Power Electronics Market Size and Growth Factors 2025 to 2034

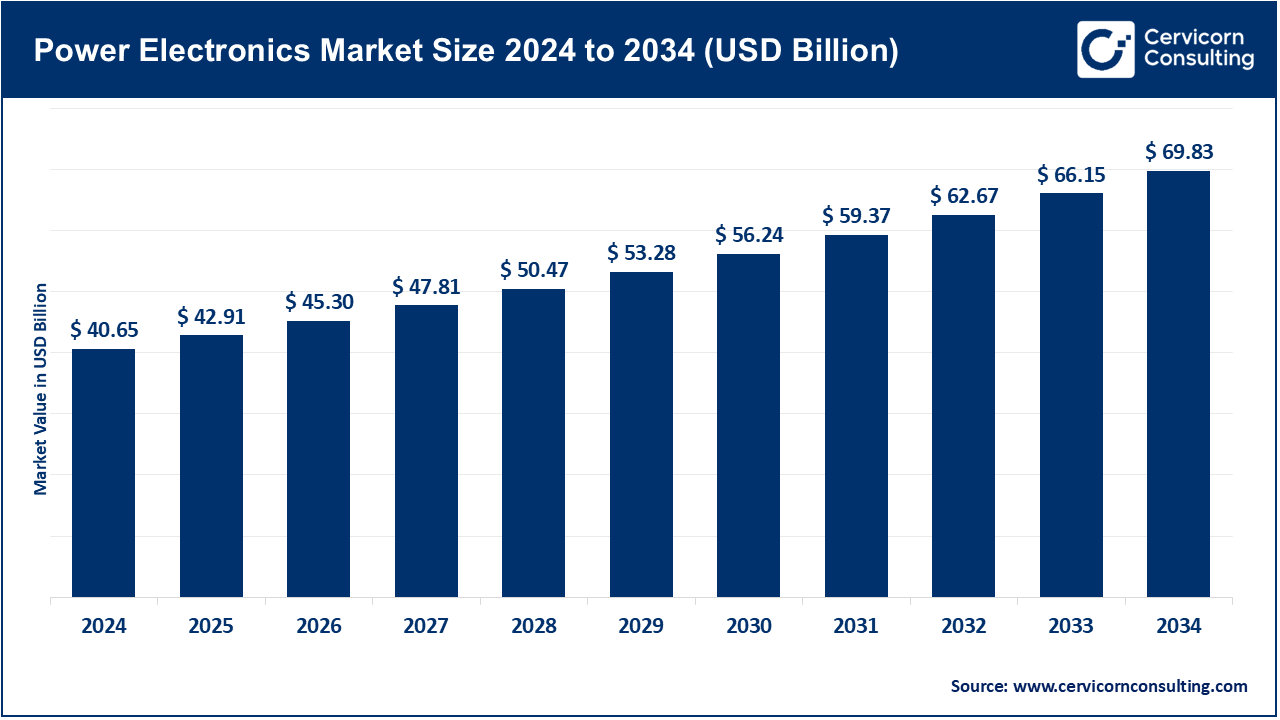

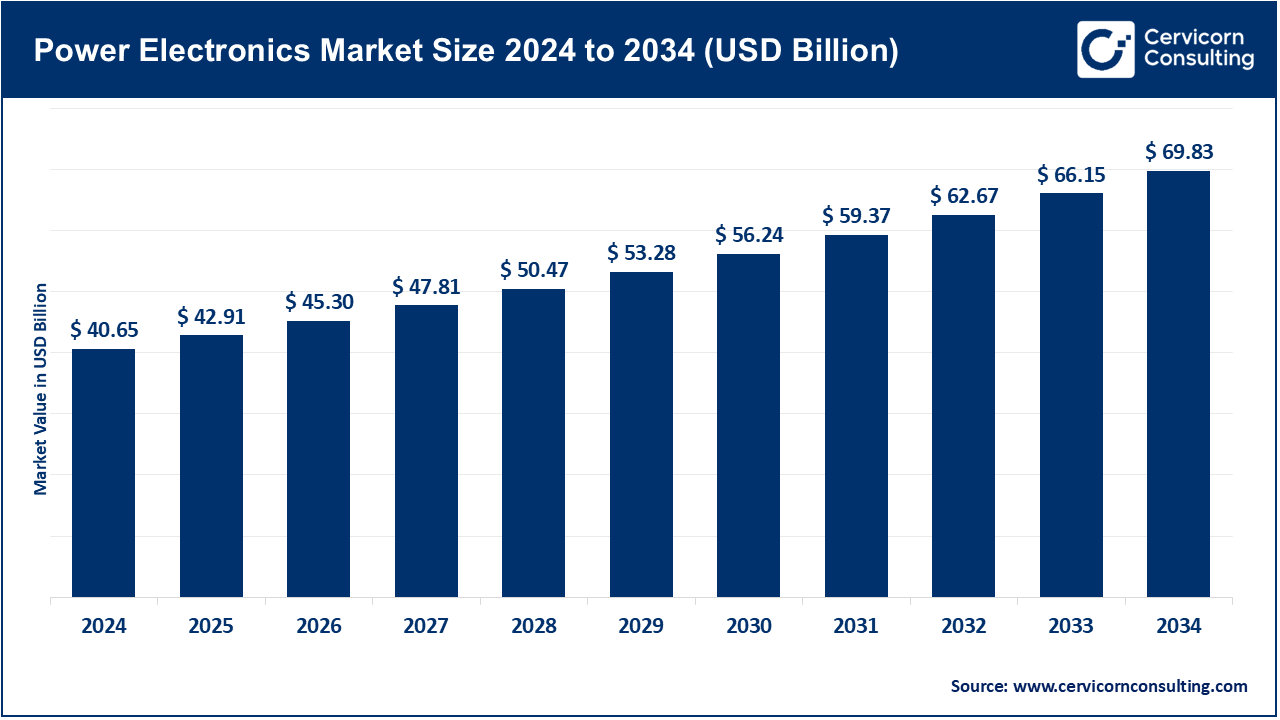

The global power electronics market size was estimated at USD 40.65 billion in 2024 and is expected to hit around USD 69.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.56% over the forecast period from 2025 to 2034. The global power electronics market is experiencing accelerated expansion, underpinned by a confluence of interrelated drivers. Foremost among these is the surging penetration of electrified transport, both battery-electric and hybrid platforms, which demands next-generation power modules, inverters, and converters designed for optimal energy efficiency. Concurrently, the proliferation of utility-scale renewable generation—most notably photovoltaic and wind—requires sophisticated power conversion and control solutions to facilitate seamless grid interconnection and enhance energy-storage deployment, thereby acting as a second growth engine. The pervasive corporate and policy-driven mandate for energy efficiency, aligned with worldwide targets for decarbonization and cleanex energy commercialization, further catalyzes widespread industry uptake.

The global power electronics market encompasses the sector dedicated to the conception, refinement, and deployment of electronic systems that govern and transform electric power with maximal efficiency. Core to this market are components such as power semiconductors, converters, inverters, and regulatory controllers which modulate energy flow across a wide spectrum of applications. By virtue of high efficiency, minimized footprint, and enhanced operational capability, power electronics permeate consumer gadgets, industrial machinery, renewable energy installations, electric mobility platforms, and smart grid infrastructures. Through the refinement of power conversion and energy stewardship, the sector undergirds advances in efficiency, sustainability, and digital integration, galvanizing innovation and facilitating the strategic migration to low-carbon energy vectors.

Power Electronics Market Report Highlights

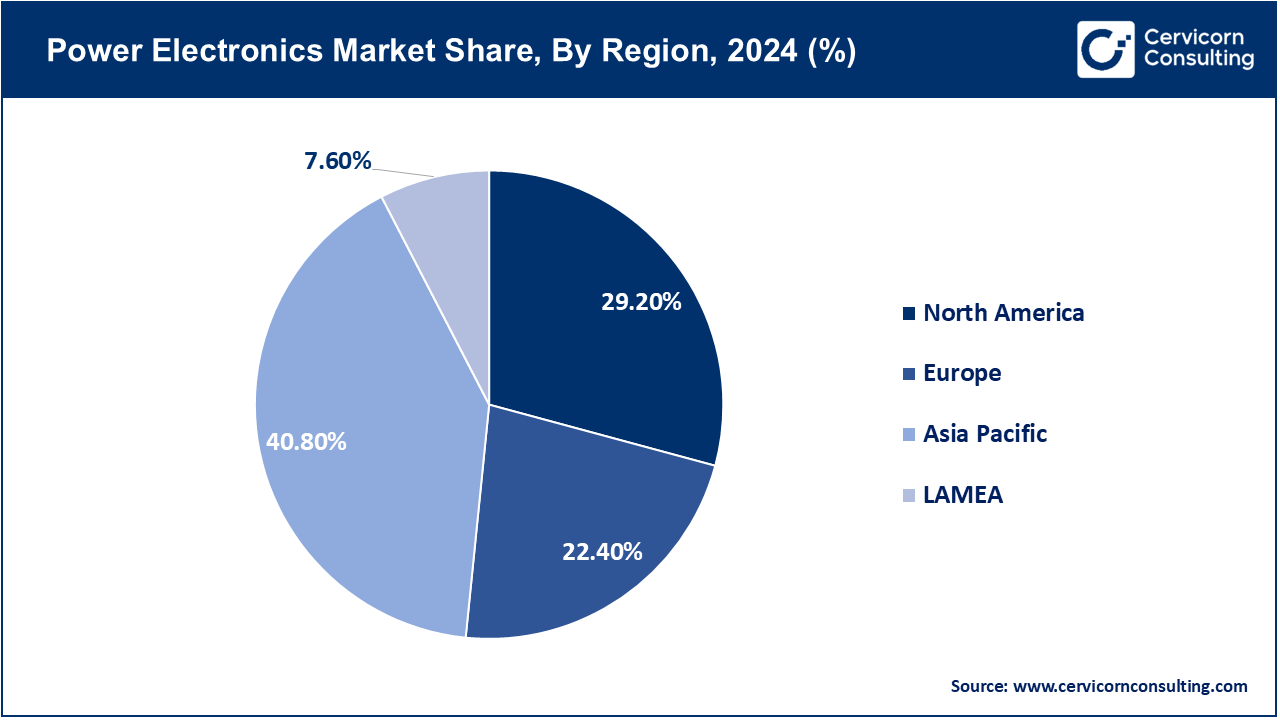

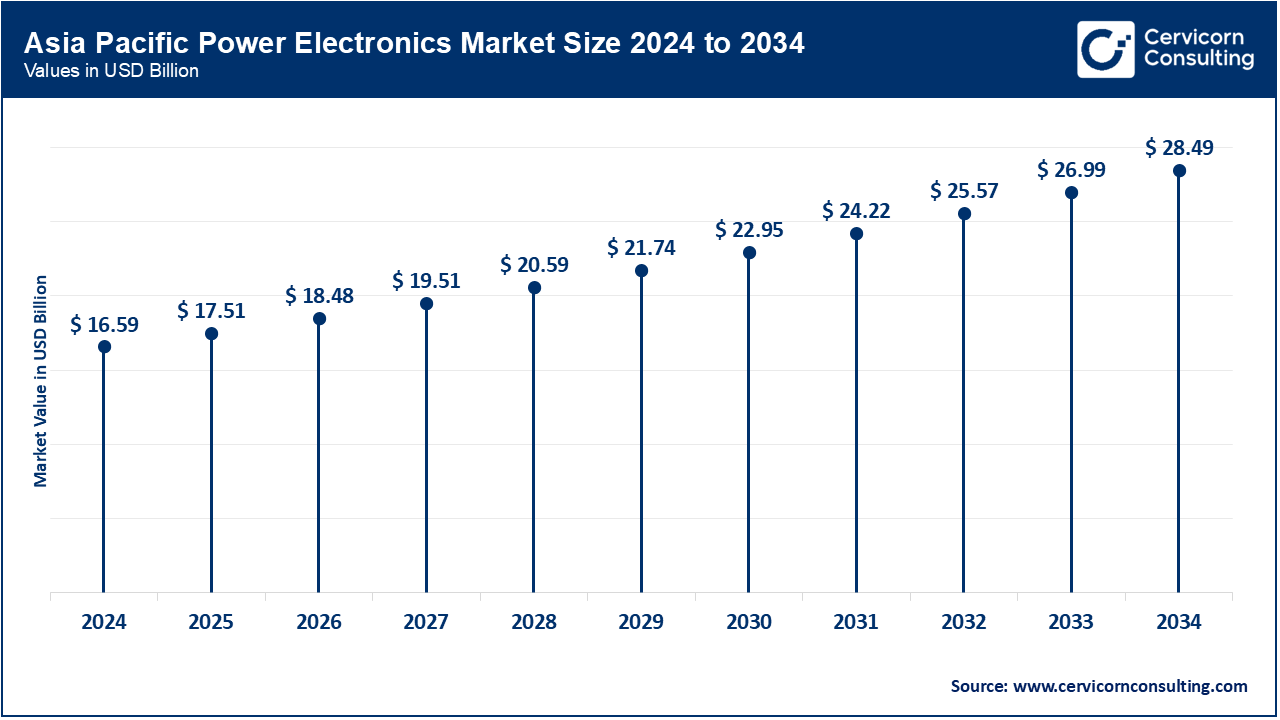

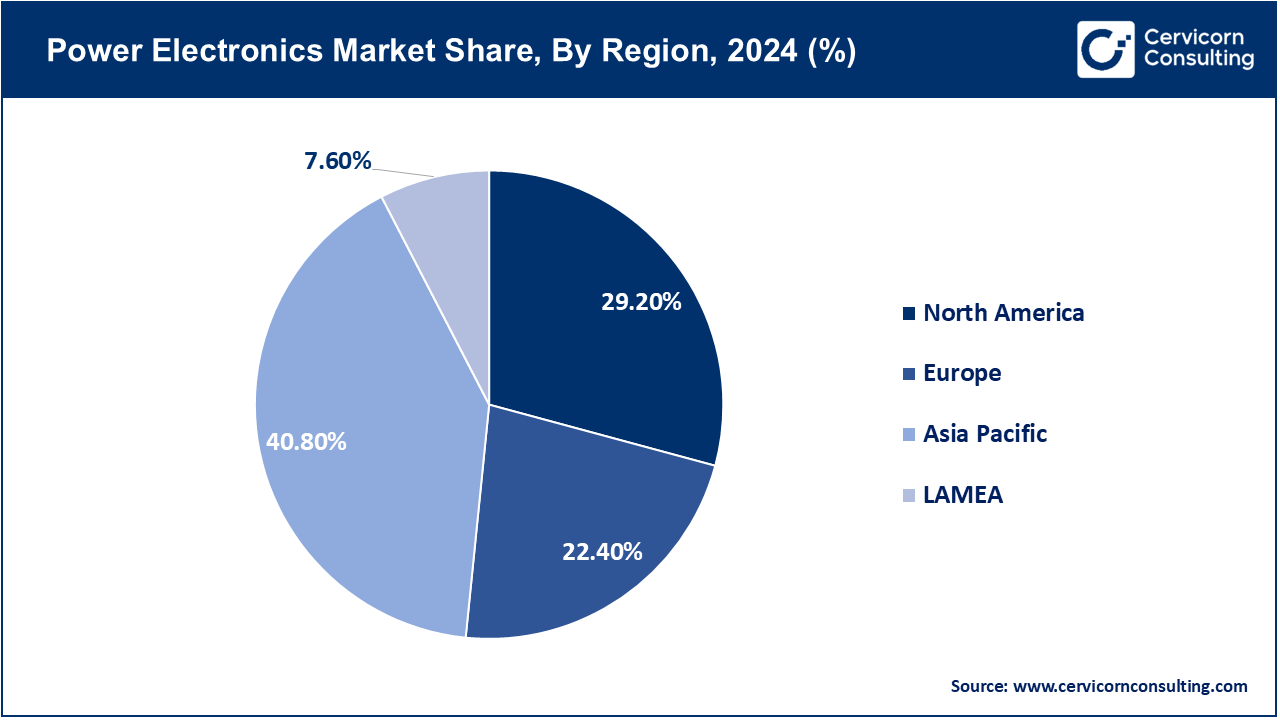

- By Region, the Asia-Pacific commands the largest share of 40.8% in 2024, projected to expand at a compound annual growth rate (CAGR) of 7 to 9%, driven by extensive electronics manufacturing, escalating EV uptake in China, and government mandated renewable-energy initiatives.

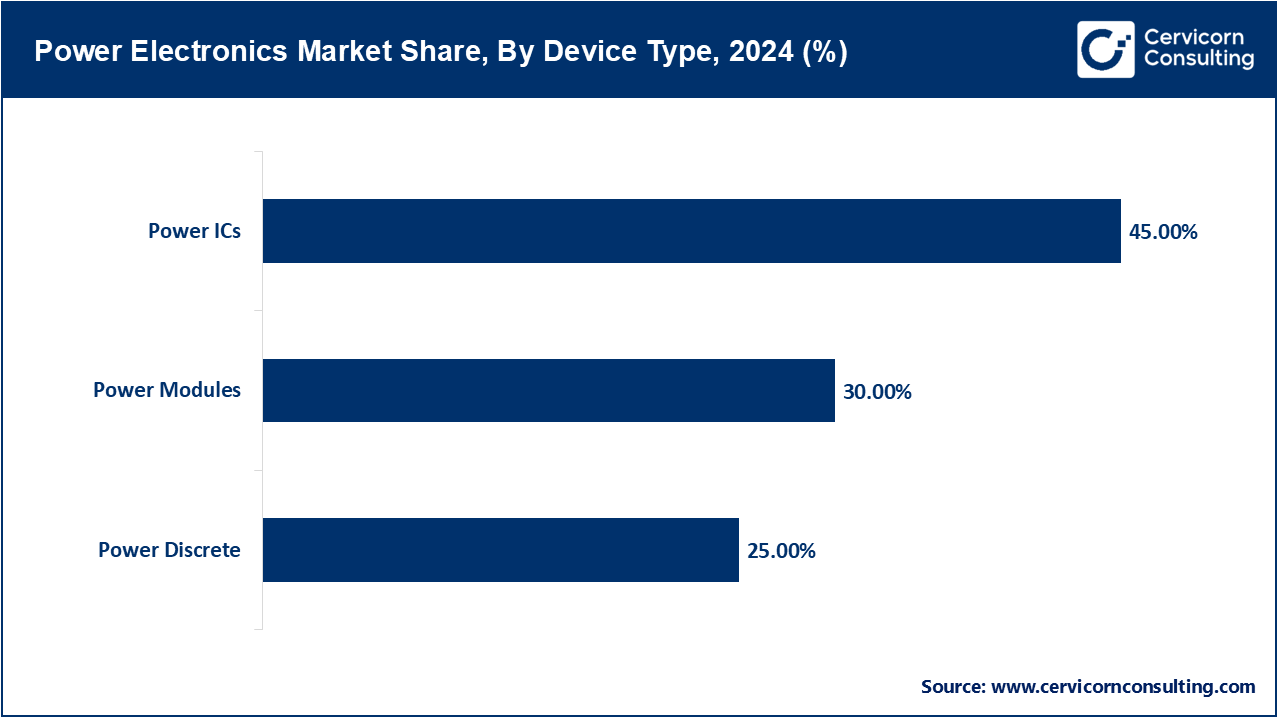

- By Device, power modules are forecast to exhibit the steepest growth, at an 8–9% CAGR, backed by demand across electric vehicles, automated manufacturing, and grid-tied renewables.

- By materials, wide-bandgap technologies, chiefly silicon-carbide and gallium-nitride, are surging at a CAGR of 15–18%, supplanting standard silicon owing to higher efficiency and superior thermal headroom.

- By applications, automotive—notably the electric and hybrid segments—takes the lead, showing a 12–14% CAGR, propelled by national electrification mandates and ongoing breakthroughs in battery design.

- By end-user, consumer electronics still leads in unit volume, while renewables and critical industries are surging fast, achieving a CAGR in the 10–12% range, owing to the roll-out of intelligent power grids and advanced energy storage systems.

Power Electronics Market Trends

- The shift toward wide-bandgap semiconductors: Market forecasts indicate that the silicon carbide (SiC) segment of the power electronics landscape will achieve a compound annual growth rate of 15 to 18% through 2030, driven by escalating deployment in inverters, chargers, and integrated power modules. Gallium nitride (GaN) devices are likewise experiencing rapid acceptance, particularly in the consumer electronics and fast-charging adapter markets, where their minimized form factor and enhanced power density confer architectural advantages. Tier-one players such as Infineon, STMicroelectronics, and Wolfspeed are channeling substantial capital into dedicated SiC and GaN manufacturing sites, with Wolfspeed recently unveiling a multi-billion-dollar investment agenda designed to alleviate worldwide supply constraints. This ongoing material transition is yielding persisting gains in energy efficiency, while concurrently lowering the bilaterally firming costs of renewable power installations and battery electric vehicle architectures, thereby undergirding a sustained increase in technological adoption across multiple application domains.

- Rise of electric mobility and transportation electrification: The second prominent trend on the technology horizon is the acceleration of electric mobility and the electrification of the broader transportation sector, solidifying its role as a strategic growth anchor for power electronics. In tandem, national governments on every continent are positioning electric vehicle uptake as a policy imperative, deploying fiscal incentives, tightening emissions ceilings, and financing the underlying charging superstructure. Analytic houses now project the worldwide EV charging infrastructure segment to expand at a compound annual growth rate (CAGR) exceeding above 20% through 2034, which will generate significant additional geographies of demand for power electronics in ultra-rapid vehicular chargers, inverters, bi-directional grid interface, and charging stations fed by renewable generation. The application scope is extending progressively beyond the passenger sector, encompassing electric buses, medium- and heavy-duty trucks, and emerging aerospace electrification concepts, thereby enlarging the systemic responsibility of power electronics across the mobility value chain.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 42.91 Billion |

| Expected Market Size in 2034 |

USD 69.83 Billion |

| Projected CAGR 2025 to 2034 |

5.56% |

| Dominant Region |

Asia-Pacific |

| Key Segments |

Device Type, Material, Voltage Level, Application |

| Key Companies |

Infineon Technologies AG, Mitsubishi Electric Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, ON Semiconductor Corporation (onsemi), Toshiba Corporation, NXP Semiconductors N.V., ABB Ltd., Fuji Electric Co., Ltd., Renesas Electronics Corporation, Wolfspeed, Inc. (Cree Inc.), Rohm Semiconductor |

Power Electronics Market Dynamics

Market Drivers

- Rising global emphasis on energy efficiency across industries and consumer applications: Power electronics have become indispensable in curbing energy loss, streamlining power conversion, and enhancing the overall efficiency of systems ranging from domestic appliances to large-scale industrial control. Anticipated growth in global electricity demand—projected to approach 25% before 2030—has elevated effective power management to a principal technical objective. In consumer electronics, high-performance power semiconductors now dominate laptops, smartphones, and rapid charging units, enabling marked reductions in thermal dissipation while maintaining the compact form factors essential to modern design. Parallel advancements in industrial sectors employ ultra-efficient inverters and converters within motor drives and factory automation, simultaneously lowering operational expenditures and advancing corporate sustainability benchmarks.

- Growing integration of renewable energy sources into global power grids: The second principal driver of accelerated value creation in the sector is the deepening integration of renewable energy resources within interconnected national and regional electricity networks, a process that depends intrinsically on highly sophisticated power electronics for conversion, regulation, and bulk energy storage. Photovoltaic and wind power installations demand arrays of inverters, dc-dc converters, and modular power devices that convert inherently intermittent resources into electricity that meets synchronizing and voltage-profile specifications for synchronism with the bulk power system. By way of illustration, contemporary photovoltaic inverters that employ silicon carbide power devices routinely attain conversion efficiencies in excess of 98%, thereby markedly compressing the payback times for renewable investment. From a market perspective, the momentum is similarly persuasive: global photovoltaic installed capacity surpassed 1,200 gigawatts in 2023, while wind capacity is projected to expand at compound annual growth rates of 8 to 10% for the next decade. Within energy storage, power electronics underpin auxiliary balancing and arbitrage functions that reinforce system stability and flatten demand curves at times of high renewable penetrations. A shortlist of the sector's foremost suppliers—ABB, Mitsubishi Electric, and Hitachi Energy—continues to deliver high-performance power converters and intelligent-automation architectures precisely optimized for renewable bulk, transport, and storage architectures.

Market Restraints

- High cost of wide-bandgap (WBG) materials: The foremost constraint confronting the expansion of next-generation power electronics is the prohibitive expense of wide-bandgap (WBG) substrates, notably silicon carbide (SiC) and gallium nitride (GaN) wafers. Although these materials confer markedly improved efficiency, elevated thermal tolerance, and reduced spatial footprint relative to silicon, the economic viability of their fabrication remains jeopardized by intricate processes and a persistent lack of sufficiently scaled supply. Current metrics indicate that commercial-grade SiC wafers command a price premium of 5 to 10 times that of equivalent silicon substrates, which elevates the embedded cost of SiC devices to levels that are prohibitive for broad-based integration, particularly within the cost-sensitive realms of consumer electronics. Although the automotive and renewable-energy sectors are integrating SiC and GaN infrastructures for anticipated lifetime efficiencies, initial capital hurdles persist, particularly within small and medium enterprises and in emerging-market economies where procurement cycles are shorter and price competition more acute. Firms such as Wolfspeed and STMicroelectronics have announced multi-billion-dollar capital expenditures intended to accelerate SiC fabrication ecosystems, yet simultaneous constraints in the global supply chain are sustaining price fluctuations and intermittent shortages.

- Complexity in design, integration, and reliability of power electronic systems: A second limiting factor is the intricate design, integration, and long-term dependability required of power electronic systems, particularly in the high-voltage and high-power domains. Devices deployed in automotive, aerospace, and industrial automation encounter extreme environments marked by elevated temperatures, sudden voltage transients, and pervasive electromagnetic interference. Ensuing deficits of standard packaging and cooling competencies predispose the inverter to malfunctions and consequent efficiency losses. Furthermore, the brisk cadence of material and topological advancements imposes a continual redesign cycle alignment with emerging certification regimes, rendering smaller and mid-sized developers ill-equipped to absorb the derivative engineering and financial overhead, thereby constraining large-scale, date-driven adoption across existing platforms.

Market Opportunities

- Global acceleration of EV adoption and charging infrastructure development: The global surge in electric vehicle penetration, alongside the rapid expansion of complementary charging infrastructure, is fundamentally driven by next-generation power electronics that optimize energy conditioning, accelerate charging rates, and enable sophisticated battery management systems. In 2023, worldwide EV sales exceeded 14 million units and are projected to exceed 40% of all new vehicle registrations by 2030, accelerating the market for power modules, inverters, and DC-DC converters. Ultra-rapid charging networks, in particular, depend on SiC and GaN devices that can operate at elevated voltages, compressing charging durations to under 30 minutes. National governments are also underwriting extensive charging networks: the U.S. aims to install 500,000 charging outlets by 2030, while the European Union is striving for a million publicly accessible chargers by 2025. These mandates collectively create substantial market openings for semiconductor developers, manufacturing equipment suppliers, and grid integration specialists to enlarge their power electronics portfolios for the electric mobility value chain.

- Integration of artificial intelligence (AI) and digitalization into power management systems: Artificial-intelligence-enhanced power electronics are now capable of continuously optimizing operational parameters in diverse applications, from smart grid management to industrial automation, which enhances system resilience and lowers the total cost of ownership. AI-empowered inverters in renewable installations can anticipate variability in solar and wind generation and refine grid integration, enhancing overall stability. Concurrently, in data centres—responsible for nearly 3% of the world’s electricity—AI-optimised power electronic modules are being rolled out to minimise power dissipation and enhance cooling effectiveness. Firms such as Siemens and Schneider Electric are coupling AI with converter and rectifier controllers to facilitate predictive maintenance, which can curtail downtime by 20 to 30%. With the momentum of Industry 4.0, the synergistic interplay of AI, IoT, and power electronics is generating novel revenue avenues across industrial automation, connected appliances, and battery storage architectures.

Market Challenges

- Global semiconductor supply chain constraints: The persistent pressure on the semiconductor supply chain has been exacerbated by surging demand for silicon carbide (SiC) and gallium nitride (GaN) devices across automotive, renewable energy, and consumer electronics sectors. Although these wide-bandgap materials deliver transformational efficiency gains, their fabrication entails intricate processes governed by a limited cadre of suppliers. Currently, Wolfspeed and Rohm command the overwhelmingly largest share of SiC wafer output, while GaN production is concentrated among a small number of leading firms, producing well-defined chokepoints. The microelectronics disruptions of the 2020–2022 timeframe and the ensuing lack of semiconductor devices curtailed automotive manufacturing cadence, with electric vehicle markers such as Tesla and Volkswagen publicly attributing material shortages to semiconductor constraints. Even now, the acceleration of 6-inch and 8-inch SiC wafer production encounters persistent hurdles, with overall cost structures remaining markedly above that of incumbent silicon substrates.

- Thermal management and performance optimization in high-power, high-voltage applications: The challenge is to transfer heat promptly while maintaining high efficiency and durability. Silicon carbide devices, though capable of denser power density and reduced conduction losses, produce fused heat that is localized, compelling the adoption of sophisticated cooling architectures. Such systems invariably increase BOM cost and design intricacy. Data analyses attribute approximately 25 percent of the field failures in EV power modules and photovoltaic inverters to thermal overstress and insufficient thermal architecture, which accentuates the associated reliability concern. Major manufacturers, including Infineon and Mitsubishi Electric, are channeling R&D effort into novel packaging concepts, for example, dual-sided cooling and engineered substrate stacks, yet broad, cost-effective adoption of these designs is progressing at a measured pace. Furthermore, the pursuit of tighter form factors in high-power and consumer-level chargers continues to collide with the same heat management imperatives.

Power Electronics Market Segmental Analysis

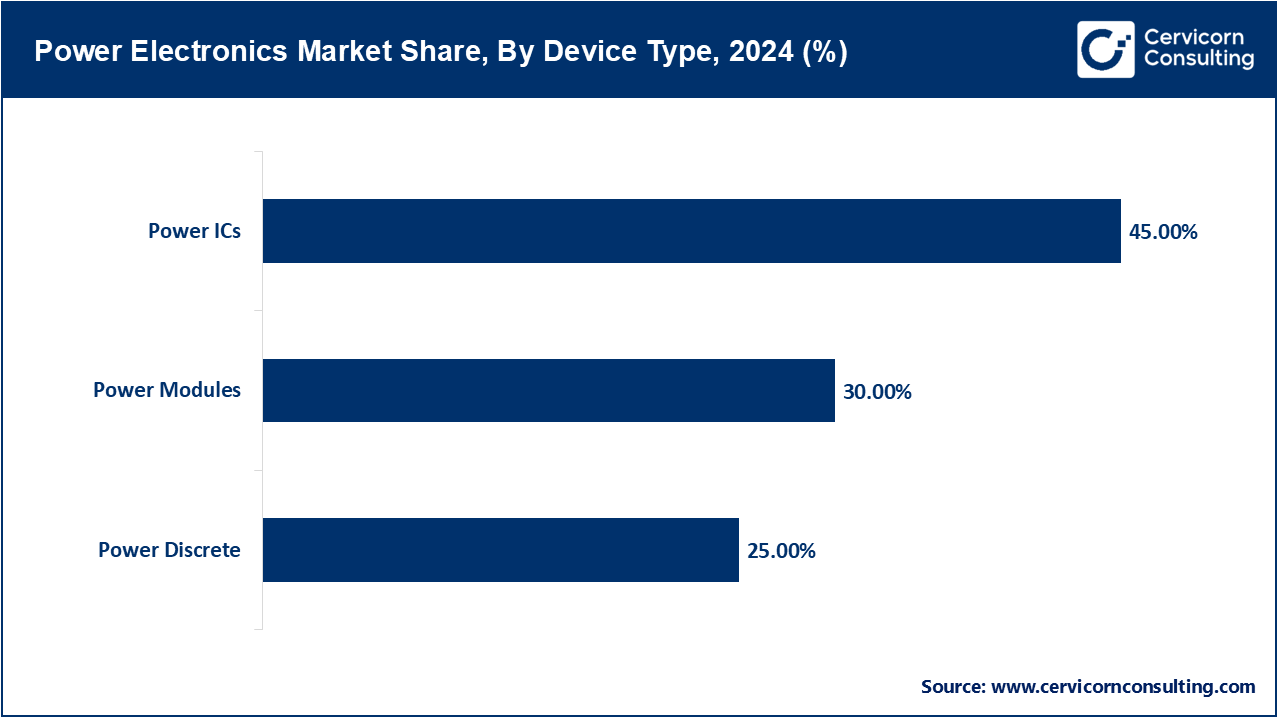

Device Type Analysis

Power Ics: Power integrated circuits (ICs) are carving out a larger footprint as size-constrained electronics and hyperscale data centers prioritize peak efficiency in power conversion. Cloud computing and the expanding Internet of Things are key drivers, propelling the IC segment toward a projected compound annual growth of 6 to 7%.

Power Modules: Power modules are the segment exhibiting the steepest growth trajectory, with a compound annual growth rate (CAGR) forecast of 8–9% through 2030, attributable to rising implementation in electric vehicles, grid-level renewable power systems, and automation. For illustration, Tesla has deployed silicon carbide power modules within the inverter architecture of select model variants to secure measurable gains in road range and overall system energy efficiency.

Power Discrete Devices: Power discrete devices—diodes, transistors, and thyristors—continue to command a sizeable portion of the electronics sector, especially in the consumer and low-power segments. Their affordability and straightforward integration fuel widespread adoption in smartphones, laptops, and various household goods, so the segment is tracking a consistent pace of 5 to 6% compound annual growth.

Material Analysis

Silicon-based Devices: The silicon segment accounted for a revenue share of 87.20% in 2024. Silicon-based power devices presently maintain predominant market share, serving the needs of cost-sensitive applications in consumer electronics, industrial settings, and low-to-medium power domains. Although the material exhibits well-defined limits in high-voltage and high-frequency domains, a mature supply chain and entrenched fabrication processes sustain its leadership, capturing in excess of 70% of the market in 2024.

Silicon Carbide (SiC) Based Devices: Silicon carbide (SiC) has solidified its position as the material with the highest growth trajectory, with forecasts indicating a compound annual growth rate (CAGR) of 15–18% during the 2025–2034 period. SiC semiconductor architectures deliver markedly improved energy efficiency, exceptional thermal conductivity, and sustained operation beyond the 1,200V threshold, rendering them well-suited for electrified transportation, grid-connected renewable energy inverters, and heavy-duty industrial power modules.

Gallium nitride (GaN) based devices: Gallium nitride (GaN) is expected to sustain a robust growth rate, projected to advance at a CAGR of 12–14% over the forthcoming decade. GaN devices excel in applications where elevated switching frequencies and compact form factors are critical, including fifth-generation (5G) base stations, large data center power supplies, and gallium nitride power adapters for consumer electronics. GaN modules are capable of delivering higher power density while maintaining thermal efficiency, permitting size reductions of nearly 40% in portable fast-charging solutions for smartphones while affording ultra-rapid charge capability. Leading firms including Apple, Samsung, and Xiaomi are progressively incorporating gallium nitride (GaN) technology into their consumer devices, while specialists such as Navitas and GaN Systems are championing its commercialization within high-performance sectors.

Application Analysis

Automotive: Among application segment, the automotive market is positioned for the most rapid expansion. Forecast CAGRs indicate growth of 12–14% from 2025 through 2034, driven by the overall electrification of transport. Electric and hybrid electric vehicles depend increasingly on power modules, inverters, and advanced battery management systems to maximize energy efficiency and range. For example, companies like Tesla and BYD now deploy SiC MOSFETs in their EV inverters, yielding driving-range improvements of 10–15%.

Consumer Electronics: The consumer electronics category commands the largest volumetric share at present, propelled by the heightened demand for ultra-energy-efficient devices including smartphones, laptops, and smart appliances. Application of discrete GaN devices and integrated circuits within batteries has resulted in substantially prolonged operational lifetimes and lower energy demand. GaN-based rapid battery chargers, with a volume savings of up to 40% and improved power-conversion efficiency over conventional silicon, illustrate the ongoing engineering refinement within personal and residential power delivery systems.

Power Electronics Market Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Consumer Electronics |

32% |

| Automotive (EV/HEV) |

28% |

| Industrial |

18% |

| Aerospace & Defense |

4% |

| ICT & Data Centers |

6% |

| Renewable Energy |

12% |

Industrial: Across industry, the accelerating pivot to automation, robotics, and advanced motor drives is driving a sustained need for high-efficiency inverters and converters. The manufacturing vertical, which is expected to grow annually by 7–8%, is being led by established economies—in particular Germany, Japan, and China—in which mature factory ecosystems are embracing smart factory enablement.

Renewable energy: For renewables, the trajectory is steeper: a 10–12% CAGR is being spurred primarily by solar and wind plants whose yield hinges on next-gen conversion hardware. Sich-based solar inverters, for instance, are now delivering conversion efficiencies in excess of 98%, a threshold that compresses the levelized cost of energy in utility-scale deployments. That factor is reinforced by the International Renewable Energy Agency reporting global solar capacity that has now exceeded 1,200 GW, thereby outlining a durable revenue horizon for power electronics developers.

Aerospace & Defense: Similarly, the aerospace and defense market, while a more modest vertical by volume, continues to burnish high barriers to entry by specifying rugged, low-fail, mission-critical power devices that service avionics, telemetry, and satellite payloads. Concurrently, the ICT and data center domain is registering brisk growth: the ongoing expansion of cloud services and the 5G rollout is tightening the need for GaN-based power architectures. The lean power profiles of GaN technology—lower on-state losses and mitigated thermal limits—are permitting substantial improvements in power density, the very lodestar of next-gen dc-dc converters and power modules. According to the Global Energy Institute, data centers are absorbing nearly 3% of world electricity, and major operators such as Google and Amazon are escalating capital allocations to next-gen power modules for holistic energy optimization and sustainability verification.

Power Electronics Market Regional Analysis

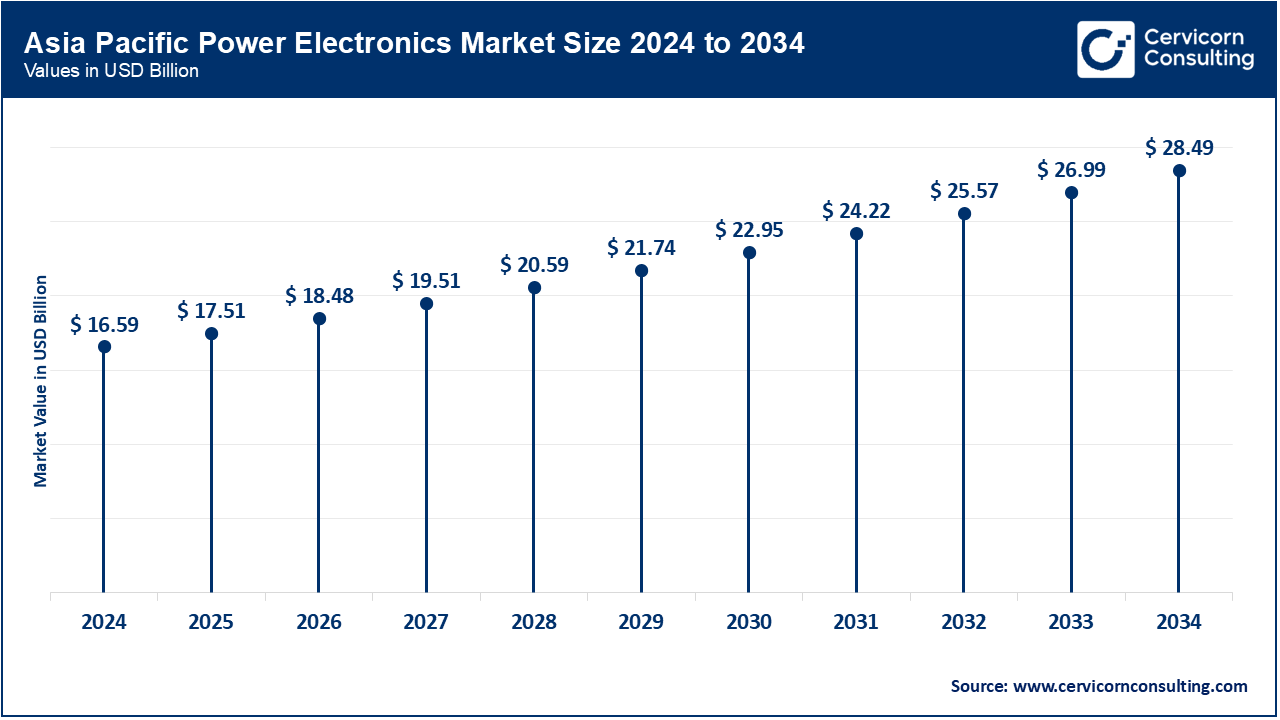

Why is Asia-Pacific leading the power electronics market?

- The Asia-Pacific power electronics market size was valued at USD 16.59 billion in 2024 and is predicted to reach around USD 28.49 billion by 2034.

The Asia-Pacific region remains the clear market heavyweight, driven by a unrivaled electronics manufacturing ecosystem, surging industrial activity, and a concerted move toward clean energy and electrified transport. At the same time, Japan and South Korea maintain a commanding position. Firms including Mitsubishi Electric, Toshiba, and Samsung are pioneering next-gen semiconductor devices and committing large resources to gallium-nitride as well as silicon-carbide advancements. Meanwhile, India is sprinting onto the stage: annual growth of 8 to 10% is forecasted until 2030 thanks to the ambition of reaching a cumulative 500 gigawatts of renewable capacity and the government’s well-targeted electric-vehicle roadmap. Thus, the Asia-Pacific’s dominance is continually cemented by expansive manufacturing scale, favorable cost structures, and policies that unambiguously back the shift to clean-tech solutions.

Why North America hits substantial expansion in the power electronics market?

- The North America power electronics market size was reached at USD 11.87 billion in 2024 and is projected to surpass around USD 20.39 billion by 2034.

North America takes the number two position, keyed to substantial expansion in scaled-up EV network investment, sharper renewable integration efforts, and ongoing aerospace electrification programs. Compounding this, Canada aims for 90% clean electricity by 2030, which calls for next-generation grid converters and scalable energy storage. Planned federal deployment of 500,000 fast charging stations by 2030 suggests annual power electronics adoption in charging gear will climb by 10–12%. Innovators like Tesla, Wolfspeed, and ON Semiconductor are at the vanguard of power electronics: Tesla now deploys SiC-based inverters in its new models, and Wolfspeed is ramping up U.S. SiC wafer output to cut import reliance.

Europe holds the third largest market share

- The Europe power electronics market size was recorded at USD 9.11 billion in 2024 and is expected to grow around USD 15.64 billion by 2034.

Europe holds the third largest market share. Aggressive EU emissions and renewable energy regulations are creating strong upward pressure for energy-efficient inverters, converters, and modular power solutions. Germany, the UK, and France are the regional heavyweights, with Germany leveraging its deep automotive capabilities and industrial automation clout. Major OEMs, including Volkswagen, BMW, and Renault, are already integrating SiC and gallium-nitride semiconductor components to trim losses and boost EV driving range. One additional competitive advantage for Europe lies in its mature renewable-energy sector, where, in markets such as Denmark and Spain, wind and solar together provide over 40% of total power. This substantial share naturally accelerates the push for sophisticated grid-integration solutions capable of seamlessly balancing fluctuating supply and predictable demand. The region’s 2050 climate-neutrality goal, designed to eliminate net greenhouse-gas emissions, is set to funnel ever-growing capital towards power-electronics innovations that enable intelligent power management, as well as batteries and other storage technologies that stock surplus energy for later use.

LAMEA Market Trends

- The LAMEA power electronics market was valued at USD 3.09 billion in 2024 and is anticipated to reach around USD 5.31 billion by 2034.

Latin America and MEA, while smaller than established markets, are steadily maturing, driven by refreshingly ambitious electrification and renewables pushes. São Paulo and Minas Gerais drive Brazilian wind and multi-purpose hydropower, while solar momentum is palpable in Puebla and Baja California. Across the Arabian Peninsula and southern Africa, flagship initiatives play a similar role: Vision 2030 in Saudi Arabia, the UAE’s 2050 clean energy plan, and the ambitious Renewable Energy Independent Power Producers Procurement Programme (REIPPPP) in South Africa. Wind and solar parks—many linked by advanced power electronics—are accumulating megawatts with impressive efficiency and remain underpinned by mounting electric vehicle (EV) goals. Even in embryonic form, both regions are poised to compound at 7–9% annually over the next decade, sweeping in steady opportunities for suppliers that can cater to the specialized requirements.

Power Electronics Market Top Companies

Recent Developments

- June 2025: Arteche's joint venture with Mondragon cooperative group officially commences at the Bizkaia site, establishing a balanced partnership dubbed Amets Power Electronics. Supported by a €5 million seed and 55 engineers, the new facility aims to develop off-the-shelf power conversion modules in conjunction with the Ikerlan technology centre’s R&D teams.

- June 2025: At Chiba University, a research consortium presents a next-generation load-independent wireless power transfer system, featuring machine-learning algorithms that re-balance output in real time. Tightening voltage tolerances has improved overall efficiency by 23.7 percentage points, now exceeding benchmarks at 86.7% under a full dynamic load.

Market Segmentation

By Device Type

- Power Modules

- Power Discrete

- Diode

- Transistor

- Thyristor

- Power ICs

By Material

- Silicon

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- Sapphire

- Others

By Voltage Level

By Application

- Consumer Electronics

- Automotive (EV/HEV)

- Industrial

- Aerospace & Defense

- ICT & Data Centers

- Renewable Energy

By Region

- North America

- APAC

- Europe

- LAMEA