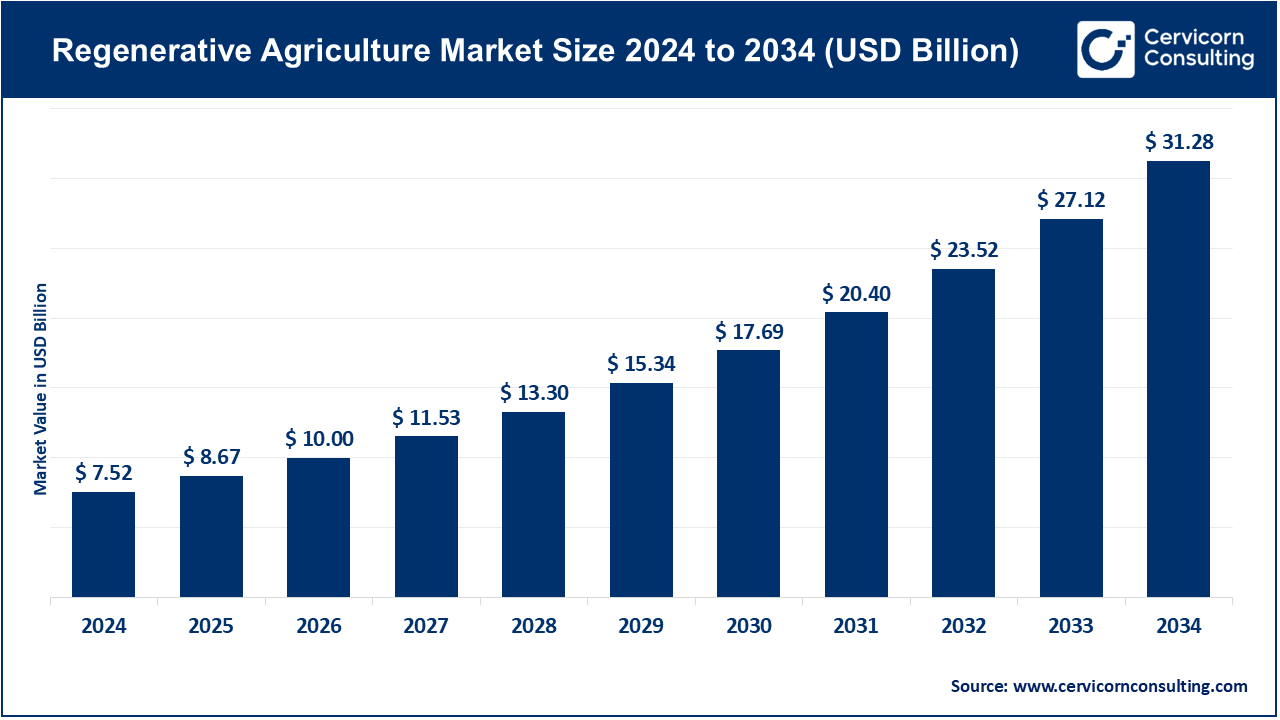

The global regenerative agriculture market size is estimated at USD 8.67 billion in 2025 and is expected to be worth around USD 31.28 billion by 2034. It is expanding at a CAGR of 15.32% from 2025 to 2034. The regenerative agriculture market is on a high growth path as farmers, agribusinesses, and technology developers are funding new solutions that shall maximize soil health and yield crops, besides minimizing environmental impact. There is growing demand of sustainable farming methods, crops resilient to climatic changes, and nutrient efficient farming which are some of the factors contributing to the uptake of regenerative agriculture systems. Contemporary farms are incorporating precision farming equipment, IoT-connected sensors, and AI-driven monitoring services to increase resources use and reduce wastage of inputs and support biodiversity.

Regenerative Agriculture encompasses practices and technologies that replenish the fertility of the soil, make it better to hold water and fossil-fuel carbon without any loss of farm productivity. Innovations in this regard, including biofertilizers, slow- and controlled-release fertilizers, cover and introduction of no-till cropping, and automated monitoring, are increasing the effectiveness, scalability, and economic feasibility of such solutions. Government granting subsidies, ESG pledges made by agribusinesses, tightening of environment-related policies, and growing knowledge in benefits of sustainable farming are important aspects that will fast-track market acceptance and allow operators to meet the proficiency in productivity, sustainability, and use of circular resources.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 8.67 Billion |

| Estimated Market Size in 2034 | USD 31.28 Billion |

| Projected CAGR 2025 to 2034 | 15.32% |

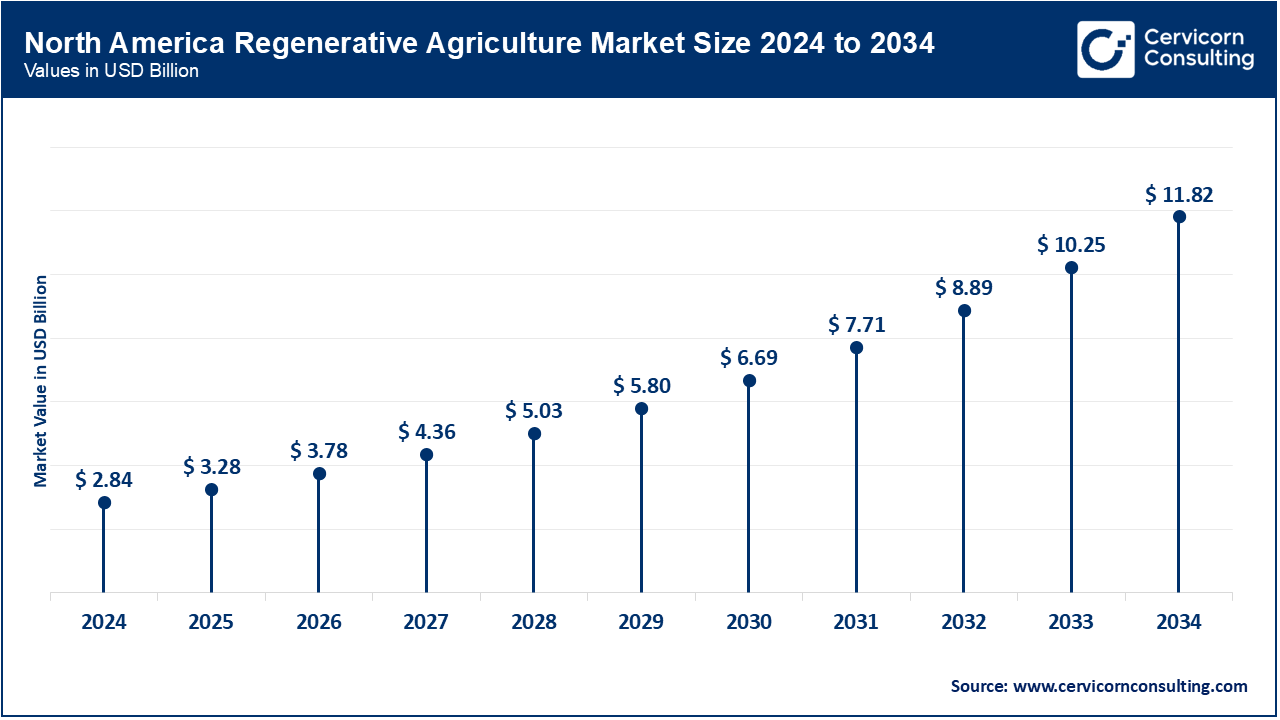

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Practice Type, Input Type, Technology, Crop Type, End-User, Region |

| Key Companies | Agreed.Earth, Aker Technologies, Inc., Astanor Ventures, Biotrex, Carbon Robotics, Cargill, Incorporated, Continuum Ag, Ecorobotix SA, Indigo Ag, Inc., Ruumi, SATELLIGENCE, Terramera Inc., Tortuga Agricultural Technologies, Inc., Vayda |

The regenerative agriculture market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North American market is a tight-knit policy regime, with robust investor interest and company ESG pledges. In June 2024, USDA increased several state-based cover cropping, rotational grazing, and soil carbon monitoring backing. California and Minnesota have gone ahead to provide incentives of financing to farmers who switch to regenerative systems. Sustainably grown products remain attractive to consumers, and large food processors are still adjusting their way of source as a result. Cooperations in the form of combinations of agri-tech companies and cooperatives are supporting the integration of precision-based regenerative practices. Increasing adoption rates are also being furthered by education programs and field trials.

Europe will enhance its adoption due to stringent environmental regulations, Green Deal objectives, and the rising consumer enlightenment. In March 2024, the European Commission invested in agroforestry pilots of large scale in France and Spain in order to enhance biodiversity and carbon sequestration. Such nations as Germany, the Netherlands and Italy are encouraging soil health initiatives associated with CAP subsidies. The increasing prices of chemicals fertilizer is sending farmers to biofertilizers and organic growth stimulants. Cross-border research program is aiding in harmonizing measurement of soil carbon among the member states. There is market demand of specific individual regenerative product categories, which retailers will introduce.

The use of regenerative practices is growing fast in the Asia-Pacific owing to soil restoration programs by the government and integration of agri-tech applications. Japan also introduced subsidy duly on biofertilizers and microbial soil additions in the month of May 2024 with the aim to enhance the productivity of paddy field. China, India, and Australia are creating show farms in demonstration farms to promote no-till, rotational crop and organic seed use. Soil degradation issues and climate resilience are the catalysts of the shift in the region. Regenerative knowledge is being availed to the smallholder farmers through mobile based advisory platforms. The regeneratively produced crops have their export markets in particular categories of premium food.

Regenerative Agriculture Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 37.80% |

| Europe | 29.70% |

| Asia-Pacific | 24.20% |

| LAMEA | 8.30% |

Renewable resources (including land restoration programs and projects led by NGOs) contribute to the development of regenerative agriculture that occurs in LAMEA as well. In April of 2024, Brazil initiated nationwide program of supporting agroforestry and silvopasture at cattle and coffee farms. Kenya and South Africa are in the process of incorporating regenerative practices in climate-wise agriculture models. Irrigation with wastewater that is treated in drought-tolerant regenerative systems is being tested in countries of the Middle East. Regenerative products are gaining market access through partnerships of established food brands in different parts of the world with local farmer cooperatives. The skill imparted to the farmers in practicing sustainable land management is through government supported training programs.

Cover Cropping: Cover cropping creating crop fields of such crops as clover or rye to ensure and fertilise soil in off-seasons. It enhances biodiversity, erosion and enhances soil structure. In November 2023, California Department of Food and Agriculture introduced a grant scheme where farmers would receive money to grow winter cover crops to sequester carbon. The program was focused towards the farms of grapes and almonds located in the Central Valley.

Crop Rotation: The crop rotation segment has dominated market. Crop rotation refers to the process in which crops are grown in succession on the same soil in an attempt to enhance the health of soil and curb the lifecycle of pests. It assists to steady nutrient consumption and favour regenerative results. The Indian council of agricultural research, in June 2024, advocated rice pulse rotation within Punjab as a way of lessening the reliance on nitrogen fertilizers. Farmers who have turned to the system claimed that there is an increase in production and a reduction in pest infestation.

Agroforestry: Agroforestry means farming, with the addition of trees and shrubs to benefit ecologically and economically. It increases carbon capture, biodiversity and fertility of the soil. The Ministry of Agriculture in Kenya also in August 2023 partnered the World Agroforestry Centre to plant leguminous trees in smallholder farms growing maize. These trees were natural nitrogen fixing trees hence decreasing number of fertilizers.

Silvopasture: Silvopasture integrates livestock grazing on forest land; it distributes and maximizes land and ecological service. It helps to provide animal shade, carbon storage and a variety of income. Farmers in Brazil in the state of Mato Grosso embraced silvopasture, consisting of eucalyptus plantations to rear beef cattle, in May 2024. This system lowered heat stress to the livestock and increased rate of weight gain. It resulted in increased soil carbon levels over a long term as well.

Managed Grazing: Managed grassing means application of movement control on livestock to avoid overgrazing and to create recovery of pasture. This technique increases the biodiversity of the plants and soil robustness. In March 2023, the DairyNZ New Zealand program trained dairy farmers on how to adopt the practice of rotational grazing to dairy farms. This enhanced the productivity of pastures and also loosened the soil. Intrusion rates of water also increased appreciably in the farms participating in the endeavour.

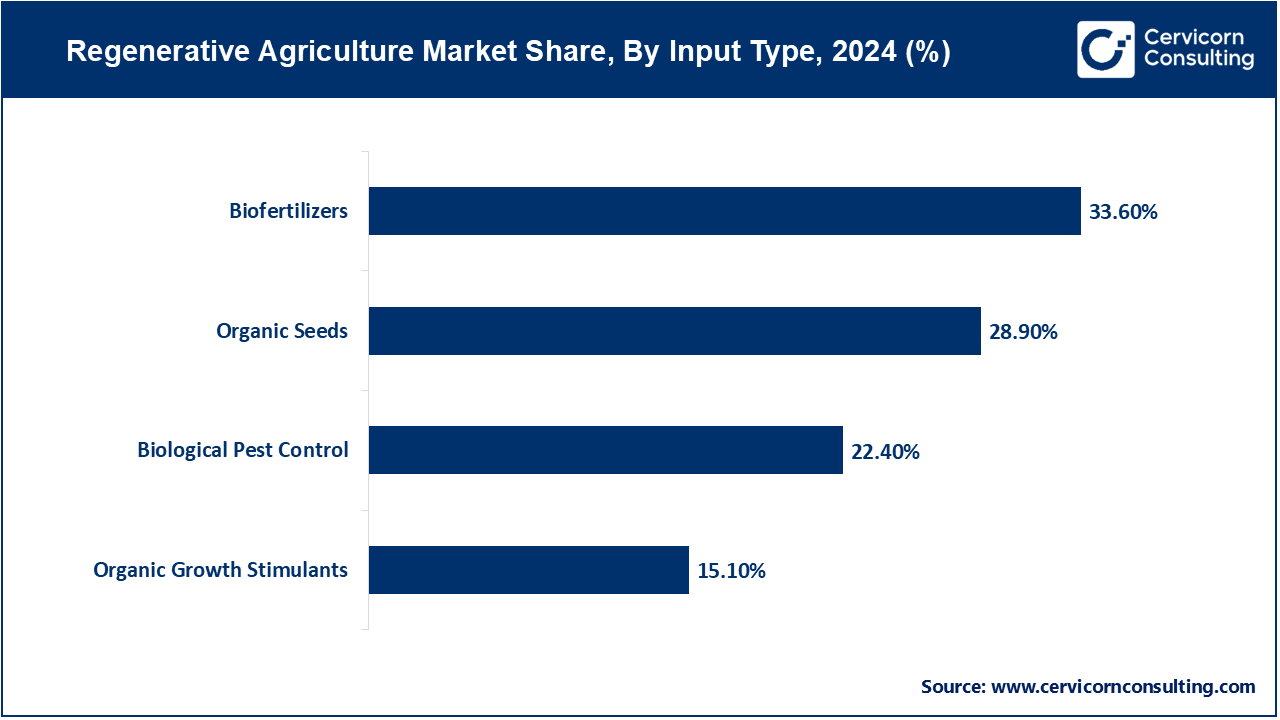

Biofertilizers: Biofertilizers are environmental friendly products enriched with microbial and aims at increasing nourishment to plants by exploiting natural phenomena such as nitrogen fixation. They curb the use of chemical fertilisers. BioConsortia Inc. introduced an other novel microbial inoculant to wheat farmers in Australia in April 2024. Trials indicated that there was 15% growth in yield without further use of chemical fertilizers. It was also a product that enhanced microbial diversity of the soil.

Organic Seeds: The mentioned organic seeds are grown without artificial pesticides and genetically definite modification giving compatibility with the regenerative farming systems. They encourage crop resilience and biodiversity. In February 2023, Vitalis Organic Seeds presented the European growers with blight-resistant tomato crops. There were also fewer outbreaks of diseases reported and an improved quality of fruit that was grown by farmers. Its varieties were EU approved organic standards.

Pest Control: Biological control of pests involves intervention of the pest using natural predators, parasites, or pathogens and the intervention is not chemical. It contributes to the balance of ecosystems in regrowth systems. In July 2024, Spanish strawberry farming entrepreneurs governed the spider mites by purchasing predatory mites at Koppert Biological Systems. This involved cutting down on the volume of pesticides employed in test farms by more than 70%. Populations of beneficial insects also rose in areas where they had received treatment.

Natural Growth Foods: Organic growth stimulants are either vegetal or microbial products, which can be used as growth enhancing factors of crops to increase crop vigor and tolerance towards various stresses. They promote good plant metabolism with no addition of additives. In October 2023, Seipasa released a biostimulant made out of seaweed products consumed on citrus farms in Mexico. Enhanced root systems, drought resistance, witnessed in field results were also obtained. Better fruit size and consistency was noted by farmers as well.

Precision Agriculture Tools: Precision farming implements are GPS-based devices and computerized information in the form of mathematical analysis by mapping business. They save waste and environment. In September 2023, John Deere released its See and Spray Ultimate that targets herbicides in the U.S. Midwest. Farmers reduced the use of herbicides by 60% and still controlled weeds. The system worked with the present farm machinery.

Remote Sensing GIS: The space information by remote sensing and GIS is available on crop health, soil moisture and land-use patterns. They make high-volume observations possible in regrowth results. Planet Labs collaborated with Rabobank in May 2024 in providing satellite monitoring to regenerative farms in Europe. This enabled the lending institutions to ensure sustainable practices without visiting the facility. The information favored special loan conditions to the farmers who took part.

Regenerative Agriculture Market Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Precision Agriculture Tools | 29.80% |

| Remote Sensing & GIS | 21.10% |

| AI & Data Analytics Platforms | 19.60% |

| IoT Soil & Crop Monitoring Systems | 16.90% |

| Automated Irrigation Systems | 12.60% |

AI and Data analytics platforms: Large datasets feed AI and data analytics platforms to help make decisions about regenerative farming. They are able to determine the success of crops and efficiency in resource utilization. In January 2024, CropX opened an AI-powered irrigation management system in Israel regenerative farms. Without yield loss, its users have reported to save 20 percent water. The system studied weather and soil data on a real-time basis.

IoT Soil & Crop Germination System: IoT networks allow monitoring soil moisture, nutrition factors and plant evolution by means of linked sensors. They give practical warnings to the farmers. In August 2023, Pycno installed wireless soil sensors on South African regenerative agriculture vineyards. It made farmers optimize irrigation programs and decrease the amount of water used by 18%. The technology also indicated early symptoms of nutrient deficiencies.

Computerized Irrigation Systems: Automated irrigation systems distribute water according to the needs of crops, so waste of water and efficiency is increased. They play an important role in regenerative farms that are prone to drought. In March 2024, Netafim tried out a solar powered heat drip irrigation system on regenerative cotton farms in India. A 30 percent decrease in water use and a rise in fiber quality were observed by farmers. The system worked comfortably off-grid.

Cereals & Grains: Wheat, maize, and rice are some of the cereals and grains that form the focus of regenerative practices because of their universal demand and the contributions they make towards soil building. In June 2023, Kansas farmers in the United States accepted regenerative wheat systems coupled with cover crops and no-till farming. This enriched soil organic matter and erosion. Protein levels and grain quality were improved, as well.

Fruits & Vegetables: Regenerative systems help build soil health, manage chemicals and boost the amount of fruit and vegetable production. Compost mulching and the integrated pest management were also practiced in Washington State regenerative apple orchards in December 2023. Harvesters noted an improvement in their harvest and less of residues fall in pesticides. The level of consumer demand of produce that is grown in a regeneratively way increased in local markets.

Regenerative Agriculture Market Share, By Crop Type, 2024 (%)

| Crop Type | Revenue Share, 2024 (%) |

| Cereals & Grains | 37.20% |

| Fruits & Vegetables | 29.10% |

| Plantation Crops | 21.70% |

| Specialty Crops | 12% |

Plantation Crops: The regenerative systems under which beans (coffee, tea, and cocoa) grow well are shade-grown systems. Agroforestry using indigenous shade trees was launched by the Ghanaian cocoa cooperatives in April 2024. These minimized warming of cocoa plants and enhanced diversity. Ethical chocolate brands paid their farmers premiums as well.

Specialty Crops: Herbs, spices, niche horticulture products and other specialty crops command a higher price with regenerative systems. Regenerative mulching and legume intercropping was introduced among the Indian turmeric farmers in July, 2023. That lowered the weed pressure and enhanced the quality of rhizomes. European consumers are willing to pay more on the regeneratively cultivated turmeric.

Big Foot Farms: The objective of achieving a sustainability target in size through regenerative practices in large commercial farms has to be maintained at profitability levels. In October 2023, a 5,000 acre farm in Illinois changed to no-till and cover crops in precision nutrient management. The transition reduced input expenses and enhanced the condition of the soil. Supply contracts with retailers were established after long-term partnership.

Cooperatives & Farmer Associations: Farmer associations and cooperatives help to share the knowledge and collectively apply regenerative systems. In May 2024, a Spanish cooperative located in Andalusia started using cover cropping on olive groves group-wide. Equipment and agronomy services were shared by members helping to reduce the cost. The collective model also increased the eligibility of carbon credit.

Agribusiness Corporations: Agribusiness corporations incorporate regenerative sourcing into the supply chain in order to achieve ESG goals. In February 2023, General Mills doubled the size of its regenerative sourcing program, to 1 million acres of wheat and oats in North America. This also met corporate climate objectives as well as brands marketing. The company offered support to farmers in terms of technical and monetary.

NGOs Development Agencies: In resource-constrained areas, NGOs and development organizations are not trying to end regenerative agriculture to enhance food security and resilience. In August 2023, the regenerative pilot in Zimbabwe was established by the Food and Agriculture Organization (FAO) based in Harare, and is centred on smallholder maize fields. They trained farmers, provided them with organic input, and soil testing assistance. There was an increase in yields even with irregular rain.

Market Segmentation

By Practice Type

By Input Type

By Technology

By Crop Type

By End-User

By Region