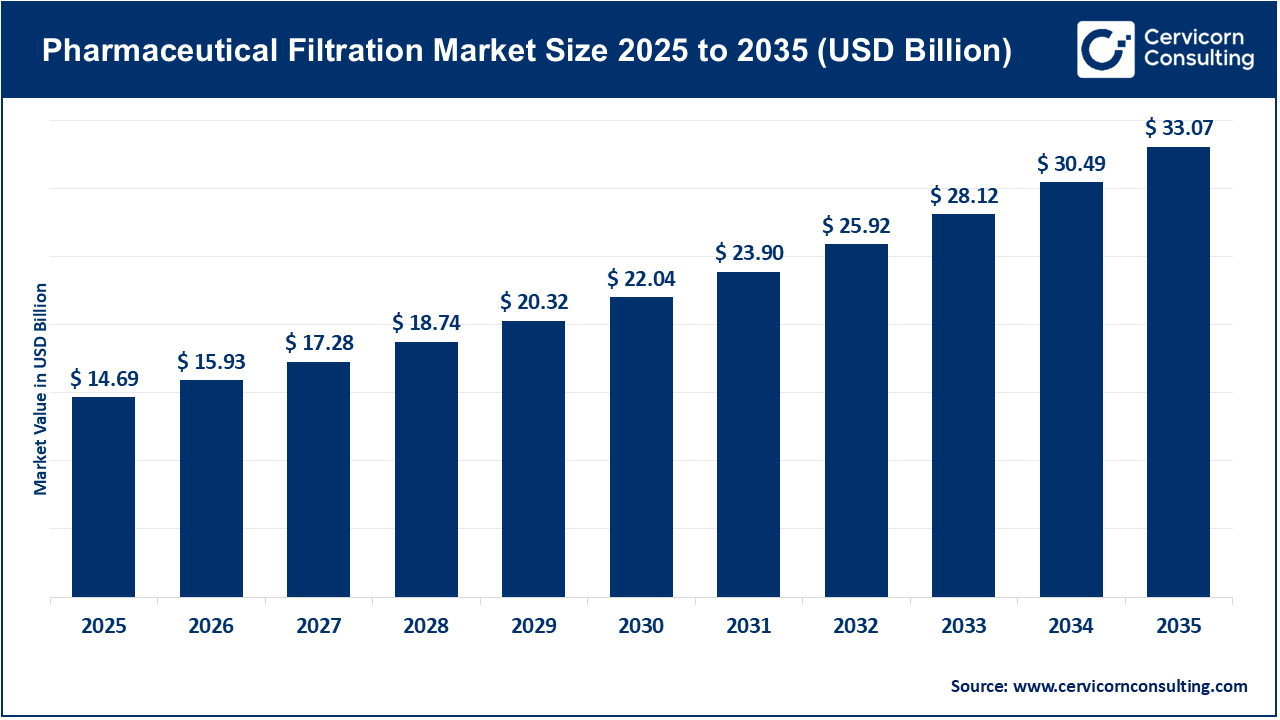

The global pharmaceutical filtration market size was valued at USD 14.69 billion in 2025 and is expected to be worth around USD 33.07 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.5% over the forecast period from 2026 to 2035. The pharmaceutical filtration market is experiencing growth due to the increasing complexity and volume of drug production. The rise in biologics, vaccines, and personalized therapies has led to higher requirements for sterility and purity. As pharmaceutical and biopharmaceutical companies expand the production of monoclonal antibodies, recombinant proteins, and advanced therapeutics, the need for reliable filtration technologies has become essential to remove contaminants and maintain product quality. Global regulatory bodies are also raising expectations for contamination control and validation, which is driving the adoption of advanced membrane, microfiltration, and ultrafiltration systems. Furthermore, the expansion of contract manufacturing organizations and the trend toward outsourcing in pharmaceutical production are encouraging investment in scalable and efficient filtration infrastructure to address diverse client requirements across different regions.

Recent trends in the pharmaceutical filtration market show both technological progress and strategic actions by leading companies. There is a clear movement toward single-use and modular filtration systems, which help reduce cross-contamination, shorten turnaround times, and support flexible manufacturing. This trend is becoming more common as facilities move to continuous production models. Manufacturers are also developing advanced filters that improve throughput and can process high-concentration biologics, meeting the challenges of new drug formulations. In addition, major companies are expanding their product lines and making acquisitions to strengthen their technology portfolios and extend their presence in different regions. The construction of new facilities focused on sterile and virus filtration highlights the industry's confidence in continued market growth.

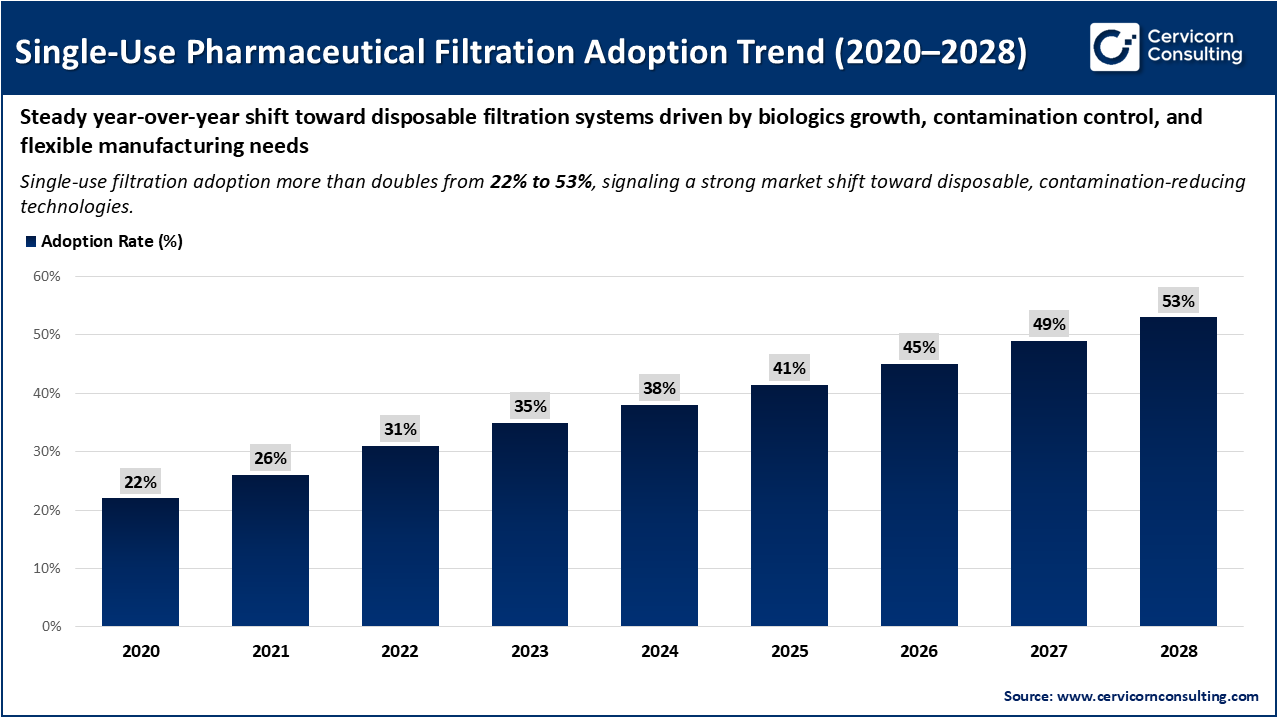

Increasing Adoption of Single-Use Technologies Driving the Market

The pharmaceutical filtration market is experiencing significant changes due to the increasing adoption of single-use technologies. These systems are transforming biopharmaceutical manufacturing by providing operational benefits compared to traditional stainless-steel setups. Single-use filtration removes the need for cleaning and sterilization between batches, which reduces downtime, lowers validation costs, and minimizes the risk of cross-contamination. This is especially important in sterile drug production and facilities that handle multiple products. Pre-assembled and disposable filtration systems also allow for flexible batch sizes and help streamline production workflows. This is particularly valuable in the manufacturing of complex biologics, gene therapies, and personalized medicines, where high standards for purity and sterility are required. As regulatory authorities focus on contamination control and manufacturers look for efficient and scalable solutions, single-use filtration systems are becoming more widely adopted. This trend is expected to drive further innovation and growth in the pharmaceutical filtration market.

The image demonstrates a consistent increase in the adoption of single-use pharmaceutical filtration systems between 2020 and 2028, with adoption rates rising from approximately 22% to over 53%. This steady year-over-year growth indicates a significant shift within the pharmaceutical industry toward disposable filtration technologies. The main factors contributing to this trend include the expansion of biologics, the growing need for contamination control, the demand for faster changeovers, and the requirement for greater flexibility in pharmaceutical manufacturing processes.

Recent Developments in Single-Use Filtration Technologies

1. Merck Opens Climate-Neutral Filter Manufacturing Facility in Ireland

Merck has opened a EUR 150 million advanced filtration manufacturing facility in Blarney Business Park, Cork, Ireland. This climate-neutral site will produce essential filtration devices for aseptic processing, tangential-flow filtration, and virus removal, supporting the production of vaccines, biologics, and cell and gene therapies. By localizing production in Europe, Merck is strengthening regional supply chains and reducing reliance on cross-border logistics for key filtration technologies. This development supports the growing global demand for sterile and high-purity pharmaceutical products, increases market capacity, and aligns with the sustainability goals that are becoming increasingly important to customers.

2. FDA Launches PreCheck Pilot Program to Accelerate U.S. Pharmaceutical Manufacturing

The U.S. Food and Drug Administration (FDA) has introduced the PreCheck Pilot Program, a new regulatory initiative that offers early engagement and clear regulatory guidance during the development of new pharmaceutical manufacturing facilities, including their filtration infrastructure. By streamlining facility design input, accelerating assessments, and prioritizing quality reviews, PreCheck is expected to lower barriers to expanding domestic production. This initiative encourages investment in advanced manufacturing technologies, such as pharmaceutical filtration systems that comply with strict FDA quality and compliance standards.

3. Sartorius Strengthens Filtration Capabilities Through Strategic Acquisition

In late 2025, Sartorius Stedim Biotech SA completed the acquisition of a company specializing in membrane filtration, expanding its ultrafiltration and microfiltration portfolio for bioprocessing applications. This move strengthens Sartorius’s technological capabilities for high-value pharmaceutical processes, increases filtration efficiency, and supports more reliable purification workflows for biologics and complex therapies. By incorporating specialized technologies, Sartorius is positioned to meet changing customer requirements and drive the adoption of advanced filtration solutions in the biopharma sector.

4. Merck & Co Acquires Single-Use Filtration Technology Firm

In early 2026, Merck & Co completed the acquisition of a company focused on single-use filtration technology, expanding its portfolio for sterile final-product processing. This acquisition enables Merck to provide comprehensive disposable filtration solutions that help reduce contamination risk, simplify validation processes, and support flexible manufacturing. These benefits are especially important in the production of biologics and personalized medicines. By enhancing its single-use filtration capabilities, Merck is responding to the increasing demand for adaptable manufacturing platforms and supporting the industry's shift toward advanced sterile production methods.erile production flows in the industry.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 15.93 Billion |

| Market Size in 2035 | USD 33.07 Billion |

| CAGR from 2026 to 2035 | 8.50% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Systems, Product, Technique, Application, Type, Scale of Operation, Region |

| Key Companies | Sartorius AG, Merck KGaA, Thermo Fisher Scientific, Danaher, Repligen, Dr. Muller AG, Meissner Filtration Products, GE Healthcare, Eaton, Donaldson Company, Parker Hannifin, Camfil, Graver Technologies, Alfa Laval |

The pharmaceutical filtration market is segmented into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

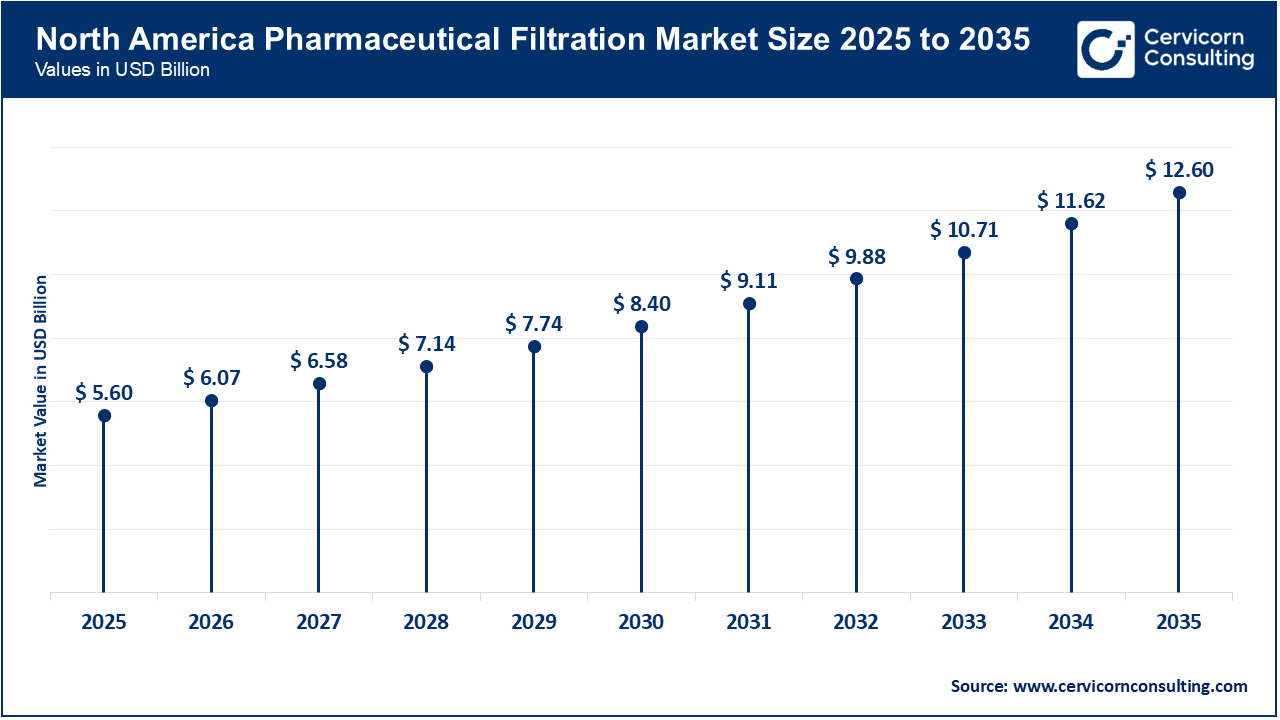

North America Pharmaceutical Filtration Market: Regulatory push & reshoring of drug manufacturing

The North America pharmaceutical filtration market size was valued at USD 5.60 billion in 2025 and is predicted to surge around USD 12.60 billion by 2035. The North American market is experiencing growth due to stronger U.S. regulatory initiatives and a policy focus on bringing pharmaceutical production back to the region. These factors are leading to increased investment in modern manufacturing infrastructure, including advanced filtration systems that are essential for sterile and high-purity production. Programs such as the FDA’s PreCheck (announced August 7, 2025) and other government efforts to shorten review timelines and reduce risks for new plant construction are making it easier and more predictable for companies and CDMOs to design facilities with advanced filtration, sterile-handling, and quality-by-design features. As a result, there is rising demand for validated single-use and reusable filtration technologies.

Recent Developments:

Asia-Pacific (APAC) Pharmaceutical Filtration Market: Rapid biologics growth and national manufacturing programs

The Asia-Pacific pharmaceutical filtration market size was estimated at USD 3.57 billion in 2025 and is forecasted to grow around USD 8.04 billion by 2035. The Asia-Pacific market is growing quickly due to increased production of biologics and vaccines, along with national manufacturing programs such as China’s biotech support and India’s PLI schemes. These developments are encouraging investment in filtration equipment for both upstream and downstream processing. Regional regulators and industry participants are also promoting the use of single-use assemblies and advanced membranes to support cell and gene therapy, vaccine scale-up, and local API production. This is leading to strong demand for both disposable filtration consumables and high-capacity reusable systems in Japan, China, India, and neighboring markets.

Recent Developments:

Europe Pharmaceutical Filtration Market: Capacity expansion & sustainability commitments

The Europe pharmaceutical filtration market size was reached at USD 4.38 billion in 2025 and is projected to surpass around USD 9.85 billion by 2035. Europe’s filtration market is being driven by major capacity expansions and sustainability commitments from leading suppliers and manufacturers. These efforts are strengthening regional supply chains and meeting the pharmaceutical industry’s requirements for both high-performance filtration and reduced carbon footprints. High-profile investments, such as Merck’s new climate-neutral filtration manufacturing facility in Cork, Ireland, are increasing the local availability of aseptic, tangential-flow, and virus-removal filters. This aligns with EU sustainability goals and encourages European drugmakers to source advanced filtration solutions within the region.

Recent Developments:

Pharmaceutical Filtration Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38.1% |

| Europe | 29.8% |

| Asia-Pacific | 24.3% |

| LAMEA | 7.8% |

LAMEA (Latin America, Middle East & Africa) Pharmaceutical Filtration Market: Localization of pharma production & strategic national plans

The LAMEA pharmaceutical filtration market was valued at USD 1.15 billion in 2025 and is anticipated to reach around USD 2.58 billion by 2035. LAMEA’s filtration market is being driven by national strategies aimed at localizing drug production and reducing import dependence. Examples include pharma initiatives aligned with the Gulf states’ Vision programs and increased investment in Brazil and other regional hubs. These strategies are prompting capital expenditure on manufacturing plants that require qualified filtration systems for water, air, and final-product sterility. As governments promote domestic capabilities and private companies invest in local capacity, demand is increasing for both turnkey filtration systems and aftermarket consumables that meet regional regulatory requirements.

Recent Developments:

The pharmaceutical filtration market is segmented into system, product, technique, application, type, scale of operation, and region.

Reusable filtration systems hold a leading position in the market, largely because they have been widely adopted in large-scale pharmaceutical manufacturing. Their durability and cost efficiency over extended production cycles make them suitable for high-volume, standardized drug production. These systems are also compatible with existing stainless-steel infrastructure, which is common in major pharmaceutical facilities. As a result, large pharmaceutical companies continue to depend on reusable systems for continuous operations, where cleaning-in-place and sterilization-in-place processes are already well established and economically viable.

Pharmaceutical Filtration Market Share, By Systems, 2025 (%)

| Systems | Revenue Share, 2025 (%) |

| Reusable | 58.6% |

| Single Use | 41.4% |

Single-use systems represent the fastest-growing segment in the market, as manufacturers are placing greater emphasis on flexibility, quicker turnaround times, and minimizing contamination risks. By removing the need for cleaning and validation between batches, these systems are particularly well suited for biologics, vaccines, and facilities that handle multiple products. The increasing adoption of single-use systems in small-batch production, personalized medicine, and contract manufacturing is further accelerating their market growth.

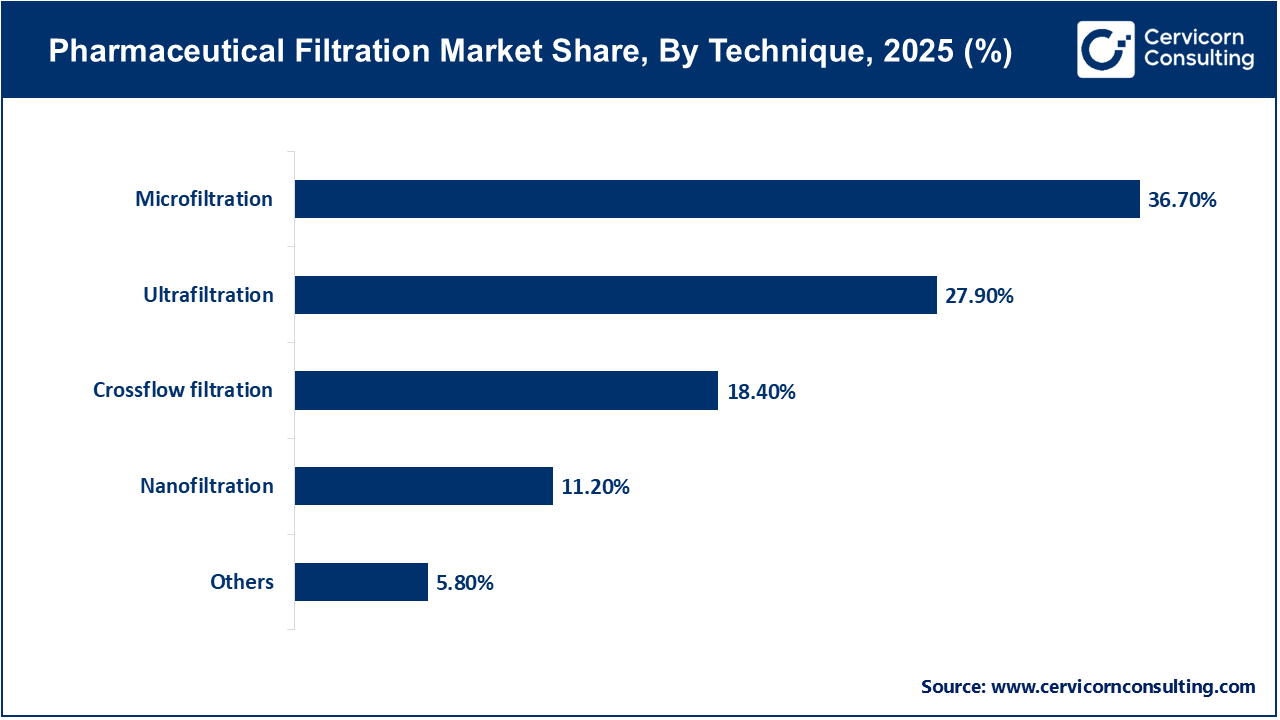

Microfiltration remains the dominant filtration technique because it is widely used to remove particulates, bacteria, and suspended solids during pharmaceutical manufacturing. Its versatility in raw material filtration, water purification, and pre-filtration steps makes it a fundamental technology in drug production processes. The cost-effectiveness and reliability of microfiltration further support its broad adoption across the industry.

Ultrafiltration is the fastest-growing technique, mainly because it is essential for protein concentration, buffer exchange, and the purification of biologics. As the importance of biologics and biosimilars continues to rise, the need for ultrafiltration in downstream processing is growing quickly. The technique’s capacity to selectively separate macromolecules while preserving product integrity is a key factor behind its rapid adoption.

Membrane filters are the leading product segment because they play a crucial role in ensuring high levels of sterility and effective particle retention throughout pharmaceutical processes. Their ability to provide precise pore size control, combined with reliability and regulatory approval, makes them essential for sterile filtration, final fill operations, and the production of biologics. The widespread use of membrane filters across various applications continues to support their strong position in the market.

Pharmaceutical Filtration Market Share, By Product, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| Membrane Filters | 34.8% |

| Cartridges & Capsules | 18.9% |

| Single-use Systems | 15.6% |

| Pre-filters & Depth Media | 11.4% |

| Filtration Assemblies | 8.2% |

| Filtration Accessories | 6.5% |

| Filter Holders | 3.1% |

| Others | 1.5% |

Single-use filtration systems are experiencing the most rapid growth, driven by the increasing use of disposable manufacturing platforms. By integrating filters, tubing, and connectors into pre-assembled units, these systems help reduce setup time and lower the risk of contamination. The growing demand from contract development and manufacturing organizations and biopharmaceutical companies for flexible and scalable solutions is contributing to the swift expansion of this segment.

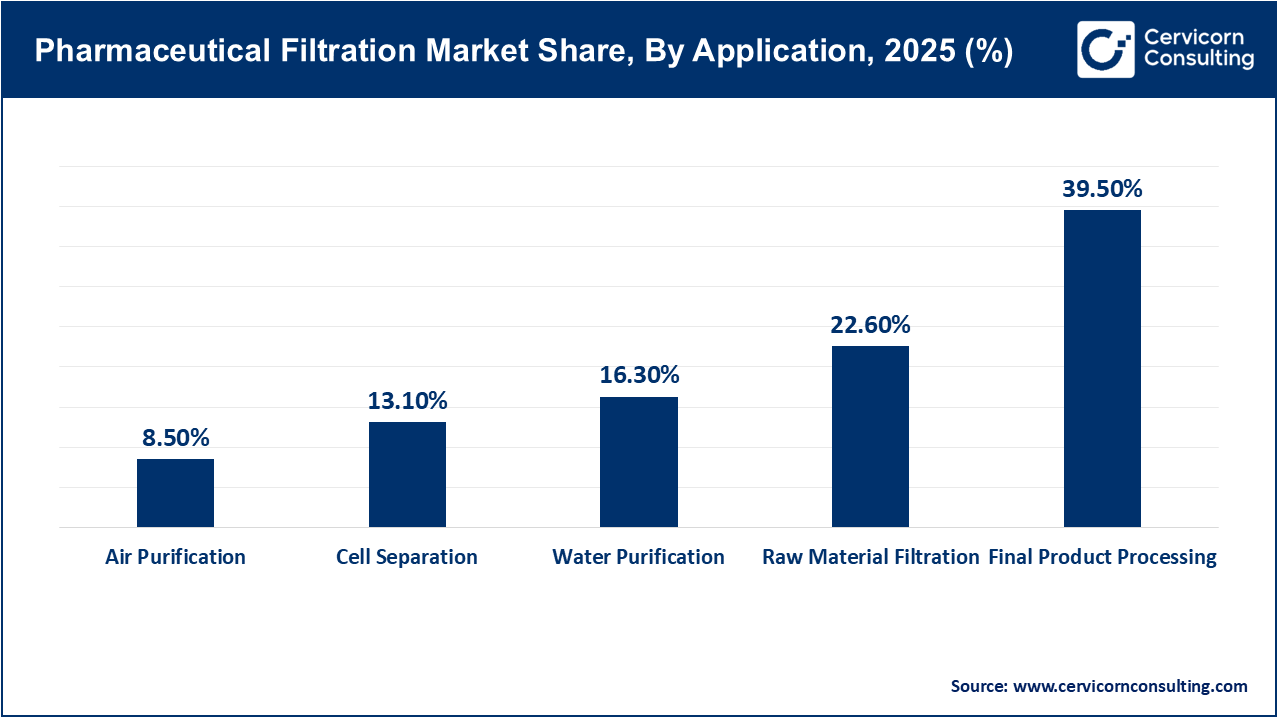

Final product processing leads the application segment, as filtration at this stage is necessary to guarantee sterility, safety, and compliance with regulatory standards before a drug is released. Regulatory agencies require validated filtration during final fill and finishing steps, making this process essential in pharmaceutical manufacturing. The presence of high-value drug products at this stage further highlights the importance of effective filtration.

Cell separation is the fastest-growing application segment, largely due to the growth of cell and gene therapy, regenerative medicine, and advanced biologics. These areas require filtration technologies that can isolate and process living cells with precision and care, ensuring cell viability is maintained. The expansion of clinical pipelines and the commercialization of cell-based therapies are further increasing demand for cell separation solutions.

Sterile filtration holds a dominant position in the market because it is essential for ensuring product safety and meeting strict pharmaceutical regulations. It is commonly used in the production of injectable drugs, ophthalmic products, biologics, and vaccines, where maintaining sterility is required. The ongoing emphasis on contamination control throughout manufacturing processes continues to support the strong presence of sterile filtration.

Pharmaceutical Filtration Market Share, By Type, 2025 (%)

| Type | Revenue Share, 2025 (%) |

| Sterile Filtration | 71.8% |

| Non-Sterile Filtration | 28.2% |

Non-sterile filtration is the fastest-growing type, as it is being used more frequently in upstream processing, raw material filtration, and intermediate purification. The expansion of bulk drug manufacturing and a greater focus on process efficiency are encouraging its adoption. Additionally, its function in lowering bioburden before sterile filtration adds to its growing significance.

Manufacturing-scale operations are the leading segment in the market because commercial drug production depends on large volumes of filtration systems that operate continuously under validated conditions. The need for high production output, regulatory compliance, and consistent product quality makes large-scale filtration an essential part of pharmaceutical manufacturing.

Pharmaceutical Filtration Market Share, By Scale of Operation, 2025 (%)

| Scale of Operation | Revenue Share, 2025 (%) |

| Manufacturing Scale | 62.9% |

| Research & Development Scale | 23.7% |

| Pilot-scale | 13.4% |

The research and development scale is the fastest-growing segment, driven by rising investment in drug discovery, biologics development, and early-stage clinical research. Filtration systems at this level are important for process development, pilot studies, and optimizing formulations. The growth of R&D pipelines in pharmaceutical and biotechnology companies is contributing to the rapid expansion of this segment.

By Systems

By Product

By Technique

By Application

By Type

By Scale of Operation

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Pharmaceutical Filtration

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Systems Overview

2.2.2 By Product Overview

2.2.3 By Technique Overview

2.2.4 By Application Overview

2.2.5 By Type Overview

2.2.6 By Scale of Operation Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Demand for Biologics and Advanced Therapies

4.1.1.2 Stringent Regulatory Requirements for Sterile Manufacturing

4.1.2 Market Restraints

4.1.2.1 High Cost of Advanced Filtration Systems

4.1.2.2 Technical Complexity and Validation Burden

4.1.3 Market Challenges

4.1.3.1 Environmental Concerns Related to Disposable Filtration

4.1.3.2 Supply Chain Disruptions and Material Availability

4.1.4 Market Opportunities

4.1.4.1 Expansion of Single-Use and Flexible Manufacturing Systems

4.1.4.2 Increasing Outsourcing to CDMOs and CMOs

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Pharmaceutical Filtration Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Pharmaceutical Filtration Market, By Systems

6.1 Global Pharmaceutical Filtration Market Snapshot, By Systems

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Single Use

6.1.1.2 Reusable

Chapter 7. Pharmaceutical Filtration Market, By Product

7.1 Global Pharmaceutical Filtration Market Snapshot, By Product

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Membrane Filters

7.1.1.2 Pre-filters & Depth Media

7.1.1.3 Single-use Systems

7.1.1.4 Cartridges & Capsules

7.1.1.5 Filtration Accessories

7.1.1.6 Filter Holders

7.1.1.7 Filtration Assemblies

7.1.1.8 Others

Chapter 8. Pharmaceutical Filtration Market, By Technique

8.1 Global Pharmaceutical Filtration Market Snapshot, By Technique

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Microfiltration

8.1.1.2 Ultrafiltration

8.1.1.3 Nanofiltration

8.1.1.4 Crossflow filtration

8.1.1.5 Others

Chapter 9. Pharmaceutical Filtration Market, By Application

9.1 Global Pharmaceutical Filtration Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Final Product Processing

9.1.1.2 Raw Material Filtration

9.1.1.3 Cell Separation

9.1.1.4 Water Purification

9.1.1.5 Air Purification

Chapter 10. Pharmaceutical Filtration Market, By Type

10.1 Global Pharmaceutical Filtration Market Snapshot, By Type

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Sterile Filtration

10.1.1.2 Non-Sterile Filtration

Chapter 11. Pharmaceutical Filtration Market, By Scale of Operation

11.1 Global Pharmaceutical Filtration Market Snapshot, By Scale of Operation

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Manufacturing Scale

11.1.1.2 Pilot-scale

11.1.1.3 Research & Development Scale

Chapter 12. Pharmaceutical Filtration Market, By Region

12.1 Overview

12.2 Pharmaceutical Filtration Market Revenue Share, By Region 2024 (%)

12.3 Global Pharmaceutical Filtration Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America Pharmaceutical Filtration Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe Pharmaceutical Filtration Market, By Country

12.5.4 UK

12.5.4.1 UK Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UKMarket Segmental Analysis

12.5.5 France

12.5.5.1 France Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 FranceMarket Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 GermanyMarket Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of EuropeMarket Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific Pharmaceutical Filtration Market, By Country

12.6.4 China

12.6.4.1 China Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 ChinaMarket Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 JapanMarket Segmental Analysis

12.6.6 India

12.6.6.1 India Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 IndiaMarket Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 AustraliaMarket Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia PacificMarket Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA Pharmaceutical Filtration Market, By Country

12.7.4 GCC

12.7.4.1 GCC Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCCMarket Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 AfricaMarket Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 BrazilMarket Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA Pharmaceutical Filtration Market Revenue, 2022-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 13. Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14. Company Profiles

14.1 Sartorius AG

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 Merck KGaA

14.3 Thermo Fisher Scientific

14.4 Danaher

14.5 Repligen

14.6 Dr. Muller AG

14.7 Meissner Filtration Products

14.8 GE Healthcare

14.9 Eaton

14.10 Donaldson Company

14.11 Parker Hannifin

14.12 Camfil

14.13 Graver Technologies

14.14 Alfa Laval