CDMO Market Size and Growth 2025 to 2034

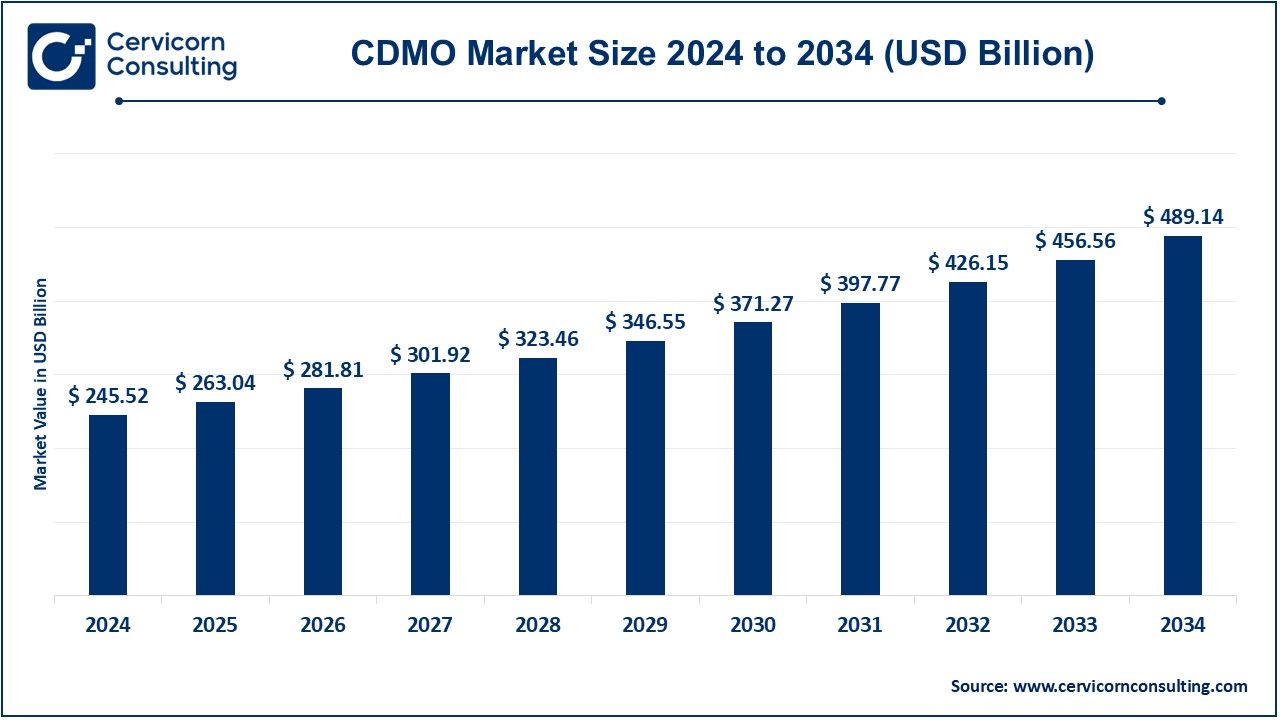

The global contract development and manufacturing organization (CDMO) market size was valued at USD 245.52 billion in 2024 and is expected to reach around USD 489.14 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.13% from 2025 to 2034. The CDMO market growth is driven by an increased demand for outsourced manufacturing services by pharmaceutical and biotechnology companies. High demand for specialized manufacturing capabilities is being driven by growth in biologics and advanced therapies. The other growing factor in this area is the increasing number of small and medium-sized pharma companies that are turning toward contract manufacturing, which allows them to outsource such production to avoid capital investment; therefore, this works in favor of growth. The regulatory requirements related to CDMO and the move towards more efficient processes are driving growth for CDMOs as well.

A contract development and manufacturing organization is an organization that offers services to drug development, manufacture, and commercialization. While providing product formulation, clinical trial, and large-scale manufacture expertise to the client base, CDMOs help the client control costs and concentrate on core competencies. These organizations manage various aspects of drug production, from preclinical through post-commercialization and are, therefore, key to the development of biologics, vaccines, and novel therapeutics in an environment that is highly regulated.

Report Highlights

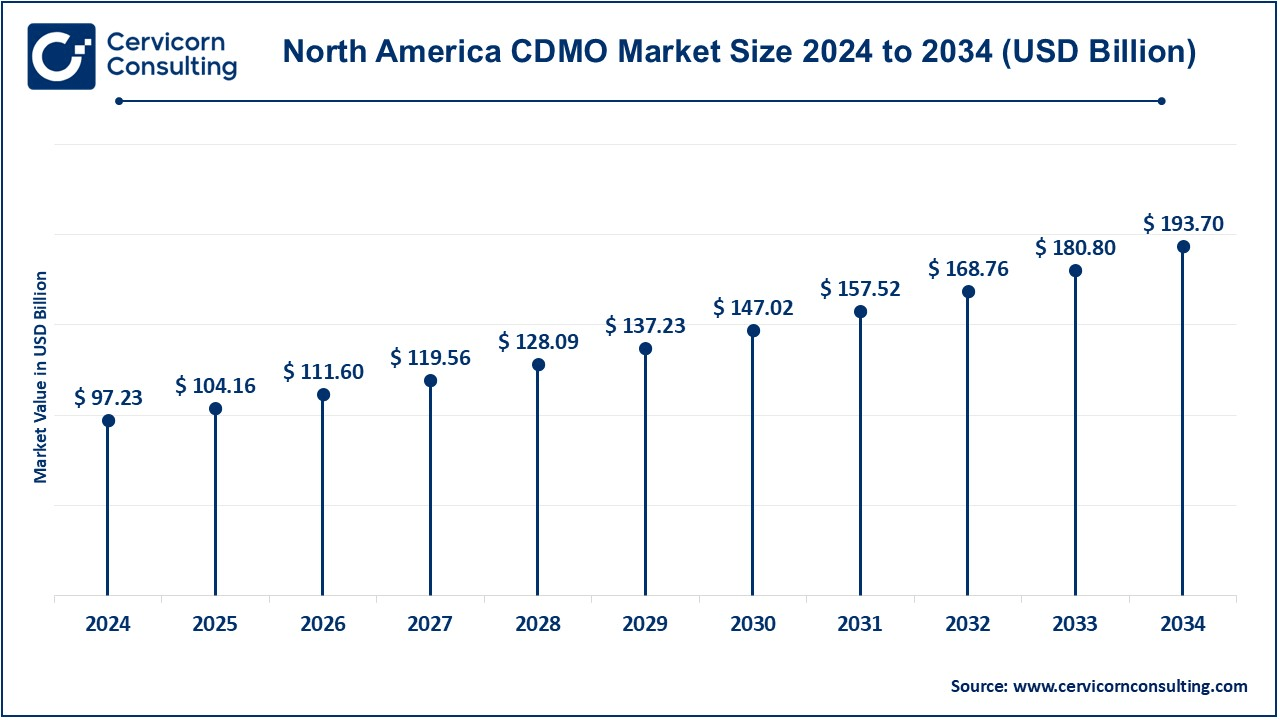

- The U.S. CDMO market size was reached at USD 71.95 billion in 2024 and is expected to hit around USD 143.34 billion by 2034.

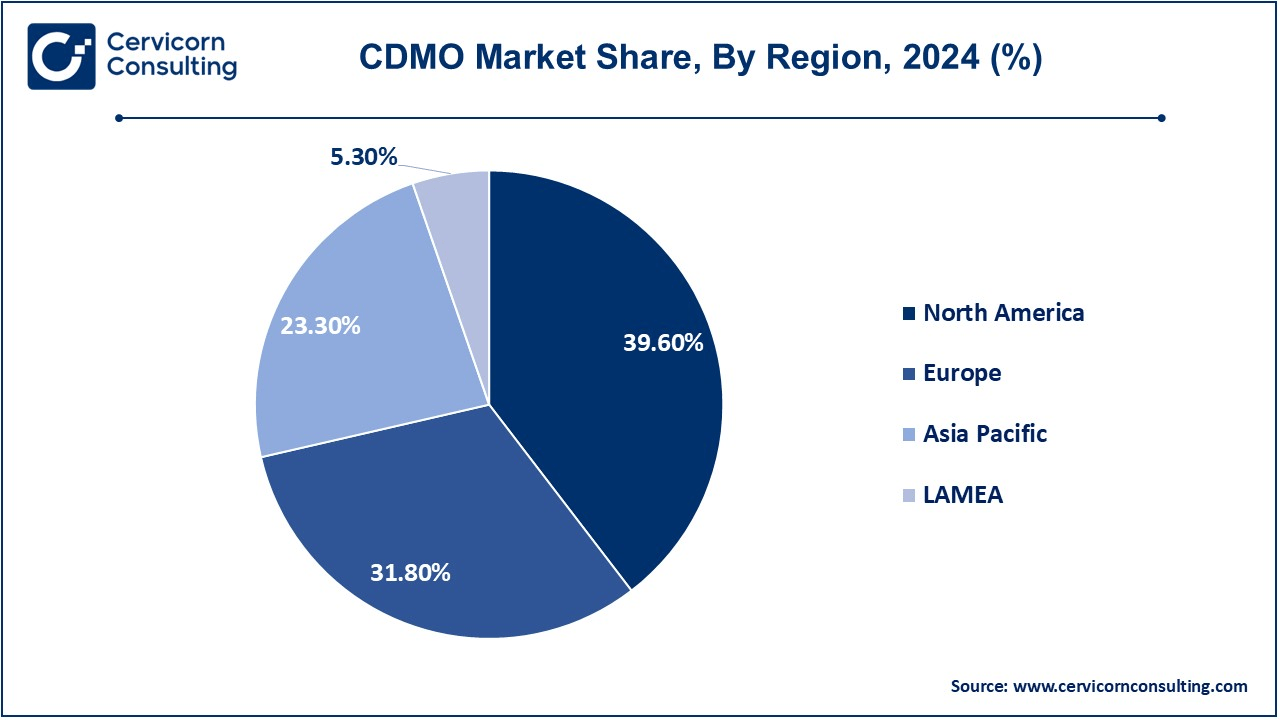

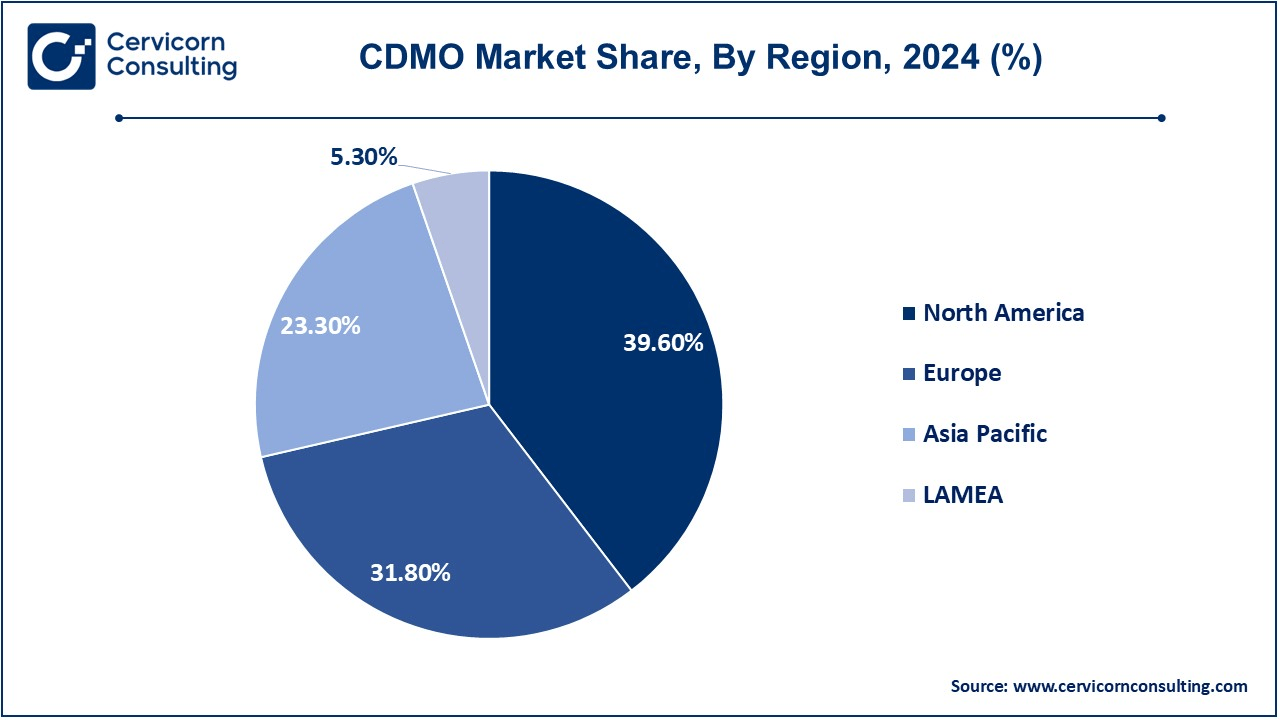

- In 2024, the North America region is expected to dominate the market, holding a revenue share of 39.60%.

- The Europe region holding a revenue share of 31.80% in 2024.

- The Asia-Pacific region is expected to witness fastest growth during the forecast period.

- By service, the CMO segment has accounted highest revenue share of 64% in 2024.

- By service, the CRO segment has held revenue share of 36% in 2024.

Key Global Trends & Market Shifts

- Tech Convergence & Innovation: CDMOs are integrating advanced technologies such as AI/ML-enabled process optimization, continuous manufacturing, and single-use bioreactor systems to meet the demands of modern biologics and personalized therapies.

- M&A and Capability Expansion: Leading operators (e.g., Lonza’s exit from the capsule business, M&A by Siegfried, Suven–Cohance merger) are consolidating service portfolios, which include biologics, APIs, ADCs, and small molecules to deliver end-to-end integrated services.

- Regional Supply-Chain Diversification: Political and regulatory shifts, such as the U.S. Biosecure Act, are prompting pharmaceutical firms to reduce their sourcing from China, boosting CDMO expansion in North America, Europe, India, and Southeast Asia.

- Government Support Programs: Countries such as Saudi Arabia (Public Investment Fund’s Lifera), India (advocating CRDMO parks and raw-material support), and others are actively investing to localize pharmaceutical manufacturing and enhance national resilience.

Market Snapshot

| Metric |

Details |

| Active CDMO Facilities |

Over 1,400 globally certified facilities (small and large molecule) |

| Biologics Share in New CDMO Projects |

Over 60% of new CDMO investments focus on biologics, including mAbs, ADCs, and cell/gene therapy. |

| US FDA-Approved Indian CDMO Sites |

Over 200 Indian sites approved by USFDA, among the highest outside the U.S. |

| Export Share of Indian CDMO Players |

Exports account for approximately 70–80% of revenue for major Indian CDMOs such as Suven, Divi’s, and Syngene. |

| New Molecules Outsourced to CDMOs |

Approximately 45% of NMEs approved by the FDA in 2023 utilized CDMO support at some stage. |

| EU GMP-Accredited CDMOs |

Over 500 facilities across Europe have EU-GMP certifications for contract manufacturing |

| U.S. CDMO Workforce |

Approx. 85,000–100,000 employees engaged in CDMO-specific operations |

| China+1 Strategy Adoption (New Contracts) |

Approximately 30–40% of new contracts in 2023–24 avoided China-based CDMOs in favor of Indian and EU alternatives. |

Growth Factors

- Increase Complexity of Biopharmaceuticals: Increased complexity in biopharmaceutical products, like biologics, gene therapies, and personalized medicines, is the greatest driver of the CDMO market. Since the products require high-end technologies and manufacturing expertise, pharmaceutical companies have depended on contract development and manufacturing organizations. As the pharmaceutical industry shifts towards biologics and other complex therapies, demand for specialized manufacturing processes, such as cell culture systems and viral vector production, increases. Experienced CDMOs in complex areas can offer specialized services needed to meet those demands and, therefore, will be an important partner for drugmakers.

- Increase R&D Spending: Pharmaceutical companies make more investments in research and development, especially regarding new innovative drugs. Some of the areas of focus include oncology, immunotherapy, and rare diseases. Companies usually outsource manufacturing and development of new drugs with high R&D efforts. This will enable the pharmaceutical company to stay focused on its core competencies; drug discovery and clinical trials may be entrusted to CDMOs, which manage their infrastructure and scale up. In fact, with the increase in pressure for a shorter time-to-market of new therapies, this trend will continue to rise.

- Advances in Contract Manufacturing Technology: The CDMO market continues to expand in light of continued advancements in contract manufacturing technology, including optimized processes, increased automation, and sophisticated analytical techniques. These innovations increase production efficiency, product quality, and compliance with regulations, allowing CDMOs to offer more aggressive and cost-competitive services. For instance, continuous manufacturing may improve the process of biologics while AI and ML in process development will help enhance the workflow in the manufacturing process. It is through this aspect that CDMOs can harness this technology to fill the ever-rising need of the pharmaceutical sector for high-quality and scalable manufacturing solutions.

Market Trends

- Industry Consolidation: This trend of consolidation in CDMO seems to be a little more pronounced, where bigger companies are engulfing smaller firms under their basket so that they increase the range of services they can deliver and expand reach. Companies will do this tapping into a far greater pool of capabilities, perhaps in specialist technologies or facilities which might be needed for highly demanded drug types or biologics or gene therapies. In addition to these, big organizations can also streamline their operations and raise their bargaining power against the pharmaceutical companies so that they can obtain long-term high-value contracts through mergers and acquisitions of smaller CDMOs.

- Expansion into Emerging Markets: CDMOs are now beginning to focus more on emerging markets such as the Asia Pacific, Latin America, and Eastern Europe to seek the increasing demand for pharmaceutical manufacturing services. Emerging markets pose affordable manufacturing platforms, a maturing base of biopharma companies, and improving healthcare infrastructure to make locations an attractive playground for CDMO expansion. These regions have helped a strong pharma industry, quality workforce, and fierce competition empower CDMOs in tapping additional streams of income and reaping cheaper operational expenses.

- Growing Demand for Flexible Manufacturing Solutions: The trend towards flexible manufacturing solutions continues to grow, because pharmaceutical companies require more CDMOs that are able to be flexible with rapidly changing market requirements. These are multi-product lines and quick ramp-up and down scaling to change with drug development cycles. High demand for such flexible, modular production platforms or multi-use facilities is witnessed from CDMOs. This is highly relevant in the biologics sector, as drug manufacturers would need to change the production volumes depending on market demand and clinical trial results.

- Integration of Digital Technologies: AI, IoT, and data analytics are the key digital technologies in the CDMO industry, which is creating a revolution in this sector. The primary intent of these integrations is the improvement of the operational efficiency along with quality control. These facilitate the CDMOs to have real-time views of the manufacturing processes, thus reducing errors as well as the chances of failing to comply with regulations. Through this digitalization process, CDMOs will increasingly become transparent and efficient in service delivery to the clients with increased speed of making decisions and good communication throughout the supply chain. Of course, this trend arises from further innovations in the process of contract manufacturing brought about by the continuous progress of digital technologies.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 263.04 Billion |

| Expected Market Size in 2034 |

USD 489.14 Billion |

| Estimated CAGR 2025 to 2034 |

7.13% |

| High-impact Region |

North America |

| High-growth Region |

Asia-Pacific |

| Key Segments |

Service, Product, End User, Region |

| Key Companies |

IQVIA, ICON plc, Syneos Health, Vetter, Parexel International (MA) Corporation, Recipharm AB, Curia Global, Inc., Thermo Fisher Scientific Inc., Unither, DPT Laboratories, LTD. NextPharma Technologies, Lonza |

Market Dynamics

Drivers

- Cost pressures on drug manufacturers: The rising operating cost is driving pharmaceutical companies to outsource some of the specific functions, drug development and manufacturing, to CDMOs. The function outsourcing enables pharmaceutical companies to skip the capital-intensive process of constructing and maintaining the manufacturing facility in-house. An economical solution CDMOs are because of the economies of scale and specialized infrastructure. Pharmaceutical companies can focus more on R&D and commercialization rather than on manufacturing. The cost-effective model is the biggest growth driver of the CDMO market.

- Accelerated Drug Development: The market is mounting pressure on the pharmaceutical industry to develop the new drug within a much-reduced timeframe. In a field like oncology and rare diseases, where competition is fierce, consumers are looking for a company that can give them quick, efficient development and manufacturing processes, hence CDMOs. CDMOs can shorten the timeline for drug development of pharmaceutical companies through process optimization, scale-up support, and the production of clinical trial material. Drugmakers may then bring their products to the market faster while competing with the best.

- Increased Demand for Specialty Drugs: Specialty drugs include biologics, cell and gene therapies, and personalized medicine, and require specialized manufacturing techniques. Such complex drugs may require highly tailored production processes and regulatory expertise. Opportunities for the CDMO with such specialty will be on the rise because chronic diseases, cancer, and rare conditions have increased in recent years. All of these can lead to high demand for the types of therapies. With expertise in producing these sophisticated drugs, CDMOs are ready to take on the growing market segment.

- Regulatory Challenges and Expertise: Another major key driver for the CDMO market growth is in the complexity of the regulatory environment found in the more mature markets like the U.S. and Europe. Pharmaceutical firms face great regulatory hurdles, which are particularly huge when dealing with novel therapies. Thus, it has been of immense value for most CDMOs in understanding the global norms on GMP and FDA approvals. In outsourcing manufacturing to an experienced CDMO, pharmaceutical companies are assured that their products comply with the appropriate regulations, thereby expediting market access and reducing the risk of costly delays.

Restraints

- Regulatory Challenges: Among the primary restraints in the CDMO market is the complicated and diverse nature of the regulatory landscape across regions. Pharmaceutical companies have to cope with varied regulatory frameworks of each market where they want to enter. Compliance with these changing standards and remaining compliant with various GMP, FDA guidelines, and EMA requirements can be challenging and time-consuming for CDMOs. Such barriers create a holdup in drug development and manufacturing. Therefore, the extension of operations of a CDMO or operating it across many regions becomes tough.

- High capital investment: A significant constraint for smaller CDMOs is the requirement for high capital investment in state-of-the-art facilities. Setting up facilities that meet industry standards, especially in complex biologic or gene therapy production, is expensive and requires a lot of upfront costs for equipment, technology, and regulatory approvals. This can prove difficult for smaller or mid-size CDMOs to obtain capital for such investment and may thereby limit their competitive ability against larger, more well-established players. Further, such infrastructures' running and up-gradation call for continuous investment, which in turn becomes a burden on the financial resources.

- Intellectual Property Issues: Intellectual property protection is still a significant issue for pharmaceutical companies and CDMOs. If the pharmaceutical companies are choosing to outsource, their proprietary formulations, manufacturing processes, and technologies are also on the table. Similarly, managing and protecting intellectual property will become a challenge for the CDMOs, since it is their lifeblood and what keeps them competitive. In fact, pharma companies tend to be rather cautious in selecting CDMOs for manufacturing and development, fearing IP disputes or breaches of confidentiality may invite legal challenges, financial losses, and reputational damage.

Opportunities

- Growth in Biologics and Cell & Gene Therapies: As a rapidly growing market due to increasing demands for biologics, which include monoclonal antibodies, vaccines, and cell and gene therapies, such opportunities abound in the hands of CDMOs. With increasing trends in global biopharmaceutical markets switching towards biologics, and as more interest in large-scale biologic productions or specialized therapy, such as gene editing, arises, such companies will attract great demand. This trend represents a significant growth opportunity for CDMOs that can offer advanced technologies and expertise in biologics manufacturing since these therapies require highly specialized knowledge and equipment.

- Expanding Service Offerings: The CDMO has the avenue to expand its reach of services out of the limited traditional manufacturing because it can work in drug development, clinical trial materials, regulatory services, and at a commercial scale, thus providing seamless services from early drug discovery phases through commercialization opportunities for deeper interaction with pharmaceutical company clients. Of course, besides adding value, this one-stop-shop approach further allows the company to develop higher-value, higher-margin relationships than the drug-making companies.

- Emerging Markets Expansion: The pharmaceutical and biotech industries are rising in emerging markets, especially within Asia Pacific, Latin America, and Eastern Europe, offering new potential for CDMOs. These are rapidly emerging in healthcare spending, biotechnology innovation, and regulatory sophistication, so a strong demand for contract manufacturing services. The expansion of operations into these areas by CDMOs will enable them to take advantage of cost-effective manufacturing, skilled labor, and increasing demand for both generics and novel therapies. The markets therefore offer CDMOs the potential to tap new customer bases while having lower operational costs.

Challenges

- Cost Competitiveness: The hardest competition CDMOs face in achieving this lies in the cost competitiveness of high-quality manufacturing services. Pharmaceutical companies always seek lower production costs about what's being put upon them, mainly the need for high-quality output and severe regulation compliance. These demands might be very conflicting in an environment where the customers are increasing pricing pressure on the CDMO. The costs associated with raw materials, labor, and technology have also continued rising, squeezing the profit margins of the CDMO.

- Technology developments: The fast-moving developments in the biotechnology and pharmaceutical manufacturing fields challenge the CDMOs constantly to keep on updating their abilities to compete and be able to keep pace. The investments necessary in new technologies for continuous manufacturing and advanced bioprocessing apparatus are enormous and demanding in order to have sufficient highly qualified specialists and finances. Pharmaceutical companies are demanding cutting-edge solutions for complex drug manufacturing processes, and those CDMOs which fail to keep pace with technological developments may become obsolete.

- Talent shortages: Finding and retaining competent workforce in these sectors, including the biologics, gene therapy, and advance manufacturing processes is going to pose a serious issue for the CDMO. As far as shortages of highly skilled labor are considered, it may outpace demands and affect both quality and efficiencies of the manufactured products. It poses a significant challenge to CDMOs operating in areas classified as high-tech and highly regulated, where specialist knowledge is important for success. Without a good workforce, it becomes difficult for CDMOs to meet clients' demands as well as run operations efficiently.

Market Segmental Analysis

The CDMO market is segmented into service, product, end user, region. Based on service, the market is classified into CMO and CRO. Based on product, the market is classified into small molecules and biologics. Based on end user, the market is classified into big pharma, small and mid-size pharma, generic pharmaceutical companies and other.

Service Type Analysis

CMOs Segment includes

Active Pharmaceutical Ingredient (API) Manufacturing: Active Pharmaceutical Ingredient (API) manufacturing is a significant service in the CDMO market, as the development of active ingredients makes up the pharmaceutical drug. In this segment, CDMOs offer several services including development, synthesis, and large-scale production of APIs. They ensure that these ingredients are developed in the line with stringent regulatory requirements while optimizing the process to be cost-efficient and of quality. It is a sensitive process requiring knowledge in chemical reactions, scalability, as well as Good Manufacturing Practices.

Finished Dosage Formulation (FDF) Development and Manufacturing: The FDF development and manufacturing process sees CDMOs convert APIs into final drug forms that can be administered directly to patients in forms such as tablets, capsules, creams, or injectables. In this respect, the APIs are optimized in formulation for stability, bioavailability, and compliance from the patient perspective. Scaling up production to meet demand while maintaining final dosage forms in accordance with regulatory requirements are also important considerations for CDMOs. Some services offered under this category are pre-formulation, formulation development, clinical trial material production, and commercial-scale manufacturing.

Secondary Packaging: The last steps of secondary packaging are used to prepare the pharmaceutical products for distribution and sale. CDMOs can offer secondary packaging services, which range from labeling, blister packaging, bottling, and carton packaging. A CDMO can guarantee that the packaging is regulatory compliant with serialization features and other requirements such as tamper-evident features. Packaging is primarily meant to protect the product during transport, ensure proper identification, and prevent counterfeiting, thus providing protection for the patient and integrity of the product.

CROs Segment includes

Preclinical: Pre-clinical services include all the research and testing conducted before the human trials. This is where the safety, pharmacokinetics, and toxicology of the new drug candidates are assessed using laboratory and animal studies. Preclinical service-specializing CROs provide sponsors with critical data for determining the feasibility and safety of compounds, enabling them to determine whether or not to conduct clinical trials. They also ensure that studies follow regulatory guidelines.

Phase I: These trials, also called the first human experiments, involve conducting Phase I safety and dosing, with additional studies to check the drug's pharmacokinetic properties. A CRO dealing with this section manages small scale early phase experiments on healthy volunteers or patients and finds how it acts within a human's body. The pharmacological company develops a range for safe dosage limits, detects potential adverse effects, and assembles information for later clinical developments.

Phase II: Phase II trials are designed to determine the efficacy and optimal dosage of a drug in patients who have the condition the drug is intended to treat. CROs offer services in the areas of trial design, patient recruitment, data collection, and regulatory compliance. The purpose of Phase II is to establish preliminary evidence that the drug works while continuing to monitor safety.

Phase III: Phase III trials are large-scale investigations conducted to verify the efficacy and safety of a drug in an expanded patient population. CROs manage such pivotal trials that provide critical data required for obtaining regulatory approval. This phase is crucial for showing the benefit-risk profile of the drug and, therefore, comprises extensive clinical trials to support the marketing authorization provided by the relevant regulatory bodies.

Phase IV: Phase IV is post-marketing surveillance and studies performed after a drug has been marketed in the commercial arena. CROs help the pharmaceutical company follow up on long-term safety, efficacy, and adverse effects of a drug on the actual population. They help with regulatory reporting and ensure that marketed drugs are continually kept under regulatory compliance.

Regional Analysis

Why is North America leading the CDMO market?

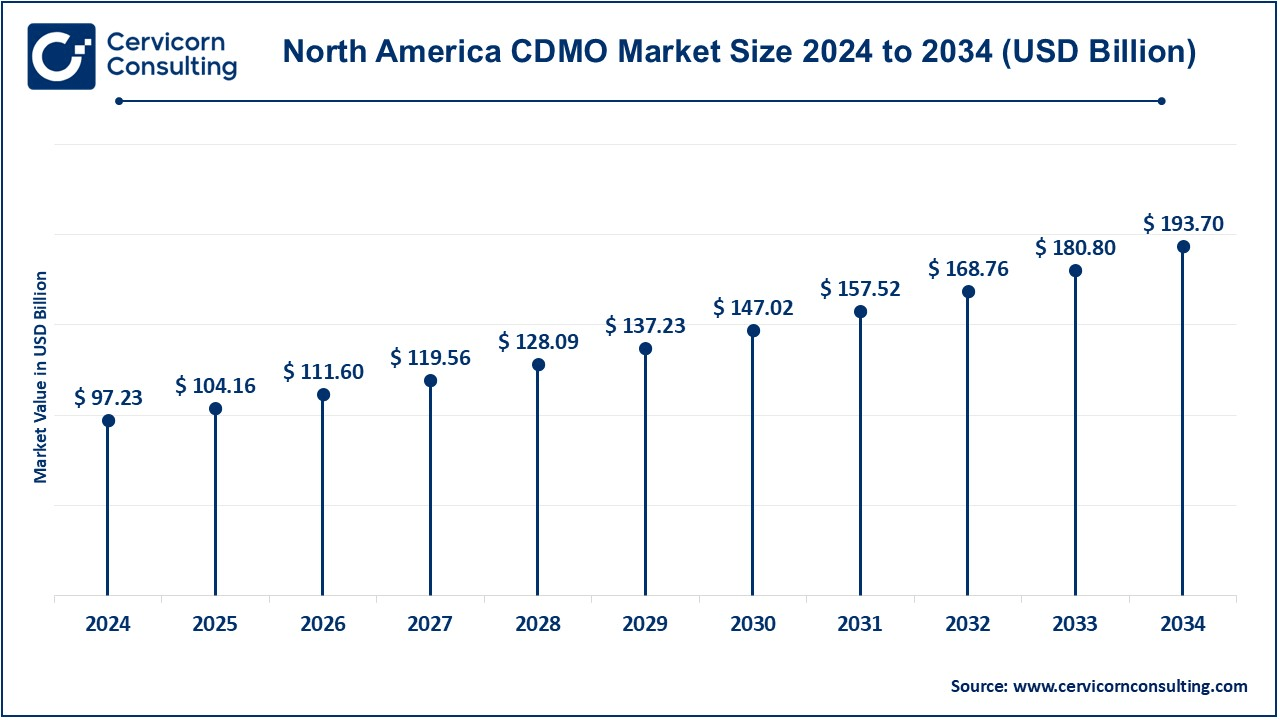

The North America CDMO market size was valued at USD 97.23 billion in 2024 and is expected to hit around USD 193.70 billion by 2034. North America comprises the United States, Canada, and Mexico. The U.S. is the leading market participant since its pharmaceutical and biotechnology industries are robust; e.g., it has an extensive healthcare infrastructure and a strong demand for contract development and manufacturing services. Canada and Mexico contribute to the continent, but both have experienced strong pharmaceutical industries under better regulatory environments and are exporting further growth in the region's CDMO market. Statistics Canada tracked performance in the pharmaceutical industry through its surveys conducted in 2021, up until June 2024. In the year, a modest growth margin was experienced from the 2020 level, whereby the industry had invested about USD 16 billion into the economy. However, it still suffered other problems, which included operating at a loss of USD 2.2 billion besides holding 102,717 fewer full-time jobs equivalents at 4.9%. Despite the disappointment listed, the industry remains significant, especially in Ontario and Quebec, which produced most of its economic activity.

Why Europe hit notable growth in the CDMO market?

The Europe CDMO market size was estimated at USD 78.08 billion in 2024 and is expected to surpass around USD 155.55 billion by 2034. The area accommodates some of the major countries, like Germany, the UK, France, Italy, and Spain, with well-developed pharmaceutical sectors. Strong regulatory environments and a surge in the outsource manufacturing operations require CDMOs in this region. Some of the major pharmaceutical players, coupled with the growth of biosimilars and complex drugs, have contributed to their large market share. Novo Nordisk had announced in November 2023 that it was confirmed to make an investment to the tune of USD 2.3 billion at an expansion for its production plant in Chartres, France as it expects its anti-obesity and diabetes medicines to be producible there. The extension will take the capacity to more than two fold and increase the direct employment opportunity over 500 jobs by the year 2028. These investments form a part of an effort by France's President, Emmanuel Macron to rebalance local manufacturing and pharma capacities amid the latest waves of drug shortages and position Novo Nordisk at the centre of the developing anti-obesity market.

Why is Asia-Pacific fast-growing CDMO market?

The Asia-Pacific CDMO market size was accounted for USD 57.21 billion in 2024 and is forecasted to surpass around USD 113.97 billion by 2034. Asia-Pacific comprises China, Japan, India, South Korea, and Australia. Both China and India offer low-cost manufacturing options and have skilled labor with a fast-growing market. Japan and South Korea are known to have a developed pharmaceutical industry and invest considerably in the provision of contract manufacturing services. For example, the pharmaceutical market in Japan stood at around USD 106 billion in 2021 to date May 2024. The big deterrents in this market include a very rigorous regulatory environment, competition level, and demographics because of its aging population. Entry would be feasible if one does enough research, adheres to local standards, and possibly forms alliances with established companies. Areas like biopharmaceuticals and AI-driven drug development are interesting in the sense that the government is trying to help through initiatives, and policies friendly to innovation also are in place. Cost advantage makes this region very attractive for global pharmaceutical companies that look for low-cost solutions.

LAMEA CDMO Market Trends

The LAMEA CDMO market size was valued at USD 13.01 billion in 2024 and is anticipated to reach around USD 25.92 billion by 2034. LAMEA includes Brazil, Argentina, Mexico, Saudi Arabia, UAE, and South Africa. The main pharmaceutical markets in Latin America are Brazil and Mexico, which have a high demand for CDMO services as healthcare needs are growing and more companies are outsourcing. In the Middle East, pharmaceutical investments are on the increase particularly in countries like Saudi Arabia and the UAE, which enhances contract manufacturing in that region. Expanding healthcare infrastructure and ever-growing demand for cheap medicines contribute to growth in Africa, making LAMEA a growing but significant market for CDMOs holding enormous scope.

CDMO Market Top Companies

CEO Statements

Ari Bousbib, CEO of IQVIA

- “In IQVIA Healthcare-grade AI and our commitment to compliance and privacy, your new assistant is ready to help you get results you can trust.”

Dr. Steve Cutler, CEO of ICON plc

- "At ICON plc, we are dedicated to delivering innovative, high-quality, and efficient solutions in the CDMO sector, enabling our clients to bring therapies to market faster. By leveraging advanced technologies and industry expertise, we support the pharmaceutical and biotech industries with cost-effective, scalable services that ensure regulatory compliance and timely delivery."

Philip Macnabb, CEO of Curia Global, Inc.

- "At Curia, we deliver innovative, flexible CDMO solutions to accelerate the development and manufacturing of critical therapies. By leveraging advanced technologies and expertise, we ensure quality, scalability, and compliance at every stage to meet the evolving needs of the pharmaceutical and biotech industries."

Recent Developments

- In October 2023, Lonza is increasing a partnership with a biopharma company in order to maximize the production of antibody-drug conjugates. The firm will construct a new bioconjugation suite at Lonza's Ibex Biopark in Visp, Switzerland. The operations are expected to be initiated by 2027, creating some 100 jobs. It will manufacture highly potent modalities. Additionally, the firm will also offer commercial-scale monoclonal antibody manufacturing from its facility at Porriño. It is said that Lonza would make streamlined product delivery of ADC therapies that target the area of the biggest unmet medical need, hard-to-treat solid tumors.

- In November 2024, Unither Pharmaceuticals acquires Carragelose. This includes an innovative group of products for treatment and prevention in respiratory tract infections, which include products isolated from red algae with multiple formulations against viral infections and ranges of usage in the therapy for the majority of viral infections. This move brings more offerings in the portfolio to Unither as well as helps it stand out in the pharmaceutical market. The portfolio of Carragelose aligns with Unither's strategic commitment to providing effective healthcare solutions and supports its growth objectives within the global pharmaceutical landscape.

- In October 2024, The company believes that this would be followed by strategic investment in further developments of its capabilities within pharmaceutical development, as well as its services, in formulation development and analytical testing. This group is examining the possibility of investing in new technologies and facilities, which could make the process of drug development more efficient and innovative. This plan looks forward to improving the support to be given to clients on how to take their products into the market. In other words, it will strengthen Recipharm as the leading company for contract development and manufacturing for high-quality pharmaceutical solutions in fulfilling the growing worldwide demand.

Market Segmentation

By Service

- CMO Segment

- Active Pharmaceutical Ingredient (API) Manufacturing

- Finished Dosage Formulation (FDF) Development and Manufacturing

- Packaging

- Primary and Secondary Packaging

- Blister Packaging

- Bottle Filling

- Labeling and Serialization

- Others

- CRO Segment

- Pre-clinical

- Discovery

- Phase I

- Phase II

- Phase III

- Phase IV

By Product

- Small molecules

- Biologics

By End User

- Big Pharma

- Small and Mid-size Pharma

- Generic Pharmaceutical Companies

- Other

By Region

- North America

- APAC

- Europe

- LAMEA