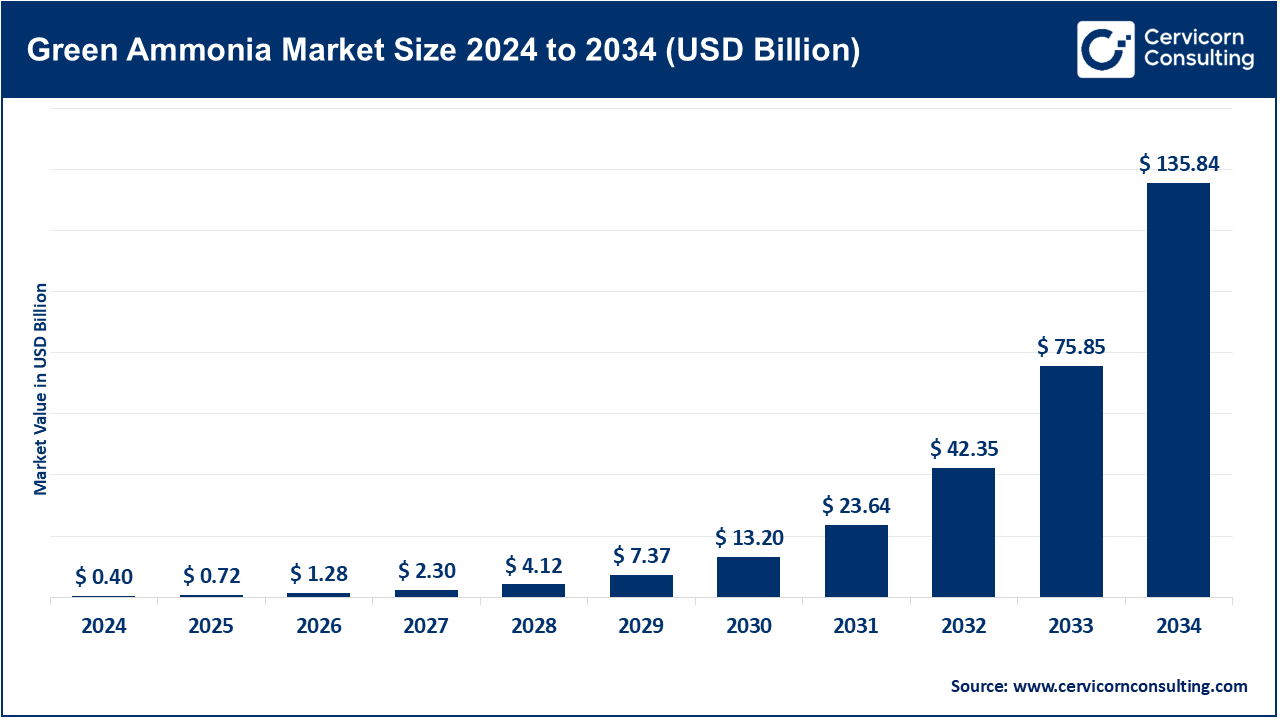

The global green ammonia market size was reached at USD 0.40 billion in 2024 and is expected to exceed around USD 135.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 79.1% over the forecast period from 2025 to 2034. The global green ammonia market is undergoing a swift transition at the epicentre of the clean-energy movement, compelled by a burning need to decarbonize industrial processes, revolutionize agriculture, and harness green ammonia as a sustainable fuel alternative. Green ammonia production takes nitrogen from the atmosphere and reacts it with green hydrogen, split via electrolysis powered by a solar, wind, or hydro energy source, coming under the banner of a carbon-neutral ammonia option. Simply put, unlike the traditional ammonia production, which relies heavily on natural gas and releases CO2 in large quantities, green ammonia offers a low-carbon alternative in pursuit of aggressive global climate goals.

Primary market drivers encompass environmental and climate concerns, ever-ridiculous regulations aimed at the cutting down of greenhouse gas emissions, and counterbalanced government incentives from all fronts of major global economies. Declining cost of renewable power and continuous enhancement of technology related to electrolysers and Haber-Bosch has brought green ammonia close to cost parity with the conventional fossil-based ammonia, consequently aiding in its wider adoption. The growing focus on sustainable agriculture is forcing growers and input suppliers to survey green ammonia as a lesser emission alternative in agriculture where ammonia is a cornerstone input for nitrogen-based fertilizer. Simultaneously, green ammonia is beginning to gain attention from the shipping and power-generation sectors as a clean fuel and energy storage. Being a hydrogen carrier that can store, and transport green hydrogen much more conveniently than pure hydrogen adds to its strategic value in global energy infrastructure. The industry is further looking to green ammonia for solutions in steelmaking, chemicals, and refining processes to help reduce the carbon footprint of several challenging hard-to-abate industries.

Large-scale investment opportunities exist in scaling-up capacity for electrolysers and integrating their production with abundant renewable energy, alongside the enlargement of ammonia distribution systems that could cater to the fuel and energy markets. The establishing of a green ammonia market can indeed work well in developing nations, with Asia-Pacific, Latin America, and the Middle East being especially fertile grounds due to strong policy support, abundant renewable resources, and growing industrial demand. Given that technological advancements would continue driving down costs, and international partnerships would nurture infrastructure development, the market outlook exhibits exponential growth. With a forecast for global ammonia demand to be twice as high by the year 2050, coupled with tighter decarbonization imperatives, green ammonia stands ready to shed off its niche-technology tag and step into the limelight as a mainstream sustainable-energy and agriculture ecosystem intervention.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 0.40 Billion |

| Expected Market Size in 2034 | USD 135.84 Billion |

| Projected Market CAGR 2025-2034 | 79.10% |

| Dominant Region | Asia-Pacific |

| Key Segments | Production Method, Technology, Capacity, Application, End-Use, Region |

| Key Companies | Siemens Energy, Yara International ASA, ENGIE, Air Products, ITM Power PLC, ThyssenKrupp AG, Iberdrola, MAN Energy Solutions, Nel Hydrogen |

Electrolysis-Based: Water electrolysis uses renewable electricity (solar, wind, etc.) to generate hydrogen and oxygen. This hydrogen is reacted with nitrogen obtained from air to form ammonia via the Haber-Bosch process. This method of manufacture is still so far, the most widely adopted, largest-scale green ammonia method, as it is entirely free of fossil fuels. It is regarded as a key technology in decarbonizing and turning ammonia production into a greener industry with less greenhouse emissions. With time, electrolyser cost and efficiency are bound to improve, along with the infrastructure for renewable energy; thus, this segment is projected to expand hugely in future years.

Green Ammonia Market Revenue Share, By Production Method, 2024 (%)

| Production Method | Revenue Share, 2024 (%) |

| Electrolysis-Based | 47.60% |

| Biomass Gasification | 35.10% |

| Others | 17.30% |

Biomass Gasification: Through biomass gasification, organic materials such as agricultural waste are partially oxidized to yield gas mixtures consisting of hydrogen, carbon monoxide, and methane. The hydrogen is then extracted and made to react with nitrogen to form green ammonia. This alternative methodology employs waste biomass as a renewable feedstock and thus offers a sustainable and carbon-neutral alternative to fossil fuels. Advantages are especially conceivable for biomass gasification in regions endowed with biomass resources. While it is still in the nascent stages of commercial implementation, there is a huge potential offered by this process in integrated bio-refineries focused on waste management and renewable energy generation to create a model of circular economy.

Other Renewable-Powered Haber-Bosch Processes: This sector coolly refers to those green ammonia productions that still rely on the conventional Haber-Bosch process but are powered using renewable energy. For instance, instead of natural gas use in these plants, you will have biogas or hydrogen produced from renewable sources. Essentially, it tries to retrofit or construct the Haber-Bosch-type plants by feeding a set of inputs with renewable electricity so that the process turns out to be carbon-free. That way, existing infrastructure can be decarbonized gradually. The systems might not reach the ultra-low emissions of their electrolysis-based counterparts, but they do present some viable options for industrial scale in the nearer term-the emphasis here being on regions with established ammonia production facilities seeking to upgrade to some form of sustainability.

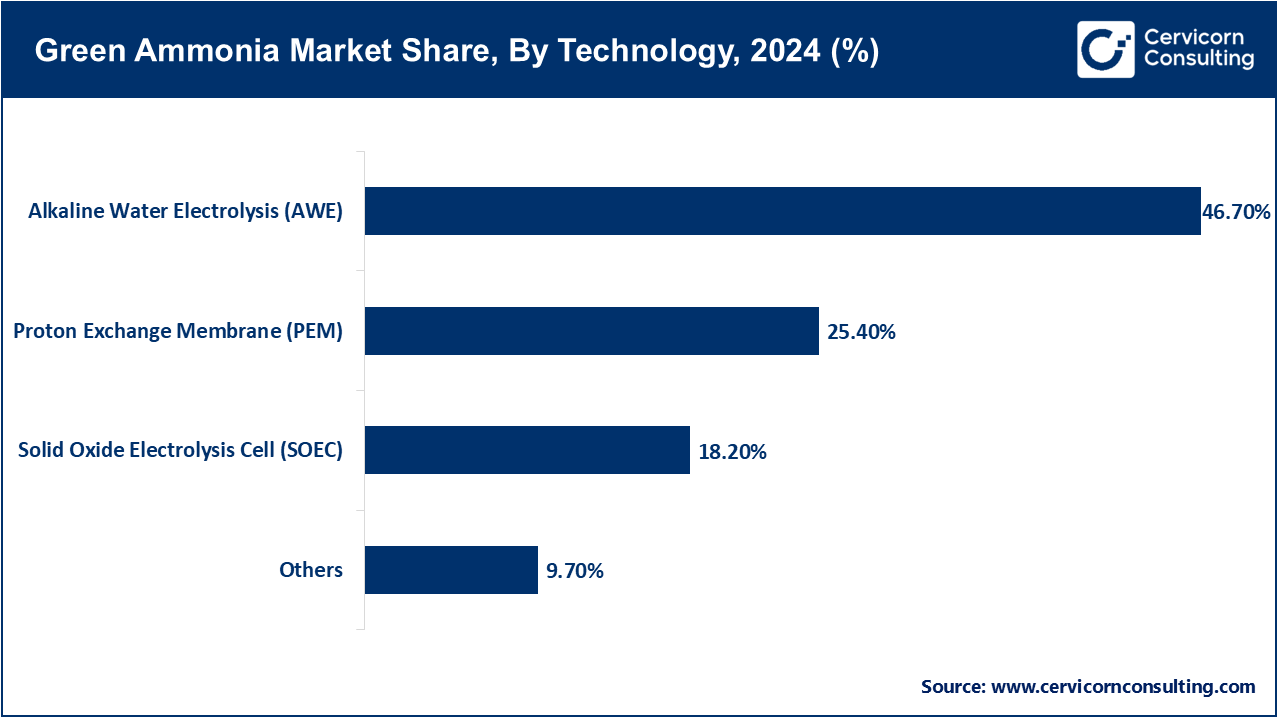

Alkaline Water Electrolysis (AWE): One of the oldest and most established methods of electrolysis is AWE. It uses alkaline electrolyte, which is usually potassium hydroxide, for the separation of water into hydrogen and oxygen. This type of electrolysis is cost-efficient, scalable, and good for large-scale green-ammonia production. Having a long operational history, it has very low capital costs and is preferred for industrial purposes. However, it has slower dynamic response compared to other newer techs, hence integration with variable renewable energy sources becomes a little bit difficult.

Proton Exchange Membrane (PEM): PEM means "Proton Exchange Membrane" electrolysis, and it is basically defined by the polymer electrolyte-ion membrane transport of protons from the anode to the cathode with gas separation. It allows the production of extremely pure hydrogen, while also designing very compact systems with a very fast response. It perfectly fits well with the integration requirements for renewable energy generation. While the PEM systems are costlier due mainly to precious metals used in their catalysts like platinum and iridium, their efficiency and operational flexibility have been perceived beneficial in the green ammonia production, particularly in projects that rely on fast start-up and high responsiveness.

Solid Oxide Electrolysis Cell (SOEC): The SOEC works at temperatures ranging from 600°C to 1000°C; therefore, it uses heat along with electricity to split water while improving overall energy efficiency. It produces hydrogen with better efficiencies than low-temperature electrolysis methods when waste heat or industrial heat sources are available. The SOEC is still under development, facing some issues such as materials' durability and high temperatures in operation; however, it poses a great chance to be used for future large-scale green ammonia production given its utmost efficiency.

Others: Emerging and hybrid electrolysis technologies, depending on the stage of their development, are either still in research or in early deployment. They might involve new membrane materials, a different electrolyte, or a system integrating electrolysis with renewables or storage facilities. Although somewhat less commercially relevant at present, such innovations intend to improve energy efficiency, reduce capital investment, and enhance flexibility from the perspective of a decentralized green ammonia production setup. These technologies are pursued mainly by startups and research institutes, thereby diversifying and evolving the market.

Fertilizer: Green ammonia focusing on agriculture can act as an awesome carbon fertilizer. It replaces the conventional ammonia-free carbon fertilizer generally derived from fossil fuels. Green ammonia produced with renewable energy by electrolyzing water fits into the global efforts to decarbonize agriculture. This, in turn, amends soils and increases crop production without potting greenhouse gases. This application sector has always been the major revenue generator due to the heavy demand for synthetic fertilizers worldwide and application of green pesticide and agriculture practices.

Power Generation: Green ammonia offers an efficient energy carrier and combustion fuel for power generation. It can be combusted or co-fired with coal in gas turbines to reduce carbon emissions. Due to enhanced storage and transport features relative to hydrogen, it becomes a viable alternative for renewable energy storage and grid balancing purposes. Countries that are going through clean-energy transition, specifically Japan and Australia, have been invested in the construction of ammonia-fired power plants, thus creating demands for this sector.

Green Ammonia Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Fertilizer | 33.40% |

| Power Generation | 17.10% |

| Transportation | 29.70% |

| Hydrogen Carrier | 10.20% |

| Others | 9.60% |

Transportation: Green-ammonia is becoming the new low-emission fuel in the transport industry, especially for maritime and heavy-duty vehicles. It has somewhat higher energy density than hydrogen and thus is easier to store and transport. To help decarbonize the globe, ammonia-fuelled engines and fuel cells are being designed for the operation of ships and trucks. With stretching emission regulations and the suggested alternative marine fuel path by IMO-in this segment, demand is picking up.

Hydrogen Carrier: Green ammonia is an efficient hydrogen carrier, providing the means for hydrogen storage and international transportation. Since it can be liquefied at relatively moderate pressures, it helps to foster subcontinental distances in hydrogen trade and reconversion to the gas phase via cracking. This facility is of utmost importance in setting up a global hydrogen trade infrastructure. Countries such as Japan and South Korea view ammonia imports as part of their hydrogen initiatives, promoting growth in this sector.

Others: Those major categories of applications include refrigeration, chemical synthesis, and energy storage. Green ammonia can act as an environmentally benign substitute for conventional ammonia in industrial processes. Also, it is being explored in research activities for seasonal energy storage and fuel cell applications. Even though they are considered niche applications, they do help develop the market because they diversify demand and foster innovation in sustainable energy and industrial solutions.

Agriculture: Agriculture primarily dictates the use of green ammonia due to its application as a nitrogenous fertilizer. Ammonia is used to produce urea and ammonium nitrate, which are essential fertilizers for crop growth. The usage of green ammonia renewable resources would largely reduce the carbon emissions normally associated with traditional fertilizer production. This demand for green fertilizers is directly aligned with the consumers' demand for sustainable farming methods and environmentally friendly inputs. Also, there have been numerous regional governments and regulatory bodies pushing for decarbonization in agriculture, thus further cementing the status of green ammonia. Due to the reliability and scalability of ammonia-based fertilizers, this segment is stable and represents a long-term demand driver.

Energy & Power: Green ammonia is emerging as a potential energy carrier and storage method in the energy & power sector. Its capability to store hydrogen in a stable, dense, and transportable manner has made it an attractive candidate for renewable energy storage and grid-level balancing. It could be burnt in power plants or reconverted into hydrogen for use in fuel cells. Japan, Australia, and other countries are trying to co-fire green ammonia in thermal power plants to decarbonize the electricity generation. This segment will prosper based on the advancements in ammonia combustion technology and the increased funding to carry the hydrogen infrastructure forward.

Green Ammonia Market Revenue Share, By End-Use, 2024 (%)

| End Use | Revenue Share, 2024 (%) |

| Agriculture | 36.70% |

| Energy & Power | 26.40% |

| Maritime & Shipping | 16.30% |

| Chemical & Pharmaceutical | 12.10% |

| Others | 8.50% |

Maritime & Shipping: The maritime industry is adopting green ammonia as a sustainable fuel alternative to adhere to the IMO's (International Maritime Organization) goals set for emissions reduction. With a growing clamour in the shipping industry to reduce greenhouse gas emissions, green ammonia offers a zero-emission solution. It may be utilized in internal combustion engines or ammonia fuel cells for the long-haul type of ship. With the developing infrastructure for ammonia bunkering and ammonia-ready engines, tremendous growth is expected in this segment. Large players along with port authorities across the globe are engaged in the pilot testing of ammonia fuelled ships, which are suggestive of large-scale application in the future.

Chemical & Pharmaceutical: The green ammonia remains a sustainable feedstock in the chemical and pharmaceutical industries for the manufacture of nitric acid, amines, and other derivatives necessary for making medicines, plastics, dyes, and synthetic fibres. These industries are increasingly being charged to decarbonize their supply chains upstream. Thus, replacing the conventionally manufactured ammonia with green alternatives helps cut down Scope 3 emissions and helps meet ESG objectives. Although the volume in this segment is not as high currently as in agriculture and energy, its value addition and increasing sustainability commitment are creating space for tremendous potential.

Others: This category covers the niche applications of refrigeration, mining explosives, and wastewater treatment. Ammonia being an energy-efficient and less environmentally damaging refrigerant has had a long history. With green ammonia, the eco-friendly status has been added, making it even greener. The other uses of green ammonia in the mining industry include making explosives like ammonium nitrate fuel oil (ANFO), albeit with a lower environmental impact. Wastewater treatment plants use green ammonia as a nutrient source and pH control, supporting its sustainability role. Though a minor share, this demand provides important diversification.

The green ammonia market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

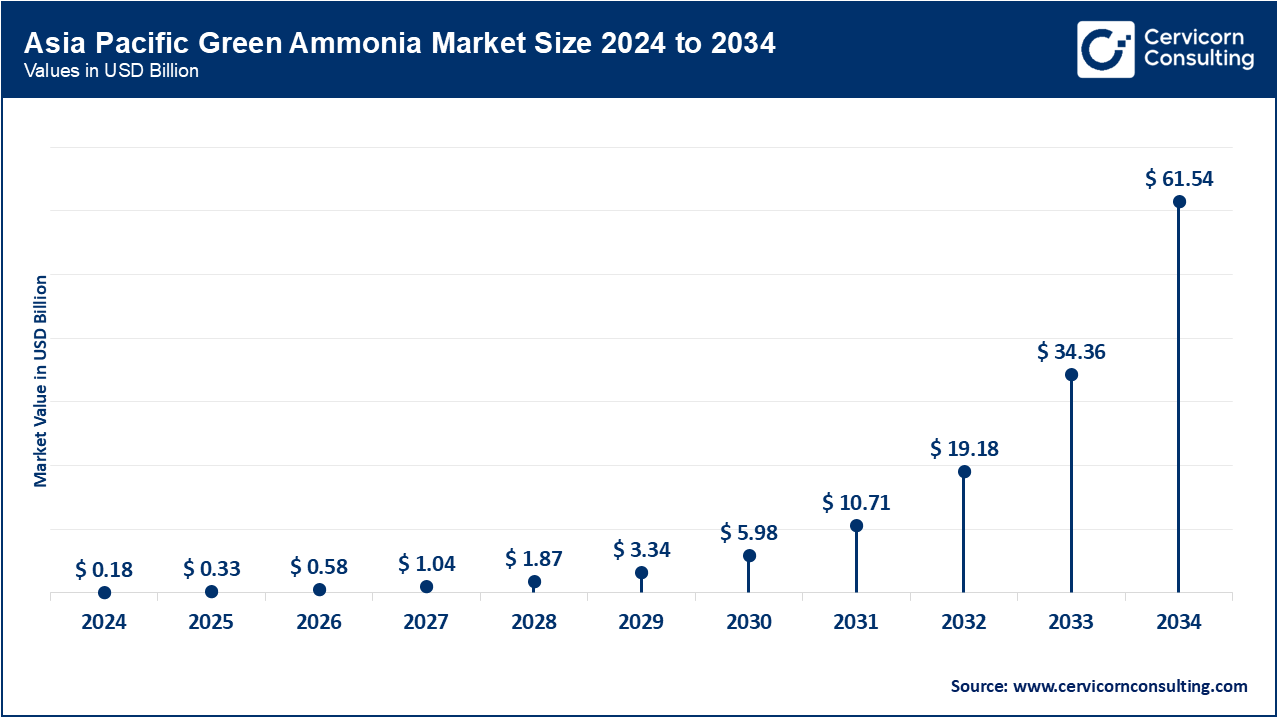

The Asia-Pacific region dominates the global green ammonia market, owing to its large industrial base, increasing renewable capacity, and robust government policies supporting decarbonization initiatives. Countries such as China, Japan, South Korea, India, and Australia are at the forefront of greener ammonia-making and usage. Japan and South Korea are investing massively in hydrogen technologies, considering ammonia as a carrier of hydrogen. Australia has been placed at the centre stage of green ammonia production with reference to its enormous renewable resources and export-oriented capability. The increasing interest in fulfilling sustainable agricultural needs and green shipping fuel requirements also strengthens the green ammonia market in the region. Strategic alliances between regional and international energy companies promote innovation and scaling-up of projects. With countries committed to net-zero targets alongside decreases in fossil fuel reliance, green ammonia offers an auspicious alternative especially for power generation and industrial applications. Additionally, favourable regulatory regimes and consolidating infrastructure support help give momentum to the region.

The North America stands on steady and promising growth, chiefly supported by the increasing drive toward sustainable agriculture, renewable energy goals, and decarbonization of transportation and industrial sectors. The U.S. and Canada steer regional collaborators, launching several pilot projects to employ green ammonia in preparing fertilizer, fuel, and hydrogen storage mechanisms. Therewith, fresh investments into clean energy technology and a set of policies for market development such as tax credits and grants find their way into the regional vocabulary. Moreover, in this operational theatre, where nature is generous with renewable resources, mostly solar and wind, cheaper prices to produce green ammonia through electrolysis can be fixed. On top of this, energy companies collaborate with research institutions to speed up technology development and commercialization. Focus accelerated on the need to slash emissions from Agri- and maritime sectors then provide further support for market expansion.

Europe is the main continent in the market, driven by climate policies, an innovation economy, and pioneer within green hydrogen. The EU or European Union Green Deal and Hydrogen Strategy put in motion the funding and infrastructural development for green ammonia. Given the necessity of combating climate change, Germany, the Netherlands, Norway, and Denmark are setting up projects for large-scale electrolysis and ammonia synthesis. In addition to being a clean fertilizer, green ammonia is considered the solution for energy storage, hydrogen transport, and decarbonizing maritime shipping in Europe. The region enjoys one of the most developed regulatory frameworks for green initiatives, coupled with a strong political will to combat greenhouse gas emissions; these ingredients have gone in Favor of the adoption of green ammonia. Furthermore, import collaboratives with the Middle East and African countries for green ammonia supplements Europe's strategic approach toward energy security and sustainability.

Green Ammonia Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 27.20% |

| Europe | 20.40% |

| Asia-Pacific | 45.30% |

| LAMEA | 7.10% |

The LAMEA region is slowly but surely setting its faces in the market with some countries letting loose on their renewable energy potential in entering the space. In Latin America, Chile and Brazil stand in front of the green hydrogen and ammonia projects, having major solar and wind resources. Chile's national green hydrogen strategy aims to advertise it as a chief exporter of green ammonia. From the Middle East, the Saudi Kingdom and UAE invest huge sums into giga projects like NEOM in diversification of their economies for the exports of green energy. Meanwhile, Africa, especially North Africa, is slowly drawing the spotlight for having cheap green ammonia production potentials for local consumption and export into Europe. While the infrastructure and regulatory framework is still being set up all over the region, international partnerships and investments have been on the rise. Its strategic location and energy potential are, therefore, contributing significantly toward considering the area as an important segment for the future green ammonia supply chain on a global level.

Market Segmentation

By Production Method

By Technology

By Capacity

By Application

By End-Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Green Ammonia

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Production Method Overview

2.2.2 By Technology Overview

2.2.3 By Capacity Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand for Sustainable Fertilizers

4.1.1.2 Green Hydrogen Synergy

4.1.1.3 Renewable Energy Cost Reductions

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Limited Renewable Energy Availability

4.1.2.3 Technological and Scalability Challenges

4.1.3 Market Challenges

4.1.3.1 Infrastructure and Storage Challenges

4.1.3.2 Policy and Regulatory Hurdles

4.1.3.3 Market Demand Uncertainty

4.1.4 Market Opportunities

4.1.4.1 Decarbonization of Hard-to-Abate Sectors

4.1.4.2 Hydrogen Economy Enabler

4.1.4.3 Government Policies & Incentives

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Green Ammonia Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Green Ammonia Market, By Production Method

6.1 Global Green Ammonia Market Snapshot, By Production Method

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Electrolysis-Based

6.1.1.2 Biomass Gasification

6.1.1.3 Other Renewable-Powered Haber-Bosch Processes

Chapter 7. Green Ammonia Market, By Technology

7.1 Global Green Ammonia Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Alkaline Water Electrolysis (AWE)

7.1.1.2 Proton Exchange Membrane (PEM)

7.1.1.3 Solid Oxide Electrolysis Cell (SOEC)

7.1.1.4 Others

Chapter 8. Green Ammonia Market, By Capacity

8.1 Global Green Ammonia Market Snapshot, By Capacity

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Small Scale

8.1.1.2 Medium Scale

8.1.1.3 Large Scale

Chapter 9. Green Ammonia Market, By Application

9.1 Global Green Ammonia Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Fertilizer

9.1.1.2 Power Generation

9.1.1.3 Transportation

9.1.1.4 Hydrogen Carrier

9.1.1.5 Others

Chapter 10. Green Ammonia Market, By End-User

10.1 Global Green Ammonia Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Agriculture

10.1.1.2 Energy & Power

10.1.1.3 Maritime & Shipping

10.1.1.4 Chemical & Pharmaceutical

10.1.1.5 Others

Chapter 11. Green Ammonia Market, By Region

11.1 Overview

11.2 Green Ammonia Market Revenue Share, By Region 2024 (%)

11.3 Global Green Ammonia Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Green Ammonia Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Green Ammonia Market, By Country

11.5.4 UK

11.5.4.1 UK Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Green Ammonia Market, By Country

11.6.4 China

11.6.4.1 China Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Green Ammonia Market, By Country

11.7.4 GCC

11.7.4.1 GCC Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Green Ammonia Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Siemens Energy

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Yara International ASA

13.3 ENGIE

13.4 Air Products

13.5 ITM Power PLC

13.6 ThyssenKrupp AG

13.7 Iberdrola

13.8 MAN Energy Solutions

13.9 Nel Hydrogen