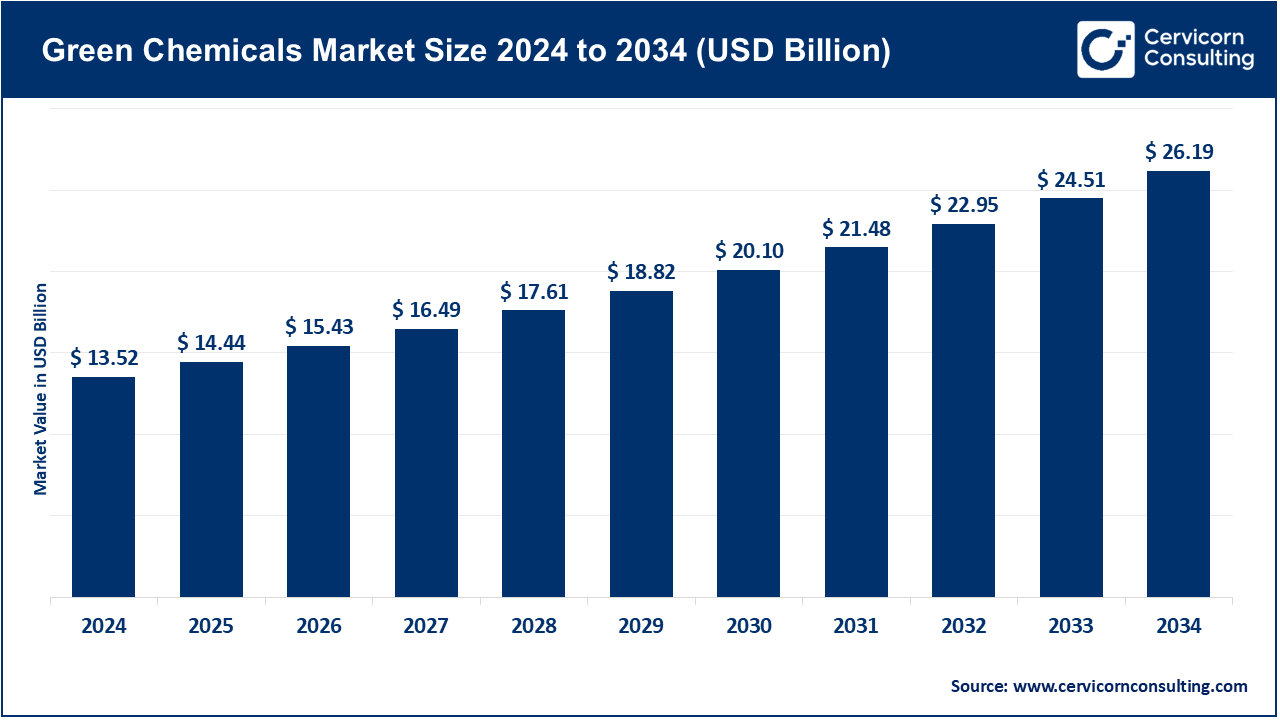

The global green chemicals market size was valued at USD 13.52 billion in 2024 and is expected to be worth around USD 26.19 billion by 2034, registering a compound annual growth rate (CAGR) of 6.84% over the forecast period from 2025 to 2034. The green chemicals market is growing at a rapid pace because industries are increasingly under pressure to meet net-zero goals, become and receive green certification and lessen the burden they put on the planet. Transcending the conventional manufacturing systems, green chemical solutions seek to minimize embodied carbon, enhance the energy intensity and encourage a circularity of resources and meet global climate targets. Increased regulatory expectations; intensified ESG commitments; and the need to address and tame climate change are just some of the few drivers that are urgently speeding adoption rate across sectors in nearly all parts of the world. This trend implies the increased awareness of the fact that sustainable production is currently the key to long-term development and competitive efficiency.

Green chemicals are becoming scalable and more economically viable through advances in bio-based polymers, green solvents and enzymatic reaction as well as zero-carbon synthesis. They apply in the field of consumer goods, agriculture, and pharmaceuticals, construction, automotive, and industrial manufacturing. Green chemicals also make the decarbonization measurable by utilizing renewable inputs as opposed to fossil-based ones; they provide compliance with the environmental standards and overall lifecycle performance improvement through biodegradable end product. Incorporated with such innovations into the industrial processes, the companies are accelerating and making the move toward a low-carbon, circular economy with profitability and resilience secured.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 14.44 Billion |

| Estimated Market Size in 2025 | USD 26.19 Billion |

| Projected CAGR 2025 to 2034 | 6.84 % |

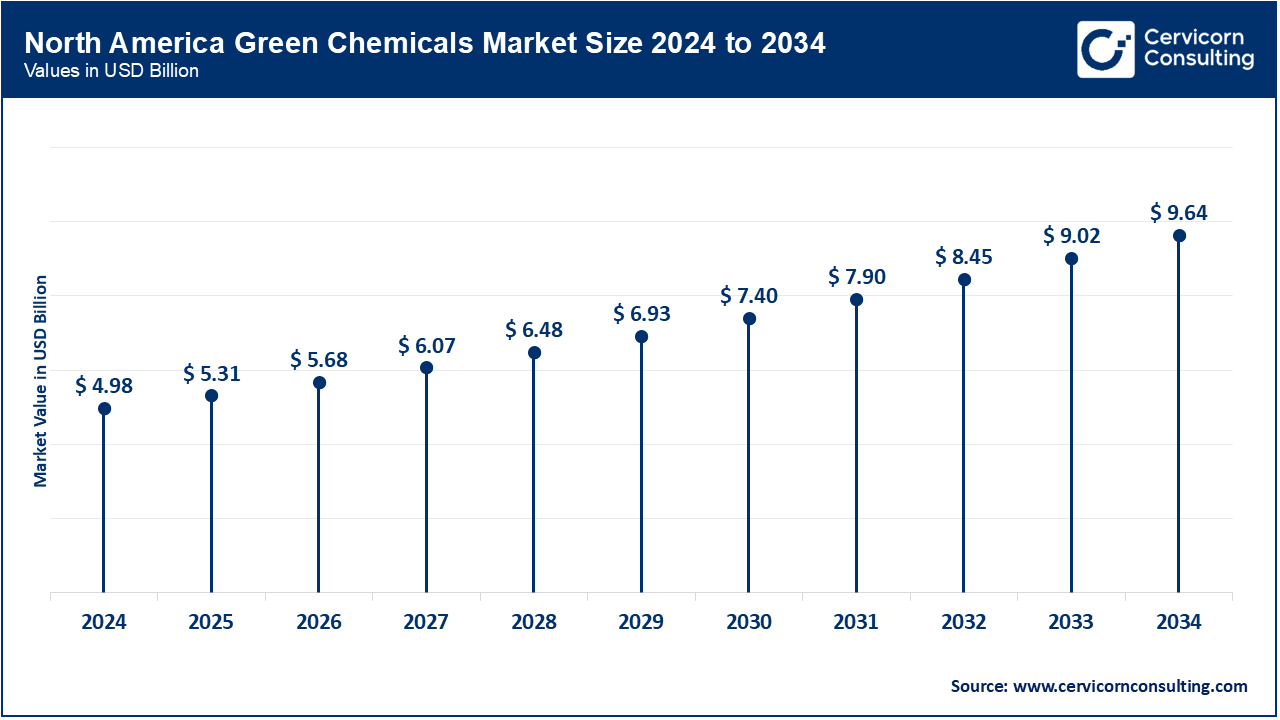

| Leading Region | North America |

| Fastets Growing Region | Asia-Pacific |

| Key Segments | Product Type, Feedstock, Technology, Application, End-Use Industry, Region |

| Key Companies | Dow, ADM, BASF, Cargill, Incorporated, Corbion, Merck KGaA, Syensqo, Solugen, Evonik, DUDECHEM GmbH, Mitsubishi Chemical Group Corporation., DuPont |

The North America market development is being driven by government incentives, ready supply of renewable feedstocks and ESG commitments by corporations. The focus of investing is in the field of bio-based polymers, green solvents and manufacturing with renewable power. Packaging, automotive and consumer goods industrial retrofits are complying with standards of low carbon. In January 2025, a U.S. based bioplastics manufacturer based in Iowa commissioned a plant in PLA that would use locally grown corn. This has strengthened supply chains within the country, and lessens the dependence on fossil based plastics.

The Europe is developing with stringent policies on climate change under the EU, the circular economy requirements, and bio-economy-related plans. Work is being done to scale cross-border supply chains of bio-based products and substitution of hazardous chemicals. Industrial parks are under development in which more than one producer can share their feedstock and research and development facilities. In February 2025, the Netherlands opened a bio refinery that turns agricultural waste into bio based poly ethylene. This provides packaging companies in Germany, France and Belgium under common sustainability objectives.

Green Chemicals Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 36.80% |

| Europe | 28.70% |

| Asia-Pacific | 25.10% |

| LAMEA | 9.40% |

The Asia-Pacific region is currently growing fast in the market with support of the government, use of renewable materials and increasing sustainability targets by the industries. These areas are the use of plant-based feedstocks, fermentation technologies and biodegradable packaging. Large-scale manufacturing is speeding up the regional and global cooperation. Japan In May 2025, an integrated green chemicals complex went on stream in Osaka capable of producing bio- based succinic acid and bioplastics. This enhanced both the domestic supply and increase exports to neighbouring countries.

Renewable integration of energy and bio-based industrial projects as well as waste-to-value use of green chemicals is increasing the LAMEA market. Producers in the Middle East are embracing biomass and solar energy in the production of chemicals in a sustainable way. Efforts to turn agricultural residues into a new energy source are being tested in African countries, and Latin America ramps up sugarcane-derived products. In April 2025, Brazil also commissioned a plant turning sugarcane bagasse into the bio-based polyethylene glycol. This is presently providing cosmetics and pharmaceutical companies in regional markets.

Bio-based Polymers: The Bio-based polymers can be recognized as plastic and resins made out of renewable materials (corn, sugarcane or cellulose) rather than oil-derived polymers. They will reduce carbon emissions and may provide biodegradability. In August, one of the largest bioplastics manufacturers in Thailand doubled the capacity of PLA production in anticipation of increased production of environmentally friendly packaging. This was seen to reinforce local supply chains and similarly cut down on the use of fossil-based plastics.

Green Solvents: Green solvents provide an environment-friendly alternative to the standard solvents, which are non-toxic, renewable, and aimed at lowering the toxicity and issuance of VOCs. They find extensive use in cleaning products and coatings as well as chemical compositions. In May 2024, a European manufacturer of coatings was converting to bio-based ethyl lactate solvents in order to meet modernized low-VOC regulations. This aided in the firm attaining environmental goals and enhancing the protection of the workers.

Plant-based Feedstocks: Green chemical production is made using plant-based feedstocks developed as raw materials via crops, forestry, or agricultural waste. By substituting inputs derived out of fossils these enable the manufacture to be sustainable. In April 2025, the Switzerland-based Bloom Biorenewables raised the funds of USD 0.015 billion to expand feedstocks based on lignin sourced in woody biomass. The goal of this project is to generate high efficient materials in terms of packaging and specialty chemicals.

Green Chemicals Market Share, By Feedstocks, 2024 (%)

| Feedstocks | Revenue Share, 2024 (%) |

| Plant-based | 78.50% |

| Waste-derived | 21.50% |

Waste-derived Feedstocks: Waste-derived feedstocks imply converting organic or industrial waste into the chemical building blocks and relying less on landfills and emissions. They facilitate sustainable manufacturing and reduced demand of resources. Technology using plant waste to make green polymers was developed by the GF Biochemicals in February 2025. New technology was a demonstration of waste and value opportunities in chemical production.

Packaging: Green chemicals facilitate the use of biodegradable, compostable or recyclable materials that substitute the petroleum-based plastics in packaging application. This aids in achieving brand sustainability objectives and regulations. In September, 2024 a global beverage company launched bottles containing 100 percent bio-based PET derived out of sugarcane. This product was aimed at the single-use reduction of plastic in consumer markets.

Agriculture: Examples of green chemicals in agriculture are bio-based fertilizers, biopesticides and soil conditioners to minimize chemical run-off and enhance soil health. They conform with environmental conservation and organic farming. An Indian agritech company introduced plant bases biopesticides to smallholder farmers in June 2024. This promoted environmentally friendly pest control and increased crop yields.

Consumer Goods: In consumer products, the green chemicals substitute petroleum based components that are used in cosmetics, personal care products and cleaning products. They enhance safety, biodegradability and green labeling. In January 2025, one of the leading brand of cosmetics has introduced their shampoos that contain the usage of plant-derived surfactants and preservatives, which are biodegradable. This was to attract the eco-conscious customers who want cleaner formulations.

Automotive & Transportation: This industry applies green chemicals in bio-based composites, lubricants and coatings to reduce emissions, and enhance recyclability. They are also used to ease loading of vehicles so as to use less fuel. In July 2024, a European-based car manufacturer employed bio-based polyurethane foams in the cars. This lessened petroleum dependency without changing product performance.

Biocatalysis: Biocatalysis uses cell or enzyme to facilitate chemical reactions that require less energy and produce less waste. It is essential to the manufacture of bio-based intermediates and specialty chemicals. One US biotech company commercialised an enzymatic process that produced bio-based nylon intermediates in March 2024. This technology provided an economic and environmental increment to petrochemical pathways.

Green Chemicals Market Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Biocatalysis | 41.60% |

| Fermentation | 58.40% |

Fermentation: The fermentation process ensures the production of fuels, materials, and chemicals of low emissions by utilizing renewable feedstocks with the help of microorganisms. It lets you scale and produce products bio-based in various industries. Production via microbial fermentation of bio-based succinic acid was launched in October 2024 by a Japanese company. This gave an eco-friendly option to be used in resins and coatings.

Market Segmentation

By Product Type

By Feedstock

By Technology

By Application

By End-Use Industry

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Green Chemicals

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Product Type Overview

2.2.3 By Feedstock Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Tough environmental laws

4.1.1.2 Biomaterials bioprocess rise in investment

4.1.2 Market Restraints

4.1.2.1 Regulatory attention to bio-based chemicals

4.1.2.2 Due to cost of production and energy costs

4.1.3 Market Challenges

4.1.3.1 Multiplication of the technology of low-emission chemicals

4.1.3.2 Conversion of the industrial sites into the production of green products

4.1.4 Market Opportunities

4.1.4.1 Reuse of legacy infrastructure in green chemistry

4.1.4.2 Specialty green chemicals of interest to investors

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Green Chemicals Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Green Chemicals Market, By Technology

6.1 Global Green Chemicals Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Biocatalysis

6.1.1.2 Fermentation

Chapter 7. Green Chemicals Market, By Product Type

7.1 Global Green Chemicals Market Snapshot, By Product Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Biopolymers

7.1.1.2 Bio-alcohols

7.1.1.3 Bio-organic Acids

7.1.1.4 Bio-ketones

7.1.1.5 Platform Chemicals

7.1.1.6 Others

Chapter 8. Green Chemicals Market, By Feedstock

8.1 Global Green Chemicals Market Snapshot, By Feedstock

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Plant-based

8.1.1.2 Waste-derived

Chapter 9. Green Chemicals Market, By Application

9.1 Global Green Chemicals Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Industrial & Chemical

9.1.1.2 Pharmaceuticals

9.1.1.3 Packaging

9.1.1.4 Food and Beverages

9.1.1.5 Construction

9.1.1.6 Automotive

9.1.1.7 Others

Chapter 10. Green Chemicals Market, By End-User

10.1 Global Green Chemicals Market Snapshot, By End-User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Consumer Goods

10.1.1.2 Automotive & Transportation

Chapter 11. Green Chemicals Market, By Region

11.1 Overview

11.2 Green Chemicals Market Revenue Share, By Region 2024 (%)

11.3 Global Green Chemicals Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Green Chemicals Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Green Chemicals Market, By Country

11.5.4 UK

11.5.4.1 UK Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Green Chemicals Market, By Country

11.6.4 China

11.6.4.1 China Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Green Chemicals Market, By Country

11.7.4 GCC

11.7.4.1 GCC Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Green Chemicals Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Dow

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 ADM

13.3 BASF

13.4 Cargill, Incorporated

13.5 Corbion

13.6 Merck KGaA

13.7 Syensqo

13.8 Solugen

13.9 Evonik

13.10 DUDECHEM GmbH

13.11 Mitsubishi Chemical Group Corporation.

13.12 DuPont