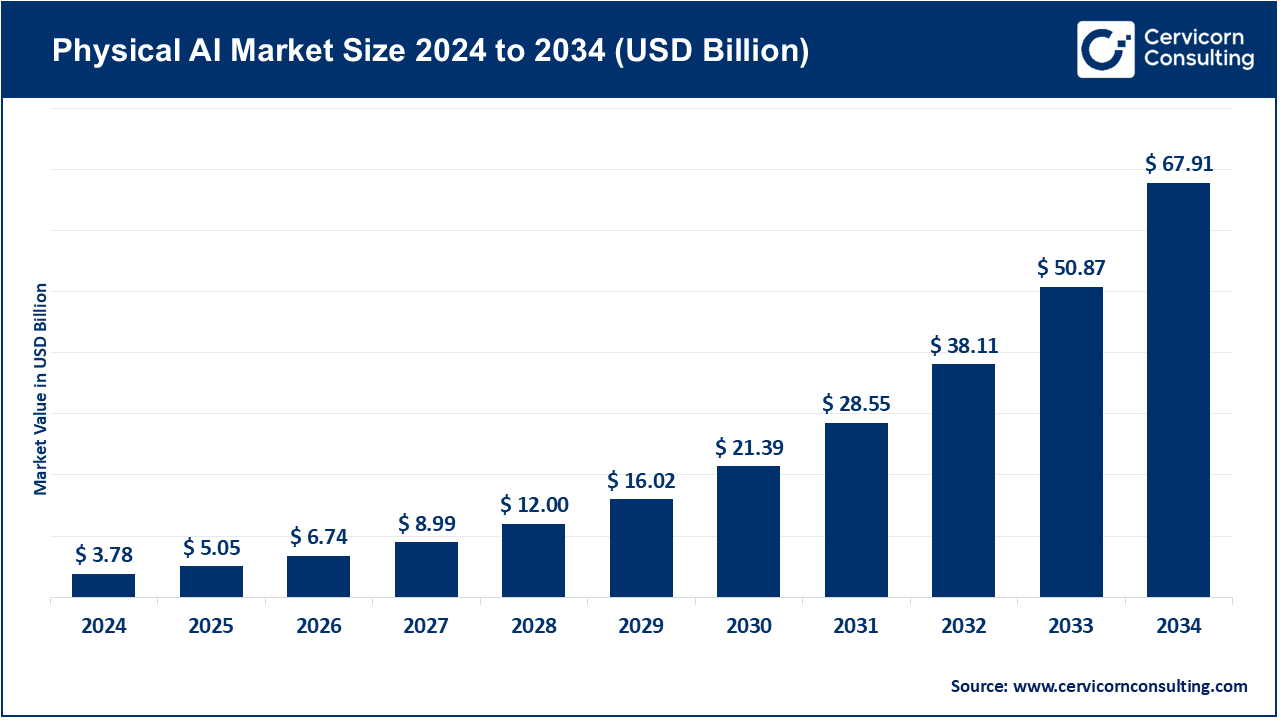

The global physical AI market size was reached at USD 5.13 billion in 2025 and is expected to be worth around USD 68.54 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 33.49% over the forecast period 2025 to 2034. The physical AI market growth is driven by rapid advancements in robotics, sensors, and AI models, enabling machines to perceive, learn, and act in the physical world. The increasing demand for automation across industries, especially in manufacturing, logistics, and healthcare, is a key factor. For example, over 70% of global manufacturers plan to boost investments in robotics and AI-driven automation to address labor shortages and improve efficiency. In healthcare, robotic surgeries are expected to grow at a double-digit annual rate as AI-enabled systems offer greater precision and better patient outcomes. Similarly, logistics companies are deploying embodied AI robots to cut last-mile delivery costs, which can make up to 53% of total shipping expenses.

Another important driver is the rising acceptance of collaborative robots (cobots) and humanoid systems designed to work alongside people. Cobot adoption alone is projected to have a CAGR of over 20% through 2034, as small- and medium-sized enterprises adopt more cost-effective automation solutions. Moreover, advancements in computer vision, reinforcement learning, and natural language processing are enhancing robots' ability to operate more flexibly in various environments. Governments across Asia, Europe, and North America are actively encouraging the adoption of smart manufacturing and robotics through different initiatives. Collectively, these developments create a strong opportunity for Physical AI to establish itself within the transformative technology landscape across multiple sectors.

What is the Physical AI?

Physical AI refers to artificial intelligence embedded in machines, robots, or devices capable of interacting with the physical environment. Physical AI is different from traditional AI based systems that exist only in software. Physical AI combines perception (sensors, cameras, microphones), cognition (AI models for learning and reasoning), and action (motors, actuators, robotic limbs) to sense, decide, and act within physical environments. In this case, machines can not only process information, but they can move, manipulate, and adapt in human environments.

The application of Physical AI spans multiple industries, including using humanoid robots to interact with customers, surgical robots for procedures, autonomous mobile robots in warehouses, and collaborative robots (cobots) in factories. Researchers are also exploring biologically inspired systems, such as soft robotics and artificial muscles, which allow machines to demonstrate human-like movement flexibility. In summary, Physical AI represents the cutting edge of AI, robotics, and materials science, with the aim of creating intelligent systems that can work with humans and operate effectively in complex and dynamic physical environments.

Here are some recent developments in the Physical AI

| Development | Key Details | Implications |

| Apptronik raises USD 350M to scale humanoid robots (“Apollo”) | Funding round led by B Capital and Capital Factory, with participation from Google. The focus is to deploy Apollo robots in warehouses, manufacturing, elder care, healthcare. | Signals strong investor confidence; move from prototype toward commercial deployment. Expanding sectors like elder care show broader applications. |

| OpenAI amps up robotics & humanoid research | Hiring researchers in humanoid systems, using simulation and teleoperation, working on physical control AI. | Shows that AGI / general intelligence efforts are reconnecting to physical agents. More resources being devoted to training AI that can operate in real, messy physical environments. |

| Ant Group unveils humanoid robot “R1” | Demonstrated tasks like cooking shrimp; use-cases envisioned in healthcare, tourism, companionship, guides. Slow movement in early demos. No pricing yet. | Entry of new big players (tech & finance firms) into humanoid robots. Focus on everyday tasks & public-facing roles (not just industry) indicates expanding use-cases. |

| SEER Robotics showcases new controllers & robots | Debuted products like the SRC-5000 embodied intelligent controller (for full body control), wheeled humanoid robot, quadruped robot dog, etc. | Advances in hardware + embodied control systems. The controllers that can integrate perception, motion, and multi-body coordination are enabling more flexible, adaptable robotics. |

| EngineAI’s new humanoid and quadruped robots | PM01 humanoid with autonomous fall recovery, fluid movements; T800 full-size heavy duty humanoid; JS01 quadruped robot for rugged terrain; SA02 for enthusiasts. | Expanding variety of robot types: from rugged outdoor / industrial to lighter versions for hobbyists. Demonstrates increasing sophistication in mobility and sensing. |

| Google DeepMind’s Gemini Robotics / Vision-Language-Action Models | Models like “Gemini Robotics”, “Vision-Language-Action” applied to robotics to improve reasoning, generalization, task adaptability. On-device versions emerging. | Trends toward combining foundation models (language + vision) with embodied control. Helps robots understand instructions, adapt to new environments or tasks. |

Rise of Collaborative Robots (Cobots)

Vision-Language-Action (VLA) Models

Growth of Humanoid and Generalist Robots

Focus on Energy Efficiency and Battery Life

Increasing Adoption of Robotics in Industries

Advancements in AI, Sensors, and Actuator Technologies

High Cost of Implementation

Limited Skilled Workforce

Growth in Healthcare and Elder Care Robotics

Expansion in Autonomous Vehicles and Delivery Systems

Safety and Regulatory Concerns

Ethical and Social Implications

The physical AI market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

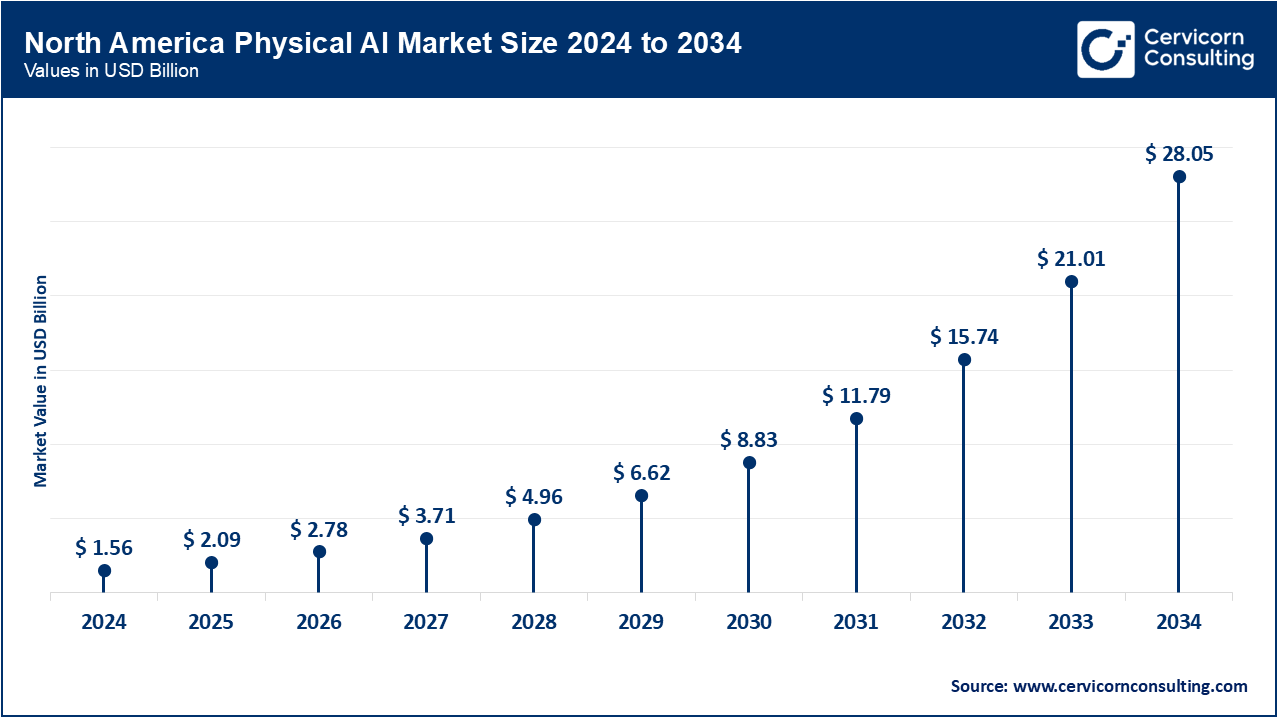

North America leads the market, driven by robust infrastructure, substantial R&D investments, and early adoption across sectors like manufacturing, healthcare, and defense. The U.S. is home to major AI innovators such as IBM, Microsoft, and NVIDIA, contributing to its market dominance. Canada is also emerging as a significant player; for instance, Canadian AI startup Cohere has expanded into Europe with the opening of a new office in Paris, aiming to increase its market share amid growing regional demand for AI services. This move aligns with French President Emmanuel Macron’s initiative to establish France as a European AI hub to strengthen digital sovereignty.

The APAC region is experiencing rapid growth in the market, fueled by industrialization, government-backed robotics initiatives, and expanding manufacturing hubs in countries like China, Japan, and South Korea. China is heavily investing in AI and robotics for smarter manufacturing and the automation of public services. Japan leads in developing humanoid and care robots for the elderly, while South Korea focuses on integrating AI into various sectors.

Europe is witnessing significant advancements, supported by strategic policies and investments in digital transformation. The European Union emphasizes ethical AI development, ensuring data privacy and regulatory compliance. Recent developments include the opening of a new office by Canadian AI startup Cohere in Paris, aiming to increase its market share amid growing regional demand for AI services. This move aligns with French President Emmanuel Macron’s initiative to establish France as a European AI hub to strengthen digital sovereignty.

The LAMEA region is experiencing rapid growth in the market, driven by increasing adoption in sectors like healthcare, agriculture, and manufacturing, supported by emerging digital transformation strategies. Countries such as Brazil, South Africa, and the UAE are investing in AI technologies to enhance industrial automation and improve public services. In Saudi Arabia, a partnership between Edarat and KPMG aims to accelerate AI adoption across the Kingdom, leveraging data center infrastructure and AI expertise to implement scalable and secure AI solutions.

The physical AI market is segmented into component, technology, robot type, application, deployment, and region.

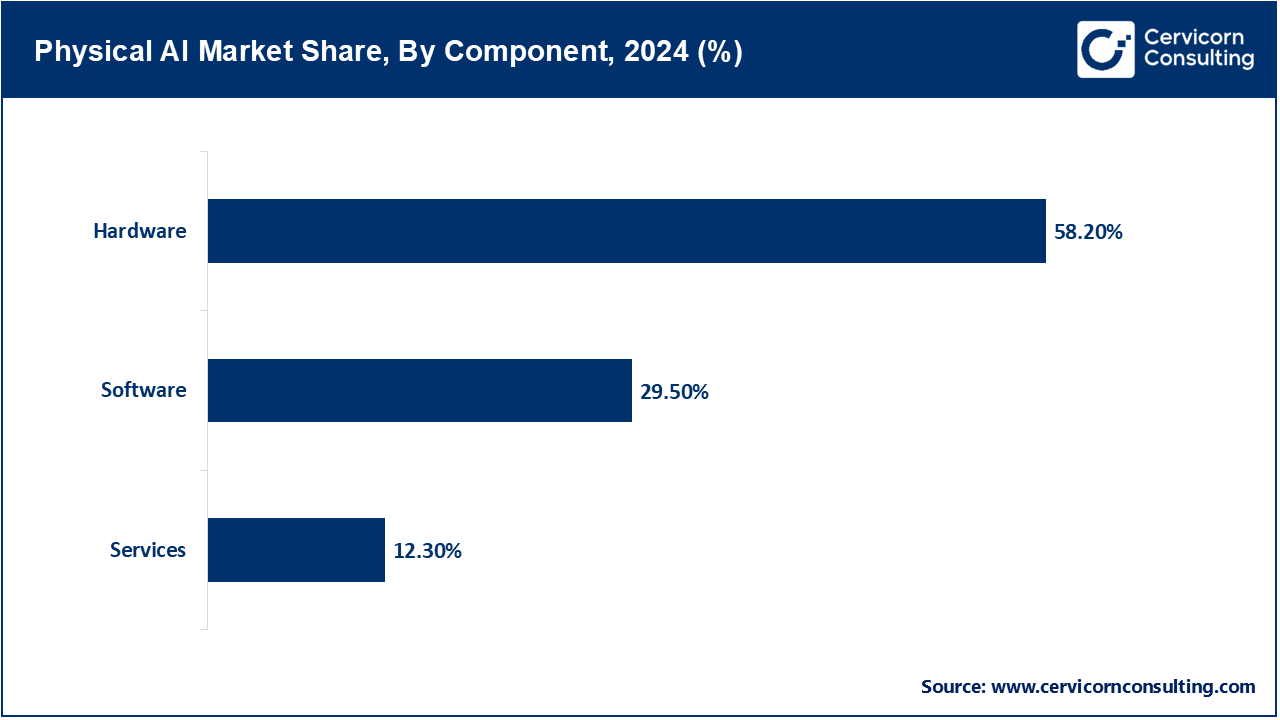

Hardware: Hardware forms the backbone of Physical AI, comprising sensors, actuators, processors, and embedded systems that enable robots to perceive and act. This segment dominates the market because hardware is mainly the initial investment in manufacturing and industrial automation. Ongoing demand for advanced sensors and high-performance chips drives consistent success in this segment.

Software: Software includes AI algorithms, machine learning models, and control systems that give robots intelligence so they can analyze data, adapt, and make decisions. This is the fastest-growing segment, driven by industry needs for flexible robots capable of functioning in constantly changing real-life situations. Software upgrades support ongoing sales growth for vendors.

Services: Offerings include integration, maintenance, consulting, and training that assist organizations in deploying Physical AI smoothly. Although this market segment is smaller, it rapidly grows to become a crucial factor in reducing adoption barriers and maximizing the advantages of operational AI systems.

Computer Vision: Computer vision leads this segment, empowering robots with the ability to “see” and interpret their surroundings. It plays a critical role in tasks like quality inspection, navigation, and object recognition in industries ranging from manufacturing to healthcare.

Speech / NLP: Natural language processing enables robots to understand and respond to voice commands, improving human-robot interaction. It is increasingly adopted in service and social robots to create seamless, natural communication experiences.

Gesture / Movement Recognition: Gesture recognition technology allows robots to interpret human movements, making collaboration safer and more intuitive. It is especially relevant for collaborative robots and assistive devices.

Reinforcement Learning & Control Systems: This is the fastest-growing technology segment, allowing robots to learn autonomously via trial-and-error and adapt to new tasks. It is vital for next-generation adaptive robots in warehouses, autonomous vehicles, and research.

Others (Multi-modal AI, Biomimetic Robotics): These include hybrid AI models and bio-inspired designs, driving innovation in advanced robotics and making machines more capable and efficient.

Industrial Robots: Industrial robots dominate the market due to their widespread use in automotive, electronics, and general manufacturing. They deliver high precision, speed, and productivity, making them the backbone of industrial automation.

Service Robots: These are deployed in healthcare, hospitality, and retail to assist humans in tasks like cleaning, delivery, or patient support. Their market share is steadily increasing as labor shortages and demand for automation grow.

Humanoids / Social Robots: Humanoid robots are designed to interact with humans in a lifelike way and are gaining adoption in education, research, and customer-facing roles. Their growth is slow but promising.

Cobots: Collaborative robots are the fastest-growing form factor, allowing safe side-by-side work with humans. Their flexibility, compact size, and affordability make them attractive to small and medium-sized enterprises.

Exoskeletons / Prosthetics: This niche segment helps improve human mobility and rehabilitation outcomes. Growing adoption in healthcare and military sectors is expected to boost demand.

Mobile Robots / Drones: Mobile robots and drones are increasingly used for logistics, agriculture, and security applications. Their ability to autonomously navigate complex environments makes them a rising force in the market.

Manufacturing & Automotive: This is the largest application segment, where Physical AI is used for welding, assembly, quality inspection, and production line automation. It drives efficiency and cost reduction in highly competitive industries.

Healthcare: Healthcare is the fastest-growing application segment as AI-driven robots are increasingly used for surgeries, rehabilitation, patient monitoring, and eldercare. Aging populations and the need to relieve healthcare staff workload are driving this growth.

Logistics & Warehousing: Robots streamline inventory handling, picking, and order fulfillment, helping e-commerce and supply chains meet rising consumer demand with speed and accuracy.

Retail & Hospitality: Robots are improving customer experience by assisting with service, restocking, and cleaning, especially in labor-constrained markets.

Defense & Security: Physical AI plays a critical role in surveillance, bomb disposal, and reconnaissance. The demand is consistent but niche.

Agriculture: Robotics enable precision farming, harvesting, and monitoring, helping farmers boost yields and reduce labor costs.

Education & Research: Robots serve as learning tools for students and as experimental platforms for advancing robotics and AI research.

Others: Specialized uses include space exploration, mining, and entertainment applications, adding diversity to the market landscape.

On-device: On-device deployment dominates because it allows real-time decision-making with low latency and strong data privacy, critical for safety and mission-critical applications.

Physical AI Market Share, By Deployment, 2024 (%)

| Deployment | Revenue Share, 2024 (%) |

| Cloud-based AI | 48.90% |

| On-device | 51.10% |

Cloud-based AI: This is the fastest-growing deployment mode, offering scalable computing power, centralized updates, and advanced AI training. As connectivity improves, more robots are expected to rely on cloud-based intelligence.

The physical AI industry is highly competitive, dominated by major technology and robotics companies that focus on integrating advanced AI with physical systems. Key players such as Boston Dynamics, ABB, FANUC, Siemens, NVIDIA, and SoftBank Robotics lead the market through continuous innovation in robotics, machine learning, and automation solutions. These companies invest heavily in R&D to develop intelligent robots capable of autonomous navigation, object recognition, and adaptive decision-making. Additionally, several startups are entering niche segments such as healthcare robotics, collaborative robots (cobots), and exoskeletons, intensifying competition and driving technological advancements. Partnerships, mergers, and acquisitions are common strategies to expand capabilities, geographic reach, and customer bases, with a strong emphasis on developing AI-driven software platforms that enhance robot intelligence and functionality.

Another key competitive factor in the Physical AI market is the growing focus on regional and sector-specific dominance. For instance, North American companies leverage their advanced technology ecosystem and venture funding to dominate industrial and service robotics, while Asia-Pacific players—particularly in Japan, South Korea, and China—are rapidly expanding in manufacturing automation, care robots, and mobility solutions. European firms emphasize ethical AI, regulatory compliance, and precision engineering, targeting healthcare and industrial automation applications. Smaller companies and startups are competing by offering highly specialized solutions, such as AI-powered logistics robots or humanoid service robots, creating pockets of intense innovation. The competitive landscape is thus defined not only by technological capability but also by the ability to adapt to regional needs, regulatory environments, and sector-specific applications, making agility and innovation critical for sustaining market leadership.

Internationally, organizations are recognizing the economic potential of Physical AI. NITI Aayog's report suggests that faster adoption of AI across key industries in India could add between USD 500 billion and USD 600 billion to the country's GDP by 2035, driven by improvements in productivity and workforce efficiency.

In the United States, Goldman Sachs reports a significant discrepancy between the economic impact of artificial intelligence and its reflection in official GDP statistics. Since 2022, AI infrastructure revenue among U.S. companies has surged by USD 400 billion, indicating a significant economic contribution. However, official GDP figures only attribute USD 45 billion (or 0.2% of GDP) of this growth to AI, while Goldman estimates the real impact is closer to USD 160 billion, leaving approximately USD 115 billion unaccounted for in government data.

Market Segmentation

By Component

By Technology

By Robot Type / Form Factor

By Deployment

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Physical AI

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Component Overview

2.2.3 By Robot Type / Form Factor Overview

2.2.4 By Deployment Overview

2.2.5 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Adoption of Robotics in Industries

4.1.1.2 Advancements in AI, Sensors, and Actuator Technologies

4.1.2 Market Restraints

4.1.2.1 High Cost of Implementation

4.1.2.2 Limited Skilled Workforce

4.1.3 Market Challenges

4.1.3.1 Safety and Regulatory Concerns

4.1.3.2 Ethical and Social Implications

4.1.4 Market Opportunities

4.1.4.1 Growth in Healthcare and Elder Care Robotics

4.1.4.2 Expansion in Autonomous Vehicles and Delivery Systems

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Physical AI Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Physical AI Market, By Technology

6.1 Global Physical AI Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Computer Vision

6.1.1.2 Speech / NLP

6.1.1.3 Gesture / Movement Recognition

6.1.1.4 Reinforcement Learning & Control Systems

6.1.1.5 Others (multi-modal AI, biomimetic robotics)

Chapter 7. Physical AI Market, By Robot Type / Form Factor

7.1 Global Physical AI Market Snapshot, By Robot Type / Form Factor

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Industrial Robots

7.1.1.2 Service Robots

7.1.1.3 Humanoids/Social Robots

7.1.1.4 Cobots

7.1.1.5 Exoskeletons/Prosthetics

7.1.1.6 Mobile Robots/Drones

Chapter 8. Physical AI Market, By Component

8.1 Global Physical AI Market Snapshot, By Component

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Hardware

8.1.1.2 Services

8.1.1.3 Software

Chapter 9. Physical AI Market, By Application

9.1 Global Physical AI Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Healthcare

9.1.1.2 Manufacturing & Automotive

9.1.1.3 Logistics & Warehousing

9.1.1.4 Retail & Hospitality

9.1.1.5 Defense & Security

9.1.1.6 Agriculture

9.1.1.7 Education & Research

9.1.1.8 Others

Chapter 10. Physical AI Market, By Deployment

10.1 Global Physical AI Market Snapshot, By Deployment

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Cloud-based AI

10.1.1.2 On-device

Chapter 11. Physical AI Market, By Region

11.1 Overview

11.2 Physical AI Market Revenue Share, By Region 2024 (%)

11.3 Global Physical AI Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Physical AI Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Physical AI Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Physical AI Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Physical AI Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Physical AI Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Physical AI Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Physical AI Market, By Country

11.5.4 UK

11.5.4.1 UK Physical AI Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Physical AI Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Physical AI Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Physical AI Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Physical AI Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Physical AI Market, By Country

11.6.4 China

11.6.4.1 China Physical AI Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Physical AI Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Physical AI Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Physical AI Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Physical AI Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Physical AI Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Physical AI Market, By Country

11.7.4 GCC

11.7.4.1 GCC Physical AI Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Physical AI Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Physical AI Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Physical AI Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 SoftBank Robotics Group

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 ABB

13.3 Toyota Motor Corporation

13.4 FANUC

13.5 Siemens

13.6 KUKA AG

13.7 Boston Dynamics

13.8 Tesla (Optimus)

13.9 NVIDIA

13.10 DeepMind

13.11 Agility Robotics

13.12 Mech-Mind Robotics

13.13 Hanson Robotics

13.14 Covariant