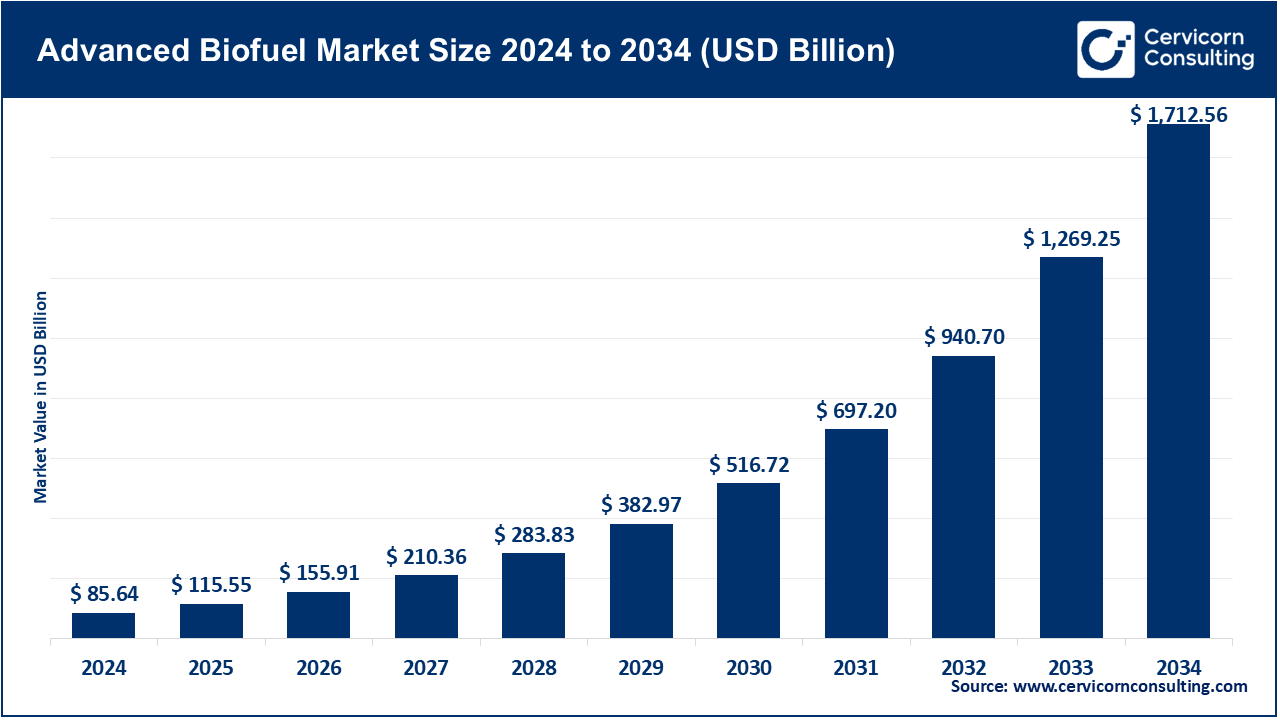

The global advanced biofuel market size was valued at USD 85.64 billion in 2024 and is expected to hit around USD 1712.56 billion by 2034, growing at a compound annual growth rate (CAGR) of 34.8% over the forecast period from 2025 to 2034. The advanced biofuel market is growing at a very fast pace as there has been an increase in the environmental issues, strict emissions standards, and the demand of renewable energy sources world over. There is an increased use of advanced biofuels generated using non-edible biomass, algal, and wastes products as alternative aviation, marine and automotive fuels. Some of the technological advances like enzymatic hydrolysis, synthetic biology and high intelligent fermentation are improving the product yield, efficiency and scale. Such innovations have turned advanced biofuels into the key sources of energy needed to slash carbon footprints, attain energy security, and achieve net-zero in times of rising demand towards cleaner and more sustainable forms of energy.

The advanced biofuel market denotes the business aimed at the production of the next-generation biofuels which utilize the non-food biomass as their raw material source including such examples as agricultural wastes, algae, and cellulosic. Advanced biofuels have greater energy and less greenhouse gas emissions compared to conventional biofuels hence more viable and environmental-friendly. The common feature of these fuels is that they are applied in transport industries such as aviation and shipping to limit the use of fossil fuels. Favourable government policies, soaring energy demands and the global decarbonization movement are some of the drivers of the market. The important technologies that will help the biomass to effectively transform into liquid or gaseous biofuels are enzymatic hydrolysis, gasification, and pyrolysis.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 115.55 Billion |

| Expected Market Size in 2034 | USD 1,712.56 Billion |

| Projected CAGR 2025 to 2034 | 34.8% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segment | Process, Advanced Biofuel Type, Raw Material, Feedstock Type, Application, Region |

| Key Companies | Advanced Biofuel Solutions, BP, Clariant, ExxonMobil, Gevo, GranBio, Green Plains, Iogen, POET, Solix Biofuels |

Biochemical Process: The biochemical process segment accounted for the highest portion of the market's revenue. Biomass is changed into fuels by means of microbial or enzyme reaction under mild conditions, this is known as a biochemical process. A European research team was even able to boost methane production by 81% by adding ferrous oxide to slaughterhouse and food waste in April 2025. This development shows better recovery of gas and economies of operation and thus the biochemical conversion of mixed organic wastes to biogas and ethanol production proves to be even more commercially viable.

Advanced Biofuel Market Revenue Share, By Process, 2024 (%)

| Process | Revenue Share, 2024 (%) |

| Biochemical Process | 62.02% |

| Thermochemical Process | 37.98% |

Thermochemical Process: Thermochemical methods are applied to convert a biomass into syngas or bio-oil such as pyrolysis and gasification. In June 2024 Licella opened a pilot hydrothermal liquefaction plant in Canada, to convert forestry and agricultural residues to biocrude. This achievement is valuable in scaling up renewable diesel and jet fuel production demonstrating how thermochemical processes are now developing to target increased-energy-density fuels with hard-to-decarbonize sectors.

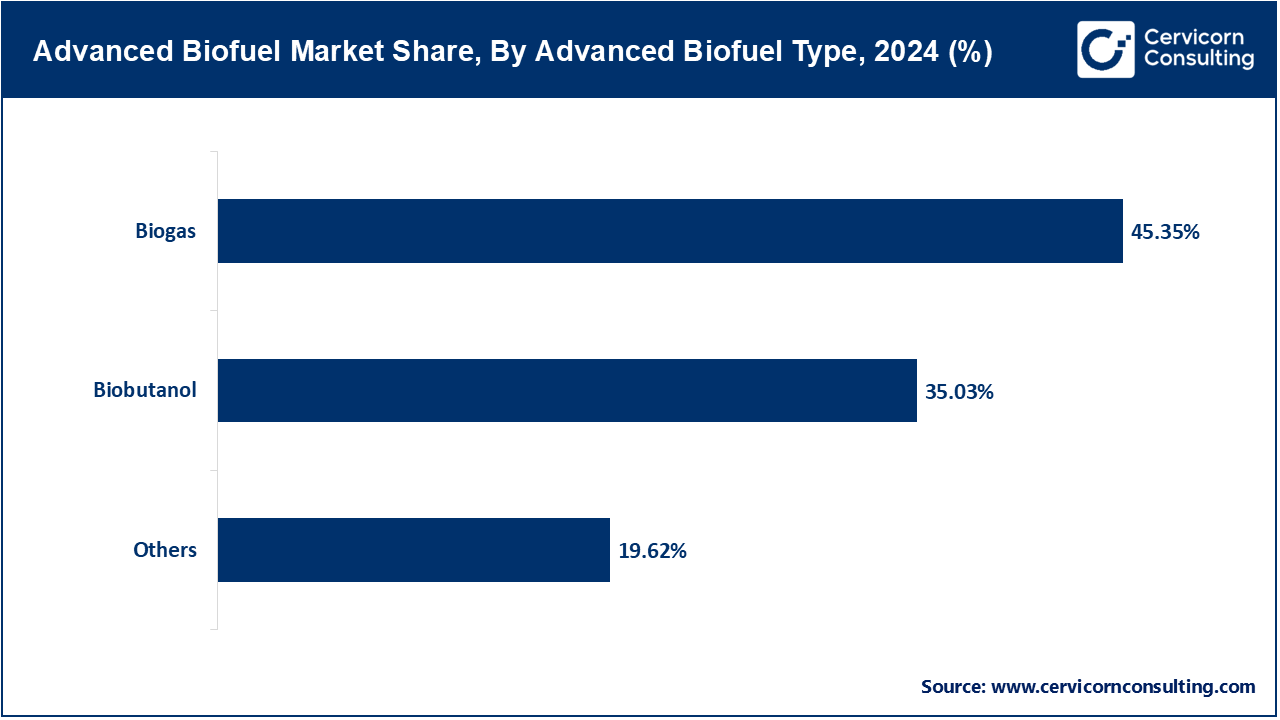

Biogas: The highest revenue share in the market was captured by the biogas segment. Biogas is created through anaerobic breakdown of organic wastes and contains a great deal of methane which could be used in electricity and transport. In July 2025, Tessman landfill in San Antonio started providing renewable natural gas to more than 400 buses which knocks out 7 million gallons of diesel per year. This transition greatly reduced the number of emissions and made it known that biogas could prove more valuable in the sphere of a certain transport system.

Biobutanol: Biobutanol is a product that is composed of four carbon molecules of alcohol which is high in energy and has blending capability as compared to ethanol. In February 2023 the U.S. EPA authorized the use of bio-isobutanol, up to 16% in gas blending, encouraging commercialization. This regulatory action allowed refiners and fuel distributors to blend biobutanol as a cleaner-burning, drop-in biofuel to make its use in transportation fuel markets across North America more marketable.

Others: Other refined biofuels are renewable jet fuel, naphtha and synthetic fuels produced through different chemical and bio processes. In November 2024, database on the IEA Bioenergy site was last updated with 258 active demonstration plants across the planet covering a wide variety of conversion technologies including: fast pyrolysis and gasification. The growth exhibits increased investment in experimental and new forms of fuels to satisfy specific decarbonization demands of the sector.

Lignocellulose: The lignocellulose segment accounted for a highest revenue share. Lignocellulose refers to the plant biomass that contains cellulose, hemicellulose, and lignin, the use which is converted to ethanol and bio-oil. In September 2024, the EU noted that the use of advanced fuels based on lignocellulosic increased significantly up to 40% in the transport biofuels. The rise in both corresponds to regulatory changes to sustainable, non-food feedstocks and an advancement in pre-treatment technologies capable of greater extraction of fermentable sugars from plant residue.

Jatropha: Jatropha is a non-edible oilseeds plant grown to produce biodiesel, especially in marginal lands and on dry land. Although little is being reported about any form of major commercial development, current studies are being conducted in India and Africa with respect to enhancing the production of crops and oil extraction. Such initiatives are meant to reinvent the interest in Jatropha as attractive potential feedstock by addressing previous observations on uneven production and economic flexibility.

Advanced Biofuel Market Revenue Share, By Raw Material, 2024 (%)

| Raw Material | Revenue Share, 2024 (%) |

| Lignocellulose | 40.27% |

| Jatropha | 16.22% |

| Camelina | 12.70% |

| Algae | 20.80% |

| Others | 10.01% |

Camelina: Camelina is a bio-low-input oil seed crop, with great suitability to biodiesel and jet fuel and it grows in arid conditions. Some of the agritech initiatives in the U.S., in 2024, came up with new cold-tolerant varieties of camelina to help in winter farming practice. These technological advances openup the potential crop as a sustainable feedstock to longer growing seasons and increased oil yields making camelina a potential source of renewable supply chain of aviation fuels.

Algae: Algae are microscopic organisms having a high amount of lipids in them, which are subjected to become biodiesel, biojet fuel, and biogas. A biogasoline method relying on genetically engineered algae sugars that greatly enhance the quality and yield of fuel came into existence in April 2025 by the research team at Princeton. This development demonstrates the versatility of algae as a part of the next generation feedstock, which can be capitalized using biotechnology to get greater yields and economic potential.

Others: The other materials are used cooking oil, municipal solid waste. In July 2025, Chinese invested more than USD 1 billion in new plants that process used cooking oil to make sustainable aviation fuel as a strategic step to avoid using fossil jet fuel. This is an indicator of the rising concerns on the use of waste-based feedstocks as a valuable alternative solution in the biofuel production.

Simple Lignocellulose: The simple lignocellulose segment has generated highest revenue share in the market. Simple lignocellulose entails such works as straw or bagasse which have the lower demands to break them down into fermentable sugars. In April 2025, a group of researchers in North America came up with optimized enzyme mixes to speedily hydrolyze these residues. This innovation greatly reduces the time it takes to ferment, maximizes the yield of ethanol, and cuts the total cost of production thereby making simple lignocellulose a competitive and scalable biofuel feedstock.

Complex Lignocellulose: Complex lignocellulose contains wood biomass which must undergo vigorous pre-treatment to break down. The IEA Bioenergy listed in November 2024 several pilot plants which apply hydrothermal liquefaction and gasification to process wood chips and bark. Such attempts illustrate the progress that was being made in regards to thermal and catalytic processes in pretreating complex biomass, making their processing more effective and facilitating the sequential extraction of fuels out of tough plant material.

Algae: Algae source crops are high yielding in oil terms per acre and are noncompeting with food crops with regard to land application. Early 2025 European bioenergy projects started pilot photobioreactor plants on growing algae oil into biodiesel. These plants are located within such facility-strategies to boost productivity and incorporation of CO 2 -capture of their neighbor industries will encourage use of algae as a source of energy and Climate improvements in green fuel plans.

Others: Other feedstock involves food waste, plastics and animal fat in the advanced conversion route. In September 2024 the U.S. Department of Energy initiated a project on sensor fusion with the use of artificial intelligence to better sort municipal waste to be used as fuel. This invention would enrich the quality of feedstock and conversion efficiency so that low-value wastes can be successfully converted into renewable fuels efficiently.

Electricity: Electricity can be obtained by using biofuels in combustion engines or turbines, in particular biogas. In March 2023 the South African Bio2Watt commissioned a 4.8 MW biogas facility which uses dairy waste to supply SAB breweries. The plant illustrates both the potential of bioelectricity in off-grid and industrial energy provision and sustainable management of organic waste by local-scale, renewable generation of energy.

Heating: Buildings and industries have heating systems in which advanced biofuels such as wood pellets, biogas and bio-oils are utilized. By July 2025, a number of RNG projects in the U.S. started feeding pipeline grade biogas into municipalities heating systems, displacing reliance on fossil natural gas. Such projects indicate a general movement to renewable heat options at the point where there is an established gas infrastructure already in place in colder areas.

Cooling: Biofuels have the potential to drive absorption coolers that serve cooling in industrial and commercial buildings. Although there have been no high-visibility commercial deployments, biogas-based chillers were tested in several pilot applications in Europe in 2024-2025 as part of food processing plants. Such programs are an indication of the ambition to adopt the use of biofuels in the cooling systems to minimize energy use in terms of electricity and carbon emissions in the heavily demanding industrial fields.

Cooking: Biofuels such as biogas and bioethanol are becoming common to clean cooking particularly in rural settings. The national biogas programme has grown in India in 2023 to cover more than 500,000 households, proving accessible, inexpensive smoke-free cookstoves using farm residues. The initiative further aids energy access objectives as well as minimizing fines in the way of health dangers and deforestation by the conventional wood and charcoal stoves in low-income societies.

Others: Other uses are in the field of transportation, chemicals, and industrial feedstocks. In May 2024, IEA indicated that the worldwide demand of transport biofuels would increase by 38 billion liters by 2028 because of increased accounting of SAF and renewable diesel. This trend centres on the extended use of biofuels beyond power and heating, in particular replacing fossil-based fuels in transport sectors where full electrification is technically or economically problematic.

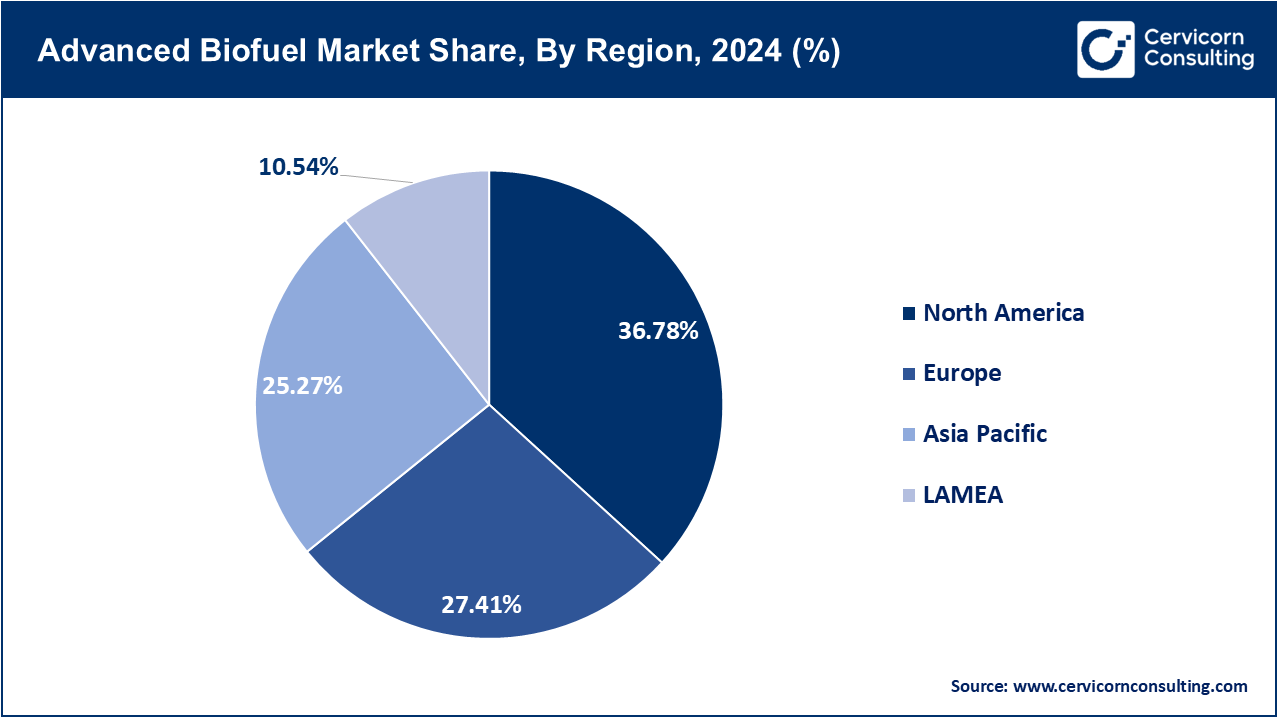

The advanced biofuel market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

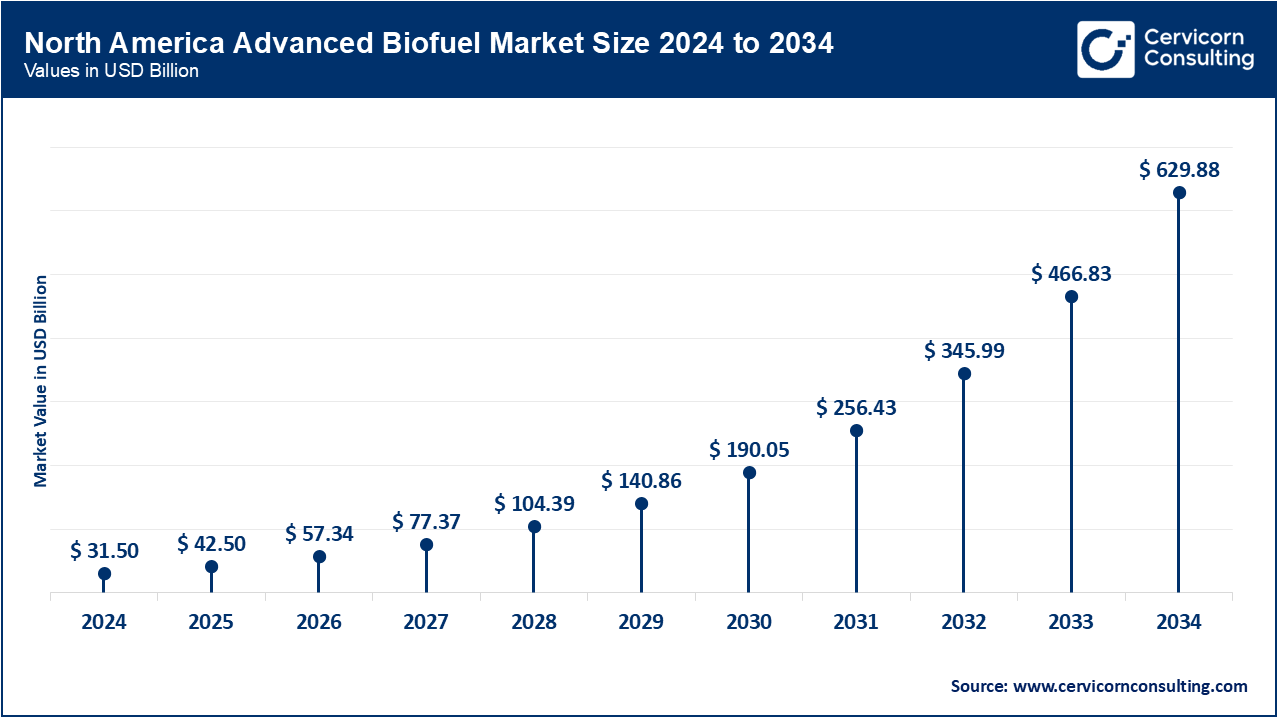

North America is a leading centre of advanced biofuel development since it has robust policy, sophisticated infrastructure and innovative bioenergy companies. The region comprises the U.S., Canada and Mexico among others making a significant contribution to the production of SAFs and renewable diesel. In March 2024 JetBlue started using sustainable aviation fuel (SAF) on a regular basis at JFK Airport in the U.S., proving commercial viability. There have also been investments to push cellulosic ethanol to meet the national Clean Fuels Regulation in Canada. Mexico, less advanced as it is, is experimenting with pilot projects. Investments will continue in Rest of North America whereby the expansion on tech collaborations will occur.

Europe is focused on decarbonization by requiring it, directives in renewable energy production, and investment in waste-to-fuel technology. Some of the major ones include Germany, France, the UK, Italy, Spain, Russia and the Netherlands. In June 2024, the EU updated its Renewable Energy Directive (RED III) and required progressive volumes of SAF and advanced biofuels to be used in transport sectors. Germany and the Netherlands are the top countries in terms of deployment of biogas and lignocellulosic ethanol. France and Spain specialise in used oils as biodiesel. Italy is betting on enzyme pre-treatment technology. Rest of Europe is matching up policies to identical EU-wide targets on sustainable energy.

Increasing demands in energy form the population, combined with favourable government programs, provide the Asia-Pacific region with a high growth rate in advanced biofuels. The area embraces China, India, Japan, the South Korea, Australia, New Zealand, and Taiwan among others. China pledged more than USD 1 billion in April 2024 to construct new SAF production facilities to supply domestic flying. This is a significant move in the region. The 2G bio-refineries and the ethanol blending programme of India are growing fast. Japan and South Korea have algae biofuel R&D on the rise. Australia and New Zealand have already piloted lignocellulose projects. The Rest of Asia-Pacific is gradually adopting technologies of biomass.

LAMEA has potentiality in using biofuel in sugarcane, agricultural residues and emerging regional policy. Brazil is the leader in ethanol and biodiesel production whereas Middle East & Africa are posing waste to fuel solutions and algae solutions. Then in August 2023, Brazil-RAIZEN reported revenue of USD 47 billion as a result of higher production of ethanol and SAF, consolidating its leadership in the world. Middle East is betting on algae-based biofuel in terms of the academic-industry R&D joint ventures. Africa is intensifying biogas and clean cook projects at household level. Infrastructure development and international cooperation are LAMEA prerequisites to the expansion of biofuels.

Market Segmentation

By Process

By Advanced Biofuel Type

By Raw Material

By Feedstock Type

By Application

By Region