Clinical Decision Support Systems Market Size and Growth 2025 to 2034

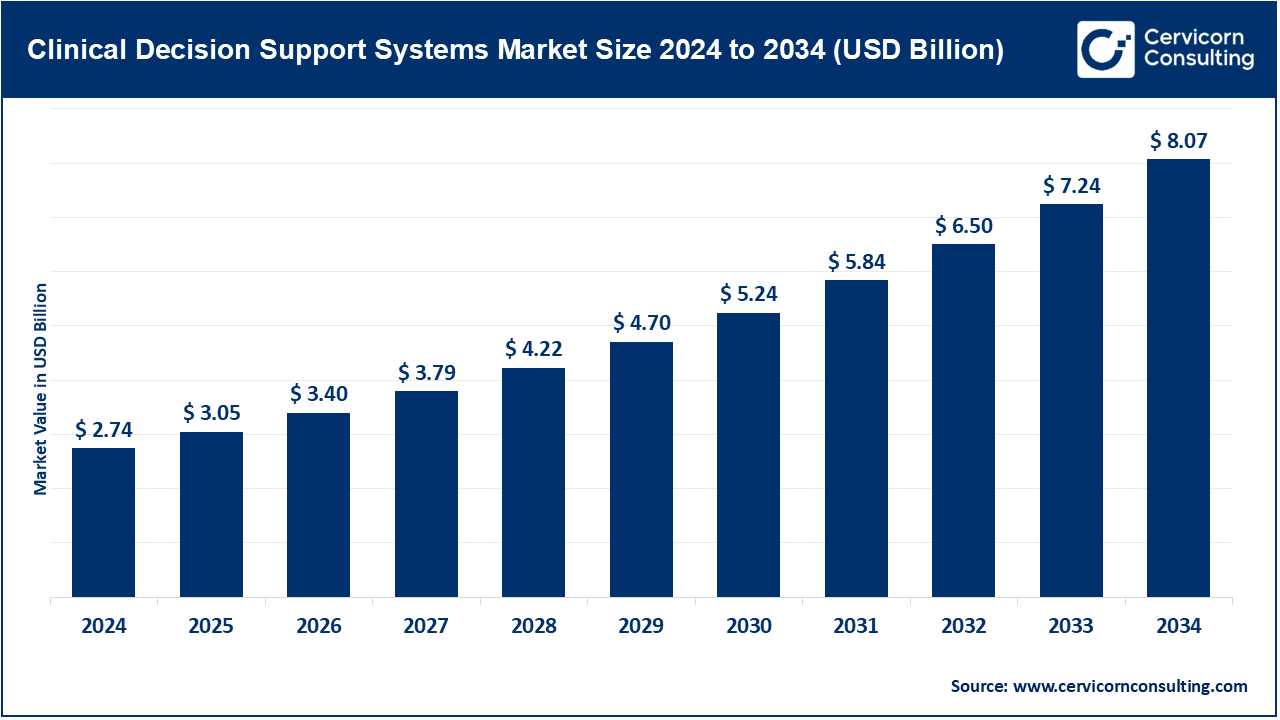

The global clinical decision support systems (CDSS) market size was valued at USD 2.74 billion in 2024 and is anticipated to reach around USD 8.07 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.41% over the forecast period from 2025 to 2034.

Integration of clinical decision support systems (CDSS) with electronic health records (EHR) and the overall healthcare information technology (IT) landscape is becoming increasingly important. With the adoption of electronic records by an increasing number of hospitals, clinics, and ambulatory care centers, there is a need for intelligent systems that deliver real-time alerts, clinical guidelines, and patient risk assessments at the point of care. This allows automatic access of patient histories, lab results, and medication records contained within EHRs by CDSS, enabling clinicians to equip them with evidence-based recommendations. These systems also generate alerts for possible drug interactions, allergy flags, and provide vital follow-up reminders. Nearly 90% of doctors' offices in the U.S. now use electronic health records (EHRs), and about 78% of these systems meet government certification standards. Across the country, 78% of healthcare institutions are actively exchanging patient data in real time through systems that meet the HL7 FHIR standard, allowing information to flow smoothly from one provider to another. As interoperability standards like FHIR, SNOMED, HL7 and others continue to evolve and gain adoption, enhanced unobtrusive integration improves clinical workflow efficiency, reduces administrative workload, lowers errors, and aligns with value-based care objectives.

What is clinical decision support systems?

The CDSS (Clinical Decision Support Systems) market is one of the fastest evolving segments in healthcare information technology as accurate data-driven clinical decision-making becomes more Executive. CDSS tools assist healthcare providers by giving real-time notification, diagnostic, treatment recommendations and guidelines based on best practice at the point of care. Rising incidences of chronic disease, increasing adoption of electronic health records (EHRs), and growth of artificial intelligence and machine learning are driving the market. With the global shift towards value-based care, patient safety, and digitization of healthcare, CDSS are critical to improving clinical efficiency and productivity, error reduction and enhanced patient outcomes.

Clinical Decision Support Systems Market Report Highlights

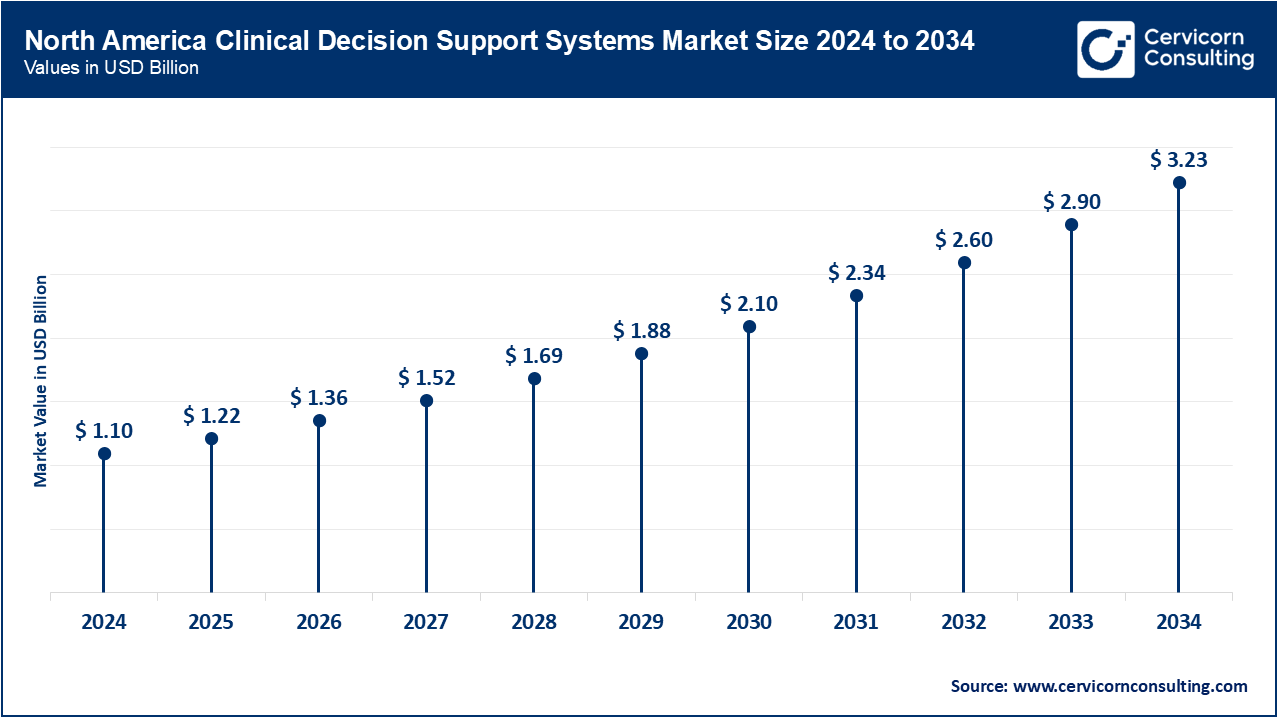

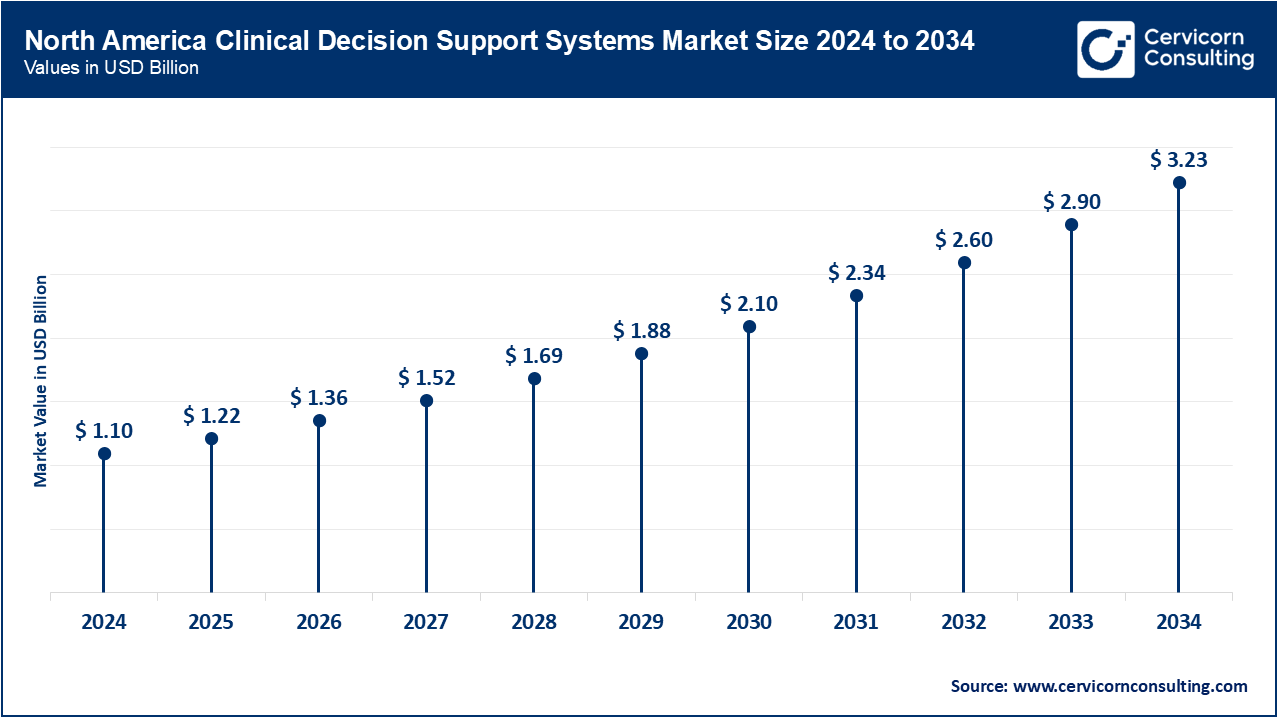

- By region, North America led the market with 40% revenue share. This is attributed to its advanced healthcare infrastructure, strong presence of key industry players, and supportive regulatory initiatives promoting health IT adoption.

- By Delivery Mode, the standalone CDSS remain the largest segment of the market, driven by their relative simplicity and autonomy.

- Non-knowledge-based, artificial-intelligence-and-machine-learning-powered CDSS is also entering the spotlight, with a 16% CAGR, largely because organizations seek data-driven insights that evolve in real time.

- By Component, software continues to dominate overall revenue and should grow at approximately 11% annually as regular updates and deeper AI integration remain priorities.

- Advanced applications including diagnostic support and precision medicine-to support fields such as oncology, cardiology, and chronic-disease management-are projected to expand at a CAGR of 13-14%.

- By Component, the service segment has generated revenue share of around 43.10% in 2024.

- By Deployment Mode, the on-premise segment has captured revenue share of 42.40% in 2024.

- By Technology, the knowledge-based CDSS segment held highest revenue share of 66% in 2024.

- By Application, the drug allergy alerts and drug–drug interaction alerts segment accounted for a revenue share of 36% in 2024.

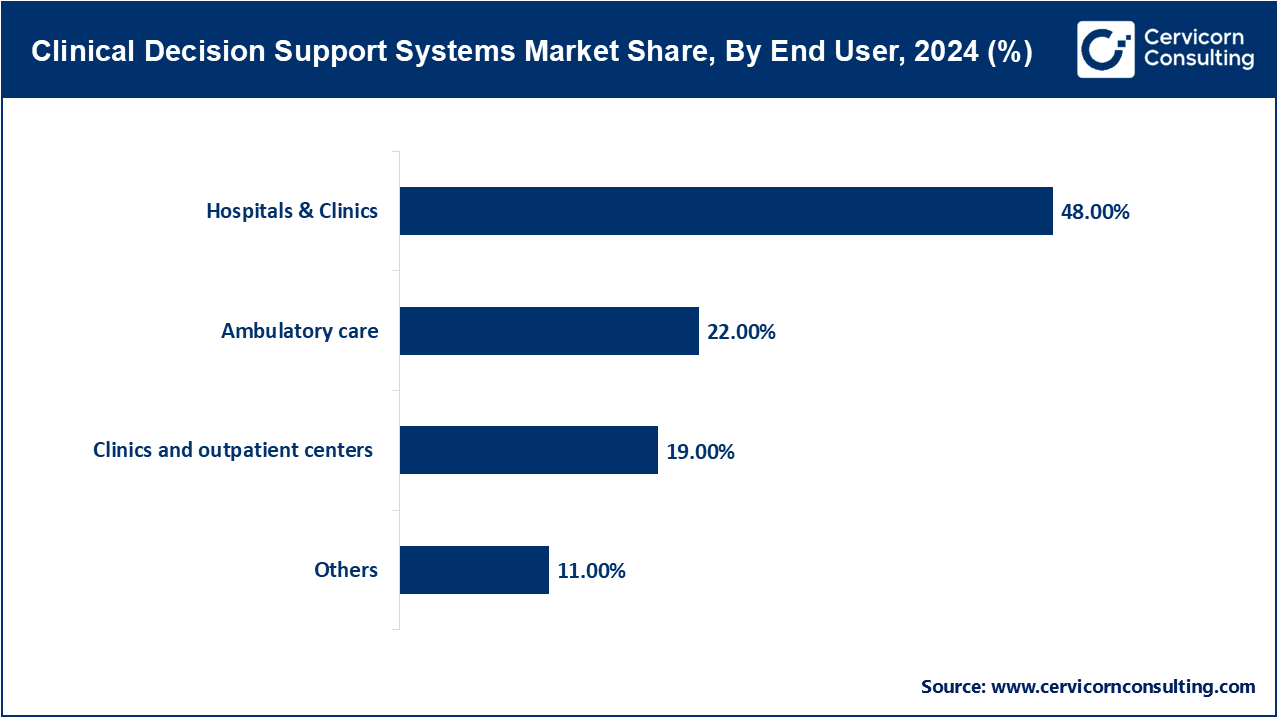

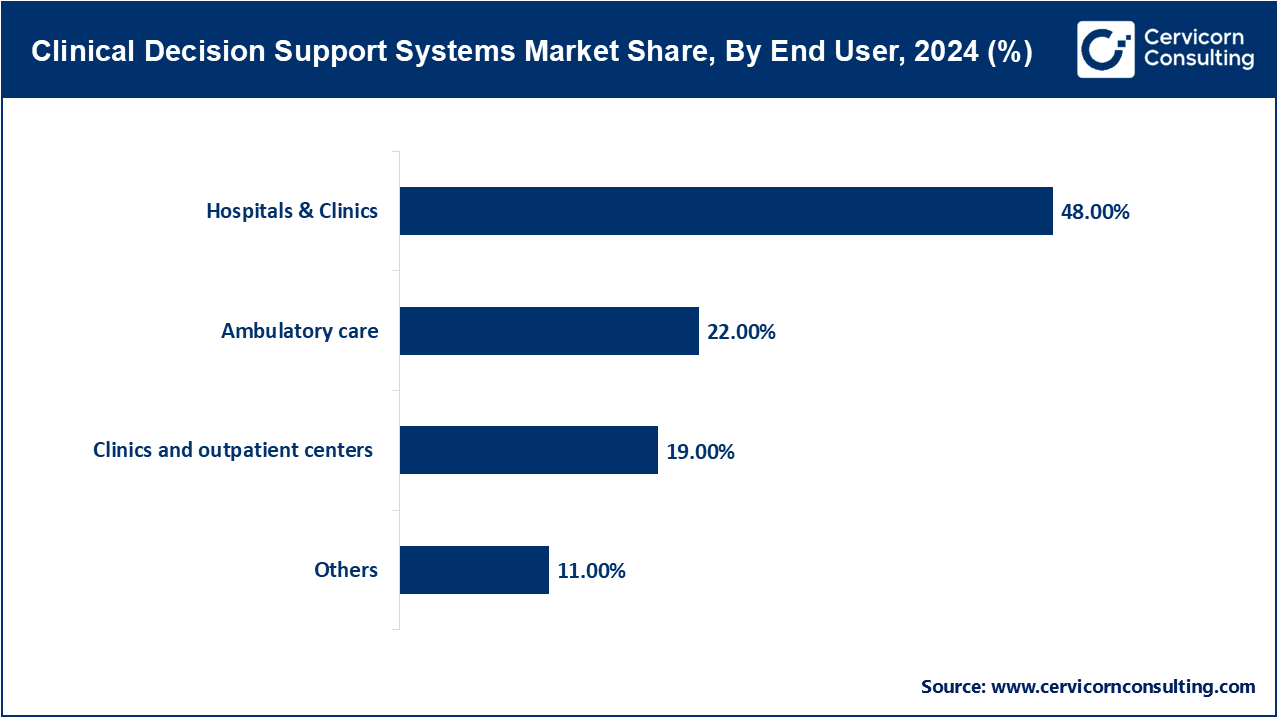

- By End User, the hospitals & clinics segment has garnered revenue share of 48% in 2024.

- By Type, the Therapeutic segment has leading the market with revenue share of 57% in 2024.

- By Level of Interactivity, the active CDSS segment dominated the market with 60% of the total revenue share in 2024.

Clinical Decision Support Systems Market Trends

- Cloud-based and interoperable CDSS platforms: Conventional on-site IT systems are being swiftly replaced, or at least supplemented, by cloud-based alternatives that offer large-scale flexibility, off-site accessibility, and streamlined links to core health technologies such as Electronic Health Records (EHRs), Computerized Physician Order Entry (CPOE), and patient-facing portals. Rising interest in telemedicine services, mobile health tools, and cross-provider care coordination now drives this shift. Leading vendors are channeling substantial resources into services that meet HL7 FHIR and SMART on FHIR interoperability standards, allowing data to flow in real time between diverse treatment locations. Such modernization enhances clinical choices made at the bedside and aligns with broader global digital health goals, especially across North America and Europe, where government and industry push for technology-led transformation grows stronger every year. In the U.S. alone, around 78% of healthcare organizations report active use of HL7 FHIR–compliant systems, enabling seamless real-time data exchange across providers.

- Integration of artificial intelligence (AI) and natural language processing (NLP): Artificial intelligence now enables healthcare platforms to rapidly process enormous volumes of both structured records and free-text sources, such as clinical notes, yielding predictive insights, flagging diseases at early stages, and personalizing treatment pathways. By 2024, AI technology in clinical decision support systems (CDSS) made significant gains. Over 72% of large U.S. hospitals now use at least one AI tool that suggests diagnoses or treatment plans. Of these hospitals, more than 60% use natural language processing (NLP) to pull insights from free-text notes, radiology reports, and other unstructured data. The next wave of AI-enhanced clinical decision-support systems is designed not only to alert providers but also to involve patients through chat interfaces, voice-guided virtual assistants, and wearable sensors linked to continuous monitoring. By creating these intelligent, responsive, and patient-facing tools, hospitals are beginning to rethink traditional care delivery models, shifting from episodic interventions to ongoing surveillance and early intervention. Taken together, these advances point toward a connected, proactive ecosystem in which data, analytics, and patient engagement converge, positioning modern CDSS as a cornerstone of precision medicine, population health, and value-based care.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 3.05 Billion |

| Projected Market Size in 2034 |

USD 8.07 Billion |

| Expected Market CAGR 2025 to 2034 |

11.41% |

| Key Region |

North America |

| Growing Region |

Asia-Pacific |

| Key Segments |

Component, Deployment Mode, Delivery Mode, Technology, Type, Level of Interactivity, Application, End User, Region |

| Key Companies |

IBM Watson Health, Cerner Corporation (Oracle Health), Siemens Healthineers, Philips Healthcare, Epic Systems Corporation, Wolters Kluwer Health, Elsevier (a RELX Group company), Allscripts Healthcare Solutions, GE HealthCare, MEDITECH (Medical Information Technology, Inc.), Zynx Health (part of Hearst Health), Change Healthcare, McKesson Corporation, eClinicalWorks, NextGen Healthcare |

Clinical Decision Support Systems Market Dynamics

Market Drivers

- Increasing Burden of Chronic Diseases: As more people live with long-standing illnesses such as diabetes, heart disease, cancer, and lung disorders, hospitals and clinics increasingly must find ways to diagnose patients faster, reduce mistakes, and organize treatment steps more efficiently. CDSS now sit at the center of those efforts. By offering rule-based suggestions, warning doctors when medications may clash, and tracking alignment with approved protocols, these tools aim to back clinicians rather than replace them. The net effect is greater patient safety, steadier quality of care, and quicker, better-informed judgments from medical staff. Over time, these gains translate into healthier patients and lower system costs. These systems produce clear benefits. Hospitals with well-implemented CDSS report medication errors drop by as much as 55%, and doctors stick to evidence-based treatment guidelines 20% to 30% more often. In oncology, AI-powered CDSS shave 15% to 25% off the time it takes to arrive at a cancer diagnosis.

- Global Push Toward Digitization and Government Initiatives Promoting Health IT Adoption: Across the globe, governments now roll out digital health plans that push hospitals and clinics toward working with electronic health records (EHRs) and clinical-decision-support software. U.S. Meaningful-Use rules, the European Unions Digital Health Action Plan, and Indias Ayushman Bharat Digital Mission have all sped up the switch to smarter IT tools in medical settings. Because each scheme pairs money, incentives, or strict deadlines with the use of EHRs, many providers feel the push-or the pull-to start seeing patient alerts and data prompts on their screens. With data pouring in from many sources, the most advanced CDSS have gone from being handy tools to critical components of patient care. They cut diagnostic delays by 30%, boost treatment adherence by 20% to 25%, and lower preventable harm by 15% to 20% in hospitals that were first to embrace the technology.

Market Restraints

- High Cost of Implementation and Integration: A major barrier to adopting clinical decision-support systems (CDSS) in many health-care settings is the steep financial outlay needed to put such tools into practice, and the challenge looms larger for low- and middle-income countries or for smaller facilities that operate on very tight budgets. Launching a CDSS project typically demands hard money for servers, cloud subscriptions, software licences, user-training, and routine upkeep. Smaller hospitals find that trying to connect new health record systems to old EHR systems can delay projects by six to twelve months. Custom links and data-sharing fixes then bump total costs up by 15 to 25%. In low- and middle-income countries, national budgets for digital health are often under five dollars a person. Those costs then become unaffordable. Fewer than one in five public hospitals can launch country-wide clinical decision support systems without money from grants or foreign funders. For these reasons many providers think twice about signing off on the up-front costs and risk the workflow slowdowns that often come during the switchover. The hesitation deepens in regions where digital infrastructure remains fragile and the promise of a clear return on investment still feels distant.

- Data Privacy, Security, and Compliance with Regulatory Standards: CDSS function effectively only when they can access comprehensive patient information such as electronic health records, laboratory results, and diagnostic images. Because these datasets contain revealing personal details, any unauthorized access or poor handling could trigger serious ethical dilemmas, costly litigation, and reputational damage for the institution. In the United States, HIPAA controls how patient data can be used. In Europe, GDPR imposes similar rules, and each region may add extra laws. Under HIPAA, fines for a single data breach can run from a hundred to fifty thousand dollars. Big leaks can total one point five million dollars a year. GDPR fines can hit twenty million euros or four percent of a company’s total revenue, whichever is higher. Despite this knowledge, numerous smaller clinics and regional hospitals struggle to fund or staff the sophisticated cybersecurity stack that such practices entail.

Market Opportunities

- Increasing Adoption of Personalized and Precision Medicine: The worldwide market for precision medicine topped 100 billion dollars in 2024 and is expected to grow by 16.15% each year through 2034. Clinical decision support systems are a central part of that growth. As healthcare moves toward personalized treatment, CDSS are set to become indispensable. By mining individual data-gene maps, past diagnoses, daily habits, and current sensor readings-the systems generate tailored diagnostic and therapy suggestions. Adding advanced statistics, artificial intelligence (AI), and machine learning (ML) sharpens risk scores, spots illnesses sooner, and crafts one-of-a-kind care plans. The result is better health for patients and closer alignment with the global shift toward value-based reimbursement. Because genome reading has become cheaper and more routine, CDSS with precision-medicine tools are now a baseline expectation in busy hospitals.

- Expansion of CDSS in Emerging Markets: Across much of Asia-Pacific, Latin America, and parts of the Middle East and Africa, health systems are quickly reinventing themselves. National authorities and providers are pouring resources into digital infrastructure, responding to rising patient volumes, stubborn chronic-disease burdens, and chronic staff shortages. Chronic conditions, such as diabetes—now affecting more than ten percent of adults in Latin America and twelve to fifteen percent of adults in the Gulf—are pushing care systems to the limit. Clinical decision support systems can scale quickly and cut costs, making it easier to deliver better care and more precise diagnoses without overloading hospitals. In that context, CDSS delivers a scalable, budget-friendly answer, creating obvious room for expansion in emerging markets.

Market Challenges

- Lack of standardization and interoperability between systems: CDSS achieve their greatest value when they sit quietly in the background of other digital tools, pulling real-time data from Electronic Health Records, Computerized Physician Order Entry systems, and Laboratory Information systems. Yet, in many hospitals and clinics, these point-of-care platforms come from competing vendors, each pushing its own technology stack. In Europe, countries can use the HL7 FHIR and SNOMED CT data-sharing frameworks, yet the actual take-up is uneven. The Netherlands and Estonia report 70 to 80% compliance, while several other countries are below 40%. The result is pockets of data that hospitals cannot share, fragmenting patient care and staff workflows. The resulting lack of common data formats and exchange protocols turns interoperability into a persistent headache, fracturing workflows, triggering irrelevant alerts, and making even simple tasks cumbersome. When alerts are late or wrong, doctors lose trust in the entire program, and the clinical safety net frays. Though standards such as HL7 FHIR and SNOMED CT appear promising, uneven adoption worldwide, especially in emerging markets, means that full consistency is still a distant goal.

- Healthcare professionals' reluctance and mistrust in automated tools: Many clinicians remain reluctant to give automated systems the final say in high-stakes clinical choices. Their hesitation stems from fears that leaning too much on technology might dull their own judgment or push them into decision fatigue when a flood of notifications lands. In many emerging economies the gap is widening: across parts of Asia-Pacific, less than 30% of hospitals rely on standard messaging formats. The result is slower alerts, needless repeat tests, and increased chances of misdiagnosis. Poorly calibrated clinical-decision-support tools that issue countless broad or cryptic alerts can deepen that fatigue, making users ignore even important advice. To build real confidence in a tool, its suggestions must be accurate, context-sensitive, and explained in plain language that a busy doctor can quickly grasp. Physicians are far more willing to adopt technology that shows its reasoning and meshes with what they already know. Still, bringing any new system on board requires heavy time from the team, as people learn, practice, and mold their routines around unfamiliar screens and prompts-a disruption nobody welcomes in an already packed clinic.

Clinical Decision Support System Market Segmental Analysis

Component Analysis

Software: The software subsegment continues progressive innovations in the health-tech industry. These applications deliver a mix of alerts, clinical reminders, evidence-based guidelines, diagnostic suggestions, and even predictive trend charts. When such functions are woven into Electronic Health Records (EHR), Computerized Physician Order Entry (CPOE), or similar IT stacks, they create a smooth workflow that supports real-time, data-driven decisions.

Services: The services segment encompasses all the hands-on work clients need-from initial setup and ongoing maintenance to staff training, expert consulting, and around-the-clock support-to ensure clinical-decision-support systems work reliably and keep delivering value over time. This segment constitutes an estimated 43.10% of the revenue in 2024 which, of the total market income, shows which professional services are very important in these systems functioning properly and in addition continues to improve in delivering value to the services offered.

Application Analysis

Drug Allergy and Drug–drug Interaction Alerts: Among the most routine uses of any CDSS are drug-allergy and drug-drug-interaction alerts. These features automatically scan a patient’s record and current medications, flagging potential adverse events before providers finalize a prescription. For instance, in a large hospital network, Epic CDSS have these alerts implemented and managed to decrease adverse drug events by 30% in the first year.

Diagnostic Support Systems: Another expanding application of clinical-decision support systems lies in diagnostic assistance, a trend now fueled by artificial intelligence and machine-learning methods. By sifting through patient symptoms, lab results, imaging studies, and relevant historical records, these algorithms produce candidate diagnoses or project how a given illness might advance.

Clinical Decision Support Systems Market Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Drug allergy alerts and drug–drug interaction alerts |

36% |

| Diagnostic Support Systems |

25% |

| Clinical Guidelines and Reminders |

29% |

| Others |

10% |

Clinical Guidelines and Reminders: CDSS also delivers real-time reminders rooted in established clinical guidelines, offering standardized recommendations at the moment care is delivered. By framing advice around the latest evidence, these alerts help ensure that clinicians follow uniform protocols and do not overlook routine tasks such as follow-up visits, vaccinations, or screening tests. Research shows reminders within the system can improve the following of clinical instructions by 20% to 40% resulting in better results for the patient and lower rates of hospital admissions.

Others: Another important application is population health management, where a clinical decision-support system (CDSS) leverages aggregate patient data to guide administrators and clinicians in prioritizing resources and tailoring interventions for whole cohorts. Alerts and recommendations aimed at preventive care further demonstrate the systems utility, pinpointing individuals whose risk profiles suggest that early action could forestall more serious illness.

End-user Analysis

Hospitals: Hospitals are still the biggest group of CDSS users, because their tangled workflows, constant admissions, and many specialties create a unique pressure only smart technology can ease. An integrated CDSS therefore acts like a nervous system, passing real-time insights between departments, cutting down on duplicated tests, and signalling when best-practice protocols are overlooked. Research has proven to show that hospitals that have integrated CDSS feature within their systems are said to suffer 30% lower errors in the medicare and up to 25% better compliance to the clinical guidelines.

Clinics and Outpatient Centers: Clinics and small outpatient centers eager to match the safety found in larger hospitals now adopt clinical-decision-support systems at a steady clip. Most of these venues choose cloud-based or stand-alone CDSS that helps both family doctors and visiting specialists anchor their choices in up-to-date evidence. As demonstrated in the study, the patient portals issued by Epic MyChart and Cerner’s HealtheLife have integrated within them the CDSS reminders and have proven to increase the compliance to medications and appointments with a 25% increase in the outpatient population.

Ambulatory Care Centers: Surgery and diagnostics units that host same-day cases increasingly lean on CDSS to smooth flow, cut procedure harm, and tighten handoffs among diverse staff. Because each visit is short yet intense, prompt alerts and proven counsel from the system serve as essential guardrails in the narrow windows just before and after fast-moving work.

Others: Diagnostic laboratories and teaching hospitals are other users that apply CDSS to train staff, conduct studies, and refine test interpretation, underscoring how adaptable these tools have become across the sector.

Clinical Decision Support Systems Market Regional Analysis

Why does North America hold the largest revenue share in the CDSS market?

- The North America CDSS market size was valued at USD 1.10 billion in 2024 and is expected to reach around USD 3.23 billion by 2034.

North America commands 40% of the world CDSS market. Early investment in health IT, well-developed EHRs, and supportive policy fuel growth. The USA alone generates over 80% of the region’s CDSS earnings. North America continues to command the largest segment of the global CDSS market, a position attributable to the regions early uptake of sophisticated health information technology, mature electronic-health-record (EHR) infrastructure, and sustained government incentives such as the HITECH Act and provisions embedded in the Affordable Care Act. Within this landscape, the United States remains the foremost leader, with CDSS tools now widely deployed in hospitals and outpatient clinics to curtail medical errors, elevate the quality of care, and streamline clinical workflows. Elevated national health expenditure, reimbursement schemes that favor digital solutions, and the proactive involvement of market powerhouses such as IBM, Oracle, and Microsoft jointly rein.

What factors are driving the rapid growth of Asia-Pacific in the CDSS market?

- The Asia-Pacific clinical decision support systems market size was estimated at USD 0.66 billion in 2024 and is projected to surpass around USD 1.94 billion by 2034.

The Asia-Pacific region is growing rapidly, driven by larger health budgets, a more affluent patient base, rising rates of chronic illness, and strong government endorsement of digital tools. Japan and South Korea, benefitting from dense hospital networks, have pushed CDSS adoption in main teaching hospitals beyond 60%. Yet smaller or rural centres lag, with uptake under 35% because the local IT systems still lack maturity. Widespread smartphone use and cloud-hosted applications further boost availability and expand the reach of clinical insight. Still, fragmented networks and differing levels of digital skill between urban hubs and rural towns pose ongoing hurdles for uniform national deployment.

Clinical Decision Support Systems Market Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

40% |

| Europe |

28% |

| Asia-Pacific |

24% |

| LAMEA |

8% |

Why is Europe the second-largest region in the CDSS market?

- The Europe clinical decision support systems market size was accounted for USD 0.77 billion in 2024 and is expected to record USD 2.26 billion by 2034.

Europe occupies the second-largest position, a growth trajectory fueled by accelerated health-care digitization, a strong patient-safety mandate, and enabling regulatory frameworks represented by the European Commissions Digital Health programmes. Germany, the United Kingdom, France, and the Netherlands emerge as vanguard countries, each launching public-financed initiatives aimed at seamless EHR-CDSS convergence across clinical settings. Europe's steadfast commitment to data protection, exemplified by stringent GDPR compliance, has in turn nurtured a culture of responsible and secure CDSS roll-out, cultivating the institutional trust essential for widespread adoption. Germany’s Krankenhauszukunftsgesetz promises EUR 4.3 billion for hospital IT, while the UK’s NHS aims for 95% digital maturity in hospitals by 2025. High internet access and the rise of telehealth together lift the region’s CDSS market by 7–9% each year.

What are the trends in the LAMEA CDSS market?

- The LAMEA CDSS market was valued at USD 0.22 billion in 2024 and is forecasted to hit around USD 0.65 billion by 2034.

In Latin America, the Middle East, and much of Africa, the CDSS market is still emerging, yet its uptake is steadily quickening as awareness spreads, healthcare modernization moves forward, and cross-border partnerships grow. The Latin America market growth is swift as countries step up healthcare modernization. Because these areas are still early in the implementation curve, they nonetheless promise considerable long-term value, given that both public agencies and private investors are pouring resources into digital upgrades and workforce training. Overall, while growth rates for CDSS solutions vary sharply from one region to another, the global trend remains positive, with mature markets aiming to refine proven platforms and newer economies opening fresh avenues for adoption.

Clinical Decision Support Systems Market Top Companies

Recent Developments

- March 2024: Researchers at Mount Sinai presented a study showing that GPT-4, when embedded into a clinical decision-support system, accurately forecasts patient admissions to emergency departments. By sifting through records from more than 864,000 visits, the model outperformed established machine-learning benchmarks such as Bio Clinical BERT and XGBoost, underscoring generative AI's utility in fast-paced triage and resource planning.

- March 2024: Zynx Health released Zynx for Primary Care, a decision-support suite purpose-built for outpatient practices. Tailored clinical pathways aim to ease documentation burden, enhance workflow continuity, and raise job satisfaction among providers by delivering context-sensitive guidance aligned with the demands of routine primary care.

- March 2024: During HIMSS 2024, Wolters Kluwer unveiled UpToDate Enterprise Edition, a consolidated platform that merges point-of-care content, workflow analytics, and patient-engagement tools into a single interface. The cornerstone of the release is AI Labs, a generative clinical AI engine that generates real-time, patient-specific insights, marking a significant advance toward seamlessly embedding AI-driven intelligence into daily care activities.

Market Segmentation

By Component

- Hardware

- Software

- Services

By Deployment Mode

- On-premise

- Cloud-based

- Web-based

By Delivery Mode

- Standalone

- Integrated (EHR, CPOE, etc.)

By Technology

- Knowledge-based CDSS

- Non-knowledge-based CDSS

By Type

By Level of Interactivity

By Application

- Drug allergy alerts and drug–drug interaction alerts

- Diagnostic Support Systems

- Clinical Guidelines and Reminders

- Others

By End User

- Hospitals & clinics

- Ambulatory care

- Clinics and outpatient centers

- Others

By Region

- North America

- APAC

- Europe

- LAMEA