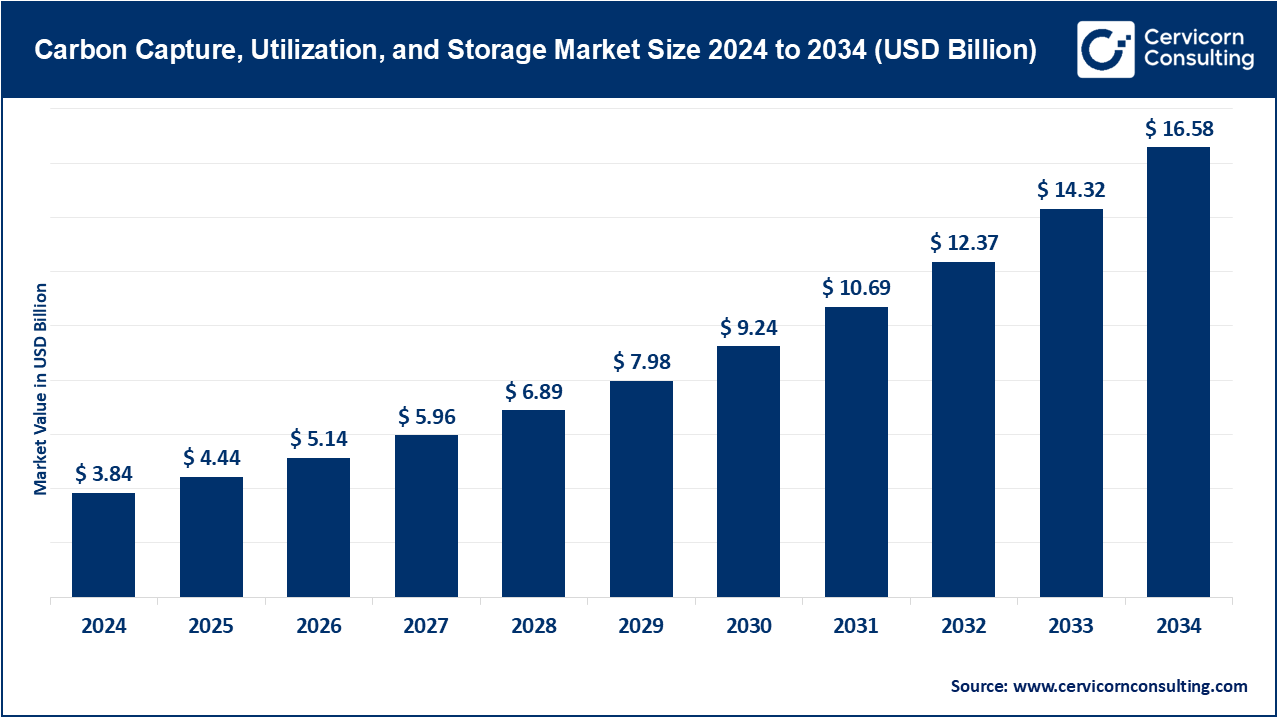

The global carbon capture, utilization, and storage market size was valued at USD 3.84 billion in 2024 and is anticipated to surpass around USD 16.58 billion by 2034, growing at a compound annual growth rate (CAGR) of 24.5% over the forecast period from 2025 to 2034.

The carbon capture, utilization, and storage (CCUS) market is picking up its pace as industries are under increasing pressure with respect to reducing climate change by adopting green operations, green certifications and net-zero pledges. Major industrial development requires more than traditional emission control practices; climate-friendly technologies need to not only minimize embodied carbon but also maximize energy efficiency, support resource circularity, and be in line with global goals set to reverse global warming. Growth in more regulatory burdens on environmental regulations, greater corporate environmental, social, and governance responsibilities, and a drive to reduce the worsening effects of global warming are also contributing to the deployment of CCUS in various industries.

What is Carbon Capture, Utilization, and Storage?

CCUS is already being relied upon to facilitate sustainable industrial transformation: intercept CO2 at source and have it turned into useful commodities or sequestered down deep in the earth where it cannot enter the atmosphere. New breakthroughs in solvent efficiency, membrane separation, direct air capture and mineralization are rendering these solutions more scalable and economical. CCUS technologies are extending to heavy industries and power generation, commercial plants and infrastructure projects, which ensures decarbonization, asset life-extension, efficiency and lifecycle emissions reduction. With the incorporation of CCUS, the industries are fast-tracking the transition to the low-carbon future ensuring economic competitiveness and achieving global climate goals.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 4.44 Billion |

| Expected Market Size in 2034 | USD 16.58 Billion |

| Projected CAGR 2025 to 2034 | 24.5% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Service, Technology, Method, Application, End User, Region |

| Key Companies | Equinor, ExxonMobil, BP, Global CCS Institute, Aker Solutions, TechnipFMC, Shell, Linde, Chevron, TotalEnergies, Air Products and Chemicals, Climeworks, Bechtel, Carbon Clean Solutions, Siemens |

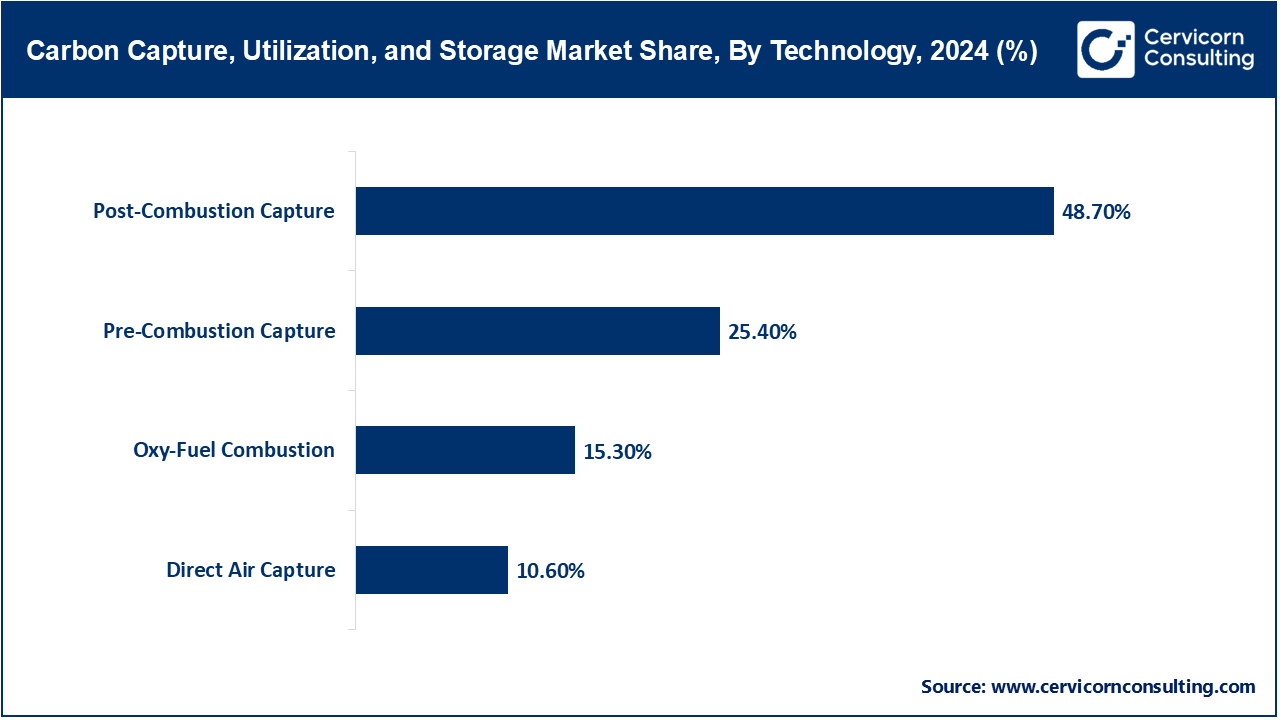

Post-Combustion Capture: The more widely used post-combustion capture method removes CO2 from flue gases once fossil fuels are burned, generally via solvents or sorbents. It has wide use in upgrading already existing power and industrial plants. Petra Nova in Texas was restarted in January 2024 with an improved version of amine-based capture technology aiming at the removal of 90 percent of the CO2 in a coal unit. It is preferred because it is sustainable to the available infrastructure and in particular in power generation and cement manufacturing.

Pre-Combustion Capture: Pre-combustion capture removes the CO2 before fuel is burned by converting the fuel to syngas and separate carbon and hydrogen before burning the syngas and other fuels. It is common in Integrated Gasification Combined Cycle (IGCC) plants. In June 2023, the Kemper County Energy Facility in Mississippi enhanced the success of its pre-combustion capture experiments to increase the efficiency of the hydrogen manufacturing process. The method is more efficient in new-build plants but needs much redesign of processes relative to post-combustion.

Oxy-Fuel Combustion: Oxy-fuel combustion burns fuel using almost pure oxygen rather than air and allows a flue gas consisting mostly of CO2 and water vapor to be more easily captured. It increases efficiency and minimizes the emission of nitrogen oxide. The Callide Oxyfuel Project in Japan shifted gears in March 2024 to show storage capacity of CO2 emitted by its oxygen coal plant. It has concentrated stream of CO2 which facilitates separation easier yet costs money to produce oxygen.

Air Direct Capture (DAC): DAC allows diffuse emissions to be removed directly and directly use CO2 gas present in the atmosphere, which can be accomplished by chemical solvents or sorbents. It is important in negative emissions strategies. Climeworks Iceland In September 2023, Climeworks opened its “Mammoth” DAC plant in Iceland, with capacity larger than the previous “Orca” system. DAC is both energy-intensive and location-flexible and enables the production of synthetic fuels.

Power Generation: CCUS in power generation involves capturing the CO2 emission into coal, gas or biomass power plants hence avoiding its emission to the atmosphere. This is one of the areas that large carbon reduction targets are focused on. In April 2024 the SaskPower company in Canada made an upgrade to its Boundary Dam Unit 3 by installing new and improved solvent technology to increase the rate of capturing CO2. These types of applications are essential to the decarbonization of electricity grids.

Industrial Processes: The industrial application consists of technologies that capture CO2 emitted by industries whose production process inevitably involves the production of emissions such as cement, steel, chemicals, etc. Holcim started to operate its cement plant CCUS system in Germany in May 2024 intending to capture 1 million tonnes each year. This category is concerned with hard-to-abate emissions that cannot be met by electrification.

Carbon Capture, Utilization, and Storage Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Power Generation | 41.30% |

| Industrial Processes | 23.20% |

| Oil and Gas | 16.10% |

| Waste Management | 11.40% |

| Others | 8% |

Oil and Gas: CCUS in oil and gas involves a capturing of CO2 in the production of refineries, LNG plants as well as petrochemical units to produce the commodity, store, or reuse. In February 2024, the ADNOC in the UAE built its Al Reyadah CCUS plant larger to capture additional fumes in the steel and gas production processes. This industry utilizes the current know-how on subsurface storage.

Waste Management: Waste management CCUS collects CO2 emitted by burning plants, waste-to-energy, or treatment of landfill gas. In August 2023, Oslo’s Klemetsrud waste-to-energy plant began installing a large-scale COâ‚‚ capture system to handle urban waste emissions. It helps to achieve the aims of a circular economy because it decreases landfill methane and CO2 emissions.

Enhanced Oil Recovery (EOR): EOR involves the use of captured carbon dioxide to increase the production of oil in aging fields as well as storing the gas in the ground. In July 2024 Occidental Petroleum doubled its operations of CO2 -EOR at Permian Basin to be combined with DAC. This is a way of integrating economic values with carbon storing.

Carbonated Beverages: The carbonation process in the food and beverage industry utilises captured CO2, meaning that the company has a safe chain supply. In October 2023, Ardagh Group collaborated with one of the UK breweries to use a CO2 produced in the nearby bioethanol plant to make carbonated beer. This lessens fertilizer dependency on industrial fossil-based CO2.

Carbon Capture, Utilization, and Storage Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Enhanced Oil Recovery | 39.50% |

| Carbonated Beverages | 20.10% |

| Building Materials | 25.40% |

| Chemicals | 15% |

Building Materials: The CO2 that has actually been captured can also be mineralized into construction materials such as concrete, bricks and aggregates making carbon permanently unavailable. In May 2024, CarbonCure technologies increased production of CO2 -injected concrete on the North American continent, which reduces the carbon footprint of building. Unlike the previous ones, this end use integrates decarbonization with innovation in material.

Chemicals: CO conquered the chemical industry where CO2 is refined into methanol, urea, and other substance chemicals. Mitsui Chemicals in Japan started operation of methanol production in March 2024 that uses CO2 it has captured and renewable hydrogen. This encourages the mitigation of emissions as well as diversification of chemical sources.

Absorption: Absorption involves absorbing CO2 by capturing it in a solvent liquid such as amines (usually) which are then subsequently regenerated to release the gas. In November 2023, Mitsubishi Heavy Industries commissioned a KS-21 amine technology in one of the Japanese biomass power plants. It is an established mature technique that is employed in post-combustion capture.

Adsorption: Adsorption involves using stationary solids such as zeolites or activated carbon to capture morsels of CO2 gases, and it serves best in small to large scale or cyclical working. Svante commissioned their solid sorbent capture facility in April 2024 in Canada to be used in the cement industry. In certain conditions, it provides less regeneration energy requirements than absorption.

Carbon Capture, Utilization, and Storage Market Share, By Method, 2024 (%)

| Method | Revenue Share, 2024 (%) |

| Absorption | 42.10% |

| Adsorption | 25.70% |

| Membrane Separation | 18.20% |

| Chemical Looping | 14% |

Membrane Separation: In this method CO2 is separated using CO2 selective membranes with respect to solubility or molecular size of the gas mixture. Air Products had started testing polymer membranes to remove CO2 in processing of natural gas in Texas in June 2023. It is space saving and modular and can fit with facilities that have limited spaces.

Chemical Looping: Chemical looping Limited metal oxides are used to move oxygen between reactors forming a pure stream of CO2 without any direct air-fuel interaction. In January 2024, the Ohio State University showed a pilot plant of coal chemical looping combustion. It generates intrinsic CO2 separation although it still remains at the early commercialisation phases.

The carbon capture, utilization, and storage market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

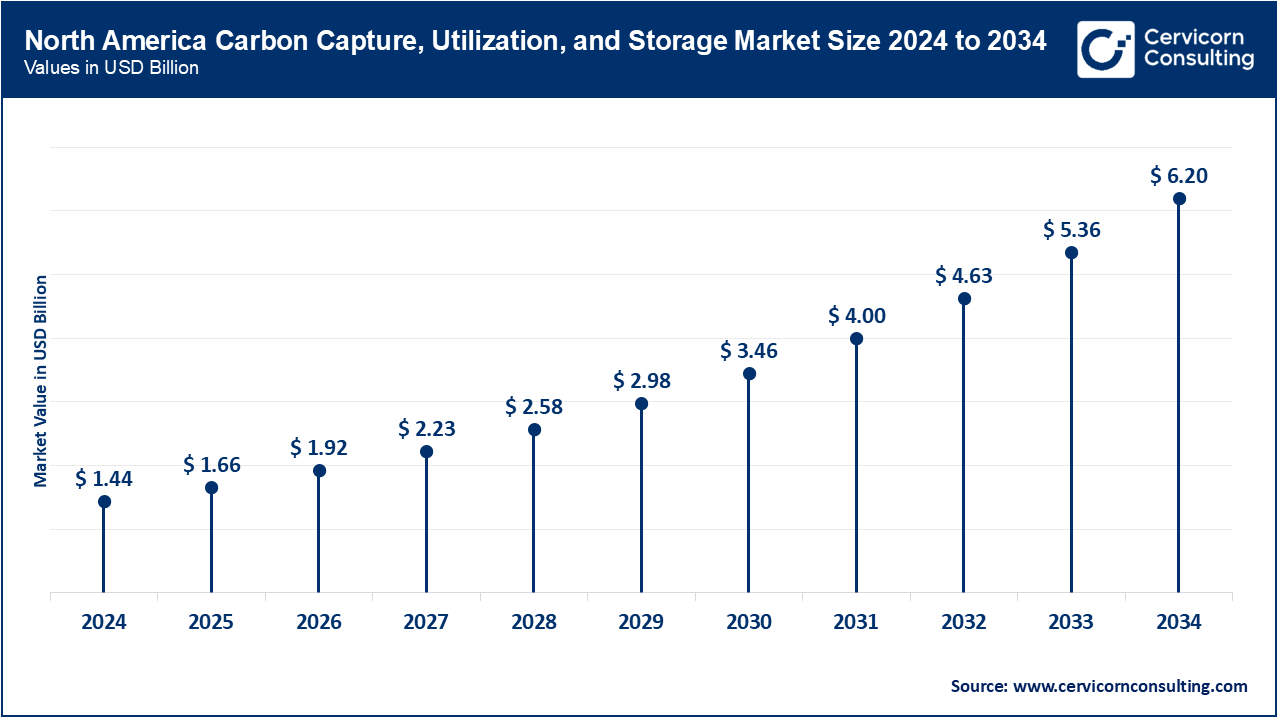

Government support through decarbonization policies as well as industrial retrofit and the adoption of CCUS in power generation and manufacturing industries have led the North American CCUS market to speed up. The projects are on the large-scale capture facilities, shared CO2 pipeline infrastructure and expansions in enhanced oil recovery (EOR). Industrial investments include investing along the path toward reduced emissions in sectors that have been labeled as hard-to cut such as cement and steel. In January 2025, officials at the U.S. Department of Energy said a large CO2 pipeline had been built in Louisiana to link a number of industrial emitters to a central storage point. This will be cementing the position of North America as a leader in commercial scalability of viable CCUS networks.

In Europe, the CCUS sector is progressing with stringent EU climate regulations, circular carbon policies and net-zero industrial policies. The focus is on cross-country deals on CO2 transportation, off-shore storage at the North Sea, and connection to the renewable production of hydrogen. To reduce expenses and derive the biggest impact, the European governments are emphasizing the use of clusters in industries, where the same CCUS infrastructure can be shared. In February 2025, the Northern Lights project in Norway inked new transport deals to sequester CO2 that could emerge at industrial plants in both France and Belgium, further cementing the European legacy in inter-state carbon management. Such efforts are establishing worldwide standards of broad-scale, collaborative decarbonization.

Asia-Pacific CCUS market is one of the fast growing markets, so we have growing industrial emissions, government support of reduction of carbon footprint and pilot projects of direct air captures and uses. The region has prioritised the integration of CCUS in the power generation, steelmaking, and chemicals, as well as offshore storage exploration. Technological alliances amid foreign companies and international leaders in CCUS development are starting to be a trend to accelerate the use. In May 2025, Japan inaugurated the first large-scale CCUS project powered by a coal-fired power plant in Hokkaido and aimed to store CO2 as well as produce methanol. These trends point to Asia-Pacific evolving in its technical capabilities on large-scale carbon management.

Carbon Capture, Utilization, and Storage Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 37.40% |

| Europe | 29.80% |

| Asia-Pacific | 25.20% |

| LAMEA | 7.60% |

The market is gaining momentum in the LAMEA CCUS market due to the growth in renewable energy development, carbon reduction endeavors in the oil and gas sector, and soaking up of CO2 in EOR and production of synthetic fuel. Middle East countries are also exploiting their experience in subsurface storage to become active leaders in initiative within the region, and Africa is pilot testing CCUS applications in cement and natural gas industries. In April 2025 the UAE commissioned a large CCUS facility at a steel plant which is expected to capture and store over 800,000 tonnes of CO2 per annum and reuse it in industry. These initiatives are making LAMEA an emerging centre of carbon capture characterisation and implementation in diverse climatic and industrial conditions.

Market Segmentation

By Service

By Technology

By Method

By Application

By End User

By Region