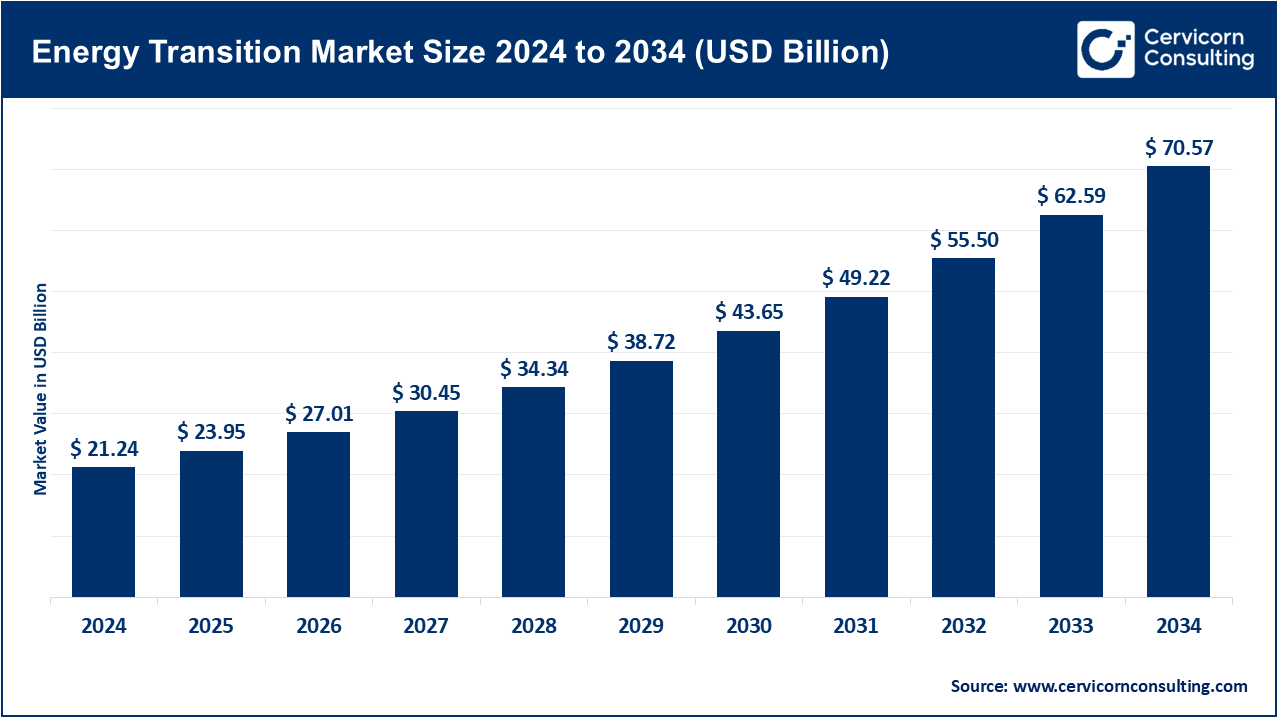

The global energy transition market size was reached at USD 21.24 billion in 2024 and is anticipated to expand around USD 70.57 billion by 2034, expanding at a compound annual growth rate (CAGR) of 12.76% from 2025 to 2034. The energy transition market is experiencing a blistering growth considering the global movement to align with the reduction in carbon emissions, energy security and efficiency. The increase in energy demand and international agreements, including Net Zero targets, are driving the shift toward renewables, electrification and renewable fuels by governments and industries. Improved technologies in solar, wind, hydrogen and battery storage solutions with the support of AI, IoT, and digital energy platforms are driving the next-generation of smarter energy management and grid optimization. In addition to this, green subsidies, carbon pricing and the creation of a green mandate are speeding up large scale investments in green technologies. The change is also facilitated by the desire of consumers to have a clean solution, electrically powered mobility and cheap renewable integration. Collectively, such drivers render the energy transition not only a necessity in environmental matters, but an economic opportunity.

What is energy transition?

The energy transition market situation is the move towards sustainable and low-carbon and renewable energies around the world, trying to get rid of fossil fuels-based energy systems. It includes technologies, rules and business concepts that are intended to move power, mobility and industry toward decarbonization and long-term energy security. These are renewable power generation (solar, wind, hydro, bioenergy, nuclear), energy storage, green hydrogen, smart grids, carbon capture utilization and storage (CCUS) and the digital platforms to enable efficiency. In addition to the substitution of fossil sources, the energy transition is also a structural change in the energy production, delivery, and consumption segments, so it plays a major role in terms of climate targets and sustainable economic development.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 23.95 Billion |

| Expected Market Size in 2034 | USD 70.57 Billion |

| Projected CAGR 2025 to 2034 | 12.76% |

| Leading Region | Asia-Pacific |

| Key Segments | Type, Source, Technology, Application, Region |

| Key Companies | Exelon Corporation, Duke Energy Corporation, Pacific Gas and Electric Company, Southern Company, American Electric Power, Edison International, Repsol, Brookfield Renewable Partners, Plug Power Inc., Enphase, First Solar, Sunpower, Enel, NextEra Energy, Inc |

The energy transition market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

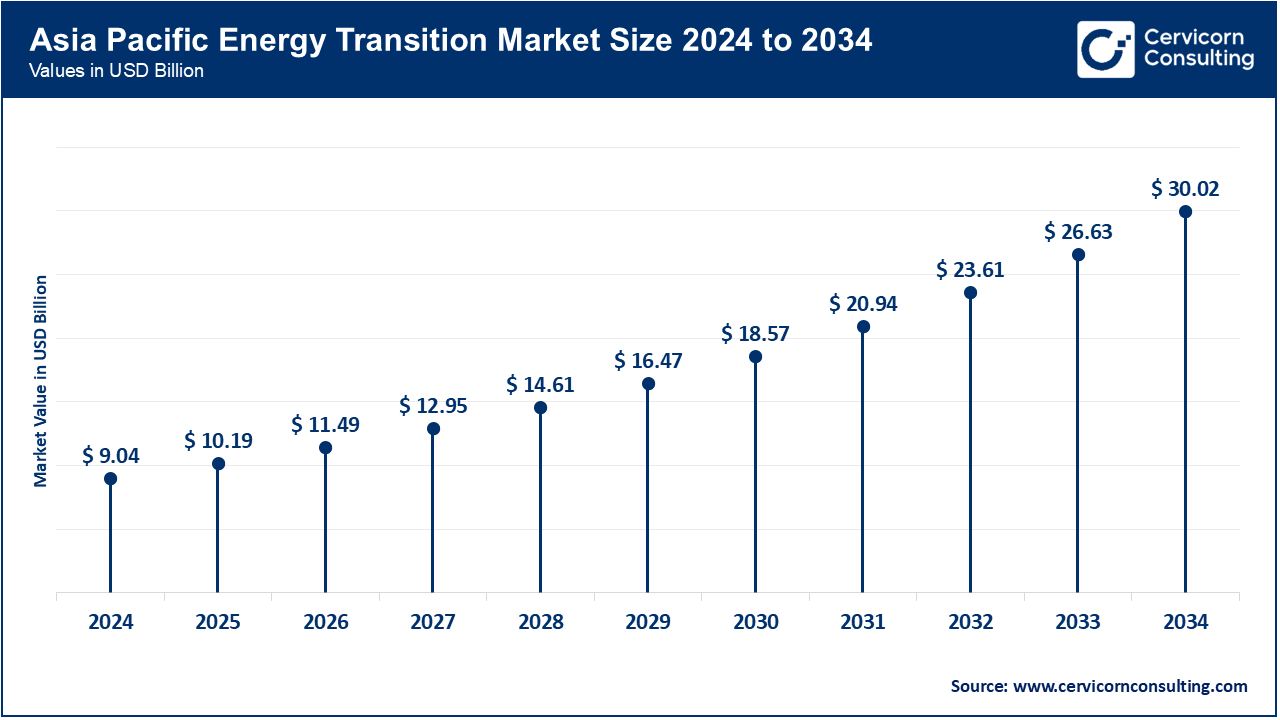

The major factor that is leading to acceleration of energy transition initiatives in the Asia-Pacific region is increasing energy demand and industrialization. In August 2025, China opened its largest green hydrogen demonstration hub in Inner Mongolia, which is supporting the steel and chemical decarbonization. India is ramping solar installations and electric vehicles and new charging corridors should be operating along national highways by July 2025. Japan is also developing smart grid test facilities to include solar, hydrogen and storage in an effort to stabilize islanded networks. In Korea, investments are coming in offshore wind and digital energy platforms in terms of predictive efficiency. Such initiatives, backed by demographic maturity, and open agrilDB ecosystems are evidence of the speed with which Asia-Pacific is deploying clean energy.

North America continues to show its lead on bringing energy transition to full potential by emphasizing the largest amount of renewables to integrate into production and by adopting high levels of advanced storage. In April 2025, California opened the Moss Landing 1,500 MW battery storage plant that offers backup of solar and wind resources. New utility-scale solar ranches across Texas are being integrated with AI-driven grid balancing, to further maximize management of intermittency. Canada is leading in the development of green hydrogen clusters with the province of Quebec moving towards pilot projects linked to hydropower. The U.S. is even more successful in its efforts to promote EVs as more than 1 million were registered as new in July 2025. All this development shows that North America is one of the leaders regarding clean energy balancing the need to decarbonize the system and keep its reliability high.

Energy Transition Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 22.18% |

| Europe | 27.21% |

| Asia-Pacific | 42.54% |

| LAMEA | 8.07% |

The Europe has the support of effective regulatory regimes and orientation to sustainability. In May 2025, Germany has scaled up its building retrofit program with a wide-reaching measure to make efficiency retrofits in residential and commercial buildings. France and the UK are on course in developing offshore wind, and they have multi-GW projects under construction in order to boost sustainable clean power generation. Spain is an early adopter of hybrid solar-hydrogen, to decarbonize heavy industry. Scandinavian countries are continuing to invest in smart grids and CCS, strong regional emission-reduction strategies. The recent focus on the importance of ecological integrity and innovation in Europe transforms it into a worldwide exemplary model of organized transition.

Energy transition efforts in the LAMEA region are advancing with selective yet transformational projects, but overall it is slow. In July 2025, Brazil entered the high-capacity clean energy development, as it developed its Porto do A C u offshore wind pilot. In June, 2025, South Africa started a solar-hybrid storage program as a means to stabilize power supply in order to overcome the rolling blackouts. A preview of what is to come in the shape of mobility pilots that use hydrogen is also being explored as part of UAE-related projects linked to Expo. Saudi Arabia meanwhile is scaling its Neom green hydrogen project and hopes to be a green hydrogen hub. Such search-light projects reflect a tempered yet proactive initiative to clean energy adaptation in LAMEA.

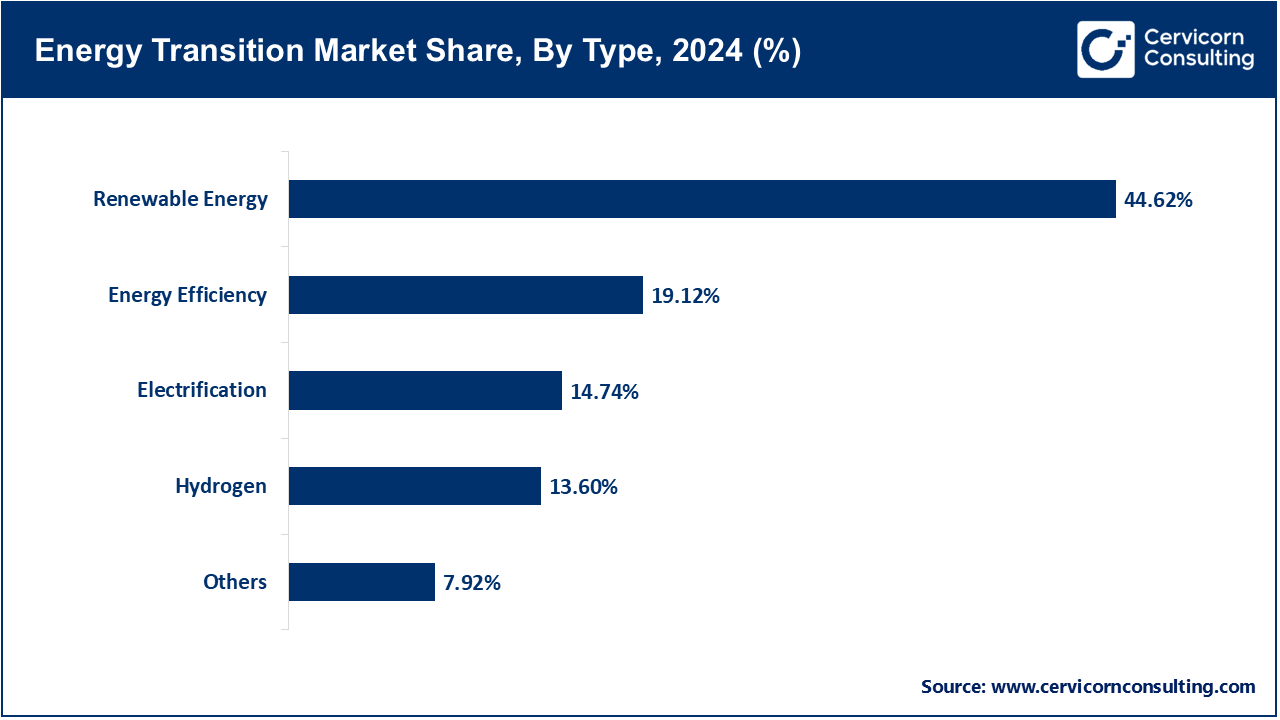

Renewable Energy: The production of renewable energy derives from resources that are continuous, natural, and self-sustaining. As of June 2025, the Berwick Bank Offshore Wind Farm was approved, aiding the UK in achieving an additional 2.3 GW of capacity. This approach illustrates the contribution of wind energy in emission reduction and accomplishing climate goals. Furthermore, renewables such as solar, wind, and hydro offer diversification to energy sourcing and reduce reliance on fossil fuels. Large scale renewables are now integrated with batteries to ease grid stability. This offshore wind investment furthers global efforts in sustainability and energy security in the short to long term.

Energy Efficiency: Energy Efficiency is the practice of lessening energy consumption without affecting the output of the system. In March 2025, Germany rolled out a building retrofit program focused on replacing insulation and hvac systems for 100,000 homes. This program saved electricity and reduced carbon footprint for the residential sector. This in turn decreases the operational expenses for industries and consumers. When paired with smart meters, efficient solutions unlock data-informed energy management systems. Renewables are complemented with energy efficiency as this optimizes energy deployments across the board. Energy efficiency also aids in achieving the emission reduction goals.

Electrification: Electrification systematically removes fossil fuel systems and replaces them with electricity options in sectors such as transport and industry. Norway expanded its electric vehicle charging network in July 2025, with the nation now supporting over 500,000 EVs. Gas and oil dependence is reduced, and renewables are increasingly utilized alongside. Accelerated adoption of electric vehicles (EVs) improves grid infrastructure as well as energy storage technologies. Electrification is a vital component for decarbonizing transport, mobility, and industrial processes.

Hydrogen: Hydrogen as a carrier of energy can store and transport energy without producing carbon emissions. Gorakhpur’s green hydrogen plant, designed for industrial and transport applications, was launched in August 2025 by Uttar Pradesh. Renewables can enable hydrogen production, thus helping decarbonise heavy industries like steel and chemicals. Where direct electrification is not possible, hydrogen production assists alongside. Investments and innovations are further spurred with the advent of green hydrogen projects. Its growing recognition in global strategies for energy transition illustrates hydrogen’s role as a long-term solution.

Others: Emerging solutions such as waste-to-energy, bioenergy, and geothermal power fit into this category. In May 2025, Iceland launched a geothermal district heating system for Reykjavik, which diminished the need for imported oil. These alternative sources provide sustainable energy and have distinct local advantages. They support energy diversification as well as local energy independence. Enhanced digital monitoring improves efficiency and reliability. In the context of energy transitions, “others” serve as critical yet niche components.

Renewable Energy: These energy sources are derived from renewable resources such as the sun, wind, and water. In June 2025, USA’s Texas Solar Ranch Project added another 500 MW of solar capacity. The cleaner energy produced reduces the greenhouse emission gases and helps in stabilizing the grid. Renewable energy supports crisis resilience and serves the need for distributed generation. Renewable energy sources are critical for addressing climate commitments and decreasing the reliance on fossil fuels. Investment in renewable energy sources continue to increase on a global scale.

Energy Transition Market Share, By Source, 2024 (%)

| Source | Revenue Share, 2024 (%) |

| Renewable Energy | 54.71% |

| Non-Renewable Energy | 45.29% |

Non-Renewable Energy: Non-renewable energy sources include coal, oil, and natural gas which come from Non-renewable resources. In February 2025, India commissioned a new natural gas power plant in Gujarat to help in meeting the peak electricity demand. Non renewable energy sources, despite having higher emissions, do provide a stable and controllable energy supply. They also support intermittent renewable generation. The emission produced can be reduced by the use of efficient technology and carbon capture. Non renewables will continue to be a part of the energy mix during integration transitional phases.

Energy Storage Systems: Energy storage systems play an important role in capturing and storing electricity for later use in balancing supply and demand. The California-based Moss Landing battery storage facility, which has a capacity of 1,500 MW and integrates with the wind and solar power facilities, was installed in April of 2025. Storage also provides renewable intermittency mitigation, grid stabilization, and enables peak shaving, load balancing, and emergency backup. Enhanced advanced battery technologies with high lifespan and cost-efficiency improve storage facility output. To adopt and use renewable technologies effectively, the storage capability needs to improve.

Electric Vehicles: Electric vehicles (EV) adoption and use is projected to replace conventional vehicles and eliminate emissions. In Germany, the charging infrastructure has been expanded which has positively improved the adoption exceeding over 1 million records in July EV2025. In addition, EVs offer ancillary services such as acting as buffer storage for electricity. There is also an increasing reduction in oil consumption and urban air pollution. The integration provides maximum environmental benefits. The adoption of EV is a pathway to innovative battery technologies and smart transportation systems.

Energy Transition Market Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Energy Storage Systems | 28.41% |

| Electric Vehicles | 41.26% |

| Smart Grids | 18.34% |

| Carbon Capture and Storage | 11.99% |

Smart Grids: With the application of smart grids in Hokkaido in March 2025, Japan made use of solar, wind, and storage AI-based demand management leading to better energy efficiency. Smart grids enable flexibility which boosts system reliability along with limited energy loss, better renewable energy and power technology efficiency and integration, and enhanced power consumption for the user. They also offer enhanced feedback with a better improved program that enables demand-response and dynamic pricing to be incorporated. The use of advanced technologies such as AI and digital technologies offer immense benefits and improve the power management systems.

Carbon Capture and Storage (CCS): CCS, or Carbon Capture and Storage, refers to the processes which capture the emissions of carbon dioxide (CO2) from power generation and industrial plants, and store them safely. In May 2025, Norway enlarged its Sleipner CCS facility in the North Sea to have capacity of 1 million tons of CO2 storage annually. CCS enables the continued utilization of fossil energy sources, mitigating their environmental impacts. It also aids the industrial decarbonization of the steel, cement, and chemical industries. The use of CCS with renewable energy improves net-zero strategies. The technology is crucial to achieve the climate change goals set in the world.

Residential: This application is about home energy. Sweden began implementing solar rooftop installations and smart meters for 50,000 households in March 2025. Improved home climate systems not only reduce energy consumption, but they also help reduce homes’ carbon footprints. Homes with solar rooftop installations are able to provide excess energy to the grid. Solar energy systems with storage capacity offer increased reliability. Empowering households increases the likelihood of achieving energy transition goals.

Commercial: These are directed to office, factory and retail building. Singapore adopted the retrofitting of HVAC and lighting systems for 200 commercial properties in April 2025. Enhanced solar energy systems improve energy supply and operational costs. These businesses will portray leadership in sustainability and improve their competitiveness. Commercial adoption also increases the impact of clean energy supply beyond homes.

Energy Transition Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Residential | 20.70% |

| Commercial | 28.92% |

| Utility Scale | 50.38% |

Utility Scale: These are major projects for the generation of power for a region or the national grid. In June 2025, the Noor Abu Dhabi solar plant with 1.2 GW renewable energy output was commissioned. These projects provide large quantities of clean energy replacing fossil fuel generation. Storage integration is important for maintaining grid stability. They attract major investments and support national climate goals. Globally, utility-scale projects are the hallmark of clean energy transition.

Market Segmentation

By Type

By Source

By Technology

By Application

By Region