invest in advanced technology. This can raise the costs of making and maintaining trucks and buses. Smaller companies might find it hard to meet these rules, which can lead to higher operating costs and possible penalties for not following the regulations.

Commercial Vehicle Market Segmental Analysis

Vehicle Type Analysis

Light Commercial Vehicle: The light commercial vehicle segment held highest revenue share. The growth of e-commerce and the need for flexible transportation in cities and towns make this segment important. These vehicles provide a good mix of payload capacity, manoeuvrability, and cost. This makes them particularly appealing to small and medium-sized businesses. Strong performance in this segment is also due to better fuel efficiency and the availability of electric options, which help reduce both operating costs and environmental impact.

Medium Commercial Vehicles: Medium commercial vans are essential for city deliveries and service businesses because they provide enclosed cargo space and are easy to maneuver in urban areas. These vans are increasingly using electric powertrains, making them suitable for zero-emission zones in cities. Medium-duty commercial trucks connect the light and heavy-duty segments and support regional distribution, construction, and specialized tasks. Both types of vehicles are embracing new technology, including advanced safety features, telematics, and alternative powertrains.

Heavy-duty Commercial Trucks: The heavy-duty commercial trucks segment is growing rapidly in the commercial vehicle market. This growth comes from more logistics operations and infrastructure projects worldwide. There are also more investments in electric and self-driving heavy-duty vehicles, as manufacturers focus on making them more efficient and environmentally friendly. This segment benefits from the increasing need for long-haul transportation and the rise of e-commerce, both of which require strong logistics networks. Additionally, advances in telematics, fleet management systems, and alternative fuel technologies are speeding up growth in this area. Government programs that support cleaner transportation and infrastructure projects create favorable conditions for the growth of heavy-duty commercial vehicles.

End-user Analysis

Passenger Transportation: Public transportation is becoming more popular, which is likely to increase the demand for commercial vehicles. In cities, public transportation is usually well-developed, and many people find it more efficient and cost-effective than driving a car. The easier access to and lower cost of passenger transport, combined with the rising costs of owning personal vehicles in both rich and developing countries, are important factors driving the demand for passenger transportation.

Logistics: The logistics segment has seen strong demand in recent years because of increased global trade. In 2024, this segment generated significant revenue due to the growth of e-commerce and retail. More consumers are choosing to shop online, which has helped the e-commerce sector expand and boosted the logistics market.

Commercial Vehicle Market Revenue Share, By End User, 2024 (%)

| End User |

Revenue Share, 2024 (%) |

| Mining & Construction |

21% |

| Logistics |

28% |

| Passenger Transportation |

25% |

| Industrial |

16% |

| Others |

10% |

Mining & Construction: In order to deliver materials for expanding infrastructure projects like roads, bridges, and airports, a sizable fleet of commercial vehicles is needed. The heavy-duty vehicle market's adoption of battery technology is increasingly being driven by mining activities. By 2030, the Innovation for Cleaner, Safer Vehicles collaboration hopes to have zero-emission haul trucks on the road, which could result in a considerable reduction in emissions across about 28,000 high-payload vehicles. In order to lower noise and particulate pollution in sensitive locations, utilities and forestry fleets are also trying electric cars. This shows that customer needs differ greatly depending on the industry, location, and operational requirements.

Others: The market for commercial vehicles used in agriculture is growing quickly. This growth comes from more farmers using machines and employing precision farming techniques. Tractors are the most common type of vehicle in this market because they can be used for many different farming tasks. The demand for these vehicles is especially strong in the crop production area.

Fuel-type Analysis

IC Engine: In 2024, internal combustion engines were the most popular choice in the medium and heavy commercial vehicle market. However, battery-electric trucks are growing quickly and are expected to continue this trend until 2030. This growth is supported by government subsidies, lower operating costs, and more urban fleets adopting electric vehicles. Internal combustion engines, especially diesel engines, are still the main power source for commercial vehicles because they provide strong torque and power for heavy-duty work. Manufacturers are investing in research to make internal combustion engines more fuel-efficient and produce fewer emissions. They are also exploring gas-based engines and those that use alternative fuels.

Commercial Vehicle Market Revenue Share, By Fuel Type, 2024 (%)

| Fuel Type |

Revenue Share, 2024 (%) |

| IC Engine |

83% |

| Electric |

17% |

Electric: The electric vehicle (EV) market is expected to grow quickly because of rising demand and strict fuel economy regulations. To boost EV sales, manufacturers are focused on lowering battery prices, which will help the market expand. Commercial EVs are quieter than traditional gas-powered vehicles and do not produce air pollution. They also have a longer driving range and are better suited for self-driving technology. Therefore, the EV market is likely to see the highest growth rate during the forecast period.

Commercial Vehicle Market Regional Analysis

Why does North America dominate the commercial vehicle market?

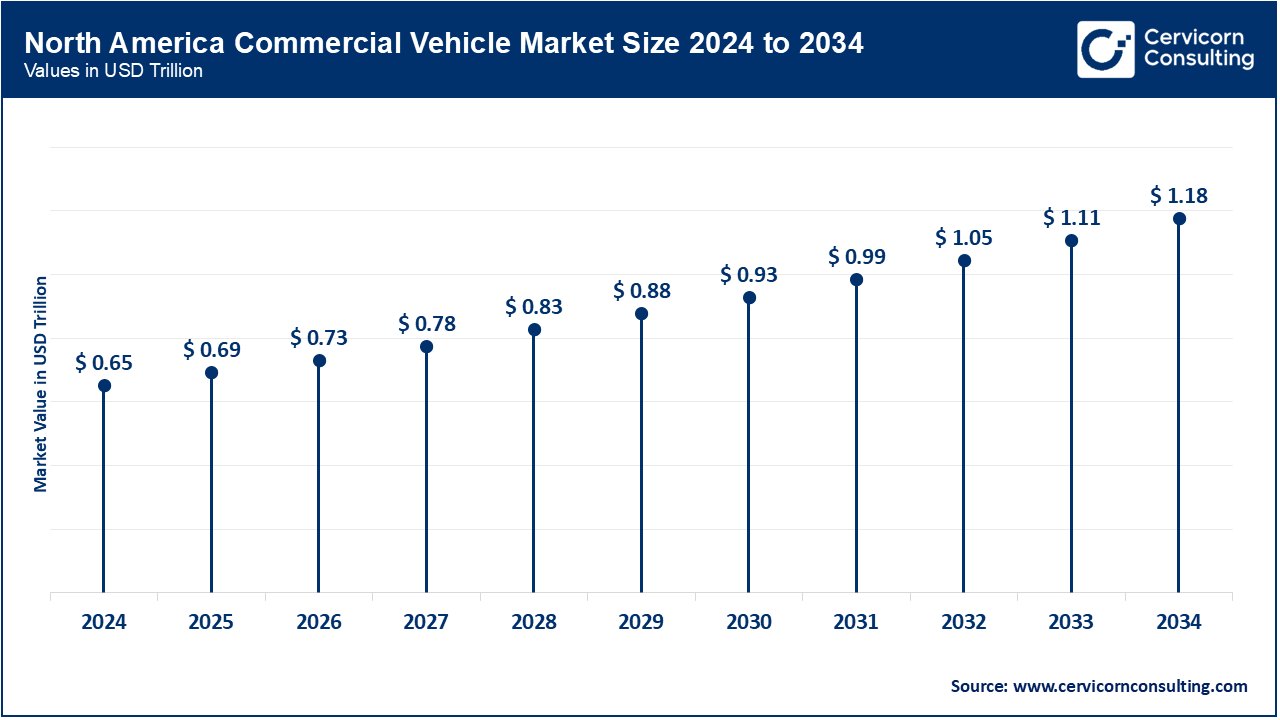

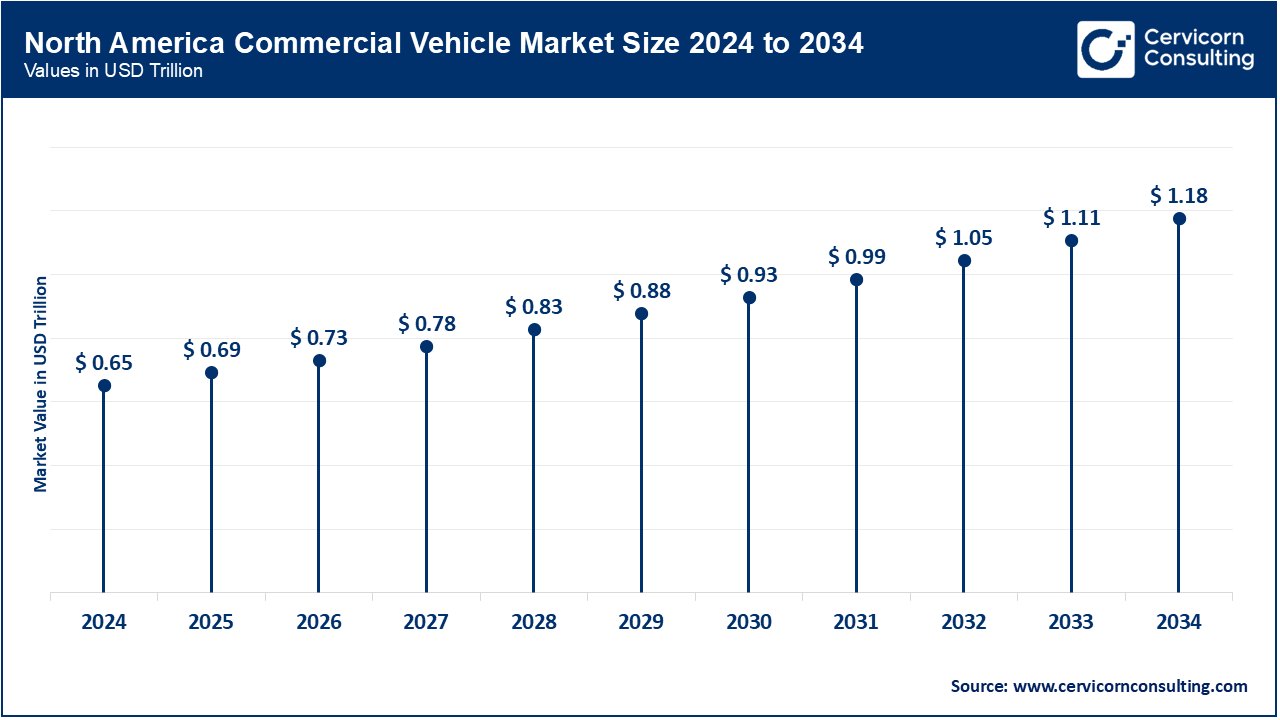

- The North America commercial vehicle market size was estimated at USD 0.65 trillion in 2024 and is forecasted to hit around USD 1.18 trillion by 2034.

North America has established markets where rules help standardize technology. California’s Advanced Clean Trucks rule affects purchasing plans nationally, as 11 other states are following its lead, representing about a quarter of the US Class 6-8 truck demand. Canada aims for 35% of truck sales to be zero-emission by 2030 and is funding charging stations along the Trans-Canada Highway. On the corporate side, Volvo and Daimler have teamed up to develop a shared operating system, while PACCAR is using its own battery packs to protect against market fluctuations.

Why is Asia-Pacific the fastest-growing region in the commercial vehicle market?

- The Asia-Pacific commercial vehicle market size was valued at USD 0.29 trillion in 2024 and is expected to reach around USD 0.53 trillion by 2034.

By 2030, this region is likely to become even stronger because companies that make vehicles are setting up battery factories, software centers, and testing facilities close to their biggest customers. In 2024, China had over 90,000 registrations for electric heavy trucks, and companies like BYD and SAIC are sending kits to Hungary and Indonesia to avoid extra taxes. India has started 14 state programs that encourage places like Uttar Pradesh and Maharashtra to create low-emission areas that promote the use of 3.5-ton battery trucks. Additionally, the growth of industries like mining and logistics in developing countries in this region will help boost the market.

What are the driving factors of Europe commercial vehicle market?

- The Europe commercial vehicle market size was accounted for USD 0.14 trillion in 2024 and is predicted to surpass around USD 0.26 trillion by 2034.

With new Euro VII requirements beginning in 2029, the EU intends to reduce CO2 emissions from large trucks by 45% by 2030. Electric vehicles (EVs) are replacing trucks powered by fossil fuels in many fleet operators. By 2021, 60% of operators desired electric or hybrid trucks, up from 40% in 2018. By 2025, operators anticipate that almost half of their fleets will be electric, and by 2030, they anticipate that 60% of the market would be made up of electric freight trucks. The expansion of the worldwide market will be aided by these developments.

Commercial Vehicle Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

56.30% |

| Europe |

12.40% |

| Asia-Pacific |

25.30% |

| LAMEA |

6% |

What are the key trends of LAMEA commercial vehicle market?

The region is starting to attract more investments, even though it began with small amounts. It's growing quickly with an annual growth rate of 9.10%. Morocco and Egypt are ordering electric buses that use parts from medium-duty trucks, which helps create a supply base in the area. Ethiopia has already surpassed its goal for electric buses by 2030, showing the success of group buying methods. In South Africa, the EV White Paper outlines a plan that aims to improve fuel efficiency in current diesel vehicles while encouraging fast-charge stations near mining areas. These efforts indicate a strong demand for electric vehicles, which could lead to significant growth in shipments once the power grid gets more reliable.

Commercial Vehicle Market Top Companies

Recent Developments

The commercial vehicles industry is very competitive, with big companies trying hard to innovate and grow. They are focusing on creating electric and self-driving vehicles and are investing a lot in research to meet customer needs and follow new environmental rules. Being quick to adapt is important, so manufacturers are improving their production and supply chains to keep up with changes in the market. Partnerships, especially in battery technology and charging stations, are becoming important for growth. Companies are also opening new factories and distribution centres in different locations and are enhancing their after-sales service to keep customers happy and loyal.

- November 2024: Stellantis introduced the STLA Frame platform, which provides 690 miles of range for hybrid vehicles and 500 miles for electric vehicles. This platform is designed for commercial use, particularly for towing and carrying heavy loads.

- November 2024: TRATON teamed up with Plus to work on self-driving trucks. They started tests in Texas and Sweden, and they plan to have commercial routes ready by the end of 2025.

- January 2024: Accelera by Cummins, Daimler Truck, and PACCAR chose Mississippi to build a lithium-iron-phosphate battery plant. The plant will cost between USD 2 and USD 3 billion and produce 21 gigawatt-hours of batteries each year.

Market Segmentation

By Vehicle Type

- Light Commercial Vehicle

- Buses & Coaches

- Heavy Trucks

By Power Source

- Gasoline

- Diesel

- HEV / PHEV

- Battery Electric Vehicle (BEV)

- Fuel Cell Vehicle

- LPG & Natural Gas

By Fuel Type

By End-user

- Mining & Construction

- Logistics

- Passenger Transportation

- Industrial

- Others

By Region

- North America

- APAC

- Europe

- LAMEA