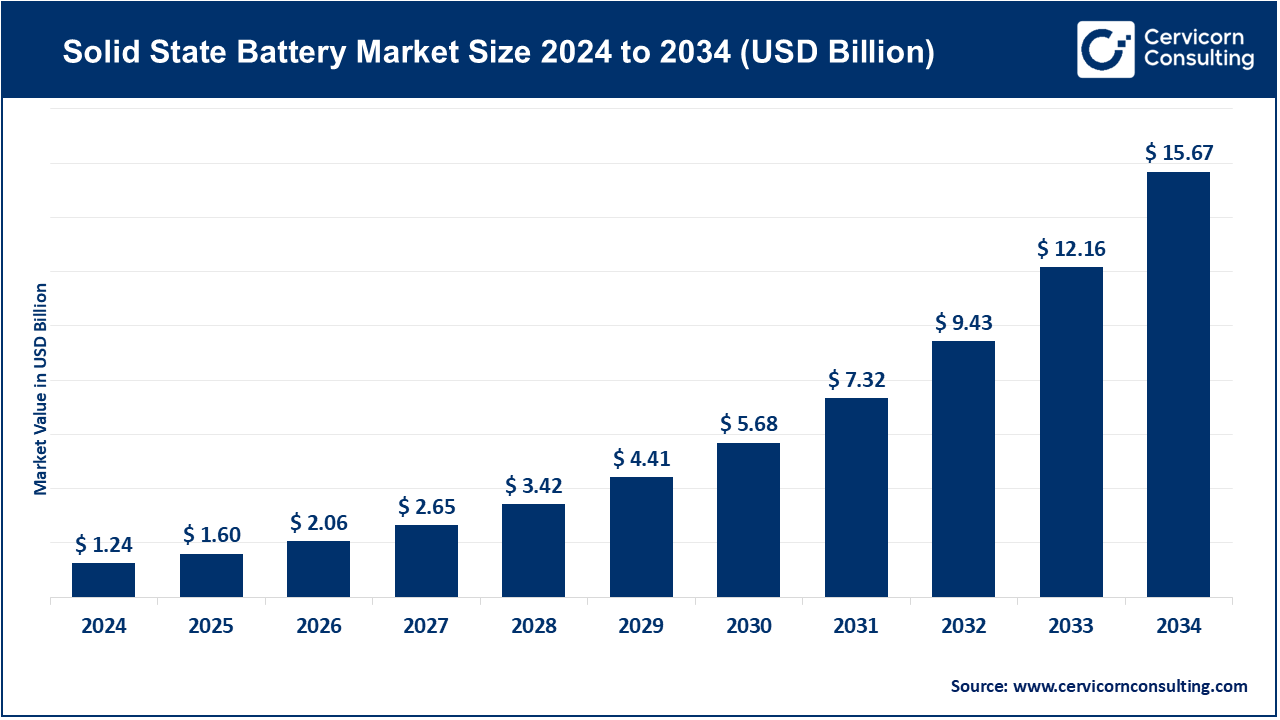

The global solid state battery market size was reached at USD 1.24 billion in 2024 and is expected to be worth around USD 15.67 billion by 2034, growing at a compound annual growth rate (CAGR) of 57% over the forecast period 2025 to 2034. The rapid emergence of the solid-state battery market is fueled by the desire for safer, more performant alternatives to lithium-ion technology across a multitude of industries. Fire and leakage risks, along with lower energy density, faster charge capability, and lifespan are some of the problems posed by liquid electrolytes. These batteries, being solid state, are lighter, more compact and offer greater energy density which makes them suitable for electric vehicles, consumer electronics, and renewable energy storage.

Sales are driven by government policies, sustainability goals, and significant funding from automotive and technology industry giants. Solid state batteries are being developed alongside lithium metal, sodium, and other solid-state chemistries, successfully transitioning from the research laboratory to commercial scale. Their rational as next-generation energy storage is well placed because they can provide the transition grid with durable and compact systems for unmatchable safekeeping as well as unparalleled efficiency during energy exchange.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.60 Billion |

| Estimated Market Size in 2034 | USD 15.67 Billion |

| Projected CAGR 2025 to 2034 | 57% |

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Category, Capacity, Application, Region |

| Key Companies | Bollore Group (Bluesolutions), QuantumScape Corporation, Toyota Motor Corporation, Solid Power, Inc., TDK Corporation, SAMSUNG SDI CO., LTD., Hitachi Zosen Corporation, Ilika plc, Ganfeng Lithium Group Co., Ltd., ProLogium Technology Co., Ltd., Ionic Materials Inc, Prieto Battery Inc., Factorial Inc, theion GmbH, Sakuu Corporation, Ion Storage Systems, SK on Co., Ltd, Natrion |

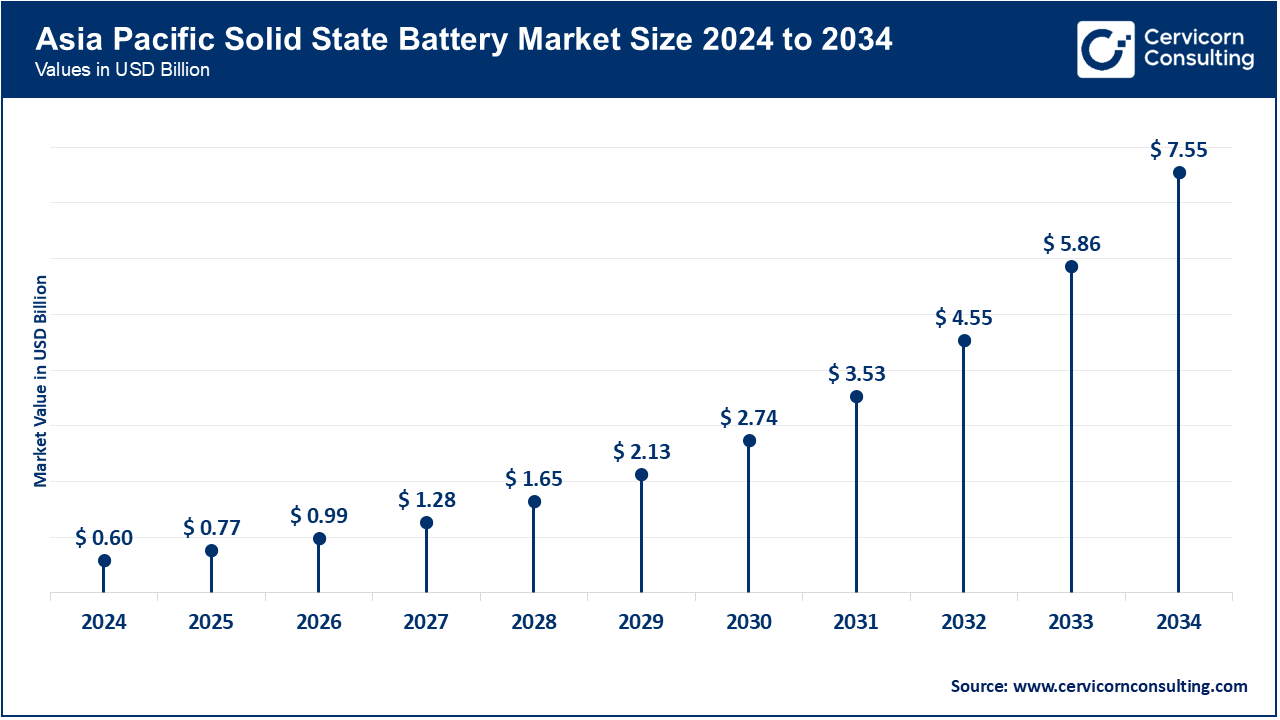

The solid state battery market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

Asia-Pacific is the most dynamic market, with powerful EV adoption and battery manufacturing. Toyota in Japan declared its first solid-state EV prototype, which is available to be tested in fleets, in August 2025, and South Korean Samsung SDI developed thin-film solid-state cells to be used in consumer electronics. CATL China keeps on increasing its multi-cell solid-state pilot lines to satisfy the energy storage and the EVs demand.

North America is the world leader in solid-state battery research and commercialisation, particularly in EVs and grid storage. In July 2025, QuantumScape increased its pilot production line in California, targeting electric vehicle automotive grade cells. In the U.S. and Canada, solid-state residential/industrial storage is also in pilot stage, in a bid to enhance safety, as well as minimize imported lithium dependence.

Europe focuses on sustainability, compliance with regulations and the next-gen battery technologies. In May 2025, BMW in Germany started road-testing EV prototypes with solid-state packs, the first in Europe to make such a transition. France and the UK also favor start-ups which are coming up with solid-state solutions to portable electronics and renewable energy storage solutions.

Solid State Battery Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 26.30% |

| Europe | 20.40% |

| Asia-Pacific | 48.20% |

| LAMEA | 5.10% |

Latin America, Middle East, Africa are on the verge of embracing solid-state technology, basically by associating with other players in the world market. In June 2025, Brazil introduced a pilot program using solid-state batteries in integrating renewable energy, and the UAE considered them in grid level backup systems. The country of South Africa is evaluating solid-state packs to automate factories and mining machines, and the regional development is slow.

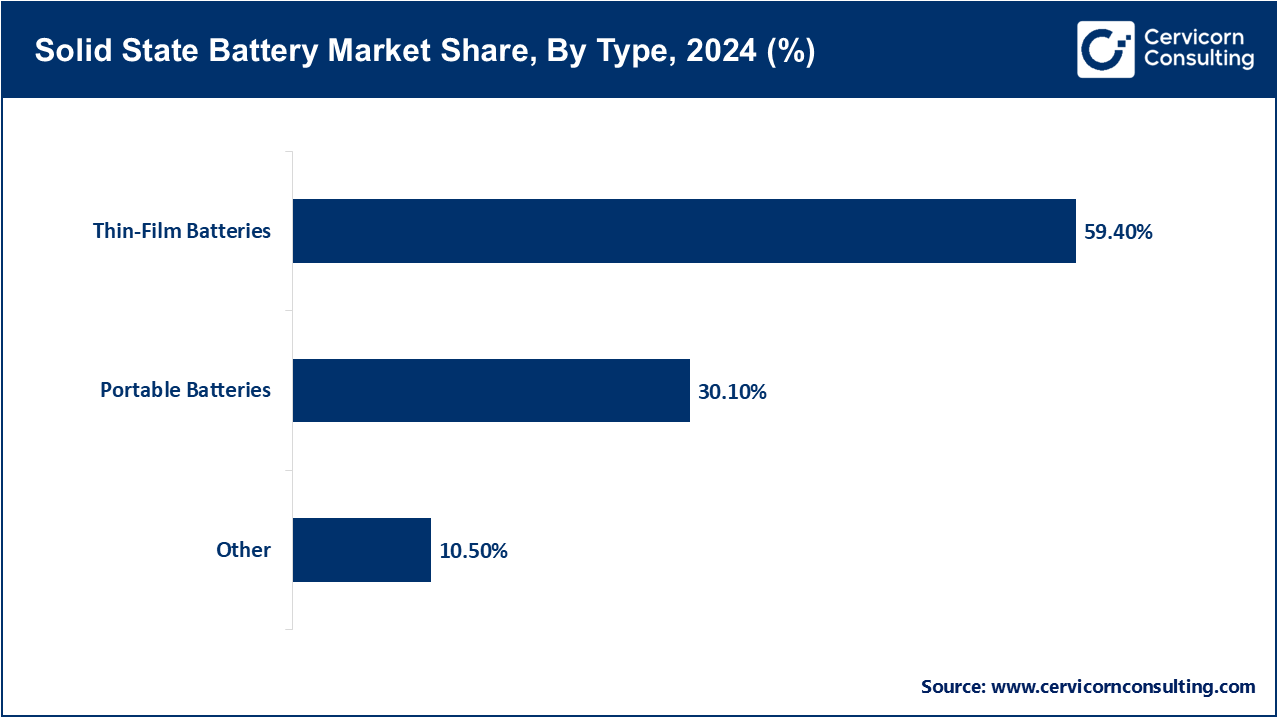

Thin-Film Batteries: Thin-film solid-state batteries are produced with layers of solid electrolytes in ultra-thin format thus allowing compact, lightweight and flexible storage of energy. They are primarily applied in wearables, medical implants and IoT sensors where reliability and miniaturization are paramount. Samsung Advanced Institute of Technology demonstrated in June 2025 a prototype of 900 Wh/L energy density in thin films, which could be used in pacemakers and other implantable devices, demonstrating their medical capabilities.

Portable Batteries: Portable solid-state batteries are small batteries that serve consumer electronics like smartphones, laptops, and tablets, are available with longer lifespan and recharge faster. They are considered to be substitutes of the traditional lithium-ion batteries used in portables. In April 2025, Panasonic announced a prototype of a portable solid-state cell, which could be recharged in minutes, and this is a breakthrough in mainstream usage in personal electronics.

Other Kinds: This category deals with large-format and experimental solid-state designs, including flexible batteries and those made to fit electric vehicles. These variants are undergoing test to specialized and energy-intensive applications. Toyota tested large-format solid-state packs in prototypes of hybrid vehicles in July 2025, a move toward EV-scale solid-state battery prototypes.

Single-cell Batteries: Single-cell solid-state batteries are individual units that are typically designed to use low-energy or testing, or can be designed to meet a niche application. The simplicity enables researchers and startups to streamline chemistries to be more stable and have longer cycle life. In May 2025, Hitachi Zosen reported a step forward in creating a single-cell solid-state system optimized to power drones, indicating that it would also be suitable in aerospace and lightweight robotics.

Solid State Battery Market Share, By Category, 2024 (%)

| Category | Revenue Share, 2024 (%) |

| Single-cell Battery | 45.40% |

| Multi-cell Battery | 54.60% |

Multi-cell Batteries: Multi-cell batteries are the batteries that consist of several solid-state cells that are stacked together to provide higher capacities that can be used in automotive, grid and industrial-scale applications. They have scalable power and enhanced safety over the conventional packs. In August 2025, CATL unveiled its first multi-cell solid-state grid energy storage multi-module in China, proving that the technology is leaving the laboratory and is ready to be integrated on a utility scale.

Below 1500 mAh: These are small-capacity batteries that find application in wearables, medical sensors, and smart cards, where dimensions and safety are important. These types of batteries focus on durability and their capability to work in hostile conditions. To achieve real-time monitoring of patients in the medical field and healthcare applications, TDK Corporation introduced a 1200 mAh solid-state cell in June 2025, specifically for smart medical patches.

1500 mAh to 2500 mAh: Mid-range solid-state batteries serve IoT devices, smartphone, and portable electronics, in which performance, rapid charging, and longer cycles are needed. In May 2025, ProLogium also proposed a 2000 mAh solid-state prototype intended to be used in smartphones, demonstrating potential to overcome the overheating and lifespan limitations of the traditional battery.

More than 2500 mAh: There exist high capacity solid-state batteries that are used in automobiles and in industry that have more driving range, longer life cycle and rapid charges. Honda has gone through a successful test of EV road tests with solid-state packs weighing over 3000 mAh in July 2025, a move that indicates that commercialization of electric vehicles is becoming more viable and it can be implemented at mass.

Consumer Electronics: Solid-state battery in consumer electronics provides extended power supply, higher safety and miniaturisation in smart phones, laptops and wearables. In April 2025, it was reported that Apple was experimenting with solid-state cells in up-coming iPhones in order to increase the lifetime of the devices and raise the charging rates.

Automobile: This is because the automotive industry is a major contributor to solid-state battery adoption, as it requires a greater range, faster charging, and fire resistance than lithium-ion. In August 2025, Nissan unveiled an EV concept with a solid-state battery, which is twice as energy-dense as standard cells, supporting their position in the next-gen mobility.

Medical Devices: Implants, portable diagnostic equipment and medical monitoring equipment in healthcare use solid-state batteries that are highly safe and reliable. In June 2025, Medtronic announced a partnership with TDK to work on solid-state cells in long-life pacemakers to increase their utility in life-saving medical practice.

Industrial: Industrial automation batteries Solid-state batteries offer backup power and robotics support to smart factories with high energy efficiency. Siemens tested packs of robotic arms in solid-state in May 2025, targeted at minimising downtimes and enhancing operational reliability in automated plants.

Energy Harvesting: These micro solid-state cells store energy in renewable environments, and IoT environments to generate power constantly to sensors and monitoring systems in a sustainable manner. In July 2025, Fraunhofer institution unveiled solid state microbatteries embedded in smart building sensors that increase the energy efficiency of the urban infrastructure.

Electric Vehicle: Solid-state batteries are seen as the foundation of EVs in the future, which have a more extended range, excellent safety, and better lifecycle performance. In August 2025, Toyota stated that its initial fleet-level solid-state EV prototypes were road test ready, one of the largest milestones in classifying to commercial EV implementation, using this technology.

Market Segmentation

By Type

By Category

By Capacity

By Application

By Region