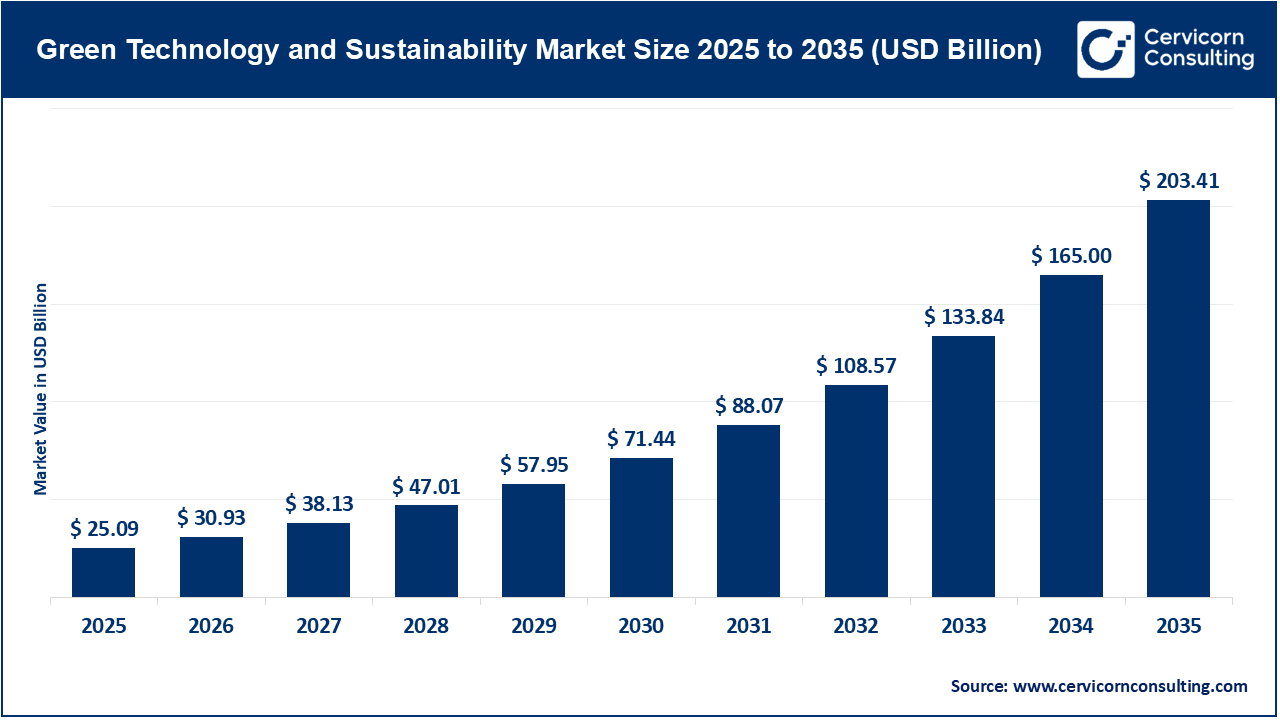

The global green technology and sustainability market size was valued at USD 25.09 billion in 2025 and is expected to be worth around USD 203.41 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 23.3% over the forecast period from 2026 to 2035. The global green technology and sustainability market is in the middle of an ever-changing growth spurt, transitioning from a niche aspect of corporate social responsibility to a fundamental aspect of the current industrial economy.

The primary macroeconomic drivers of this market are likely connected to the global imperative for decarbonization and the increasingly critical implementation of environmental, social, and governance (ESG) considerations in business models. For instance, governments have created aggressive policy frameworks, such as the European Green Deal and the U.S. Inflation Reduction Act, which provide the fiscal incentives and regulatory requirements to de-risk green investments. At the same time, the financial sector has begun to correlate the cost of capital to ESG performance, therefore creating an economic feedback loop. Companies that do not adopt sustainable technologies face regulatory penalties, increased capital costs, and negative investor perception, while leading green technology companies, which receive immediate cost/efficiencies, attract positive investor perception.

Leveraging Digital Twins and Analytics to Achieve Sustainable Operations

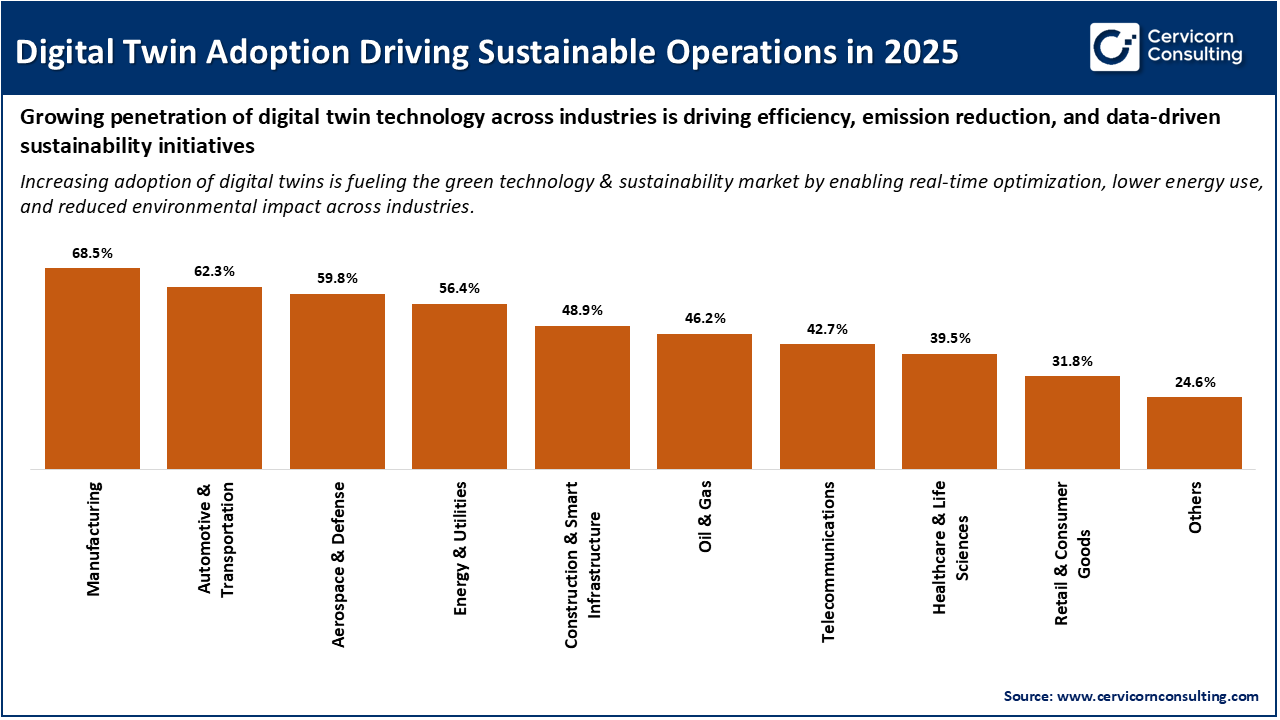

Sustainable digital transformation is the most relevant trend present in the market; that is, the utilization of Industry 4.0 technologies (e.g., ERPs, digital twins, industrial analytics, etc) are being redirected to mitigate ecological crises. Research indicates that deploying digital twins and predictive analytics can create real time optimization of industrial processes and achieve up to an 80% reduction in waste and energy consumption. This Twin Transition is pathway to ensure sustainability is woven into the modernization of IT infrastructure through decreasing environmental footprint. The trend is consuming toward autonomous sustainability, where AI and machines manage building environments and manufacturing lines with minimal human input, while simultaneously maximizing efficiency through continuous machine learning.

The image highlights widespread adoption of digital twin technology across industries in 2025, particularly in asset-intensive sectors, indicating a strong shift toward data-driven and sustainable operations. This growing adoption is driving the green technology and sustainability market by increasing demand for cloud-based platforms, AI and analytics, and real-time monitoring solutions that enable energy optimization, emission reduction, and waste minimization. As organizations leverage digital twins for predictive maintenance and process efficiency, investments in sustainable digital infrastructure continue to rise, reinforcing the “Twin Transition” where digital transformation directly supports environmental and operational sustainability goals.

1. Major Government Initiatives and Carbon Reductions Statistics

In recent years, government policies have acted as the regulatory floor for the green technology market. The U.S. Inflation Reduction Act (IRA) and the EU's Carbon Border Adjustment Mechanism (CBAM) have fundamentally changed the competitive landscape on a global scale. In fact, empirical evidence suggests these policies catalyzed an increase in domestic manufacturing for clean energy components and forced international trade partners to align towards stricter standards for carbon accounting. A recent statistical study in 2024 illustrate a measured decoupling of economic growth and carbon emissions in several developed economies including the U.S., UK, Eurozone, and Japan - demonstrating that green technology integration can produce industrial output and still meet the most aggressive net-zero goals.

2. Transition of Capital Markets to Renewable Infrastructure Investment

The market has transitioned (strategically) in allocated capital to renewable energy infrastructure investment, expanding beyond solar and wind to long-duration energy storage and advanced grid management. Breakthroughs in solid-state battery technology and grid-scale thermal storage have helped address the intermittency challenges associated with renewable resources. In 2025, green bonds and sustainable financing volumes reached all-time highs, indicating institutional investors now consider renewable infrastructure to be imperative to core asset class investment. This milestone matters as it defines and supplies the liquidity necessary to transition national power grids to reliablity and decarbonized.

3. Corporate Adoption of Carbon Accounting Standards

A pivotal moment in the corporate sector has been the widespread adoption of rigorous carbon accounting standards - specifically Scope 3 emissions reporting. Similar to how the SEC's climate disclosure mandates and the EU's Corporate Sustainability Reporting Directive (CSRD) are requiring companies to disclose audited information on the environmental impacts of their entire value chain. This shift has created a rapid uptick in specialized ESG SaaS platforms that integrate with incumbent Enterprise Resource Planning (ERP) software. Unless demand signals immediate fiber precursor material availability, organizations have moved from estimating their carbon footprints to carbon accounting based on primary data. This milestone cannot be overstated - it represents a significant leap toward providing demand-side financial-grade transparency in environmental data.

4. Global Expansion of Green Hydrogen Production Facilities

The global expansion of green hydrogen production facilities represents an important development to help drive industrial decarbonization with hard-to-abate sectors like heavy manufacturing and shipping. During 2024-2026, numerous multi-gigawatt electrolyzer projects sanctioned final investment decisions, driven by government subsidies for those interested in carbon neutral hydrogen distribution models or corporate off-take agreements. This expansion is critical for developing a successful hydrogen economy capable of replacing a stram of fossil fuels in industrial processes requiring high-heat. Further, the focal point for project development has shifted toward reducing the levelized cost of hydrogen through technological innovations in membrane efficacy and scaling demands for electrolyzer component manufacturing.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 30.93 Billion |

| Market Size in 2035 | USD 203.41 Billion |

| Market CAGR 2026 to 2035 | 23.30% |

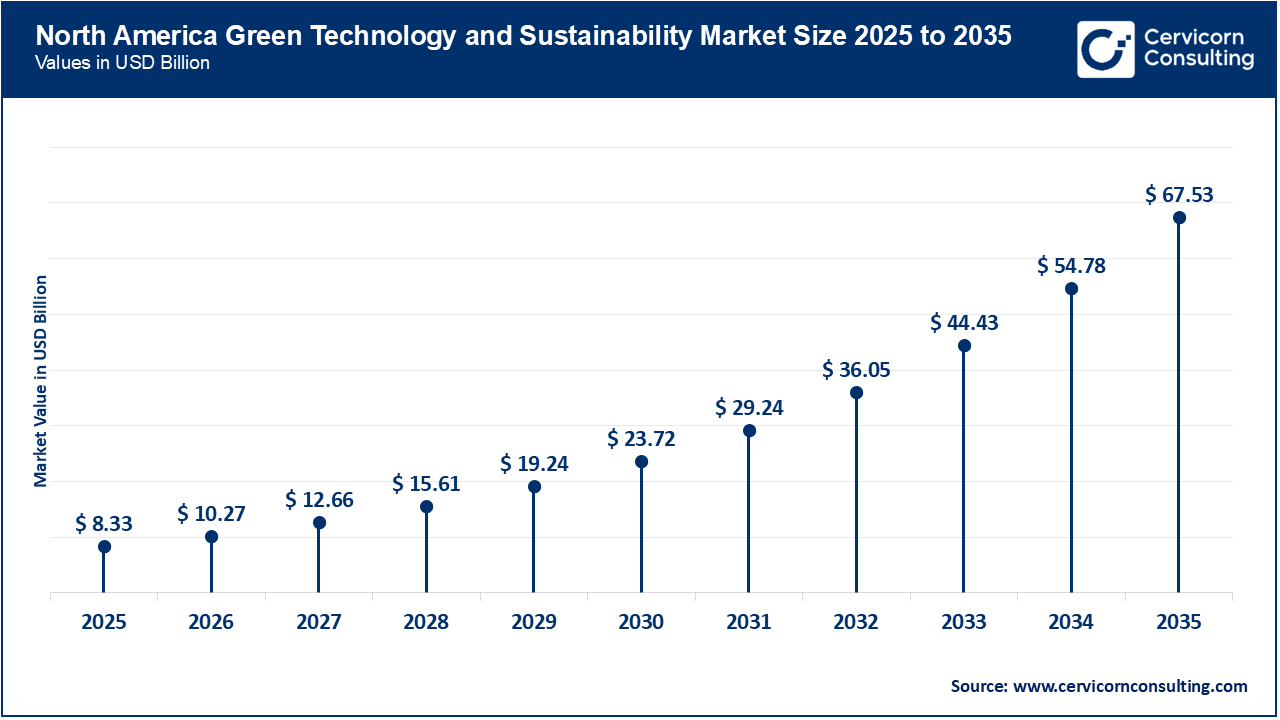

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Offering, Technology, Application, End User, Region |

| Key Companies | Schneider Electric, Siemens, IBM, SAP, Microsoft, Google, Amazon Web Services (AWS), Salesforce, Oracle, GE (General Electric), EcoVadis, Engie Impact, Persefoni, Watershed |

The green technology and sustainability market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America green technology and sustainability market size was estimated at USD 8.33 billion in 2025 and is expected to reach around USD 67.53 billion by 2035. North America is currently in the lead due to its strong technological infrastructure and its venture capital ecosystem, and ample innovation hubs. The markets will be driven largely by the United States Inflation Reduction Act (IRA) that will put billions of dollars into domestic clean energy manufacturing and carbon capture projects. In addition to these fast growing or rapidly emerging sectors, technology giants such as Microsoft, Google, and Amazon, which are accelerating the development of sustainability software and cloud-based ESG tools. These are not just nature-based software producers but also large consumers themselves, setting targets for net zero that have huge impacts for their large supplier networks across North America.

Recent Developments:

The Asia-Pacific green technology and sustainability market size was valued at USD 6.12 billion in 2025 and is projected to surpass around USD 49.63 billion by 2035. The Asia-Pacific region is the fastest growing market. Rapid industrialization, huge urbanization, and aggressive government policies are driving this growth. China, India, and Japan are developing and heavily investing in renewable energy and smart city infrastructure to combat pollution and energy security concerns. China is leading the industry through their growth in producing solar panels, wind turbines, and EV batteries. Along with investment into renewable energy, macro-trends are driving the shift toward sustainable practices in Southeast Asian manufacturing, to maintain their competitive advantage in a global market driven by green supply chains.

Recent Developments:

The Europe green technology and sustainability market size was reached at USD 5.52 billion in 2025 and is forecasted to hit around USD 44.75 billion by 2035. Europe is characterized by a mature market ecosystem with the most holistic regulatory mandates globally. The European Green Deal and Corporate Sustainability Reporting Directive (CSRD) have created a standardized and transparent environment for the adoption of green technology. As a result, European companies tend to lead the industry in circular economy practices and carbon accounting practices. Europe is placing emphasis on the Twin Transition, which have prompted significant developments in industrial software and green hydrogen. In addition, the European financial sector is advancing and providing sustainable finance, and has already enacted strict taxonomies to guide capital to activities that support the environment, ensuring the investment flow is maintained to the green tech market.

Recent Developments:

Green Technology and Sustainability Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 33.2% |

| Asia-Pacific | 24.4% |

| Europe | 22.0% |

| LAMEA | 20.4% |

The LAMEA green technology and sustainability market was valued at USD 5.12 billion in 2025 and is anticipated to reach around USD 41.50 billion by 2035. The LAMEA region presents new opportunities, especially in the areas of natural resource management and renewable energy potential. Middle Eastern oil-exporting countries are diversifying their economies with enormous investments in solar power and green hydrogen projects and aspire to be in the driver’s seat for energy in the future. In Latin America and Africa, nations tend to concentrate on sustainable agriculture, forest partnerships, and utilizing decentralized renewable energy systems to increase energy access. The current LAMEA market is small compared to the global north, but it has possibilities to grow as it can skip the traditional fossil-fuel intensive development and leapfrog to green technologies.

Recent Developments:

The green technology and sustainability market is segmented into offering, application, technology, end user, and region.

In terms of market penetration, software currently dominates in frequency of use, because software delivers the data layer required for actual deployment and monitoring. ESG management platforms, carbon accounting software, and energy management systems (EMS) now provide visibility and audit trail of impacts with minimal physical disruption to organizations. Software as a service (SaaS) platforms allow for scale and integration into existing ERP systems as a single source of truth for sustainability data, trust and governance structure possibilities.

Green Technology and Sustainability Market Share, By Offering, 2025 (%)

| Offering | Revenue Share, 2025 (%) |

| Software | 57.8% |

| Services | 42.2% |

Alternatively, the services segment is growing rapidly as organizations engage with the private sector to find expertise in the regulatory and technical landscape. Services include strategic consulting for net-zero road mapping, technical audits for carbon footprint assessments, and managed services for renewable energy procurement. As the regulatory landscape continues to become more stringent, so does the demand for third-party verification and assurance services. While hardware, such as sensors, smart meters, and carbon capture equipment remain the physical platforms for the market, more of the value is shifting toward the software that evaluates the data and the services that evaluate the software for strategic positioning.

In applications, corporate ESG reporting, and energy emission reduction are the two leading segments. The push for corporate transparency has made ESG reporting a State of Affairs (SoA) function for large firms. This application generates data across environmental metrics (carbon, water, waste), social metrics (labor practices, diversity), and governance metrics (board composition, ethics). That the segment is of high maturity is less due to an accountable framework and compliance with international reporting mandates and more due to the data requirements of institutional investors seeking to develop ESG scores as proxy measures of long-term risk mitigation.

Green Technology and Sustainability Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Corporate ESG & Compliance | 26.4% |

| Energy & Emission Reduction | 21.2% |

| Carbon Neutrality & Climate Strategy | 18.6% |

| Sustainable Supply Chain & Logistics | 13.8% |

| Environmental Protection & Regulatory Compliance | 11.4% |

| Others | 8.6% |

Energy emission reduction applications are equally important and can address the immediate mitigation of Scope 1 and Scope 2 emissions. The implementation of building monitoring technology, industrial energy improvements, and the evolving phase-out of traditional energy sources are examples of some the improvements. Research shows that energy management is typically the first entry point for firms entering the green technology landscape, as the immediate return on investment (ROI) is measurable (i.e., reduced utility expense). The inclusion of IoT capabilities and AI models enables organizations to analyze energy use at a granular level across various platforms while proactively responding to grid and carbon intensity conditions.

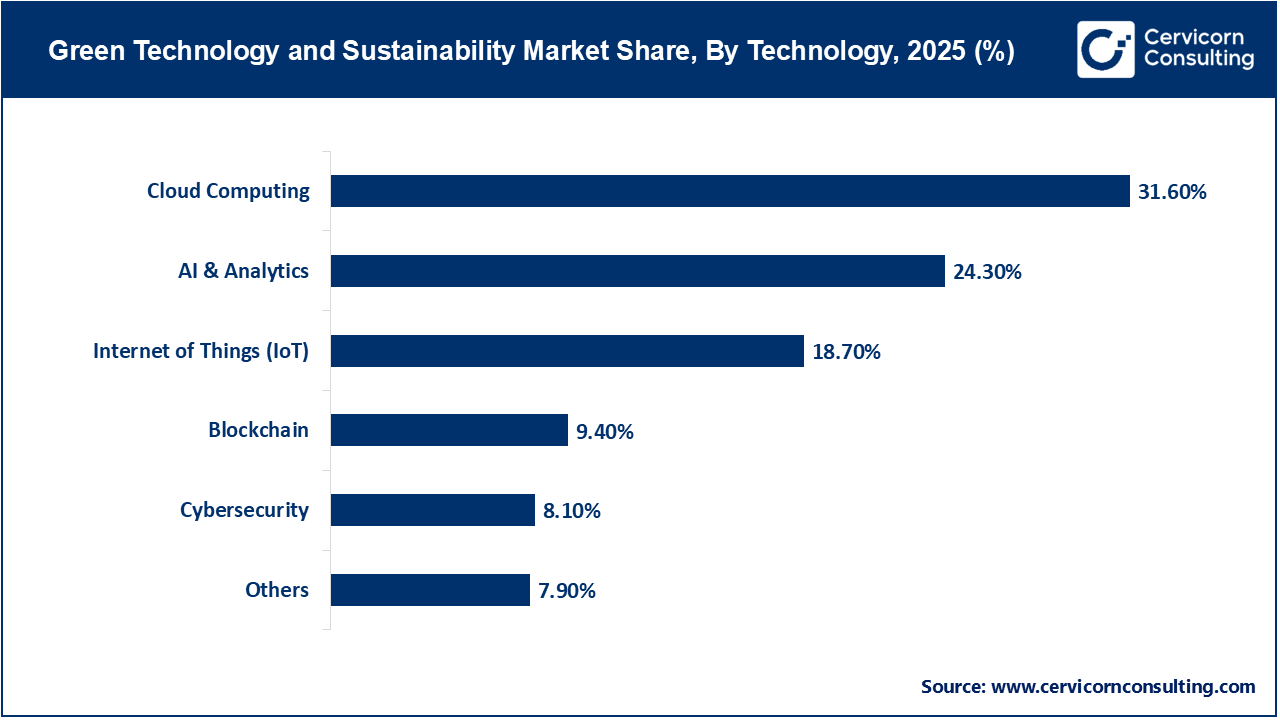

The technological segment of the green technology and sustainability market is framed through the convergence of cloud computing and artificial intelligence (AI). The cloud serves as a missing component for the necessary infrastructure correlating to explosion of Sustainability Apps, which need the scale provided in order process volumes of environmental data sourced from global supply chains. The Sustainability Clouds provide data centralization that dismantles proprietary silos with views of a company's environmental footprint from a total corporate perspective.

AI and generative analytics mark the next era of market transformation from reporting backwards to optimizing prediction. AI-based systems can manage energy grids and industrial operations. However, one major contradiction exists with this trend: the energy requirements of the AI models. Research has shown that the power consumed at the data centers hosting these sustainability tools could potentially offset some environmental benefit and necessitates green AI to improve computing architectures for energy efficiency.

The sectors of energy, utilities, and manufacturing mark up the highest demand for green technology due to their high carbon intensity and exposure to direct regulations. In the energy and utility sector, the current focus is on the energy transition, which involves the shift from highly centralized fossil fuel power generation to decentralized, renewable-heavy grids. To do this requires huge investments into smart grid technologies, energy storage, and developing demand-response systems. Energy users are increasingly seeing their utility companies positioning themselves more as energy service providers, working with their customers to optimize their consumption through green tech.

Green Technology and Sustainability Market Share, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Technology & Software Providers | 14.2% |

| Telecommunications | 7.9% |

| Retail & Consumer Goods | 12.4% |

| Transportation & Logistics | 13.1% |

| Energy & Utilities | 19.8% |

| Manufacturing | 18.3% |

| Healthcare & Life Sciences | 6.7% |

| Others | 7.6% |

Manufacturing is crucial due to the difficulty of decarbonizing industrial processes. Green manufacturing involves practices based on a circular economy where waste is minimized, and materials are kept in use for as long as possible. Manufacturers have started deploying Internet of Things (IoT) sensors, which allow them to monitor their resource use in real time, while also experimenting with low-carbon alternatives for heat-intensive processes, such as green hydrogen or electrification. In manufacturing, adoption of green tech has less to do with compliance, but more to do with developing a more efficient, resilient production model that can withstand future resource scarcity and carbon taxes.

1. Strategic Developments in Industrial Sustainability: Schneider Electric and Siemens

The competitive landscape is evolving in a way where national and global actors that have successfully transitioned to become software-led sustainability providers are defining the industry. Schneider Electric and Siemens are leading the establishment of digital competitive advantages by embedding their core capabilities in electrical engineering and industrial automation with advanced software and digital platforms. Schneider Electric's EcoStruxure and Siemens' Xcelerator capabilities enable customers to reduce their energy use and carbon footprint across buildings, data centers, and industrial plants. The trend is the idea of Sustainability-as-a-Service, where they provide the hardware, software, and consulting for those seeking to achieve net zero targets.

2. Enterprise Software and Cloud Innovations: IBM, SAP, and Microsoft

As it relates to enterprise software, IBM, SAP, and Microsoft are competing to become the operating system for sustainability. SAP, for example, provides enterprises the capabilities to integrate carbon and sustainability metrics directly into the company's Enterprise Resource Planning (ERP) systems. There are now green ledgers that sit alongside their financial ledgers. IBM’s focus on advanced AI and data science with its Envizi platform offers deep analytical capabilities for complex ESG data. Finally, Microsoft has created a senior management-level Azure cloud sustainability offering that integrates their environmental reporting and sustainability management models to help enterprises integrate sustainability into their global operations.

3. Hyperscale Sustainability Initiatives: Google and Amazon Web Services

Hyperscale cloud providers such as Google Cloud and Amazon Web Services (AWS) serve a dual role in sustainability. As one of the largest energy consumers, they are responsible for more renewable energy consumption through the signing of massive Power Purchase Agreements (PPAs) reducing the demand for fossil-fuels at the grid level. Second, they serve as technology providers for carbon tracking and environmental modeling software using their infrastructure. Google is the poster child of data-driven carbon-intelligent computing, using artificial intelligence to shift workloads across data centers to the times and sites where the energy supply is its cleanest. AWS, for example, is developing a carbon footprint assessment based on customers' use and offers tools to track carbon emissions from cloud sourced systems.

By Offering

By Application

By Technology

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Green Technology and Sustainability

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Offering Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Mandated Environment Regulatory and Policy Frameworks

4.1.1.2 Increasing Corporate Commitment to Net-Zero Targets

4.1.2 Market Restraints

4.1.2.1 High Upfront Capex for Sustainable Technology

4.1.2.2 The Expertise Required to Integrate Green Solutions with Legacy Architectures

4.1.3 Market Challenges

4.1.3.1 No Standardized ESG Reporting Metrics Across Industries

4.1.3.2 Resource Scarcity and Supply Chain Disruption for Green Inputs

4.1.4 Market Opportunities

4.1.4.1 Demand for Blockchain-based Supply Chain Transparency

4.1.4.2 Growth in Sustainable Finance and Green Investment Tools

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Green Technology and Sustainability Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Green Technology and Sustainability Market, By Technology

6.1 Global Green Technology and Sustainability Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Cloud Computing

6.1.1.2 AI & Analytics

6.1.1.3 Blockchain

6.1.1.4 Internet of Things (IoT)

6.1.1.5 Cybersecurity

6.1.1.6 Others

Chapter 7. Green Technology and Sustainability Market, By Offering

7.1 Global Green Technology and Sustainability Market Snapshot, By Offering

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Software

7.1.1.2 Services

Chapter 8. Green Technology and Sustainability Market, By Application

8.1 Global Green Technology and Sustainability Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Corporate ESG & Compliance

8.1.1.2 Energy & Emission Reduction

8.1.1.3 Sustainable Supply Chain & Logistics

8.1.1.4 Carbon Neutrality & Climate Strategy

8.1.1.5 Environmental Protection & Regulatory Compliance

8.1.1.6 Others

Chapter 9. Green Technology and Sustainability Market, By End-User

9.1 Global Green Technology and Sustainability Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Technology & Software Providers

9.1.1.2 Telecommunications

9.1.1.3 Retail & Consumer Goods

9.1.1.4 Transportation & Logistics

9.1.1.5 Energy & Utilities

9.1.1.6 Manufacturing

9.1.1.7 Healthcare & Life Sciences

9.1.1.8 Others

Chapter 10. Green Technology and Sustainability Market, By Region

10.1 Overview

10.2 Green Technology and Sustainability Market Revenue Share, By Region 2024 (%)

10.3 Global Green Technology and Sustainability Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Green Technology and Sustainability Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Green Technology and Sustainability Market, By Country

10.5.4 UK

10.5.4.1 UK Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Green Technology and Sustainability Market, By Country

10.6.4 China

10.6.4.1 China Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Green Technology and Sustainability Market, By Country

10.7.4 GCC

10.7.4.1 GCC Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Green Technology and Sustainability Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Siemens AG

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 IBM

12.3 Schneider Electric

12.4 SAP

12.5 Microsoft

12.6 Google

12.7 Amazon Web Services (AWS)

12.8 Salesforce

12.9 Oracle

12.10 GE (General Electric)

12.11 EcoVadis

12.12 Engie Impact

12.13 Persefoni

12.14 Watershed