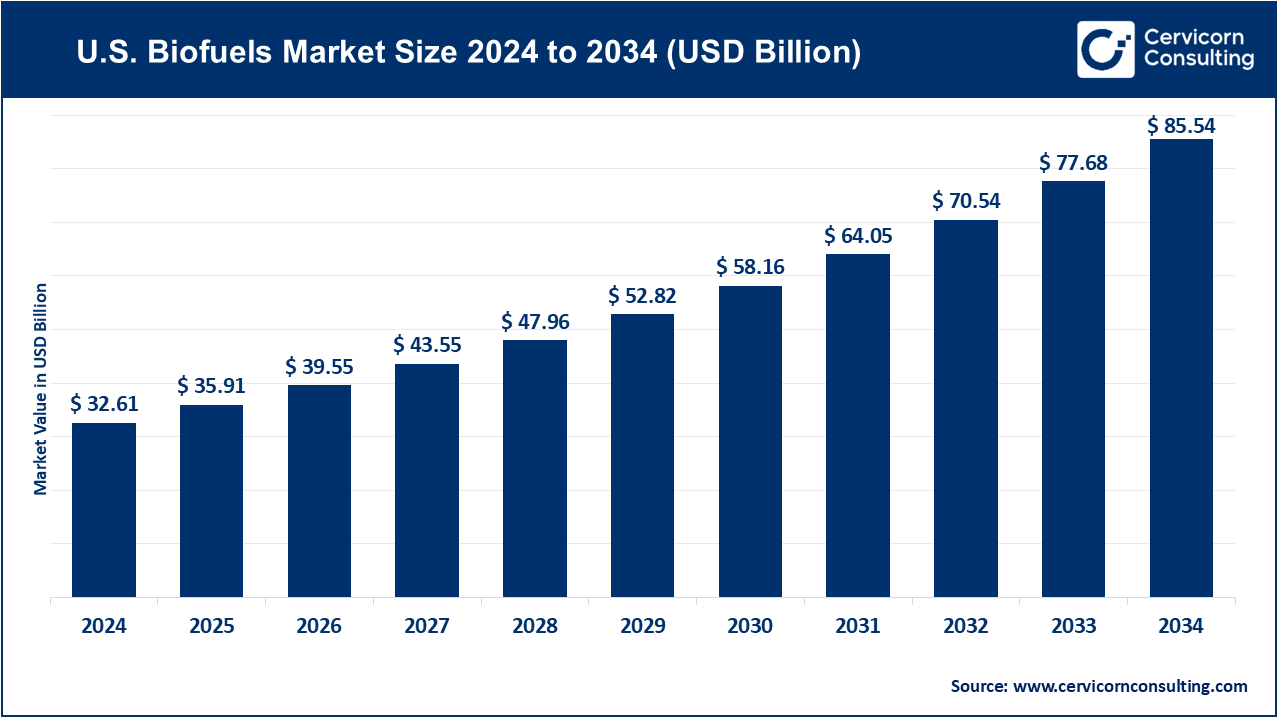

The U.S. biofuels market size was valued at USD 32.61 billion in 2024 and is expected to reach around USD 85.54 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.5% over the forecast period from 2025 to 2034. The U.S. biofuels market in is experiencing impressive growth and this has been due to the government subsidies, sustainability requirements, and the rising demand of low-carbon substitutes. The renewable fuel standard (RFS) and incentives in the Inflation Reduction Act (IRA) are promising to invest in advanced biofuel production, including biodiesel, renewable diesel, and sustainable aviation fuel (SAF). The contribution to market growth in the transportation and aviation industries through increasing the use of low-carbon fuels is also increasing.

The market is also taking a different shape as a result of innovations, with next generation biofuels being produced using non-food feeds such as agricultural residues, algae and forestry wastes. The combination of AI, IoT, and automation of biorefinery is improving efficiency, output, and real-time tracking. Energy companies, biotech companies, and farmers are developing strategic alliances that improve the supply chain and facilitate the implementation of the circular economy. Consequently, the biofuels industry of the U.S. is getting smarter, green, and closer to national clean energy and decarbonization objectives.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 35.91 Billion |

| Estimated Market Size in 2034 | USD 85.54 Billion |

| Projected CAGR 2025 to 2034 | 11.50% |

| Key Segments | Biofuel Type, Feedstock, Production Technology, Form, Application |

| Key Companies | Chevron Renewable Energy Group, Pacific Biodiesel Technologies, POET LL, Valero Energy Corporation, Green Plains Inc., ADM (Archer Daniels Midland Company), REX American Resources, Montauk Renewables, LanzaJet, Gevo Inc. |

Increased Renewable Energy and Decarbonization Demand

Move to High-technological and Sustainable Biofuels

Great Development and Implementation Varies

Regulatory and Certification Requirements

Supply Chain Vulnerabilities

Technological Complexity and Skills Gap

Combination with Electric and Hybrid Transportation

Expansion of Emerging and Regional Markets

Ethanol: Ethanol is the most common biofuel in the U.S. which is primarily produced from corn since it is high in starch. It is also the most widely used gasoline additive as it boosts the octane rating and lowers emissions. Current production facilities use AI and IoT technologies to predictive monitor and optimize production processes. Non-food biomass is becoming a potential substitute source for cellulosic ethanol. Government mandates such as the Renewable Fuel Standard (RFS) help the market adoption. Constant innovations focus on improving yields, reducing carbon footprints, and increasing energy efficiency which are all positive for the environment.

Biodiesel: Biodiesel is produced from vegetable oils, animal fats, and waste oils, making it a renewably available alternative to diesel. It is mainly used in transportation and industrial sectors to reduce greenhouse gas emissions. Transesterification optimization is facilitated through IoT and AI analytics. There are legal sustainability and waste oil feedstock use incentives. Production is now upgrading to modular and fully automated styles. This segment’s growth has been automated with the increasing adoption of fleet corporate sustainability.

Market Share, By Biofuel Type, 2024 (%)

| Biofuel Type | Revenue Share, 2024 (%) |

| Ethanol | 48.50% |

| Biodiesel | 19.10% |

| Renewable Diesel | 12.20% |

| Sustainable Aviation Fuel (SAF) | 8.30% |

| Wood Pellets | 4.20% |

| Syngas | 3% |

| Green Hydrogen | 2.90% |

| Others | 1.80% |

Renewable Diesel: While it is true that renewable diesel is comparable to petroleum diesel, it is made from HVO (Hydrotreated Vegetable Oil) or another renewable feedstock, not petroleum. It has lower emissions, is compatible with current diesel engines, is used in heavy-duty trucks, provides more energy, and is extremely efficient. AI and IoT systems supervise and optimize the control parameters of the reactions. Massive production is made possible with the IRA and RFS incentives. There is ongoing R&D to optimize processes and improve feedstock flexibility. In the trucking industry, renewable diesel is used to lower the carbon footprint in the transport sector and is also in heavy-duty trucks.

Sustainable Aviation Fuel: Sustainable Aviation Fuel (SAF) is a type of biofuel used in the aviation industry, specifically biofuels made through the HEFA (Hydroprocessed Esters and Fatty Acids) and ATJ (Alcohol-to-Jet) processes. SAF is installed on current jet engines. It also reduces carbon emissions. With the help of artificial intelligence, predictive analytics, and monitoring systems designed and developed specifically for the aviation industry, SAF production is more efficient and quality controlled. Partnerships between airlines and biofuel production companies are encouraged by government incentives as well as low carbon fuel standards. Sustainable and scalable advanced feedstocks like algae and waste oils are also available.

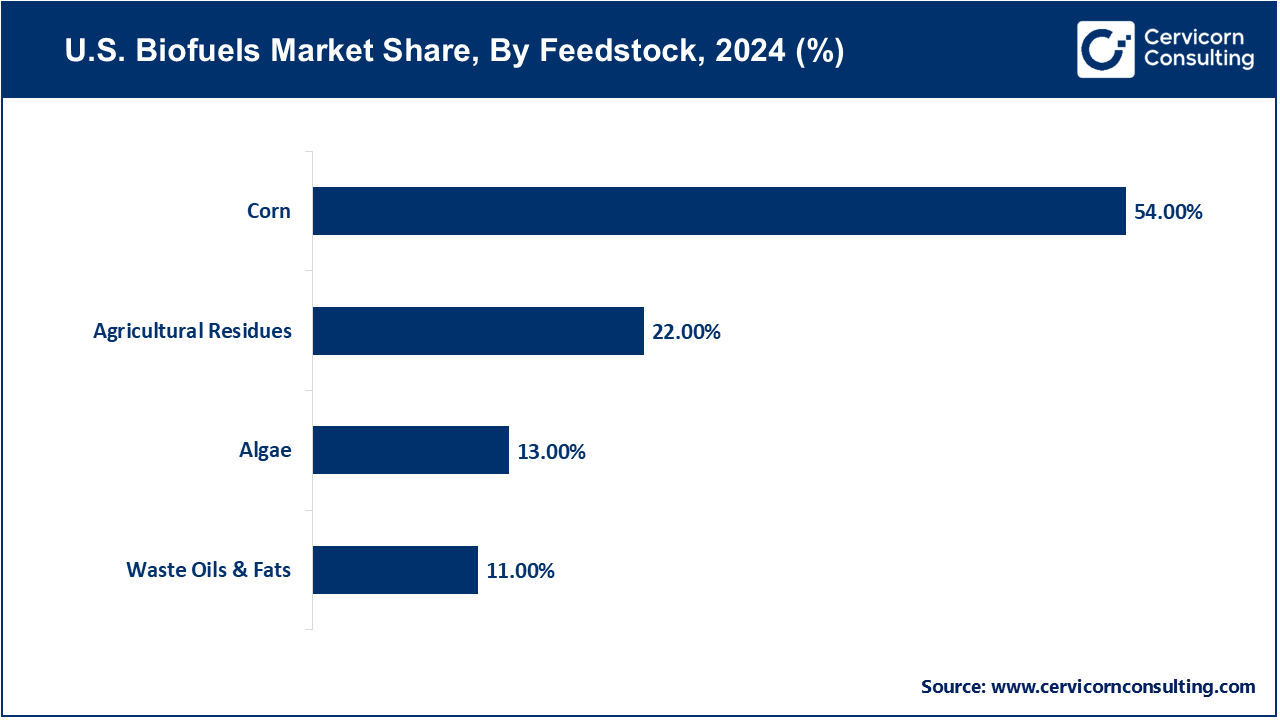

Corn: When it comes to making ethanol, corn is the most popular feedstock. As a starch-dense grain, it is also low-cost, and is readily available along established supply channels. AI and IoT technologies streamline the fermentation process by converting sugars and energy. Initiatives such as the RFS guarantee a government-sponsored and underwritten, commanding demand to ensure the marketed adoption. The U.S. biofuels market primarily consists of corn-based ethanol and every sector of the market is underpinned by refined corn-based ethanol. Almost all modern bio-refineries are far less wasteful and emission friendly, and constant R&D enables increased production guaranteed by sustainable practices.

Algae: Algae can produce high-yield biofuels while occupying less land compared to other sources. They produce biodiesel, renewable diesels, and sustainable aviation fuels with much lower carbon emissions. Productivity is further increased with AI-based growth monitoring and automated harvesting techniques. More positive environmental benefits are achieved when coupled with carbon capture technology. Initial business uptake, driven by sustainability incentives, is underway. Algae-based feedstocks align with advanced biofuels and the circular economy.

Agricultural Residues: Cellulosic ethanol and renewable diesel use straw, husks, and corn stover as agricultural residues. Effective lignocellulosic biomass conversion occurs with pretreatment and fermentation. AI and sensors monitor moisture, composition, and quality. Residues sustain waste and meet sustainability requirements. Lower-carbon feedstock use qualifies for government incentives. Conversion processes state of the art control systems advanced in cost reduction and conversion efficiency

Waste Oils and Waste Fats: Waste oils and waste fats are economical feedstock in production of biodiesel and renewable diesel. AI and IoT systems transesterification and hydrogenation is streamlined. Waste oils are used to minimize lifecycle and emission burden making it more sustainable. Adoption is encouraged through corporate sustainability programs. Real-time monitoring of fuel quality and regulations enables constant provision. High biorefineries are optimized in terms of yield and performance.

Fermentation: Fermentation is one of the oldest and most common methods for producing ethanol from corn, sugarcane, and cellulosic biomass, or cellulosic biomass. Enhanced bioreactors, driven by AI and IoT sensors, manage the conversion of sugars while controlling temperature and pH in a closed loop. Real-time supervision guarantees maximum yield and efficiency of the process. Cellulosic fermentation gives the opportunity to convert biomass that is non-food to ethanol, which is a sustainable practice. Modular plants along with automation for cellulosic fermentation lowers operational costs and energy use. Environmental strain compliance gets enhanced from ongoing R&D.

Transesterification: Vegetable oils and animal fats can be transformed chemically into biodiesel by transesterification. Waste oils feedstocks have been used increasingly to improve the process sustainability. Process cistern automation reduced human error, enhanced throughput, and timing of operational tasks. Implementation of low-carbon fuels is supported by government incentives and corporates as part of their sustainable programs. Focus of sustainable biodiesel production is on yield increase and production cost.

Hydrogenation: Hydrogenation refers to the conversion of vegetable oils or waste fats in the manufacture of renewable diesel and hydrogenation drop-in fuels. Systems of AI and IoT enhance the efficiency of hydrogenation reactions and help with feedstock utilization. Real-time monitoring helps to maintain compliance with standards and fuel quality. The technology is compatible with high-powered diesel engines, which carries incentive fuel and commercial use fuel stream diesel. The primary focus of, Continuous, and Research & Development is kept on process optimization and feedstock diversification.

Gasification and Fischer-Tropsch: Gasification and Fischer Trope synthesis provides innovative ways in converting biomass and waste to synthetic fuel including renewable diesel and SAF. Gasification and synthesis conditions are tailored using AI analytics and IoT-enabled sensors. AI analytics and IoT-enabled sensors provides innovative ways in optimal gasification and synthesis conditions. Innovative ways in optimal gasification and synthesis conditions ensures the efficient utilization of agricultural residues, forestry waste and other diverse feedstocks. Modular systems for biomass gasification and Fischer Trope synthesis provides scalability in flexible production capacities. Integrating carbon capture gasification and Fischer Trope systems helps achieve decarbonized, lower lifecycle emissions and reduced environmental impact. Through innovative ways, improved conversion efficient, product quality and reliable operations are achieved in gasification systems.

Market Segmentation

By Biofuel Type

By Feedstock

By Production Technology

By Form

By Application