Autonomous Vehicle Market Size and Growth 2025 to 2034

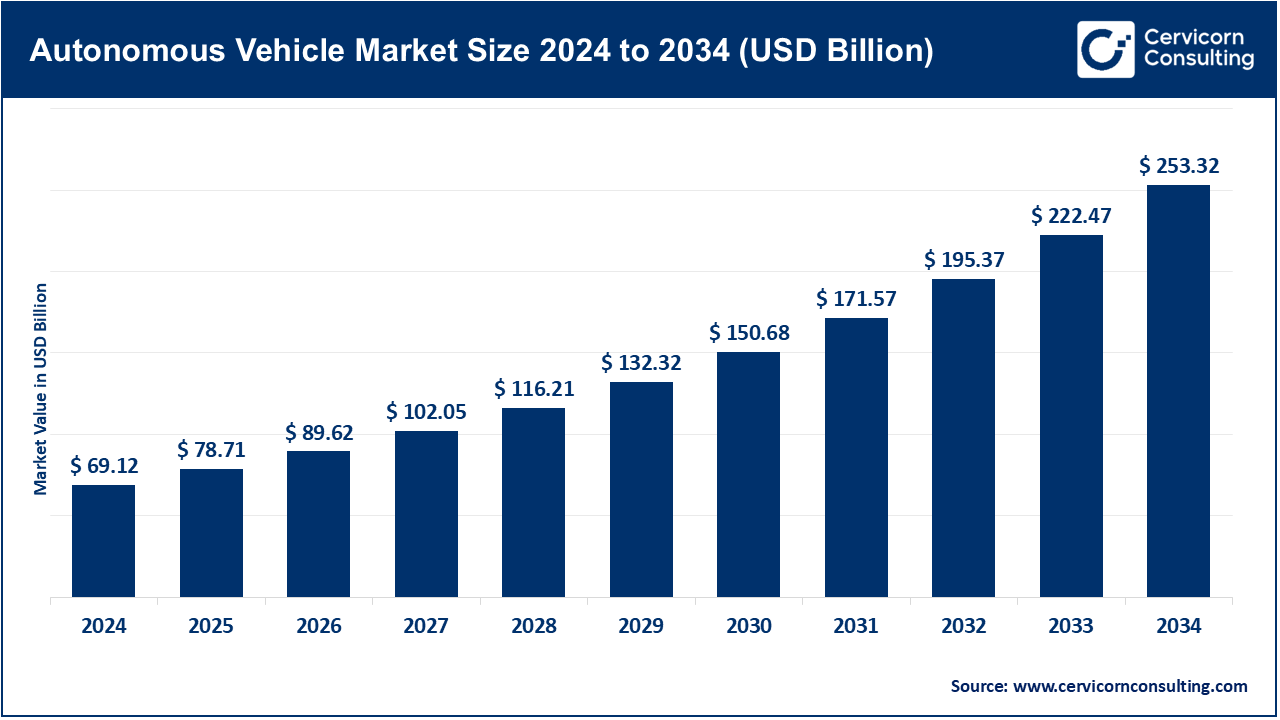

The global autonomous vehicle market size was accounted for USD 69.12 billion in 2024 and is expected to hit around USD 253.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.12% over the forecast period from 2025 to 2034. The autonomous vehicle market is expected to grow significantly owing to advancements in AI-driven navigation, increasing demand for safer and efficient transportation, and government support for intelligent mobility solutions. Rising investments in sensor technology, connectivity, and autonomous driving software—combined with consumer interest in smart mobility—are accelerating deployment across passenger and commercial segments, paving the way for widespread autonomous adoption.

Availing opportunities for growth in the autonomous vehicle (AV) market, sensor fusion, AI-based navigation, and real-time data processing are being rapidly developed. Collaboration between technology and automotive companies is underway to achieve Level 4 and 5 autonomies for urban transport and freight mobility. Regulatory frameworks, infrastructural policies, and higher demand for automated driver services are fostering development. Industry AV ecosystems are maturing and AVs are expected to transform the future of global transport and mobility with driver's safety, greater operational efficiency, and lower emissions.

Autonomous Vehicle Market Report Highlights

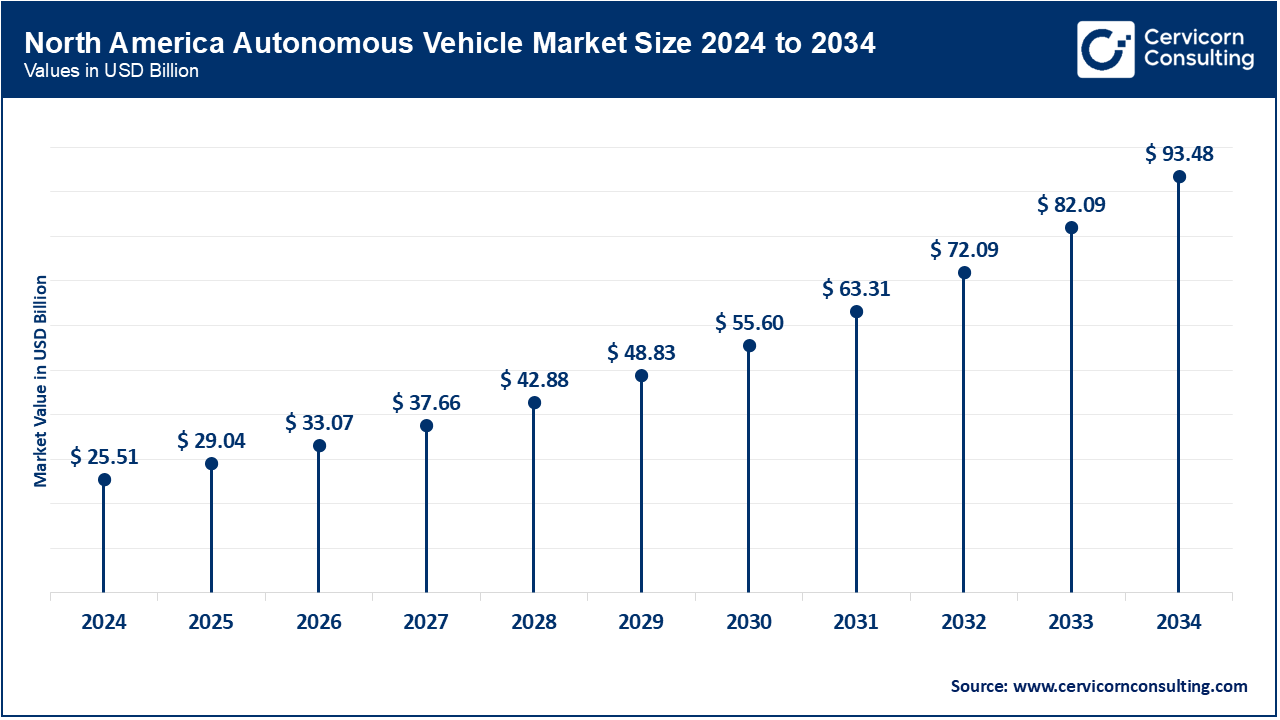

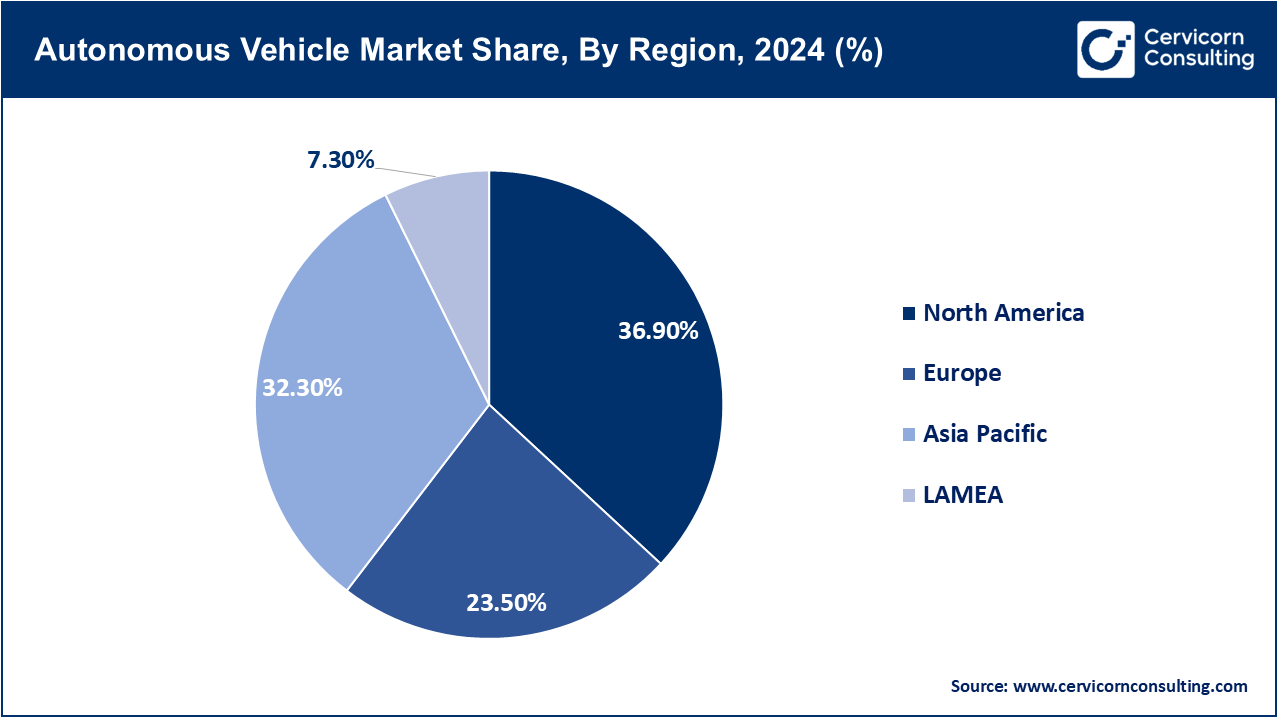

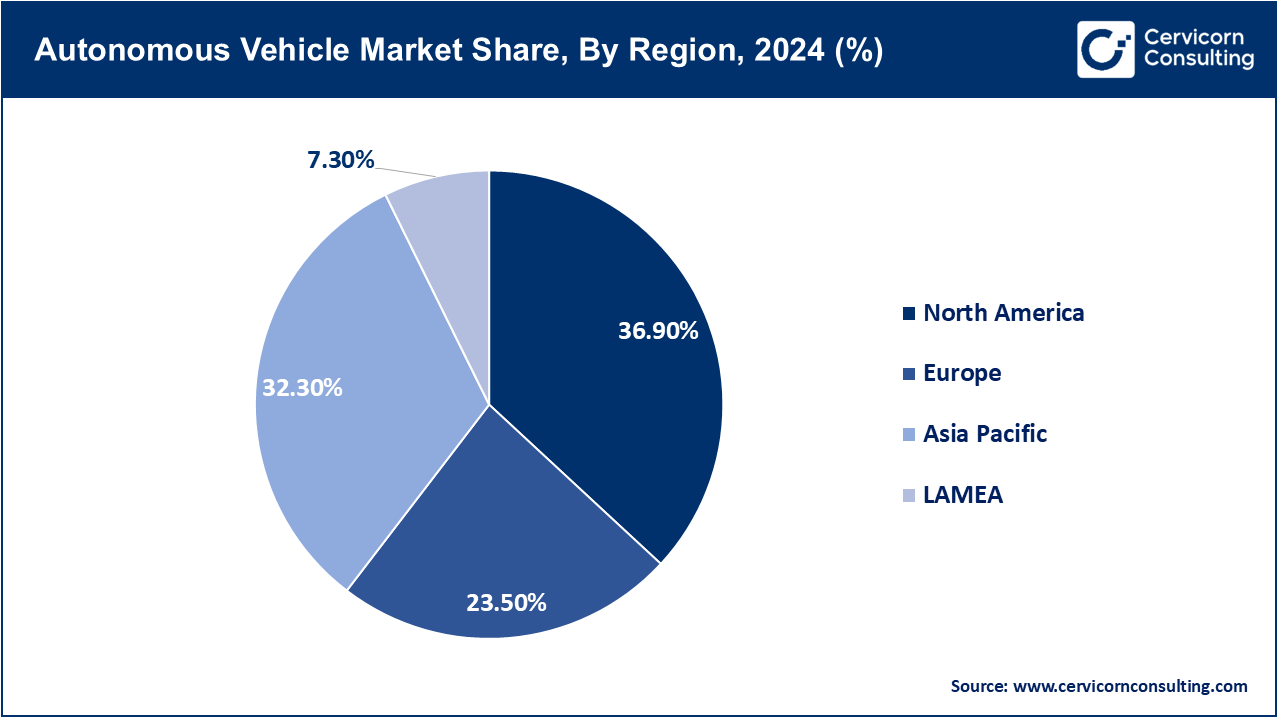

- By Region, North America has accounted highest revenue share of around 36.9% in 2024.

- By Component, the hardware segment accounted for a revenue share of 57% in 2024.

- By Vehicle Type, the passenger vehicle segment has recorded a revenue share of around 68.5% in 2024, leading to strong consumer adoption driven by growing demand for advanced driver-assistance features and urban mobility solutions.

- By Application, the transportation segment has recorded a revenue share of around 82.5% in 2024, reflecting the increasing deployment of autonomous fleets in ride-hailing, delivery, and shared mobility services.

- By Level of Autonomy, the level 3 segment has recorded a revenue share of around 66.5% in 2024, indicating rapid commercialization and regulatory support for conditional automation in mainstream vehicles.

Autonomous Vehicle Market Growth Factors

- Improvements to LiDAR and Camera Systems and Their Impact on AV Functionality and Efficiency: Today’s self-driving cars require state-of-the-art camera systems to accurately capture the surroundings. Vehicles can now perceive objects in fog or during nighttime driving with more clarity due to advancements in sensor fusion technology. This enhances automation AV user trust, safety, decision-making, compliance approval, and regulatory standards. As AI improves, the mass-production feasibility of autonomous Vehicle systems AVs increases. The decreased costs of sensors and integration with AI accelerates commercial deployment in logistics and rideshare transport sectors.

- Increased Integration of AI, Edge NPUs, and Deep Learning Algorithms: Real-time data processed from onboard sensors is now utilized to power deep learning algorithms. Predictive models trained by AI to anticipate pedestrian movements, road conditions, and traffic makes AV more responsive and flexible to change. Low-latency decision-making is now enabled by edge computing and embedded NPUs, increasing efficiency further. The integration of machine learning with AV systems as NPUs elevates responsiveness ensures AV systems continuous refinement through adaptive learning strengthens industry growth. The fast-paced development of the industry is accelerated by the integration of AI technologies.

- Smart Cities Development and Connected Infrastructure: The construction of smart city infrastructure such as V2X (vehicle-to-everything) communication and 5G networks is advancing the safety and efficiency of autonomous driving. Connected smart traffic signals and intersections, as well as digital road mapping, allow for real-time data exchange with AVs (automated vehicles) alongside their onboard sensors. These technologies are crucial for reducing high reaction time in dense urban ecosystems. Strategic AV infrastructure smart investments made by the state in these regions are particularly pronounced in the Asia-Pacific and European countries, thus speeding up the adoption of AVs in private and commercial transport.

- Regulatory Support with Government Initiatives: Pilot testing zones together with tax benefits are being introduced by different governments around the globe actively fostering the autonomous mobility innovation. In the United States, the Department of Transportation, China's MIIT, and the EU Commission have all issued recommendations advancing safe AV testing which include dedicated lanes, AV-targeted legislation, and investment in AI research establishing a positive climate for the industry. This climate is equally beneficial for tech newcomers and traditional OEMs as public safety needs are upheld. The legal environment becomes clearer, including for the autonomous shuttle and delivery vehicles which improves deployment rates.

Autonomous Vehicle Market Trends

- Investment in Shared Autonomous Mobility Services: As a reaction to the issues of congestion and cost-per-mile, businesses are concentrating on the development of shared mobility services such as robotaxis and self-driving shuttle buses. Their operation in San Francisco and Phoenix accompanies evolving adoption due to the services’ user-friendliness and reduced environmental impact. Adoption of shared models by consumers is likely to drive shifts in ownership patterns, thereby changing the economics of urban mobility.

- Adoption of Autonomous Freight and Trucking: The logistics sector is adopting autonomous freight trucking to solve understaffed operations and enhance productivity on long-haul routes. Initial studies in the US and China are starting to yield results deploying Level 4 autonomous trucks on highways. AV trucks enhance productivity through reduced driver fatigue, increased continuous operation, better time adherence to schedules, and improved delivery speeds which makes them very useful for bulk transporters. Autonomous trucking is expected to become one of the dominating factors for growth in the AV industry.

- Incorporating AVs into Urban Planning: City planners are now incorporating designs for autonomous mobility into the urban planning of future cities. New city models incorporate dedicated lanes and AV-only zones as well as intelligent parking systems. This type of planning facilitates the operation of AVs and makes the concept of autonomous transit more attractive to municipalities. It also provides a unique opportunity for ecosystem participants to collaborate with city authorities for infrastructure co-development.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 78.71 Billion |

| Expected Market Size in 2034 |

USD 253.32 Billion |

| Projected CAGR 2025 to 2034 |

18.12% |

| Dominant Region |

North America |

| Fastest Growing Region |

Asia-Pacific |

| Key Segments |

Component, Vehicle Type, Level of Autonomy, Application, Region |

| Key Companies |

AB Volvo, AUDI Aktiengesellschaft (Volkswagen Group), Bayerische Motoren Werke AG, Daimler AG, Ford Motor Company, General Motors, Tesla Inc., Toyota Motor Corporation, Uber Technologies Inc., Waymo LLC |

Autonomous Vehicle Market Dynamics

Market Drivers

- Urbanization and Last-Mile Delivery Demand: With the increase of e-commerce, the metropolitan population is growing which increases the demand for a better last mile delivery system. Sidewalk bots, drones, and autonomous vans are adapting in order to solve the issues of traffic congestion, human resource costs, and 24/7 delivery enablement. Retailers and logistics providers are willing to test such technologies in order to enhance urban distribution. This scenario presents an innovative opportunity for the AV industry to develop solutions for short, high-frequency autonomous trips.

- Reduction in Human-Driven Errors: Over 90 percent of car crashes are the result of human negligence. Autonomous vehicles with 360-degree awareness, predictive AI, and fatigue-free operation stand to benefit immensely from the integration of technology as these vehicles have a vast potential in reducing accidents. Vehicles maintained by fleets, insurance companies, and regulatory bodies view safety as a key feature. Consumer awareness of the benefits surrounding autonomous vehicles is on the rise which makes this an emerging motivator for the use of AVs in public and private mobility.

- Tech Integration Within Stakeholders: The Automotive Industry Original Equipment Manufacturer (OEM), AI and machine learning (ML) chip developers, telecom companies, and software developers have started to collaborate in order to hasten the progress of AV technology. Corporations such as NVIDIA, Qualcomm, and Waymo are establishing AV technology integration to provide complete AV systems. The collaborations combine the various Ai, telecommunication, and AV technologies to create unified systems, shortening development time and accelerating commercialization. Open-source development frameworks as well as AVCC and other cross-industry consortiums aid in shrinkage of duplication of efforts and dissemination of information, accelerating growth.

Market Restraints

- Significant Development and Component Expenses: The substantial costs of developing autonomous systems have advanced Radars, LiDAR technologies, and AI computing systems which need significant robotics R&D. Traditional vehicles do not bear these costs at all, creating AVs out of such systems makes their price comparatively steeper. Increasing price sensitivity serves as a barrier for new start-ups willing to invest since the projected cost decreases to be the only driver of value markets growth in the future. Enhanced System Design or Minimal Response AV Pricing are optional AV adoption strategies that need further exploration.

- Autonomous Vehicle Liability and Compliance: Each region has its own set of laws governing the testing and deployment of AVs, creating fragmentation of global uniformity for multi-regional OEMs. Compliance hurdles may be caused also by legal lacunas concerning responsibility attribution for AVs in incidents involving other AVs. The lack of promptable policy creates the autonomous technology adoption stagnation curve due to hopeless commercialisation paralysis AVs face. Advanced automated technologies suffer partial dependency on more fundamental economic and legal structures.

- Limited Real-World Testing Data: Collecting data through a hands-on approach for preparing AVs to unpredictable situations remains crucial, but outside legal constraints, the collection process is exceedingly expensive and time-consuming. The growing importance of simulation technology cannot replace the significant processes necessary to AV autonomy systems exposure, meaning failure to perform conditioned reflex to edge cases AVs poses serious safety risks for autonomous AV systems.

Market Opportunities

- Other Countries Are Singapore, the UAE and China AV-Enabled Public Transport Initiatives: These countries are integrating automated shuttles and taxis into urban transport systems. Such initiatives templates for other emerging markets which provides massive scope for vendors concentrating on mass transit systems.

- The Development of AV-Based Logistics Ecosystem: This segment is rapidly evolving into a high-value segment with autonomous self-driving delivery vans and warehouse robots. AV systems provide scalable and precise delivery options, particularly for e-commerce platforms. There is increased investment in autonomous depots, robotic sorters, and AI-powered delivery bots, creating additional revenue streams for suppliers.

- Advancements in Real-Time HD Digital Mapping and Twins: AV navigation requires next-gen digital mapping and real-time localization. Companies pioneering these fields are developing platforms for digital twins and AI-enhanced HD maps that are capable of continuously updating the current status of the road. Such technologies improve planning and foster AV implementation in new cities, thus positioning digital mapping as a major growth driver.

Market Challenges

- Rare Ambiguous Scenarios in Autonomous Vehicle (AV) Technology Driving: Urban settings, AVs, and pedestrians are accompanied by unique challenges which include road structures and construction areas. For AVs, sectors that call for humanlike reasoning pose a problem even after decades of improvements automating vehicles. Edge cases that require different real-world learning for each autonomous vehicle further postpone absolute independence.

- Public Perception and Ethical Concerns: Accidents involving fully autonomous vehicles increase distrust among the general public. Questions concerned with moral AV decision during absolute last resort accidents are still under consideration. Worrying AV responses do impact the speed of technology adjustment while also drawing the attention of the regulators, thus making public education on AVs a necessity for the innovation to take flight.

- Cybersecurity Risks in Connected Vehicles: V2X and onboard AI automation systems call for permanent investments in encrypted architecture, intrusion prevention systems, and fortified wireless links which leads to unattended operating structures. AVs become with the mounting increase of cybernetics. Hacking vehicles communication or attendance system on the other hand could lead to drastic safety outcomes.

Autonomous Vehicle Market Segmental Analysis

Vehicle Type Analysis

Passenger Vehicle: The passenger vehicles segment has recorded highest revenue share. The passenger vehicles are poised to become the first to be mass adopted as convenience, safety, and mobility needs increase. This category encompasses sedans, SUVs, and hatchbacks equipped with ADAS systems which incorporate lane-keeping assist and adaptive cruise control. XPeng, Mercedes-Benz, and Tesla are funneling investment into AI, radar, and sensor fusion as they await the approval of Level 2 and Level 3 autonomy features. It is expected that this segment will primarily catalyze the shift toward private self-driving vehicles, with widespread use in metropolitan areas and smart cities.

Autonomous Vehicle Market Revenue Share, By Vehicle Type, 2024 (%)

| Vehicle Type |

Revenue Share, 2024 (%) |

| Passenger Vehicle |

68.50% |

| Commercial Vehicle |

31.50% |

Commercial vehicles: Commercial autonomous vehicles include buses, delivery vans, and trucks intended for public service, logistics, and freight transport. These vehicles have predictable service areas which allows for faster implementation of higher levels of automation. Waymo Via, Aurora, and TuSimple are testing automation in what has been termed “driver-out” pilot programs to reduce workload, cut expenses, and enhance efficiency. Autonomous vehicles are also critical to e-commerce last-mile delivery to mitigate the driver shortage and increase resiliency in the supply chain.

Application Analysis

Transportation: The transportation segment has registered highest revenue share. This category encompasses shared self-driving mobility services including robo-taxis, autonomous shuttles, and buses. It seeks to improve urban transport by alleviating congestion, lowering emissions, and improving access. Waymo, Zoox, and Cruise are key players. Governments support these pilots through smart city programs and infrastructural investments.

Industrial: Industrial applications include self-driving forklifts, tractors, and mining trucks in controlled areas like warehouses, ports, farms, and construction sites. These vehicles already operate at Level 4 autonomy and are deployed as self-driving forklifts. Operational efficiency, worker safety, and costs are enhanced. Caterpillar, Komatsu, and John Deere are among industry leaders.

Commercial: This includes business use cases such as mobile retail delivery vans, logistics fleets, and delivery bots. AVs enable faster delivery of goods while cutting down on labor expenses. This is being targeted by FedEx and Amazon through sidewalk robots and autonomous vans. Key focus areas are improved supply chain agility and customer interaction.

Personal: This area deals with the automation of vehicles concentrating on passenger convenience, infotainment, safety, and long journeys. AVs are cars that now serve as enhanced vehicles meant for commuting. Increased digital data flows and younger population cohorts will raise demand.

Autonomous Vehicle Market Revenue Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Transportation |

82.50% |

| Defense |

17.50% |

Defense: UGVs are employed by armed forces for remote monitoring and logistics tasks and are therefore considered autonomous defense vehicles. The goal of autonomous vehicle (AV) technology in military use is to reduce risk to personnel, improve the flexibility of operations, increase sortie automation in high risk environments, and diminish human presence in unsafe situations. Urgent initiatives for national security and active defense continually strain budgetary spending, which propels research AI powered systems by Lockheed Martin and Rheinmetall.

Level of Autonomy Analysis

Level 1 (Assisted Driving): At this stage, the vehicle is equipped with features such as adaptive cruise control or lane-keeping assist. The driver remains fully engaged and responsible. Level 1 vehicles are still commonplace, serving as an intermediate stage toward greater automation.

Level 2 (Partial Automation): Features such as cruise control and lane centering qualify as integrated elements where the human user must still be present as a supervisor. We categorize Tesla Autopilot and GM Super Cruise systems in this level. Due to its automation capabilities in dense traffic, this automation level is being adopted more widely.

Level 3 (Conditional Automation): With this level, the vehicle is capable of steering, accelerating, and braking within defined boundaries like during high-speed driving on a highway. With this level of automation, the user must remain on standby to take over control if needed. This is already permitted in countries like Germany and China. Models equipped with Level 3 features have already been released by Audi, Mercedes-Benz, and Honda.

Level 4 (High Automation): This includes self-driving vehicles that can operate fully autonomously within specific boundaries or conditions. No human help is required, although there might be a manual override option to suspend full autonomy. Illustrating this level are self-driving taxis and self-driving shuttles; Waymo One and Cruise operate these vehicles which have some degree of human oversight while performing autonomously.

Level 5 (Full Automation): AVs of Level 5 (Full Automation) are able to operate in any environment or condition without requiring human interaction. Such vehicles can completely do away with steering wheels and pedals. Level 5 remains an entirely conceptual construct as fully automated vehicles are not available in the market because of infrastructure, regulatory, and technological limitations. It is the aspiration mark of AV development.

Autonomous Vehicle Market Regional Analysis

The autonomous vehicle market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

Why is North America at the forefront of the autonomous vehicle market?

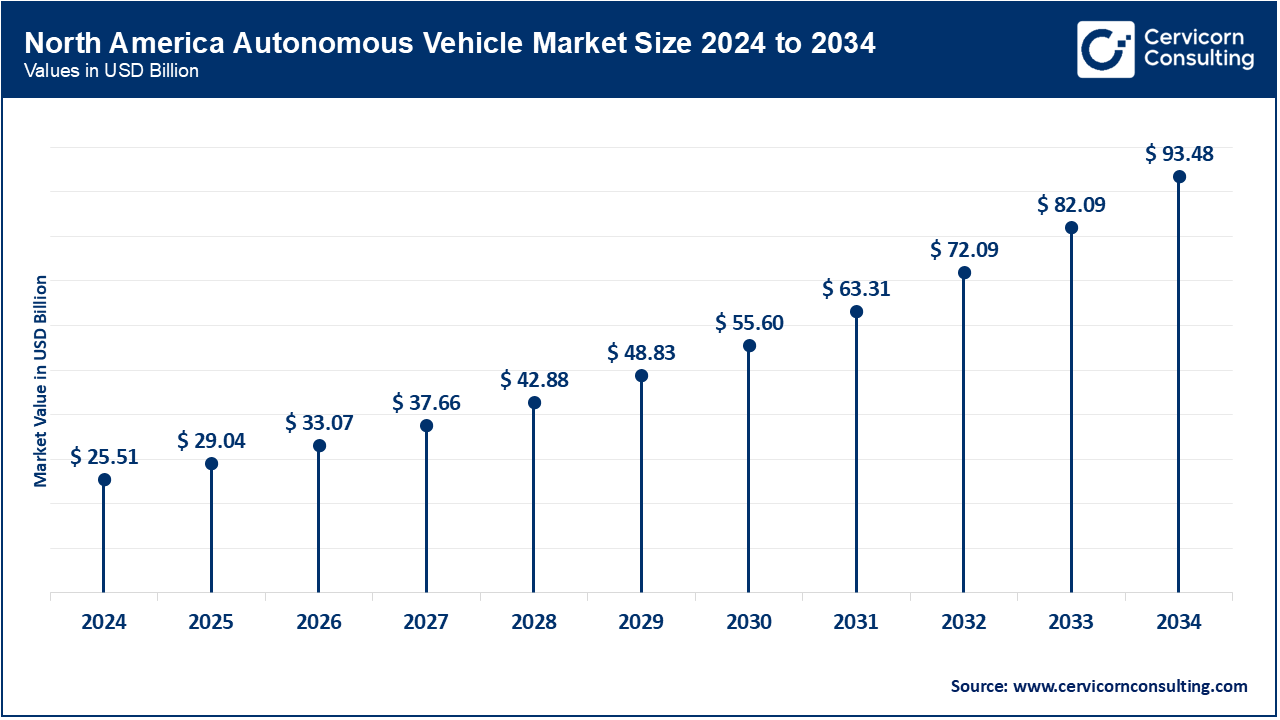

- The North America autonomous vehicle market size was valued at USD 25.51 billion in 2024 and is expected to reach around USD 93.48 billion by 2034.

The continent is still at the forefront of the market primarily due to the investments made by technology companies and automobile manufacturers in the Northeastern part of the continent. Companies like Tesla, Waymo, and GM Cruise are investing in fully autonomous driving projects. The self-driving technology along with urban mobility and logistics innovations are driven by autonomous vehicles infrastructure and government policies supporting testing.

What are the significant growth factors of Europe autonomous vehicle market?

- The Europe autonomous vehicle market size was estimated at USD 16.24 billion in 2024 and is projected to surpass around USD 59.53 billion by 2034.

Most European countries are noted to have AVs due to strong regulation frameworks and cross-border testing. France and The Netherlands are leading because of AV friendly policies and investment on smart transport infrastructure. Moreover, Volkswagen, BMW, and Renault together with AI companies are working on advancements in autonomy levels while observing safety, sustainability, and European frameworks as GDPR.

Why Asia-Pacific hits rapid growth in the autonomous vehicle market?

- The Asia-Pacific autonomous vehicle market size was accounted for USD 22.33 billion in 2024 and is expected to record USD 81.82 billion by 2034.

Japan, China and South Korea are at the forefront of the AV industry within the Asia Pacific region. China is at the forefront in commercializing L3-approved vehicles and has robust 5G and smart city policies. Honda and Toyota focus on smart city infrastructure for AVs in Japan; V2X communications are South Korea's specialty. The region is also benefitting from advanced urbanization, accelerating technological adoption, and skilled manufacturing.

What are the key trends of LAMEA autonomous vehicle market?

- The LAMEA autonomous vehicle market size was reached at USD 5.05 billion in 2024 and is anticipated to reach around USD 18.49 billion by 2034.

Latin America and Africa face infrastructure and regulatory challenges; however, the region is testing autonomous vehicles (AVs) for logistical and last-mile delivery in a relatively emergent opportunity for AVs. Middle East countries such as Saudi Arabia and the UAE are integrating AVs into smart city projects, leading the way. Ongoing digital transformation in the region, coupled with foreign investment, is shaping mobility futures.

Autonomous Vehicle Market Top Companies

Recent Developments

Key players in the autonomous vehicle industry such as Tesla Inc., NVIDIA Corporation, Mobileye (Intel), and Aurora Innovation Inc. are accelerating innovation by integrating advanced AI chips, edge computing, and sensor fusion technologies into autonomous driving systems. In March 2024, Tesla expanded its Full Self-Driving (FSD) beta to additional global markets, leveraging real-time fleet learning. NVIDIA, in January 2025, unveiled its next-gen DRIVE Thor platform, enabling Level 4 autonomy with a unified architecture for AI processing and infotainment. Mobileye, backed by Intel, launched a commercial robotaxi service in Germany in late 2024, supported by REM (Road Experience Management) mapping. Meanwhile, Aurora scaled its autonomous freight pilot with FedEx and Uber Freight, emphasizing safety and logistics efficiency. These milestones mark the ongoing convergence of AI, automotive, and cloud infrastructure, enabling scalable, safe, and intelligent autonomous mobility solutions.

- In February 2025, China introduced landmark regulations enabling the deployment of Level 3 (L3) autonomous driving technology for personal vehicles. The legislation provides a robust legal framework that allows leading automakers such as XPeng, Li Auto, and Tesla to accelerate the commercialization of L3-equipped models. This development marks a pivotal moment in the global autonomous vehicle industry, as China becomes one of the first major markets to formally authorize mass production and consumer adoption of L3 autonomy.

- In January 2025, Sony and Honda jointly announced the upcoming launch of their first autonomous electric vehicle under the Afeela brand. Set for release in Japan and the U.S. by 2026, the Afeela EV will feature integrated AI and advanced self-driving capabilities. This strategic collaboration reflects the growing convergence of consumer electronics and automotive sectors, reinforcing Japan’s role in the evolution of intelligent and connected mobility.

- In October 2024, Toyota Motor Corporation and NTT Corporation unveiled a strategic partnership to co-develop a “Mobility AI Platform” with an investment commitment of ¥500 billion (approx. $3.3 billion) by 2030. The initiative focuses on integrating high-speed communication networks, cloud computing, and advanced AI to connect vehicles and people in real time. Core objectives include eliminating traffic accidents, advancing software-defined vehicles (SDVs), and enabling data-driven driving experiences.

Market Segmentation

By Component

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Level of Autonomy

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

By Application

- Transportation

- Industrial

- Commercial

- Personal

- Defense

By Region

- North America

- APAC

- Europe

- LAMEA