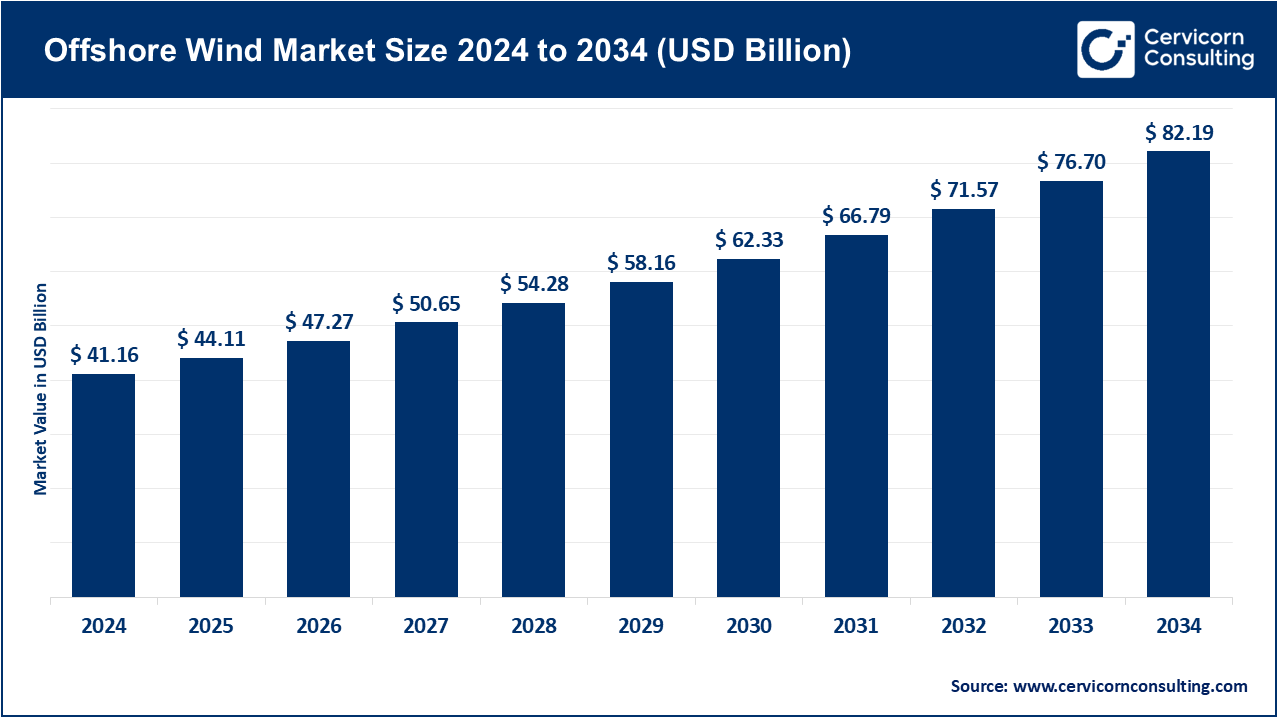

The global offshore wind market size is calculated at USD 44.11 billion in 2025 and is anticipated to be worth around USD 82.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.16% over the forecast period from 2025 to 2034. The offshore wind market is expected to grow significantly owing to rising global energy demand, supportive government policies, and increasing investments in renewable energy infrastructure. Technological advancements in turbine design, floating wind platforms, and subsea cabling are reducing installation and maintenance costs. Additionally, the global push for decarbonization and energy security is accelerating offshore wind projects, especially in Europe, Asia-Pacific, and the U.S., positioning the sector as a cornerstone of the clean energy transition.

What is offshore wind?

The use of wind turbines built in vast bodies of water, usually the sea or ocean, to capture wind energy and produce electricity is known as offshore wind. Offshore wind turbines have a greater capacity to generate electricity because they can be substantially larger and are situated in regions with stronger and more reliable winds than their onshore counterparts. Submarine cables are used to transport the produced electricity to land. The technology enables the construction of wind farms farther out from the coast by utilizing both floating foundations, which are anchored to the seafloor in deeper waters, and fixed-bottom foundations, which are fastened to the seabed in shallow waters. This technique provides a substantial and reliable source of clean power, making it an essential part of the global transition to renewable energy.

Advancement in Toward Floating Offshore Wind Farms: Technologies like semi-submersible and spar-buoy foundations make it possible to deploy structures in deep-water (>60 meters) areas, opening up significant offshore real estate for countries like Japan, the US West Coast, Brazil, and Scotland. Floating wind turbines do not have to deal with seabed limitations and can circumvent geophysical barriers to installation. Reduction of prototype costs will lead to increased scaling and lowered total project cost. Floating wind technologies also support wind-to-hydrogen applications at remote or decommissioned offshore oil platforms. The new technologies open up round-the-world project development much beyond shallow waters.

The use of AI and Predictive Maintenance: Digital twins, AI blade monitoring, and predictive analytics platforms enhance performance and minimize downtime. Algorithms prevent failures caused by icing, mechanical issues, or pitch settings too many degrees off. Inspecting turbine blades and their underwater structures is done by drones and AUVs, alleviating both cost and risk associated with servicing these parts. These developments are in line with the shift to case-by-case maintenance as opposed to routine scheduled maintenance which will further improve service performance and return on investment. Changing to data-driven systems attracts more investors, extends turbine service life, and decreases the net present value of costs attributed to unplanned outages.

The Localization of Supply Chains: Countries are now establishing local fabrication yards for monopile, blade, and nacelle assembly to avoid tariffs and reduce logistics expenses. Content localization directly supports job creation and mitigates regulatory burdens. Governments tend to add localized content requirements in the procurement processes. Consequently, complete regional supply chain ecosystems which include port upgrades, dedicated vessel fleets, and associated manufacturing clusters are emerging in Northeast Asia, Europe, and the U.S. This also reduces lead times while industrial participation is enhanced along with reduced dependencies on shipping through longer international routes.

Wind-to-hydrogen or other hybrid offshore wind projects: These projects are capable of coupling offshore wind with hydrogen production facilities enabling storage of energy and sector coupling. Offshore generation in excess can power electrolyzers where green hydrogen is produced to be used as feedstock or stored during off-peak seasons. Some platforms have plans for offshore floating wind farms with integrated freshwater desalination or offshore electrolyzers. This trend is beneficial for grid stability and addresses issues with intermittency. Hybrid models tend to attract multi-sector investments, policy support including hydrogen mandates, and new streams of revenue aside from the sale of electricity which is the primary focus.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 44.11 Billion |

| Estimated Market Size in 2034 | USD 82.19 Billion |

| Projected CAGR 2025 to 2034 | 7.16% |

| Leading Region | Europe |

| Fastest Grwing Region | Asia-Pacific |

| Key Segments | Installation, Capacity, Water Depth, Component, Turbine Type, End-User, Region |

| Key Companies | General Electric, Vestas, Shanghai Electric Wind Power Equipment Co., Siemens Gamesa, Doosan Heavy Industries and Construction, Hitachi, Rockwell Automation, Nordex SE, Hyundai Motor Group, Schneider Electric, Zhejiang Windey Co., Taiyuan Heavy Industry Co. |

The offshore wind market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The market in North America, particularly in the United States, is still in the early phases, but there is substantial potential for growth. The federal government of the United States plans to deploy 30 GW of offshore wind by 2030, with significant activity projected along the Atlantic Coast. Achievements are being made including state-level procurement goals, advantageous leasing auction results, and upgrades to existing infrastructure. Critical milestones are being achieved with projects such as Vineyard Wind and Dominion Energy’s Coastal Virginia Offshore Wind. Moreover, advancing supply chain development, grid integration, and permitting resolve remaining challenges. Interest is also growing for floating wind in the Pacific Coast. While Canada is looking into projects offshore of Nova Scotia and British Columbia, these remain quite underdeveloped.

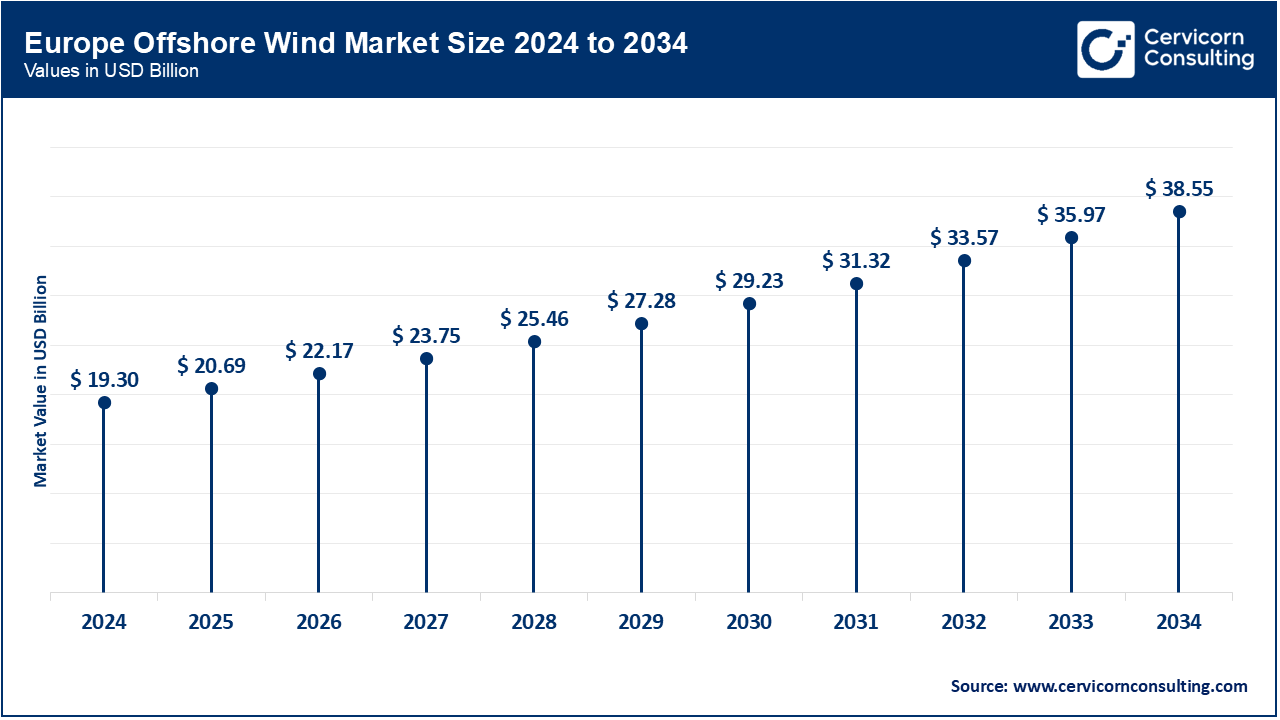

Europe has continued to dominate the sector, holding over 46.90% of capacity in 2024. The UK, Germany, the Netherlands, and Denmark are mature markets with developed and climate-motivated regulatory frameworks, robust grids, and supportive infrastructure. Investing continues to be sustained by the EU Green Deal and national pledges towards net zero emissions. Moreover, the region is being pushed to pioneer integrated wind solutions such as floating wind power, HVDC grid connections, and integrated energy islands. The North Sea and Baltic Seas are particularly targeted for exports. Regions with strong OEM and developer ecosystems, balanced financing, stable policies, and favorable custromer ROI estopbolish Europe as the offshore growth leader.

China, Taiwan, Japan, and South Korea are rapidly emerging as a key offshore wind hub. State-backed developers and manufacturing dominance are propelling China as the largest offshore wind installer by annual capacity. Taiwan and South Korea focus on floating wind to capture deep-sea resources while Japan seeks to reduce nuclear power dependency through offshore wind development. Incentives focused on local manufacturing, grid construction, and upgrades are aiding regional growth. Compounded by a demand for energy and maritime expertise, the region’s coastline has potential, despite the shallow water sites. Offshore wind expansion is, however, challenged by typhoons and permitting delays.

Offshore Wind Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 18.30% |

| Europe | 46.90% |

| Asia-Pacific | 29.20% |

| LAMEA | 5.60% |

The region is still developing for offshore wind but Colombia and Argentina are looking into prospective projects and Brazil is further developing the field. Brazil is a forerunner as it has favorable wind resources along the coastline. The regulatory framework is developing towards auctions as well as integration to the grid offshore wind. Brazil, Argentina, and Colombia hydropower countries which also depend on energy diversification priorities will benefit from offshore wind. There are still gaps in infrastructure, local knowledge, investment policies, and the pace of progress is sluggish. To accelerate development, international partnerships and technology transfers will be critical. Policy and financing conditions in the region, target emissions, and global climate needs provide a sustainable opportunity.

Fixed Structure: Wind turbines mounted to an offshore fixed structure are anchored to the sea bed using monopile, jacket, or gravity-based foundations. These installations are positioned in shallow to medium-depth waters, usually not exceeding 60 meters in depth. Fixed structures dominate the offshore market due to their maturity, cost efficiency, and established supply chains. The UK, Germany, and China have heavily invested into fixed-bottom offshore wind farms. Operationally lower risk offshore wind farms present a critical opportunity in dense large-scale renewable integration into national grids alongside significantly high energy yields. Limitations in deployment depth may restrict potential in certain coastal geographies.

Offshore Wind Market Share, By Installation, 2024 (%)

| Installation | Revenue Share, 2024 (%) |

| Fixed Structure | 56.30% |

| Floating Structure | 43.70% |

Floating Structure: Floating offshore wind structures are designed to be deployed in deeper waters where fixed foundations would not be economically feasible. These turbines can be placed at greater than 60 meters utilizing moored platforms like spar buoys, tension leg platforms, and semi-submersibles. These solutions are less mature and more capital intensive when compared to fixed solutions. However, they do provide access to previously untapped wind resources. Countries with narrow continental shelves like Japan and the US West Coast will find these resources particularly beneficial. Pilot projects in the UK, Norway, and South Korea are using floating systems which are expected to accelerate growth for the next wave of offshore wind expansion.

Up to 3 MW: Initially offshore wind power innovations adopted turbines utilizing 3 MW rated capacity units as these systems were uncomplicated and dependable. They are still in use for new installations, decommissioned site, or repowering projects. Advantages of these turbines are diminishing with preference of larger rated units. They still serve a purpose in initial stages of deployment as well as demonstration projects and distributed generation. Redesigns for these systems are increasing output limits although they are not built for larger capacities rotors as well as drivetrains.

3 MW to 5 MW: These offshore wind turbines are intersectoral as a bridge connecting the size and complexity of the systems. These turbines are used in medium scale projects and areas with average wind profiles. With the presence of better economies of scale than sub-3 MW units, lower infrastructure upgrades demand than ultra-large turbines, these serve well for expansion. Europe’s offshore buildout has been dominated by this segment as well as the hybrid intermediately deepwater operated ones. Through evolving technology, the industry is shifting towards growth turbines exceeding 5 MW.

5 MW and above: Floating wind turbines designed for use in commercial wind farms have increased in size and efficiency, with state-of-the-art models from Vestas and Siemens Gamesas boasting over 10 MW capacity. Such floating wind turbines allow for the optimization of space utilization, as an increase in power output per turbine helps in reducing balance-of-system expenses. In areas with deep water and high winds, this technology accelerates gigawatt-scale deployments which achieve decarbonization targets. The integration of high-capacity turbines into floating arrays will become more widespread as floating technology advances, thereby reducing the LCOE of offshore installations.

Shallow Water (<30 M Depth): Shallow water installations—less than 30 meters deep—are the most economically viable and technically feasible. These sites allow for easy construction, maintenance, and grid connection, which lowers installation costs. This segment has been the backbone of offshore wind growth in Europe, particularly in the North Sea and Baltic regions. The proximity of crucial coastal economies is marked by shallower locations, thus severely limiting accessibility. Such restrictions, however, are speeding up the move towards deeper submarine constructions, which serves to underline the growing long-term demand for floatage solutions.

Transitional Water (from 30 to 60 m depth): This encompasses the semi-deep offshore zones which still can be reached with fixed installations, although they entail considerable additional engineering works, complex logistics, and resilience to environmental impact. It improves the balance between shallow and deep-water installations, hence increasing the potential for fixed-bottom turbine expansion. Advancement in jacket foundation designs as well as suction bucket technology has improved the feasibility of these areas. Numerous projects across Europe are now being installed in transitional depths, which provide high-capacity factors and are near urban centers that heavily demand power.

Turbine: The turbines offshore used to generate wind energy systems consist of the turbine blades, nacelle, generator, rotor hub, and other components essential for energy generation. These systems capture both the kinetic energy of winds and transform it first to mechanical and thereafter electrical energy. Compared to onshore units, offshore turbines are larger and significantly more powerful; recent designs exceed 15 MW to improve efficiency and reduce the cost per megawatt. For offshore turbines, critical factors include turbine efficiency, rotor diameter, and extreme marine condition durability. Vestas, GE, and Siemens Gamesa are global players that win market segments by competing on turbine size, performance enhancement, and digitalization. It is also an area of concentrated investment for new technology development since offshore installations incur turbine CAPEX costs of approximately 30-40%.

Substructure: The substructures, which support the turbines and anchor them to the seabed, are designed according to the specific water depth, seabed conditions, and the load from the turbine. Located in shallow to transitional waters, fixed-bottom structures include monopiles, jackets, and gravity-based structures. Semi-submersible, spar-buoy, and tension leg platforms serve as floating structures that provide access to deep waters. The geographic location, type of foundation, and level of complexity in installation significantly affect the substructure costs. Offshore projects have multiple cost drivers, but in this case, structural support serves as the primary cost driver. These shallow ocean floors or substructures face extreme ocean dynamics which require careful strategic spatial consideration. Recently, advancements in modular and hybrid designs, among other novel innovations, have improved the speed of deployment of both fixed and floating installations, significantly lowering costs and expanding feasible areas for installation.

Electrical Infrastructure (Cables and Substations): This category also includes array cables that interconnect turbines, as well as export cables that carry power to the shore. Additionally, there are offshore as well as onshore substations that perform the necessary functions of voltage step-up and grid integration. For far-offshore sites, HVDC technology is preferred because of lower transmission losses. In the case of undersea cables, the performance insulation requirements of the cable requires high strength, resistance to corrosion, and reliability over long periods of time. Roughly 15–20% of the total cost for offshore projects goes towards electrical infrastructure. It improves energy transfer efficiency, enhances grid stability, and reduces maintenance needs. Electrical infrastructure also improves reliability for real-time data collection, power monitoring, and fault isolation, enabling advanced remote system control. Important suppliers include Prysmian, NKT, and Nexans. The industry still lacks solutions to grid bottlenecks and permitting issues.

Control Systems: In offshore wind farms, the control systems function to manage turbine operation in energy capture optimization, load sharing, and overall system safety. SCADA systems, condition monitoring units, CMUs, wind forecasting modules, as well as AI and machine learning based predictive analytics technologies are all encompassed here. The advanced control systems are able to respond to environmental factors by adjusting blade pitch, yaw angle, and power output flexibly. Increased efficiency in automation as well as remote diagnostics improves operational maintenance activities, thus reducing cost and downtime. The expansion of wind farms increases the urgent need for robust digital infrastructure for seamless integration with grid requirements. Special focus is on cybersecurity and real-time control for floating wind systems. Primary Providers of these technologies include ABB, Siemens, and GE.

Horizontal Axis Wind Turbines (HAWT): In offshore wind sectors, the HAWT is the most common turbine type used, characterized by a horizontal shaft and blades set at right angles to the wind. Their upwind configuration allows for the best aerodynamic efficiency and makes them suitable for power generation on a utility scale. These turbines allow for pitch and yaw control which improves energy recovery. Most utility-scale offshore turbines, such as those made by GE, Siemens Gamesa, and Vestas, use Horizontal Axis Wind Turbines (HAWTs). Although these turbines might have a higher cost compared to other options, they benefit from design maturity, proven scalability, and an established supply chain, which provides these turbines with dominant installations worldwide. These turbines may have exact alignment requirements; additionally, they are turbulent wind, thus they require advanced control as well as supervision systems.

VAWTs: Vertical axis wind turbines (VAWT) capture wind from any direction since their blades rotate around a vertical shaft, hence do not require active orientation. While less common for offshore applications, VAWTs are being increasingly considered for floating use because of their simpler mechanisms and low center of gravities. Such designs result in easier maintenance spindle access and smaller turbine spacing. VAWTs seem to lack the efficiency and power output compared to HAWTs, however. Prototypes of these turbines for deep sea floating wind farms are being developed by startups and research institutions. Further research is needed to make commercial offshore deployment possible.

Utilities: Offshore wind farms are owned and operated by utilities, which makes them the largest end-users. Ørsted, Iberdrola and RWE are global leaders. Utilities enjoy a very stable regulatory environment with long-term power purchase agreements (PPAs) and significant investment capacity. They require collaboration with technology companies, EPC contractors, and transmission operators to execute sophisticated offshore wind projects. Driven by the strategic need to decarbonize portfolios and reduce reliance on fossil fuels, utilities have made offshore wind a key focus in Europe, the U.S. and emerging markets in the Asia-Pacific region.

Independent Power Producers (IPPs): These are privately owned businesses that generate electricity for sale to utility companies or industrial clients through long-term contracts. To finance and operate offshore wind farms, they often partner with other developers or investors. Unlike state-owned utilities, IPPs have greater operational agility. They can pursue competitive auctions, merchant projects, or even hybrid offshore wind plus hydrogen initiatives. They are expanding in regions where deregulation encourages private investment. Some examples are Equinor and SSE Renewables. Regardless of the difficulties Independent Power Producers (IPPs) encounter with gaining grid access and stabilizing long-term revenue contracts, they continue to be an innovative force and help with the diversification of the offshore sector.

Oil and gas giants: Renewable energy investments are being made by oil and gas giants Shell, BP, Equinor and TotalEnergies have kept their concentration in oil and gas along with possessing industry know-how, capital, global reach, and project management capabilities which enable them to make aggressive forays into offshore wind investments for business diversification and sustainability objectives. Because of the companies' existing competencies in offshore engineering, these firms are particularly well suited to the wind energy sector, particularly to floating wind which aligns with their deep-sea operational strengths. New players are augmenting competition and driving innovation for turbines, hybrid (wind and hydrogen) platforms, and offshore storage systems. Nonetheless, for many companies moving away from serving the traditional p ower markets, full integration within these markets remains fraught with considerable challenges.

Market Segmentation

By Installation

By Capacity

By Water Depth

By Component

By Turbine Type

By End-User

By Region