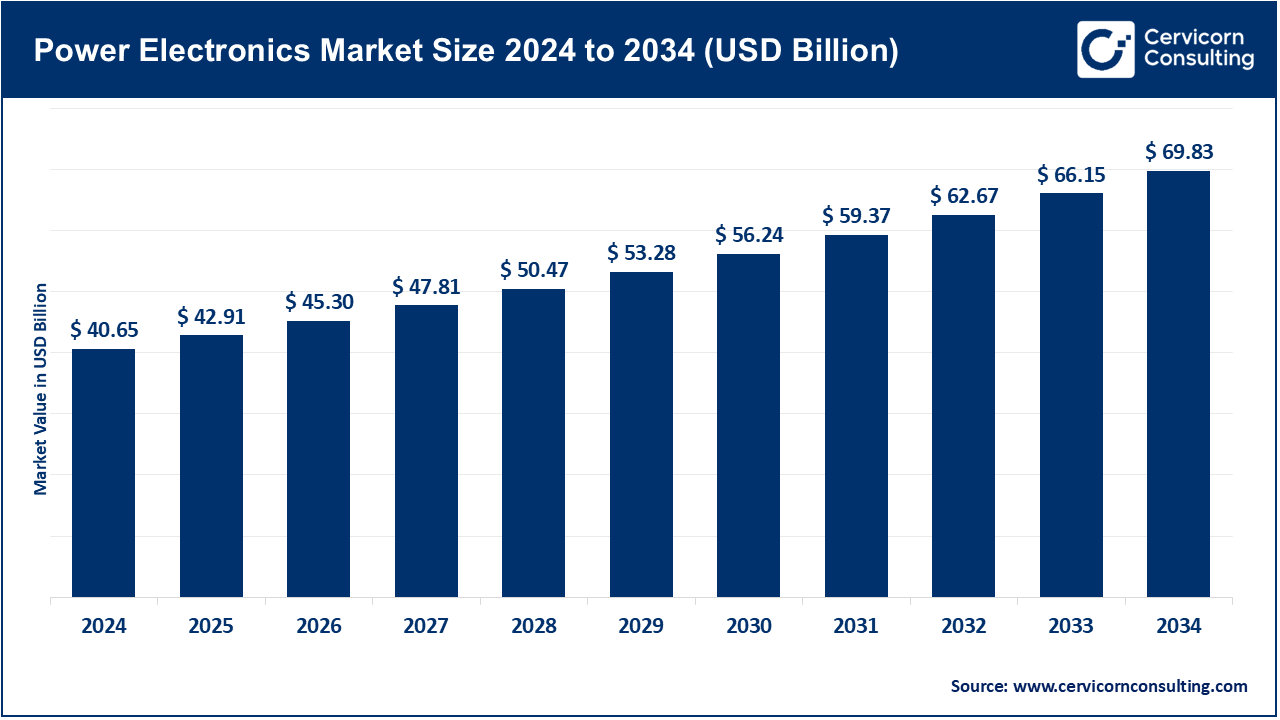

The global power electronics market size was estimated at USD 40.65 billion in 2024 and is expected to hit around USD 69.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.56% over the forecast period from 2025 to 2034. The global power electronics market is experiencing accelerated expansion, underpinned by a confluence of interrelated drivers. Foremost among these is the surging penetration of electrified transport, both battery-electric and hybrid platforms, which demands next-generation power modules, inverters, and converters designed for optimal energy efficiency. Concurrently, the proliferation of utility-scale renewable generation—most notably photovoltaic and wind—requires sophisticated power conversion and control solutions to facilitate seamless grid interconnection and enhance energy-storage deployment, thereby acting as a second growth engine. The pervasive corporate and policy-driven mandate for energy efficiency, aligned with worldwide targets for decarbonization and cleanex energy commercialization, further catalyzes widespread industry uptake.

The global power electronics market encompasses the sector dedicated to the conception, refinement, and deployment of electronic systems that govern and transform electric power with maximal efficiency. Core to this market are components such as power semiconductors, converters, inverters, and regulatory controllers which modulate energy flow across a wide spectrum of applications. By virtue of high efficiency, minimized footprint, and enhanced operational capability, power electronics permeate consumer gadgets, industrial machinery, renewable energy installations, electric mobility platforms, and smart grid infrastructures. Through the refinement of power conversion and energy stewardship, the sector undergirds advances in efficiency, sustainability, and digital integration, galvanizing innovation and facilitating the strategic migration to low-carbon energy vectors.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 42.91 Billion |

| Expected Market Size in 2034 | USD 69.83 Billion |

| Projected CAGR 2025 to 2034 | 5.56% |

| Dominant Region | Asia-Pacific |

| Key Segments | Device Type, Material, Voltage Level, Application |

| Key Companies | Infineon Technologies AG, Mitsubishi Electric Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, ON Semiconductor Corporation (onsemi), Toshiba Corporation, NXP Semiconductors N.V., ABB Ltd., Fuji Electric Co., Ltd., Renesas Electronics Corporation, Wolfspeed, Inc. (Cree Inc.), Rohm Semiconductor |

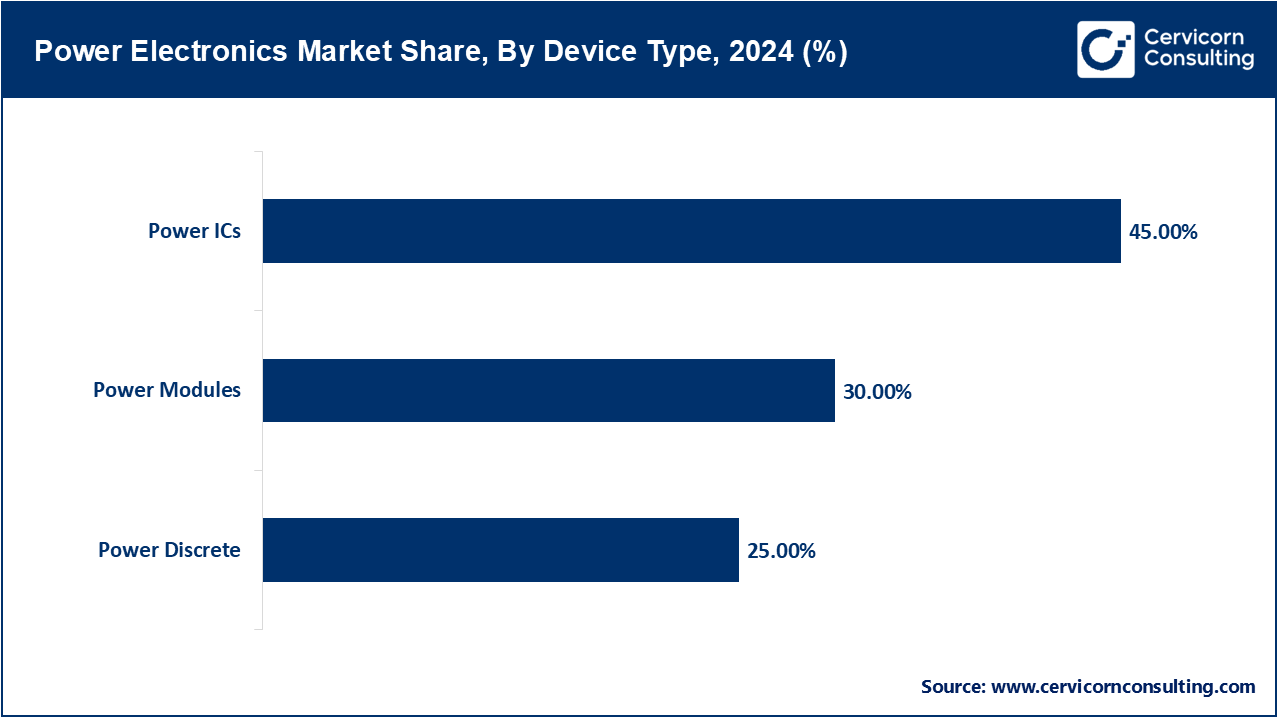

Power Ics: Power integrated circuits (ICs) are carving out a larger footprint as size-constrained electronics and hyperscale data centers prioritize peak efficiency in power conversion. Cloud computing and the expanding Internet of Things are key drivers, propelling the IC segment toward a projected compound annual growth of 6 to 7%.

Power Modules: Power modules are the segment exhibiting the steepest growth trajectory, with a compound annual growth rate (CAGR) forecast of 8–9% through 2030, attributable to rising implementation in electric vehicles, grid-level renewable power systems, and automation. For illustration, Tesla has deployed silicon carbide power modules within the inverter architecture of select model variants to secure measurable gains in road range and overall system energy efficiency.

Power Discrete Devices: Power discrete devices—diodes, transistors, and thyristors—continue to command a sizeable portion of the electronics sector, especially in the consumer and low-power segments. Their affordability and straightforward integration fuel widespread adoption in smartphones, laptops, and various household goods, so the segment is tracking a consistent pace of 5 to 6% compound annual growth.

Silicon-based Devices: The silicon segment accounted for a revenue share of 87.20% in 2024. Silicon-based power devices presently maintain predominant market share, serving the needs of cost-sensitive applications in consumer electronics, industrial settings, and low-to-medium power domains. Although the material exhibits well-defined limits in high-voltage and high-frequency domains, a mature supply chain and entrenched fabrication processes sustain its leadership, capturing in excess of 70% of the market in 2024.

Silicon Carbide (SiC) Based Devices: Silicon carbide (SiC) has solidified its position as the material with the highest growth trajectory, with forecasts indicating a compound annual growth rate (CAGR) of 15–18% during the 2025–2034 period. SiC semiconductor architectures deliver markedly improved energy efficiency, exceptional thermal conductivity, and sustained operation beyond the 1,200V threshold, rendering them well-suited for electrified transportation, grid-connected renewable energy inverters, and heavy-duty industrial power modules.

Gallium nitride (GaN) based devices: Gallium nitride (GaN) is expected to sustain a robust growth rate, projected to advance at a CAGR of 12–14% over the forthcoming decade. GaN devices excel in applications where elevated switching frequencies and compact form factors are critical, including fifth-generation (5G) base stations, large data center power supplies, and gallium nitride power adapters for consumer electronics. GaN modules are capable of delivering higher power density while maintaining thermal efficiency, permitting size reductions of nearly 40% in portable fast-charging solutions for smartphones while affording ultra-rapid charge capability. Leading firms including Apple, Samsung, and Xiaomi are progressively incorporating gallium nitride (GaN) technology into their consumer devices, while specialists such as Navitas and GaN Systems are championing its commercialization within high-performance sectors.

Automotive: Among application segment, the automotive market is positioned for the most rapid expansion. Forecast CAGRs indicate growth of 12–14% from 2025 through 2034, driven by the overall electrification of transport. Electric and hybrid electric vehicles depend increasingly on power modules, inverters, and advanced battery management systems to maximize energy efficiency and range. For example, companies like Tesla and BYD now deploy SiC MOSFETs in their EV inverters, yielding driving-range improvements of 10–15%.

Consumer Electronics: The consumer electronics category commands the largest volumetric share at present, propelled by the heightened demand for ultra-energy-efficient devices including smartphones, laptops, and smart appliances. Application of discrete GaN devices and integrated circuits within batteries has resulted in substantially prolonged operational lifetimes and lower energy demand. GaN-based rapid battery chargers, with a volume savings of up to 40% and improved power-conversion efficiency over conventional silicon, illustrate the ongoing engineering refinement within personal and residential power delivery systems.

Power Electronics Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Consumer Electronics | 32% |

| Automotive (EV/HEV) | 28% |

| Industrial | 18% |

| Aerospace & Defense | 4% |

| ICT & Data Centers | 6% |

| Renewable Energy | 12% |

Industrial: Across industry, the accelerating pivot to automation, robotics, and advanced motor drives is driving a sustained need for high-efficiency inverters and converters. The manufacturing vertical, which is expected to grow annually by 7–8%, is being led by established economies—in particular Germany, Japan, and China—in which mature factory ecosystems are embracing smart factory enablement.

Renewable energy: For renewables, the trajectory is steeper: a 10–12% CAGR is being spurred primarily by solar and wind plants whose yield hinges on next-gen conversion hardware. Sich-based solar inverters, for instance, are now delivering conversion efficiencies in excess of 98%, a threshold that compresses the levelized cost of energy in utility-scale deployments. That factor is reinforced by the International Renewable Energy Agency reporting global solar capacity that has now exceeded 1,200 GW, thereby outlining a durable revenue horizon for power electronics developers.

Aerospace & Defense: Similarly, the aerospace and defense market, while a more modest vertical by volume, continues to burnish high barriers to entry by specifying rugged, low-fail, mission-critical power devices that service avionics, telemetry, and satellite payloads. Concurrently, the ICT and data center domain is registering brisk growth: the ongoing expansion of cloud services and the 5G rollout is tightening the need for GaN-based power architectures. The lean power profiles of GaN technology—lower on-state losses and mitigated thermal limits—are permitting substantial improvements in power density, the very lodestar of next-gen dc-dc converters and power modules. According to the Global Energy Institute, data centers are absorbing nearly 3% of world electricity, and major operators such as Google and Amazon are escalating capital allocations to next-gen power modules for holistic energy optimization and sustainability verification.

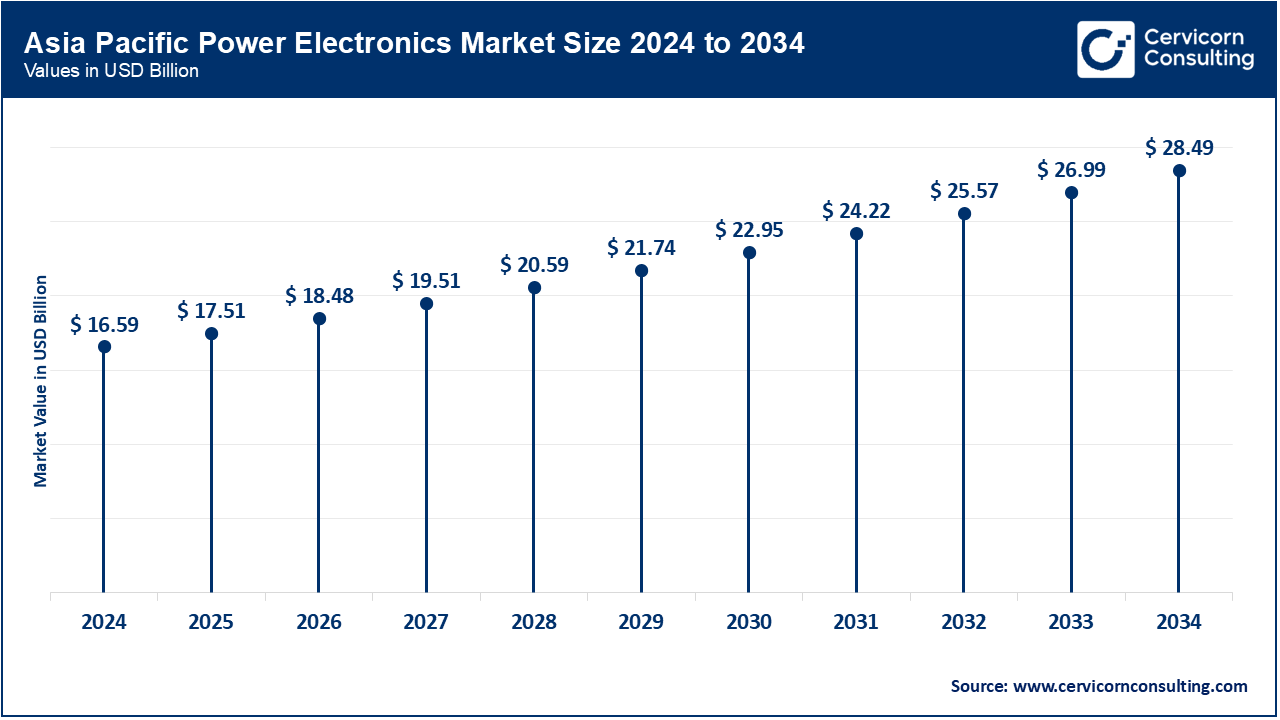

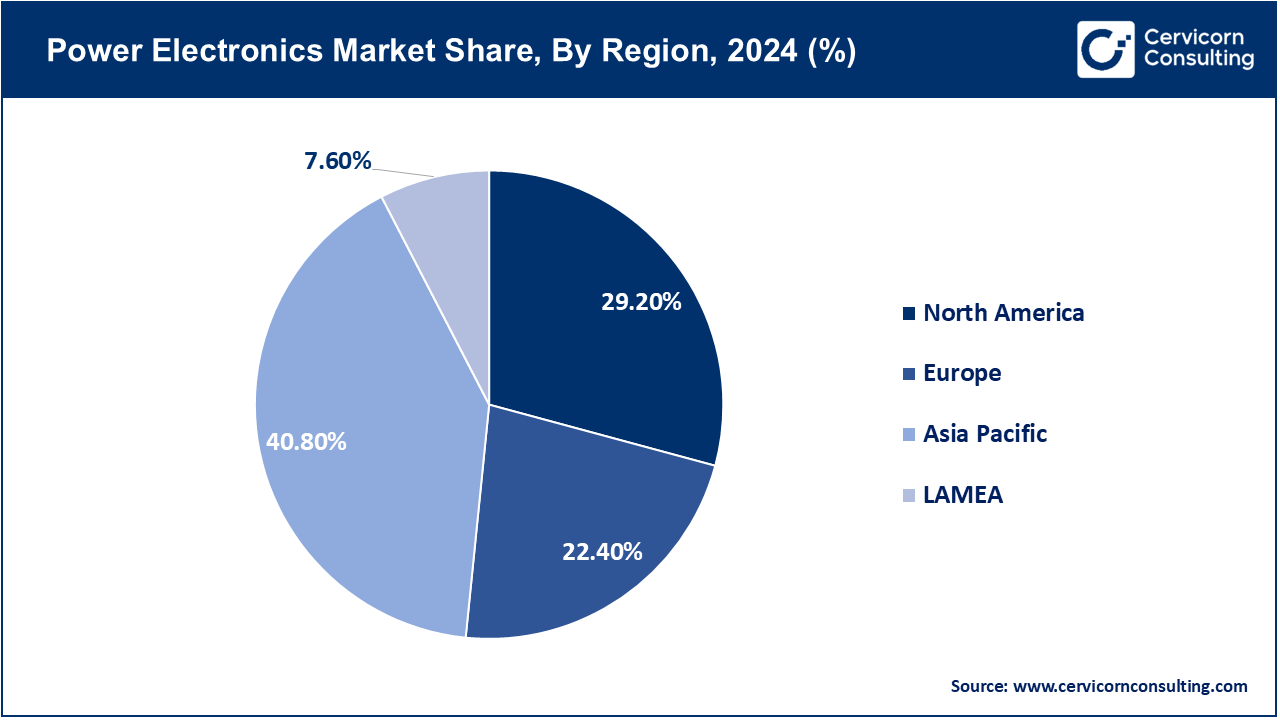

The Asia-Pacific region remains the clear market heavyweight, driven by a unrivaled electronics manufacturing ecosystem, surging industrial activity, and a concerted move toward clean energy and electrified transport. At the same time, Japan and South Korea maintain a commanding position. Firms including Mitsubishi Electric, Toshiba, and Samsung are pioneering next-gen semiconductor devices and committing large resources to gallium-nitride as well as silicon-carbide advancements. Meanwhile, India is sprinting onto the stage: annual growth of 8 to 10% is forecasted until 2030 thanks to the ambition of reaching a cumulative 500 gigawatts of renewable capacity and the government’s well-targeted electric-vehicle roadmap. Thus, the Asia-Pacific’s dominance is continually cemented by expansive manufacturing scale, favorable cost structures, and policies that unambiguously back the shift to clean-tech solutions.

North America takes the number two position, keyed to substantial expansion in scaled-up EV network investment, sharper renewable integration efforts, and ongoing aerospace electrification programs. Compounding this, Canada aims for 90% clean electricity by 2030, which calls for next-generation grid converters and scalable energy storage. Planned federal deployment of 500,000 fast charging stations by 2030 suggests annual power electronics adoption in charging gear will climb by 10–12%. Innovators like Tesla, Wolfspeed, and ON Semiconductor are at the vanguard of power electronics: Tesla now deploys SiC-based inverters in its new models, and Wolfspeed is ramping up U.S. SiC wafer output to cut import reliance.

Europe holds the third largest market share. Aggressive EU emissions and renewable energy regulations are creating strong upward pressure for energy-efficient inverters, converters, and modular power solutions. Germany, the UK, and France are the regional heavyweights, with Germany leveraging its deep automotive capabilities and industrial automation clout. Major OEMs, including Volkswagen, BMW, and Renault, are already integrating SiC and gallium-nitride semiconductor components to trim losses and boost EV driving range. One additional competitive advantage for Europe lies in its mature renewable-energy sector, where, in markets such as Denmark and Spain, wind and solar together provide over 40% of total power. This substantial share naturally accelerates the push for sophisticated grid-integration solutions capable of seamlessly balancing fluctuating supply and predictable demand. The region’s 2050 climate-neutrality goal, designed to eliminate net greenhouse-gas emissions, is set to funnel ever-growing capital towards power-electronics innovations that enable intelligent power management, as well as batteries and other storage technologies that stock surplus energy for later use.

Latin America and MEA, while smaller than established markets, are steadily maturing, driven by refreshingly ambitious electrification and renewables pushes. São Paulo and Minas Gerais drive Brazilian wind and multi-purpose hydropower, while solar momentum is palpable in Puebla and Baja California. Across the Arabian Peninsula and southern Africa, flagship initiatives play a similar role: Vision 2030 in Saudi Arabia, the UAE’s 2050 clean energy plan, and the ambitious Renewable Energy Independent Power Producers Procurement Programme (REIPPPP) in South Africa. Wind and solar parks—many linked by advanced power electronics—are accumulating megawatts with impressive efficiency and remain underpinned by mounting electric vehicle (EV) goals. Even in embryonic form, both regions are poised to compound at 7–9% annually over the next decade, sweeping in steady opportunities for suppliers that can cater to the specialized requirements.

Market Segmentation

By Device Type

By Material

By Voltage Level

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Power Electronics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Device Type Overview

2.2.2 By Material Overview

2.2.3 By Application Overview

2.2.4 By Voltage Level Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising global emphasis on energy efficiency across industries and consumer applications

4.1.1.2 Growing integration of renewable energy sources into global power grids

4.1.2 Market Restraints

4.1.2.1 High cost of wide-bandgap (WBG) materials

4.1.2.2 Complexity in design, integration, and reliability of power electronic systems

4.1.3 Market Challenges

4.1.3.1 Global semiconductor supply chain constraints

4.1.3.2 Thermal management and performance optimization in high-power, high-voltage applications

4.1.4 Market Opportunities

4.1.4.1 Global acceleration of EV adoption and charging infrastructure development

4.1.4.2 Integration of AI and digitalization into power management systems

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Power Electronics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Power Electronics Market, By Device Type

6.1 Global Power Electronics Market Snapshot, By Device Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Power Modules

6.1.1.2 Power Discrete

6.1.1.3 Power ICs

Chapter 7. Power Electronics Market, By Material

7.1 Global Power Electronics Market Snapshot, By Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Silicon

7.1.1.2 Silicon Carbide (SiC)

7.1.1.3 Gallium Nitride (GaN)

7.1.1.4 Sapphire

7.1.1.5 Others

Chapter 8. Power Electronics Market, By Application

8.1 Global Power Electronics Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Consumer Electronics

8.1.1.2 Automotive (EV/HEV)

8.1.1.3 Industrial

8.1.1.4 Aerospace & Defense

8.1.1.5 ICT & Data Centers

8.1.1.6 Renewable Energy

Chapter 9. Power Electronics Market, By Voltage Level

9.1 Global Power Electronics Market Snapshot, By Voltage Level

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Low

9.1.1.2 Medium

9.1.1.3 High

Chapter 10. Power Electronics Market, By Region

10.1 Overview

10.2 Power Electronics Market Revenue Share, By Region 2024 (%)

10.3 Global Power Electronics Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Power Electronics Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Power Electronics Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Power Electronics Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Power Electronics Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Power Electronics Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Power Electronics Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Power Electronics Market, By Country

10.5.4 UK

10.5.4.1 UK Power Electronics Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Power Electronics Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Power Electronics Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Power Electronics Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Power Electronics Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Power Electronics Market, By Country

10.6.4 China

10.6.4.1 China Power Electronics Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Power Electronics Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Power Electronics Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Power Electronics Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Power Electronics Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Power Electronics Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Power Electronics Market, By Country

10.7.4 GCC

10.7.4.1 GCC Power Electronics Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Power Electronics Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Power Electronics Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Power Electronics Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Infineon Technologies AG

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Mitsubishi Electric Corporation

12.3 STMicroelectronics N.V.

12.4 Texas Instruments Incorporated

12.5 ON Semiconductor Corporation (onsemi)

12.6 Toshiba Corporation

12.7 NXP Semiconductors N.V.

12.8 ABB Ltd.

12.9 Fuji Electric Co., Ltd.

12.10 Renesas Electronics Corporation

12.11 Wolfspeed, Inc. (Cree Inc.)

12.12 Rohm Semiconductor