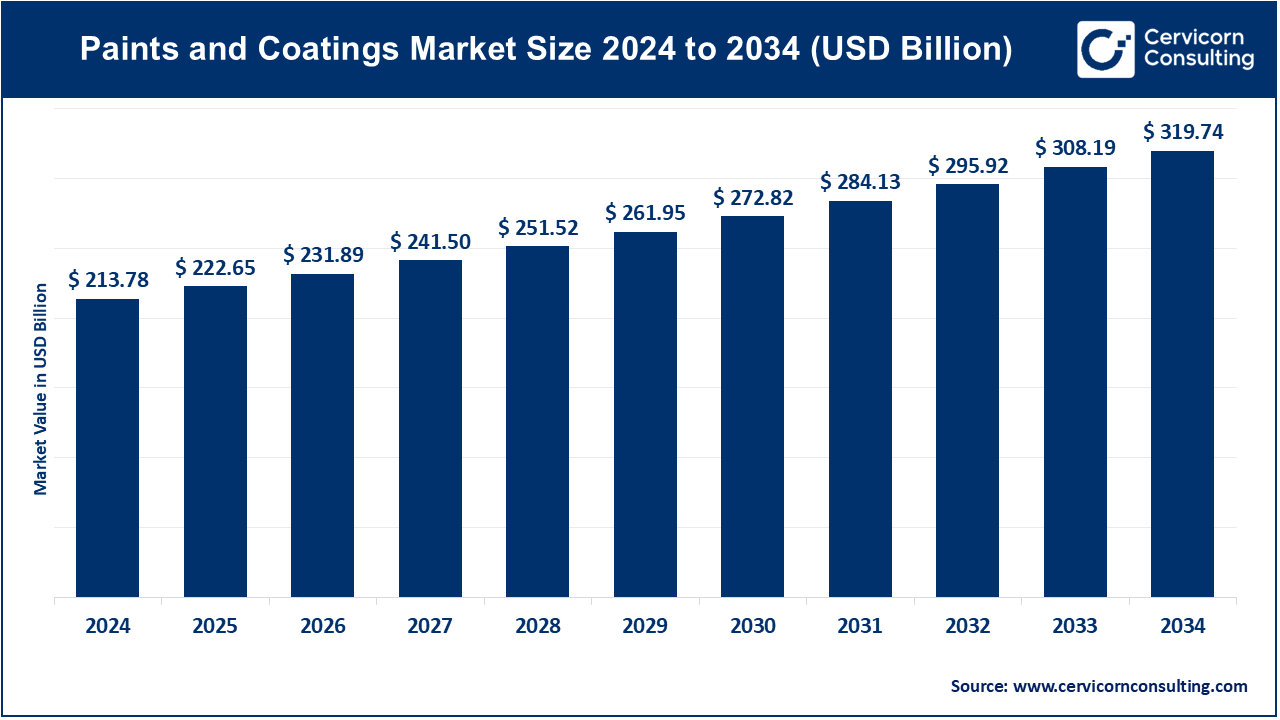

The global paints and coatings market size was valued at USD 222.65 billion in 2025 and is expected to be worth around USD 332.30 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.09% over the forecast period 2026 To 2035. The global paints and coatings industry is evolving rapidly, fueled by demand from critical sectors such as automotive, infrastructure, aerospace, consumer goods, and industrial manufacturing. These products not only enhance aesthetics but provide vital functional properties such as corrosion resistance, UV shielding, thermal insulation, anti-bacterial protection, and environmental durability. Rapid urbanization and infrastructure development in emerging economies, particularly in Asia-Pacific, are fueling the demand for decorative and protective coatings. The growth of the automotive industry, driven by rising consumer incomes and vehicle ownership, has also led to increased use of high-performance coatings for durability and aesthetic appeal. Additionally, government initiatives for smart cities and sustainable infrastructure are further boosting market demand. Environmental concerns and evolving consumer preferences have led to a surge in demand for eco-friendly and sustainable coating solutions, such as water-based and low-VOC formulations. Technological advancements, including the development of nanotechnology-based and self-healing coatings, are opening new opportunities in sectors like healthcare and electronics.

The paints and coatings market involves the production and distribution of various types of paints and coatings used for protection, aesthetics, and functionality across multiple industries. This market is segmented by product type, technology, resin type, application, and region. Key product types include architectural, industrial, and specialty coatings. Technologies like water-based, solvent-based, powder, and UV-cured coatings cater to diverse applications such as construction, automotive, aerospace, and marine. Driven by urbanization, infrastructure development, and industrial growth, the market is expanding, with sustainability and innovation playing crucial roles in meeting evolving consumer and regulatory demands.

Government & Policy Drivers

Governments globally are actively supporting the paints and coatings ecosystem through regulatory incentives, trade agreements, and infrastructure investment.

Key Initiatives:

Key Global Trends Reshaping the Paints and Coatings Market

What is paints and coatings?

Paints and coatings are substances applied to surfaces to protect, decorate, or provide specific functional properties such as corrosion resistance, waterproofing, or UV protection. They consist of four primary components: binders, pigments, solvents, and additives. Paints are used mainly for decorative purposes, offering aesthetic appeal, while coatings focus on functional applications, like industrial protection or surface enhancement. The types of paints and coatings include water-based, solvent-based, powder coatings, and specialty coatings. Water-based paints are eco-friendly and widely used in residential and commercial projects, while solvent-based coatings are valued for their durability and weather resistance. Powder coatings are applied without solvents, ensuring eco-efficiency, and specialty coatings cater to niche needs, such as heat resistance or anti-fouling properties.

Global Trade & Export-Import Performance

| Region | Key Data Point (2024) |

| United States | Exported USD 2.8 billion worth of paint and coatings products; positive trade surplus of USD 1.6 billion |

| Top Export Markets (U.S.) | Canada (USD 1.24 Bn), Mexico (USD 722 Mn), China (USD 127 Mn), Japan (USD 52 Mn), South Korea (USD 46 Mn) |

| India | Exports under HS Code 39069090 primarily to APAC, GCC, and Africa, driven by coating emulsions and additives |

| Top Exporting Indian Ports | Nhava Sheva, Mundra, Chennai – major hubs for bulk coating chemicals |

| Global Demand Trend | Countries are diversifying away from China — India is emerging as the preferred alternate sourcing destination |

Advancements in Nanotechnology:

Rising Demand in the Marine Industry:

Fluctuating Raw Material Prices:

Complex Regulatory Environment:

Growth in the Renewable Energy Sector:

Development of Eco-Friendly and Biodegradable Coatings:

Intense Competition and Market Saturation:

Environmental Impact and Waste Management:

Acrylic: Acrylic resins are known for their versatility, durability, and UV resistance, making them popular in both interior and exterior paints. They offer excellent color retention and weather resistance. Trends include the increased use of water-based acrylics for eco-friendly solutions and advancements in formulation to enhance performance and reduce VOC content.

Alkyd: Alkyd resins are traditional and widely used for their excellent gloss, hardness, and durability. They are commonly found in oil-based paints and coatings. Trends include a shift towards modified alkyds that improve drying times and lower environmental impact, as well as their use in industrial and protective coatings.

Polyurethane: Polyurethane resins offer superior abrasion resistance, flexibility, and chemical resistance. They are used in high-performance coatings for automotive, industrial, and wood applications. Trends include the development of waterborne polyurethane coatings to meet environmental regulations and advancements in formulations for enhanced durability and application ease.

Epoxy: Epoxy resins are valued for their strong adhesion, chemical resistance, and mechanical properties. They are commonly used in industrial coatings, protective coatings, and floorings. Trends include the development of low-VOC and fast-curing epoxy formulations to improve performance and environmental compliance, as well as their use in advanced applications like aerospace and marine coatings.

Polyester: Polyester resins are known for their excellent weather resistance, gloss, and hardness, making them suitable for both decorative and protective coatings. Trends include the growing use of powder polyester coatings for metal surfaces and advancements in high-performance polyesters for automotive and architectural applications.

Others: The "Others" segment includes various specialty resins such as silicone and vinyl. Silicone resins offer exceptional heat resistance and durability, while vinyl resins are used for their water and chemical resistance. Trends involve the development of these specialty resins for niche applications and innovations to enhance their performance characteristics in specific environments.

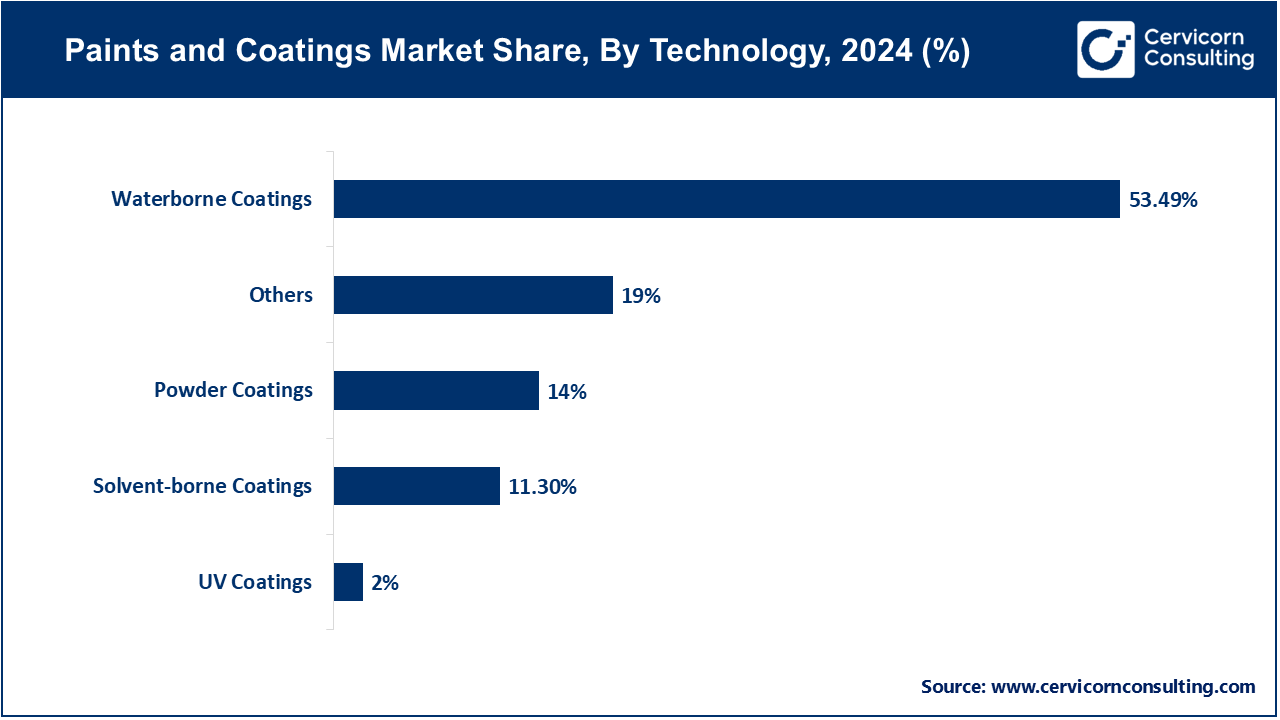

Water-based Coatings: Water-based coatings segment has reported revenue share of 53.49% in 2025. Water-based coatings use water as the primary solvent, making them more environmentally friendly compared to solvent-based alternatives. They offer low VOCs and easier cleanup. Trends include growing adoption due to stringent environmental regulations and consumer preference for sustainable products. Advances in formulation technology are improving performance characteristics such as durability and coverage, enhancing their market appeal.

Solvent-based Coatings: Solvent-based coatings segment has calculated revenue share of 11.30% in 2025. Solvent-based coatings utilize organic solvents to dissolve resins, providing strong adhesion and durability. They are valued for their excellent finish and resistance properties. Trends include a gradual shift towards water-based and low-VOC coatings due to environmental concerns, though solvent-based coatings remain popular for their superior performance in specific applications. Innovations aim to reduce VOC content while maintaining quality.

Powder Coatings: Powder coatings segment has registed revenue share of 14% in 2025. Powder coatings are applied as a dry powder and cured under heat to form a solid coating. They offer excellent durability, resistance to chipping, and minimal environmental impact. Trends include increasing use in industrial applications due to their efficiency and eco-friendliness. Advances in powder coating technology are expanding their applications to more decorative and complex surfaces.

UV-Cured Coatings: UV-Cured coatings segment has garnered revenue share of 2% in 2025. UV-cured coatings cure rapidly when exposed to ultraviolet light, resulting in quick drying and high durability. They are used for various applications, including automotive and electronics. Trends include growth driven by the demand for faster production times and high-performance finishes. Technological advancements are improving UV-cured coatings' versatility and adhesion properties.

Others: Other segment has generated revenue share of 19% in 2025. This segment includes specialized coatings like silicone, fluoropolymer, and high-temperature coatings. Trends involve the development of advanced formulations for niche applications, such as extreme weather conditions and high-temperature environments. Innovations focus on enhancing performance characteristics and expanding the range of applications, catering to specific industry needs and regulatory requirements.

Construction: The construction application of paints and coatings includes exterior and interior finishes for residential, commercial, and infrastructure projects. Trends involve the growing demand for eco-friendly, high-performance coatings with properties such as durability, weather resistance, and low VOC emissions. Innovations like self-cleaning and antimicrobial coatings are becoming increasingly popular, enhancing both functionality and aesthetic appeal in construction.

Automotive: In the automotive sector, paints and coatings are used for both protective and decorative purposes, including finishes for vehicles and components. Trends include the adoption of advanced coatings with improved scratch resistance, corrosion protection, and color customization. Innovations such as nano-coatings and high-performance finishes are driven by consumer demand for enhanced vehicle appearance and durability.

Aerospace: Aerospace coatings are crucial for protecting aircraft and spacecraft from harsh environmental conditions and ensuring structural integrity. Trends involve the development of lightweight, high-performance coatings that offer resistance to extreme temperatures, UV radiation, and chemicals. Innovations focus on enhancing fuel efficiency and reducing maintenance costs while meeting stringent safety and performance standards.

Marine: Marine coatings protect ships, boats, and offshore structures from corrosion, fouling, and environmental damage. Trends include the increasing use of anti-fouling and anti-corrosive coatings to improve vessel performance and reduce maintenance. Innovations in this segment focus on developing durable, eco-friendly coatings that enhance fuel efficiency and extend the lifespan of marine assets.

Industrial: Industrial coatings are used to protect machinery, equipment, and infrastructure from wear, corrosion, and chemical exposure. Trends include the growing demand for coatings that offer high durability, resistance to harsh environments, and ease of maintenance. Advances in technology are leading to the development of specialized coatings for specific industrial applications, enhancing performance and reducing downtime.

Packaging: In the packaging industry, paints and coatings are applied to containers and packaging materials for protection, decoration, and compliance with safety regulations. Trends include the shift towards sustainable and recyclable coatings that meet regulatory standards and consumer preferences for eco-friendly products. Innovations focus on improving the functionality and aesthetics of packaging while reducing environmental impact.

Furniture: Furniture coatings are applied to enhance the appearance and durability of wood, metal, and other materials. Trends include the growing demand for water-based and low-VOC coatings that offer superior finishes and environmental benefits. Innovations in this segment focus on achieving high-quality aesthetics, improved scratch resistance, and easy maintenance for various types of furniture.

Others: The "Others" segment includes diverse applications such as electronics, textiles, and sports equipment. Trends involve the development of specialized coatings that meet unique performance requirements, such as conductivity, flexibility, or abrasion resistance. Innovations are driven by the need for customized solutions that enhance the functionality and durability of products in various niche markets.

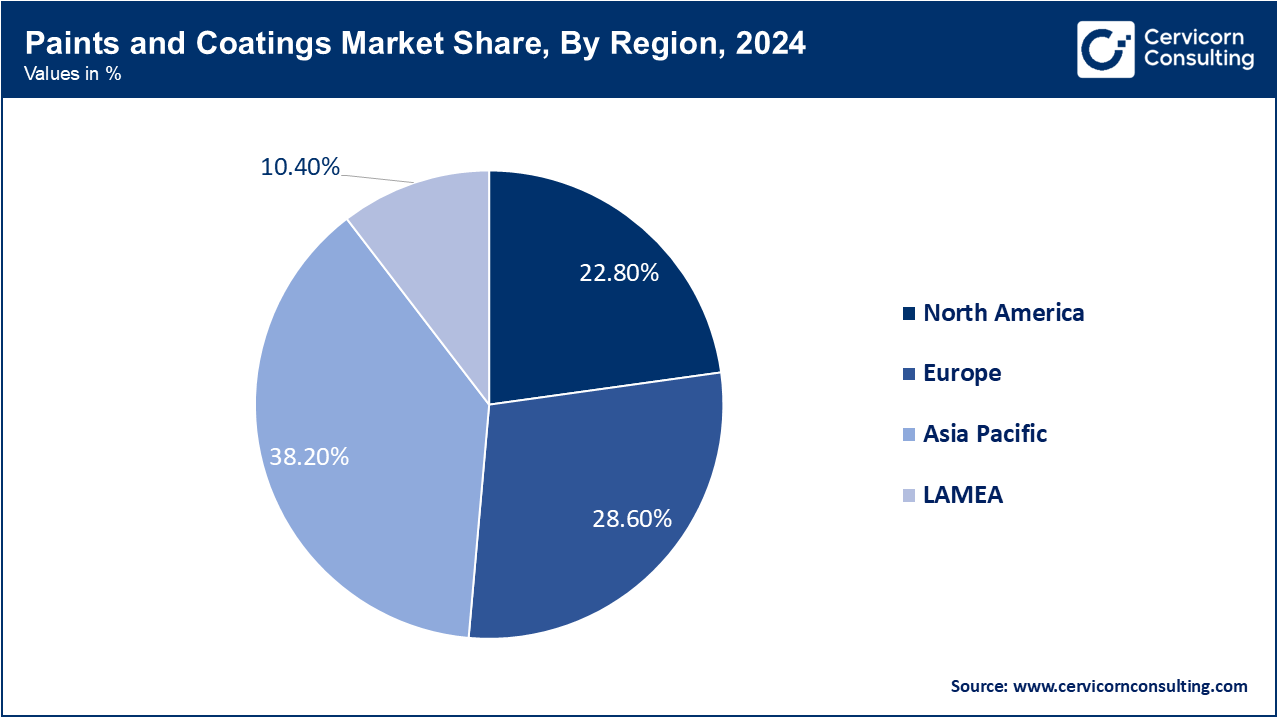

The North America paint and coating market was valued at USD 50.65 billion in 2025 and is projected to grow USD 75.60 billion by 2035. In North America, the paints and coatings market is driven by advancements in technology and a focus on sustainability. Trends include the increasing adoption of eco-friendly and low-VOC coatings due to stringent environmental regulations. The region also sees growth in the automotive and construction sectors, with innovations in high-performance and durable coatings that meet industry demands for aesthetics and functionality.

The Europe paint and coating market was measured at USD 63.83 billion in 2025 and is projected to grow USD 95.27 billion by 2035. Europe's paints and coatings market is characterized by a strong emphasis on environmental sustainability and regulatory compliance. Trends include the rise of green and bio-based coatings as the region enforces stricter environmental regulations. Additionally, there is a growing demand for high-performance coatings in automotive and industrial applications, driven by the need for advanced solutions to enhance efficiency and reduce environmental impact.

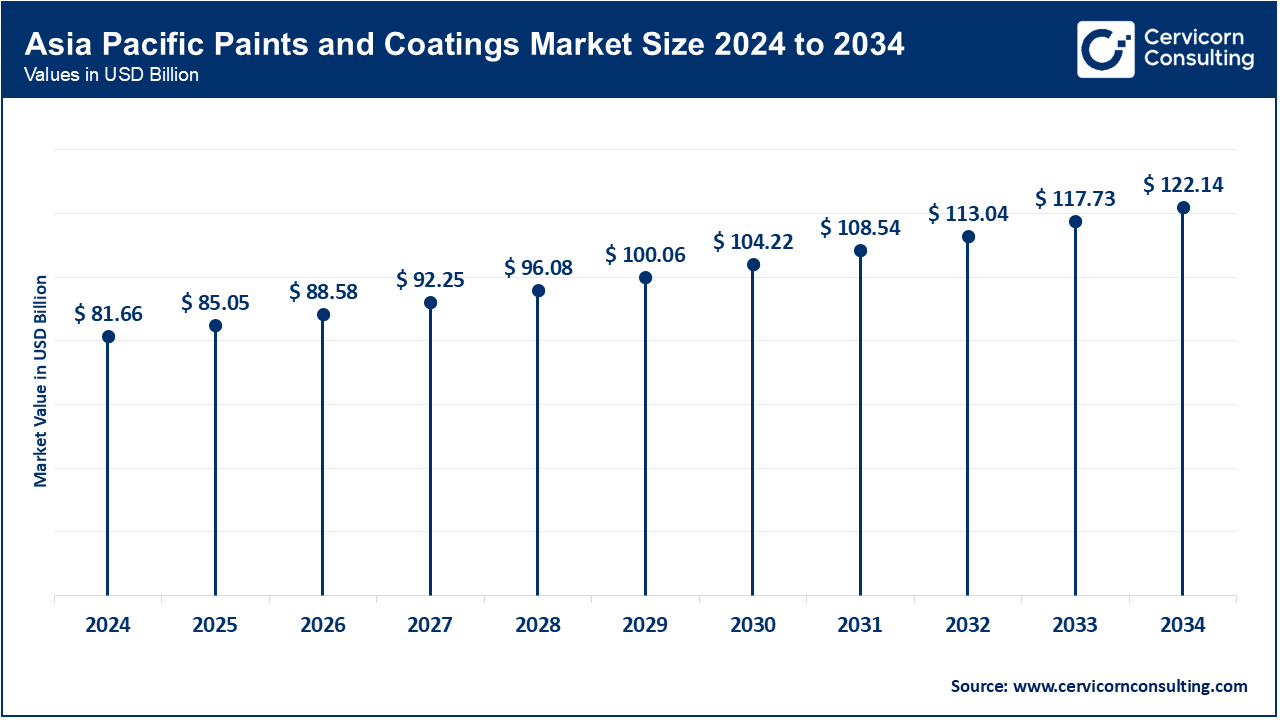

The Aisa-Pacific paint and coating market was reported at USD 84.94 billion in 2025 and is predicted to grow USD 126.77 billion by 2035. In the Asia-Pacific region, rapid industrialization and urbanization are key drivers for the paints and coatings market. Trends include the growing demand for architectural coatings in emerging economies as infrastructure projects and residential developments increase. Additionally, the region is experiencing a rise in automotive and industrial coating applications, with a focus on cost-effective and durable solutions to support expanding manufacturing sectors.

The LAMEA region is seeing growth in the paints and coatings industry driven by infrastructure development and industrial expansion. Trends include increased investments in construction and manufacturing sectors, leading to higher demand for protective and decorative coatings. In the Middle East and Africa, there is also a focus on coatings that offer durability and resistance to extreme environmental conditions, supporting the region's diverse industrial needs.

New players entering the paints and coatings market are focusing on innovation through advanced formulations and sustainable solutions. Companies like Farrow & Ball and Made of Air are pioneering eco-friendly coatings with minimal environmental impact. Key players dominating the market include AkzoNobel, BASF, and Sherwin-Williams, who lead with extensive R&D investments and broad product portfolios. They focus on technological advancements, such as high-performance and low-VOC coatings, ensuring high-quality products that meet diverse industrial and consumer needs, maintaining their competitive edge in the global market.

Market Segmentation

By Resin

By Technology

By Application

By Region