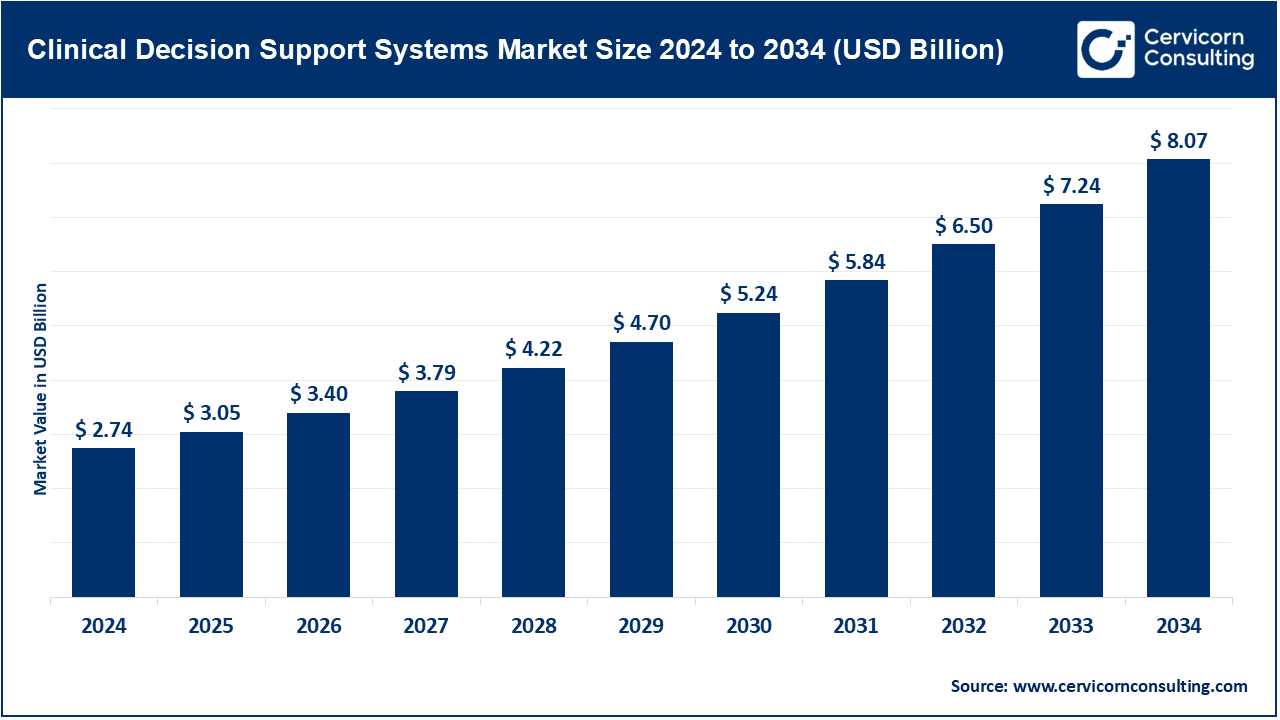

The global clinical decision support systems (CDSS) market size was valued at USD 2.74 billion in 2024 and is anticipated to reach around USD 8.07 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.41% over the forecast period from 2025 to 2034.

Integration of clinical decision support systems (CDSS) with electronic health records (EHR) and the overall healthcare information technology (IT) landscape is becoming increasingly important. With the adoption of electronic records by an increasing number of hospitals, clinics, and ambulatory care centers, there is a need for intelligent systems that deliver real-time alerts, clinical guidelines, and patient risk assessments at the point of care. This allows automatic access of patient histories, lab results, and medication records contained within EHRs by CDSS, enabling clinicians to equip them with evidence-based recommendations. These systems also generate alerts for possible drug interactions, allergy flags, and provide vital follow-up reminders. Nearly 90% of doctors' offices in the U.S. now use electronic health records (EHRs), and about 78% of these systems meet government certification standards. Across the country, 78% of healthcare institutions are actively exchanging patient data in real time through systems that meet the HL7 FHIR standard, allowing information to flow smoothly from one provider to another. As interoperability standards like FHIR, SNOMED, HL7 and others continue to evolve and gain adoption, enhanced unobtrusive integration improves clinical workflow efficiency, reduces administrative workload, lowers errors, and aligns with value-based care objectives.

What is clinical decision support systems?

The CDSS (Clinical Decision Support Systems) market is one of the fastest evolving segments in healthcare information technology as accurate data-driven clinical decision-making becomes more Executive. CDSS tools assist healthcare providers by giving real-time notification, diagnostic, treatment recommendations and guidelines based on best practice at the point of care. Rising incidences of chronic disease, increasing adoption of electronic health records (EHRs), and growth of artificial intelligence and machine learning are driving the market. With the global shift towards value-based care, patient safety, and digitization of healthcare, CDSS are critical to improving clinical efficiency and productivity, error reduction and enhanced patient outcomes.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 3.05 Billion |

| Projected Market Size in 2034 | USD 8.07 Billion |

| Expected Market CAGR 2025 to 2034 | 11.41% |

| Key Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Component, Deployment Mode, Delivery Mode, Technology, Type, Level of Interactivity, Application, End User, Region |

| Key Companies | IBM Watson Health, Cerner Corporation (Oracle Health), Siemens Healthineers, Philips Healthcare, Epic Systems Corporation, Wolters Kluwer Health, Elsevier (a RELX Group company), Allscripts Healthcare Solutions, GE HealthCare, MEDITECH (Medical Information Technology, Inc.), Zynx Health (part of Hearst Health), Change Healthcare, McKesson Corporation, eClinicalWorks, NextGen Healthcare |

Software: The software subsegment continues progressive innovations in the health-tech industry. These applications deliver a mix of alerts, clinical reminders, evidence-based guidelines, diagnostic suggestions, and even predictive trend charts. When such functions are woven into Electronic Health Records (EHR), Computerized Physician Order Entry (CPOE), or similar IT stacks, they create a smooth workflow that supports real-time, data-driven decisions.

Services: The services segment encompasses all the hands-on work clients need-from initial setup and ongoing maintenance to staff training, expert consulting, and around-the-clock support-to ensure clinical-decision-support systems work reliably and keep delivering value over time. This segment constitutes an estimated 43.10% of the revenue in 2024 which, of the total market income, shows which professional services are very important in these systems functioning properly and in addition continues to improve in delivering value to the services offered.

Drug Allergy and Drug–drug Interaction Alerts: Among the most routine uses of any CDSS are drug-allergy and drug-drug-interaction alerts. These features automatically scan a patient’s record and current medications, flagging potential adverse events before providers finalize a prescription. For instance, in a large hospital network, Epic CDSS have these alerts implemented and managed to decrease adverse drug events by 30% in the first year.

Diagnostic Support Systems: Another expanding application of clinical-decision support systems lies in diagnostic assistance, a trend now fueled by artificial intelligence and machine-learning methods. By sifting through patient symptoms, lab results, imaging studies, and relevant historical records, these algorithms produce candidate diagnoses or project how a given illness might advance.

Clinical Decision Support Systems Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Drug allergy alerts and drug–drug interaction alerts | 36% |

| Diagnostic Support Systems | 25% |

| Clinical Guidelines and Reminders | 29% |

| Others | 10% |

Clinical Guidelines and Reminders: CDSS also delivers real-time reminders rooted in established clinical guidelines, offering standardized recommendations at the moment care is delivered. By framing advice around the latest evidence, these alerts help ensure that clinicians follow uniform protocols and do not overlook routine tasks such as follow-up visits, vaccinations, or screening tests. Research shows reminders within the system can improve the following of clinical instructions by 20% to 40% resulting in better results for the patient and lower rates of hospital admissions.

Others: Another important application is population health management, where a clinical decision-support system (CDSS) leverages aggregate patient data to guide administrators and clinicians in prioritizing resources and tailoring interventions for whole cohorts. Alerts and recommendations aimed at preventive care further demonstrate the systems utility, pinpointing individuals whose risk profiles suggest that early action could forestall more serious illness.

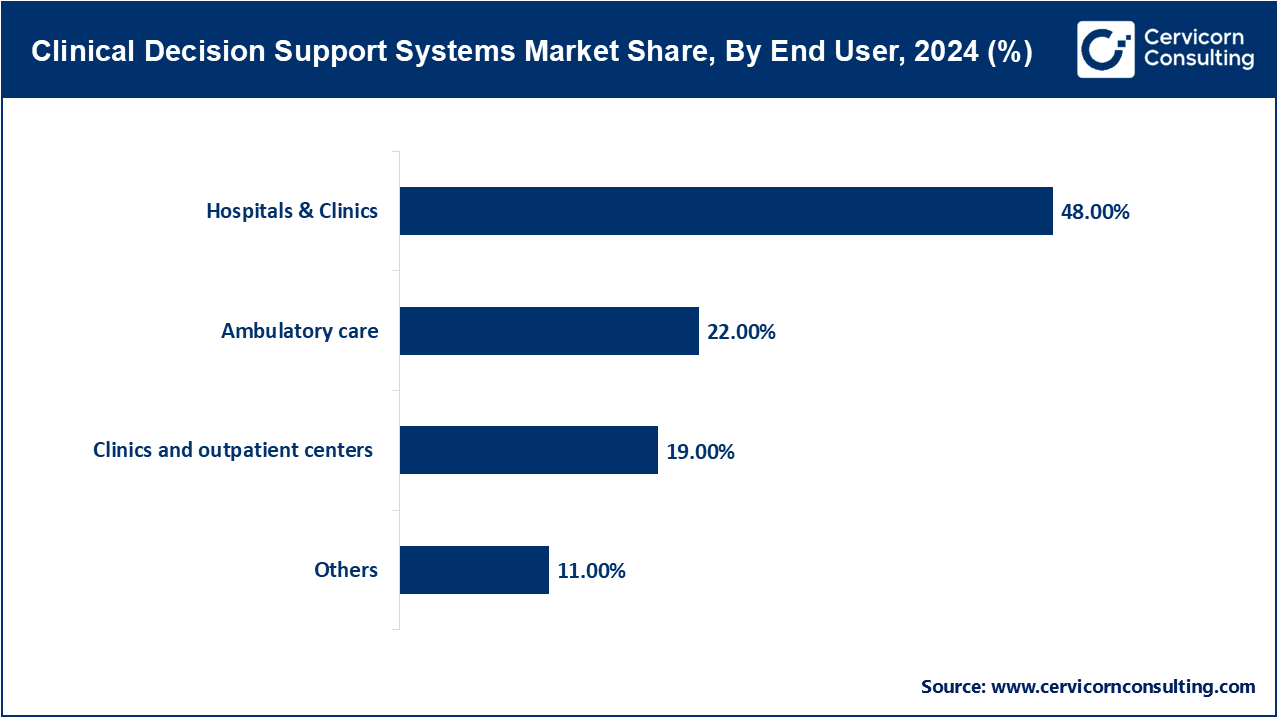

Hospitals: Hospitals are still the biggest group of CDSS users, because their tangled workflows, constant admissions, and many specialties create a unique pressure only smart technology can ease. An integrated CDSS therefore acts like a nervous system, passing real-time insights between departments, cutting down on duplicated tests, and signalling when best-practice protocols are overlooked. Research has proven to show that hospitals that have integrated CDSS feature within their systems are said to suffer 30% lower errors in the medicare and up to 25% better compliance to the clinical guidelines.

Clinics and Outpatient Centers: Clinics and small outpatient centers eager to match the safety found in larger hospitals now adopt clinical-decision-support systems at a steady clip. Most of these venues choose cloud-based or stand-alone CDSS that helps both family doctors and visiting specialists anchor their choices in up-to-date evidence. As demonstrated in the study, the patient portals issued by Epic MyChart and Cerner’s HealtheLife have integrated within them the CDSS reminders and have proven to increase the compliance to medications and appointments with a 25% increase in the outpatient population.

Ambulatory Care Centers: Surgery and diagnostics units that host same-day cases increasingly lean on CDSS to smooth flow, cut procedure harm, and tighten handoffs among diverse staff. Because each visit is short yet intense, prompt alerts and proven counsel from the system serve as essential guardrails in the narrow windows just before and after fast-moving work.

Others: Diagnostic laboratories and teaching hospitals are other users that apply CDSS to train staff, conduct studies, and refine test interpretation, underscoring how adaptable these tools have become across the sector.

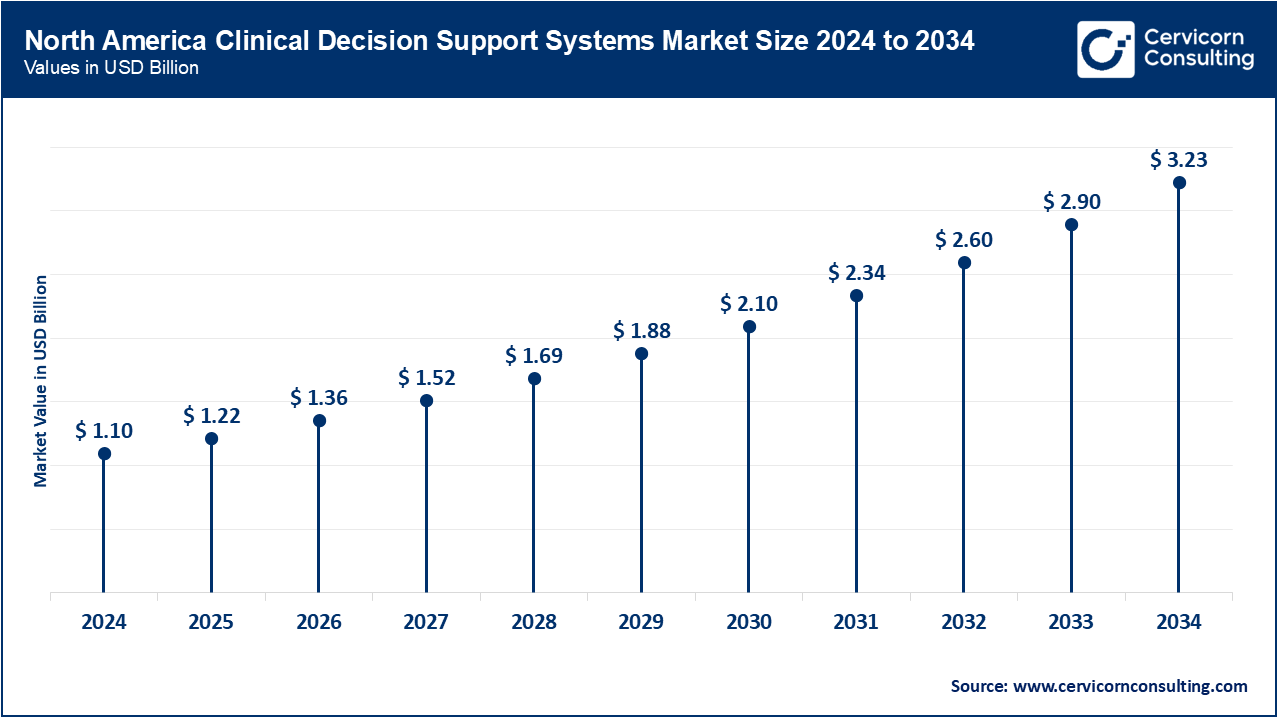

North America commands 40% of the world CDSS market. Early investment in health IT, well-developed EHRs, and supportive policy fuel growth. The USA alone generates over 80% of the region’s CDSS earnings. North America continues to command the largest segment of the global CDSS market, a position attributable to the regions early uptake of sophisticated health information technology, mature electronic-health-record (EHR) infrastructure, and sustained government incentives such as the HITECH Act and provisions embedded in the Affordable Care Act. Within this landscape, the United States remains the foremost leader, with CDSS tools now widely deployed in hospitals and outpatient clinics to curtail medical errors, elevate the quality of care, and streamline clinical workflows. Elevated national health expenditure, reimbursement schemes that favor digital solutions, and the proactive involvement of market powerhouses such as IBM, Oracle, and Microsoft jointly rein.

The Asia-Pacific region is growing rapidly, driven by larger health budgets, a more affluent patient base, rising rates of chronic illness, and strong government endorsement of digital tools. Japan and South Korea, benefitting from dense hospital networks, have pushed CDSS adoption in main teaching hospitals beyond 60%. Yet smaller or rural centres lag, with uptake under 35% because the local IT systems still lack maturity. Widespread smartphone use and cloud-hosted applications further boost availability and expand the reach of clinical insight. Still, fragmented networks and differing levels of digital skill between urban hubs and rural towns pose ongoing hurdles for uniform national deployment.

Clinical Decision Support Systems Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 40% |

| Europe | 28% |

| Asia-Pacific | 24% |

| LAMEA | 8% |

Europe occupies the second-largest position, a growth trajectory fueled by accelerated health-care digitization, a strong patient-safety mandate, and enabling regulatory frameworks represented by the European Commissions Digital Health programmes. Germany, the United Kingdom, France, and the Netherlands emerge as vanguard countries, each launching public-financed initiatives aimed at seamless EHR-CDSS convergence across clinical settings. Europe's steadfast commitment to data protection, exemplified by stringent GDPR compliance, has in turn nurtured a culture of responsible and secure CDSS roll-out, cultivating the institutional trust essential for widespread adoption. Germany’s Krankenhauszukunftsgesetz promises EUR 4.3 billion for hospital IT, while the UK’s NHS aims for 95% digital maturity in hospitals by 2025. High internet access and the rise of telehealth together lift the region’s CDSS market by 7–9% each year.

In Latin America, the Middle East, and much of Africa, the CDSS market is still emerging, yet its uptake is steadily quickening as awareness spreads, healthcare modernization moves forward, and cross-border partnerships grow. The Latin America market growth is swift as countries step up healthcare modernization. Because these areas are still early in the implementation curve, they nonetheless promise considerable long-term value, given that both public agencies and private investors are pouring resources into digital upgrades and workforce training. Overall, while growth rates for CDSS solutions vary sharply from one region to another, the global trend remains positive, with mature markets aiming to refine proven platforms and newer economies opening fresh avenues for adoption.

Market Segmentation

By Component

By Deployment Mode

By Delivery Mode

By Technology

By Type

By Level of Interactivity

By Application

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Clinical Decision Support Systems

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Deployment Mode Overview

2.2.3 By Delivery Mode Overview

2.2.4 By Technology Overview

2.2.5 By Type Overview

2.2.6 By Level of Interactivity Overview

2.2.7 By Application Overview

2.2.8 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Burden of Chronic Diseases

4.1.1.2 Global Push Toward Digitization and Government Initiatives Promoting Health IT Adoption

4.1.2 Market Restraints

4.1.2.1 High Cost of Implementation and Integration

4.1.2.2 Data Privacy, Security, and Compliance with Regulatory Standards

4.1.3 Market Challenges

4.1.3.1 Lack of standardization and interoperability between systems

4.1.3.2 Healthcare professionals' reluctance and mistrust in automated tools

4.1.4 Market Opportunities

4.1.4.1 Increasing Adoption of Personalized and Precision Medicine

4.1.4.2 Expansion of CDSS in Emerging Markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Clinical Decision Support Systems Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Clinical Decision Support Systems Market, By Component

6.1 Global Clinical Decision Support Systems Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hardware

6.1.1.2 Software

6.1.1.3 Services

Chapter 7. Clinical Decision Support Systems Market, By Deployment Mode

7.1 Global Clinical Decision Support Systems Market Snapshot, By Deployment Mode

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 On-premise

7.1.1.2 Cloud-based

7.1.1.3 Web-based

Chapter 8. Clinical Decision Support Systems Market, By Delivery Mode

8.1 Global Clinical Decision Support Systems Market Snapshot, By Delivery Mode

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Standalone

8.1.1.2 Integrated (EHR, CPOE, etc.)

Chapter 9. Clinical Decision Support Systems Market, By Technology

9.1 Global Clinical Decision Support Systems Market Snapshot, By Technology

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Knowledge-based CDSS

9.1.1.2 Non-knowledge-based CDSS

Chapter 10. Clinical Decision Support Systems Market, By Type

10.1 Global Clinical Decision Support Systems Market Snapshot, By Type

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Therapeutic

10.1.1.2 Diagnostics

10.1.1.3 Web-based

Chapter 11. Clinical Decision Support Systems Market, By Level of Interactivity

11.1 Global Clinical Decision Support Systems Market Snapshot, By Level of Interactivity

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Active CDSS

11.1.1.2 Passive CDSS

Chapter 12. Clinical Decision Support Systems Market, By Application

12.1 Global Clinical Decision Support Systems Market Snapshot, By Application

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Drug allergy alerts and drug–drug interaction alerts

12.1.1.2 Diagnostic Support Systems

12.1.1.3 Clinical Guidelines and Reminders

12.1.1.4 Others

Chapter 13. Clinical Decision Support Systems Market, By End-User

13.1 Global Clinical Decision Support Systems Market Snapshot, By End-User

13.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

13.1.1.1 Hospitals & clinics

13.1.1.2 Ambulatory care

13.1.1.3 Clinics and outpatient centers

13.1.1.4 Others

Chapter 14. Clinical Decision Support Systems Market, By Region

14.1 Overview

14.2 Clinical Decision Support Systems Market Revenue Share, By Region 2024 (%)

14.3 Global Clinical Decision Support Systems Market, By Region

14.3.1 Market Size and Forecast

14.4 North America

14.4.1 North America Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.4.2 Market Size and Forecast

14.4.3 North America Clinical Decision Support Systems Market, By Country

14.4.4 U.S.

14.4.4.1 U.S. Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.4.4.2 Market Size and Forecast

14.4.4.3 U.S. Market Segmental Analysis

14.4.5 Canada

14.4.5.1 Canada Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.4.5.2 Market Size and Forecast

14.4.5.3 Canada Market Segmental Analysis

14.4.6 Mexico

14.4.6.1 Mexico Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.4.6.2 Market Size and Forecast

14.4.6.3 Mexico Market Segmental Analysis

14.5 Europe

14.5.1 Europe Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.5.2 Market Size and Forecast

14.5.3 Europe Clinical Decision Support Systems Market, By Country

14.5.4 UK

14.5.4.1 UK Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.5.4.2 Market Size and Forecast

14.5.4.3 UKMarket Segmental Analysis

14.5.5 France

14.5.5.1 France Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.5.5.2 Market Size and Forecast

14.5.5.3 FranceMarket Segmental Analysis

14.5.6 Germany

14.5.6.1 Germany Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.5.6.2 Market Size and Forecast

14.5.6.3 GermanyMarket Segmental Analysis

14.5.7 Rest of Europe

14.5.7.1 Rest of Europe Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.5.7.2 Market Size and Forecast

14.5.7.3 Rest of EuropeMarket Segmental Analysis

14.6 Asia Pacific

14.6.1 Asia Pacific Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.6.2 Market Size and Forecast

14.6.3 Asia Pacific Clinical Decision Support Systems Market, By Country

14.6.4 China

14.6.4.1 China Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.6.4.2 Market Size and Forecast

14.6.4.3 ChinaMarket Segmental Analysis

14.6.5 Japan

14.6.5.1 Japan Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.6.5.2 Market Size and Forecast

14.6.5.3 JapanMarket Segmental Analysis

14.6.6 India

14.6.6.1 India Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.6.6.2 Market Size and Forecast

14.6.6.3 IndiaMarket Segmental Analysis

14.6.7 Australia

14.6.7.1 Australia Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.6.7.2 Market Size and Forecast

14.6.7.3 AustraliaMarket Segmental Analysis

14.6.8 Rest of Asia Pacific

14.6.8.1 Rest of Asia Pacific Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.6.8.2 Market Size and Forecast

14.6.8.3 Rest of Asia PacificMarket Segmental Analysis

14.7 LAMEA

14.7.1 LAMEA Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.7.2 Market Size and Forecast

14.7.3 LAMEA Clinical Decision Support Systems Market, By Country

14.7.4 GCC

14.7.4.1 GCC Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.7.4.2 Market Size and Forecast

14.7.4.3 GCCMarket Segmental Analysis

14.7.5 Africa

14.7.5.1 Africa Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.7.5.2 Market Size and Forecast

14.7.5.3 AfricaMarket Segmental Analysis

14.7.6 Brazil

14.7.6.1 Brazil Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.7.6.2 Market Size and Forecast

14.7.6.3 BrazilMarket Segmental Analysis

14.7.7 Rest of LAMEA

14.7.7.1 Rest of LAMEA Clinical Decision Support Systems Market Revenue, 2022-2034 ($Billion)

14.7.7.2 Market Size and Forecast

14.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 15. Competitive Landscape

15.1 Competitor Strategic Analysis

15.1.1 Top Player Positioning/Market Share Analysis

15.1.2 Top Winning Strategies, By Company, 2022-2024

15.1.3 Competitive Analysis By Revenue, 2022-2024

15.2 Recent Developments by the Market Contributors (2024)

Chapter 16. Company Profiles

16.1 IBM Watson Health

16.1.1 Company Snapshot

16.1.2 Company and Business Overview

16.1.3 Financial KPIs

16.1.4 Product/Service Portfolio

16.1.5 Strategic Growth

16.1.6 Global Footprints

16.1.7 Recent Development

16.1.8 SWOT Analysis

16.2 Cerner Corporation (Oracle Health)

16.3 Siemens Healthineers

16.4 Philips Healthcare

16.5 Epic Systems Corporation

16.6 Wolters Kluwer Health

16.7 Elsevier (a RELX Group company)

16.8 Allscripts Healthcare Solutions

16.9 GE HealthCare

16.10 MEDITECH (Medical Information Technology, Inc.)

16.11 Zynx Health (part of Hearst Health)

16.12 Change Healthcare

16.13 McKesson Corporation

16.14 eClinicalWorks

16.15 NextGen Healthcare