Green Ammonia Market Size and Growth 2025 to 2034

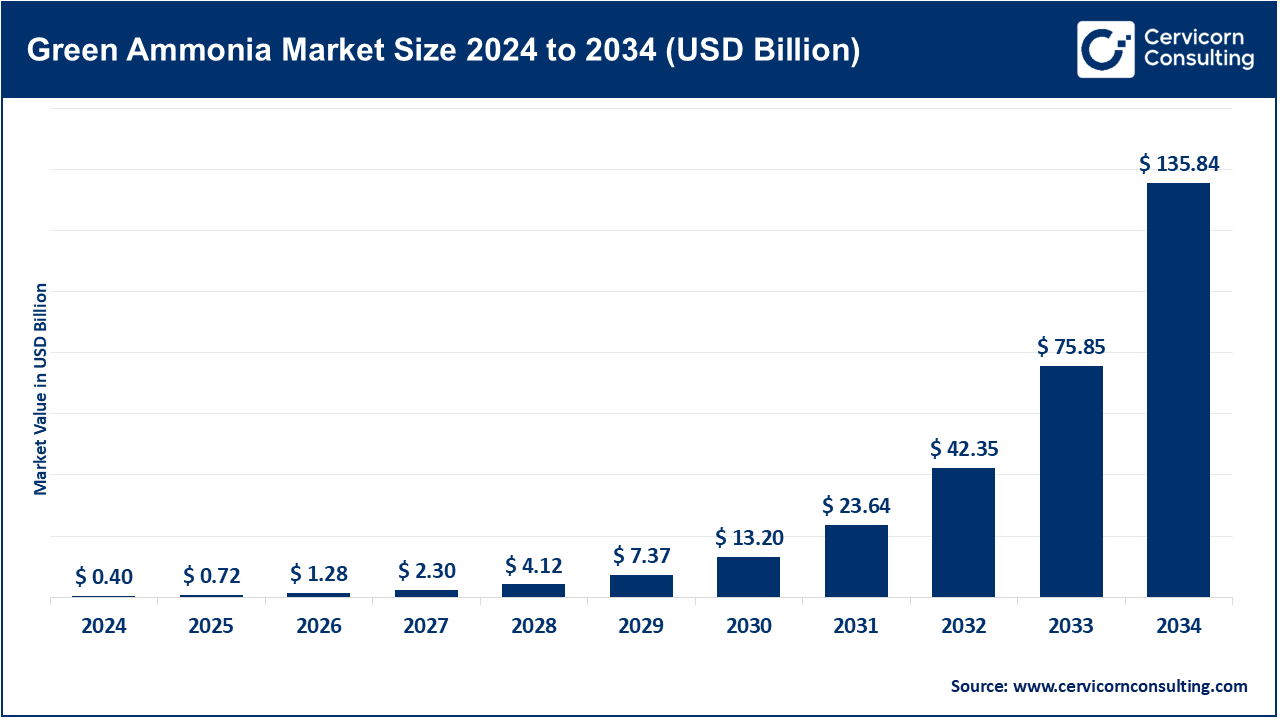

The global green ammonia market size was reached at USD 0.40 billion in 2024 and is expected to exceed around USD 135.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 79.1% over the forecast period from 2025 to 2034. The global green ammonia market is undergoing a swift transition at the epicentre of the clean-energy movement, compelled by a burning need to decarbonize industrial processes, revolutionize agriculture, and harness green ammonia as a sustainable fuel alternative. Green ammonia production takes nitrogen from the atmosphere and reacts it with green hydrogen, split via electrolysis powered by a solar, wind, or hydro energy source, coming under the banner of a carbon-neutral ammonia option. Simply put, unlike the traditional ammonia production, which relies heavily on natural gas and releases CO2 in large quantities, green ammonia offers a low-carbon alternative in pursuit of aggressive global climate goals.

Primary market drivers encompass environmental and climate concerns, ever-ridiculous regulations aimed at the cutting down of greenhouse gas emissions, and counterbalanced government incentives from all fronts of major global economies. Declining cost of renewable power and continuous enhancement of technology related to electrolysers and Haber-Bosch has brought green ammonia close to cost parity with the conventional fossil-based ammonia, consequently aiding in its wider adoption. The growing focus on sustainable agriculture is forcing growers and input suppliers to survey green ammonia as a lesser emission alternative in agriculture where ammonia is a cornerstone input for nitrogen-based fertilizer. Simultaneously, green ammonia is beginning to gain attention from the shipping and power-generation sectors as a clean fuel and energy storage. Being a hydrogen carrier that can store, and transport green hydrogen much more conveniently than pure hydrogen adds to its strategic value in global energy infrastructure. The industry is further looking to green ammonia for solutions in steelmaking, chemicals, and refining processes to help reduce the carbon footprint of several challenging hard-to-abate industries.

Large-scale investment opportunities exist in scaling-up capacity for electrolysers and integrating their production with abundant renewable energy, alongside the enlargement of ammonia distribution systems that could cater to the fuel and energy markets. The establishing of a green ammonia market can indeed work well in developing nations, with Asia-Pacific, Latin America, and the Middle East being especially fertile grounds due to strong policy support, abundant renewable resources, and growing industrial demand. Given that technological advancements would continue driving down costs, and international partnerships would nurture infrastructure development, the market outlook exhibits exponential growth. With a forecast for global ammonia demand to be twice as high by the year 2050, coupled with tighter decarbonization imperatives, green ammonia stands ready to shed off its niche-technology tag and step into the limelight as a mainstream sustainable-energy and agriculture ecosystem intervention.

Green Ammonia Market Report Highlights

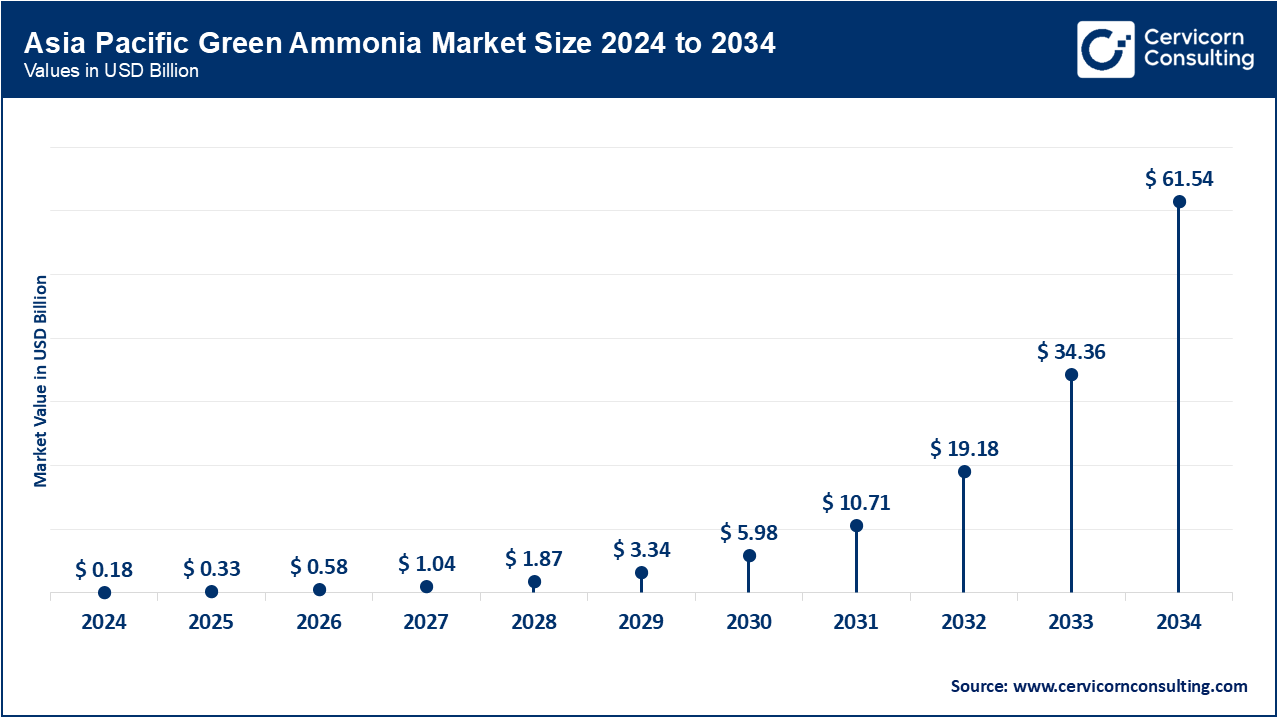

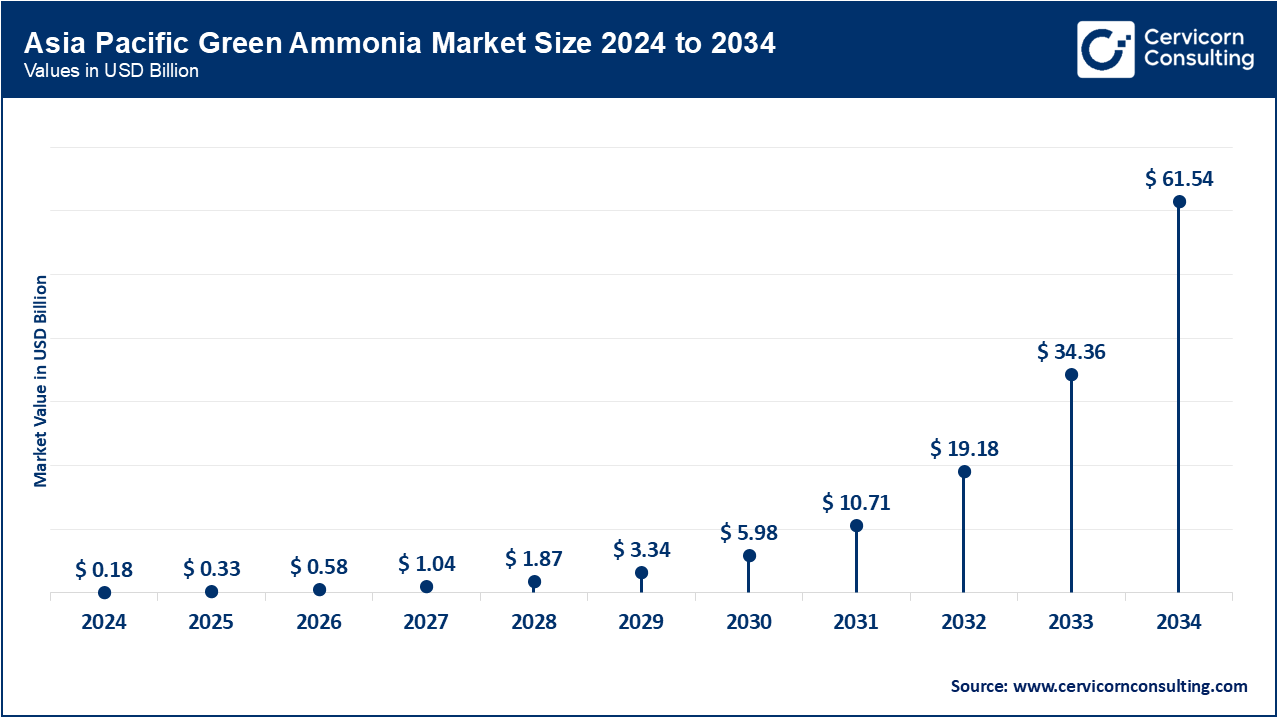

- By Region, Asia-Pacific has accounted highest revenue share of around 45.30% in 2024.

- By Production Method, in 2024, about 47.60% of the revenue share of this market was taken up by the Electrolysis-Based segment. The segment was considered the leader due to the practicality of scaling its processes, maturity in technology, and harmony with the zero-emission goals. In this way, environmentally sustainable hydrogen production occurs by combining hydrogen with nitrogen to produce ammonia using renewable electricity, and this process has become the most popular choice amid rampant global decarbonization efforts.

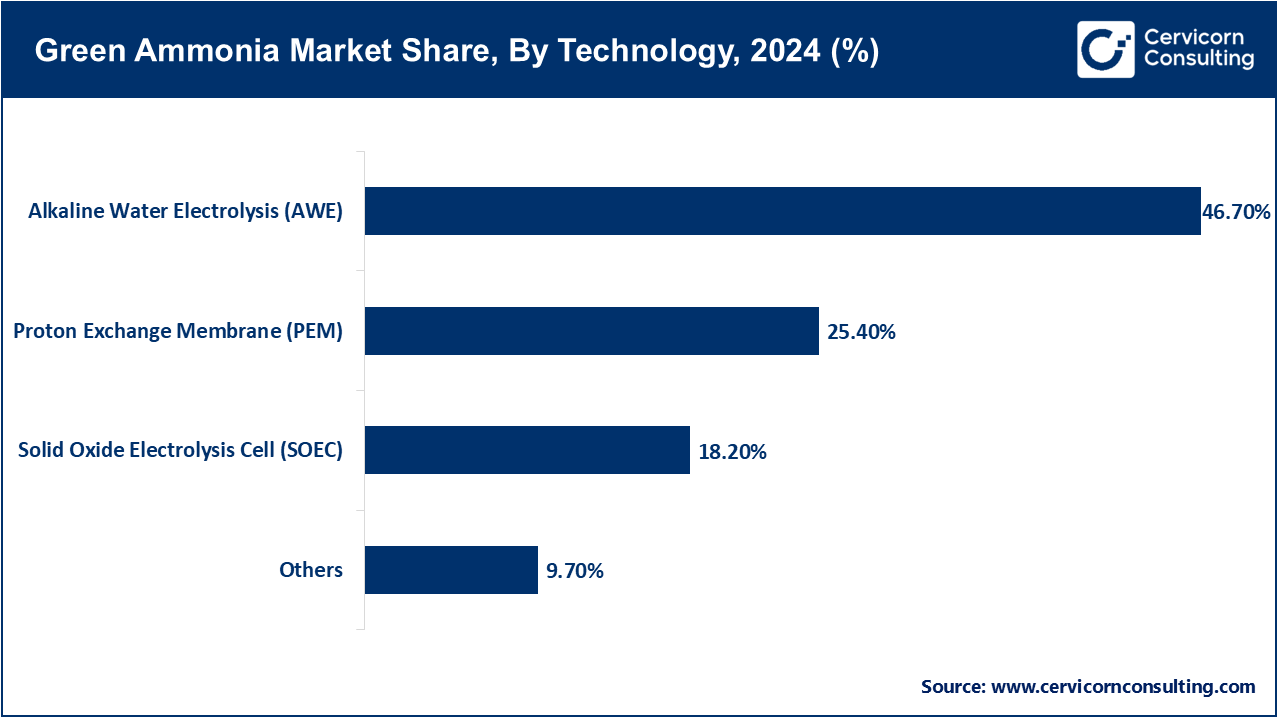

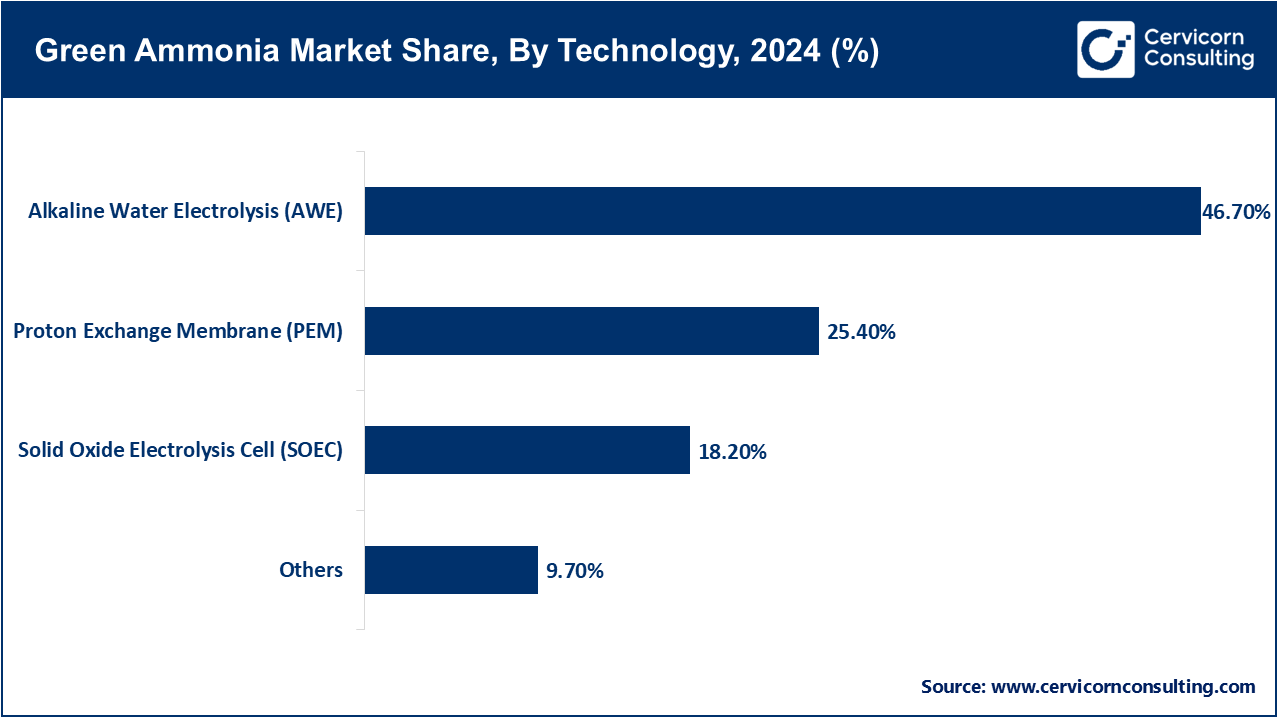

- By Technology, the Alkaline Water Electrolysis (AWE) segment has recorded revenue share of around 46.70% in 2024. This is due to its technological maturity, lower capital costs, and operational simplicity compared to newer alternatives. AWE is well-suited for large-scale hydrogen production, making it ideal for green ammonia synthesis. Its proven reliability and integration into existing infrastructure have further strengthened its widespread adoption across industrial applications.

- By Application, around 33.4% of revenues went to the fertilizer segment in 2024. The fertilizer segment commands a larger share of the global green ammonia market due to its near-universal acceptance of ammonia as a nitrogen source in agriculture. With the rising push for sustainable agriculture, alongside carbon reduction initiatives, green ammonia is increasingly being recognized as an eco-friendly alternative. Being fully compatible with the existing application infrastructure for fertilizers also justifies its top position in the application segment, rendering it the largest segment in this market.

- By End-Use Industry, in 2024, the agriculture segment was estimated to check in with around 36.70% of revenue share. This dominance is primarily driven by the extremely widespread use of ammonia as a nitrogen-rich fertilizer for essential crop productivity. Global food demand is increasing, and with it, sustainable agriculture is gaining ground. The trend indeed supports green ammonia, as it is produced using renewable energy. Also, Governments and other regulatory agencies have been promoting low-carbon inputs for agricultural activities to decrease the environmental footprint of agricultural developments. Other than its environmentally friendly attribute, its easy fit into present-day fertilizer infrastructure is also a major factor that nurtures the prominence of the segment, with agriculture being one of the largest consumers in the market.

Green Ammonia Market Growth Factors

- Decarbonization & Climate Commitments: The massive uptake of green ammonia is being expedited by worldwide decarbonization goals. Every day from the conventional method of producing ammonia, tons of carbon dioxide are introduced into the atmosphere; the governments and industries are thus seeking cleaner methods. Agriculture, shipping, and energy are some of the sectors that must be forced to decarbonize under the agreements of the Paris Accord and the International Maritime Organization (IMO). Using renewable energy and electrolysis, green ammonia can be a clean alternative. This pressure to shift from fossil ammonia to alternatives with less carbon content has obliged enormous intact fertilizer companies and energy producers to dip their feet in green ammonia infrastructure, hence supporting fertilized market nurturing.

- Falling Renewable & Electrolyser Costs: Advances in solar and wind energy and in electrolysers dramatically cut the cost of green ammonia production. Over the last 10 years, renewable energy price collapses meant electricity prices for water electrolysis also came down. In the meantime, efficiency improvements in electrolysers-especially PEM, Alkaline, and Solid Oxide Electrolysers-are increasing hydrogen yields while simultaneously reducing power consumption. These techno-economic developments are pushing green ammonia to compete in substantivity with the traditionally synthesized ammonia. More industrial players find the conversion to green ammonia economically attractive at the decreasing levelized cost of production, hence accelerating its diffusion in the market.

- Supportive Policies & Financial Incentives: Policies, incentives, and subsidies to promote green ammonia are being offered by governments across the world. The U.S. Inflation Reduction Act, for instance, offers huge tax credits to support the production of hydrogen, whereas the National Green Hydrogen Mission of India considers ammonia as a prominent hydrogen carrier. Such initiatives are derisking private investments and providing greater impetus for project pipelines. Furthermore, development banks and climate funds have also been stepped up in financing green ammonia infrastructure. Regulatory frameworks in Favor of carbon pricing and emissions trading make green ammonia stronger from the competition. These steps acting as unprecedented incentives are vital in realizing further capacity expansion and hence permanent interest from long-term investors.

- Technological Innovation & Industry Collaboration: Making green ammonia even more efficient and scalable needs new modern production technologies. New electrolysers, alternative paths to ammonia synthesis and ways of coupling production with renewables are assisting in upping operational cost reductions. The green ammonia under large-scale projects is witnessing strategic alliances among large industry players. Energy companies, fertilizer companies, shipping companies, and port authorities are working together to establish an end-to-end supply chain. Pilot projects and commercial plants in places such as the Middle East, Australia, and Europe are drawing up standards of operation. All these efforts bridge several technical and logistical challenges to ensure that green ammonia is viable commercially on a global scale.

Green Ammonia Market Trends

- Green Ammonia as a Hydrogen Carrier: Since green ammonia is viewed as a good F2T2 (fissile) hydrogen transport medium, working around storage and logistics issues of F2, advancements in its production are being investigated. Higher in energy density than hydrogen and with an existing shipping infrastructure, ammonia is deemed more suitable for world trade. Projects such as Japan's Suiso Frontier (a liquid H2 ship) consider ammonia as a safer option. Countries like Germany and South Korea can split ammonia into hydrogen again at the port of destination and thereby import renewable energy. This dual-use characteristic motivates the further development of cracking technology and import facilities, particularly in countries relatively dependent on imported energy.

- Co-Firing Ammonia in Power Plants: Examples of the countries piloting ammonia-coal/gas co-firing to reduce emissions from existing power plants are Japan and South Korea. JERA of Japan plans to use 20% ammonia-coal mixes by 2030 and expects pure ammonia power generation by 2050. However, there are problems of NOx emissions and flame stability; hence companies like IHI Corporation are developing burners to address these. This trend would thus provide an interim-based decarbonization path for those countries still using coal, and the projects are fast spreading in the EU and Southeast Asia. Government subsidy could further accelerate market adoption (e.g., GX League in Japan).

- Emergence of Green Ammonia Trading Hubs: In the creation of global trade hubs for the commercialization of green ammonia, Chile, Australia, and the Middle East-the big exporters-are teaming up with Japan, Germany, and the Netherlands-the big importers-to work on an agreed pricing formula. Meanwhile, the Ammonia Energy Association is working on standardizing the distinction between “green” and “low carbon” ammonia certification. Ports of Rotterdam and Singapore are gradually setting up dedicated ammonia bunkering and storage facilities. Financial instruments such as futures contracts are also on the drawing board, with ICE Futures now looking into ammonia derivatives. This also gives a look-alike to the market journey of LNG, enabling liquidity and scaling demand.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 0.40 Billion |

| Expected Market Size in 2034 |

USD 135.84 Billion |

| Projected Market CAGR 2025-2034 |

79.10% |

| Dominant Region |

Asia-Pacific |

| Key Segments |

Production Method, Technology, Capacity, Application, End-Use, Region |

| Key Companies |

Siemens Energy, Yara International ASA, ENGIE, Air Products, ITM Power PLC, ThyssenKrupp AG, Iberdrola, MAN Energy Solutions, Nel Hydrogen |

Green Ammonia Market Dynamics

Market Drivers

- Rising Demand for Sustainable Fertilizers: Dominated by fertilizer production, the $70B international ammonia market is conventional in the sense that it is based on steam methane reforming and emits approximately 2.6 tons of CO2 per ton of ammonia. With agribusinesses and governments pushing for low-carbon farming as part of their ESG mandate, green ammonia becomes an attractive option. Yara and CF Industries are retrofitting plants to work on green hydrogen, while at the same time, startups like Ammonia are pursuing electrochemical ammonia synthesis. The EU's implementation of the Carbon Border Adjustment Mechanism (CBAM) will impose tariffs on carbon-intensive fertilizers, boosting further demand for green ammonia. In regions like India and Africa, where fertilizer subsidies are high, the governments have started pilots with green-ammonia-based urea to reduce fertilizer imports and carbon emissions. According to the World Bank, about 20% of the market could be taken up in 2030 by sustainable fertilizers, with Latin America and Southeast Asia being the key growth regions.

- Green Hydrogen Synergy: Ammonia is regarded as the most efficient hydrogen carrier, providing a higher energy density, triple that of compressed hydrogen, and easier liquefaction, at -33°C compared to -253°C of hydrogen. This then makes it very attractive for global hydrogen trade, thus from renewable-rich areas (Australia, the Middle East, Chile) to energy-consuming markets (Europe, Japan). The NEOM $8.4B green ammonia plant (Saudi Arabia), and Asian Renewable Energy Hub (AREH) in Australia are planning to ship millions of tons per year. On the other hand, JOGMEC of Japan is supporting pilot projects wherein cracking ammonia to release hydrogen for fuel cells besties; H2Global of Germany is auctioning green ammonia import contracts. The Hydrogen Council expects that, by 2030, 50% of traded hydrogen will be shipped as ammonia, with the main drivers being shipping economics and safety.

- Renewable Energy Cost Reductions: Levelized cost of energy (LCOE) of renewables has been throwing a landslide. Solar PV became 90% cheaper in prices since 2010, and this development has further made electrolysis-based ammonia feasible. Today, in places where renewable energy costs less than $30 per MWh (Chile, Oman, etc.), green ammonia production is anywhere between $400 and $600 per ton, getting closer to $200-$300 per ton of grey ammonia. A few down-the-road developments, such as advanced solid oxide electrolysers (SOEC) and dynamic ammonia synthesis, offer an appeal to the cost side. Deutsche Energiewirtschafts AG (DOE) intends to achieve the $1/kg H2 goal by 2030 under its Hydrogen Shot initiative, which would render green ammonia to be cost-competitive. Currently, offshore wind-projects for making ammonia (like the Ørsted project in Denmark) are picking up pace, with BP and EnBW looking to develop hubs in the North Sea. Bloomberg NEF states that green ammonia will become cheaper than grey ammonia by 2035 due to carbon taxes and a scaling of renewable energies.

Market Restraints

- High Production Costs: Green ammonia production is much more costly compared with the conventional method because of its dependence on renewable energy and electrolysis. Electrolysis presents substantial capital expenditure while operating costs add to the prices. The intermittent supply of electricity from the renewable sources, such as solar or wind, can only drive the prices higher. Finally, the conversion of hydrogen and nitrogen to ammonia through the Haber-Bosch method requires big amounts of pressure and heat and thereby big amounts of energy. For the case of retrofitting of existing ammonia plants or erecting green ammonia facilities from scratch, there will be enormous upfront capital expenditures, rendering it very cheap to contest without subsidies or carbon prices. With the achievement of economies of scale and reduction of technological costs, green ammonia will be opposing these cheaper fossil-based alternatives.

- Limited Renewable Energy Availability: Green ammonia production requires abundant and consistent renewable energy, such as solar and wind. In contrast, many places in the world do not possess sufficient renewable capacity or experience intermittent generation patterns that contribute to the union of unreliable supply. Areas with low solar irradiance or weak wind resources face higher costs for importing clean electricity or storing energy. Large-scale green ammonia projects require dedicated renewable power plants, which may compete with other sectors for limited clean energy. Without stable and scalable renewable energy supply, production efficiency drops with an increase in cost and restriction in market development. Geographic constraints further account for the challenges in hosting the widespread adoption of green ammonia.

- Technological and Scalability Challenges: Current green ammonia synthesis techniques are evolving in efficiency and scalability. Electrolytic technologies like PEM and alkaline still need to work on diminishing energy losses. While the Haber-Bosch method is well-established, it is also considered an energy-intensive process and not completely optimized for green hydrogen inputs. Alternative methods of synthesis, such as electrochemical production of ammonia, are at embryonic stages. Ammonia also presents challenges regarding storage and transportation for being corrosive and toxic, therefore demanding specialized infrastructure. Mass production to meet global demand will require breakthroughs in bringing costs down, boosting energy efficiency, and improving safety. Until then, the commercialization of large-scale plants will stay difficult.

Market Opportunities

- Decarbonization of Hard-to-Abate Sectors: Green ammonia is increasingly being marketed as a solution for industries in which emission cuts are otherwise difficult. Maritime shipping stands out as a heavily fossil fuel-dependent industry; thus, ammonia could be harnessed as a zero-carbon solution for vessel propulsion. The stringent emission targets set forth by the International Maritime Organization (IMO) are further accelerating its adoption. Ammonia can be burned in thermal plants in lieu of a coal-based fuel or be used as a fuel in gas turbines, with Japan and South Korea especially leading the way in investments into ammonia co-firing technologies. In addition to fertilizers, chemicals, and explosives are traditional industries that have always depended on carbon-intensive production of ammonia. By switching to green ammonia, those industries will be able to continue their production at nearly full capacity while significantly reducing emissions. Due to its ability to be scaled up to large production, green ammonia stands as one of the very few options available to decarbonize heavy industries without economically viable alternatives, thus, placing it right into the spotlight of global climate strategies.

- Hydrogen Economy Enabler: Ammonia is quickly becoming a viable hydrogen storage and transport medium, posing a solution to some of the greatest obstacles in a true hydrogen economy. Hydrogen suffers problems in long-distance transportation due to its low energy density and high volatility. Whereas ammonia can be stored in the liquid state at mild pressures and made easier for handling. Japan and Germany are working on the establishment of ammonia import terminals to ensure the supply of hydrogen. Green ammonia in turn can be cracked into hydrogen at point of-use to provide a clean energy source for fuel cells and industrial processes. This very dual functionality as a direct fuel and carrier of hydrogen enhances the strategic value of green ammonia in global energy trade. As the corresponding infrastructure for hydrogen is put in place in different countries, the logistic benefits of ammonia will therefore offer itself as a good bridge linking renewable energy producers and consumers.

- Government Policies & Incentives: Government support leads to the primary driver of green-ammonia adoption. According to the REPowerEU plan and the Inflation Reduction Act (IRA) in the U.S., subsidies and tax credits for green hydrogen and ammonia projects reduce production costs. Governments in the Middle East and Australia are initiating export-driven green ammonia hubs by capitalizing on their abundant renewable resources. India, through its National Green Hydrogen Mission, and China, through its pilot projects, charity an accelerated production of the same at home. The policies that mandate emission reductions in areas of shipping and industry add to the demand. Such regulatory frameworks strip away any investment risks and lure private capital into these initiatives. As more countries incorporate ordinance that price carbon and require clean fuels, green ammonia projects will stand to gain from increased financial backing and be assured of the long-term market growth.

Market Challenges

- Infrastructure and Storage Challenges: Existing infrastructure for ammonia is essentially designed for fossil-fuel-based production and would demand certain modifications for handling green ammonia. Further, storage and transportation of ammonia pose difficulties as it is corrosive and toxic, requiring special containment systems. Existing port facilities must be revamped for large-scale green ammonia export, posing a significant capital challenge. More stringent safety concerns than liquid hydrogen or other fuels go into ammonia logistics, thereby contributing to their complexity. The unavailability of dedicated infrastructure for green ammonia is a protracted unmet need in the market expansion, higher costs, and operational risks borne by producers and consumers. Scaling up green ammonia trade will remain constrained without coordinated investments into storage, transport, and port amenities.

- Policy and Regulatory Hurdles: Lack of a united global green ammonia certification system creates market uncertainty with definitions of "green" varying by region. Some countries incentivize and subsidize it, while others do not, so that the market evolves on uneven footing. Carbon pricing regimes in those jurisdictions that have them heighten green ammonia's competitiveness, whereas investors are deterred by lack of binding regulations in other jurisdictions. Slow permitting procedures for bigger projects involving renewable energy supply also are holding back production capacity. Without a unified international set of standards and a stronger policy framework, financial and regulatory risks are placed in the developers' path and serve as deterrents to any long-term commitments. While once clear and constant regulations come into force, the industry will grow at a rapid pace, the introduction of which, however, is hampered by political and economic considerations.

- Market Demand Uncertainty: In terms of commercialization of green ammonia, demand from industries like shipping and agriculture is important, yet long-term contracts hardly ever come by. Demand gets split up among green fuels that go by the names of hydrogen, e-methanol, and possibly some others, preventing the scaling economies of ammonia. End-use demand, such as maritime ones, needs ammonia to undergo engine modifications to combust safely, thus delaying the use of ammonia. Fertilizer producers-i.e., the traditional market for ammonia-may resist increased costs without regulatory imposition. Without guaranteed demand, investors shy from investing in large-scale projects, and that thus impede market growth. Demand-side policies such as mandates for fuel use or subsidies for end-users may underpin the market but are not yet widespread.

Green Ammonia Market Segmentation Analysis

Production Method Analysis

Electrolysis-Based: Water electrolysis uses renewable electricity (solar, wind, etc.) to generate hydrogen and oxygen. This hydrogen is reacted with nitrogen obtained from air to form ammonia via the Haber-Bosch process. This method of manufacture is still so far, the most widely adopted, largest-scale green ammonia method, as it is entirely free of fossil fuels. It is regarded as a key technology in decarbonizing and turning ammonia production into a greener industry with less greenhouse emissions. With time, electrolyser cost and efficiency are bound to improve, along with the infrastructure for renewable energy; thus, this segment is projected to expand hugely in future years.

Green Ammonia Market Revenue Share, By Production Method, 2024 (%)

| Production Method |

Revenue Share, 2024 (%) |

| Electrolysis-Based |

47.60% |

| Biomass Gasification |

35.10% |

| Others |

17.30% |

Biomass Gasification: Through biomass gasification, organic materials such as agricultural waste are partially oxidized to yield gas mixtures consisting of hydrogen, carbon monoxide, and methane. The hydrogen is then extracted and made to react with nitrogen to form green ammonia. This alternative methodology employs waste biomass as a renewable feedstock and thus offers a sustainable and carbon-neutral alternative to fossil fuels. Advantages are especially conceivable for biomass gasification in regions endowed with biomass resources. While it is still in the nascent stages of commercial implementation, there is a huge potential offered by this process in integrated bio-refineries focused on waste management and renewable energy generation to create a model of circular economy.

Other Renewable-Powered Haber-Bosch Processes: This sector coolly refers to those green ammonia productions that still rely on the conventional Haber-Bosch process but are powered using renewable energy. For instance, instead of natural gas use in these plants, you will have biogas or hydrogen produced from renewable sources. Essentially, it tries to retrofit or construct the Haber-Bosch-type plants by feeding a set of inputs with renewable electricity so that the process turns out to be carbon-free. That way, existing infrastructure can be decarbonized gradually. The systems might not reach the ultra-low emissions of their electrolysis-based counterparts, but they do present some viable options for industrial scale in the nearer term-the emphasis here being on regions with established ammonia production facilities seeking to upgrade to some form of sustainability.

Technology Analysis

Alkaline Water Electrolysis (AWE): One of the oldest and most established methods of electrolysis is AWE. It uses alkaline electrolyte, which is usually potassium hydroxide, for the separation of water into hydrogen and oxygen. This type of electrolysis is cost-efficient, scalable, and good for large-scale green-ammonia production. Having a long operational history, it has very low capital costs and is preferred for industrial purposes. However, it has slower dynamic response compared to other newer techs, hence integration with variable renewable energy sources becomes a little bit difficult.

Proton Exchange Membrane (PEM): PEM means "Proton Exchange Membrane" electrolysis, and it is basically defined by the polymer electrolyte-ion membrane transport of protons from the anode to the cathode with gas separation. It allows the production of extremely pure hydrogen, while also designing very compact systems with a very fast response. It perfectly fits well with the integration requirements for renewable energy generation. While the PEM systems are costlier due mainly to precious metals used in their catalysts like platinum and iridium, their efficiency and operational flexibility have been perceived beneficial in the green ammonia production, particularly in projects that rely on fast start-up and high responsiveness.

Solid Oxide Electrolysis Cell (SOEC): The SOEC works at temperatures ranging from 600°C to 1000°C; therefore, it uses heat along with electricity to split water while improving overall energy efficiency. It produces hydrogen with better efficiencies than low-temperature electrolysis methods when waste heat or industrial heat sources are available. The SOEC is still under development, facing some issues such as materials' durability and high temperatures in operation; however, it poses a great chance to be used for future large-scale green ammonia production given its utmost efficiency.

Others: Emerging and hybrid electrolysis technologies, depending on the stage of their development, are either still in research or in early deployment. They might involve new membrane materials, a different electrolyte, or a system integrating electrolysis with renewables or storage facilities. Although somewhat less commercially relevant at present, such innovations intend to improve energy efficiency, reduce capital investment, and enhance flexibility from the perspective of a decentralized green ammonia production setup. These technologies are pursued mainly by startups and research institutes, thereby diversifying and evolving the market.

Application Analysis

Fertilizer: Green ammonia focusing on agriculture can act as an awesome carbon fertilizer. It replaces the conventional ammonia-free carbon fertilizer generally derived from fossil fuels. Green ammonia produced with renewable energy by electrolyzing water fits into the global efforts to decarbonize agriculture. This, in turn, amends soils and increases crop production without potting greenhouse gases. This application sector has always been the major revenue generator due to the heavy demand for synthetic fertilizers worldwide and application of green pesticide and agriculture practices.

Power Generation: Green ammonia offers an efficient energy carrier and combustion fuel for power generation. It can be combusted or co-fired with coal in gas turbines to reduce carbon emissions. Due to enhanced storage and transport features relative to hydrogen, it becomes a viable alternative for renewable energy storage and grid balancing purposes. Countries that are going through clean-energy transition, specifically Japan and Australia, have been invested in the construction of ammonia-fired power plants, thus creating demands for this sector.

Green Ammonia Market Revenue Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Fertilizer |

33.40% |

| Power Generation |

17.10% |

| Transportation |

29.70% |

| Hydrogen Carrier |

10.20% |

| Others |

9.60% |

Transportation: Green-ammonia is becoming the new low-emission fuel in the transport industry, especially for maritime and heavy-duty vehicles. It has somewhat higher energy density than hydrogen and thus is easier to store and transport. To help decarbonize the globe, ammonia-fuelled engines and fuel cells are being designed for the operation of ships and trucks. With stretching emission regulations and the suggested alternative marine fuel path by IMO-in this segment, demand is picking up.

Hydrogen Carrier: Green ammonia is an efficient hydrogen carrier, providing the means for hydrogen storage and international transportation. Since it can be liquefied at relatively moderate pressures, it helps to foster subcontinental distances in hydrogen trade and reconversion to the gas phase via cracking. This facility is of utmost importance in setting up a global hydrogen trade infrastructure. Countries such as Japan and South Korea view ammonia imports as part of their hydrogen initiatives, promoting growth in this sector.

Others: Those major categories of applications include refrigeration, chemical synthesis, and energy storage. Green ammonia can act as an environmentally benign substitute for conventional ammonia in industrial processes. Also, it is being explored in research activities for seasonal energy storage and fuel cell applications. Even though they are considered niche applications, they do help develop the market because they diversify demand and foster innovation in sustainable energy and industrial solutions.

End-Use Analysis

Agriculture: Agriculture primarily dictates the use of green ammonia due to its application as a nitrogenous fertilizer. Ammonia is used to produce urea and ammonium nitrate, which are essential fertilizers for crop growth. The usage of green ammonia renewable resources would largely reduce the carbon emissions normally associated with traditional fertilizer production. This demand for green fertilizers is directly aligned with the consumers' demand for sustainable farming methods and environmentally friendly inputs. Also, there have been numerous regional governments and regulatory bodies pushing for decarbonization in agriculture, thus further cementing the status of green ammonia. Due to the reliability and scalability of ammonia-based fertilizers, this segment is stable and represents a long-term demand driver.

Energy & Power: Green ammonia is emerging as a potential energy carrier and storage method in the energy & power sector. Its capability to store hydrogen in a stable, dense, and transportable manner has made it an attractive candidate for renewable energy storage and grid-level balancing. It could be burnt in power plants or reconverted into hydrogen for use in fuel cells. Japan, Australia, and other countries are trying to co-fire green ammonia in thermal power plants to decarbonize the electricity generation. This segment will prosper based on the advancements in ammonia combustion technology and the increased funding to carry the hydrogen infrastructure forward.

Green Ammonia Market Revenue Share, By End-Use, 2024 (%)

| End Use |

Revenue Share, 2024 (%) |

| Agriculture |

36.70% |

| Energy & Power |

26.40% |

| Maritime & Shipping |

16.30% |

| Chemical & Pharmaceutical |

12.10% |

| Others |

8.50% |

Maritime & Shipping: The maritime industry is adopting green ammonia as a sustainable fuel alternative to adhere to the IMO's (International Maritime Organization) goals set for emissions reduction. With a growing clamour in the shipping industry to reduce greenhouse gas emissions, green ammonia offers a zero-emission solution. It may be utilized in internal combustion engines or ammonia fuel cells for the long-haul type of ship. With the developing infrastructure for ammonia bunkering and ammonia-ready engines, tremendous growth is expected in this segment. Large players along with port authorities across the globe are engaged in the pilot testing of ammonia fuelled ships, which are suggestive of large-scale application in the future.

Chemical & Pharmaceutical: The green ammonia remains a sustainable feedstock in the chemical and pharmaceutical industries for the manufacture of nitric acid, amines, and other derivatives necessary for making medicines, plastics, dyes, and synthetic fibres. These industries are increasingly being charged to decarbonize their supply chains upstream. Thus, replacing the conventionally manufactured ammonia with green alternatives helps cut down Scope 3 emissions and helps meet ESG objectives. Although the volume in this segment is not as high currently as in agriculture and energy, its value addition and increasing sustainability commitment are creating space for tremendous potential.

Others: This category covers the niche applications of refrigeration, mining explosives, and wastewater treatment. Ammonia being an energy-efficient and less environmentally damaging refrigerant has had a long history. With green ammonia, the eco-friendly status has been added, making it even greener. The other uses of green ammonia in the mining industry include making explosives like ammonium nitrate fuel oil (ANFO), albeit with a lower environmental impact. Wastewater treatment plants use green ammonia as a nutrient source and pH control, supporting its sustainability role. Though a minor share, this demand provides important diversification.

Green Ammonia Market Regional Analysis

The green ammonia market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

Why is Asia-Pacific region dominates the green ammonia market?

- The Asia-Pacific green ammonia market size was valued at USD 0.18 billion in 2024 and is projected to be worth around USD 61.54 billion by 2034.

The Asia-Pacific region dominates the global green ammonia market, owing to its large industrial base, increasing renewable capacity, and robust government policies supporting decarbonization initiatives. Countries such as China, Japan, South Korea, India, and Australia are at the forefront of greener ammonia-making and usage. Japan and South Korea are investing massively in hydrogen technologies, considering ammonia as a carrier of hydrogen. Australia has been placed at the centre stage of green ammonia production with reference to its enormous renewable resources and export-oriented capability. The increasing interest in fulfilling sustainable agricultural needs and green shipping fuel requirements also strengthens the green ammonia market in the region. Strategic alliances between regional and international energy companies promote innovation and scaling-up of projects. With countries committed to net-zero targets alongside decreases in fossil fuel reliance, green ammonia offers an auspicious alternative especially for power generation and industrial applications. Additionally, favourable regulatory regimes and consolidating infrastructure support help give momentum to the region.

Why North America stands on steady and promising growth in green ammonia market?

- The North America green ammonia market size was valued at USD 0.11 billion in 2024 and is expected to hit around USD 36.95 billion by 2034.

The North America stands on steady and promising growth, chiefly supported by the increasing drive toward sustainable agriculture, renewable energy goals, and decarbonization of transportation and industrial sectors. The U.S. and Canada steer regional collaborators, launching several pilot projects to employ green ammonia in preparing fertilizer, fuel, and hydrogen storage mechanisms. Therewith, fresh investments into clean energy technology and a set of policies for market development such as tax credits and grants find their way into the regional vocabulary. Moreover, in this operational theatre, where nature is generous with renewable resources, mostly solar and wind, cheaper prices to produce green ammonia through electrolysis can be fixed. On top of this, energy companies collaborate with research institutions to speed up technology development and commercialization. Focus accelerated on the need to slash emissions from Agri- and maritime sectors then provide further support for market expansion.

Why is Europe hits significant growth in green ammonia market?

- The Europe green ammonia market size was estimated at USD 0.08 billion in 2024 and is expected to reach around USD 27.71 billion by 2034.

Europe is the main continent in the market, driven by climate policies, an innovation economy, and pioneer within green hydrogen. The EU or European Union Green Deal and Hydrogen Strategy put in motion the funding and infrastructural development for green ammonia. Given the necessity of combating climate change, Germany, the Netherlands, Norway, and Denmark are setting up projects for large-scale electrolysis and ammonia synthesis. In addition to being a clean fertilizer, green ammonia is considered the solution for energy storage, hydrogen transport, and decarbonizing maritime shipping in Europe. The region enjoys one of the most developed regulatory frameworks for green initiatives, coupled with a strong political will to combat greenhouse gas emissions; these ingredients have gone in Favor of the adoption of green ammonia. Furthermore, import collaboratives with the Middle East and African countries for green ammonia supplements Europe's strategic approach toward energy security and sustainability.

Green Ammonia Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

27.20% |

| Europe |

20.40% |

| Asia-Pacific |

45.30% |

| LAMEA |

7.10% |

Why is LAMEA region growing slowly in the green ammonia market?

- The LAMEA green ammonia market size was surpassed at USD 0.03 billion in 2024 and is anticipated to reach around USD 9.64 billion by 2034.

The LAMEA region is slowly but surely setting its faces in the market with some countries letting loose on their renewable energy potential in entering the space. In Latin America, Chile and Brazil stand in front of the green hydrogen and ammonia projects, having major solar and wind resources. Chile's national green hydrogen strategy aims to advertise it as a chief exporter of green ammonia. From the Middle East, the Saudi Kingdom and UAE invest huge sums into giga projects like NEOM in diversification of their economies for the exports of green energy. Meanwhile, Africa, especially North Africa, is slowly drawing the spotlight for having cheap green ammonia production potentials for local consumption and export into Europe. While the infrastructure and regulatory framework is still being set up all over the region, international partnerships and investments have been on the rise. Its strategic location and energy potential are, therefore, contributing significantly toward considering the area as an important segment for the future green ammonia supply chain on a global level.

Green Ammonia Market Top Companies

Recent Developments

- In June 2024, the inauguration of the Yara renewable hydrogen plant at Herøya Industrial Park in Norway was announced by ITM Power. At present, this facility with 24 MW capacity is the largest of its kind in Europe, designed to produce sufficient green hydrogen to create 20,500 tons of ammonia on an annual scale. This ammonia will be used in turning 60,000 to 80,000 tons of green fertilizer. Hydrogen production through this plant is by way of renewable energy and an ITM development known as PEM electrolyze technology. This technology substitutes natural gas while sequestering about 41,000 tons of CO2 annually at the site.

- In January 2024, Engie and Enaex entered a partnership for the HyEx project, located in Antofagasta, Chile. According to this scheme, Engie will produce renewable hydrogen to be converted into green ammonia by Enaex, which will then be used in the manufacture of explosives for mining. The idea behind this collaboration is to try to decarbonize Chilean mining using renewable energy.

- October 30, 2023, DAI has signed an MoU with Siemens Energy to produce green hydrogen from renewable energy in East Port Said. Hence, under the MoU, Siemens Energy will provide electrolysers, auxiliary plant systems, and essential equipment for the hydrogen island. The two companies will provide engineering services together during the project development phase. DAI intends to manufacture green ammonia at Ra with an aggregate output of 2 mtpa, with the start date planned around 2028. The green ammonia will be sold to German and mainly European off takers, while the bigger share of green ammonia production will be consumed in the maritime sector as fuel.

- June 2023, The Green Ammonia Project with capacity up to 1.2 MT of ammonia has been established in Oman under the leadership of the ENGIE-POSCO Consortium. Through the leadership roles of ENGIE and POSCO in the consortium formed for mobilizing the renewable energy resources in Oman, the group intends to develop a green ammonia project of 1.2 million tonnes per annum capacity. Other members of the consortium are Samsung Engineering, Korea East-West Power Co. (EWP), Korea Southern Power Co. (KOSPO), and FutureTech Energy Ventures Company Ltd. (a subsidiary of PTTEP). The project comprises new wind and solar capacities up to around 5 GW, Battery Energy Storage System (BESS), and a renewable hydrogen plant of up to 200 ktpa. Hydrogen will be transported by pipeline from the hydrogen plant to somewhere near the port of Duqm, where it will be integrated with ammonia production. 1.2 mtpa of green ammonia will see exports for Korea in 2030.

Market Segmentation

By Production Method

- Electrolysis-Based

- Biomass Gasification

- Other Renewable-Powered Haber-Bosch Processes

By Technology

- Alkaline Water Electrolysis (AWE)

- Proton Exchange Membrane (PEM)

- Solid Oxide Electrolysis Cell (SOEC)

- Others

By Capacity

- Small Scale

- Medium Scale

- Large Scale

By Application

- Fertilizer

- Power Generation

- Transportation

- Hydrogen Carrier

- Others

By End-Use

- Agriculture

- Energy & Power

- Maritime & Shipping

- Chemical & Pharmaceutical

- Others

By Region

- North America

- APAC

- Europe

- LAMEA