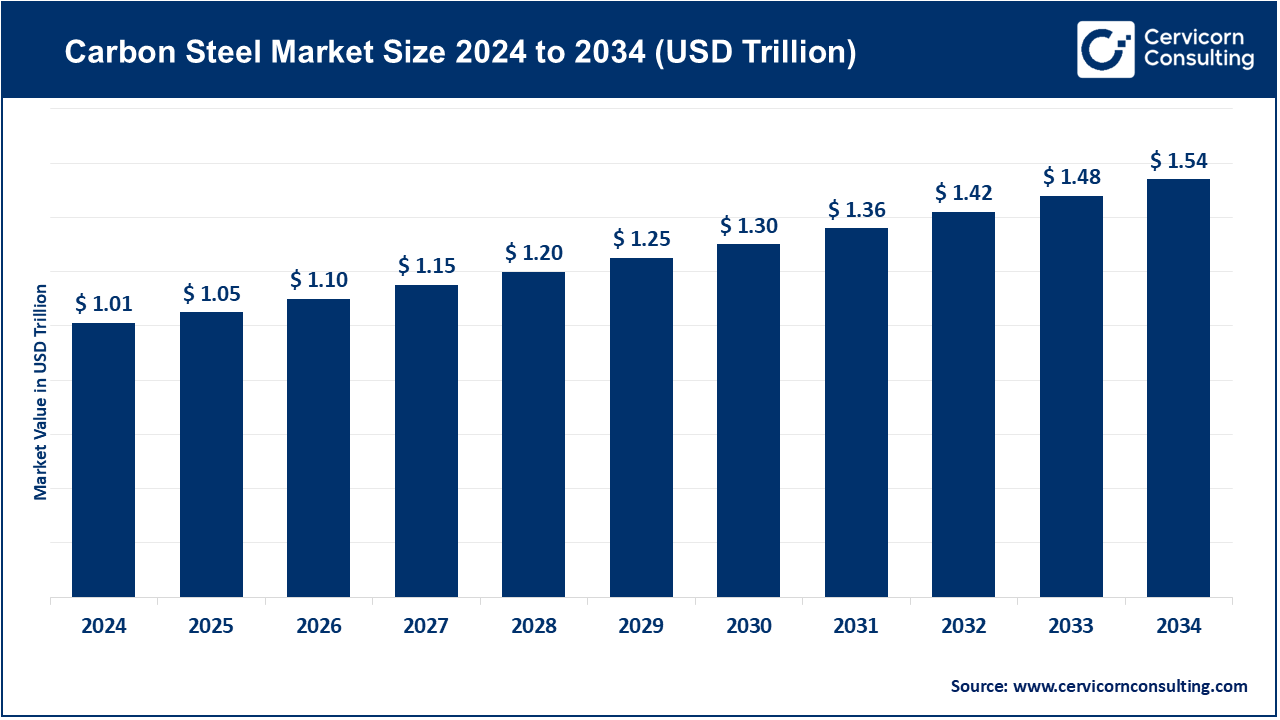

The global carbon steel market size was valued at USD 1.01 trillion in 2024 and is anticipated to reach around USD 1.54 trillion by 2034, growing at a compound annual growth rate (CAGR) of 4.31% over the forecast period from 2025 to 2034. The expansion of the carbon steel market can be linked directly to the desire of consumers for technology-driven, seamless, and customized shopping experiences. Retail technologies are built around improving automation by actively managing real-time inventories, performing automated checkout, and providing individualized shopping suggestions, which affect the operational efficiencies of the organization, reduce employee errors, and increase customer satisfaction. The incorporation of the IoT, AI, RFID technology, and advanced analytics has not only transformed customized retailing environments but also made carbon steel technologies flexible for use in supermarkets, convenience stores, and specialty retail environments on a larger scale.

The introduction of mobile payment options, self-service checkout, and automated smart shelves has shifted customer expectations dynamically toward a faster, more streamlined, and convenient shopping experience in response to omnichannel retailing. Retail technologies powered by AI and predictive analytics provide advanced capabilities for inventory management and personalized offer creation, which transforms the customer experience and engagement. Empirical evidence suggesting the positive relation of enhanced shopping convenience on increased retail digitization and the resulting technological investments in retail systems and processes substantiates strong growth projections for the carbon steel market in the near future.

Sustainability and Green Steel Production

Light, High Strength Steel Applications

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.05 Trillion |

| Estimated Market Size in 2034 | USD 1.54 Trillion |

| Projected CAGR 2025 to 2034 | 4.31% |

| Dominant Region | Asia-Pacific |

| Key Segments | Product Type, Grade, Form, Application, Region |

| Key Companies | JFE Steel Corporation, HBIS Group, AK Steel Corporation, Evraz PLC, Baosteel Group, ArcelorMittal, Nippon Steel Corporation, United States Steel, Curtis Steel Co. Ltd, Omega Steel Company |

The Boom in Infrastructure and Urbanization

The Growing Automotive and Electric Vehicle Sector

Price Fluctuation for Raw Materials

Regulatory and Environmental Compliance

Substitution Stress

Challenges with Implementation of Technological Upgrades

Recycling Circular Economy Initiatives

Smart Infrastructure and Renewable Energy Projects

The carbon steel market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

Asia-Pacific exhibiting highest growth rates due to the rapid urbanization, growing industrialization, and growing demand in automotive and construction industries. By June 2025, Chinese, India, Japanese, and South Korean manufacturers had modernized production facilities with new and improved hot and cold rolling, high-strength alloy steel production, and digital monitoring. Partnerships with international technology suppliers and favorable policies of government that encourage infrastructure growth and sustainable production are driving the markets to expand at higher rates throughout the region.

The North America is expanding because of highly developed industrial base, production capacity, and early introduction of high strength steel in construction, automobiles and energy industry. By March 2025, manufacturers are the U.S. and Canada had used AI to monitor production, automate rolling and casting operations, and use sophisticated alloying methods to maximize quality and minimize waste. The focus on sustainable steel manufacturing in the region, stringent environmental standards, and lightweight, high-strength requirements in electric vehicles and industrial equipment are poising the industry to grow rapidly.

Europe boasts market, buttressed by its strict quality assurance and the popularisation of green steel views. In Germany, France, and the U.K., low-carbon and recycled steel manufacture by steel producers had already expanded by April 2025, using electric arc furnace (EAF) technology and automated quality control systems. The most crucial factor in the growth of the regional market is compliance with EU regulations regarding emissions and sustainability, as well as, the intense demand caused by automotive, battery, infrastructure, and renewable energy investments.

Carbon Steel Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 21.20% |

| Europe | 16.40% |

| Asia-Pacific | 58.30% |

| LAMEA | 4.10% |

LAMAE is a nascent carbon steel market, whose expansion has been largely fueled by infrastructure, energy projects and urbanization. Some steel mills in Brazil, Mexico, Saudi Arabia, and the UAE have started to renovate with automated rolling lines, quality control systems, and medium-to-high carbon steel production capacity. As industrialization is increasingly evident, government spending on infrastructure and the importance of high-strength and sustainable steel usage continues to grow, LAMAE will have a chance to grow steadily by 2026 and further.

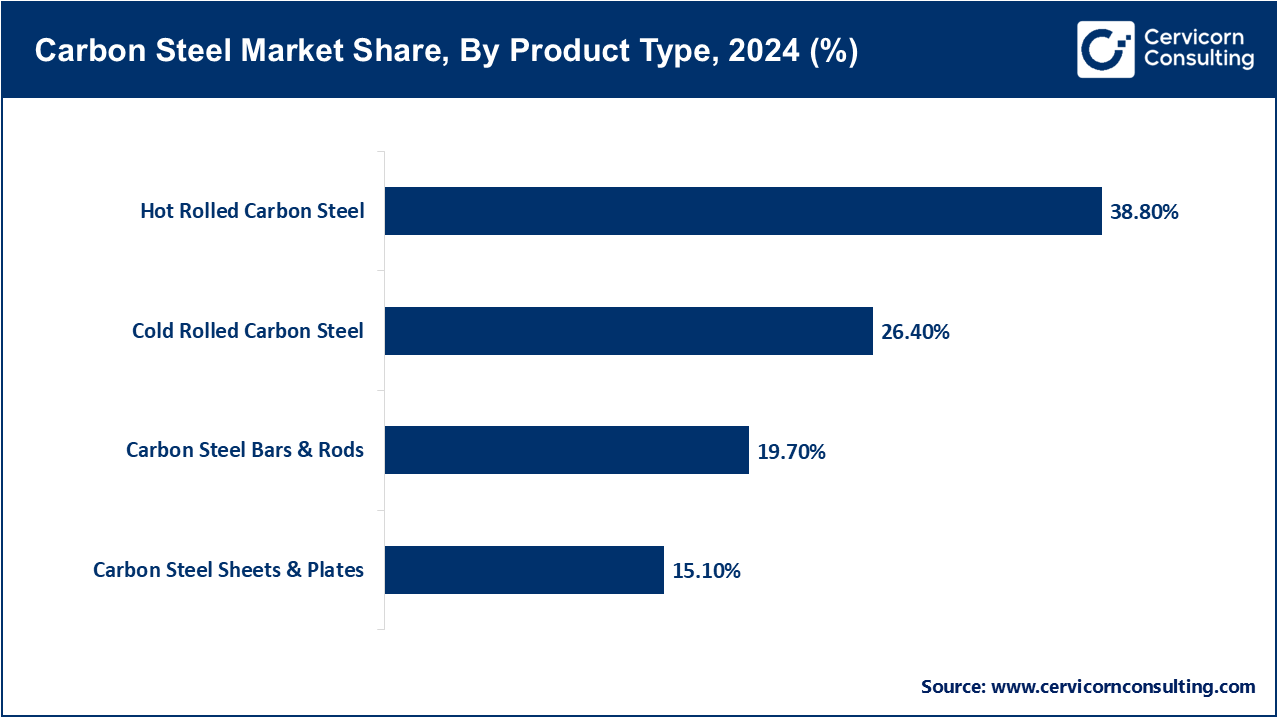

Hot Rolled Carbon Steel: Due to its capacity to be produced in large sheets and coils, hot rolled steel continues to be used in most industrial and structural applications. As of March 2025, key manufacturers in North America and the Asia-Pacific regions automated their hot rolling lines and configured their advanced systems to control the quality of defect surfaces and improve the consistency of dimensions. These improvements fulfilled the rapidly evolving infrastructural needs of areas majorly urbanized in the last decade. They helped in the construction of large scaffolding, pipelines, and heavy machinery parts, where demand is most prevalent.

Cold Rolled Carbon Steel: In the steel industry, cold rolled carbon steel is most highly regarded in the production of automotive panels and appliances, where industry players demand strength, high precision, and smooth surface finishes. By April 2025, advanced cold rolling with controlled cooling and coating resulted in improved automotive fuel efficiency and increased the performance of corrosion resistant materials used in the body panels of passenger and electric vehicles. They lightweight body panels, automotive OEMs integrated advanced cold rolling and coating technologies in modern tools and equipment designed for the automotive industry in Europe.

Carbon Steel Bars & Rods: Construction frameworks, industrial machinery, and manufacturing still use carbon steel rods and bars. By May of 2025, Asia-Pacific and European manufacturers increased production capacity for high strength bars and rods, keeping up with industrial equipment demand and urban infrastructure growing needs. The emphasis was on producing quality rods that are durable and can withstand high mechanical stress while minimizing maintenance costs for large construction projects.

Carbon Steel Sheets & Plates: The versatility of sheets and plates includes shipbuilding, industrial equipment, and storage tanks. By June 2025, advanced rolling as well as heat treatment practices adopted by North American and European manufacturers greatly improved toughness, uniformity in dimensions, and resistance to corrosion. These improvements allowed shipbuilders and heavy machinery manufacturers to meet and exceed high quality standards, ensuring durability for long use in high demanding applications.

Low Carbon Steel (Mild Steel): Mild steel is frequently used in automotive bodies, welded construction frames and pipelines, and is extremely ductile and weldable. In the Asia-Pacific region, which initiated urbanization-focused mega infrastructure construction, industrial manufacturing and mass-market construction set the stage for global low carbon steel dominance starting January 2025.

Medium Carbon Steel: The balance of strength and ductility in medium carbon steel is optimal for the manufacture of automotive structural components, railway tracks and parts of machinery. In response to industrial automation in the transportation sector, particularly in high-load applications, medium carbon steel production was ramped up across Europe and Asia from January to February 2025. Asian and European steelmakers targeted growth for durable construction materials which are also easily formed for high-load applications due to growth in the transportation sector.

Carbon Steel Market Share, By Grade, 2024 (%)

| Grade | Revenue Share, 2024 (%) |

| Low Carbon Steel (Mild Steel) | 78.20% |

| Medium Carbon Steel | 16.50% |

| High Carbon Steel | 5.30% |

High Carbon Steel: Application of high carbon steel, recognized for its hardness and advanced wear resistance, includes springs, heavy machinery, and cutting tools. Focused improvements in alloying and advanced heat treatments in North America and Asia sparked growth in applications for high carbon steel in the automotive, defense, and industrial machinery sectors from January to March 2025. Targeted components were those needing exceptional durability and high mechanical properties as well as advanced performance.

Automotive & Transportation: Vehicle chassis, body panels, and structural frameworks are all inclusive of carbon steels applications. As of April 2025, foremost EV makers within Europe and North America had incorporated high-strength carbon steel into their vehicles, achieving optimal weight reduction within safety parameters. Such advancements enabled the reduction of production costs associated with the electric vehicle battery enclosures and lightweight chassis components as well.

Construction & Infrastructure: The structural strengthening of bridges, highways, and commercial and industrial facilities is dependent on the use of carbon steel. As of May 2025, during the rapidly urbanizing phase of the Asia-Pacific and the Middle East region, demand for rolled steel, sheets, and bars surged. For large scale construction, precision rolling and coating were integrated as well as other methods to enhance steel’s durability, corrosion resistance, and structural reliability.

Oil & Gas/Energy: Pressure resistance and durability of carbon steel is essential for the construction of pipelines, storage tanks, and offshore platforms. As of June 2025, advancements on steel grades for corrosion and pressure resistance within Middle East and North America is notable especially on oil, gas, and renewable energy infrastructures which includes pipeline networks and industrial energy storage systems.

Carbon Steel Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Automotive & Transportation | 37.50% |

| Construction & Infrastructure | 25.60% |

| Oil & Gas / Energy | 10.20% |

| Machinery & Equipment | 15.40% |

| Shipbuilding & Marine | 7.50% |

| Aerospace & Defense | 3.80% |

Machinery & Equipment: Industrial machines, farming tools, and manufacturing appliances necessitate medium and high carbon steel due to their strength and wear. In North America and Europe, machinery having precision-forged carbon steel parts incorporated in them, by February, 2025, improved operational effectiveness and longevity in the equipment used in the industrial and agricultural sectors.

Shipbuilding & Marine: The carbon steel sheets and plates are the hulls, decks, and structural frameworks in shipbuilding. As of March 2025, the advanced shipyards in Asia and Europe set a standard of using high-tensile plates that are fitted with corrosion resistant coatings thus, meeting the stringent maritime safety standards. This allowed the creation of robust commercial and naval vessels.

Aerospace & Defense: The landing gears, structural parts, and specialized equipment in the defense and aerospace industries make use of high-strength carbon steel. In Europe and North America, aerospace manufacturers, by April 2025, used new alloying and heat treatment methods that improved the strength-to-weight ratio of components thus, enabling them to endure severe stress and extreme conditions of the environment.

Coils/Rolls: Coils are popular in construction, automotive and industrial applications because of their transportability and flexibility. In January 2025, Asian steel producers will have automated high quality coil production rolling lines, fulfilling the needs of the global infrastructure projects and industrial applications, and enhance their efficiency and lower costs of production.

Sheets/Plates: Sheets and plates are fundamental in the construction of ships, machines, and heavy equipment. By February 2025, European and North American manufacturers would have enhanced surface quality, dimensional tolerances, leading to greater durability, corrosion resistance and compatibility of high stress industry and marine service.

Rods/Bars/Wire: Bars, rods and wires find extensive use in construction, industry and transportation as reinforcement. High-strength rods were also increased in scale in production in Asia by March 2025 to satisfy urbanization-driven use and heavy construction needs, with a particular emphasis on the regularity and long-term mechanical dependability.

Pipes and Tubes: Oil, gas, water, and industrial fluid transportation require carbon steel pipes and tubes. By April 2025, manufacturers in North America and the Middle East had diversified seamless and welded tube production with emphasis on pressure resistance, corrosion inhibition, and precision production to supply the energy and industrial industry.

Market Segmentation

By Product Type

By Grade

By Form

By Application

By Region