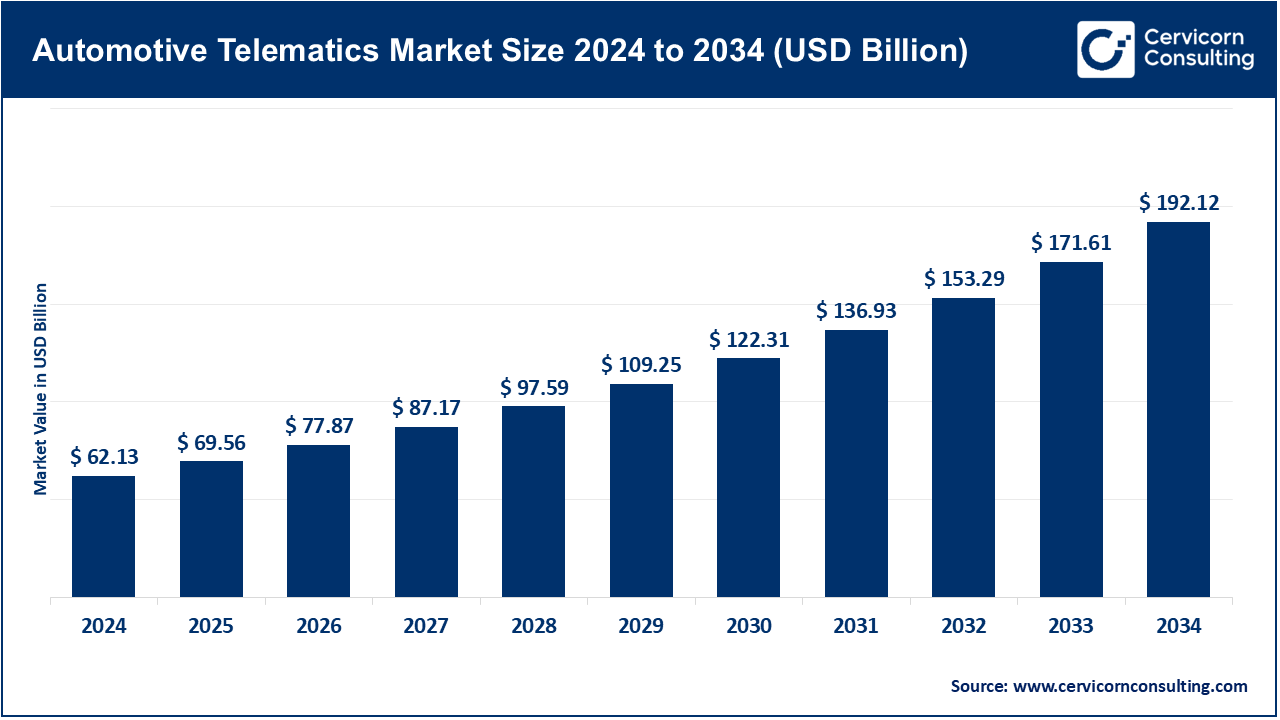

The global automotive telematics market size was valued at USD 62.13 billion in 2024 and is expected to surpass around USD 192.12 billion by 2034, growing at a compound annual growth rate (CAGR) of 15.2% over the forecast period from 2025 to 2034. The automotive telematics market is expected to grow significantly owing to the rising demand for connected vehicles, enhanced fleet management solutions, and increasing emphasis on vehicle safety and regulatory compliance. Growing integration of GPS, real-time tracking, remote diagnostics, and V2X communication in both passenger and commercial vehicles is driving adoption. Additionally, government mandates for eCall systems and insurance telematics, along with advancements in 5G and cloud platforms, are further fueling market expansion across mobility ecosystems, smart transpo00rtation networks, and autonomous driving infrastructure.

Automotive telematics is the combined application of telecommunications and informatics to share, recoup, and keep matters with respect to vehicles and vehicle residents. It incorporates the use of onboard diagnostics, GPS, and wireless connectivity, which allows real-time monitoring, real-time navigation, diagnostic management, and remote and fleet diagnostics. Telematics systems have become common in vehicle tracking and driver behavior analysis, emergency, and predictive maintenance, and infotainment. The technology can improve the safety of vehicles, their efficiency and the user experience. Both consumer and commercial vehicles are incorporating automotive telematics because of the increase in the demand of the connected mobility as an option to receive information, regulatory drivers, and the development of wireless communication infrastructure.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 69.56 Billion |

| Expected Market Size in 2034 | USD 192.12 Billion |

| Projected CAGR 2025 to 2034 | 15.20% |

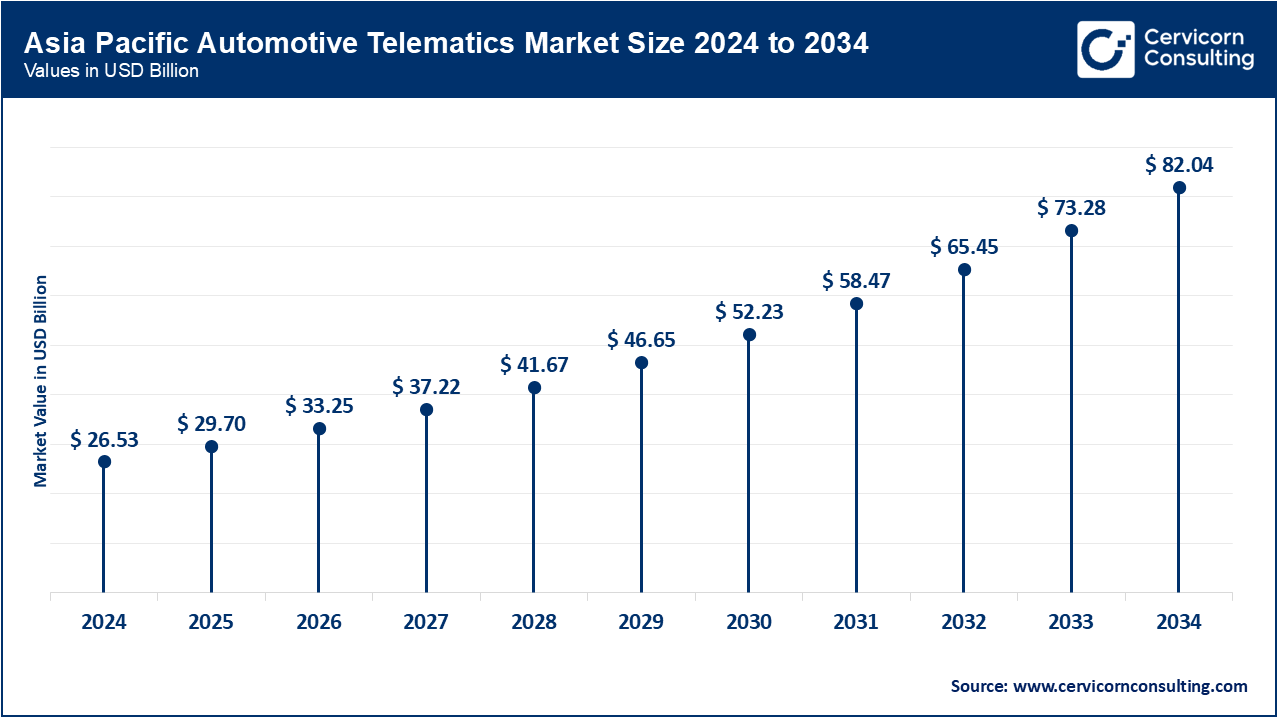

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Technology, Solution, Vehicle, Sales Channel, Service, Connectivity, Application, Region |

| Key Companies | Ford Motor Company, Toyota Motor Corporation, Mercedes-Benz AG, Volkswagen AG, General Motors Company, BMW Motors, AB Volvo, Hyundai Motor Company, Tata Motors, Nissan Motor Co., Ltd |

The automotive telematics market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

In China, Japan, South Korea, and India: These countries are leaders in the automobile market. The region has a growing rate of automobile production along with a developing middle class population and government support for the smart transport systems which drives adoption. In China, domestic OEMs have accelerated telematics with AI integration, while in India, fleet telematics are growing with the expanding logistics industry. The deployment of integrated and tethered vehicle systems continues to be supported within the region by the adoption of low-cost smartphones, as well as the proliferation of 4G and 5G networks.

In North America, the connected vehicle ecosystem, safety regulations, and multiple collaborations with telematics OEMs enables telematics adoption to spets fron other regional for North America. Advanced telematics systems in logistics and insurance serve considerable commercial fleets in the USA and Canada. In addition, the region leads in driving smart mobility, real-time diagnostics, and deep consumer analytics alongside significant growth in electric vehicle (EV) adoption.

Automotive Telematics Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 22.30% |

| Europe | 26.50% |

| Asia-Pacific | 42.70% |

| LAMEA | 8.50% |

The Europe region is driven by eCall and other safety regulation compliance as well as the green environment policy objectives. Leading automotive countries Germany, France, and the UK are proactive in telematics and fleet management as well as in ADAS innovation, focusing on embedded telematics, fleet surveillance, and ADAS integration. Other supporting factors include telematics-based insurances, adoption of EVs, and investments into smart infrastructures driven by the EU’s connected mobility agenda.

The adoption of telematics in LAMEA is taking place through fleet management, insurance, and security systems. Brazil and Mexico are leading this trend in Latin America due to increased urbanization and the growing commercial fleets. The Middle East, particularly Saudi Arabia and UAE, concentrates on smart city projects coupled with mobility-as-a-service. While there are still gaps in infrastructure and high cost concerns, telematics driven logistics alongside government digitization initiatives are creating fresh opportunities for growth.

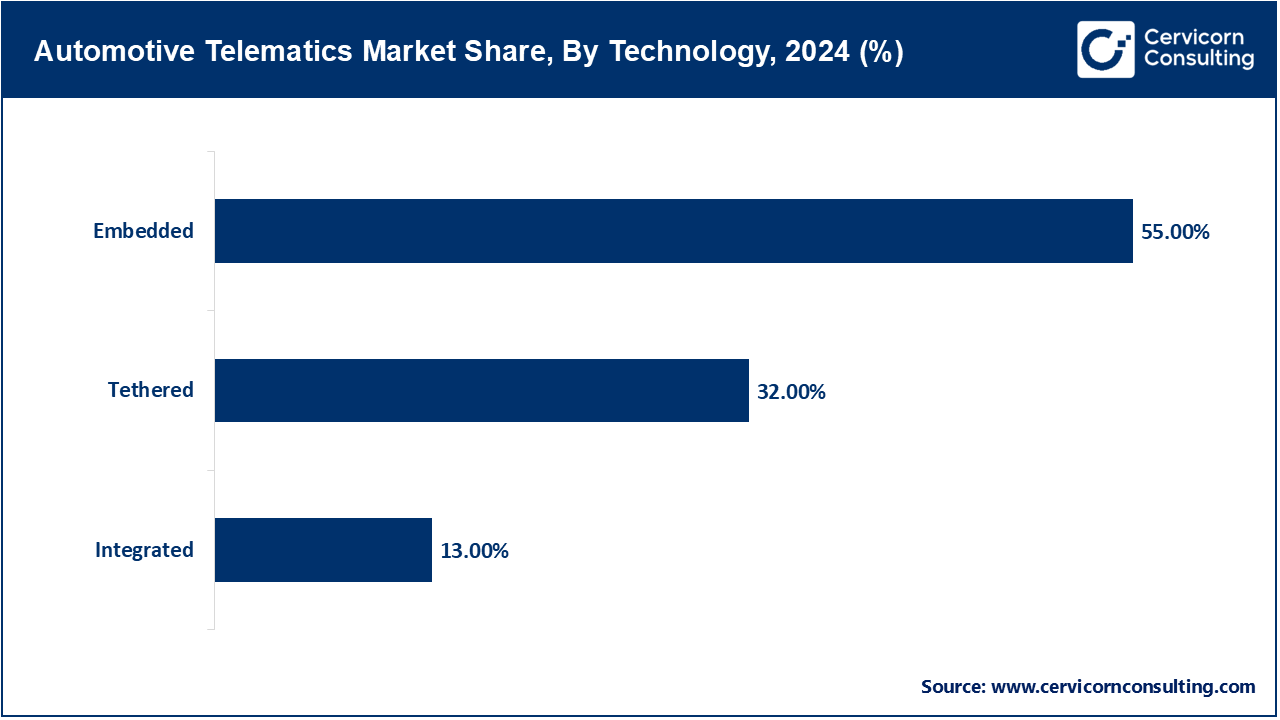

Embedded: The embedded segment has accounted highest revenue share in the market. Within-vehicle embedded systems link to telematics systems which are integrated and installed by a vehicle's manufacturer. They support advanced mobility functions like remote diagnostics and emergency calls, real-time crash notification, and navigation integration. These systems are becoming more desirable due to their lower cost and increased accuracy. OEM-generated data serves as the basis for subscription services, which now require compliance with safety mandates issued by governing bodies. The integral embedded telematics systems are vital for advancing mobility solutions – the growing desire for connected and autonomous vehicles, more sophisticated telematics systems, and fleet management systems fulfills that need.

Tethered: Connectivity of vehicles via dongles or other peripheral devices marks the emergence of tethered telematics systems. With this advancement, smartphones can now be viewed as the main instruments for the receiving and sending of information. Such telematics systems are utilized in lower-tier automobiles, where they can be purchased as aftermarket enhancements, thus offering a greater accessibility relative to embedded systems. Through tethered telematics, owners can access basic vehicle diagnostics alongside emergency and navigation services; however, these functions are dependent on the mobile device's data connection and battery life. Although tethered telematics are less advanced than embedded telematics, they are popular among budget-conscious customers and regions with limited OEM availability.

Integrated: Integrated telematics combines embedded and tethered functions and permits users to make use of onboard modules while connecting with external devices or cloud services. It facilitates the provision of sophisticated services such as smart infotainment, V2X communication, OTA updates, real time data streaming and analytics. These systems are used by automobile manufacturers and service providers in order to enhance the drivers’ experience by merging hardware-driven systems with software systems. This solution is becoming increasingly popular as vehicles shift towards being connected and software-define.

Component: The component segment has generated highest revenue share in the market. Component-based telematics includes hardware elements like control units, sensors, GPS modules, antennas, and connectivity chips. These are critical for enabling communication between the vehicle and external systems. As vehicles become more complex and interconnected, the demand for efficient, lightweight, and high-performance components has grown. OEMs are now more dependent on developments in telematics components to streamline latency, bolster cybersecurity measures, and facilitate 5G for the transmission of data in real-time.

Automotive Telematics Market Revenue Share, By Solution, 2024 (%)

| Solution | Revenue Share, 2024 (%) |

| Component | 57% |

| Service | 43% |

Service: service-based telematics includes the software components’ cloud service systems, portals for fleet management, and advanced analytics systems serving the telematics data. This segment is critical in the management of driver behavior, routing, predictive maintenance, and emergency management response. With the emergence of subscription-based models and smart mobility platforms, services are turning into the center of value for telematics. OEMs, Tier 1 suppliers, and telematics service providers gain enhanced functionality alongside recurring revenue streams through integration with CRM systems, estimation insurance, and Advanced Driver Assistance Systems (ADAS).

Passenger: The passenger cars segment has captured maximum revenue share in the market. The telematics market integrates technology and vehicles mainly for passenger cars mostly for tracking and navigation entertainment due to increased consumer interest. Telemetry is integrated by OEMs to meet compliance (e.g., eCall in Europe), strengthen brand perception, maintain customer loyalty, and foster brand loyalty by providing remote diagnostics and concierge services. The implementation of electric and connected vehicles telematics into this sector for real-time active connectivity is a necessity with regard to the passenger car experience.

Automotive Telematics Market Revenue Share, By Vehicle, 2024 (%)

| Vehicle | Revenue Share, 2024 (%) |

| Passenger | 73% |

| Commercial | 27% |

Commercial: Telematics is utilized for productivity and fuel management in commercial vehicles for the fleet management of logistics operations. Telemetry includes GPS-based tracking, real-time driver evaluation, and scheduled maintenance. Regulatory requirements for vehicle monitoring such as ELD mandate in USA have expedited telematics uptake. In sectors like delivery, construction, or logistics, telematics improves compliance with regulatory mandates, reduces system downtimes, and enhances overall asset utilization. With increasing fleet electrification, commercial telematics will need to evolve to include data on charging, battery status, and emissions.

OEM: The OEM segment has recorded major revenue share in the market. Telematics manufactured OEM are combined with infotainment systems and ADAS during the telematics unit’s production. OEM telematics are leveraged by automakers for gated access to customer information, data security, and paying with information-preserved gated access. In addition to Tesla’s Autopilot and GM’s OnStar, proprietary platforms these ecosystems serve alongside ecosystem-agnostic telematics-enabled services and infrastructure frameworks. Telemetry systems from the manufacturers are integrated with the vehicle's architecture which guarantees their proper operation and maintenance of usability, especially in luxury and connected vehicles.

Automotive Telematics Market Revenue Share, By Sales Channel, 2024 (%)

| Sales Channel | Revenue Share, 2024 (%) |

| OEM | 65% |

| Aftermarket | 35% |

Aftermarket: Aftermarket telematics systems are implemented on older vehicles and are preferred by fleet managers and individual car drivers looking for budget-friendly ways to enhance telematics connectivity. These systems are offered as plug-and-play units, as well as smartphone applications featuring tracking, fuel usage, and driver safety evaluation. The aftermarket segment focuses on older and budget cars alongside commercial fleets. There is an increasing number of aftermarket providers addressing fleets of small and medium-sized enterprises as subscription services expand, offering cloud-based systems and mobile applications.

Information & Navigation: This consists of location-based services, location tracking, real-time navigation updating, and turn-by-turn guidance. With the rise of AI, telematics systems have begun to include voice command navigational assistants, weather information, and AI-based route optimizing. These features, along with other information-based options, are fundamental to the experiences offered by connected vehicles, which aim at convenience and safety for the drivers, while also supporting larger goals of smart city integration.

Safety & Security: eCall services, vehicle theft recovery, crash notification, and geofencing enhance vehicle safety through telematics. Real-time monitoring as well as unauthorized access using predictive analytics ensure safety. Telemetry safety has become important to Original Equipment Manufacturers (OEMs) and insurance companies due to compliance laws requiring telematics safety features, vehicle safety systems, coupled with liability fraud safeguards.

Fleet Management: The fleet management segment has recorded leading position in the market. Telemetry aids in diagnosing problems with commercial fleet vehicles and in their maintenance, route optimization, as well as driver and fuel management. Enhanced fleet and fuel management systems improve compliance with industry standards, control costs, reduce vehicle maintenance, achieve functional improvement, and operational efficiency. Companies today have the ability to reduce operational costs while driving compliance and improving maintenance with these systems. Advanced systems today offer AI-driven analytics, integration with ERP systems, and real-time mobile dashboards for decision-making.

Insurance Telematics: Insurance telematics, or telematics based insurance (UBI), allows insurers to track and monitor client’s driving habits in real-time. Metrics like acceleration, speed, braking, and even geolocation are captured to adjust premiums to the insurer's actual risk exposure. Telematics supports discounts for safe drivers but also fosters improved driving behaviors. Insurers apply the data also for claims validation and fraud prevention.

Others: This category features new use cases like vehicle-to-infrastructure communication, remote vehicle diagnostics, over-the-air software updates, driver wellness monitoring, and infotainment customization. Such use cases further the development of connected and autonomous vehicles for niche and experimental purposes as the automotive industry shifts toward increased digitalization.

Key players in the automotive telematics industry—such as Verizon Connect, Continental AG, Geotab, and Trimble Inc.—are redefining intelligent mobility through the integration of AI, IoT, and cloud connectivity into telematics platforms. In March 2024, Verizon Connect enhanced its fleet management software with AI-powered driver behavior analytics and predictive maintenance modules. Continental AG unveiled its next-gen OTA (over-the-air) architecture in September 2023 to support remote diagnostics and feature updates. Geotab introduced cross-OEM telematics data harmonization tools in May 2024 to support interoperability in large mixed fleets. Trimble, in June 2025, integrated real-time route optimization and energy monitoring tools specifically for electric vehicle fleets. These advancements underscore how telematics is evolving into a central pillar of data-driven, connected, and sustainable transportation ecosystems.

Market Segmentation

By Technology

By Solution

By Vehicle

By Sales Channel

By Service

By Connectivity

By Application

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Automotive Telematics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Solution Overview

2.2.3 By Vehicle Overview

2.2.4 By Sales Channel Overview

2.2.5 By Service Overview

2.2.6 By Connectivity Overview

2.2.7 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 The Growth of Electric Vehicles in Parallel with Mobility-as-a-Service (MaaS) Platforms

4.1.1.2 Insurance Telematics (UBI – Usage-Based Insurance)

4.1.1.3 AI and Predictive Analytics Integration

4.1.2 Market Restraints

4.1.2.1 The Cost of Integration of Advanced Telematics Features

4.1.2.2 Compliance Issues and Data Privacy

4.1.3 Market Opportunities

4.1.3.1 Integration with Electric Vehicle (EV) Ecosystems

4.1.3.2 Development of Autonomous Driving Features

4.1.3.3 Telematics Expansion for Insurance Purposes in Emerging Markets

4.1.3.4 Use in Aerospace and Defense Applications

4.1.4 Market Challenges

4.1.4.1 Lack of International Regulations and Standards

4.1.4.2 Developing Areas Boundaries of Telemetric Technologies

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Automotive Telematics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Automotive Telematics Market, By Technology

6.1 Global Automotive Telematics Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Embedded

6.1.1.2 Tethered

6.1.1.3 Integrated

Chapter 7 Automotive Telematics Market, By Solution

7.1 Global Automotive Telematics Market Snapshot, By Solution

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Component

7.1.1.2 Service

Chapter 8 Automotive Telematics Market, By Vehicle

8.1 Global Automotive Telematics Market Snapshot, By Vehicle

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Passenger

8.1.1.2 Commercial

Chapter 9 Automotive Telematics Market, By Sales Channel

9.1 Global Automotive Telematics Market Snapshot, By Sales Channel

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 OEM

9.1.1.2 Aftermarket

Chapter 10 Automotive Telematics Market, By Service

10.1 Global Automotive Telematics Market Snapshot, By Service

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Emergency Calling

10.1.1.2 On-Road Assistance

10.1.1.3 Remote Diagnostics

10.1.1.4 Insurance Risk Assistance

10.1.1.5 Stolen Vehicle Assistance

Chapter 11 Automotive Telematics Market, By Connectivity

11.1 Global Automotive Telematics Market Snapshot, By Connectivity

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Satellite

11.1.1.2 Cellular

11.1.1.3 4G/3G

11.1.1.4 5G

Chapter 12 Automotive Telematics Market, By Application

12.1 Global Automotive Telematics Market Snapshot, By Application

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Information & Navigation

12.1.1.2 Safety & Security

12.1.1.3 Fleet Management

12.1.1.4 Insurance Telematics

12.1.1.5 Others

Chapter 13 Automotive Telematics Market, By Region

13.1 Overview

13.2 Automotive Telematics Market Revenue Share, By Region 2024 (%)

13.3 Global Automotive Telematics Market, By Region

13.3.1 Market Size and Forecast

13.4 North America

13.4.1 North America Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.4.2 Market Size and Forecast

13.4.3 North America Automotive Telematics Market, By Country

13.4.4 U.S.

13.4.4.1 U.S. Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.4.4.2 Market Size and Forecast

13.4.4.3 U.S. Market Segmental Analysis

13.4.5 Canada

13.4.5.1 Canada Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.4.5.2 Market Size and Forecast

13.4.5.3 Canada Market Segmental Analysis

13.4.6 Mexico

13.4.6.1 Mexico Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.4.6.2 Market Size and Forecast

13.4.6.3 Mexico Market Segmental Analysis

13.5 Europe

13.5.1 Europe Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.5.2 Market Size and Forecast

13.5.3 Europe Automotive Telematics Market, By Country

13.5.4 UK

13.5.4.1 UK Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.5.4.2 Market Size and Forecast

13.5.4.3 UK Market Segmental Analysis

13.5.5 France

13.5.5.1 France Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.5.5.2 Market Size and Forecast

13.5.5.3 France Market Segmental Analysis

13.5.6 Germany

13.5.6.1 Germany Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.5.6.2 Market Size and Forecast

13.5.6.3 Germany Market Segmental Analysis

13.5.7 Rest of Europe

13.5.7.1 Rest of Europe Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.5.7.2 Market Size and Forecast

13.5.7.3 Rest of Europe Market Segmental Analysis

13.6 Asia Pacific

13.6.1 Asia Pacific Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.6.2 Market Size and Forecast

13.6.3 Asia Pacific Automotive Telematics Market, By Country

13.6.4 China

13.6.4.1 China Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.6.4.2 Market Size and Forecast

13.6.4.3 China Market Segmental Analysis

13.6.5 Japan

13.6.5.1 Japan Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.6.5.2 Market Size and Forecast

13.6.5.3 Japan Market Segmental Analysis

13.6.6 India

13.6.6.1 India Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.6.6.2 Market Size and Forecast

13.6.6.3 India Market Segmental Analysis

13.6.7 Australia

13.6.7.1 Australia Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.6.7.2 Market Size and Forecast

13.6.7.3 Australia Market Segmental Analysis

13.6.8 Rest of Asia Pacific

13.6.8.1 Rest of Asia Pacific Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.6.8.2 Market Size and Forecast

13.6.8.3 Rest of Asia Pacific Market Segmental Analysis

13.7 LAMEA

13.7.1 LAMEA Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.7.2 Market Size and Forecast

13.7.3 LAMEA Automotive Telematics Market, By Country

13.7.4 GCC

13.7.4.1 GCC Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.7.4.2 Market Size and Forecast

13.7.4.3 GCC Market Segmental Analysis

13.7.5 Africa

13.7.5.1 Africa Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.7.5.2 Market Size and Forecast

13.7.5.3 Africa Market Segmental Analysis

13.7.6 Brazil

13.7.6.1 Brazil Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.7.6.2 Market Size and Forecast

13.7.6.3 Brazil Market Segmental Analysis

13.7.7 Rest of LAMEA

13.7.7.1 Rest of LAMEA Automotive Telematics Market Revenue, 2022-2034 ($Billion)

13.7.7.2 Market Size and Forecast

13.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 14 Competitive Landscape

14.1 Competitor Strategic Analysis

14.1.1 Top Player Positioning/Market Share Analysis

14.1.2 Top Winning Strategies, By Company, 2022-2024

14.1.3 Competitive Analysis By Revenue, 2022-2024

14.2 Recent Developments by the Market Contributors (2024)

Chapter 15 Company Profiles

15.1 Ford Motor Company

15.1.1 Company Snapshot

15.1.2 Company and Business Overview

15.1.3 Financial KPIs

15.1.4 Product/Service Portfolio

15.1.5 Strategic Growth

15.1.6 Global Footprints

15.1.7 Recent Development

15.1.8 SWOT Analysis

15.2 Toyota Motor Corporation

15.3 Mercedes-Benz AG

15.4 Volkswagen AG

15.5 General Motors Company

15.6 BMW Motors

15.7 AB Volvo

15.8 Hyundai Motor Company

15.9 Tata Motors

15.10 Nissan Motor Co., Ltd