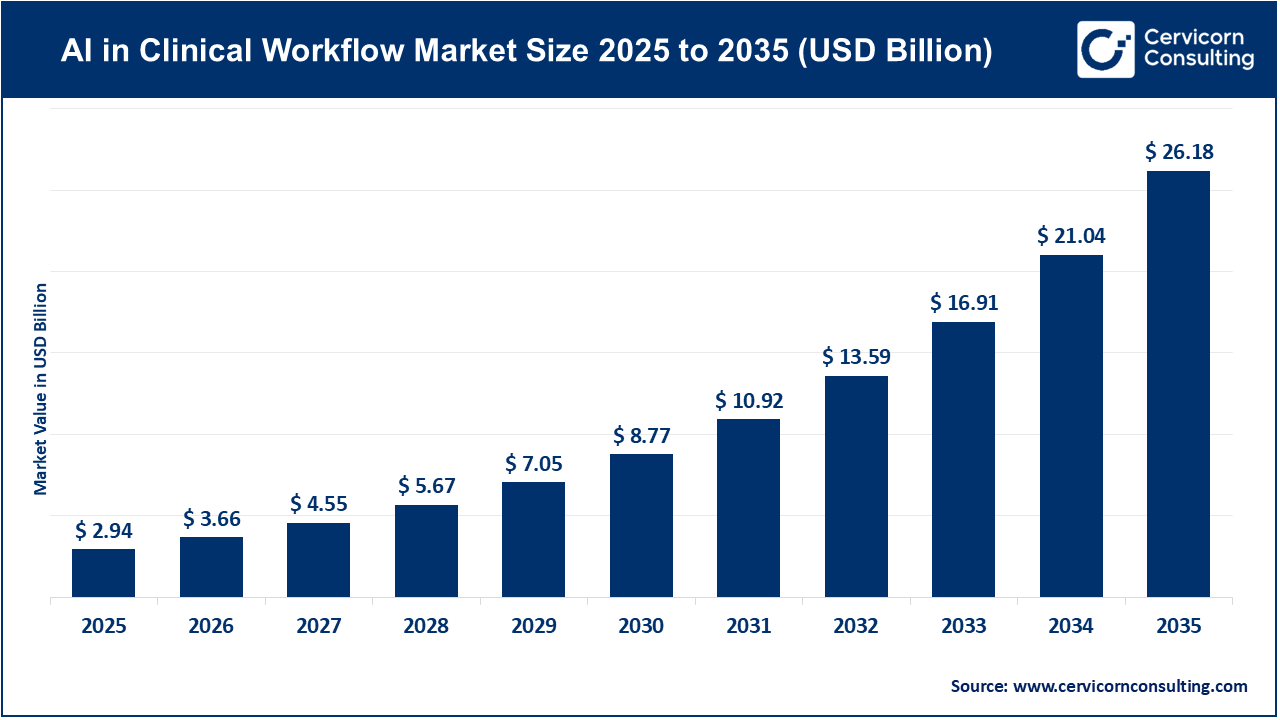

The global AI in clinical workflow market size was valued at USD 2.94 billion in 2025 and is expected to be worth around USD 26.18 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 24.5% over the forecast period 2026 to 2035. The rising emphasis over offering patient centric services with early and advanced solutions brings potential to the expansion of AI in clinical workflow market.

While artificial intelligence is on track to transform workflows in every sector, the revolution is innovating the entire healthcare market. AI is changing healthcare from reacting to illness to predicting problems early by spotting risk patterns that humans often miss. This allows hospitals to step in sooner, preventing complications, lowering ICU admissions, reducing treatment costs, and saving lives. At the same time, AI is helping reduce doctor burnout because paperwork and admin tasks take up nearly 30–40% of a clinician’s time. By automating these routine tasks, AI gives doctors more time to care for patients, creating one of the most important improvements in how modern healthcare actually works.

1. Patient Intake & Triage

AI-powered chatbots and virtual assistants gather patient symptoms, medical history, and insurance details before clinical visits, reducing front-desk dependency. These systems shorten waiting times, accurately prioritize high-risk cases, and optimize appointment scheduling based on urgency and resource availability.

2. Clinical Documentation & EHR Automation

Natural language processing (NLP) tools automatically convert clinician–patient conversations into structured, compliant clinical documentation within EHR systems. This reduces documentation time by up to 50–70%, lowers physician burnout, and improves data accuracy for audits and regulatory reporting.

3. Diagnostic Support

AI algorithms analyze medical imaging, pathology slides, and laboratory data to identify abnormalities with high precision and consistency. This enables earlier detection of cancers, cardiac, and neurological conditions while supporting clinicians with evidence-based insights rather than replacing clinical judgment.

4. Treatment Planning & Clinical Decision Support

AI-driven decision support systems compare individual patient data against clinical guidelines and millions of historical cases. These platforms deliver personalized treatment recommendations, flag potential drug interactions, and guide clinicians toward standardized, evidence-based care pathways.

Growing Global Shortage of Healthcare Professionals

Data Privacy and Security Concerns

Government Initiatives Supporting Healthcare AI Adoption

Expert panel at Cervicorn Consulting believes that AI adoption will move beyond task automation toward deeply integrated, real-time intelligence that supports predictive care, personalized treatment pathways, and population health management. Healthcare providers will increasingly prioritize AI solutions that are explainable, interoperable, and compliant by design, as trust and regulatory alignment become just as critical as performance.

We also expect accelerated convergence between AI, electronic health records, connected medical devices, and value-based care models, enabling healthcare organizations to deliver better outcomes at lower costs. As investment and policy support continue to grow, AI-driven clinical workflows will become a standard operating layer across hospitals, clinics, and virtual care platforms, reshaping how care is delivered at scale.

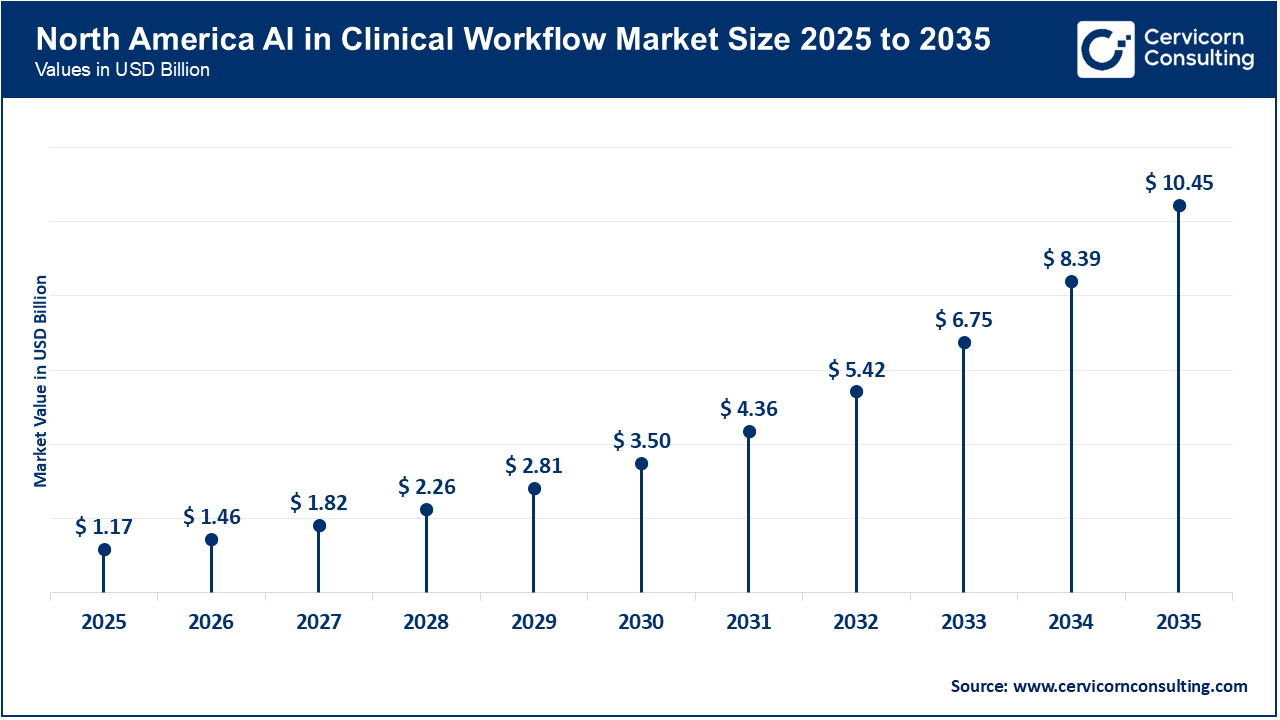

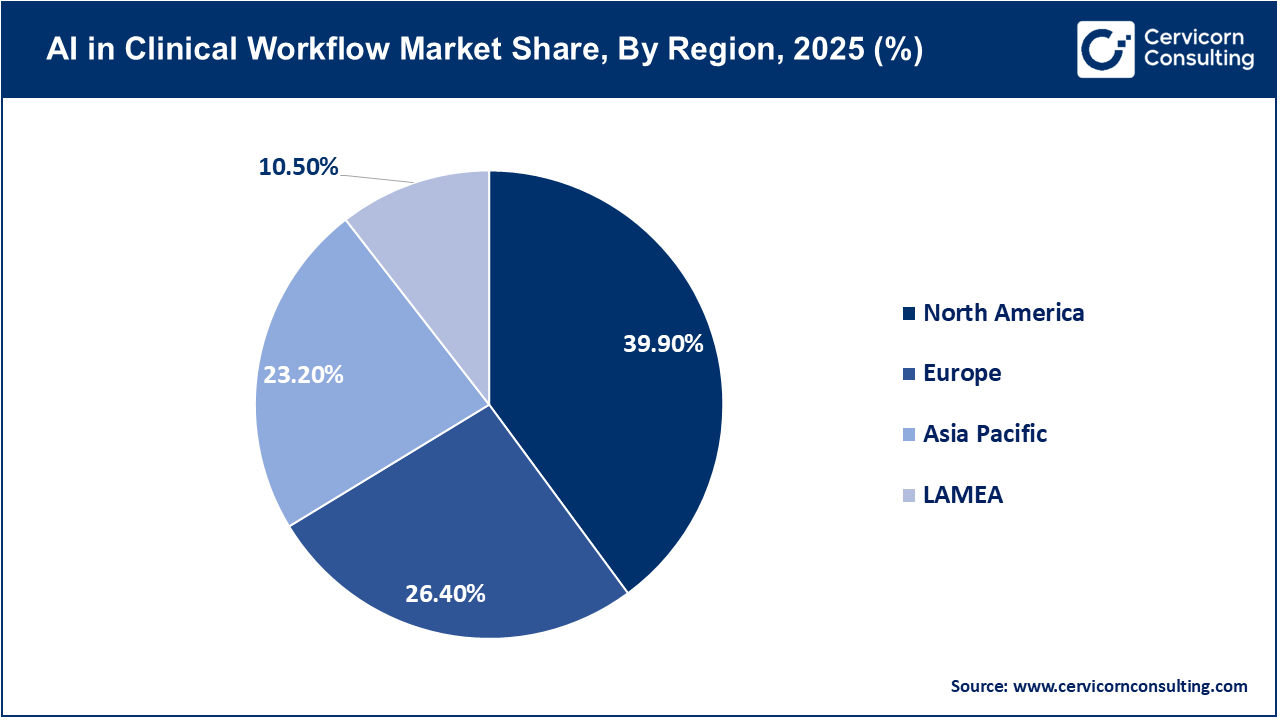

The North America AI in clinical workflow market size was eztimated at USD 1.17 billion in 2025 and is projected to hit around USD 10.45 billion by 2035. North America continues to lead the global market due to its deeply digitized healthcare ecosystem and early integration of advanced health IT infrastructure. The region accounts for nearly 40% of global AI-enabled clinical workflow adoption, supported by widespread EHR penetration exceeding 95% among hospitals and strong interoperability standards. Healthcare systems across the U.S. and Canada are increasingly deploying AI to automate documentation, optimize patient flow, and enhance clinical decision-making, with over 70% of large hospital networks reporting active use of AI-based workflow tools. Continued federal support for health IT modernization, combined with persistent clinician burnout challenges, is expected to sustain long-term demand for AI-driven efficiency solutions across inpatient and outpatient care settings.

United States’ Leadership in the Market

The United States’ growth in the market is driven by large-scale healthcare spending, strong public-sector digital health initiatives, and rapid commercialization of clinical AI technologies. More than 60% of U.S. hospitals currently use AI-enabled tools for clinical documentation, diagnostic prioritization, or operational decision support, while adoption among large academic medical centers exceeds 75%. AI integration has demonstrated tangible outcomes, including 20–30% reductions in documentation time, up to 25% improvements in diagnostic turnaround, and 15–20% declines in avoidable readmissions through predictive care models.

The Asia-Pacific AI in clinical workflow market size was reached at USD 0.68 billion in 2025 and is anticipated to surpass around USD 6.07 billion by 2035. Asia Pacific is projected to register the fastest growth in the market over the next decade, outpacing all other regions due to a powerful combination of rapid digital transformation, rising healthcare demand, and strategic national investments. The region’s healthcare AI adoption is being catalyzed by accelerating digital infrastructure, with internet and smartphone penetration exceeding 70%, enabling AI-powered clinical tools to reach both urban hospitals and rural clinics. Healthcare systems in countries such as China, India, Japan, and South Korea are increasingly deploying AI for diagnostics, predictive analytics, and workflow automation as a response to workforce shortages and high patient volumes, creating scale effects unmatched in other regions.

China to Dominate the Asian Industry for AI in Clinical Workflow by 2050, Know How?

China is positioned as a major contributor to the industry, driven by aggressive regulatory approvals, large-scale clinical validation, and deep integration of AI across hospital and telemedicine ecosystems. Unlike many markets where AI adoption remains fragmented, China is deploying AI at system level, embedding it into diagnostics, triage, physician decision support, and longitudinal patient management. This scale-first approach, combined with strong state backing and domestic innovation, is accelerating clinical acceptance and workflow transformation across public and private healthcare institutions.

Medical imaging remains the cornerstone of AI healthcare deployment in China, accounting for approximately 67% of the 59 Class III AI-based medical devices approved by the National Medical Products Administration (NMPA). These high-risk, high-impact approvals signal regulatory confidence in AI for core diagnostic workflows rather than peripheral use cases. Platforms such as Tencent Miying have demonstrated real-world clinical performance, achieving around 90% accuracy in early esophageal cancer screening across validations conducted in over 100 large hospitals, reinforcing AI’s role in improving early detection and clinician productivity at scale.

Major Factors Driving India’s Growth in AI in Clinical Workflow Market

| Company | Recent Development | Key Offering |

| Microsoft | In 2025, launched Dragon Copilot, an advanced ambient AI tool to automate clinical documentation. | AI medical dictation, workflow automation, clinical decision support, and cloud-based healthcare AI through Azure. |

| Epic System Corporation | In 2024, introduced generative AI capabilities into its EHR ecosystem to automate note creation and improve clinician productivity. | AI-integrated EHR solutions, predictive analytics, clinical decision support, care coordination, and workflow management. |

| Oracle Health | In 2024, introduced generative AI capabilities into its EHR ecosystem to automate note creation and improve clinician productivity. | Clinical documentation automation, population health tools, and healthcare data analytics. |

| GE Healthcare | In 2024, launched advanced AI-based imaging and workflow orchestration tools to improve diagnostic accuracy and operational efficiency. | Diagnostic support, workflow automation, remote monitoring, and clinical analytics. |

| Abridge AI | In 2025, Expanded its AI clinical documentation platform following major funding to scale real-time medical conversation analysis. | Speech-to-text automation, and EHR integration for physician documentation. |

| Truveta | In 2023, launched a proprietary healthcare language model to structure and analyze large-scale real-world clinical data. | AI-driven data harmonization, population health insights, and research-focused healthcare platforms. |

Software segment dominated the AI in clinical workflow market as of 2025, serving as the primary vehicle through which clinical AI capabilities are deployed. These platforms encompass AI-enabled clinical decision support systems, natural language processing for documentation, automated coding and billing engines, and integrated diagnostic interfaces. Their dominance is fueled by healthcare organizations’ preference for modular, scalable software that can integrate with existing electronic health records and hospital information systems.

The services segment is expected to grow at the fastest rate during the forecast period. Services including consulting, implementation, customization, support, and managed services, represent the fastest growing offering segment in the AI clinical workflow market. As healthcare systems adopt increasingly complex AI technologies, they require specialist expertise to tailor solutions to local workflows, ensure interoperability, and maintain regulatory compliance. Service providers play a crucial role in bridging the gap between technical innovation and clinical utility, helping organizations to integrate AI into live environments with minimal disruption.

“How did Machine Learning Hold the Largest Share of AI in Clinical Workflow Market?”

The machine learning stands as the dominant AI technology in clinical workflow applications in 2025, underpinning most diagnostic, predictive, and decision-support tools deployed in hospitals and clinics. Machine learning’s strength lies in its ability to analyze large volumes of structured and unstructured clinical data, from lab results and imaging to patient histories and to extract patterns that inform more accurate diagnoses, risk stratification, and treatment planning. Given its proven performance, scalability, and versatility, it has become the default technology for core clinical AI use cases, from predictive patient deterioration models to automated anomaly detection in imaging and clinical records.

Natural language processing is the fastest growing technology segment within AI clinical workflows, driven by surging demand to extract meaningful insights from narrative clinical documentation. As clinicians generate vast volumes of unstructured text including progress notes, discharge summaries, and patient communications, NLP enables automated transcription, contextual interpretation, and real-time summarization.

“The Diagnostics Segment Dominated the AI in Clinical Workflow Market in 2025”

Diagnostics maintain its position as the dominant use case within AI clinical workflow sector in 2025. AI-powered diagnostic tools, particularly in imaging, pathology, and risk prediction have demonstrated consistent performance improvements, helping providers detect conditions earlier and with greater precision. These tools augment clinician judgment, streamline interpretation workflows, and reduce turnaround times for diagnostic reports.

In-visit clinical recording segment is fastest growing as AI solutions increasingly focus on real-time capture and interpretation of patient encounters. Advanced speech recognition, contextual understanding, and automated note generation reduce clinicians’ clerical burdens and improve documentation accuracy. Real-time capture liberates physicians from manual charting, enabling more meaningful patient engagement and optimizing clinician time.

“The Hospitals Segment Led the Market with the Largest Share in 2025”

Hospitals segment represented the largest end user segment in the AI in clinical workflow market, driven by their significant patient volumes, complex care pathways, and extensive documentation requirements. Large hospital systems have the infrastructure, budgets, and clinical diversity that make them early and sustained adopters of AI tools that improve operational efficiency, reduce clinician burden, and enhance quality of care.

Telemedicine and virtual care providers is the fastest growing end user segment in the AI clinical workflow market, propelled by the rapid expansion of remote care adoption, hybrid care models, and digital patient engagement strategies. AI augments virtual platforms by enabling automated triage, symptom assessment, real-time consultation support, and patient follow-up automation. With the normalization of virtual care, telemedicine platforms leverage AI to enhance clinician productivity, improve patient satisfaction, and manage high-volume digital queues efficiently.

By Offering

By Technology

By Speciality

By Integration Type

By Function

By End User

By Region