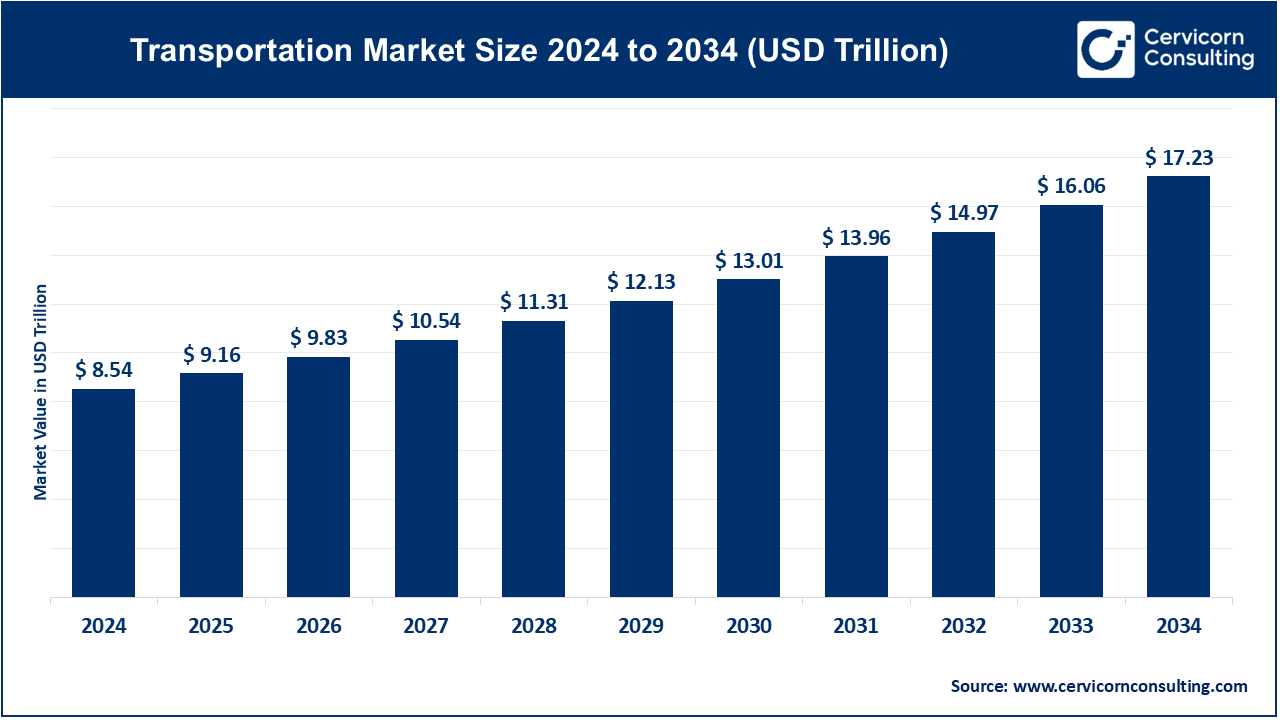

The global transportation market size was valued at USD 8.54 trillion in 2024 and is expected to be worth around USD 17.23 trillion by 2034, exhibiting a compound annual growth rate (CAGR) of 7.27% over the forecast period 2025 to 2034. The global transportation market is driven by rapid urbanization, increasing e-commerce activity, and a growing demand for efficient logistics and passenger mobility solutions. Government and private investment in smart cities and digital infrastructure, coupled with the development of intelligent transportation systems, electric vehicles (EVs), and autonomous technology, are propelling growth. For example, in 2024, Amazon doubled its electric delivery fleet in the U.S. and Europe to support its net-zero carbon aspirations, significantly boosting the green logistics segment. Likewise, governments such as India and the EU have initiated large-scale infrastructure developments like highway expansion, intelligent traffic management systems, and mass transit upgrades to alleviate urban congestion and enhance connectivity.

Additionally, the post-pandemic shift in consumer behavior towards online shopping has increased demand for last-mile delivery services, prompting logistics providers to innovate with drone deliveries and automated warehousing. In 2023, FedEx and Zipline collaborated to test autonomous drone delivery in rural areas, indicating the growing role of automation in transportation. Furthermore, environmental policies and climate change commitments are pushing the transport industry to adopt cleaner, sustainable energy sources. The integration of AI, IoT, and data analytics in fleet management and route optimization is proving crucial in cutting costs and enhancing operational efficiency, creating new growth opportunities worldwide.

What is Transportation?

Transportation refers to the movement of individuals, commodities, and services from one location to another through various modes such as road, rail, air, water, and even, more recently, space. It plays a vital role in economic development, trade, globalization, and urbanization by facilitating connectivity and access. Transportation networks are widely used in sectors including logistics, tourism, public transport, agriculture, manufacturing, and emergency services. Applications encompass freight delivery, passenger travel, ride-sharing, cargo shipping, and supply chain distribution. The transportation industry has been transformed by the advent of smart technologies. For instance, in 2024, Tesla began testing its Full Self-Driving (FSD) Beta in Europe, while countries like China accelerated the development of high-speed rail to improve regional trade and mobility.

What are the types of transportation?

Electrification of Transportation

The transportation industry is increasingly leaning towards electrification, driven by green considerations and advances in battery technology. Electric vehicles (EVs) are gaining global popularity, with governments and automakers committing to carbon-neutral objectives. In 2023, worldwide EV sales surged dramatically, with China leading the market as the largest producer and consumer of electric vehicles. Brands such as BYD have surpassed traditional automakers like Tesla in EV sales, indicating a significant shift in the automotive industry.

Autonomous Vehicles and Freight Automation

Autonomous vehicles (AVs) are transforming the transportation industry, particularly in freight and logistics. With Aurora Innovation and Waymo conducting trials of autonomous trucks, the goal is to address driver shortages, enhance safety, and reduce operating costs. Autonomous vehicles are poised to be a significant game-changer for the logistics sector in terms of efficiency and error minimization.

Advanced Air Mobility (AAM) and eVTOL Aircraft

Advanced Air Mobility (AAM) is gaining momentum with the advent of electric vertical takeoff and landing (eVTOL) aircraft, which will transform urban air transport. Electric air taxis offer a replacement for conventional land transport in metropolitan areas, providing a potential solution for alleviating traffic while delivering faster mobility for city residents.

Supply Chain Resilience and Risk Management

As international events such as the COVID-19 pandemic and geopolitical tensions further complicate supply chains, the transportation sector is emphasizing resilience and risk management. The industry is investing more in technologies to improve logistics activities, enhance forecasting, and reduce disruptions. The aim is to develop stronger transportation systems that can accommodate unforeseen challenges and mitigate vulnerabilities.

Shift in Freight Dynamics Due to Global Trade Changes

Geopolitical tensions and evolving trade dynamics are heavily impacting global shipping and freight industries. For instance, Chinese bookings to the U.S. sharply declined in 2024, with countries like Vietnam emerging as alternative bases for international shipping. These factors are prompting businesses to rethink supply chain strategies, adapt to new tariff agreements, and explore more efficient shipping routes.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 9.16 Trillion |

| Expected Market Size in 2034 | USD 17.23 Trillion |

| Projected CAGR from 2025 to 2034 | 7.27% |

| Dominant Region | Asia-Pacific |

| Key Segments | Mode of Transportation, Service Type, End-User, Region |

| Key Companies | Joby Aviation, Archer Aviation, Lilium GmbH, Vertical Aerospace, Volocopter, EHang, Wisk Aero, Beta Technologies, Embraer’s Eve Air Mobility, Bell Textron, Supernal (Hyundai Motor Group), Urban Aeronautics |

Technological Advancements

Technological advancement is essential for the development of the transportation industry. The emergence of autonomous cars, electric vehicles (EVs), and advanced air mobility (eVTOL) systems is transforming transportation. For instance, autonomous trucks can reduce the reliance on human drivers, enhancing efficiency and safety in the freight industry. Similarly, electric vehicles support the transition towards sustainability and carbon-free transportation. The integration of intelligent traffic management systems, AI-based logistics, and IoT in vehicles is also promoting greater efficiency in transportation.

Rising Demand for E-Commerce and Logistics

With the rapid expansion of e-commerce, there is a heightened need for swift and efficient logistics solutions. This is driving the growth of transportation networks to meet the demand for prompt deliveries. In recent years, Amazon and Alibaba have significantly invested in developing their transportation fleets, including drones, self-driving cars, and advanced fleet management software. The increasing demand for last-mile delivery services, particularly in urban areas, is also propelling transportation services.

High Infrastructure Costs

One of the biggest hurdles for the transportation industry is the significant investment required for infrastructure, including roads, railways, airports, and ports. Developing and maintaining this infrastructure to support new technologies, such as electric charging points for EVs or autonomous vehicle lanes, can be cost-prohibitive for both governments and corporations. The transition to more environmentally friendly infrastructure, like electrified rail tracks or intelligent traffic systems, necessitates substantial capital investment, which can limit expansion opportunities in certain areas.

Regulatory and Safety Concerns

The rapid adoption of emerging technologies, like self-driving cars and drones, has created significant regulatory and safety challenges. Different levels of regulation exist between countries and territories for these new technologies, creating difficulties for companies trying to conduct business internationally. Moreover, regulatory guidelines for emerging technologies are still being developed, requiring firms to navigate complex legal frameworks to achieve compliance. Autonomous trucks, for example, continue to undergo testing and remain in the experimental stages of fully integrating into conventional logistics due to regulatory barriers and safety concerns.

Electrification and Sustainable Transportation Solutions

With the world increasingly focused on sustainability, there are great opportunities in electrification and the use of clean energy solutions. Electric cars, trucks, buses, and even air taxis are becoming more popular, fueled by government incentives and consumers' growing desire for environmentally friendly choices. In 2024, leading automakers such as Ford and General Motors are expanding their electric vehicle offerings, aiming to address both environmental objectives and consumer demand. The growth of renewable energy sources and charging infrastructure also presents a significant opportunity for additional expansion in the electric mobility market.

Urban Mobility and Smart City Developments

As cities expand, the need for effective public transport and urban mobility solutions is increasing. Smart cities are leveraging technology to enhance transport systems, making them more efficient, connected, and green. Opportunities here include the creation of shared mobility services such as ride-hailing, electric bike-sharing, and even micro-mobility solutions such as electric scooters. Additionally, innovation in autonomous transportation, including autonomous buses and eVTOL aircraft for urban air mobility, presents new opportunities for investment and expansion.

Supply Chain Disruptions and Capacity Shortages

The transportation sector is facing supply chain issues exacerbated by international events such as the COVID-19 pandemic and ongoing geopolitical tensions. For instance, the world freight market is grappling with container shortages, port congestion, and fluctuating fuel prices. As we move into 2024, the logistics sector continues to contend with global supply chain disruptions, characterized by shipment delays and rising transport service costs. The challenge lies in enhancing the flexibility and resilience of transportation infrastructure to address these disruptions and ensure timely deliveries.

Environmental Impact and Sustainability Goals

Despite the increasing trend toward sustainability, the transport sector remains one of the largest emitters of greenhouse gases globally. While electric vehicles and other clean technologies promise a more sustainable future, the transition to completely sustainable transportation is not without challenges. The production of electric vehicles still necessitates the extraction of raw materials that may pose environmental risks, and the existing transportation infrastructure must be restructured to accommodate cleaner technologies. Additionally, achieving carbon neutrality across the entire transportation sector will require collaboration among governments, corporations, and consumers, which could prove challenging given the magnitude of the issue.

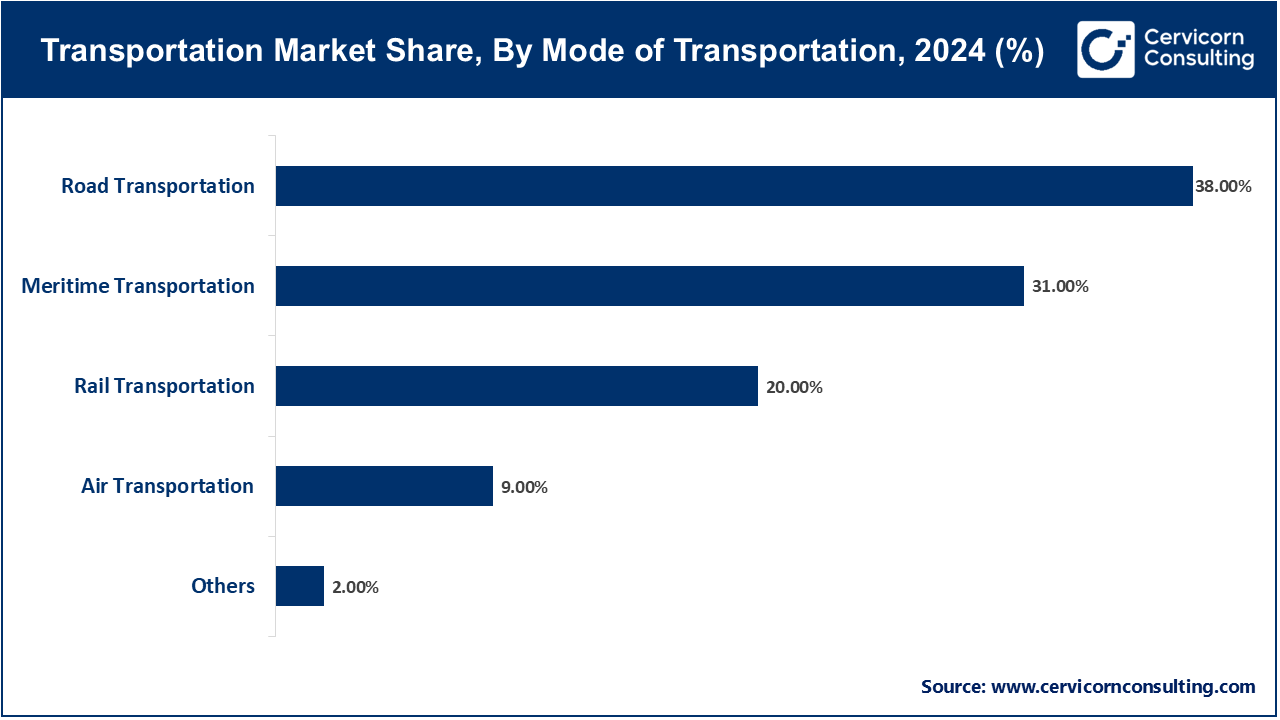

The transportation market is segmented into mode of transportation, service type, end user, and region. Based on mode of transportation, the market is classified into road transportation, air transportation, rail transportation, maritime transportation, and others. Based on the service type, the market is categorised into freight & logistics services (warehousing and storage, and freight information management), passenger services (smart ticketing and passenger information), technology & operations (vehicle telematics and traffic management), urban infrastructure services (parking management), and others. Based on end user, the market is classified into logistics & supply chain companies, freight & cargo operators, shipping companies, airlines & air cargo providers, public transport authorities, households/individuals, government & municipalities, and others.

Road transportation is the dominant mode in the global market. It plays a vital role in passenger and freight services, linking cities, towns, and nations, thereby facilitating door-to-door delivery. Advancements in electric vehicle (EV) and autonomous driving technology are enhancing the efficiency and sustainability of road transport. Companies such as Tesla, Rivian, and Daimler are at the forefront of electric truck and bus production, contributing to the reduction of emissions in urban and freight transport. As EV adoption increases, road transport remains the cornerstone of global mobility and logistics.

Air transportation is the fastest-growing segment. Driven by a rising demand for quicker travel and the growth of e-commerce, this mode is receiving significant investment in infrastructure and technology. The new technology of eVTOL airplanes promises to transform urban air mobility. Companies such as Joby Aviation and Lilium are spearheading air taxi projects in major metropolitan areas, which will alleviate city congestion and enhance the efficiency of transportation systems. Moreover, the growth of air cargo, fueled by international trade, has strengthened the air transportation sector.

Freight and logistics services dominate the service-type segment. The need for effective supply chain management and faster delivery systems, particularly with the growth of e-commerce, is driving this leadership. Businesses are investing more in smart and automated warehouses that utilize AI, robotics, and IoT technologies to improve inventory management and delivery times. Major logistics players like Amazon, DHL, and FedEx are leading the way with their advanced warehousing solutions, making it the most vital sector in transportation services.

Vehicle telematics is the fastest-growing service type. It optimizes vehicle management, ensures operational safety, and provides real-time information. Telematics solutions are increasingly being integrated into commercial and corporate fleets, enabling better route planning, fuel monitoring, and predictive maintenance. Industry leaders such as Verizon Connect and Geotab are advancing the availability of telematics solutions to enhance the efficiency and reliability of vehicle fleets, playing a significant role in the growth of this market segment in the transportation industry.

Logistics and supply chain companies dominate the end-user segment. They are essential to the world's transportation network, managing the flow of products from producers to customers. The rising demand for faster, cheaper shipping options drives this leadership. The convergence of digital platforms, AI, and blockchain technologies enhances the transparency, traceability, and speed of logistics. Key players such as Maersk, XPO Logistics, and DB Schenker are at the heart of this segment's growth, innovating modern logistics and supply chain management.

The airlines and air cargo providers are the fastest-growing end-user segment. Growth in international trade and e-commerce, along with an increase in global passenger traffic, fuels this trend. Airlines are expanding their fleets to meet passenger and cargo needs. Other companies, like UPS and FedEx, are also investing in their own air cargo fleets to accommodate the rising e-commerce demand. Since air cargo remains crucial for the rapid transportation of high-value commodities across borders, this market is likely to experience significant growth in the coming years.

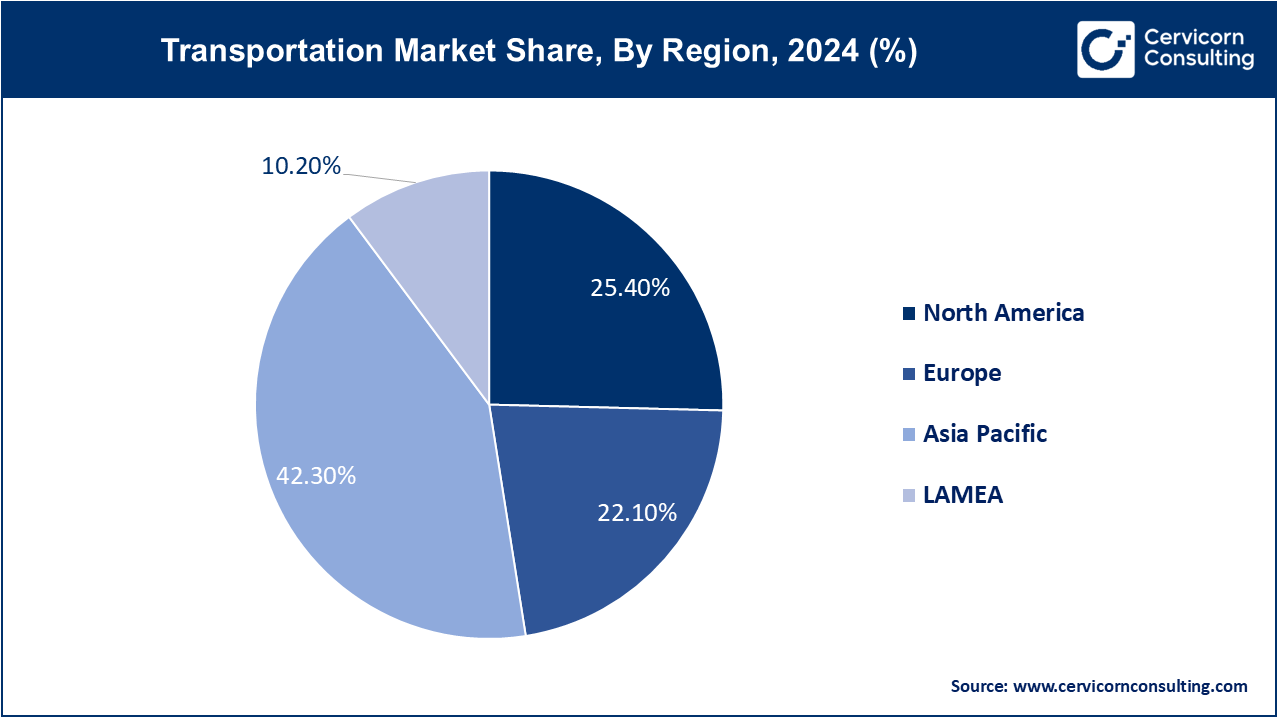

The transportation market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

The North America transportation market size was estimated at USD 2.17 trillion in 2024 and is expected to reach around USD 4.38 trillion by 2034. North America holds a significant share, due to its mature infrastructure, early technology adoption, and government policies that promote smart mobility. The U.S. is the leading country in the region, investing in self-driving cars, electric vehicles, smart traffic systems, and eco-friendly logistics. The U.S. Bipartisan Infrastructure Law allocates more than $600 billion to upgrade roads, railways, public transport, and EV charging infrastructure, fueling market modernization. Moreover, the growth of e-commerce and the increasing demand for efficient freight logistics have led to warehouse automation and the expansion of last-mile delivery services. Canada's focus on sustainable transportation and the efficiency of cross-border logistics with the U.S. also contributes to regional market expansion.

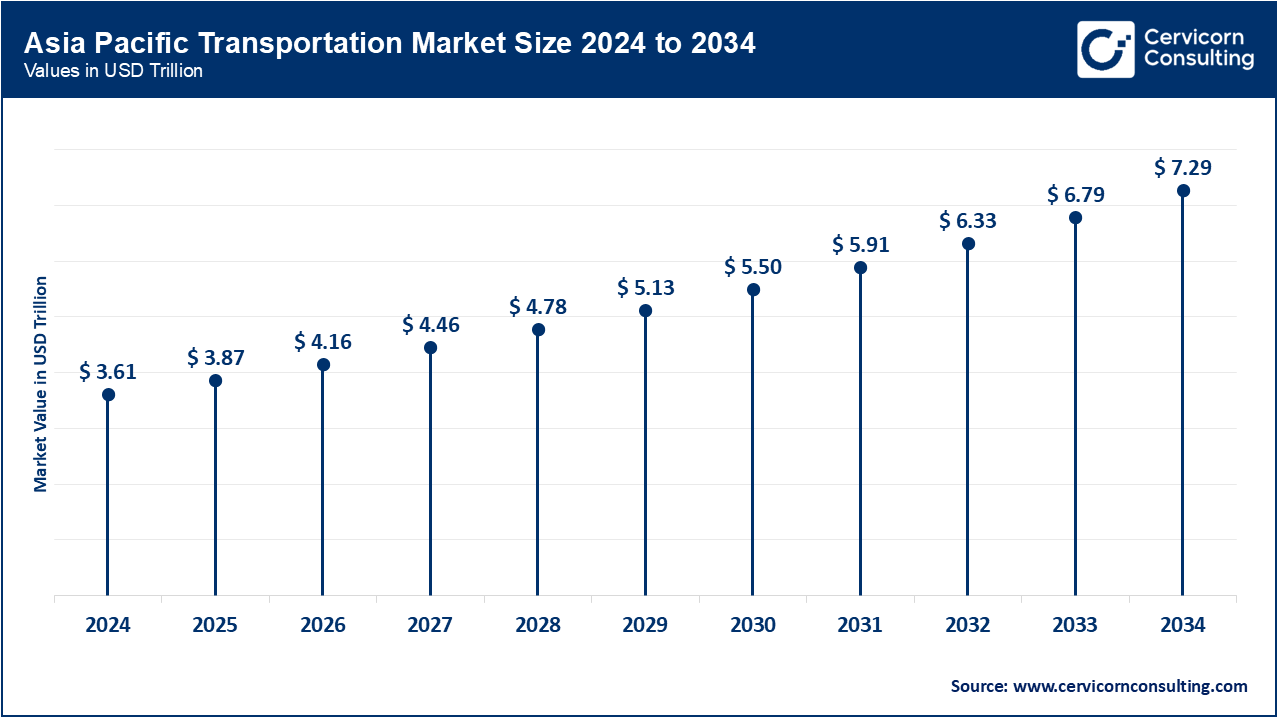

The Asia-Pacific transportation market size was accounted for USD 3.61 trillion in 2024 and is projected to surpass around USD 7.29 trillion by 2034. The Asia-Pacific region is the fastest-growing market, driven by rapid urbanization, a growing population, and government expenditure on infrastructure and smart mobility. China, India, Japan, and South Korea are the leading countries investing substantially in metro, high-speed rail, urban air mobility, and electric vehicles. China's "Belt and Road Initiative" continues to enhance cross-border transport and trade infrastructure, while India's Gati Shakti program targets integrated logistics and road networks. Furthermore, Japan and South Korea are at the forefront of developing autonomous vehicles and digitizing public transportation. The rapidly expanding e-commerce market in APAC, coupled with the increasing demand for cost-effective freight and passenger services, is set to drive market growth further.

The Europe transportation market size was reached at USD 1.89 trillion in 2024 and is predicted to hit around USD 3.81 trillion by 2034. Europe’s transportation market is being reshaped by a focus on sustainability, digitalization, and regulatory changes. The European Green Deal and initiatives like "Fit for 55" seek to cut emissions by revolutionizing mobility systems with electric vehicles, rail freight growth, and low-emission zones. Germany, France, and the Netherlands are investing in electric bus fleets, intelligent ticketing systems, and intermodal transport centers. The EU's Mobility Strategy further promotes cross-border digital rail networks and port electrification. Supported robustly by both the public and private sectors, Europe is at the forefront of developing greener, networked, and efficient transport.

The LAMEA transportation market was valued at USD 0.87 trillion in 2024 and is anticipated to reach around USD 1.76 trillion by 2034. LAMEA is an emerging region, witnessing growing investments in road, rail, and urban transit infrastructure. Latin American nations such as Brazil and Mexico are developing logistics networks to facilitate regional trade and alleviate congestion. In the Middle East, the UAE and Saudi Arabia are undertaking grand-scale smart mobility initiatives like hyperloop networks, autonomous vehicles, and airport upgrades as part of their future visions (e.g., Saudi Vision 2030). Africa is experiencing incremental advancements in transport via partnerships and investment in road connectivity and freight corridors. In spite of financial and regulatory problems, increasing urbanization and public-private partnerships are slowly improving infrastructure for transportation in LAMEA.

The competitive landscape of the transportation industry, particularly in the advanced air mobility and electric aviation segment, is marked by intense innovation and strategic partnerships among key players. Companies like Joby Aviation, Archer Aviation, Lilium GmbH, and Vertical Aerospace are setting the pace with strong R&D pipelines and successful flight testing, offering to commercialize electric air taxis in urban settings. Volocopter and EHang are concentrating on pilot operations and regulatory approvals in Singapore and Guangzhou, respectively. Firms like Wisk Aero and Beta Technologies are developing autonomous flight technology, while Embraer's Eve Air Mobility and Bell Textron introduce established aerospace experience into the fray. Automaker-backed Supernal and innovation-focused Urban Aeronautics are adding to the competitive landscape with differentiated vehicle designs and ecosystem creation. The market is being increasingly influenced by partnerships with governments, infrastructure providers, and regulators to drive faster deployment and achieve first-mover benefits.

Market Segmentation

By Mode of Transportation

By Service Type

By End-User

By Region