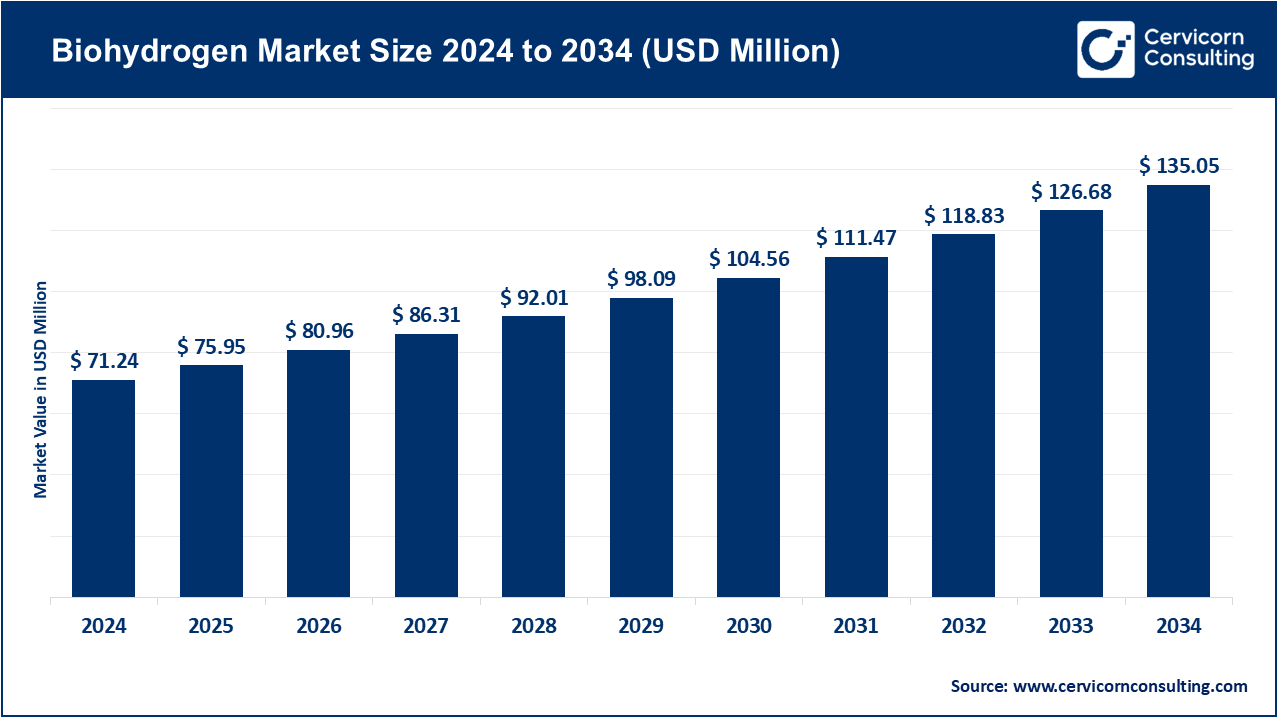

The global biohydrogen market size was valued at USD 71.24 million in 2024 and is expected to be worth around USD 135.05 million by 2034, growing at a compound annual growth rate (CAGR) of 7.4% over the forecast period 2025 to 2034. Biohydrogen industry is picking the pace as industries seek a sustainable, renewable and high efficiency source of power. The potential application fields of biohydrogen are the transportation sector, electricity production, chemical sector, and health care where clean energy source, less pollution, and long-term energy sustainability are essential. Emerging trends towards decarbonization, urbanization and the introduction of strict environmental regulations are driving the demand, whereas continued innovation in biotechnological processes, microbial fermentation, and cost-effective production methods are further improving the scalability and sustainability.

What is biohydrogen?

Biohydrogen refers to hydrogen gas (H2) created by biological means that utilise microbial, algal or enzyme activity to turn organic material or water into hydrogen. Unlike standard hydrogen that is produced using fossil fuels, Biohydrogen is environmentally friendly since it is produced via renewable methods: it is carbon neutral with no fossils. It can be produced via pathways that include dark fermentation, photo-fermentation, and biophotolysis and has specific advantages in regard to the yield and scalability. Its renewal, recycling energy systems, reusability in more industries, Biohydrogen is destined to be one of the green energy carriers of the global markets.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 75.95 Billion |

| Estimated Market Size in 2034 | USD 135.05 Billion |

| Projected CAGR 2025 to 2034 | 7.40% |

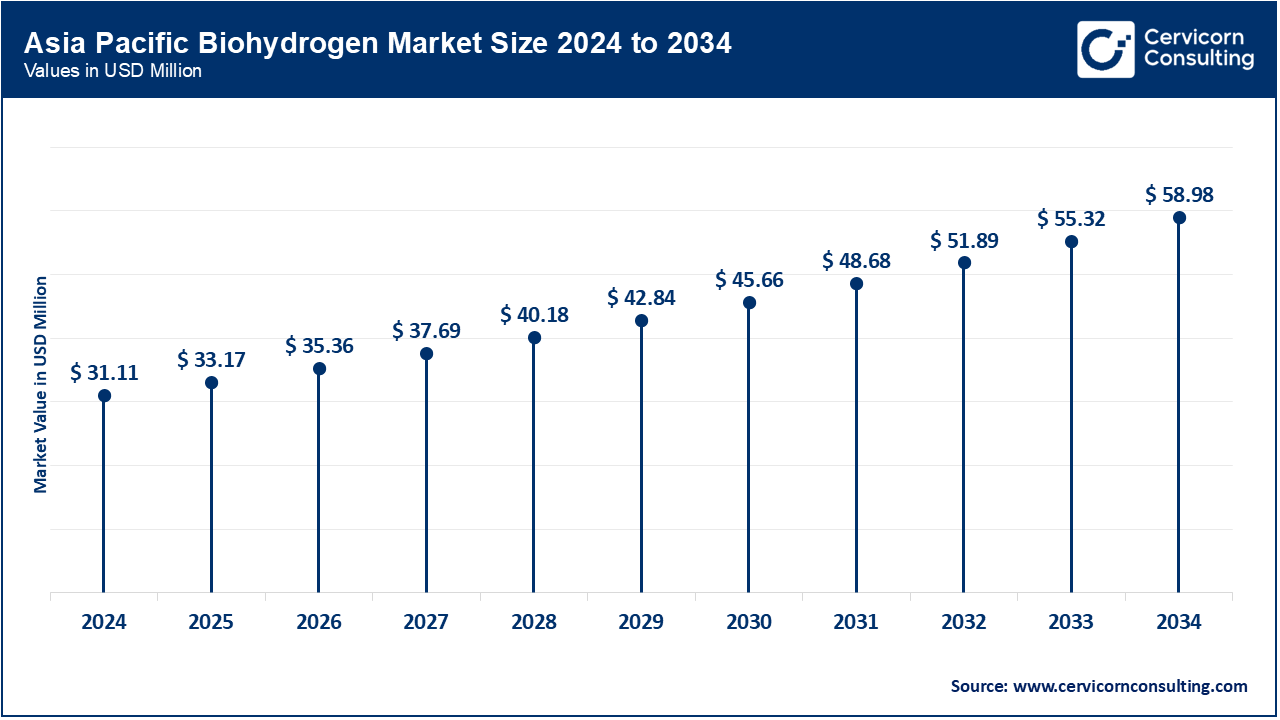

| Leading Region | Asia-Pacific |

| Key Segments | Production Method, Feedstock, Technology, Application, Region |

| Key Companies | Air Products and Chemicals, Inc., Linde plc, Engie SA, Air Liquide, Shell plc, Cummins Inc. (Hydrogenics), Plug Power Inc., Ballard Power Systems, ITM Power, Siemens Energy AG |

The biohydrogen market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). Here’s an in-depth look at each region.

Asia-Pacific is advancing biohydrogen adoption with major industrial projects, especially in China. In August 2025, a biohydrogen industrial park in Shandong Province was launched with an investment of over USD 2 billion. The project combines algae cultivation with hybrid biological and chemical secondary hydrogen production methods. The industrial center illustrates China’s efforts to control coal consumption and dominate the global hydrogen industry.

Due to robust government investments and a conducive research environment, North America is emerging as a center for biohydrogen development. A noteworthy instance occurred in April 2025, when the U.S. Department of Energy unveiled a pilot biohydrogen project in California, which was supported by over USD 1.2 billion in clean energy investments. The project aims to scale up microbial electrolysis systems using agricultural residues as feedstock. This showcases the dual emissions reduction and renewable hydrogen production goals the U.S. is pursuing at a commercial scale.

Europe is still the number one region in biohydrogen development, and this is mainly due to the climate policies and green fuel incentives. In March 2025, Germany funded a €40 million program for the conversion of agricultural residues to hydrogen through dark fermentation. This is part of the Germany’s national hydrogen strategy which promotes the use of renewable hydrogen in industry and transport. In addition, the program fosters rural development by enabling farmers to earn from waste products.

Proactive linked biohydrogen adoption with renewable energy projects in the LAMEA region. In July 2025, Brazil’s state of Ceará launched a biohydrogen facility at Wind Farm 3, which was financed to the tune of USD 600 million. The initiative harnesses microbial processes, seeking to combine abundant renewable electricity with hydrogen generation. It marks the first large-scale integration of biohydrogen with wind energy in Latin America.

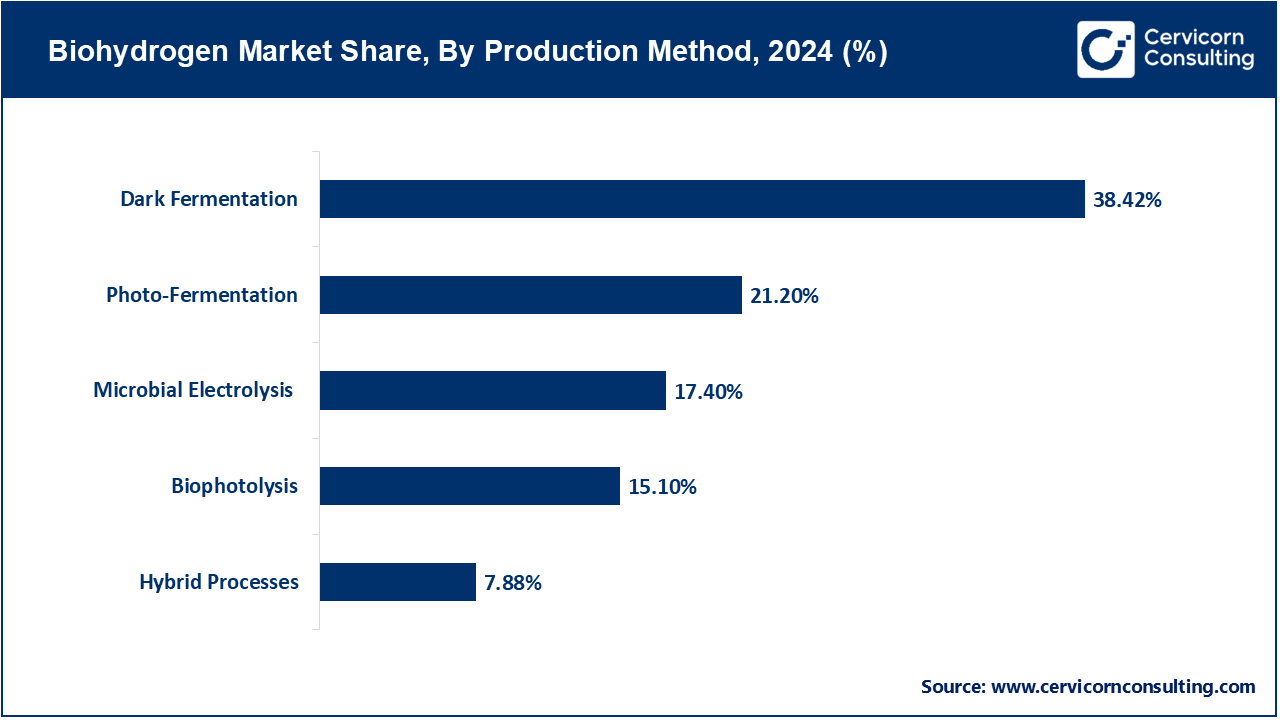

Dark Fermentation: This is a process of producing hydrogen gas from organic material using anaerobic bacteria breakdown without light. As of now, it is considered one of the simplest and most scalable biological methods. In January 2025, a packed-bed bioreactor synthesized wastewater and converted it into hydrogen. This hydrogen was subsequently utilized in a fuel cell to produce electricity. This process highlighted the wastewater treatment and the biohydrogen generation, proving the dual benefits of bioreactor systems.

Photo-Fermentation: This is a process in which organic substrates and light are utilized by photosynthetic bacteria to produce hydrogen. This process is done in combination with dark fermentation. In July 2025, a study was conducted using Rhodopseudomonas bacteria and scaled photo-fermentation to 0.2 L and 4 L reactors. The larger bioreactor was able to achieve higher efficiency which is a promising factor for photo-fermentation in future pilot plants.

Biophotolysis: This is the process in which photosynthetic microorganisms such as algae split water, producing hydrogen and oxygen, under light. This is the cleanest method as it only requires water and sunlight. A South Korean researcher tested green algae strains in controlled environments and reported enhanced hydrogen yield yields through biophotolysis in March 2024. This indicates the potential as a solar-driven hydrogen pathway.

Microbial Electrolysis: Microbial electrolysis is the process of producing hydrogen from microbes adhered to electrodes with the help of a small electrical current. It is the integration of bioelectrochemical systems and hydrogen recovery. In February 2025, Japanese researchers created a microbial electrolysis system which treated brewery wastewater while generating hydrogen gas. The study confirmed its dual-purpose viability for wastewater treatment and energy recovery.

Hybrid Processes: Hybrid processes integrate several production pathways such as the dark fermentation followed by phototrophic fermentation to increase hydrogen yield. These methods are intended to decrease feedstock waste along with increasing overall productivity. In October 2024, a European group reported a pilot-scale hybrid system that attained a 40% increase in hydrogen production as compared to stand-alone methods. This highlighted the potential of biochemical pathway integration to a single system.

Agricultural Residues: Agricultural residues encompass byproducts from farming activities such as husks, straw, and stalks, which can be transformed into biohydrogen via fermentation processes. These residues are valued for their abundance and low cost. An Indian study conducted in April 2025 demonstrated dark fermentation of rice straw, yielding substantial quantities of hydrogen while tackling residue disposal concerns. This study illustrated the double benefit of waste valorization coupled with clean energy production.

Industrial Waste: Waste from industries, particularly wastewater and organic effluents, presents an economically viable and environmentally friendly feedstock for biohydrogen production. These organic effluents waste streams are rich in nutrients, which can benefit biohydrogen production. In January 2025, researchers in Europe conducted an experiment with dark fermentation of simulated industrial wastewater, yielding hydrogen gas which was later used in a fuel cell to generate power. These results highlighted the industrial application of the technique for companies looking for sustainable waste treatment alternatives.

Biohydrogen Market Share, By Feedstock, 2024 (%)

| Feedstock | Revenue Share, 2024 (%) |

| Agricultural Residues | 36.15% |

| Industrial Waste | 23.40% |

| Municipal Solid Waste | 14.20% |

| Algae & Microorganisms | 17.50% |

| Food Waste | 8.75% |

Organic Waste: 'Municipal solid waste’ (MSW) is the term given to the collection of waste by households and by city authorities, which is then used to produce hydrogen. This technique addresses the sustainable disposal of urban waste. In March 2025, an Italian pilot project achieved the conversion of organic municipal waste into hydrogen gas through dark fermentation. This project set out to demonstrate the feasibility of integrating waste treatment in urban centers with the production of renewable hydrogen gas.

Algae & Microorganisms: Algae, along with certain specialized microorganisms, can be cultivated for hydrogen production via photolysis or fermentation. They serve as renewable biological energy factories. In February 2025, scientists from China developed a strain of green algae that was able to produce hydrogen at higher rates under light conditions during laboratory tests. This made algae more useful for implementation into biohydrogen production facilities.

Food Waste: Food waste, due to its high carbohydrate and protein content, is widely accepted as a substrate for dark fermentation and other hybrid modes of biohydrogen generation. This not only helps address biohydrogen generation, but also helps with food waste disposal problems. In May 2025, one group from South Korea reported a two-stage system that utilizes household food waste and achieves higher hydrogen yields than single-stage setups. This research showcased food waste as a prominent scalable substrate for biohydrogen energy recovery.

Transportation Fuel: This branch of biofuel technology is aimed at reducing the use of fossil fuels in vehicles which biohydrogen can aid in through fuel cells. The technology is particularly useful for clean mobility initiatives. A Japanese consortium experimented with biohydrogen fueled buses in urban areas in April 2025 which served as pilot trials for emission reduction. These trials confirmed the success of biohydrogen in public transportation systems.

Power Generation: Power generation is the application of biohydrogen in fuel cells and turbines for electricity generation. Biohydrogen serves as a clean replacement for fossil fuel burnt in coal or gas plants. A German research team in January 2025 reported success in powering a small scale fuel cell system with biohydrogen produced from agricultural waste. The project confirmed that biohydrogen can effectively serve as a renewable electricity source.

Industrial Energy: This branch of biofuel technology is aimed at reducing the carbon emission in factories and heavy industries as a cleaner heat and energy source. A steel plant in South Korea experimented with blending biohydrogen with coal in their furnaces as a coal reduction strategy in March 2024. The trial confirmed energy cost reductions and improved sustainability performance.

Chemical and Refining: Hydrogen is an essential feedstock for numerous industries, including the production of ammonia and methanol. Biosources of hydrogen provide a biological approach to the renewable hydrogen economy. In line with EU sustainability regulations, European chemical manufacturers undertook experimental production of biohydrogen feedstock for ammonia synthesis in December 2024. This initiative represents a key milestone toward the sustainability of the chemical supply chain.

Healthcare and Biotechnology: Biohydrogen is being investigated in healthcare and biotechnology for its applications in powering medical facilities and bioprocessing. It can be harnessed to provide clean energy in more sensitive and fragile environments. In critical care in the UK, researchers tested biohydrogen-powered fuel cells in May 2025 as backup power for hospitals during power disruptions. This demonstrates the reliability of biohydrogen in critical care.

Fermentation-Based Technology: Fermentation-based technology is one of the most researched pathways in biohydrogen production. This technology is based on the activity of microorganisms in anaerobic conditions and is used to convert organic matter into hydrogen. Indian researchers recently optimized a dark fermentation setup using sugarcane bagasse and achieved improved yields in hydrogen production in February 2025. This further validates the potential of fermentation-based systems in scaling hydrogen production.

Photobiological Technology: Photobiological technology focuses on using biological systems such as algae and bacteria to produce hydrogen under the influence of light. It is an into-the-wild mimic of natural photosynthesis with an optimized output tailored toward fuel applications. An advancement in this field was achieved by South Korean scientists in March 2024 when they enhanced algal photosystems to produce hydrogen more efficiently under light laboratory conditions. This achievement was a notable step toward practical applications of photobiological hydrogen production.

Biocatalyst Technology: Biocatalyst technology applies the use of biocatalysts in the form of enzymes and microorganisms to assist in the production of hydrogen. The utilization of biocatalysts in the form of enzymes and microbes increases the efficiency and speed of reactions. The enzyme systems were expected to become commercially viable and were accelerated by the new variant of hydrogenase enzymes developed by European labs in October 2024, which was found to increase the hydrogen yield during microbial fermentation.

Gasification & Thermochemical Routes: Gasification and thermochemical pathways include the processes of pyrolysis and gasification which occur at high temperatures to derive biomass into hydrogen-rich gases and biohydrogen. These processes exhibit a within the continuum of biological and thermal processes. In the US, researchers conducted a pilot project thermochemically converting municipal waste to hydrogen fuel as a proof of concept to its capability to cope with large feedstock volumes. This validated thermochemical pathways as feasible options of urban energy recovery.

Hybrid Biological-Chemical Systems: Hybrid biological-chemical systems optimally employ biological fermentation and chemical processing to realize efficiency in hydrogen production. This approach ensures better utilization of the substrate. In Europe, a project implemented dark fermentation with gas catalytic upgrading, which resulted in the production of hydrogen with greater purity. This result showed the promise of hybrid systems in overcoming the limitations of mono-tech route systems.

Market Segmentation

By Production Method

By Feedstock

By Technology

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Biohydrogen

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Feedstock Overview

2.2.3 By Application Overview

2.2.4 By Production Method Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 The projected growing need of renewable fuels

4.1.1.2 Favourable policy and research incentives

4.1.2 Market Restraints

4.1.2.1 High production costs

4.1.2.2 A shortage of distribution infrastructure

4.1.3 Market Challenges

4.1.3.1 Scaling up production to an industrial level

4.1.3.2 Consistency of feedstock availability

4.1.4 Market Opportunities

4.1.4.1 Discoveries in microbial engineering

4.1.4.2 An increase in at Satellite hydrogen infrastructure investments

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Biohydrogen Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Biohydrogen Market, By Technology

6.1 Global Biohydrogen Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Fermentation-Based Technology

6.1.1.2 Photobiological Technology

6.1.1.3 Biocatalyst Technology

6.1.1.4 Gasification & Thermochemical Routes

6.1.1.5 Hybrid Biological-Chemical Systems

Chapter 7. Biohydrogen Market, By Production Method

7.1 Global Biohydrogen Market Snapshot, By Production Method

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Dark Fermentation

7.1.1.2 Photo-Fermentation

7.1.1.3 Biophotolysis

7.1.1.4 Microbial Electrolysis

7.1.1.5 Hybrid Processes

Chapter 8. Biohydrogen Market, By Application

8.1 Global Biohydrogen Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Transportation Fuel

8.1.1.2 Power Generation

8.1.1.3 Industrial Energy

8.1.1.4 Chemical & Refining

8.1.1.5 Healthcare & Biotechnology

Chapter 9. Biohydrogen Market, By Feedstock

9.1 Global Biohydrogen Market Snapshot, By Feedstock

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Agricultural Residues

9.1.1.2 Industrial Waste

9.1.1.3 Municipal Solid Waste

9.1.1.4 Algae & Microorganisms

9.1.1.5 Food Waste

Chapter 10. Biohydrogen Market, By Region

10.1 Overview

10.2 Biohydrogen Market Revenue Share, By Region 2024 (%)

10.3 Global Biohydrogen Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Biohydrogen Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Biohydrogen Market, By Country

10.5.4 UK

10.5.4.1 UK Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Biohydrogen Market, By Country

10.6.4 China

10.6.4.1 China Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Biohydrogen Market, By Country

10.7.4 GCC

10.7.4.1 GCC Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Biohydrogen Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Air Products and Chemicals, Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Linde plc

12.3 Engie SA

12.4 Air Liquide

12.5 Shell plc

12.6 Cummins Inc. (Hydrogenics)

12.7 Plug Power Inc.

12.8 Ballard Power Systems

12.9 ITM Power

12.10 Siemens Energy AG