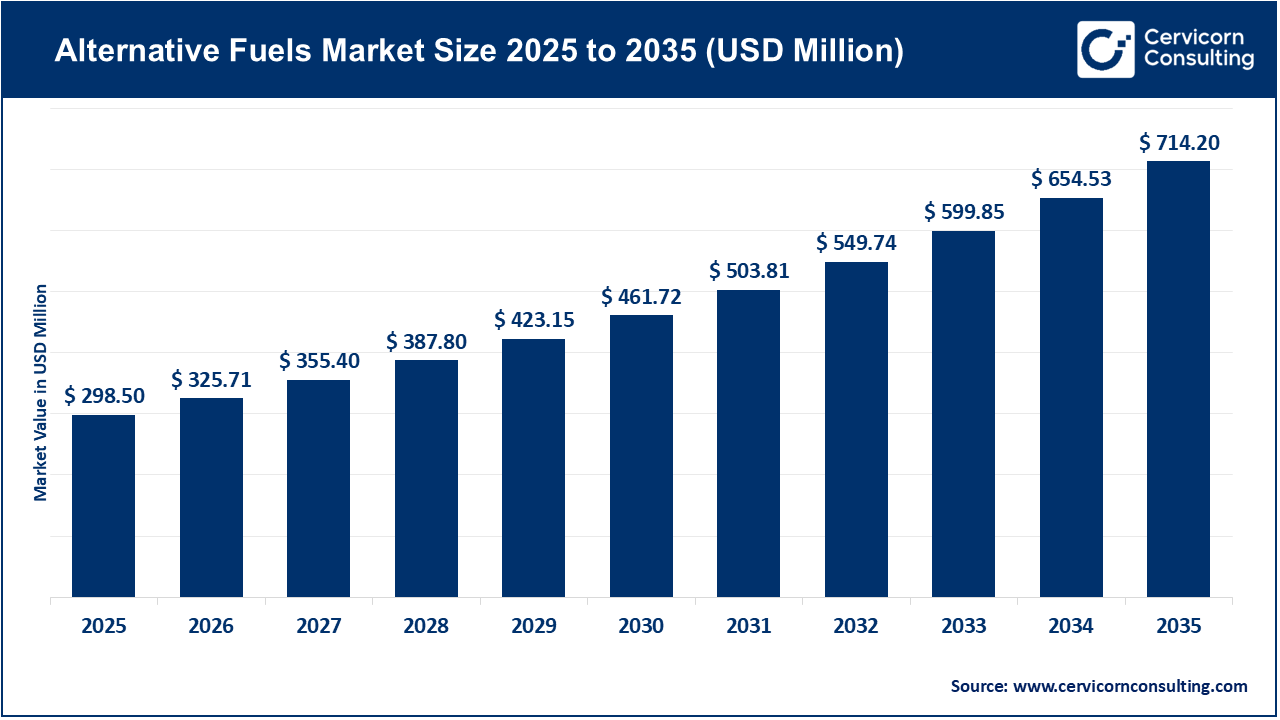

The global alternative fuels market size was accounted for USD 298.50 million in 2025 and is anticipated to hit around USD 714.20 million by 2035, growing at a compound annual growth rate (CAGR) of 9.20% over the forecast period from 2026 to 2035. The global demand for sustainable fuel solutions holds the largest potential for the alternative fuels market to grow.

Alternative fuels refer to energy sources that are used in place of conventional petroleum-based fuels such as gasoline and diesel. These fuels are developed to reduce greenhouse gas emissions, improve air quality, and decrease dependence on finite fossil resources. Unlike traditional fuels, alternative fuels typically offer lower lifecycle carbon emissions and can often be integrated into existing engines and infrastructure with limited modifications.

The market is expected to grow at a robust pace over the next decade as countries strengthen emission regulations, expand blending mandates, and invest in clean energy infrastructure. Alternative fuels are moving beyond pilot-scale projects toward large-scale commercial deployment. As governments and industries pursue cleaner energy systems, alternative fuels are becoming a critical component of the global energy transition.

“Cervicorn Consulting experts highlight that alternative fuels are no longer viewed solely as compliance solutions, but as economically competitive energy options. Levelized production costs for several biofuels and renewable diesel pathways have declined by more than 30% over the past five years, while green hydrogen production costs in leading markets have fallen by nearly 40%. This cost compression is accelerating commercial adoption and long-term offtake agreements across transportation, industrial, and power-generation sectors.”

Rising Emphasis on Energy Security

One of the strongest drivers of the alternative fuels market is the global effort to reduce carbon emissions while improving energy security. Governments across the world are introducing stricter emission standards, fuel-blending mandates, and net-zero targets, which directly increase the use of alternative fuels. Many countries now require ethanol and biodiesel blending in gasoline and diesel, while others are promoting hydrogen and sustainable aviation fuel through policy support and incentives.

High Production Cost and Infrastructure Gaps

Despite strong momentum, high production costs and limited infrastructure continue to restrain market growth. Many alternative fuels, especially green hydrogen and synthetic fuels, remain more expensive than conventional fossil fuels due to costly production processes and the need for advanced technologies. In addition, the lack of widespread refueling and distribution infrastructure slows adoption, particularly in developing regions. For instance, hydrogen fueling stations and sustainable aviation fuel supply chains are still concentrated in a few countries, making large-scale deployment challenging.

Large Scale Investments in Decarbonization

The growing focus on industrial decarbonization presents a major opportunity for the alternative fuels market. Heavy industries such as steel, cement, chemicals, and refining are under pressure to reduce emissions, and many of these sectors cannot rely on electrification alone. Alternative fuels like hydrogen, biofuels, and waste-derived fuels offer practical solutions for high-temperature and continuous industrial processes. Several industrial companies are already piloting hydrogen-based production lines and biofuel-powered boilers to cut emissions.

Top Government Initiatives for Promoting Alternative Fuels’ Usage- 2026

| Country | Initiative | Key Highlight |

| European Union | Renewable Energy Directive III | The EU implemented RED III, mandating that nearly 29 % of transport energy must come from renewable sources by 2030 |

| United States | Clean Fuel Tax Credit | The U.S. Treasury issued updated rules under the Clean Fuel Production Credit, offering up to $1 per gallon tax incentives for low-carbon fuels like ethanol, biodiesel and SAF |

| India | Natural Biofuel Policy | The National Biofuels Policy and initiatives such as SATAT for CBG (Compressed Biogas) and strengthens production and consumption of multiple alternative fuels. |

| Brazil | RenovaBio National Decarbonization Program | Brazil’s RenovaBio sets binding targets for biofuel use and issues tradable carbon credits (CBIOs) for certified reduction of GHGs |

| Indonesia | Biodiesel Blending Mandates | Significantly increasing domestic biodiesel use to reduce diesel imports and support palm oil value chains. |

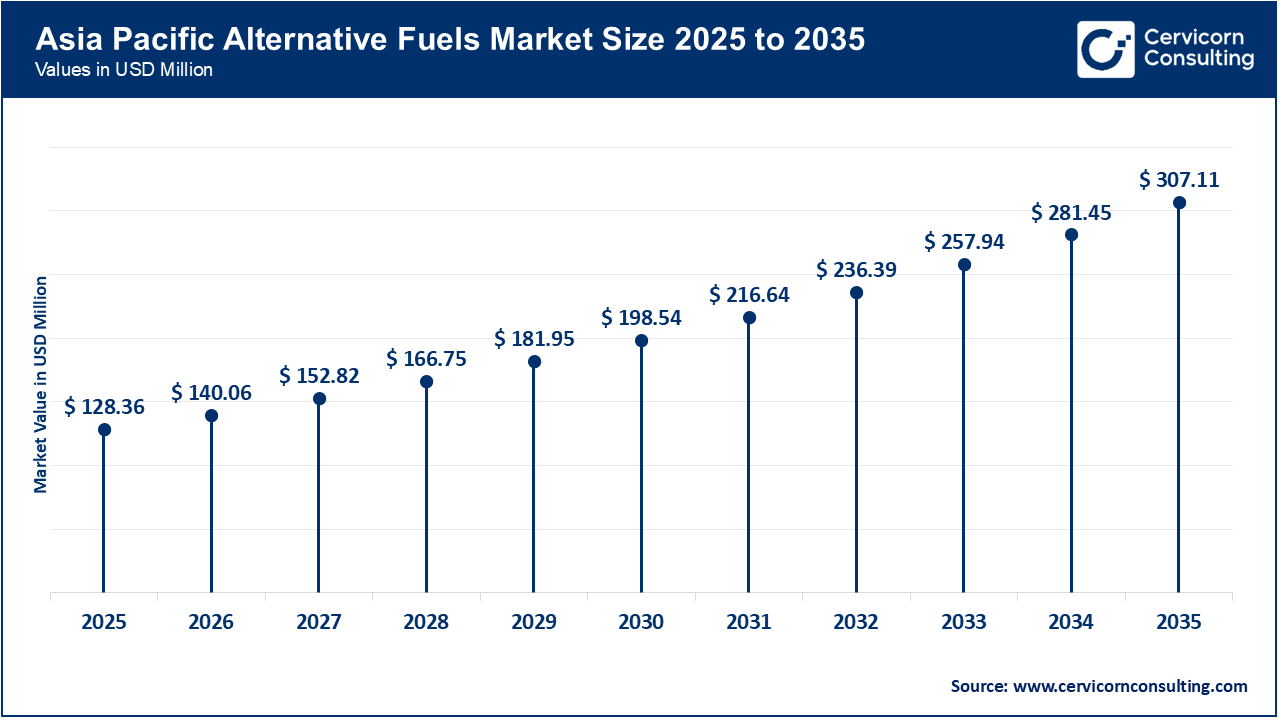

The Asia-Pacific alternative fuels market size was estimated at USD 128.36 million in 2025 and is anticipated to reach around USD 307.11 million by 2035. Asia Pacific led the market in 2025, the region is also expected to hold the largest share by the conclusion of forecast period. driven by large-scale production, government mandates, and rising domestic consumption. Countries such as China, India, Japan, and Indonesia are at the forefront, leveraging abundant feedstocks, robust industrial infrastructure, and supportive policies to expand alternative fuel production.

Southeast Asian countries are scaling biodiesel production with blending mandates like B40–B50 biodiesel, supporting both domestic energy security and export potential. These policies, combined with investments in renewable diesel, green hydrogen, and SAF, are ensuring that Asia Pacific remains a hub for alternative fuel innovation and adoption.

China and India Altenative Fuels Market Landscape

The North America alternative fuels market size was valued at USD 62.69 million in 2025 and is forecasted to grow around USD 149.98 million by 2035. North America is set to experience the fastest rate of growth in the market during the forecast period. The market in North America is poised for rapid growth, driven primarily by favorable government policies, expanding infrastructure, and strong private sector investment. Among North American countries, the United States is expected to remain the dominant shareholder, contributing a substantial portion of regional market size and growth.

The growth in the U.S. is fueled by initiatives such as the Renewable Fuel Standard (RFS), which mandates blending of renewable fuels into transportation fuels, and the Clean Fuel Production Credit (Section 45Z), which incentivizes low-carbon fuels like ethanol, biodiesel, and sustainable aviation fuel (SAF). These programs have created a stable and predictable market, encouraging both domestic and multinational companies to expand production capacities.

“In 2025, U.S. ethanol production alone is projected at over 14 billion gallons, with biodiesel output around 2 billion gallons. SAF production is also gaining traction, with federal blending targets ensuring 1–2 % of jet fuel consumption is sustainable by 2025. This positions the U.S. as the largest contributor to alternative fuel volumes in North America.”

Moreover, the region is witnessing rapid technological advancements, including investments in green hydrogen, electrofuels, and renewable diesel, which further strengthen North America’s share in the global alternative fuels market. Private companies such as Valero Energy, ADM, REG, and HIF Global are actively scaling up production, while infrastructure investments in CNG/LNG fueling stations, hydrogen hubs, and biofuel terminals are enhancing accessibility for end users.

The Europe alternative fuels market size was reached at USD 83.58 million in 2025 and is projected to surpass around USD 199.98 million by 2035. Besides North America and Asian countries, Europe is seen to witness a rapid pace of growth in alternative fuels market. The European Union’s regulatory framework is accelerating the transition to alternative fuels by setting ambitious binding targets, mandates, and supportive policies that are reshaping the regional market. At the core of this effort is the Revised Renewable Energy Directive (RED III), which significantly raises the EU’s renewable energy targets.

“Under RED III, the EU aims for at least 42.5 % of its total energy consumption to come from renewable sources by 2030, up from about 25 % in 2024; a near doubling of the renewable share in just a few years.”

The binding nature of these mandates compels energy producers, airlines, and fuel suppliers to scale up production and use of biofuels, renewable fuels of non biological origin (RFNBOs), and other alternative fuels. Analysts project that EU demand for renewable hydrogen and RFNBOs could reach around 2.8 million tonnes per year by 2030, reflecting regulatory driven growth in clean fuels across industry and transport.

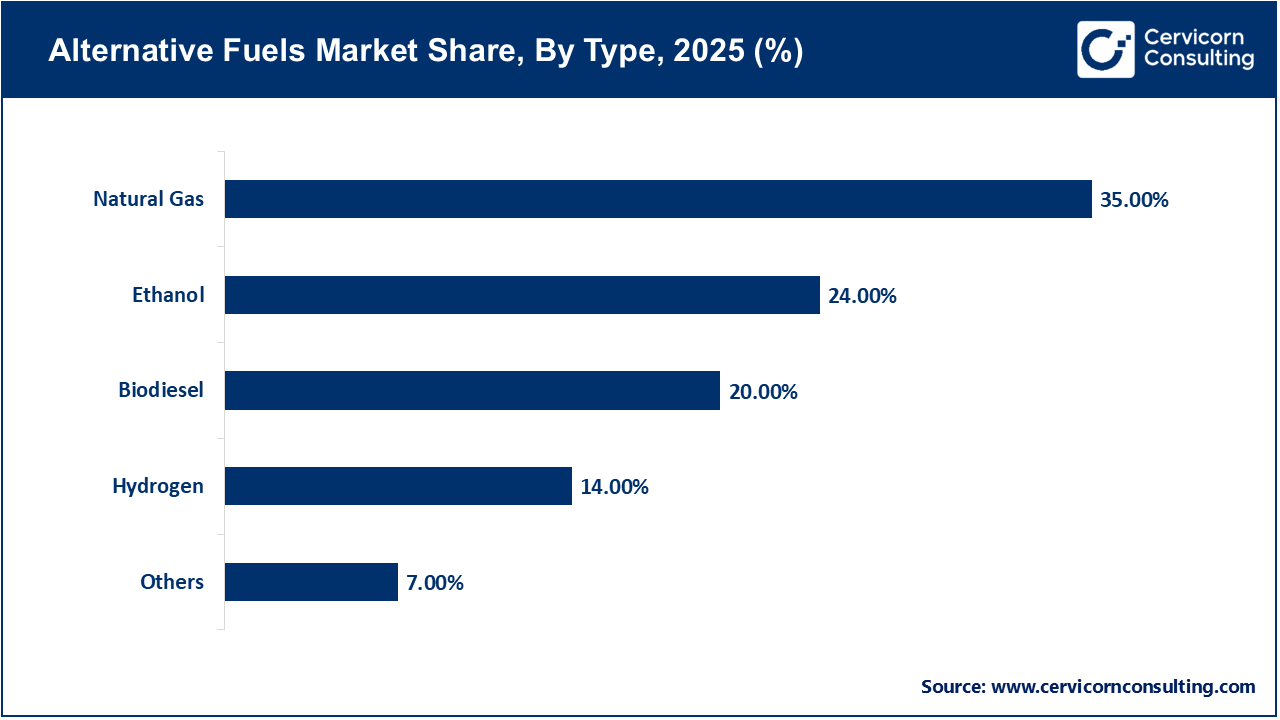

“The Natural Gas Segment Dominated the Alternative Fuels Market in 2025, Expected to Grow Significantly”

Natural gas dominated the alternative fuels market in 2025 due to its strong global infrastructure base, cost competitiveness, and immediate compatibility with existing vehicle and industrial systems. CNG and LNG are widely adopted across public transportation fleets, heavy-duty trucks, and power generation facilities as transitional low-carbon fuels. Countries such as China, India, the U.S., and Italy continue to expand natural gas vehicle (NGV) stations and LNG corridors, particularly for long-haul trucking and urban buses. For instance, several logistics companies in North America and Europe have shifted portions of their fleets to LNG-powered trucks to reduce operating costs and meet emission compliance targets.

Biodiesel is the fastest-growing fuel type, driven by rising blending mandates, circular economy initiatives, and increasing use of waste-based feedstocks such as used cooking oil and animal fats. Governments worldwide are strengthening biodiesel blending targets (B10–B20 and higher), creating consistent demand from the transportation and agricultural sectors. In countries like Brazil, Indonesia, and the United States, national biodiesel programs have accelerated production capacity expansions.

“Hydroprocessing Segment to Sustain a Leader as Processing Technique for Alternative Fuels Market”

The Hydroprocessing segment dominated alternative fuel production in 2025 due to its extensive use in producing renewable diesel and sustainable aviation fuel. The technology allows existing petroleum refineries to be retrofitted for processing bio-based feedstocks, significantly lowering capital costs. Major energy companies have converted or upgraded refineries to produce hydroprocessed renewable fuels, particularly in North America and Europe. This scalability and refinery compatibility make hydroprocessing the most commercially mature production route.

Alternative Fuels Market Revenue Share, By Processing, 2025 (%)

| Processing | Revenue Share, 2025 (%) |

| Gasification | 11% |

| Hydroprocessing | 31% |

| Pyrolysis | 10% |

| Steam Methane Reforming | 23% |

| Carbon Capture & Storage (CCS) | 6% |

| Electrolysis | 19% |

The Carbon Capture & Storage (CCS) is the fastest-growing processing segment, driven by tightening emission regulations and net-zero commitments. CCS enables fossil-based hydrogen and fuel production to meet low-carbon standards. Large-scale CCS projects are being deployed in the U.S., Norway, and the Middle East, supporting blue hydrogen and low-carbon fuel production. This rapid deployment is making CCS a critical enabler of near-term decarbonization.

“The Transportation Segment Dominated the Market with the Largest Share in 2025”

Transportation dominated the alternative fuels market in 2025 due to large-scale adoption of alternative fuel vehicles and blending mandates. Passenger vehicles, buses, trucks, and rail systems increasingly rely on natural gas, biodiesel, ethanol, electricity, and hydrogen. Public transit agencies worldwide are shifting to CNG, LNG, and biofuel-powered fleets to meet air quality standards. Transportation remains the largest demand generator across fuel types.

Alternative Fuels Market Revenue Share, By End-use, 2025 (%)

| End-use | Revenue Share, 2025 (%) |

| Transportation | 48% |

| Chemical | 12% |

| Aviation | 10% |

| Marine & Shipping | 8% |

| Agricultural | 6% |

| Industrial | 14% |

| Others | 2% |

Industrial end-use is the fastest-growing segment as manufacturers adopt alternative fuels to decarbonize high-temperature processes and power generation. Steel, cement, chemicals, and refining industries are integrating hydrogen, biofuels, and waste-derived fuels. Industrial decarbonization strategies are driving sustained demand growth.

By Type

By Processing

By Vehicle Type

By End-use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Alternative Fuels

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Processing Overview

2.2.3 By Vehicle Type Overview

2.2.4 By End-use Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Driver

4.1.1.1 Rising Emphasis on Energy Security

4.1.2 Market Restraint

4.1.2.1 High Production Cost and Infrastructure Gaps

4.1.3 Market Opportunity

4.1.3.1 Large Scale Investments in Decarbonization

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Alternative Fuels Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Alternative Fuels Market, By Type

6.1 Global Alternative Fuels Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Natural Gas

6.1.1.2 Biodiesel

6.1.1.3 Ethanol

6.1.1.4 Hydrogen

6.1.1.5 Others

Chapter 7. Alternative Fuels Market, By Processing

7.1 Global Alternative Fuels Market Snapshot, By Processing

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Gasification

7.1.1.2 Hydroprocessing

7.1.1.3 Pyrolysis

7.1.1.4 Steam Methane Reforming

7.1.1.5 Carbon Capture & Storage (CCS)

7.1.1.6 Electrolysis

Chapter 8. Alternative Fuels Market, By Vehicle Type

8.1 Global Alternative Fuels Market Snapshot, By Vehicle Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Light Commercial Vehicle

8.1.1.2 Heavy Commercial Vehicle

8.1.1.3 Luxury Vehicles

Chapter 9. Alternative Fuels Market, By End-use

9.1 Global Alternative Fuels Market Snapshot, By End-use

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Transportation

9.1.1.2 Chemical

9.1.1.3 Aviation

9.1.1.4 Marine & Shipping

9.1.1.5 Agricultural

9.1.1.6 Industrial

9.1.1.7 Others

Chapter 10. Alternative Fuels Market, By Region

10.1 Overview

10.2 Alternative Fuels Market Revenue Share, By Region 2024 (%)

10.3 Global Alternative Fuels Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Alternative Fuels Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Alternative Fuels Market, By Country

10.5.4 UK

10.5.4.1 UK Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Alternative Fuels Market, By Country

10.6.4 China

10.6.4.1 China Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Alternative Fuels Market, By Country

10.7.4 GCC

10.7.4.1 GCC Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Alternative Fuels Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Valero Energy Corporation

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Archer Daniels Midland Company

12.3 Renewable Energy Group

12.4 Green Plains Inc.

12.5 HIF Global

12.6 Westport Fuel Systems

12.7 Bangchak Corporation Public Company Limited

12.8 Jilin Fuel Ethanol Co., Ltd.

12.9 Henan Tianguan Group

12.10 Sinopec Group

12.11 China National Petroleum Corporation (CNPC)

12.12 Neste Corporation

12.13 BP plc

12.14 Shell plc

12.15 TotalEnergies SE

12.16 INEOS Group