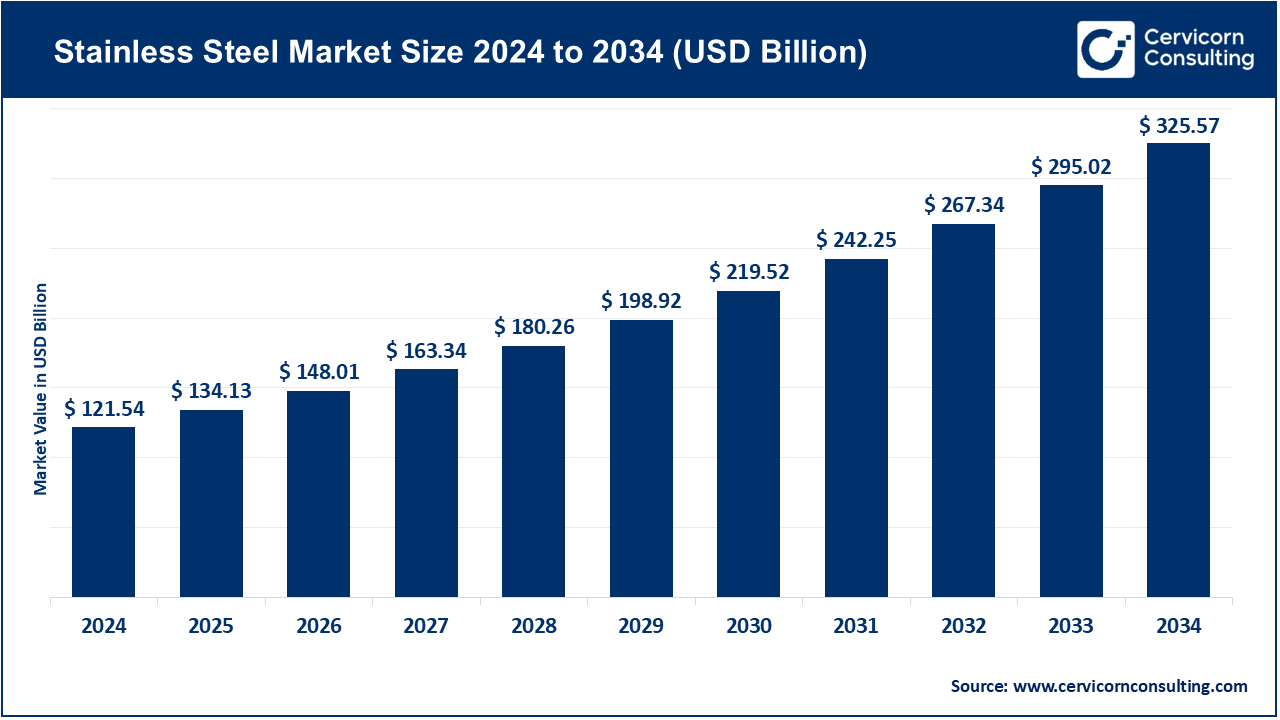

The global stainless steel market size was valued at USD 121.54 billion in 2024 and is expected to be worth around USD 325.57 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.36% during the forecast period 2025 to 2034. The stainless steel industry is picking up following the increasingly high demand of sustainable, durable, and high-performance materials that industries use in their undertakings. Application areas of stainless steel include the construction industry, automobile industry, consumer goods industry and medical industries that require strength, corrosion resistance, and recyclability. The increasing infrastructure requirements, urbanization, and tightening of environmental laws are spurring on adoption, and advances in alloy development and energy-cost efficient processes in production plants are contributing to increase efficiency and sustainability as well.

What is stainless steel?

Stainless steel is characterized as an iron alloy with a minimum of 10.5% chromium that creates a passive protective film known to make the substance highly resistant to rusting, corrosion, stains, etc. Based on its make up, stainless steel is divided into austenitic, ferritic, martensitic, duplex and precipitation hardening grades that have their diverse usages. Its incomparable strength, recyclability, and the ability to meet the most extreme conditions make it one of the most versatile and most used metals on the global market.

Value of iron and steel imported into India from financial year 2011 to 2023 (in billion Indian rupees)

| Year | Iron and Steel Import Values (Billion Indian Rupees) |

| FY2011 | 665.19 |

| FY2012 | 874.82 |

| FY2013 | 963.1 |

| FY2014 | 765.87 |

| FY2015 | 997.53 |

| FY2016 | 979.6 |

| FY2017 | 783.88 |

| FY2018 | 942.06 |

| FY2019 | 1,235.01 |

| FY2020 | 1,088.95 |

| FY2021 | 890.78 |

| FY2022 | 1,290.06 |

| FY2023 | 1,812.25 |

The stainless steel market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). Here’s an in-depth look at each region.

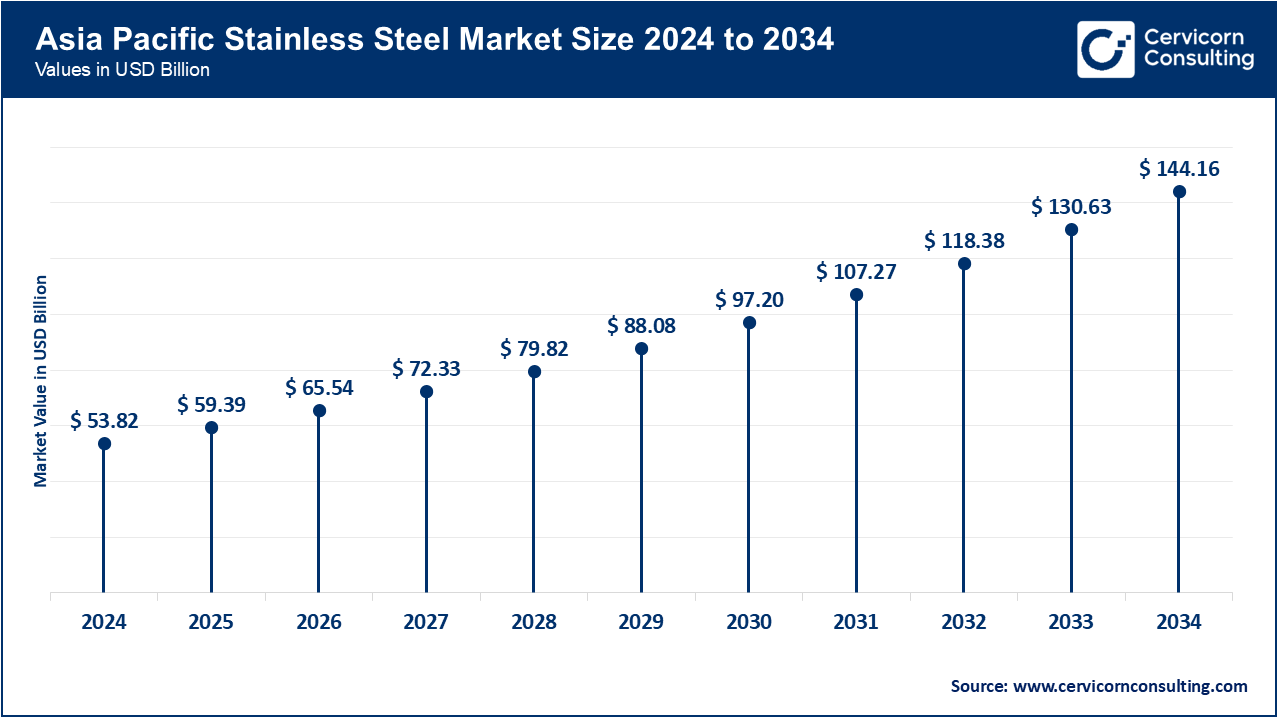

China and India continue to dominate the global regions for production and consumption of stainless steel. Moreover, In August 2025, China operationalized a new stainless steel mill in Shandong to serve both domestic infrastructure and export markets. Additionally, India, which had earlier launched the “National Stainless Steel Policy” in May 2025, reported increased use of stainless steel in railway and metro urban projects. Japan advanced the use of stainless steel in construction projects for earthquake-resilient buildings in Osaka, which were approved in July 2025. In the shipbuilding sector, South Korea still relies a lot on duplex stainless, which is exemplified by Hyundai Heavy’s LNG carrier orders that were delivered in June of 2025. This illustrates how the Asia Pacific still remains as a supplier and demand producer for the region.

The region’s demand for stainless steel continues to be sustained by the construction industry, automotive, and oil and gas sectors. On April 2025, Cleveland-Cliffs announced upgrades to its stainless steel operations in Ohio, which were aimed to increase domestic supply in response to growing demand spurred by infrastructure investments. Toronto’s implementation of green building codes is also boosting demand for stainless steel in Canada, particularly the requirement for corrosion-resistant structural steel in public works as of February 2025. Mexico’s automotive manufacturing hubs are benefitting from nearshoring trends and rising stainless steel consumption, which is further fueled by the new automotive part manufacturing plant in Monterrey that began operations in May 2025. These developments illustrate steady infrastructure-supported consumption from the region.

Europe is further developing region as a result of sustainability policies and integration of renewables. Germany’s “Solar Roofs for All” program, which commenced in April 2025, included contracts mandating stainless steel parts for the rooftops to mitigate corrosion. Aperam announced new recycling initiatives aimed at boosting stainless steel circularity in the region in Belgium in March 2025. This further demonstrates Europe’s commitment to sustainable metallurgy. France further focused on specialized stainless steel France saw ArcelorMittal upgrade a stainless steel production line for hydrogen-ready pipelines, further increasing its pendant hydrogen pipelines in June 2025. These are examples of Europe progressing towards a stainless ecosystem which is low carbon and clean energy and industrial strategies deeply intertwined.

Stainless Steel Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 18.42% |

| Europe | 24.10% |

| Asia-Pacific | 44.28% |

| LAMEA | 13.20% |

The LAMEA region is actively pursuing new applications for stainless steel in construction, energy, and transport. Brazil incorporated stainless steel into the wind energy infrastructure of the 500-turbine program located in Ceará that began construction in July 2025. South Africa commissioned stainless steel pipelines in Limpopo as part of a water resilience program in June 2025, demonstrating the need for corrosion resistant materials in arid regions. Saudi Arabia linked stainless steel demand to its Neom project which incorporated stainless components into hydrogen facilities tested in May 2025. The UAE showcased stainless in sustainable mobility ventures tied to Expo-linked infrastructure in March 2025. While the region is more conservative in its use of technology compared to Asia, its strategic use of stainless steel for energy and construction is essential.

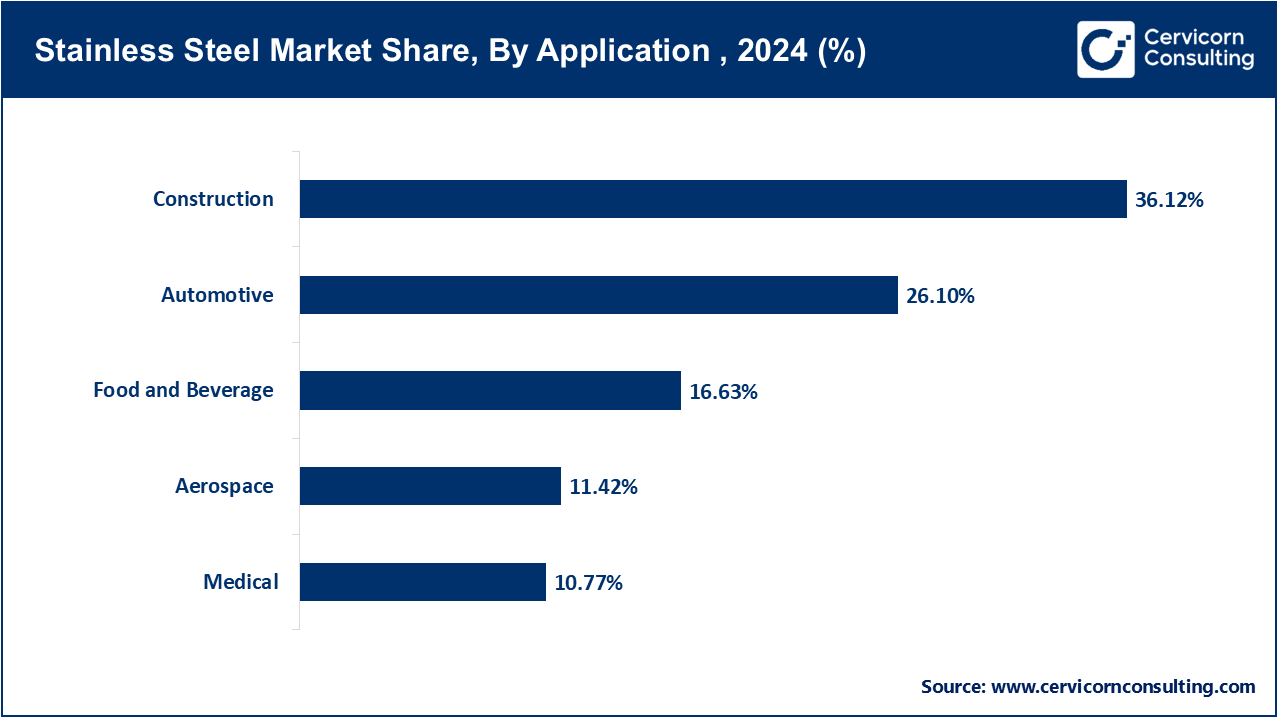

Construction: Stainless steel's properties make it useful in construction for structural frameworks, roofing, cladding, and reinforcing bars. It provides long-term durability for residential and commercial projects. In April 2023, SAIL announced the supply of stainless steel for the Delhi High-Rise Housing Project, indicating urban infrastructure demand. The steel was also used in cladding and support beams for environmental exposure protection. This project showcased the growing incorporation of stainless steel into modern city developments for safety and design integration.

Automotive: In the automotive industry, stainless steel finds application in exhaust parts, trims, structural components, and the casings of EV batteries due to its heat resistance and light weight. It also enhances vehicle safety and sustainability. In October 2023, BMW announced the stainless steel-integrated EV exhaust and battery shielding systems for their models in Germany, citing safety concerns for high-temperature conditions. This marked a strategic use of stainless steel in electric mobility advancements. The shift underscored the evolving impact of stainless steel in transport manufacturing and reduced carbon footprint.

Aerospace: In aerospace, stainless steel is used for jet engine components, fasteners, and structural parts which must withstand extreme temperatures and pressure. It guarantees safety and performance reliability. Space X in June 2023, disclosed the increase in the stainless steel supply for the Starship project, which reinforced the material's importance in reusable spacecraft. Its application led to lower costs and greater performance durability in launches. This also highlights the fact that aerospace is batched stainless steel into high-tech, long-duration missions.

Food and Beverage: In the food and beverage industry, stainless steel's non-reactivity and hygienic attributes make it suitable for use in storage tanks, processing machinery, and packaging equipment. It also ensures safety in food contact applications. In August 2023, Nestlé modified its processes by installing new stainless steel processing lines at its Swiss chocolate manufacturing facility to improve operational efficiency and enhance strict hygienic measures. This shift reinforced the importance of stainless steel in safeguarding food and nutrition quality and safety during large-scale production. This exemplifies the importance in the efficiency of supply chains and its relevance in food systems.

Clinical: Stainless steel’s biocompatibility and sterility make it useful for surgical tools, medical implants, and hospital equipment. These factors also contribute to patient safety and the durability of the medical stainless steel devices. In February 2023, Johnson & Johnson increased the production capacity of their USA based surgical stainless steel instrument facility owing to the increased market demand for durable medical tools. The company also mentioned the safety of stainless steel in surgical environments, illustrating the dependence of the healthcare industry on stainless steel.

Flat Products: Flat products comprise sheets and plates utilized in construction, automobiles, shipbuilding, and appliances due to their ease of welding and versatility. They are among the most widely used forms of stainless steel. In May, 2023, Outokumpu stainless steel flat sheets to Denmark’s offshore wind projects to withstand seawater corrosion. This marked flat products’ contribution to sustainable infrastructure. Their reflection reveals the shift toward renewable energy in stainless steel’s use.

Long Products: Long Products comprise beams, structural sections, and rails widely utilized in construction and infrastructure. They provide strength and structural stability. In July 2023, ArcelorMittal stainless steel long products for Paris Metro Rail Expansion and paid special attention to reliability and safety for underground transit. These products are preferred for their vibration and environmental stress durability. The project reinforced the use of stainless steel in critical transportation networks.

Stainless Steel Market Share, By Product Form, 2024 (%)

| Product Form | Revenue Share, 2024 (%) |

| Flat Products | 41.85% |

| Long Products | 21.71% |

| Bars and Rods | 16.44% |

| Wire | 8% |

| Pipes and Tubes | 12% |

Bars and Rods: Bars and rods are semi-finished products utilized for machining, fasteners, tools, and reinforcing structures. They are praised for their strength and ease to machine. In September 2023, Jindal Stainless increased their Bar and Rod products exports to Europe for engineering tools and fasteners for the automotive industry. Their relevance in global supply chains was underscored. The move also indicates the higher demand for industrial machinery.

Wire: Stainless steel wire is used in springs, cables, fasteners, and mesh because of its ductility and resistance to corrosion. It is important in both consumer and industrial markets. In March 2023, Germany’s Bekaert introduced new applications for stainless steel wires in high-durability springs for electric vehicles (EVs) citing improved life cycle. This innovation emphasized wire’s adaptability in stainless steel electric vehicle market integration. It also demonstrated continued reliance in the precision parts manufacturing industries.

Pipes and Tubes: Pipes and tubes are essential for the transportation of fluids and gases in the oil and gas, water, and chemicals industries. Stainless steel does not corrode and can withstand high pressure. In December 2023, Tenaris supplied stainless steel pipes for the offshore oil exploration projects in Brazil. The choice was driven by extreme seawater exposure and safety requirements. This reinforced the notion of the stainless steel in energy exploration.

Austenitic: The most common grade, austenitic stainless steel, is renowned for its superb corrosion resistance and formability. It is employed throughout the construction, kitchenware, and chemical equipment industries. In January 2023, Aperam increased its austenitic steel production in Belgium for use in packaging and industrial applications. The expansion highlighted austenitic steel’s increasing use in sustainable manufacturing. It continues to dominate and its versatility reinforces its use in multiple industries.

Ferritic: Ferritic stainless steels are widely used for automotive exhausts and appliances due to their decent corrosion and thermal conductivity along with reasonable pricing. Their lower cost when compared to other grades makes them more attractive. In June 2023, Nippon Steel increased production of ferritic stainless steel in Japan to meet the rising demand for exhaust systems from automobile manufacturers. This further emphasized ferritic’s cost-benefit advantage in large-scale automotive applications. It showcased the ever-constant need for balanced performance and affordability.

Martensitic: Martensitic stainless steels are used where strength and wear resistance is critical, such as in cutlery, tools, and turbines. Their moderate corrosion resistance makes them relatively favorable. In October 2023, Allegheny Technologies (ATI) in the U.S. reported increasing use of martensitic stainless steel for defense tools and turbine blades. The adoption showcased the material’s importance in demanding industrial applications. Their hardness and durability makes them a favorable demand in targeted sectors.

Duplex: Duplex stainless steels offer a combination of austenitic and ferritic traits, providing high strength and corrosion resistance, particularly in chloride-rich environments and within the chemical and marine industries. In August 2023, Sandvik Materials Technology expanded their supplies of duplex stainless steels for desalination plants in Saudi Arabia. The resistance of duplex stainless steels to seawater corrosion was crucial in water infrastructure. This affirmed the marked suitability of duplex stainless steels in hydraulically demanding circumstances.

Precipitation Hardening: Precipitation hardening stainless steels are employed in areas which require simultaneous high strength, corrosion resistance, and toughness. Their application is widespread, particularly in aerospace and defense. In November 2023, Carpenter Technology supplied the USA with aerospace fasteners forged with precipitation hardening grades. Their selection was due to the fasteners’ strength-to-weight ratio in jet engines. This served to illustrate the advanced aerospace engineering application of these fasteners.

Building and Construction: Stainless steel is used within the building and construction industry for frameworks, façades, roofing, and reinforcing owing to its strength and aesthetic appeal. It is critical for environmentally sustainable structures. The maintenance report for Shanghai Tower issued in March 2023 noted the extensive use of stainless steel façades for long-term weather resistance, reinforcing the material’s contribution to modern architecture. Its use in iconic projects is still expanding.

Transportation: These include railways, buses, trucks, and ships, where stainless steel guarantees safety, structural strength, and reduced costs over the lifecycle. It is critical in heavy-duty mobility solutions. The introduction of stainless steel passenger coaches in Indian Railways in May 2023 showcased the focus on passenger safety and reduced maintenance costs associated with corrosion, further reinforcing transportation's dependence on stainless steel. The infrastructure modernization initiative was further supported with this development.

Stainless Steel Market Share, By End Use Industry, 2024 (%)

| End Use Industry | Revenue Share, 2024 (%) |

| Building and Construction | 35.76% |

| Transportation | 26.31% |

| Oil and Gas | 16.33% |

| Consumer Goods | 13.10% |

| Pharmaceuticals | 8.50% |

Oil and Gas: These industries utilize stainless steel for pipelines, refineries, and offshore drilling because of extreme corrosion and pressure conditions. It guarantees safety in energy extraction. QatarEnergy’s partnership with European suppliers for LNG projects with stainless steel tubing in July 2023 reinforced the claim’s significance within harsh hydrocarbon work environments. This further showcased the irreplaceable role of stainless steel in energy operations.

Consumer Goods: Household stainless steel items such as appliances, cookware, and furniture are popular due to the alloy’s durability and hygienic properties. South Korean LG Electronics recently launched stainless steel-finished microwaves and refrigerators in September 2023, citing consumer appeal for the stainless steel look and enduring microwave durability. This emphasis reiterated stainless steel’s undeniable role in modern living and its relevance in lifestyle sectors.

Pharmaceuticals: The pharmaceutical industry utilizes stainless steel for sterile equipment, reactors, and piping due to the need for sterile-free contamination equipment in drug manufacturing. During February 2023, Pfizer enhanced its stainless steel reactors for biopharmaceuticals in Belgium due to increased EU hygiene requirements, showing stainless steel’s role in pharmaceutical hygiene and manufacturing. It remains essential in the reliable production of safety drugs.

Market Segmentation

By Product Form

By Grade

By Application

By End Use Industry

By Region