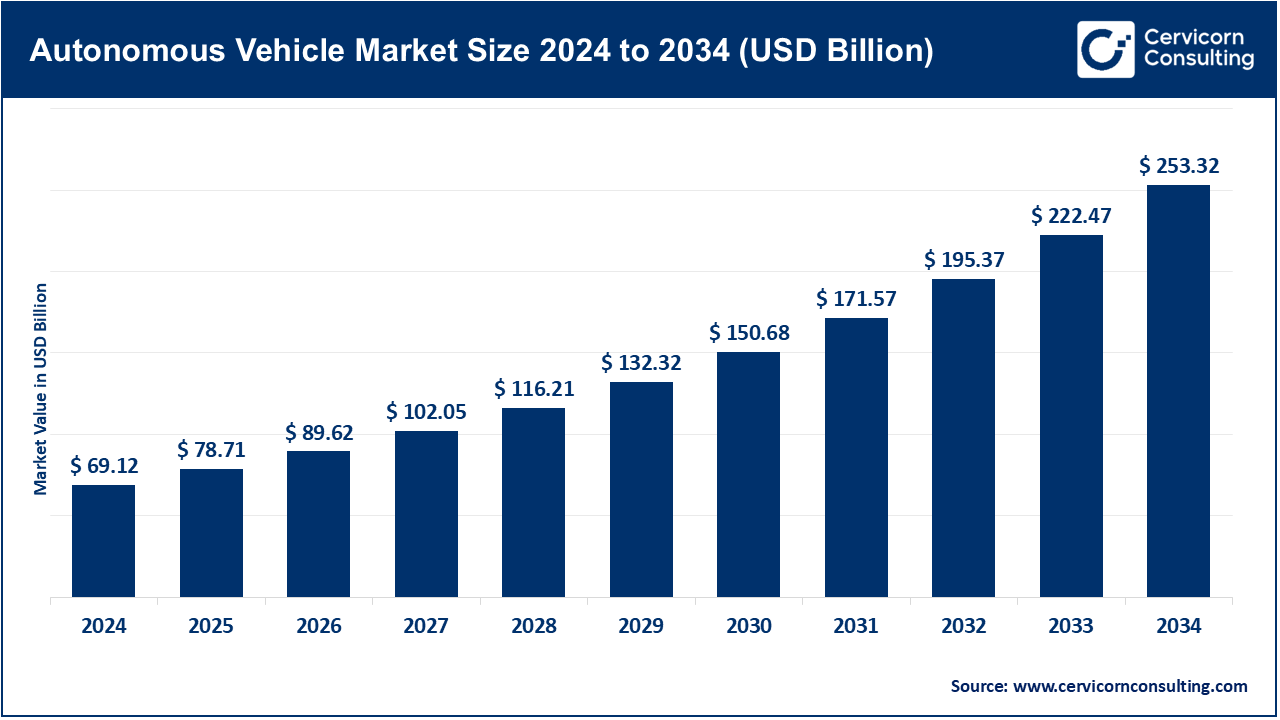

The global autonomous vehicle market size was accounted for USD 69.12 billion in 2024 and is expected to hit around USD 253.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.12% over the forecast period from 2025 to 2034. The autonomous vehicle market is expected to grow significantly owing to advancements in AI-driven navigation, increasing demand for safer and efficient transportation, and government support for intelligent mobility solutions. Rising investments in sensor technology, connectivity, and autonomous driving software—combined with consumer interest in smart mobility—are accelerating deployment across passenger and commercial segments, paving the way for widespread autonomous adoption.

Availing opportunities for growth in the autonomous vehicle (AV) market, sensor fusion, AI-based navigation, and real-time data processing are being rapidly developed. Collaboration between technology and automotive companies is underway to achieve Level 4 and 5 autonomies for urban transport and freight mobility. Regulatory frameworks, infrastructural policies, and higher demand for automated driver services are fostering development. Industry AV ecosystems are maturing and AVs are expected to transform the future of global transport and mobility with driver's safety, greater operational efficiency, and lower emissions.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 78.71 Billion |

| Expected Market Size in 2034 | USD 253.32 Billion |

| Projected CAGR 2025 to 2034 | 18.12% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component, Vehicle Type, Level of Autonomy, Application, Region |

| Key Companies | AB Volvo, AUDI Aktiengesellschaft (Volkswagen Group), Bayerische Motoren Werke AG, Daimler AG, Ford Motor Company, General Motors, Tesla Inc., Toyota Motor Corporation, Uber Technologies Inc., Waymo LLC |

Passenger Vehicle: The passenger vehicles segment has recorded highest revenue share. The passenger vehicles are poised to become the first to be mass adopted as convenience, safety, and mobility needs increase. This category encompasses sedans, SUVs, and hatchbacks equipped with ADAS systems which incorporate lane-keeping assist and adaptive cruise control. XPeng, Mercedes-Benz, and Tesla are funneling investment into AI, radar, and sensor fusion as they await the approval of Level 2 and Level 3 autonomy features. It is expected that this segment will primarily catalyze the shift toward private self-driving vehicles, with widespread use in metropolitan areas and smart cities.

Autonomous Vehicle Market Revenue Share, By Vehicle Type, 2024 (%)

| Vehicle Type | Revenue Share, 2024 (%) |

| Passenger Vehicle | 68.50% |

| Commercial Vehicle | 31.50% |

Commercial vehicles: Commercial autonomous vehicles include buses, delivery vans, and trucks intended for public service, logistics, and freight transport. These vehicles have predictable service areas which allows for faster implementation of higher levels of automation. Waymo Via, Aurora, and TuSimple are testing automation in what has been termed “driver-out” pilot programs to reduce workload, cut expenses, and enhance efficiency. Autonomous vehicles are also critical to e-commerce last-mile delivery to mitigate the driver shortage and increase resiliency in the supply chain.

Transportation: The transportation segment has registered highest revenue share. This category encompasses shared self-driving mobility services including robo-taxis, autonomous shuttles, and buses. It seeks to improve urban transport by alleviating congestion, lowering emissions, and improving access. Waymo, Zoox, and Cruise are key players. Governments support these pilots through smart city programs and infrastructural investments.

Industrial: Industrial applications include self-driving forklifts, tractors, and mining trucks in controlled areas like warehouses, ports, farms, and construction sites. These vehicles already operate at Level 4 autonomy and are deployed as self-driving forklifts. Operational efficiency, worker safety, and costs are enhanced. Caterpillar, Komatsu, and John Deere are among industry leaders.

Commercial: This includes business use cases such as mobile retail delivery vans, logistics fleets, and delivery bots. AVs enable faster delivery of goods while cutting down on labor expenses. This is being targeted by FedEx and Amazon through sidewalk robots and autonomous vans. Key focus areas are improved supply chain agility and customer interaction.

Personal: This area deals with the automation of vehicles concentrating on passenger convenience, infotainment, safety, and long journeys. AVs are cars that now serve as enhanced vehicles meant for commuting. Increased digital data flows and younger population cohorts will raise demand.

Autonomous Vehicle Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Transportation | 82.50% |

| Defense | 17.50% |

Defense: UGVs are employed by armed forces for remote monitoring and logistics tasks and are therefore considered autonomous defense vehicles. The goal of autonomous vehicle (AV) technology in military use is to reduce risk to personnel, improve the flexibility of operations, increase sortie automation in high risk environments, and diminish human presence in unsafe situations. Urgent initiatives for national security and active defense continually strain budgetary spending, which propels research AI powered systems by Lockheed Martin and Rheinmetall.

Level 1 (Assisted Driving): At this stage, the vehicle is equipped with features such as adaptive cruise control or lane-keeping assist. The driver remains fully engaged and responsible. Level 1 vehicles are still commonplace, serving as an intermediate stage toward greater automation.

Level 2 (Partial Automation): Features such as cruise control and lane centering qualify as integrated elements where the human user must still be present as a supervisor. We categorize Tesla Autopilot and GM Super Cruise systems in this level. Due to its automation capabilities in dense traffic, this automation level is being adopted more widely.

Level 3 (Conditional Automation): With this level, the vehicle is capable of steering, accelerating, and braking within defined boundaries like during high-speed driving on a highway. With this level of automation, the user must remain on standby to take over control if needed. This is already permitted in countries like Germany and China. Models equipped with Level 3 features have already been released by Audi, Mercedes-Benz, and Honda.

Level 4 (High Automation): This includes self-driving vehicles that can operate fully autonomously within specific boundaries or conditions. No human help is required, although there might be a manual override option to suspend full autonomy. Illustrating this level are self-driving taxis and self-driving shuttles; Waymo One and Cruise operate these vehicles which have some degree of human oversight while performing autonomously.

Level 5 (Full Automation): AVs of Level 5 (Full Automation) are able to operate in any environment or condition without requiring human interaction. Such vehicles can completely do away with steering wheels and pedals. Level 5 remains an entirely conceptual construct as fully automated vehicles are not available in the market because of infrastructure, regulatory, and technological limitations. It is the aspiration mark of AV development.

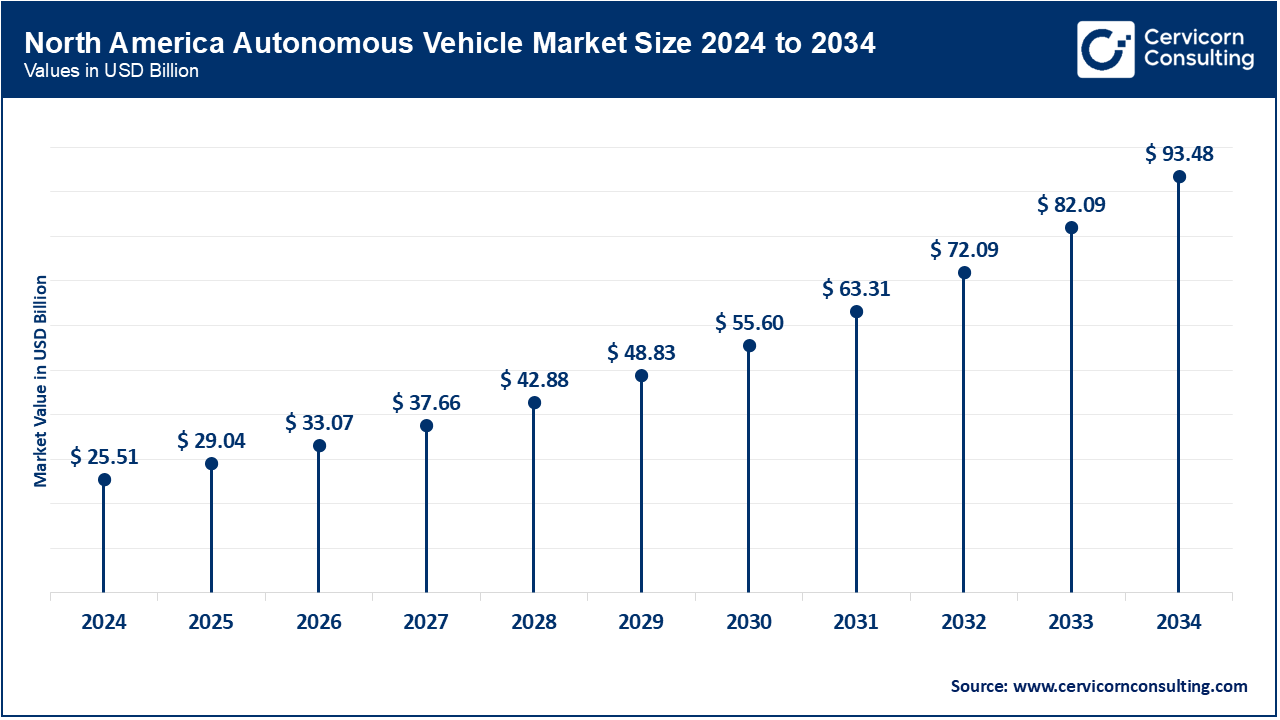

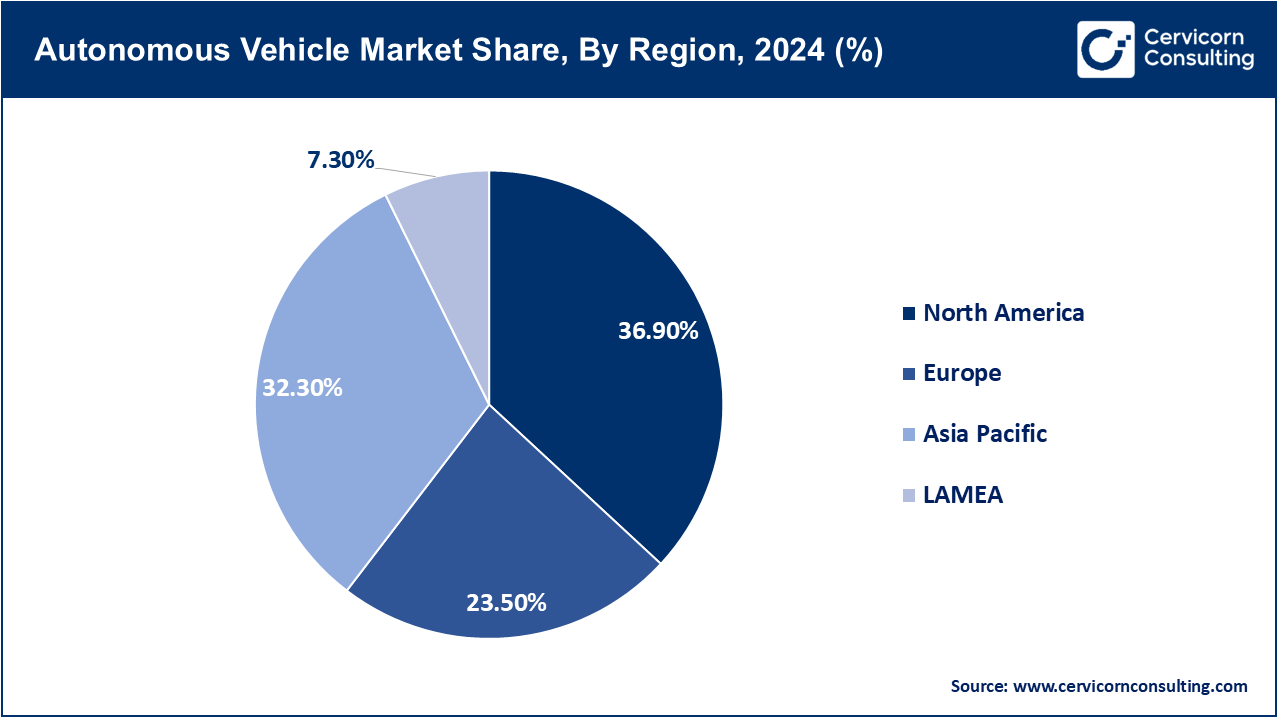

The autonomous vehicle market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The continent is still at the forefront of the market primarily due to the investments made by technology companies and automobile manufacturers in the Northeastern part of the continent. Companies like Tesla, Waymo, and GM Cruise are investing in fully autonomous driving projects. The self-driving technology along with urban mobility and logistics innovations are driven by autonomous vehicles infrastructure and government policies supporting testing.

Most European countries are noted to have AVs due to strong regulation frameworks and cross-border testing. France and The Netherlands are leading because of AV friendly policies and investment on smart transport infrastructure. Moreover, Volkswagen, BMW, and Renault together with AI companies are working on advancements in autonomy levels while observing safety, sustainability, and European frameworks as GDPR.

Japan, China and South Korea are at the forefront of the AV industry within the Asia Pacific region. China is at the forefront in commercializing L3-approved vehicles and has robust 5G and smart city policies. Honda and Toyota focus on smart city infrastructure for AVs in Japan; V2X communications are South Korea's specialty. The region is also benefitting from advanced urbanization, accelerating technological adoption, and skilled manufacturing.

Latin America and Africa face infrastructure and regulatory challenges; however, the region is testing autonomous vehicles (AVs) for logistical and last-mile delivery in a relatively emergent opportunity for AVs. Middle East countries such as Saudi Arabia and the UAE are integrating AVs into smart city projects, leading the way. Ongoing digital transformation in the region, coupled with foreign investment, is shaping mobility futures.

Key players in the autonomous vehicle industry such as Tesla Inc., NVIDIA Corporation, Mobileye (Intel), and Aurora Innovation Inc. are accelerating innovation by integrating advanced AI chips, edge computing, and sensor fusion technologies into autonomous driving systems. In March 2024, Tesla expanded its Full Self-Driving (FSD) beta to additional global markets, leveraging real-time fleet learning. NVIDIA, in January 2025, unveiled its next-gen DRIVE Thor platform, enabling Level 4 autonomy with a unified architecture for AI processing and infotainment. Mobileye, backed by Intel, launched a commercial robotaxi service in Germany in late 2024, supported by REM (Road Experience Management) mapping. Meanwhile, Aurora scaled its autonomous freight pilot with FedEx and Uber Freight, emphasizing safety and logistics efficiency. These milestones mark the ongoing convergence of AI, automotive, and cloud infrastructure, enabling scalable, safe, and intelligent autonomous mobility solutions.

Market Segmentation

By Component

By Vehicle Type

By Level of Autonomy

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Autonomous Vehicle

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Vehicle Type Overview

2.2.3 By Application Overview

2.2.4 By Level of Autonomy Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Urbanization and Last-Mile Delivery Demand

4.1.1.2 Reduction in Human-Driven Errors

4.1.1.3 Tech Integration Within Stakeholders

4.1.2 Market Restraints

4.1.2.1 Significant Development and Component Expenses

4.1.2.2 Autonomous Vehicle Liability and Compliance

4.1.2.3 Limited Real-World Testing Data

4.1.3 Market Challenges

4.1.3.1 Rare Ambiguous Scenarios in Autonomous Vehicle (AV) Technology Driving

4.1.3.2 Public Perception and Ethical Concerns

4.1.3.3 Cybersecurity Risks in Connected Vehicles

4.1.4 Market Opportunities

4.1.4.1 Other Countries Are Singapore, the UAE and China AV-Enabled Public Transport Initiatives

4.1.4.2 The Development of AV-Based Logistics Ecosystem

4.1.4.3 Advancements in Real-Time HD Digital Mapping and Twins

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Autonomous Vehicle Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Autonomous Vehicle Market, By Component

6.1 Global Autonomous Vehicle Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hardware

6.1.1.2 Software

Chapter 7. Autonomous Vehicle Market, By Vehicle Type

7.1 Global Autonomous Vehicle Market Snapshot, By Vehicle Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Passenger Vehicle

7.1.1.2 Commercial Vehicle

Chapter 8. Autonomous Vehicle Market, By Application

8.1 Global Autonomous Vehicle Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Transportation

8.1.1.2 Defense

Chapter 9. Autonomous Vehicle Market, By Level of Autonomy

9.1 Global Autonomous Vehicle Market Snapshot, By Level of Autonomy

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Level 1

9.1.1.2 Level 2

9.1.1.3 Level 3

9.1.1.4 Level 4

9.1.1.5 Level 5

Chapter 10. Autonomous Vehicle Market, By Region

10.1 Overview

10.2 Autonomous Vehicle Market Revenue Share, By Region 2024 (%)

10.3 Global Autonomous Vehicle Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Autonomous Vehicle Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Autonomous Vehicle Market, By Country

10.5.4 UK

10.5.4.1 UK Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Autonomous Vehicle Market, By Country

10.6.4 China

10.6.4.1 China Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Autonomous Vehicle Market, By Country

10.7.4 GCC

10.7.4.1 GCC Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Autonomous Vehicle Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 AB Volvo

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 AUDI Aktiengesellschaft (Volkswagen Group)

12.3 Bayerische Motoren Werke AG

12.4 Daimler AG

12.5 Ford Motor Company

12.6 General Motors

12.7 Tesla Inc.

12.8 Toyota Motor Corporation

12.9 Uber Technologies Inc.

12.10 Waymo LLC