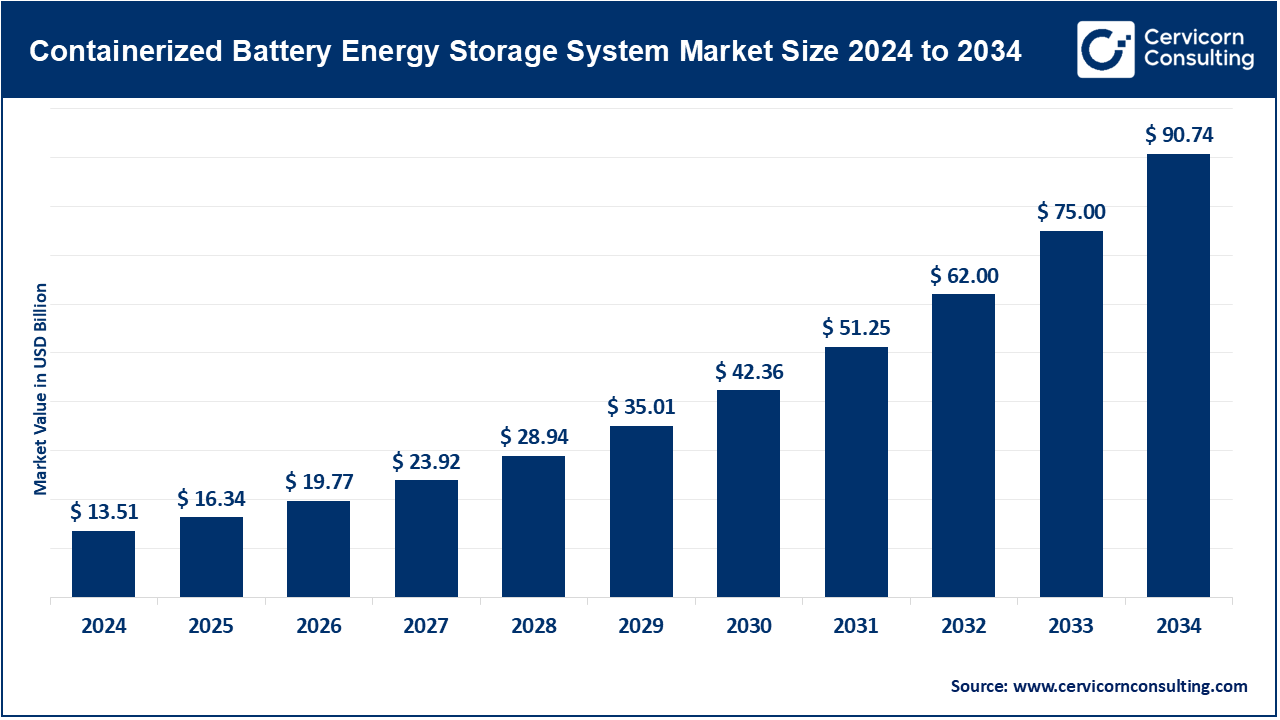

The global containerized battery energy storage system (BESS) market size was valued at USD 13.51 billion in 2024 and is anticipated to reach around USD 90.74 billion by 2034, growing at a CAGR of 21% from 2025 to 2034. The containerized battery energy storage system (BESS) market is growing at a fast pace due to current global decarbonization and energy security along with integration of renewables. Among the significant factors are the increasing demand in electricity, the goals of Net Zero and moving towards the depletion of fossil fuels. Grid optimization and storage efficiency are being boosted by advancements in technology in the fields AI, IoT, online platforms, and smart grids. Favorable government measures like green subsidies, the price of carbon and renewable mandates are being the further drivers of speedy adoption. Strong investments in solar, wind, and hydrogen, and electrification highlight the importance of BESS as an energy transition instrument. Moreover, the growth in the market is being strengthened by consumer concern over clean solutions and the e-mobility.

What is containerized BESS?

The containerized battery energy storage system (BESS) market can be defined as transportable battery energy storage systems that can be deployed flexibly at utility, commercial, and industrial scale. These systems facilitate built in energy-storage, integration of renewable power as well as stabilization of the grid due to the fact that they are able to store surplus power and release the same in an event of an increase in demand. In addition to backup power, containerized BESS can increase long-term sustainability by reducing the dependence on fossil fuel, contributing to climate targets, and realising structural transformation of energy generation, delivery, and consumption.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 16.34 Billion |

| Estimated Market Size in 2034 | USD 90.74 Billion |

| Projected CAGR 2025 to 2034 | 21% |

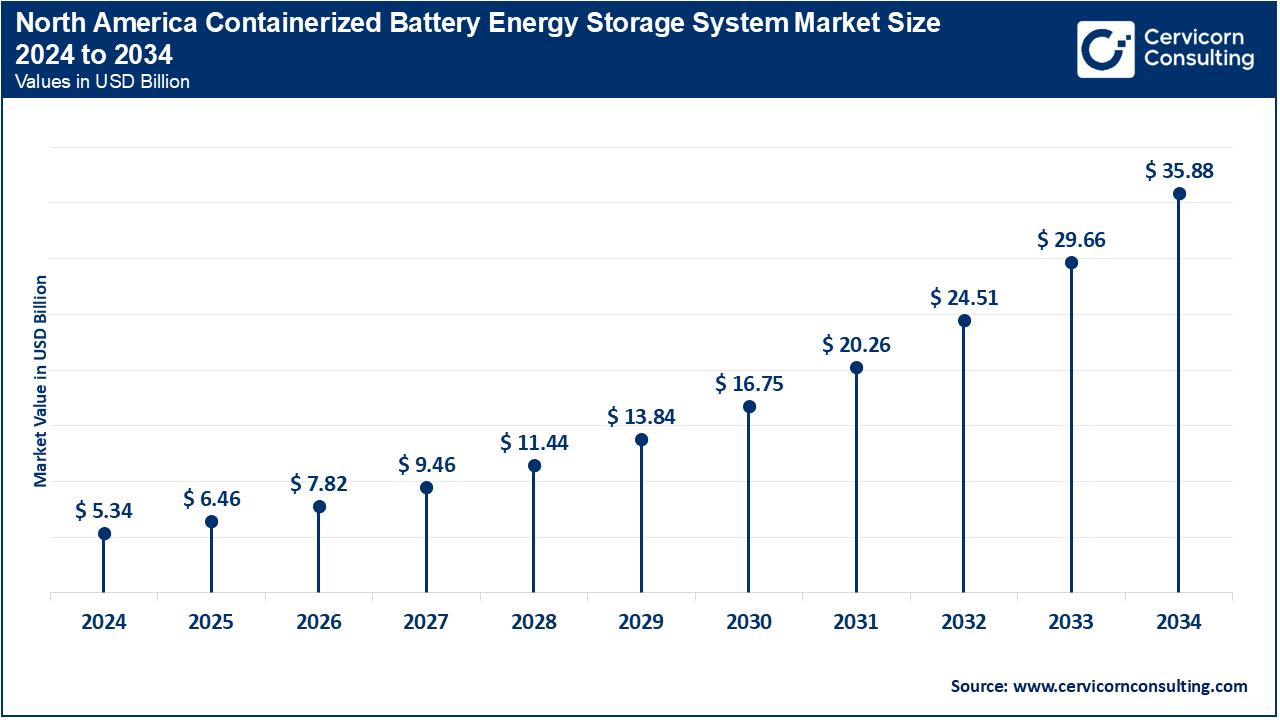

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Battery Type, Power Rating, Container Size, Application, End-User, Region |

| Key Companies | CATL, Samsung SDI, ABB, Eaton, Fluence, EVE Energy, Tesla, LG, Gotion, Pylon Technologies, BYD, Saft Group, CALB, Hitachi, Kokam, Narada |

The containerized BESS market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America is leading the global market in deploying containerized BESS due to the integration of renewables and modernization of the grid. California expanded the Edwards Sanborn Solar-plus-Storage project to 875 MW/3.287 MWh in March 2025, making it one of the containerized BESS systems in the world. Texas is actively connecting large solar ranches to containerized storage, aided by AI-based energy management systems to manage grid intermittency. Canada is integrating BESS with green hydrogen pilot projects started in Quebec in February 2025. Mobility electrification in the U.S. is also being strengthened with New York installing a 100 MW containerized BESS to serve EV charging hubs in May 2025. North America is seeking to achieve decarbonization while maintaining reliable power delivery.

Europe has developed a robust base for containerized BESS due to a combination of climate policies and the growth of renewables. The UK ‘s offshore wind expansion has permitted the installation of containerized BESS. Germany is integrating containerized BESS with its “Solar Roofs for All” program launched in April 2025 to ensure that storage complements localized solar growth and is not an afterthought. France is focused more on hybrid solar-wind-BESS configurations and completed the installation of a 50 MW system in Normandy in June 2025. Spain is a pioneer with the hydrogen-linked BESS for decarbonizing industrial processes with a pilot program started in Valencia in March 2025. These collective and coordinated steps from the member states puts Europe in the forefront of the systematic and strategic transformation to clean energy.

Rapidly increasing energy requirements, urban decarbonization, and strategies are expediting the adoption of containerized BESS in the Asia-Pacific region. As of August 2025, China had operationalized its 200 MW containerized BESS in Shandong Province in aid of a solar farm and continues to lead in storage deployment. India has been more aggressive with renewable-linked storage, as evidenced with the 50 MW containerized BESS in Rajasthan, operationalized in May 2025, which aids in stabilizing solar-heavy grid energy. Japan continues its smart grid testing, and in July 2025, it instituted a containerized BESS pilot project in Okinawa to fortify resilience for islanded communities. South Korea is adopting containerized BESS with offshore wind, evidenced by the 30 MW system in Jeju which was announced in June 2025. These developments illustrate how the Asia Pacific is becoming a global focal point for the diverse and multifunctional storage applications in urban, rural, and industrial settings.

Containerized Battery Energy Storage System Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 39.54% |

| Europe | 19.46% |

| Asia-Pacific | 32.60% |

| LAMEA | 9.40% |

Progressing in LAMEA (Latin America, Middle East, and Africa) region, containerized BESS is being adopted with some impactful projects focused on integration with renewables. Brazil implemented a 40 MW containerized BESS project in Ceará in July 2025 to serve the growing winds in the region. To curb the rolling blackouts in South Africa, a 20 MW solar plus BESS hybrid project was initiated in Limpopo in June 2025, to aid in the persistent grid instability. In the Middle East, Saudi Arabia has integrated containerized storage with the Neom hydrogen project, where containerized units were tested in May 2025 as part of the giga-project’s framework. The UAE has also tested containerized hydrogen BESS systems for mobility integration during sustainability projects tied to the Expo earlier in 2025. These illustrate the strategic approaches to BESS deployment in LAMEA to address urgent energy security issues, even though progress is tempered in comparison to other areas.

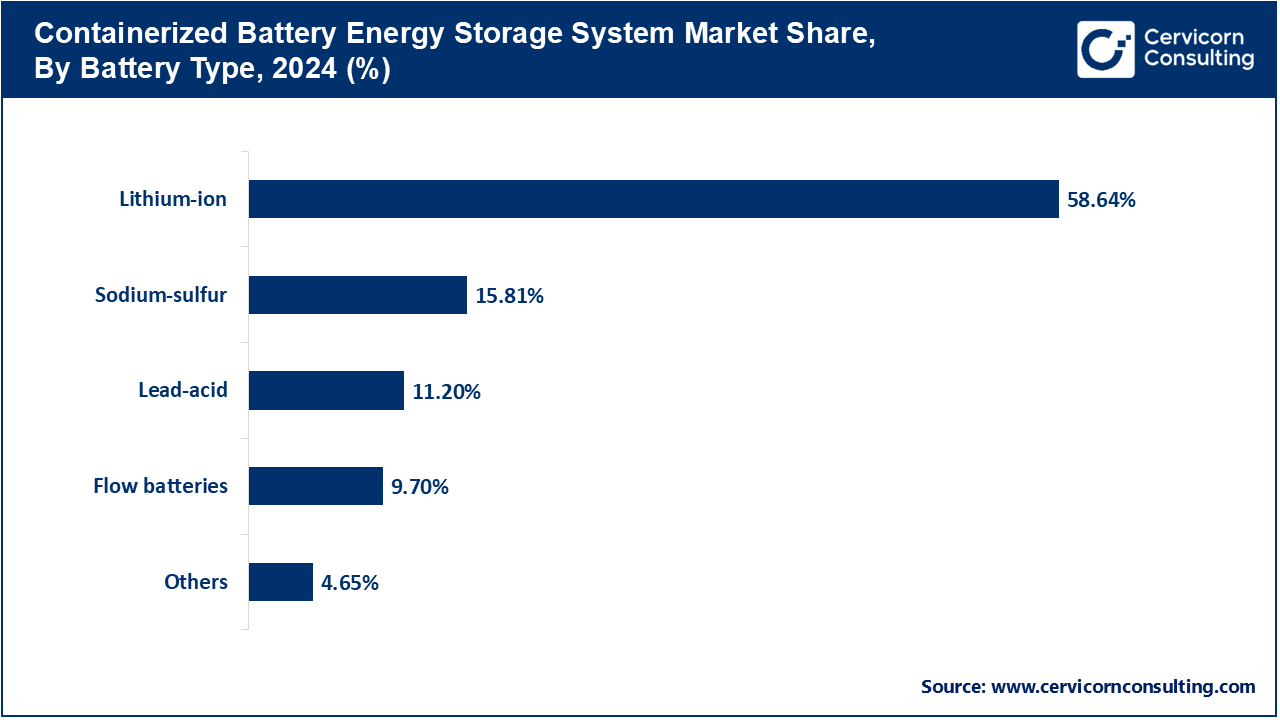

Lithium-ion: Due to their extensive use in integration and grid-balancing applications, lithium-ion batteries dominate the BESS market due to their high energy density, fast response, and a long cycle life. Wärtsilä showcased the technology’s prowess in frequency regulation and renewables intermittency management with the 200MW/400MWh lithium-ion containerized BESS supplied to ERCOT in May 2023. The lithium-ion technology’s continued declining cost and support from manufacturers solidify its dominance in large scale applications.

Sodium-sulfur: Valued for their long-duration performance, sodium-sulfur (NaS) batteries are high-temperature systems with storage capacity ranging from 6 to 10 hours. Suitable for utility-scale load leveling and renewables firming, NaS batteries also support wind energy long-duration backup in Hokkaido, Japan, with the 50MW expansion in February 2023 aimed at providing long-duration backup for wind energy. Additionally, NaS batteries support the stabilization of remote areas with variable renewable energy. The Asia-Pacific’s harsh operating environments enhances the need for these batteries, improving their operational efficiency.

Lead-acid: Lead-acid batteries remain important in containerized BESS for cost-sensitive applications and as backup power sources. These batteries are still used in off-grid and small industrial facilities. As part of a rural electrification initiative, Exide Technologies deployed a 10 MW containerized lead-acid system in India in August 2022. Although lead-acid batteries are less efficient than lithium-ion batteries, they are easier to recycle and cheaper. These factors lead to their use in emerging markets.

Flow batteries: Conventional batteries are outperformed by flow batteries, which store energy in liquid electrolytes, as they offer greater lifespan and capacity. They are ideal for microgrids and areas rich in renewables. As a testament to their long-duration storage capability, Invinity Energy Systems deployed a 7.8 MWh vanadium flow battery in California in November 2023, showcasing its minimal capacity fade ability over time. Moreover, flow batteries are becoming increasingly popular in containerized configurations where long-term resilience and durability are critical.

Others: The secondary batteries under consideration also feature zinc based, hybrid-ion, as well as newly developing solid-state technologies which are entering the containerized BESS space. These new expansion types seek to overcome the burden of lithium-ion’s cost and supply chain difficulties. In July 2023, as part of a demonstration for levelized grid-scale resiliency, Eos Energy delivered a 3 MWh zinc-hybrid battery project in Pennsylvania. Innovations like this are a clear demonstration of the efforts of hybrid niche chemistries towards wider scalability. This remains in the experimental space, but being able to test and minimize material dependency is important for sustainability.

Utility-scale storage: Utility-scale containerized BESS systems play a vital role in stabilizing and integrating renewables into the grid while also providing frequency regulation. They are typically greater than 50 MW in size and support national grids. To strengthen grid reliability in the face of heightened renewable energy penetration, Fluence commissioned a 150 MW/300 MWh BESS in Victoria, Australia, in April 2023. This project showed the energy security benefits and reduction in renewables curtailment that containerized BESS systems enable. Such large deployments are also the primary focus of ongoing market investment.

Commercial & industrial (C&I): C&I storage systems are implemented by factories and warehouses and are used by business districts to manage peak demand charges and ensure business continuity. There is modularity and scalability in containerized BESS systems in these sectors. Schneider Electric deployed a 5 MW containerized BESS at a French manufacturing hub for improved operational costs and energy resilience in June 2023. These businesses implemented this system to achieve their sustainability targets while reducing reliance on grid fluctuations.

Containerized Battery Energy Storage System Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Utility-scale Storage | 46.83% |

| Commercial & Industrial | 24.62% |

| Residential | 9.20% |

| Off-grid Solutions | 7.05% |

| Microgrids | 12.30% |

Residential: The scale might be smaller, but containerized BESS units are now finding their way into high-end residential estates as well as community housing projects. These systems enable homes to couple with rooftop solar panels, making energy self-sufficiency achievable. Containerized residential battery units were launched by Tesla in California in March 2023, providing backup storage for multi-home communities and marking a shift towards decentralized energy resilience. Though adoption remains a niche, the trend is increasing in developed economies as power outages become more common.

Off-grid solutions: Serving remote villages, islands, and mining sites with unstable grid access are the off-grid applications of containerized BESS. These systems enhance sustainability and reduce the dependence on diesel-powered generators. Siemens demonstrated the potential of BESS in Africa by delivering a 3 MW containerized BESS to electrify off-grid communities in Namibia in September 2023, which remain powered by hybrid solar-diesel systems. Such systems are lifesaving for developing regions.

Microgrids: Containerized BESS supported microgrids form resilient and self-sufficient micro electric power systems that operate independently from larger grids. These systems are essential for military bases, remote industrial centers, and regions prone to disasters. In October 2023, Hitachi Energy launched a microgrid supported with BESS for a mining operation in Chile, enabling a 10 MW BESS to reduce diesel consumption. This highlighted the rise of containerized BESS and their role in enabling off-grid renewables-dominated power generation. There is a global surge in the deployment of microgrids for resilience planning.

Below 500 kW: These categories of BESS systems are more suited for residential and small commercial and community-based structures. They serve as backups as well as peak shavers. In January 2023, a 400 kW BESS was installed at a rural school in South Korea in a bid to guarantee energy supply. This underscores the role of BESS in strengthening energy access for smaller facilities. They include containerized systems that are compact and can be deployed rapidly.

500 kW - 1 MW: These systems serve medium-sized commercial establishments and localized microgrids. They are cost-effective, yet provide a good balance between scalability and performance. In July 2023, Siemens deployed a 750 kW BESS at a logistics park in Germany to facilitate EV charging as well as energy optimization. This project demonstrated the flexibility of containerized BESS in promoting clean mobility. The segment continues to expand in response to rising EV charging demand.

Containerized Battery Energy Storage System Market Share, By Power Rating, 2024 (%)

| Power Rating | Revenue Share, 2024 (%) |

| Below 500 kW | 10.20% |

| 500 kW – 1 MW | 16.40% |

| 1 MW – 5 MW | 37.41% |

| 5 MW – 10 MW | 21.80% |

| Above 10 MW | 14.19% |

1 MW – 5 MW: This segment features some of the fastest expanding scales found in industrial areas and through partnerships with utilities. These systems are capable of managing grid balancing and enabling renewables. In February 2023, Powin Energy completed a 3 MW containerized system for a municipal grid in Oregon that provided frequency stability. These systems are modular; therefore, expansion is simple and can be performed as demand increases. They are appealing because of their scalability and cost-effectiveness.

5 MW – 10 MW: These are adopted for industrial scale operations, renewable plants, and small utilities. They also deliver longer duration backup, as well as grid reinforcement. In May 2023, CATL provided a 9 MW BESS in Spain, which was integrated with solar to reinforce regional electricity distribution. This trend displays the increasing utilization of large-scale containerized storage in Europe. These installations play a critical role in alleviating local grid issues.

Above 10 MW: These are used by national grid operators and renewable developers for bulk storage. They are also used in supporting wind and solar farms. NextEra Energy deployed a 100 MW containerized BESS in Arizona in November 2023 to relieve solar curtailment. This project emphasized the prominence and scale of containerized storage and its pivotal role in the energy transition. Such deployments form the pillars of grid modernization globally.

Power utilities: Utilities have containerized BESS for purchase to improve grid stability, manage loads, and integrate renewables into their systems. National Grid UK recently commissioned a 50 MW BESS to improve frequency stability in its transmission network. This underscores the reliance of utilities on containerized storage for resilience. Their adoption continues to support the scaling of clean energy.

Renewable energy developers: Renewable energy project developers can now manage excess renewable generation using containerized BESS, thus ensuring dispatchability. This enhances the bankability of wind and solar projects. In March 2023, Enel Green Power solar integrated a 30 MW BESS into its Chilean solar plant to ensure stable grid powering. This showed the value of project storage. Containerized systems are increasingly viewed by developers as essential project additions.

Containerized Battery Energy Storage System Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Power Utilities | 44.26% |

| Renewable Energy Developers | 23.70% |

| Data Centers | 14.21% |

| Transportation & Logistics Hubs | 10.62% |

| Military & Defense | 7.21% |

Data centers: Data centers need seamless power energy access, thus making containerized BESS critical for backup as well as peak power demand management. In August 2023, Google replaced diesel generators powering its data center with a 10 MW BESS located in Belgium. This step aligned data infrastructure with sustainability goals. Their adoption shrinks carbon footprints and improves reliability.

Hubs for logistics and transportation: Port and airport logistics centers integrate containerized BESS for EV charging, cargo electrification, and for seamless operational reliability. In September 2023, Hamburg Port deployed a 5 MW BESS to support electrified cranes and trucks. This highlights logistic facilities’ early embracement of storage to meet decarbonization targets. Such adoption is expected to increase alongside electrification trends.

Military and defense: Mobile energy supply, off-grid mobilized operations, and resilient power networks are consolidated together with containerized BESS in defense operations. In October 2023, the US Army enhanced energy resilience and reduced fossil fuel reliance by installing a 2.5 MW BESS at Fort Carson. This indicates the widening role of storage in military readiness. Portability and rapid deployment in conflict zones make containerized solutions more favorable.

Market Segmentation

By Battery Type

By Power Rating

By Container Size

By Application

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Containerized BESS

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Battery Type Overview

2.2.2 By Power Rating Overview

2.2.3 By Container Size Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Asia-Pacific demand growth

4.1.1.2 Renewable policy integration

4.1.2 Market Restraints

4.1.2.1 All capital intensive

4.1.2.2 Safety and fire risks

4.1.3 Market Challenges

4.1.3.1 Community and regulatory pushback

4.1.3.2 Policy uncertainty and safety legislations

4.1.4 Market Opportunities

4.1.4.1 Utility-scale implementation grid reliability benefit

4.1.4.2 Investment and big portfolio projects

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Containerized BESS Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Containerized BESS Market, By Battery Type

6.1 Global Containerized BESS Market Snapshot, By Battery Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Lithium-ion

6.1.1.2 Sodium-sulfur

6.1.1.3 Lead-acid

6.1.1.4 Flow batteries

6.1.1.5 Others

Chapter 7. Containerized BESS Market, By Power Rating

7.1 Global Containerized BESS Market Snapshot, By Power Rating

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Below 500 kW

7.1.1.2 500 kW – 1 MW

7.1.1.3 1 MW – 5 MW

7.1.1.4 5 MW – 10 MW

7.1.1.5 Above 10 MW

Chapter 8. Containerized BESS Market, By Container Size

8.1 Global Containerized BESS Market Snapshot, By Container Size

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 10 Feet

8.1.1.2 20 Feet

8.1.1.3 40 Feet

Chapter 9. Containerized BESS Market, By Application

9.1 Global Containerized BESS Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Utility-scale storage

9.1.1.2 Commercial & industrial

9.1.1.3 Residential

9.1.1.4 Off-grid solutions

9.1.1.5 Microgrids

Chapter 10 Containerized BESS Market, By End-User

10.1 Global Containerized BESS Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Power utilities

10.1.1.2 Renewable energy developers

10.1.1.3 Data Centers

10.1.1.4 Transportation & logistics hubs

10.1.1.5 Military & Defense

Chapter 11 Containerized BESS Market, By Region

11.1 Overview

11.2 Containerized BESS Market Revenue Share, By Region 2024 (%)

11.3 Global Containerized BESS Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Containerized BESS Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Containerized BESS Market, By Country

11.5.4 UK

11.5.4.1 UK Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Containerized BESS Market, By Country

11.6.4 China

11.6.4.1 China Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Containerized BESS Market, By Country

11.7.4 GCC

11.7.4.1 GCC Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Containerized BESS Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 CATL

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Samsung SDI

13.3 ABB

13.4 Eaton

13.5 Fluence

13.6 EVE Energy

13.7 Tesla

13.8 LG

13.9 Gotion

13.10 Pylon Technologies

13.11 BYD

13.12 Saft Group

13.13 CALB

13.14 Hitachi

13.15 Kokam

13.16 Narada