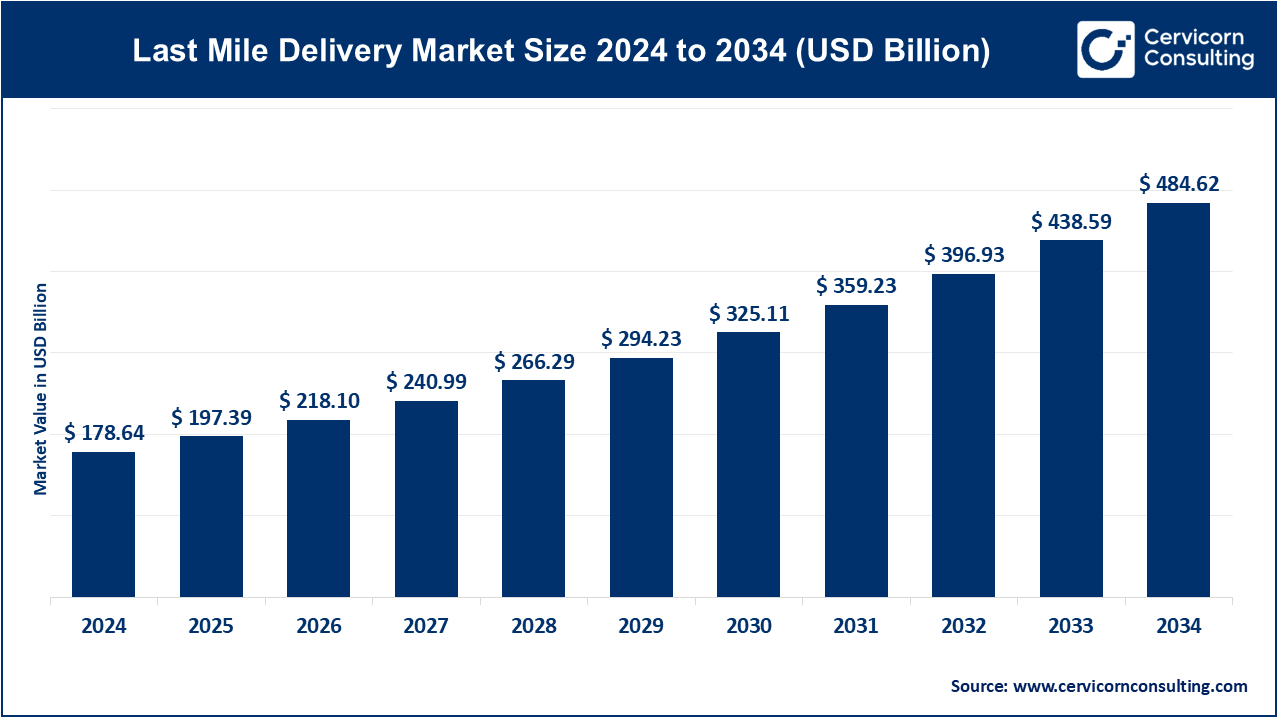

The global last mile delivery market is set to expand from USD 178.64 billion in 2024 to about USD 484.62 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.49% over the forecast period 2025 to 2034. The last-mile delivery market is experiencing rapid growth, driven primarily by the explosion of e-commerce, changing consumer expectations, and technological advancements. The COVID-19 epidemic has fueled a surge in online purchasing, resulting in increasing demand for rapid and safe delivery, prompting merchants and logistics companies to optimize last mile operations.

Consumers now anticipate same-day or two-hour deliveries, prompting businesses to invest in hyperlocal delivery hubs, crowdsourced delivery fleets, and automated systems. Furthermore, the rise of quick commerce (Q-commerce), which provides immediate delivery of groceries, meals, and necessities, has driven the market further. Urbanization and the increasing demand for contactless deliveries have also fuelled the industry's growth, making last-mile logistics a business differentiator.

Technological advancements are also a primary driver, with companies leveraging AI-based route planning, real-time monitoring, and autonomous delivery options (robots, drones, and autonomous trucks) to reduce costs and maximize efficiency. Green pressures are accelerating the adoption of electric vehicles (EVs) and bicycle couriers, especially in high-density cities with severe emissions restrictions. Over and above this, crowdsourced and gig economy models (Uber Eats and Amazon Flex, for example) have made flexible, scalable delivery networks possible. Growth is also being driven by expanding markets in Asia, Latin America, and Africa as improved digital infrastructure and growing smartphone penetration power online retailing. With continued investment in smart logistics, automation, and green delivery options, the last-mile delivery market is poised to keep growing in the coming years.

What is Last Mile Delivery?

Last mile delivery is the final step in the delivery process where products are delivered from a local warehouse or distribution center directly to the customer's door. It is an important part of the supply chain because it directly impacts customer satisfaction. As e-commerce has been growing at a rapid rate and there is an increasing demand for same-day or next-day delivery, companies are more than ever focused on making this final step as fast, efficient, and reliable as possible. Although it is usually the shortest distance in the process, it usually is the most complex and costly due to traffic, unpredictable delivery points, and high customer expectations.

There is several types of last mile deliveries, including business-to-consumer (B2C) e-commerce, business-to-business (B2B) retail supply chain, and crowdsourced delivery with gig staff on platforms like Uber Eats or Dunzo. Its applications cut across industries like retail, food and grocery, healthcare, and courier services, all heavily depend on successful last mile delivery. From packages and food to the transportation of critical medical supplies, last mile delivery plays an important role in delivering products to customers in time and securely.

Rise of Quick Commerce (Q-Commerce)

Q-commerce, or quick commerce, is designed to deliver products, mainly groceries and essentials, within 10 to 30 minutes. It is a highly evolved business model that has developed extremely rapidly in urban centers due to higher customer expectations for convenience and speed. Companies are investing extensively in hyperlocal delivery facilities in order to fulfill this requirement.

Adoption of Sustainable Delivery Solutions

Sustainability is becoming a high-priority agenda in last mile delivery, and businesses are reducing carbon emissions through the use of electric vehicles, bicycles, and route optimization. Some logistics providers are also utilizing carbon offsetting schemes.

Expansion of AI and Route Optimization Technologies

Artificial intelligence is utilized to optimize route planning, delivery time estimation, and delay minimization. Artificial intelligence-driven platforms help companies to increase efficiency, save capital, and improve customer satisfaction.

Increasing Use of Real-Time Tracking and Customer Communication

Customers desire on-time visibility of their orders. Advanced tracking capabilities and active notification (e.g., real-time messages or estimated time windows) increase satisfaction and reduce abandoned delivery attempts.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 197.39 Billion |

| Expected Market Size in 2034 | USD 484.62 Billion |

| Projected Market CAGR 2025 to 2034 | 10.49% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Service Type, Delivery Model, Technology, End-User, Region |

| Key Companies | Flirtey, Amazon Logistics, Deutsche Post AG, XPO Logistics, Inc, A1 Express Services Inc, United Parcel Service, Inc, FedEx, Jet Delivery, Inc, Kerry Logistics Network Limited, A2Z Drone Delivery, LLC, Drone Delivery Canada Corp, YTO Express Group Co. |

Growth in E-commerce and Consumer Expectations

Technological Advancements in Delivery Systems

High Operational Costs

Traffic Congestion and Urban Delivery Restrictions

Adoption of Electric and Sustainable Delivery Vehicles

Expansion in Tier 2 and Tier 3 Cities

Failed or Missed Deliveries

Logistics Infrastructure Gaps in Remote Areas

The last mile delivery market is segmented into service type, delivery model, technology, end-user industry, and region. Based on service type, the market is classified into B2B (business-to-business), B2C (business-to-consumer), and C2C (customer-to-customer). Based on the delivery model, the market is classified into standard delivery, same-day delivery, and instant delivery. Based on technology, the market is classified into autonomous vehicles, non-autonomous vehicles, and drone. Based on end-user industry, the market is classified into e-commerce & retail, food & grocery delivery, healthcare & pharmaceuticals, logistics & courier services, and others.

The B2C (Business-to-Consumer) segment is the dominant force in the last mile delivery market in 2024, driven by the rapid expansion of online retail. As consumers increasingly expect quick and secure home deliveries for an increasingly diverse assortment of products, from electronics to groceries, corporations have expanded their B2C logistics network. These giants like Amazon, Flipkart, and Alibaba are placing significant investments on route optimization, local warehousing, and fleets for deliveries in order to handle increasing expectations. This segment occupies the highest portion of the market, with that dominance set to continue as deeper e-commerce penetration increases, particularly in emerging markets.

Last Mile Delivery Market Revenue Share, By Service Type, 2024 (%)

| Service Type | Revenue Share, 2024 (%) |

| B2B (Business-to-Business) | 70.51% |

| B2C (Business-to-Consumer) | 19.64% |

| C2C (Customer-to-Customer) | 9.85% |

The C2C (Customer-to-Customer) segment is emerging as a niche yet growing area in 2024, fueled by the popularity of peer-to-peer marketplaces like OLX, eBay, and Facebook Marketplace. These marketplaces are gaining traction, resulting in a greater demand for cheap and convenient delivery between individuals. Courier companies and logistics startups are filling the gap with low-cost and convenient solutions to serve this informal but growing market. Though smaller in terms of size relative to B2B and B2C, C2C is demonstrating encouraging signs of gradual growth.

Standard delivery continues to dominate the delivery model landscape, offering cost-effective and predictable shipping for non-urgent packages. Implemented by conventional retailers and e-tailers heavily, standard delivery is the best-selling model today because it has proved to be the most consistent and economical way of delivering items. It gains high popularity within rural and sub-urban spaces where same-day infrastructure is limited. Despite the rising trend of faster delivery models, standard delivery maintains a stronghold, especially for large or less time-sensitive shipments.

Instant delivery is the fastest-growing delivery model in 2024, driven by consumer demand for ultra-fast service. New-age startups such as Zepto and Blinkit are setting new standards with deliveries between 10 to 30 minutes, particularly in the grocery and FMCG categories. This model succeeds in high-density urban locations with micro-fulfillment centers and technology-enabled dispatch systems. The market for instant delivery has witnessed investments of over USD 5 billion worldwide, reflecting future growth potential as convenience emerges as a major competitive advantage.

Non-autonomous vehicles, including scooters, vans, and bikes operated by human drivers, dominate the technology segment in last mile delivery. These vehicles provide flexible, scalable, and affordable means of traversing urban and suburban road networks. Logistics companies still depend on this model for its versatility in different landscapes and regulatory environments. With minimal infrastructure requirements and ease of driver deployment, non-autonomous vehicle deliveries remain the most practical solution in many regions.

Last Mile Delivery Market Revenue Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Autonomous Vehicles | 5% |

| Non-Autonomous Vehicles | 94% |

| Others | 1% |

Drone delivery is the fastest-growing technology in 2024, with increasing adoption in healthcare, rural deliveries, and disaster relief. Organizations such as Zipline and Amazon Prime Air are sending out drones to rapidly deliver packages and avoid traffic congestion, particularly to hard-to-reach areas. In Rwanda and Ghana, for example, over 5 million medical supplies have been delivered through drones by Zipline. With regulatory environments changing and costs slowly reducing, drone technology has the potential to transform last mile logistics in certain industries.

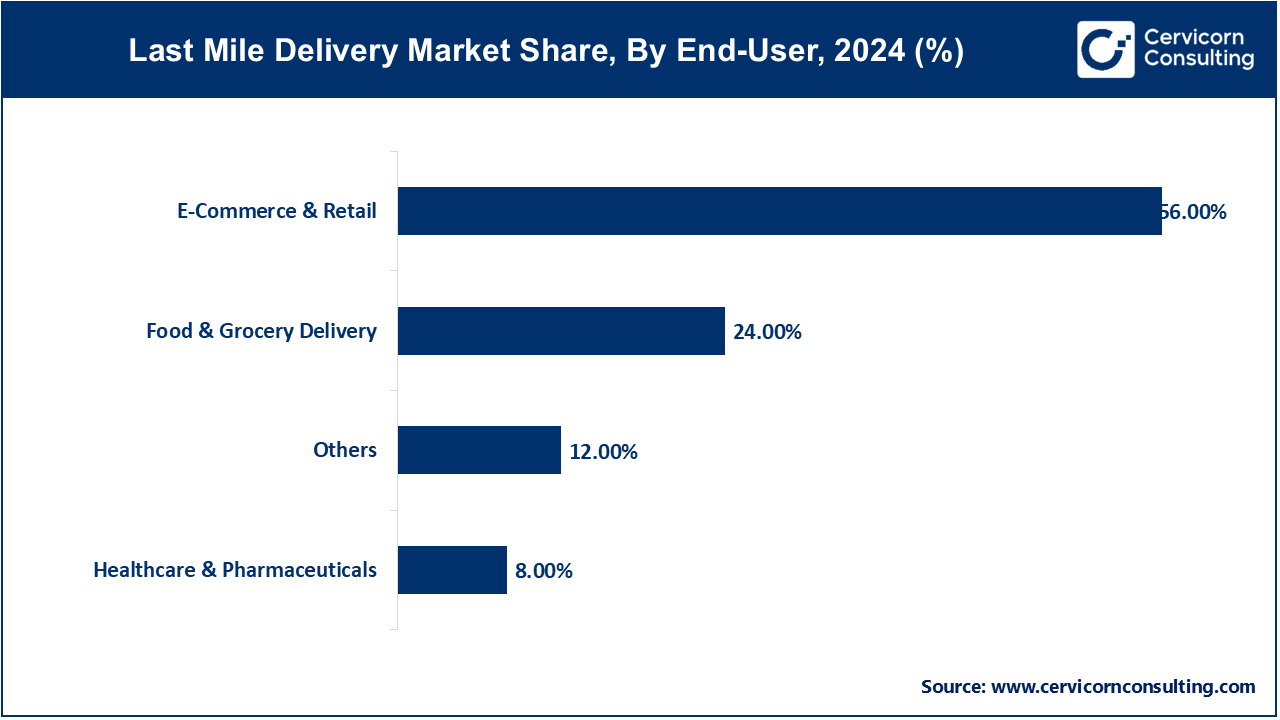

The e-commerce & retail segment remains the dominant end-user in last mile delivery due to the global surge in online shopping. Retailers are concentrating on improving customer satisfaction by making deliveries faster and more efficient. Industry leaders are adopting AI-driven routing systems, localized warehouses, and hybrid logistics models to manage huge volumes, particularly during peak-demand seasons such as holiday seasons or sales. This segment accounts for the bulk of last mile volume and revenue, with strong growth expected to continue as digital commerce expands.

Healthcare & pharmaceuticals is the fastest-growing end-user segment in 2024. The demand for reliable, timely, and sometimes temperature-sensitive delivery of medicines, vaccines, and health equipment is fueling specialized logistics solutions. Post-COVID, the industry has witnessed aggressive investment in cold-chain delivery and telemedicine enablement. For instance, temperature-controlled delivery of COVID-19 vaccines and on-demand drug delivery have driven innovation. The segment is also experiencing growth at an accelerated pace owing to growing healthcare awareness and infrastructure development across urban and remote areas.

The last mile delivery market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

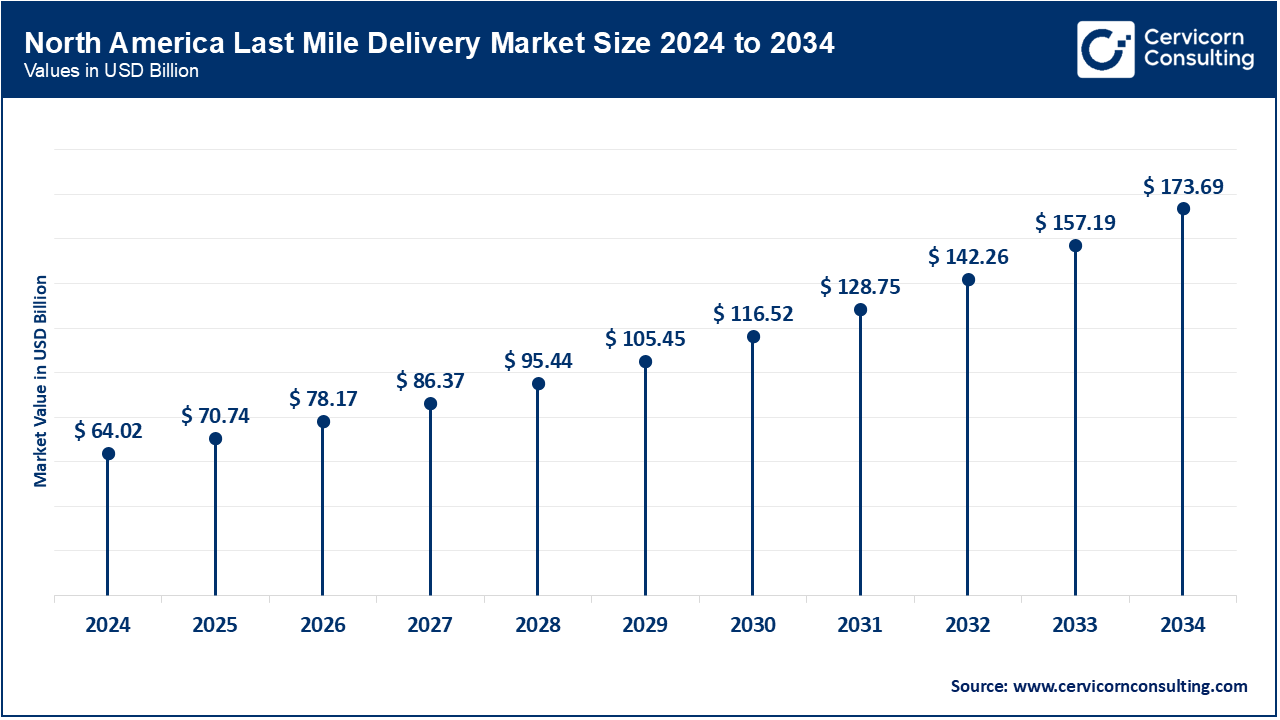

The North America last mile delivery market size was valued at USD 64.02 billion in 2024 and is projected to reach around USD 173.69 billion by 2034. North America remains the leading region in the last mile delivery market, driven by advanced infrastructure, digital innovation, and a strong e-commerce ecosystem. Major players like Amazon and Walmart continue to invest heavily in logistics automation, micro-fulfillment centers, and AI-driven route optimization to meet rising consumer expectations for same-day and next-day deliveries. The adoption of electric vehicles and autonomous delivery solutions is also accelerating across urban centers. In 2024, Amazon alone invested over USD 1 billion to expand its same-day delivery services across North America, highlighting the region’s aggressive push to strengthen last mile capabilities and maintain its dominance.

The Asia-Pacific last mile delivery market size was estimated at USD 48.82 billion in 2024 and is predicted to reach around USD 132.45 billion by 2034. Asia-Pacific is rapidly emerging as the fastest-growing region in last mile delivery, fueled by explosive e-commerce growth, mobile-first consumers, and government incentives for smart logistics. Hyperlocal delivery apps, real-time tracking, and gig economy models are witnessing widespread adoption in markets like China, India, and Indonesia. Innovative players are transforming the industry with 10-minute grocery delivery, drone pilots, and AI-driven logistics systems. In India, for instance, the quick commerce sector grew 45% in 2024 on back of platforms such as Zepto and Blinkit, which are revolutionizing consumer expectations and fueling investment in high-speed fulfillment networks.

Last Mile Delivery Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 35.84% |

| Asia-Pacific | 23.91% |

| Europe | 27.33% |

| LAMEA | 12.92% |

The Europe last mile delivery market size was accounted for USD 42.71 billion in 2024 and is forecasted to reach around USD 115.87 billion by 2034. Europe continues to lead in sustainable and regulation-driven last mile logistics, supported by environmental policies, carbon neutrality targets, and innovation in urban freight solutions. Governments and logistics companies are working together to reduce emissions through electrification, low-emission zones, and cargo bike fleets. Cities like Amsterdam and Paris are setting global examples in green delivery models. A reflection of this momentum, DHL now operates a fleet of over 20,000 electric vehicles across Europe, showcasing the region’s commitment to low-carbon logistics and its proactive stance on ESG compliance in the delivery value chain.

The LAMEA last mile delivery market was reached at USD 23.08 billion in 2024 and is exibited to hit around USD 62.61 billion by 2034. Latin America and the Middle East & Africa (LAMEA) are gaining traction in the Last Mile Delivery market due to increasing smartphone usage, digital payments, and innovative urban logistics models. In Latin America, companies like Mercado Libre and Rappi are building proprietary networks to overcome infrastructure gaps and improve delivery speed. The Middle East is investing in cutting-edge logistics technologies, including drone corridors and AI-powered sorting hubs, while Africa is leveraging mobile platforms and gig workers to address rural delivery challenges. Demonstrating the region’s growing importance, Mercado Libre invested USD 1.6 billion in 2024 to expand its last mile and logistics operations in Brazil, marking one of the largest logistics investments in Latin America to date.

The last mile delivery market is highly competitive and dynamic, with principal players from the logistics, e-commerce, and drone technology fields. Amazon Logistics, UPS, FedEx, and Deutsche Post AG are at the forefront of the traditional logistics market with state-of-the-art infrastructure and optimized networks. Flirtey, A2Z Drone Delivery, and Drone Delivery Canada Corp are innovators of the drone delivery market with quick, efficient solutions. XPO Logistics, Kerry Logistics, and YTO Express Group are transforming global supply chains with latest technologies for end-to-end delivery. Niche players such as Jet Delivery and A1 Express Services specialize in niche delivery services, catering to specific customer requirements. This technology and competition are transforming last-mile logistics, focusing on sustainability, speed, and reliability.

Market Segmentation

By Service Type

By Delivery Model

By Technology

By End-User

By Region