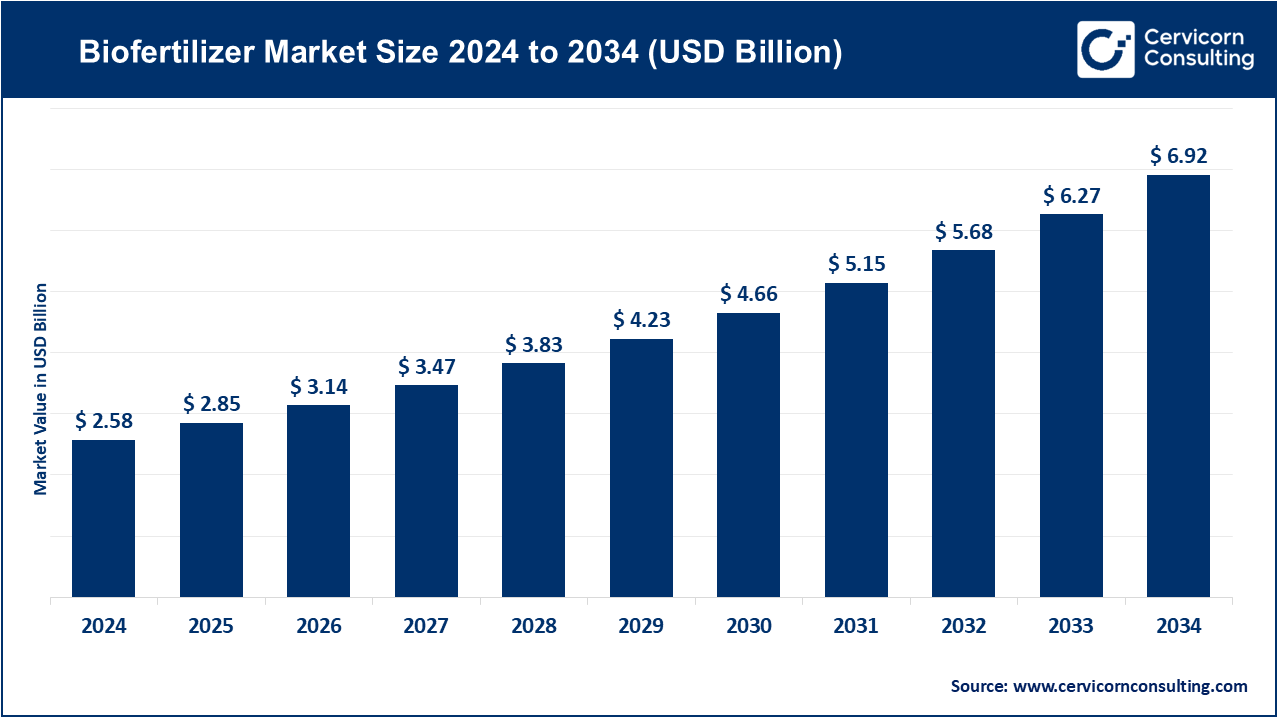

The global biofertilizer market is set to expand from USD 2.58 billion in 2024 to about USD 6.92 billion by 2034, growing at a 10.37% CAGR over the forecast period 2025 to 2034. The biofertilizer market is changing rapidly due to changes in precision farming, new sustainable production systems, and developments in microbial technology. With agriculture opting for more sustainable and efficient systems for nutrient management, there is growing demand among farmers and producers for more customized, precision solutions relative to soil and crops. Enhanced productivity with environmental sustainability is the new challenge for manufacturers adopting biotechnological advancements like microbial strain manipulation, automation, and soil data analytics. These innovations transform the understanding and management of soil fertility, nutrient supply, and crop resilience.

The fusion of the principles of 3D bioprinting, synthetic biology, and environmentally friendly packaging materials opens new frontiers in the formulation and the delivery of biofertilizers. New technologies such as CRISPR strain editing, biocapsules for controlled release, and embedded smart sensors for biofertilizers enhance sustainability, efficiency, and accessibility. The increasing need to meet environmental, social, and governance (ESG) goals and reduce the use of chemical fertilizers fuels the position of biofertilizers in regenerative agriculture. The sustainable and precision growth of biofertilizers promises to transform the regenerative agriculture space and the future of global food production.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 2.85 Billion |

| Estimated Market Size in 2034 | USD 6.92 Billion |

| Expected CAGR 2025 to 2034 | 10.37% |

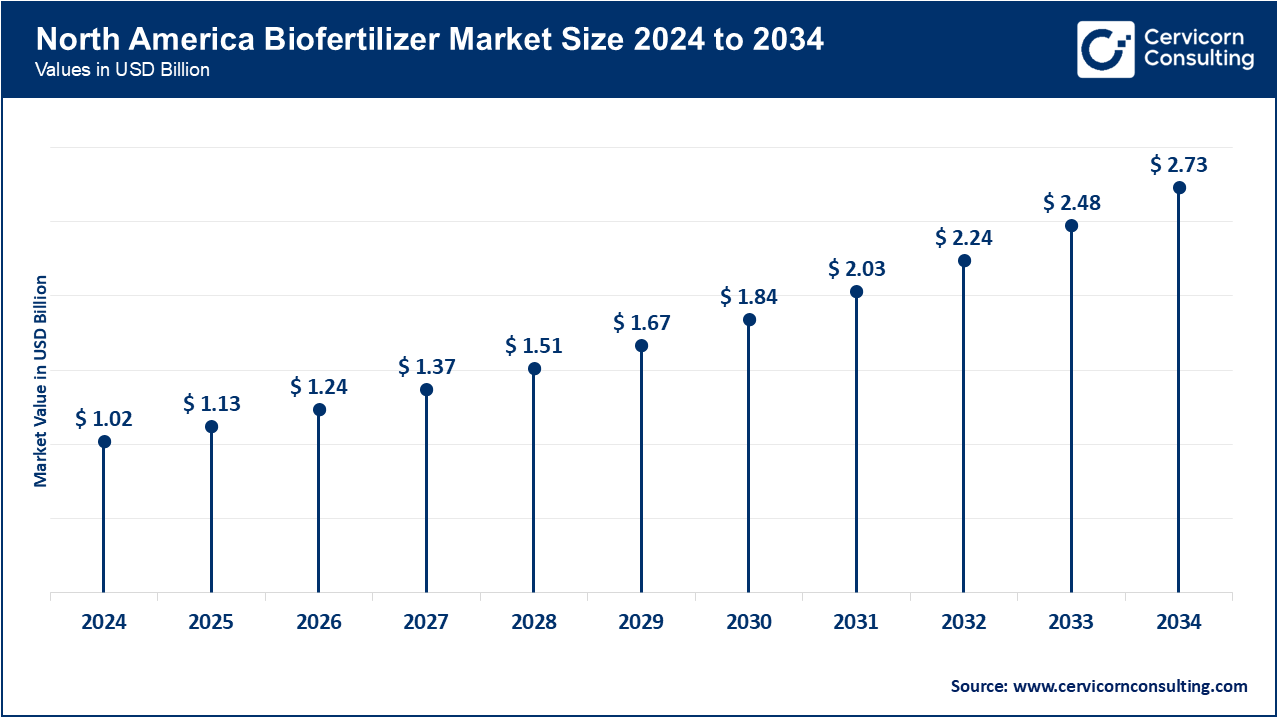

| Dominant Region | North America |

| Highest Growth Region | Asia-Pacific |

| Key Segments | Product, Crop Type, Microorganism Type, Technology, Material, Distribution Model, End Use, Application, Region |

| Key Companies | Novozymes, Lallemand Inc., National Fertilizers Limited, Gujarat State Fertilizers & Chemicals Ltd., Rizobacter Argentina S.A., Koppert Biological Systems Inc., Symborg, T. Stanes and Company Limited, BioConsortia, Kula Bio |

The biofertilizer market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The development of the market continues with the increase of research and development and adoption of sustainable farming. In June 2023, the AgriTech Solutions launched liquid Azotobacter for rice paddies which enhances soil health and boosts yield. Canada is working on developing biofertilizers in granular and encapsulated forms. The Growth is driven by the trend of Organic Farming, and ESG initiatives. North America is becoming the center of advanced biofertilizers.

The growth of the market in this region is mainly due to the implementation of stringent environmental laws and the rising demand for organic farming. In July 2023, BioGrow Labs of Germany tested phosphate-solubilizing granules which led to increased corn yields and reduced the need for chemical fertilizers. France and the Netherlands are developing microbial consortia and controlled release forms. The increase of EU policies leads to the growth of sustainable farming. Europe is the leader in biofertilizer innovation.

The growth in this region is attributed to rapid urbanization and increase food demand. The region is also supported by the government. In October 2024, EcoSoil Systems (India) launched Rhizobium-coated seeds which improves germination and yield. Japan and China are looking into biofertilizers and foliar fertilizers. South Korea is combining biofertilizers with precision farming. The region is known for innovative and cost-effective solutions.

Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 39.50% |

| Europe | 23.20% |

| Asia-Pacific | 25.40% |

| LAMEA | 11.90% |

Countries in emerging markets continue to grow steadily because of their focus on sustainability, particularly in farming. In April 2024, Brazil's NaturaAgro tested phosphate granules on soybeans and was able to increase soybean productivity. Mexico and Saudi Arabia are investing in biofertilizers made from microbes. South Africa is collaborating with universities on Mycorrhizal products. International partnerships are helping develop innovative Mycorrhizal products.

Based on crop type, the market is segmented into cereals & grains, fruits & vegetables, plantation crops and others. The cereals & grains segment has captured highest revenue share in 2025.

Market Revenue Share, By Crop Type, 2024 (%)

| Crop Type | Revenue Share, 2024 (%) |

| Cereals & Grains | 41.00% |

| Fruits & Vegetables | 27.30% |

| Plantation Crops | 23.10% |

| Others | 8.60% |

Conventional Fermentation: Cultivating microbes in batch or fed-batch systems remains the traditional and most widely adopted method in biofertilizer production. Its simplicity and scalability make it ideal for many small and medium scale farms. In March 2024, BioGrow Labs (India) optimized Rhizobium cultivation using this method. They improved microbial survival while reducing contamination, allowing farmers to receive dependable seed and soil treatments. This approach also reduced costs while production and quality remained consistent. In biofertilizer manufacturing, conventional fermentation has baseline technology status and continues to be widely used.

Advanced Fermentation / Continuous Bioreactors: Continuous fermentation systems are the most advanced technology and automate much of the production cycle, which aids in decreasing human error. As such, they are able to maintain a steady microbial population while also increasing yield. In July 2024, AgriTech Solutions (U.S.) implemented continuous bioreactors for phosphate-solubilizing bacteria and was able to cut production time by 30%. This advancement bolstered quality control during production and improved the biofertilizer field efficacy. As a result, large scale commercial farms gained access to high-performance biofertilizers. Continuous fermentation technology is becoming widely used in modern production facilities.

CRISPR-Based Microbial Engineering: CRISPR technology allows precise edits to microbial genomes to improve nitrogen fixation and stress tolerance. This technology is used to develop high-yield and resilient strains. BioAgri Insights (Europe) launched CRISPR-modified Azotobacter strains in trial runs and increased wheat yield by 25% in September 2023. This reduces dependence on chemical fertilizers and rapid R&D is in advanced crop-specific formulations. Biofertilizers developed via CRISPR technology are the next best inputs in precision agriculture.

Encapsulation/Controlled Release Technology: Encapsulation extends the microbial lifespan and encapsulated formulations reduce the number of applications needed. Microbial survival is extended to controlled dispensing of nutrients to crops. In February 2024 EcoSoil Systems (India) released shelf stable encapsulated Bacillus biofertilizers which improved soil colonization and plant growth. Farmers made fewer applications which reduced costs and labor. Encapsulation is becoming crucial to sustainable agriculture and high-value crops.

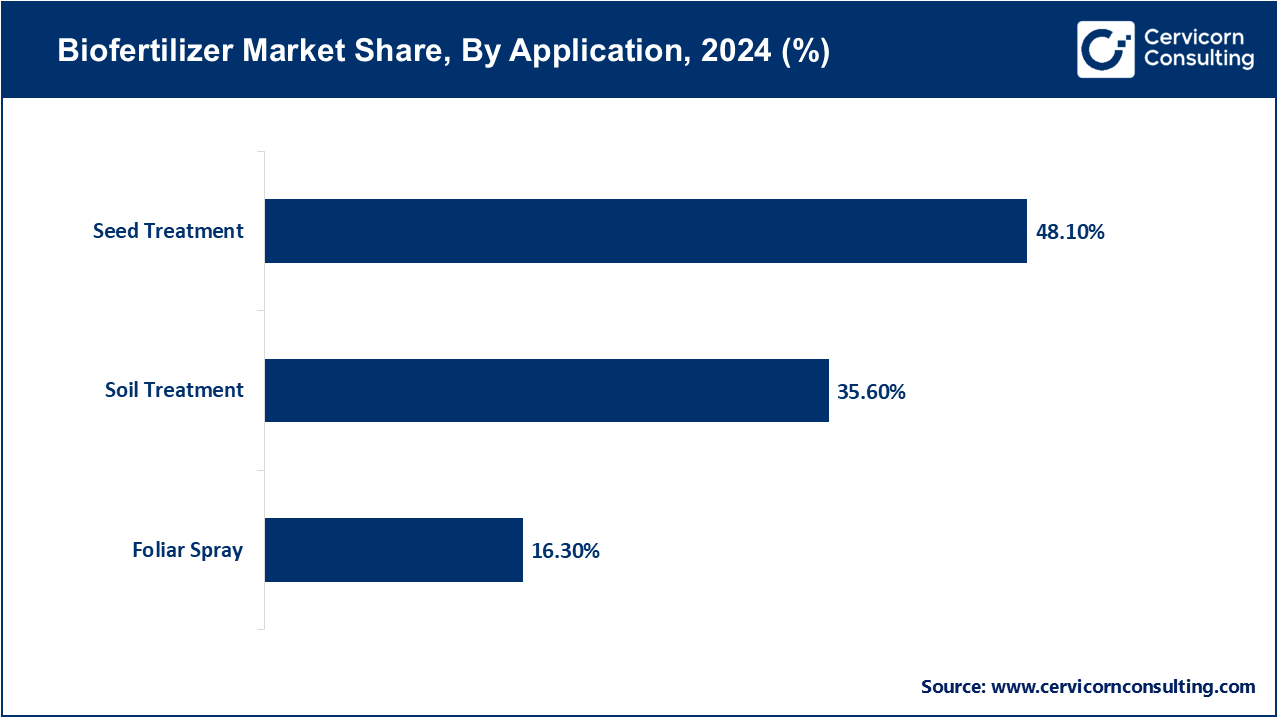

Seed Treatment: Biofertilizers are directly applied to seeds for microbial colonization and chemical seed treatment. This is an early microbe-to-plant contact for improved nutrient uptake and germination. AgriSmart Technologies improved germination by 15% in coated soybeans treated with Rhizobium in May 2024. This resulted in increased early crop vigor. Reports from farmers indicate that the plants were healthier and chemical fertilizers were reduced. This offers cost-effective seed treatment for smallholder farms.

Soil Treatment: The use of Biofertilizers on soil enhances microbial diversity and makes nutrients readily available. This results in stronger root systems and greater potential for high yields. In June 2024, BioGrow Labs demonstrated that phosphate-solubilizing biofertilizers increased corn yield by 20% in field trials. Treatment of the soil improves long-term soil health and fertility. It also minimizes reliance on synthetic fertilizers. This method is being adopted on large-scale farms for sustainability on an increasing basis.

Foliar Spray: Biofertilizers in this form are used to improve the vigor of a plant and are applied on top of the soil and seed treatments. This method is used when rapid absorption of nutrients is needed. In August 2023, AgriNext (Israel) applied Bacillus sprays to tomato crops, reducing fertilizer run-off and enhancing growth. This method is used during stressful conditions on the crops as it ensures that the nutrients are readily available to the plants. This procedure is aimed toward high-value horticultural crops.

Liquid Biofertilizers: To facilitate easier and even application, the biofertilizers in this form are protected in a microbial liquid suspension for faster activation and enhanced microbial survival. In April 2024, EcoSoil Systems launched liquid Azotobacter for rice paddies, improving root colonization and plant growth. These are preferred for use in irrigation systems and for spraying. This reduces the labor needed and application costs. The use of liquid biofertilizers in precision agriculture for liquid suspension is done widely.

Carrier-Based / Powdered Biofertilizers: Microbes are embedded in solid carriers like peat, compost, or lignite for stability. These powders allow easier storage and transport. In July 2023, BioGrow Labs introduced Rhizobium powders for pulses, maintaining microbial viability for six months. Powders release microbes gradually in soil. They are ideal for smallholder and large-scale farms. Carrier-based forms improve shelf life and field effectiveness.

Granular / Encapsulated Biofertilizers: Granules or encapsulated forms protect microbes and provide controlled nutrient release. They extend shelf life and reduce application frequency. In January 2024, AgriTech Solutions launched phosphate biofertilizer granules with 90-day field efficacy. Farmers applied fewer doses while achieving higher crop productivity. Granular biofertilizers are particularly suitable for long-duration crops. Encapsulation ensures efficiency and sustainability in nutrient delivery.

Farmers: Farmers directly apply biofertilizers to improve soil fertility and crop yields. They benefit from cost savings and reduced chemical inputs. In March 2024, Indian smallholder farmers adopted Azotobacter-coated seeds, reporting higher yields and healthier crops. This promoted sustainable practices at the field level. Farmers gained better soil health and crop resilience. Direct use ensures immediate productivity impact.

Commercial Growers and Agribusinesses: Large-scale producers focus on cost reduction and consistency improvement through the use of biofertilizers, combining them with precision agriculture systems. For instance, in June 2024, a U.S. corn farm used 500 acres of land for liquid biofertilizer application and achieved 18% higher yields. This also helped depend less on chemical fertilizers. Large-scale growers operational efficiency improvements and the commercial adoption of biofertilizers helps in passing certification standards for sustainable practices.

Research Django: Agri-Tech Labs or Research institutes focus on testing, developing novel microbial strains, and biofertilizer formulations while ensuring crop and soil safety and efficacy. For instance, in September 2023, the University of Nairobi, in collaboration with local startups, began trialing Mycorrhizal biofertilizers under drought conditions, which rapidly enhanced local adaptation and expedited regulatory approval. Labs also serve as the innovation engine for precision agriculture, for which R&D drives innovation, creating new biofertilizer products for the market.

Direct Sales (B2B): Suppliers sell biofertilizer products directly to commercial farms and agribusinesses to guarantee bulk delivery and tailored formulations. BioAgriTech, for instance, initiated a direct sales model to Europe in February 2024 for a faster fulfillment and higher quality end products. Direct sales in B2B model empower the economic interdependence of suppliers and farmers while cutting down intermediaries, hence lowering the overall cost. This model of direct sales is most preferred on large scale applications.

Distributor and Dealer Networks: EcoSoil Systems support their dealers by helping them develop their networks in rural regions and distributing small packs to smallholder farmers in order to complete the last mile. This method supports accessibility and marketing assistance. In March 2024, EcoSoil Systems expanded its dealer networks in 10 Indian states and improved the field-based technical support provisions. Trust-building at the retail network level is important, and at that stage assistance on appropriate application is important. Wider adoption is facilitated by the dealer network.

Online Platforms / E-commerce: Biofertilizers are sold online for personalized and direct delivery. This channel caters to urban and tech-savvy growers. In May 2024, AgriNext sold customized microbial blends via e-commerce portals to rooftop gardeners. Online sales offer convenience and real-time ordering. Consumers access tailored solutions quickly. Digital platforms expand reach beyond traditional markets.

Market Segmentation

By Product

By Crop Type

By Microorganism Type

By Technology

By Material

By Distribution Model

By End Use

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Biofertilizer

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Product Overview

2.2.3 By Crop Type Overview

2.2.4 By Microorganism Type Overview

2.2.5 By Material Overview

2.2.6 By Distribution Model Overview

2.2.7 By Application Overview

2.2.8 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Global Push for Sustainable Agriculture

4.1.1.2 Advancements in Biotech and Fermentation Technology

4.1.2 Market Restraints

4.1.2.1 Limited Shelf Life and Storage Sensitivity

4.1.2.2 Low Farmer Awareness and Adoption Barriers

4.1.3 Market Challenges

4.1.3.1 Standardization and Quality Control

4.1.3.2 Regulatory Complexity Across Regions

4.1.4 Market Opportunities

4.1.4.1 Integration with AI-Powered Precision Agriculture Platforms

4.1.4.2 Public-Private Collaborations for Sustainable Farming

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Biofertilizer Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Biofertilizer Market, By Technology

6.1 Global Biofertilizer Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Conventional Fermentation

6.1.1.2 Advanced Fermentation/Continuous Bioreactors

6.1.1.3 CRISPR-Based Microbial Engineering

6.1.1.4 Encapsulation/Controlled Release Technology

Chapter 7. Biofertilizer Market, By Product

7.1 Global Biofertilizer Market Snapshot, By Product

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Nitrogen Fixing

7.1.1.2 Phosphate Solubilizing

7.1.1.3 Other Products

Chapter 8. Biofertilizer Market, By Crop Type

8.1 Global Biofertilizer Market Snapshot, By Crop Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Cereals & Grains

8.1.1.2 Fruits & Vegetables

8.1.1.3 Plantation Crops

8.1.1.4 Others

Chapter 9. Biofertilizer Market, By Microorganism Type

9.1 Global Biofertilizer Market Snapshot, By Microorganism Type

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Rhizobium

9.1.1.2 Azotobacter

9.1.1.3 Mycorrhizae

Chapter 10. Biofertilizer Market, By Material

10.1 Global Biofertilizer Market Snapshot, By Material

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Liquid Biofertilizers

10.1.1.2 Carrier-Based/Powdered Biofertilizers

10.1.1.3 Granular/Encapsulated Biofertilizers

Chapter 11. Biofertilizer Market, By Distribution Model

11.1 Global Biofertilizer Market Snapshot, By Distribution Model

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Direct Sales (B2B)

11.1.1.2 Distributor and Dealer Networks

11.1.1.3 Online Platforms / E-commerce

Chapter 12. Biofertilizer Market, By Application

12.1 Global Biofertilizer Market Snapshot, By Application

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Seed Treatment

12.1.1.2 Soil Treatment

12.1.1.3 Foliar Spray

Chapter 13. Biofertilizer Market, By End-User

13.1 Global Biofertilizer Market Snapshot, By End-User

13.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

13.1.1.1 Farmers

13.1.1.2 Commercial Growers and Agribusinesses

13.1.1.3 Research Django

Chapter 14. Biofertilizer Market, By Region

14.1 Overview

14.2 Biofertilizer Market Revenue Share, By Region 2024 (%)

14.3 Global Biofertilizer Market, By Region

14.3.1 Market Size and Forecast

14.4 North America

14.4.1 North America Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.4.2 Market Size and Forecast

14.4.3 North America Biofertilizer Market, By Country

14.4.4 U.S.

14.4.4.1 U.S. Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.4.4.2 Market Size and Forecast

14.4.4.3 U.S. Market Segmental Analysis

14.4.5 Canada

14.4.5.1 Canada Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.4.5.2 Market Size and Forecast

14.4.5.3 Canada Market Segmental Analysis

14.4.6 Mexico

14.4.6.1 Mexico Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.4.6.2 Market Size and Forecast

14.4.6.3 Mexico Market Segmental Analysis

14.5 Europe

14.5.1 Europe Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.5.2 Market Size and Forecast

14.5.3 Europe Biofertilizer Market, By Country

14.5.4 UK

14.5.4.1 UK Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.5.4.2 Market Size and Forecast

14.5.4.3 UKMarket Segmental Analysis

14.5.5 France

14.5.5.1 France Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.5.5.2 Market Size and Forecast

14.5.5.3 FranceMarket Segmental Analysis

14.5.6 Germany

14.5.6.1 Germany Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.5.6.2 Market Size and Forecast

14.5.6.3 GermanyMarket Segmental Analysis

14.5.7 Rest of Europe

14.5.7.1 Rest of Europe Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.5.7.2 Market Size and Forecast

14.5.7.3 Rest of EuropeMarket Segmental Analysis

14.6 Asia Pacific

14.6.1 Asia Pacific Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.6.2 Market Size and Forecast

14.6.3 Asia Pacific Biofertilizer Market, By Country

14.6.4 China

14.6.4.1 China Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.6.4.2 Market Size and Forecast

14.6.4.3 ChinaMarket Segmental Analysis

14.6.5 Japan

14.6.5.1 Japan Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.6.5.2 Market Size and Forecast

14.6.5.3 JapanMarket Segmental Analysis

14.6.6 India

14.6.6.1 India Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.6.6.2 Market Size and Forecast

14.6.6.3 IndiaMarket Segmental Analysis

14.6.7 Australia

14.6.7.1 Australia Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.6.7.2 Market Size and Forecast

14.6.7.3 AustraliaMarket Segmental Analysis

14.6.8 Rest of Asia Pacific

14.6.8.1 Rest of Asia Pacific Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.6.8.2 Market Size and Forecast

14.6.8.3 Rest of Asia PacificMarket Segmental Analysis

14.7 LAMEA

14.7.1 LAMEA Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.7.2 Market Size and Forecast

14.7.3 LAMEA Biofertilizer Market, By Country

14.7.4 GCC

14.7.4.1 GCC Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.7.4.2 Market Size and Forecast

14.7.4.3 GCCMarket Segmental Analysis

14.7.5 Africa

14.7.5.1 Africa Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.7.5.2 Market Size and Forecast

14.7.5.3 AfricaMarket Segmental Analysis

14.7.6 Brazil

14.7.6.1 Brazil Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.7.6.2 Market Size and Forecast

14.7.6.3 BrazilMarket Segmental Analysis

14.7.7 Rest of LAMEA

14.7.7.1 Rest of LAMEA Biofertilizer Market Revenue, 2022-2034 ($Billion)

14.7.7.2 Market Size and Forecast

14.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 15. Competitive Landscape

15.1 Competitor Strategic Analysis

15.1.1 Top Player Positioning/Market Share Analysis

15.1.2 Top Winning Strategies, By Company, 2022-2024

15.1.3 Competitive Analysis By Revenue, 2022-2024

15.2 Recent Developments by the Market Contributors (2024)

Chapter 16. Company Profiles

16.1 Novozymes

16.1.1 Company Snapshot

16.1.2 Company and Business Overview

16.1.3 Financial KPIs

16.1.4 Product/Service Portfolio

16.1.5 Strategic Growth

16.1.6 Global Footprints

16.1.7 Recent Development

16.1.8 SWOT Analysis

16.2 Lallemand Inc.

16.3 National Fertilizers Limited

16.4 Gujarat State Fertilizers & Chemicals Ltd.

16.5 Rizobacter Argentina S.A.

16.6 Koppert Biological Systems Inc.

16.7 Symborg

16.8 T. Stanes and Company Limited

16.9 BioConsortia

16.10 Kula Bio