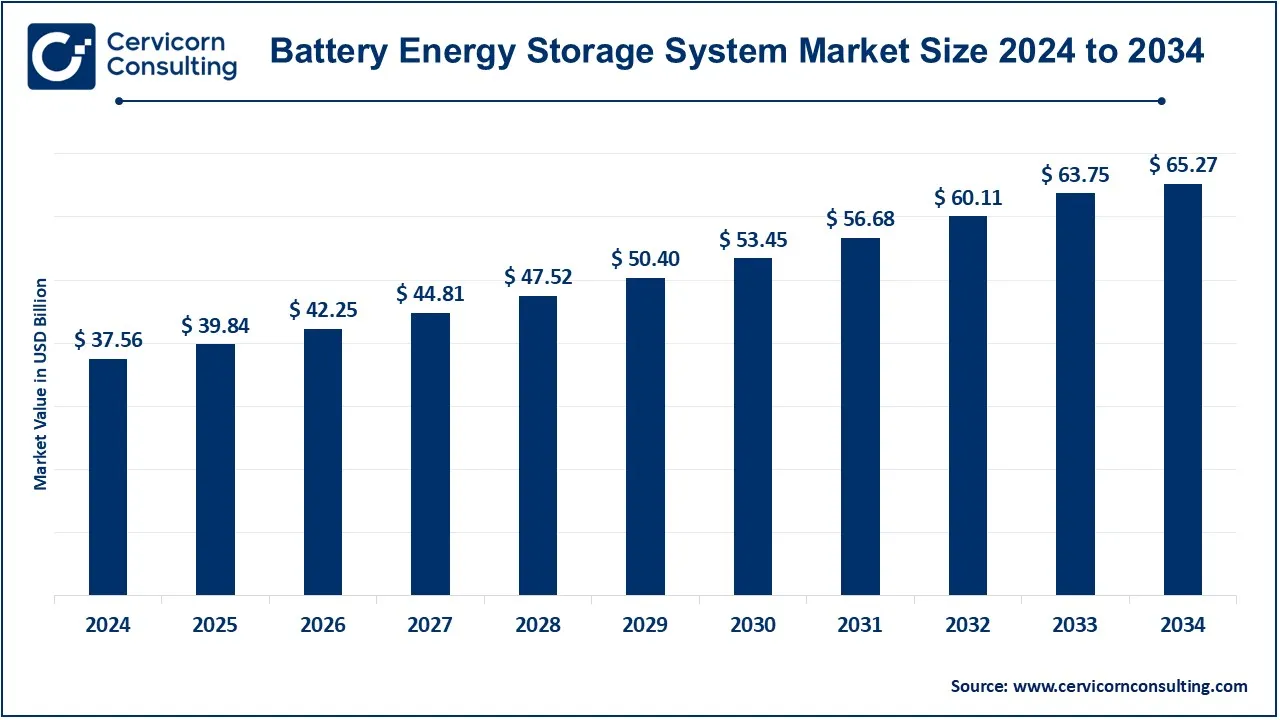

The global battery energy storage system (BESS) market size was valued at USD 39.84 billion in 2025 and is anticipated to exceed around USD 70.84 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.05% over the forecast period from 2026 to 2035.

The battery energy storage system (BESS) market is growing rapidly due to the increasing adoption of renewable energy and the rising demand for efficient energy storage solutions. Market growth is fueled by government incentives, technological advancements, and the push toward reducing carbon emissions. As of recent years, the energy storage market is expanding significantly, with projections for continued growth driven by declining battery costs and increased interest from utilities and commercial entities. The demand for BESS is anticipated to further surge in the coming years, particularly with the development of large-scale grid storage systems, and as electric vehicle (EV) adoption increases, adding more focus on energy storage infrastructure. The global transition to cleaner energy systems and the need for reliable, flexible grid solutions are key drivers of the market's expansion.

A battery energy storage system (BESS) is a system designed to store electrical energy for later use, providing backup power, load leveling, or integration with renewable energy sources. BESS typically uses rechargeable batteries like lithium-ion, lead-acid, or sodium-sulfur to store energy and discharge it when needed. These systems are increasingly used to enhance grid reliability, support renewable energy integration (such as solar or wind), and provide peak shaving to reduce energy costs. There are several types of BESS, including stationary and mobile units, with stationary systems being more common in grid-scale applications. Different battery chemistries have unique advantages, such as lithium-ion's high energy density and longer lifespan, while lead-acid batteries are less expensive but offer shorter lifespans and lower efficiency.

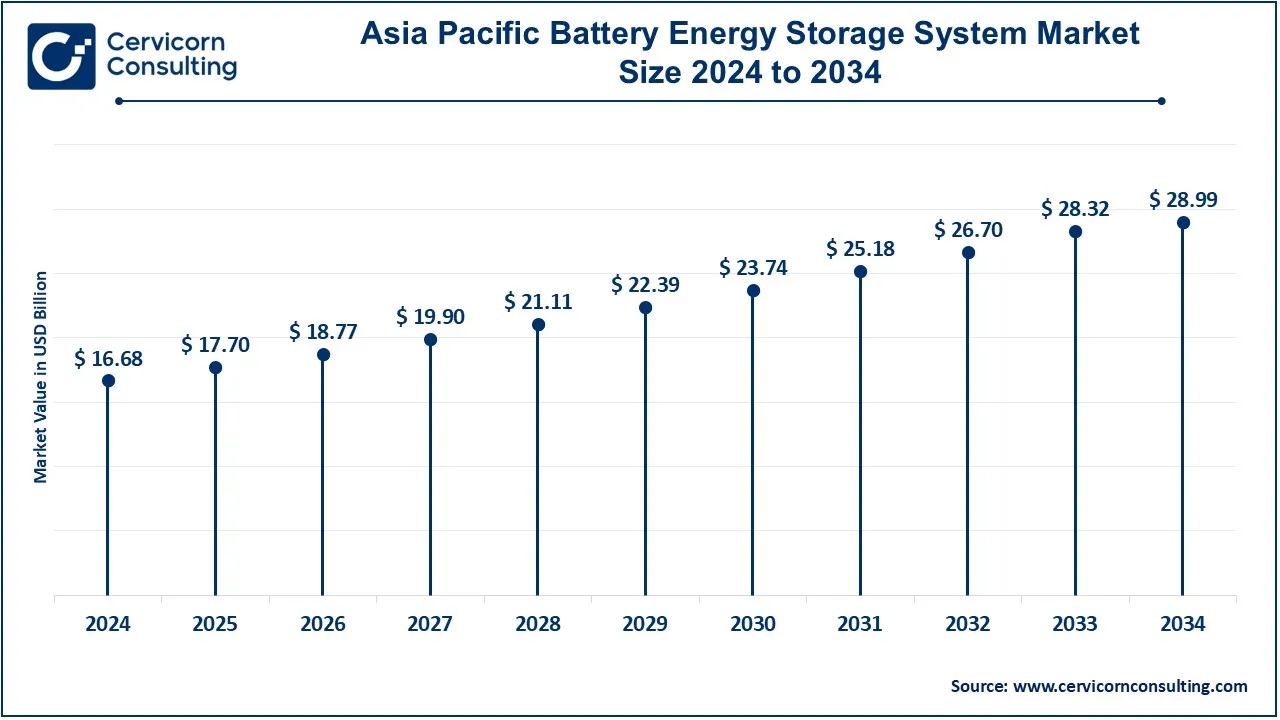

Asia Pacific is seen to grow at a rapid pace to capture a significant spot in battery energy storage system market's landscape. According to report, the region will hold 70% of the market's share by 2026. Especially, Southeast Asia is rapidly capturing the market's share with the global momentum, Singapore has already moved ahead by mandating BESS in particular projects recognizing its significance. The region's expansion is driven by rising energy adoption, energy security concerns and grid modernization efforts taken from governments as well as private sectors.

Moreover, renewable integration and grid stability demand holds a potential for the BESS market to grow. China alone added 125 GW of new renewable energy capacity in 2022, nearly 76% of new power plant capacity region-wide, creating corresponding storage demand. Reduction in the overall cost of batteries and improvement in supply chain strength creates a strong factor for the market too. Chinese companies produced 1.29 TWh of batteries in 2025 versus 843 GWh in 2024, illustrating rapid industrial expansion.

Government Support and Policies for BESS Sector in Asia Pacific

| Country | Policy/Targets | Key Highlight |

| China | Long-term capacity targets | Targeting 180 GW of BESS by 2027, doubling from an estimated 85 GW in 2024. |

| India | Viability Gap Funding Scheme (VGF) | Approved 4,000 MWh of BESS projects by FY31 with $1.12 billion initial support |

| South Korea | Capacity & market frameworks | Government plans to reach 2.22 GW BESS capacity by 2029 via auctions and industrial incentives. |

| Japan | Renewable & storage synergy | Solar on new homes mandates and first commercial grid BESS projects with trading reforms to encourage storage. |

| Vietnam | Early auctions & targets | Vietnam targeting 16.3 GW by 2030, Malaysia launched 400 MW auction rounds for dispatchable power. |

The Role of Battery Gigafactories in Driving BESS Market Growth

Battery gigafactories are playing a pivotal role in accelerating the growth of the BESS market. These large-scale production facilities, dedicated to manufacturing high-capacity batteries, are essential in meeting the increasing global demand for energy storage solutions. As the adoption of renewable energy sources like solar and wind rises, the need for efficient, scalable energy storage solutions becomes more critical to stabilize grids and ensure reliable energy distribution.

The establishment of gigafactories, especially in key regions like China, Europe, and North America, is enabling the rapid scaling of battery production. Companies such as Tesla, CATL, and Panasonic are at the forefront of this transformation, investing billions into new facilities that produce advanced lithium-ion and solid-state batteries. These factories are not only reducing production costs but also advancing battery technologies, which improves energy density, efficiency, and lifecycle, all of which contribute to lowering the overall cost of energy storage systems.

China

United States

United Kingdom

Samsung SDI (South Korea)

Sungrow (China)

Fluence (Siemens + AES)

BYD (China)

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 42.25 Billion |

| Expected Market Size in 2035 | USD 70.84 Billion |

| CAGR (2026 to 2035) | 6.05% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Technology, Storage System, Connection Type, Ownership, Energy Capacity, Application, Region |

| Key Companies | Tesla, Inc., LG Energy Solution, Ltd., Samsung SDI Co., Ltd., BYD Company Limited, Panasonic Corporation, ABB Ltd., Siemens AG, Schneider Electric SE, and General Electric Company |

Increasing Demand for Energy Independence and Security:

Declining Costs of Battery Technologies:

High Initial Capital Costs:

Limited Battery Recycling Infrastructure:

Integration with Renewable Energy Sources:

Advancements in Battery Technologies:

Technological Limitations and Performance Variability:

Regulatory and Policy Uncertainties:

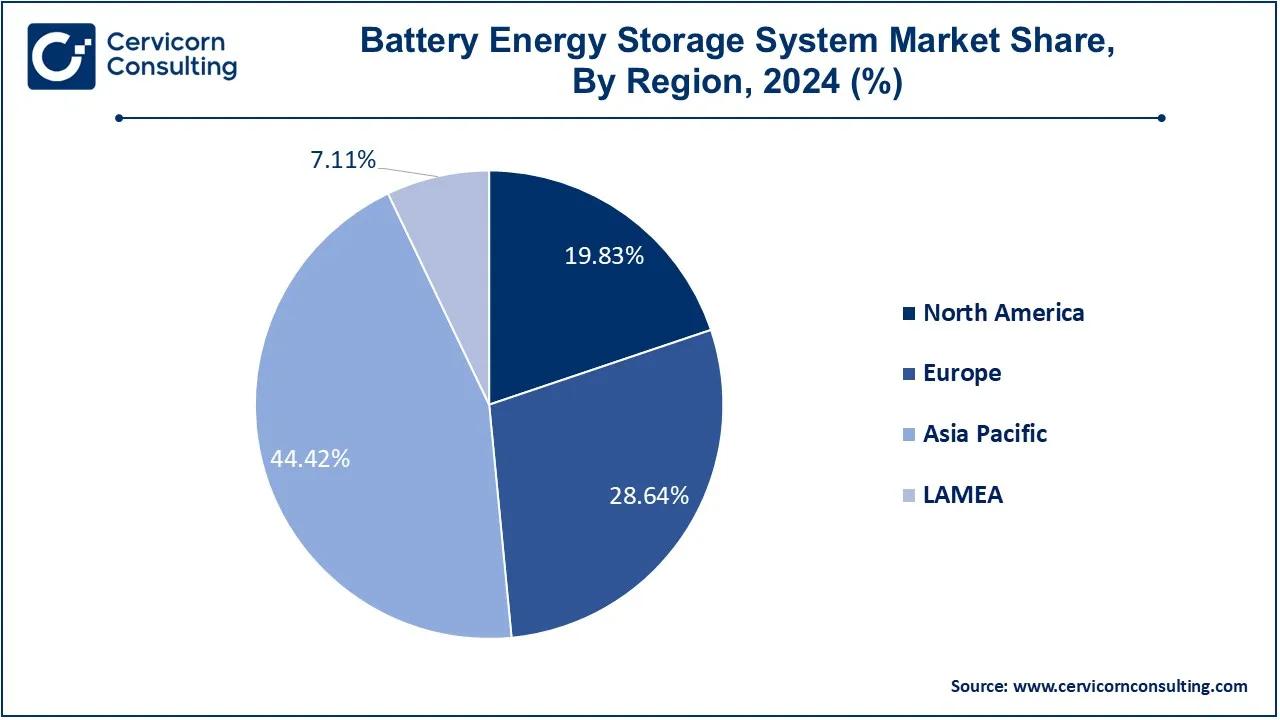

The North America BESS market was valued at USD 7.87 billion in 2025 and is projected to grow USD 14.00 billion by 2035. is experiencing robust growth in the BESS market due to increased investment in renewable energy projects, energy storage incentives, and supportive regulatory policies. The integration of BESS with solar and wind energy projects is expanding, driven by state-level mandates and federal initiatives aimed at reducing greenhouse gas emissions and enhancing grid resilience.

The Europe BESS market size was estimated at USD 11.37 billion in 2025 and is expected to hit around USD 20.21 billion by 2035. Europe is at the forefront of adopting BESS technology, driven by aggressive climate goals and regulatory support for renewable energy. The European Union's Green Deal and national policies promote energy storage to stabilize the grid and integrate intermittent renewable sources. High-profile projects and subsidies for energy storage systems are contributing to rapid market growth.

The Asia Pacific BESS market size was worth USD 17.77 billion in 2025 and is expected to reach around USD 31.60 billion by 2035. The Asia-Pacific region is witnessing significant growth in the BESS market due to rapid industrialization, urbanization, and increasing demand for reliable energy solutions. Countries like China and India are investing heavily in energy storage to support large-scale renewable projects and improve grid stability. Technological advancements and favorable government policies are accelerating adoption in this region.

In the LAMEA region, the BESS market is emerging (7.11% market share in 2025) with growth driven by the need for reliable energy access and integration of renewable resources. Investments in grid infrastructure and renewable energy projects, along with decreasing battery costs, are supporting market expansion. However, adoption rates vary significantly across countries due to different levels of economic development and regulatory support.

The BESS market is segmented into technology, connection type, storage system, ownership, energy capacity, application and region. Based on technology, the market is classified into lithium-ion batteries, lead-acid batteries, flow batteries, sodium-based batteries, others. Based on storage system, the market is classified into front-of-the-meter and behind-the-meter. Based on connection type, the market is classified into on-grid and off-grid. Based on ownership, the market is classified into customer-owned, third-party owned, utility-owned. Based on energy capacity, the market is classified into below 100 MWh, between 100 to 500 MWh, above 500 MWh. Based on application, the market is classified into residential, commercial and utility.

Lithium-ion Batteries: Lithium-ion batteries segment has reported market share of 48% in 2025. Lithium-ion batteries are widely used due to their high energy density, long cycle life, and relatively low maintenance requirements. They are prevalent in residential, commercial, and utility-scale applications. Trends include advancements in solid-state lithium-ion technologies and efforts to improve safety and reduce costs, driving broader adoption and innovation.

Lead-Acid Batteries: Lead-acid batteries segment has registered market share of 25% in 2025. Lead-acid batteries are an older technology known for their reliability and cost-effectiveness. They are commonly used in backup power and off-grid applications. Recent trends include improvements in deep-cycle performance and hybrid designs, although they face competition from newer technologies with higher energy density and efficiency.

Flow Batteries: Flow batteries segment has accounted market share of 16% in 2025. Flow batteries use liquid electrolytes to store and release energy, offering scalability and long cycle life. They are ideal for large-scale energy storage solutions, such as grid stabilization. Current trends focus on enhancing efficiency, reducing costs, and expanding commercial applications, particularly in renewable energy integration.

Sodium-Based Batteries: Sodium-based batteries segment has exhibited market share of 11% in 2025. Sodium-based batteries, including sodium-sulfur and sodium-ion types, are emerging as a cost-effective alternative to lithium-ion batteries. They offer advantages like lower material costs and high-temperature operation. Trends include ongoing research to enhance performance and safety, with potential applications in grid energy storage and large-scale deployments.

Others: This category includes various emerging technologies, such as solid-state batteries, zinc-air, and nickel-based systems. These alternatives aim to address limitations of conventional batteries, such as safety concerns and cost. Current trends involve significant R&D efforts to improve performance, increase energy density, and develop commercial viability.

Front-of-the-Meter: FTM segment has noted market share of 80% in 2025. Front-of-the-meter (FTM) energy storage systems are large-scale installations located on the utility side of the electric meter. They are used for grid stabilization, load shifting, and integrating renewable energy sources into the grid. The FTM segment is growing due to increased investments in grid infrastructure and renewable energy integration. Regulatory incentives and advancements in large-scale battery technologies are driving this growth, enhancing grid reliability and supporting energy transition goals.

Behind-the-Meter: BTM segment has garnered market share of 20% in 2025. Behind-the-meter (BTM) storage systems are installed at residential or commercial properties and are used to manage energy consumption, reduce utility bills, and provide backup power. The BTM segment is expanding due to rising consumer interest in energy independence and cost savings. Technological advancements in battery efficiency and declining costs are driving adoption. Additionally, incentives and rebates for residential solar and storage systems are contributing to market growth.

On-grid: On-grid segment has reported market share of 58% in 2025. On-grid Battery Energy Storage Systems (BESS) are integrated with the main power grid, allowing them to store excess electricity generated during low-demand periods and discharge it during peak demand times. This connection type supports grid stability, enhances energy reliability, and facilitates the integration of renewable energy sources. The trend is toward expanding on-grid systems to accommodate increasing renewable energy installations and enhance grid resilience.

Off-grid: Off-grid segment has generated market share of 42% in 2025. Off-grid Battery Energy Storage Systems (BESS) operate independently of the main power grid, providing energy storage for remote or isolated locations. These systems are crucial for areas with limited or no grid access, supporting energy independence and reliability. Trends include increased use in remote communities and rural areas, driven by advancements in battery technology and a push for sustainable energy solutions.

Customer-owned: Customer-owned BESS are installed and maintained by individual homeowners or businesses. This model allows users to manage their own energy storage, often in conjunction with solar panels, enhancing energy independence and reducing electricity bills. The trend is growing, driven by decreasing battery costs, incentives for renewable energy adoption, and increasing awareness of energy management and sustainability.

Third-party Owned: Third-party owned BESS involve external entities, such as energy service providers or financing companies, installing and maintaining storage systems at customer sites. These arrangements often include performance-based contracts or power purchase agreements. The trend is rising due to the lower upfront costs for customers and the expansion of service models that make energy storage more accessible to a broader audience.

Utility-owned: Utility-owned Battery Energy Storage Systems are managed and operated by energy utilities to support grid stability and manage peak demand. Utilities invest in large-scale storage systems to enhance grid reliability, integrate renewable energy, and reduce operational costs. This segment is expanding as utilities increasingly seek to leverage storage solutions for grid modernization and to meet regulatory requirements for renewable energy integration.

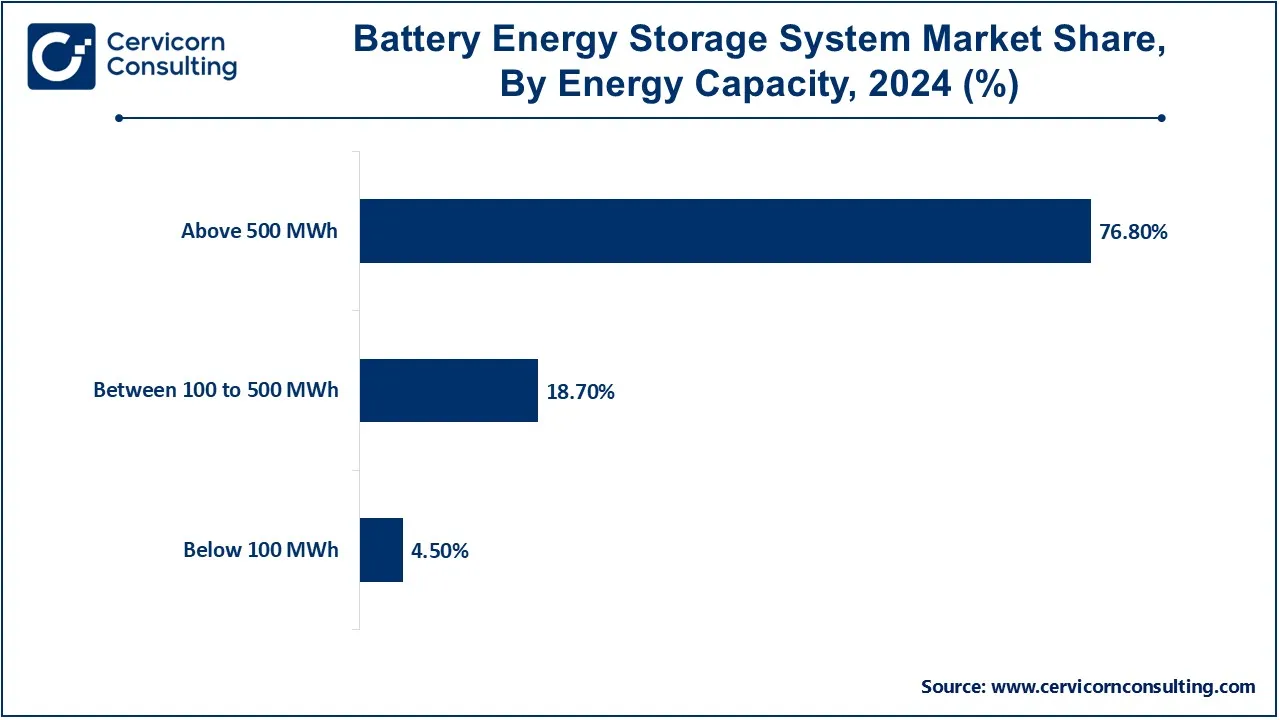

Below 100 MWh: Below 100 MWh segment has generated market share of 4.5% in 2025. Battery Energy Storage Systems (BESS) with a capacity below 100 MWh are typically used for smaller-scale applications, such as residential, commercial, and small industrial uses. These systems are suitable for localized energy storage needs, supporting short-term energy supply and demand balancing. The segment is experiencing growth due to increasing adoption in residential solar setups and small-scale commercial applications. Advances in battery technology and declining costs are making these systems more accessible and attractive to individual consumers and small businesses.

Between 100 to 500 MWh: Below 100 to 500 MWh segment has accounted share of 18.7% in 2025. BESS with capacities between 100 and 500 MWh are designed for medium to large-scale applications, including commercial facilities, industrial operations, and utility-scale projects. These systems provide substantial energy storage to support grid stability, peak shaving, and backup power. This segment is expanding due to rising investments in grid infrastructure and renewable energy integration. These systems help manage variability in energy supply, improve grid resilience, and facilitate the transition to cleaner energy sources. Growing demand for large-scale energy storage solutions is driving innovation and investment.

Above 500 MWh: Above 500 MWh segment has captured highest share of 76.8% in 2025. Battery Energy Storage Systems with capacities above 500 MWh are used in large-scale applications, such as utility-scale energy storage projects and large grid stabilization efforts. These systems offer significant energy storage capabilities for grid management, large renewable energy farms, and regional energy reserves. The market for large-scale BESS is growing rapidly as utilities and large energy providers invest in energy storage to enhance grid reliability and support the integration of renewable energy sources. Technological advancements and decreasing costs are enabling more extensive deployments, making this segment a key focus for energy infrastructure development.

Residential: Residential BESS are designed for individual homes to store electricity from various sources, such as solar panels or the grid, for later use. They help manage energy consumption, reduce electricity bills, and provide backup power during outages. increasing adoption of residential solar installations and advancements in battery technology are driving growth. Homeowners are increasingly interested in energy independence and sustainability, leading to higher demand for residential BESS solutions.

Commercial: Commercial BESS serve businesses and industrial facilities by providing energy storage for peak shaving, load management, and backup power. They help optimize energy costs, improve operational efficiency, and support sustainability goals. Businesses are leveraging BESS to manage peak demand charges and integrate renewable energy sources. Growing focus on energy efficiency and carbon reduction initiatives in commercial sectors is fueling the expansion of BESS applications.

Utility: Utility-scale BESS are large-scale installations designed to support the electricity grid by storing and dispatching energy on a larger scale. They enhance grid stability, enable load shifting, and integrate renewable energy sources. Increasing investment in grid modernization and renewable energy integration drives the growth of utility-scale BESS. Advances in large-scale battery technologies and regulatory support for grid reliability and sustainability are key trends in this segment.

New players like Eos Energy Enterprises and Fluence Energy are innovating with unique technologies, such as zinc-based batteries and modular systems, to enhance energy density and lower costs. Tesla, Samsung SDI and LG Energy Solution dominate the market through advanced lithium-ion technologies and large-scale production capabilities. Tesla's Powerwall and Powerpack systems and LG's RESU series offer high performance and efficiency, solidifying their market leadership through technological advancements and extensive deployment across residential, commercial, and utility-scale applications.

By Technology

By Storage System

By Connection Type

By Ownership

By Energy Capacity

By Application

By Region