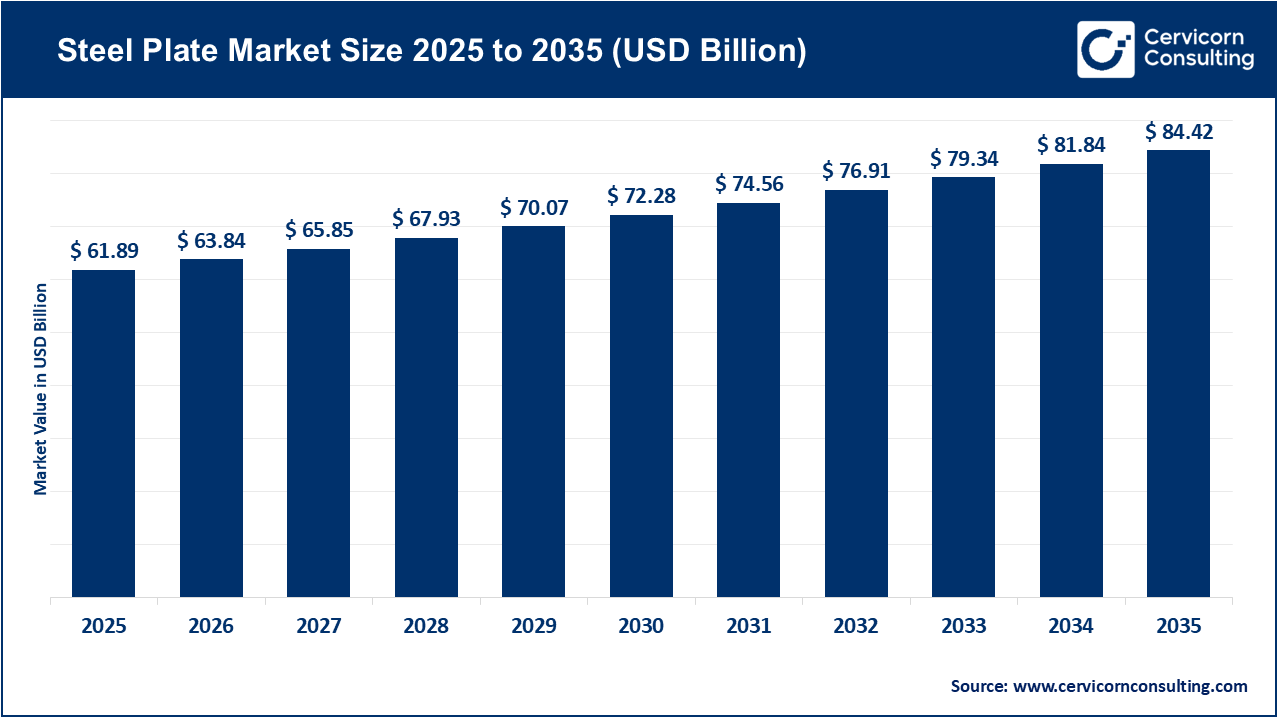

The global steel plate market size was estimated at USD 61.89 billion in 2025 and is expected to hit around USD 84.42 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.3% over the forecast period from 2026 to 2035. The steel plate market is growing strongly, primarily due to rapid uvbanisation and rising infrastructure development, particularly in emerging economies in Asia and Africa. The growing need for infrastructure in these regions drives demand for carbon and alloy steel plates that provide structural integrity under high-stress conditions. Additionally, in developed regions, growth is supported by the modernization of existing infrastructure and the replacement of aging structures. Many existing buildings, bridges, and industrial facilities require retrofitting or reconstruction using advanced steel plate materials with higher load-bearing capabilities than current designs. Modern cities are increasingly adopting high-performance steel designs that prioritize efficient material use and long lifespan to reduce maintenance costs.

The global shift toward renewables and extensive decarbonization of industries are significant drivers for the worldwide steel plate market. Large renewable energy projects, such as wind turbine towers, offshore environmental foundations, and solar thermal installations, demand heavy steel plates that withstand extreme environmental conditions and resist corrosion. Furthermore, the rise of the electric vehicle industry and the need for specialized manufacturing equipment and battery housings create additional opportunities for market growth. This expansion is supported by international climate agreements and subsidies to promote "green steel" and low-carbon production.

Digitalization and Industry 4.0 Technology Adoption

The adoption of Industry 4.0 technologies is emerging as a significant growth driver for the steel plate market. Technologies such as the Internet of Things (IoT), artificial intelligence, and digital twins are transforming how steel plates are manufactured, monitored, and delivered. Digitalization allows steel producers to track the entire life cycle of a steel plate, from initial casting and rolling processes to final installation in structures like bridges or ships. This enhances quality assurance and traceability throughout the value chain. Consequently, the steel plate market is evolving toward "smart plates" with real-time tracking capabilities, enabling engineers to assess stress and fatigue of the material during operation.

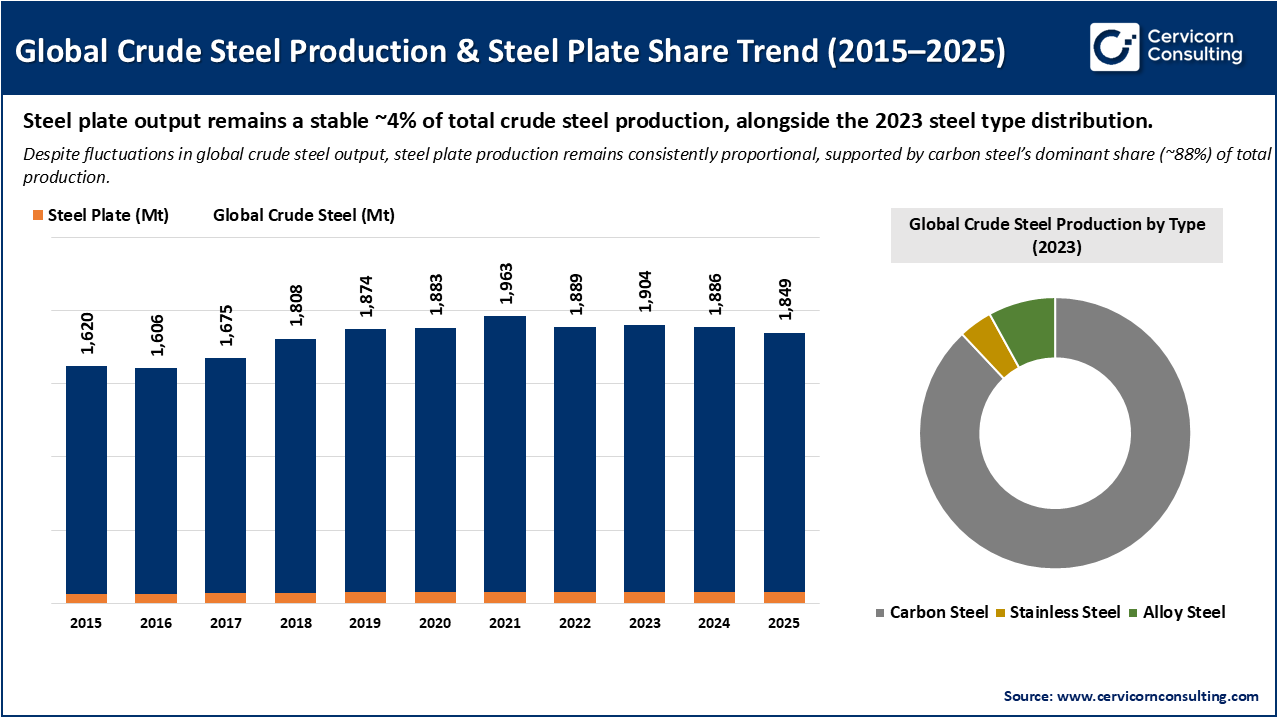

Global Crude Steel Production & Steel Plate Market Trend (2015–2025)

The chart shows the trend in global crude steel production from 2015 to 2025, along with the estimated share of steel plate production, which stays steady at about 4% of total output. Crude steel production reached its highest point in 2021 and then slightly declined through 2025, mainly due to changes in demand and global economic conditions. In 2023, carbon steel made up about 88% of production, while stainless and alloy steels had smaller shares. The data indicates that steel plate demand is closely tied to overall steel production, with its share remaining stable as the market changes.

1. Strategic Relocation and Infrastructure Optimization

A significant milestone in the steel industry is the strategic consolidation of production facilities to benefit from strong logistics and infrastructure. For example, the acquisition and subsequent concentration of modern production facilities in major industrial hubs, such as Duisburg, demonstrate an extensive movement in the industry to optimize supply chains for large-scale steel products. As part of this shift, operations in older industrial centers were either closed or relocated to more favorable locations. The infrastructure of older production centers has become an environmental focus for steel production, processing, and distribution. This transition has been a strategic goal to reduce logistics costs and improve delivery speed, which can be very challenging over longer distances.

2. Implementation of the Inflation Reduction Act (IRA)

The establishment and enactment of the U.S. Inflation Reduction Act (IRA) mark a significant milestone for the steel plate market, especially in North America. The IRA provides substantial incentives for domestic production and clean energy infrastructure, which directly boosts the demand for high-quality steel plates. Through tax credits and subsidies, the IRA promotes large-scale investments in wind, solar, and hydrogen projects, creating a stable, long-term market for steel plates that support renewable energy development across the region.

3. Advancement of Small Modular Reactor (SMR) Infrastructure

The development and application of Small Modular Reactor (SMR) technologies present a major opportunity for the steel plate market. SMR technologies require highly specialized steel plates designed for containment vessels and modular components, which are different from those used in traditional nuclear power plants. In 2024, the International Atomic Energy Agency (IAEA) Milestone Approach for nuclear power infrastructure guided several nations to incorporate Advanced Reactor technologies into energy production. This development is significant for the steel industry because SMR designs will need advanced plate technology, including ultra-thick and high-purity plates.

4. ESG Disclosure and Sustainability Timeline Standardization

The introduction of the ESG disclosure obligation required companies to openly and transparently report the sustainability of their operations to stakeholders. As of March 2024, more than 4,500 investors and service providers have committed to implementing global ESG frameworks for their decision-making, creating a strong financial incentive for steel companies to enhance their sustainability performance and reduce environmental impact. This milestone has allowed many steel products to undergo Life Cycle Assessments (LCAs), which enable the steel producer to accurately measure the carbon footprint of the plate from the extraction of iron ore to the end-of-life recycling of the product.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 63.84 Billion |

| Market Size in 2035 | USD 84.42 Billion |

| CAGR 2026 to 2035 | 3.30% |

| Dominant Region | Asia-Pacific |

| Key Segments | Product Type, Application, Region |

| Key Companies | China Baowu Group, ArcelorMittal, Ansteel Group, Nippon Steel Corporation, HBIS Group, Shagang Group, Jianlong Group, POSCO Holdings, Shougang Group, Tata Steel Group, Delong Steel, JSW Steel Limited, Hunan Steel Group, JFE Steel Corporation, Nucor Corporation |

The steel plate market is segmented into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

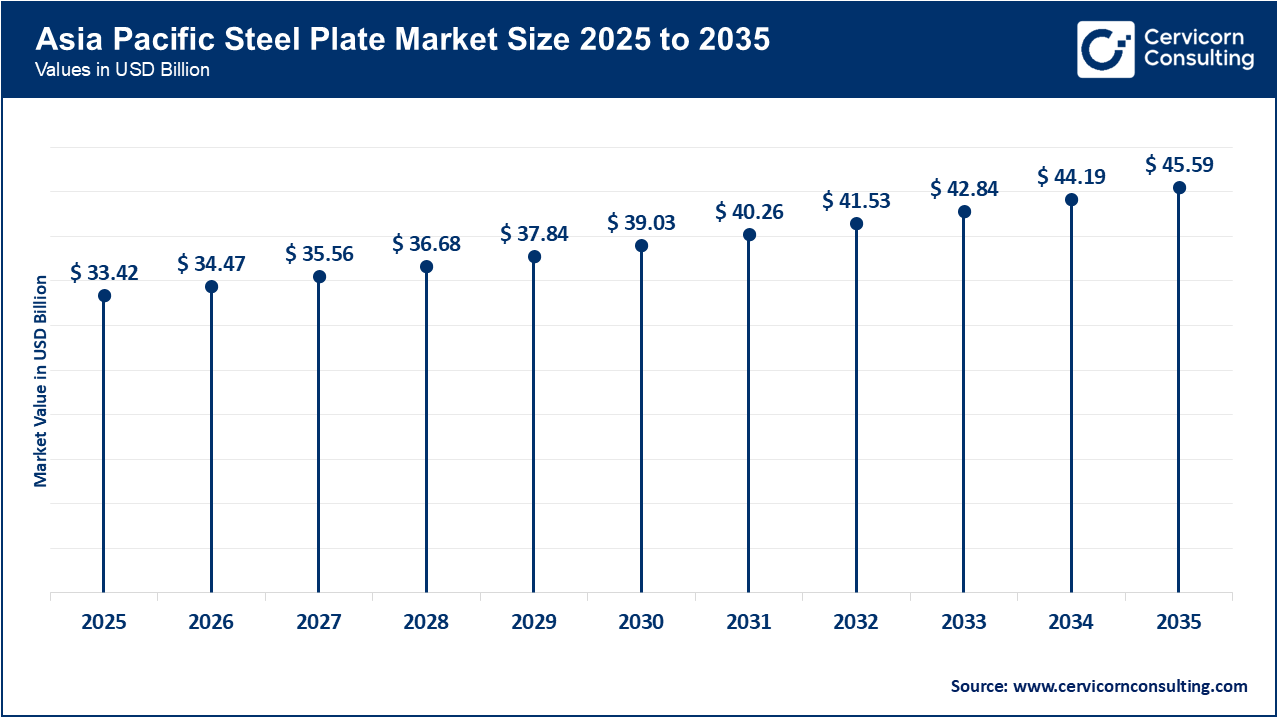

The Asia-Pacific steel plate market size was estimated at USD 33.42 billion in 2025 and is predicted to record around USD 45.59 billion by 2035. The Asia Pacific market leads the global steel plate industry due to high levels of consumption and production capacity, which result in sustained industrialization and strong infrastructure development. Asia Pacific's prominent position is driven by domestic policies in China that continue to promote significant state investments in high-speed rail networks, urban transit systems, and large energy corridors, all of which continue to absorb substantial quantities of structural steel plates. Additionally, shipbuilding centers in South Korea and Japan are benefiting from a super-cycle of orders for new LNG-powered vessels that require specific cryogenic and high-tensile plates.

Recent Developments:

The North America steel plate market size was valued at USD 10.52 billion in 2025 and is forecasted to grow around USD 14.35 billion by 2035. The North America market is experiencing a significant transformation, mainly driven by domestic manufacturing and a focus on energy security. Government initiatives such as the Inflation Reduction Act (IRA) and "Buy American" policies have encouraged localized steel production for renewable energy projects and upgrades to ageing infrastructure nationwide. Additionally, North America is swiftly shifting toward EAF production, which uses recycled scrap and has a smaller environmental footprint compared to traditional blast furnace methods. These changes align well with the sustainability goals of both corporate and government contractors.

Recent Developments:

The Europe steel plate market size was reached at USD 13.62 billion in 2025 and is projected to surpass around USD 18.57 billion by 2035. Europe steel plate market is increasingly characterized by decarbonization, and the region can be regarded as a testing ground for “green steel.” The introduction of the Carbon Border Adjustment Mechanism (CBAM) has reshaped market conditions by putting a price on high-emission imports while creating a financial incentive for local manufacturers to invest in low-carbon production. The European market is successfully transitioning to ultra-high quality, and special products that automotive and construction consumers will pay a “green premium.” Therefore, the region is moving away from commodity-grade steel and shifting into high-specification plates to meet the modern industrial economy's Environmental, Social, and Governance (ESG) requirements.

Recent Developments:

Steel Plate Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 54% |

| Europe | 22% |

| North America | 17% |

| LAMEA | 7% |

The LAMEA steel plate market was valued at USD 4.33 billion in 2025 and is anticipated to hit around USD 5.91 billion by 2035. The LAMEA region is a key growth area, driven by extensive resource extraction and a new wave of urbanization and industrial development across the Middle East, Africa, and Latin America. In the Middle East, for example, mega-projects like NEOM are generating unprecedented demand for structural steel plates used in futuristic buildings and industrial cities. Meanwhile, Brazil and South Africa's mining sectors are major consumers of wear-resistant and high-strength plates used in heavy machinery and mineral processing infrastructure.

Recent Developments:

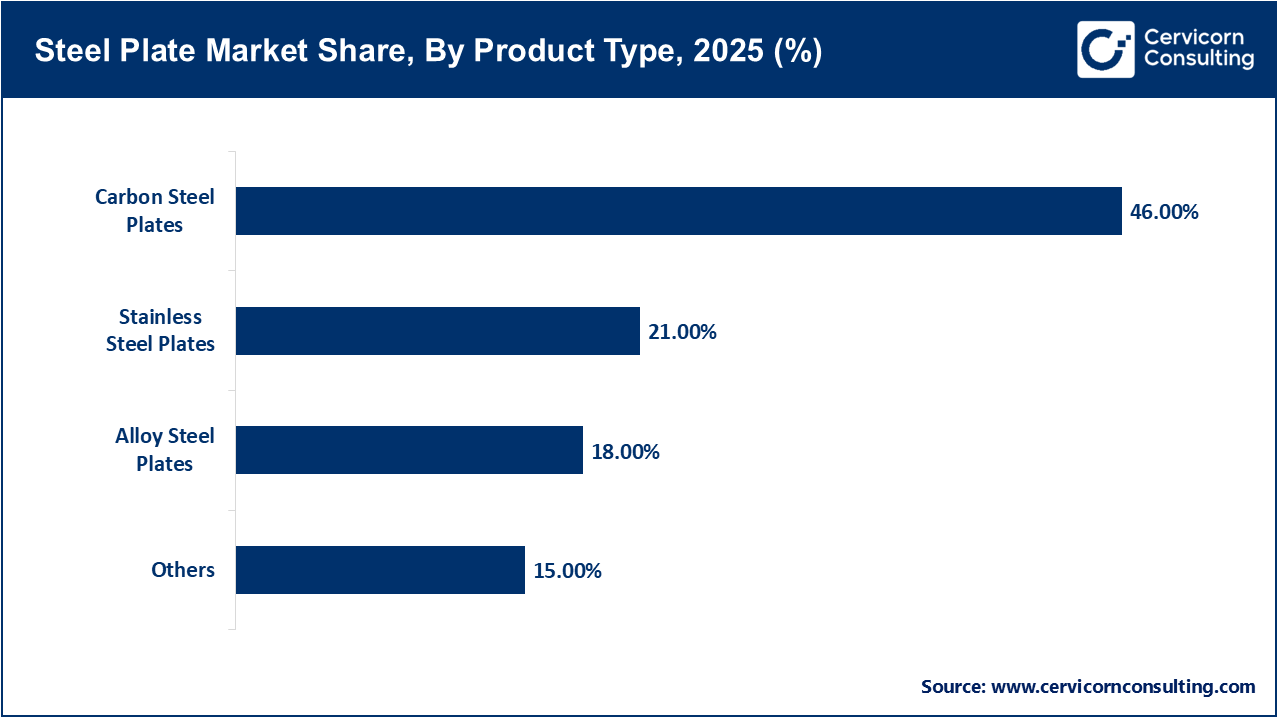

The steel plate market is segmented into product type, application, and region.

Carbon steel plates are the dominant segment of market due to their versatility, exceptional strength-to-weight ratio, and cost-effectiveness in large-scale applications. Carbon steel plates are the primary structural material used in heavy equipment, shipbuilding, and industrial construction projects, where the use of high-performance alloy steels would significantly increase costs without providing benefits. Furthermore, recent innovations in the production of carbon steel plates, including the introduction of High-Strength Low-Alloy (HSLA) grades, have enabled engineers to reduce the weight of structures without compromising safety and durability.

Stainless steel plates are the fastest-growing segment of the market because of their essential use in high-duty and corrosive environments. This steel is highly demanded in sectors such as chemical processing, desalination plants, and the emerging green hydrogen economy, where traditional carbon steel fails due to rapid environmental degradation. The emerging global water scarcity is leading to increased investments in desalination as part of new construction projects, while the transition toward hydrogen energy will require corrosion-resistant materials for storage, transportation, and processing. As a result, stainless steel plates are growing faster than the overall market.

The construction sector remains the largest application for the steel plates market, serving as the main volume driver for the global industry. Steel plates are used in construction components such as girders, columns, and floor systems for modern high-rise buildings and large public structures. The rapid urbanization continues to speed up worldwide, especially in developing regions, driving ongoing investments in residential, commercial, and infrastructure projects. As cities grow and building designs evolve, the construction sector's role as the top consumer of steel plates is reinforced by continuous advances in material efficiency and structural innovation.

Steel Plate Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Construction | 41% |

| Automotive | 21% |

| Shipbuilding | 15% |

| Oil & Gas | 11% |

| Industrial Machinery | 7% |

| Others | 5% |

The oil and gas sector is the fastest-growing application segment for the steel plates market, mainly due to the dual demands of energy security and a more technical extraction environment. Steel plates are increasingly employed in building pipelines, storage tanks, and offshore drilling platforms. Additionally, advanced manufacturing techniques such as additive manufacturing are becoming more common in this sector. The sector's growth is also supported by expansion in liquefied natural gas (LNG) infrastructure, which requires cryogenic steel plates for storage and transport.

By Product Type

By Application

By Region