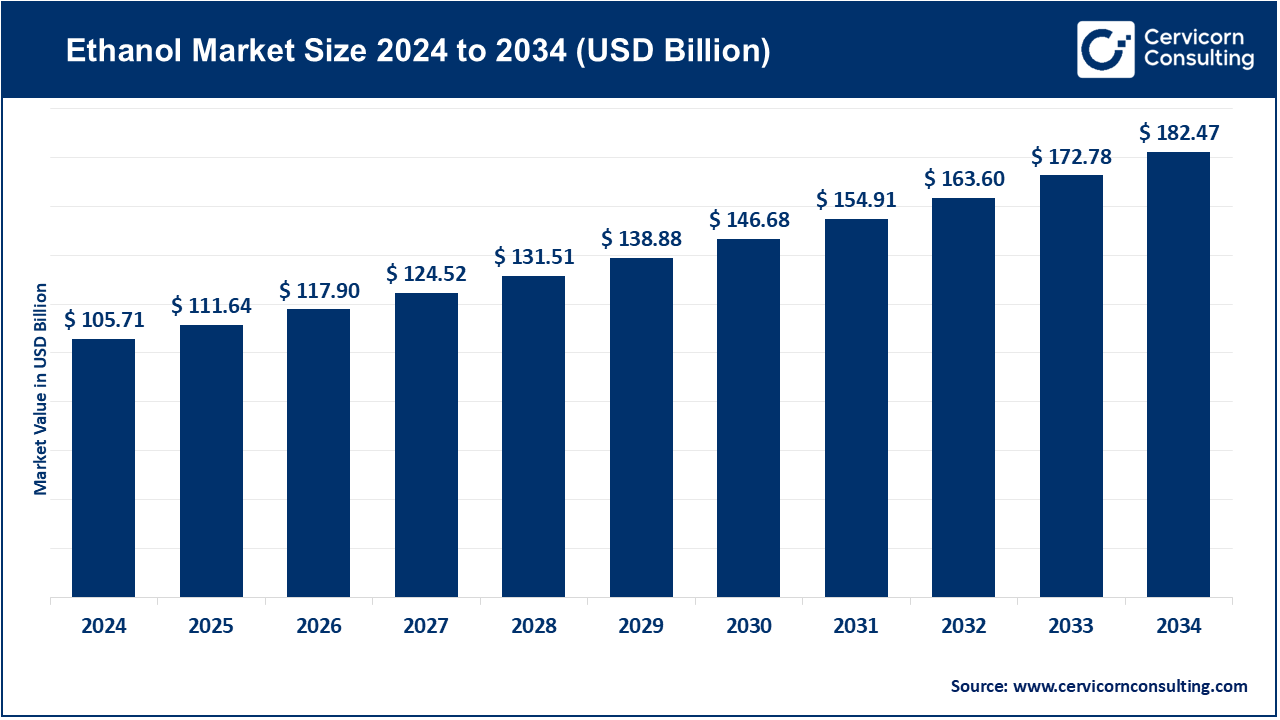

The global ethanol market size was valued at USD 105.71 billion in 2024 and is estimated to reach around USD 182.47 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.61% over the forecast period from 2025 to 2034. The ethanol market is experiencing intense growth due to the fast industrialization, urbanization, and the increasing demand by the automotive, energy, and chemical industries. Automation, AI-powered production systems, and digital twin are all increasingly used to make the industry more efficient in its operations, optimize quality, and minimize carbon emissions. To achieve sustainability and energy transition, governments in the world are encouraging biofuel projects, funding new technologies in producing ethanol, and implementing practices in the circular economy.

Meanwhile, intelligent production and ionic monitoring systems are assisting manufacturers to streamline energy consumption, maintain uniform quality, and reduce wastage. The firms are heavily investing in the production of low-carbon ethanol, second-generation biofuels, and use of renewable feedstock to fulfill the changing environmental regulations. New value chains of clean energy and carbon neutrality based on collaborations between energy producers, automakers, and biofuel companies are also being established. Consequently, the Ethanol Market is becoming a long-term growth and digitally-enhanced, sustainable and innovation-driven ecosystem by gradually replacing the traditional biofuel segment.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 111.64 Billion |

| Estimated Market Size in 2034 | USD 182.47 Billion |

| Projected CAGR 2025 to 2034 | 5.61% |

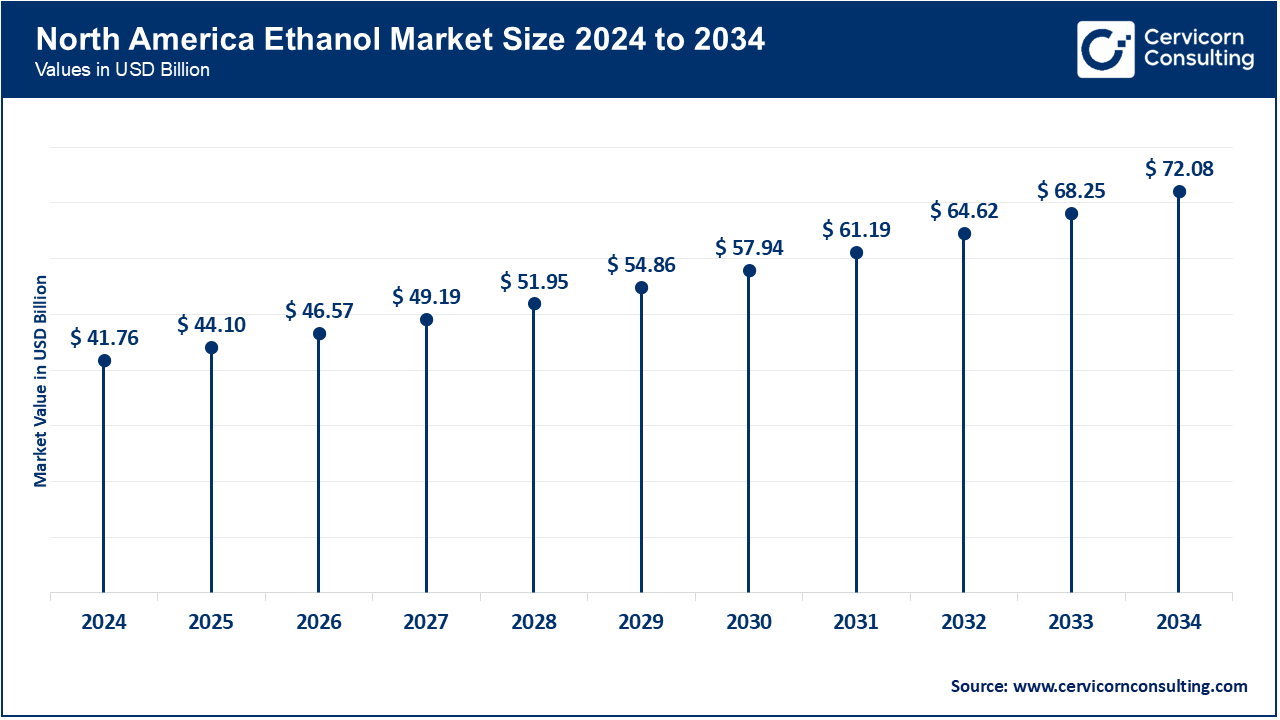

| Prime Region | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Source, Technology, Application, Region |

| Key Companies | Archer Daniels Midland Company (ADM), POET LLC, Green Plains Inc., Valero Energy Corporation, Flint Hills Resources, Raízen S.A., Petrobras, BP pl, Praj Industries Ltd., Shell plc |

The ethanol market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America is still among the most developed and technologically advanced in the world ethanol market. The US is the leader in terms of massive production of ethanol based on corn with robust federal biofuel requirements and renewable fuel infrastructure investments. There is also increasing use of second-generation (2G) ethanol plants that use cellulosic feedstock like corn stover and agricultural wastes in the region. Canada is boosting its biofuel blending efforts and spreading sustainable aviation fuel (SAF) which is made using ethanol. There is an innovation spurred by strategic partnerships between fuel producers, auto companies and renewable energy companies; especially in the areas of carbon capture, and process optimization with AI. The government subsidies in low-carbon technologies and clean fuel policies also enhance the leadership of North America in the production and consumption of ethanol.

Europe is a dynamic market in ethanol fuels that is motivated by strict sustainability laws and the efforts of the EU to be carbon neutral. Countries like Germany, France and U.K are key players and they are laying stress on bioethanol as a form of renewable transport energy. The region is considering diversifying its feedstock resources which includes waste products, cellulosic feedstock to decrease dependence on food crops. Fermentation and biorefinery technologies are being developed by major research institutions and companies in order to increase the yields and efficiency of ethanol. The use of ethanol in higher biofuels and synthetic fuels to power aircraft and shipping fleets is picking up. The focus on the practices of the circular economy and decreasing greenhouse gas emissions in Europe places it as one of the worldwide innovators of sustainable ethanol production.

Asia-Pacific is growing at a fastest pace as it is characterized by the high rate of industrialization, urbanization, and increased energy demand. Such countries as India, China, and Thailand are actively increasing ethanol blending programs to decrease the import of crude oil and facilitate clean fuel programs. The move by India towards the goal of a 20% ethanol mix is supported by massive investments in the first and second-generation biorefineries. China remains invested in ethanol made out of corn as well as cassava, Japan and South Korea are looking to use ethanol fuel in aviation. Public-private partnerships are also increasing production in the southeast Asian countries such as Indonesia and Vietnam. Asia-Pacific presents a large development hotspot in the ethanol industry due to the large quantity of agricultural residues, good policy frameworks, and increased renewable energy integration.

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 39.50% |

| Europe | 29.40% |

| Asia-Pacific | 23.60% |

| LAMEA | 7.50% |

The LAMEA region is rising because of its large agricultural foundation and the new renewable energy objectives. Brazil is leading Latin America in ethanol production based on sugarcane, facilitated by the use of flex-fuel vehicles and bioenergy. Other countries like Argentina and Colombia are also developing ethanol initiatives by use of sustainable sugar and corn feedstock. Saudi Arabia and UAE are the countries in the Middle East that are considering using ethanol as an option in their clean fuels diversification. Small scale or medium scale production plants of ethanol are being established in African nations such as South Africa, Kenya, and Nigeria to cut down on reliance on fossil fuel, as well as generate opportunities to the locals. Increased government sponsorship, renewable energy and investor backing, and trans-border technology transfer is making LAMEA a prospective frontier in ethanol production.

Sugarcane: Sugarcane has been the most popular feedstock used in the manufacture of ethanol especially in Brazil and India. Availability of sugarcane juice and molasses guarantees production of ethanol in large quantities at very cheap production costs. Its role has been enhanced by government biofuel requirements and blending schemes. By 2025, sugarcane-ethanol would contribute a significant portion of the global ethanol production from bioethanol, as the relentless process of expanding the facility and increasing fermentation yields streamlined the process. Manufacturers are also laying emphasis on the use of bagasse in production of power to boost sustainability and energy self-sufficiency.

Corn: In North America, corn-based ethanol remains the leader and it has been sustained by highly developed dry- and wet-milling methods. The U.S. is the largest world producer and the investments are into carbon capture, low-water-use fermentation, and increase in yield. Corn ethanol is also a source of the expanding market in co-products that include DDGS (Distillers Dried Grains with Solubles ) to be fed to livestock as a high-protein source of food. The current trend of carbon intensity reduction pursuant to the U.S. Renewable Fuel Standard (RFS) and Inflation Reduction Act is contributing to the better performance of the lifecycle emissions by producers.

Wheat: The production of ethanol using wheat is on the increase especially in Europe and in some areas of Asia. It gives flexibility to ethanol producers particularly in low corn supply or high prices. European Union still contributes to the development of wheat ethanol with the clean transport fuel targets and sustainability certification schemes. The advances in technology of the yeast strains and continuous fermentation are increasing the yield of ethanol and recovery of by-products.

Barley: Ethanol obtained as a product of barley is gaining popularity in those regions where the climate is colder, like in Northern Europe or Canada. Barley being a niche feedstock, nevertheless, has drought and low-quality soil resistance. The studies are concerned with the enhancement of the efficacy of the process of starch extraction, as well as the combination of biorefineries to convert several grains at the same time to the creation of ethanol and bio-based chemicals.

Molasses: Molasses as a by-product of sugar production is also a significant feedstock in ethanol in Asia-Pacific, and Latin America. Its affordability and the fact that it is compatible with the current distillery infrastructure have made it the choice in the developing economies. Firms are embracing continuous fermenting and the use of low energy consumption distillation to lower the cost of production and increase ethanol purity. The mix of the necessity and the export of goods are also increasing demand.

Denatured Ethanol: Denatured ethanol which is mainly a solvent in the industry and a fuel constitutes a major share of the market. It is also commonly utilized as a process gasoline blending (E10, E20, E85) and in the industrial market like in paints, coatings and cleaning agents. As the need to use biofuels in the transport industry keeps increasing, the manufacture of denatured ethanol has been booming both in the developed and the emerging economies. The high-quality standards and low-carbon fuel certification plans are also promoting the use of technology and traceability platforms in all the production units.

Market Share, By Product Type, 2024 (%)

| Product Type | Revenue Share, 2024 (%) |

| Denatured | 61.40% |

| Undenatured | 38.60% |

Undenatured Ethanol: Pure ethanol is also called undenatured ethanol, which is mostly used in drinks, pharmaceuticals, and personal care products. The high-purity ethanol has been in high demand as more sanitizers and pharmaceutical production has been going up. In Europe and Asia, there are food-grade ethanol plants being developed with sophisticated purification processes such as the multi-pressure distillation and molecular sieve dehydration that guarantee adherence to the international safety standards.

Semi-Fuel & Energy: The biggest and most rapidly expanding market, ethanol as a transportation fuel remains under the positive influence of biofuel blending initiatives and decarbonization objectives. Countries like the U.S., Brazil, India and China are increasing blending ratios and developing ethanol-to-power schemes. Alcohol-to-jet is another avenue that is being investigated as a production of sustainable aviation fuel (SAF) using ethanol. This segment is the core of global net-zero goals with the growing focus on energy transition.

Industrial: The industrial uses of ethanol are in solvents, coating and cleaning agents. Replacement of ethanol is being fueled by growth in the paints, adhesives and printing industry coupled with increased environmental regulations restricting the use of petrochemical solvents. The manufacturers are now coming up with better formulations that are more volatility-controlled and lowering VOC emissions, which sets ethanol as a green industrial solvent.

Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Fuel & Energy | 55.30% |

| Industrial | 18.40% |

| Beverage & Food | 13.70% |

| Pharmaceutical & Personal Care | 8.10% |

| Chemical Feedstock | 4.50% |

Beverage & Food: Ethanol is widely employed in drinks, flavorings as well as food preservatives. The premium beverages and flavor extraction are also growing in Europe, Asia-Pacific, and Latin America. Hygiene and quality control are causing increased use of undenatured food-grade ethanol in distilleries and food processing units.

Pharmaceutical and Personal Care: This category has also expanded consistently after the pandemic because of the consumption of ethanol in sanitizers, in medical disinfectants, and cosmetics. Pharmaceutical grade ethanol is also taken as an extraction solvent and preservative. Manufacturers are spending on developing refining technologies that can address pharmacopeia requirements in such regions as the U.S., Japan, and India.

Chemical Feedstock: Ethanol is a major raw material to the manufacture of ethyl acetate, acetic acid, and ethylene. The trend in impetus towards bio-based chemicals has made it relevant to green chemistry. The emerging trend in integrated biorefineries is on ethanol conversion to bio-ethylene to be used in plastics and packaging to enhance the goals of the circular economy.

Conventional Fermentation: Traditional sugar and starch fermentation to produce ethanol is the fastest-established path to ethanol production and it is the cornerstone of the ethanol industry. Automation of the processes, optimization of yeast and real time monitoring of the process processes are enhancing efficiency. Several producers are also embracing the use of energy recovery systems to minimize the amount of heat used when doing the distillation.

Enzyme, Cellulosic Hydrolysis: The 2G ethanol also known as advanced cellulosic technology uses the agricultural residues to develop bioethanol as an alternative to food resources. The innovation of enzymes and pre-treatment technologies is keeping costs down and enhancing the rate of conversion. Pilot plants in India, Europe, and U.S. are now running on a commercial scale and a change is brought towards the production of biofuels sustainably.

Market Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Conventional Fermentation | 58.70% |

| Cellulosic Enzymatic Hydrolysis | 20.80% |

| Gasification & Syngas Fermentation | 14.40% |

| Algal Fermentation | 6.10% |

Gasification/ Syngas Fermentation: This is a new route whereby biomass or municipal solid waste are converted to syngas and the latter is fermented to produce ethanol. It provides a long term waste-to-fuel option particularly to the cities. To further cut the number of emissions, companies are incorporating the use of carbon capture systems.

Algal Fermentation: Algal ethanol production is in the research and pilot stage and has the potential to be realized due to the high lipid and carbohydrate contents of algae. CO 2 absorption is also supported by the process and this makes it an attractive industrial decarbonization technology. Joint R&D is being executed to enhance scalability and cost effectiveness.

Market Segmentation

By Source

By Product Type

By Technology

By Application

By Region