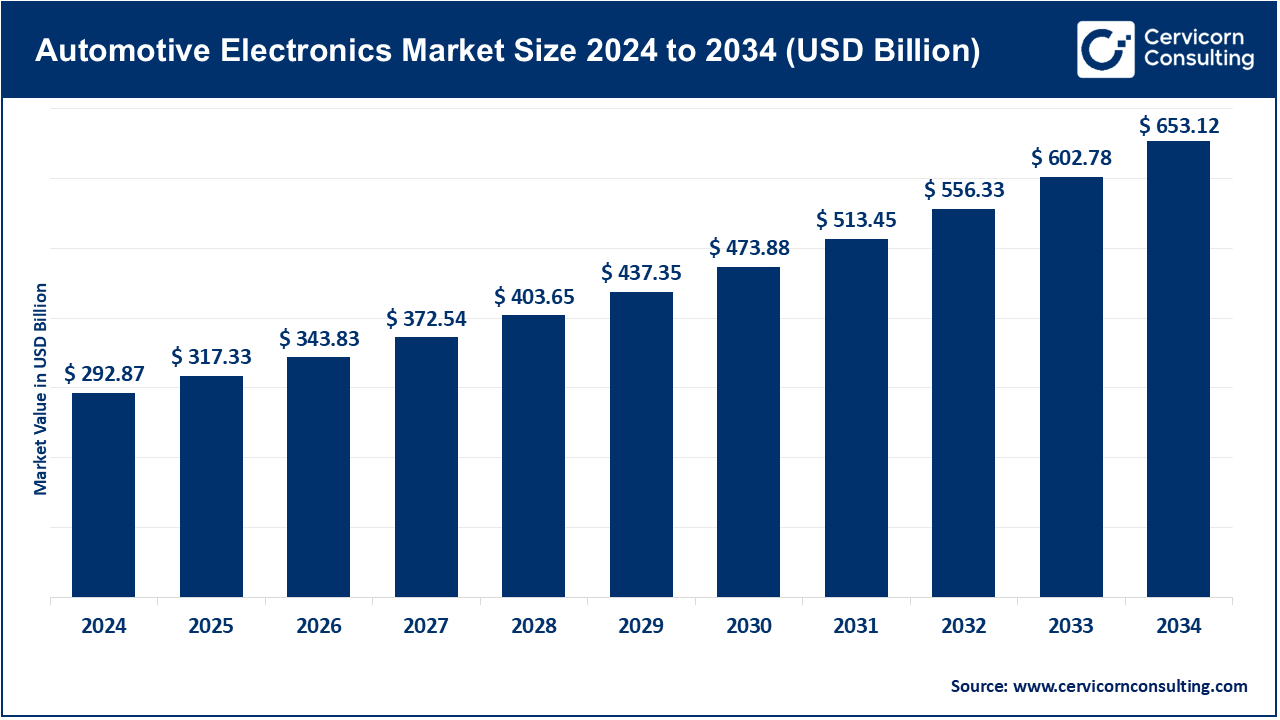

The global automotive electronics market size was valued at USD 292.87 billion in 2024 and is expected to hit around USD 653.12 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.2% over the forecast period from 2025 to 2034.

The automotive electronics market is expected to grow significantly owing to the rising integration of advanced driver-assistance systems (ADAS), growing adoption of electric vehicles (EVs), and increasing consumer demand for in-vehicle infotainment and connectivity solutions. Enhanced safety regulations, autonomous driving innovations, and the shift toward energy-efficient mobility are pushing manufacturers to embed more electronic components in vehicles. Additionally, government incentives for EVs and digital transformation in automotive production are accelerating the demand for reliable, intelligent, and connected automotive electronics systems across global markets.

Automotive electronics are used in vehicles to make an automotive system to work better, safer, more comfortable, and efficient. Some of these are engine control units (ECUs), infotainment systems, advanced driver-assistance systems (ADAS), powertrain electronics and body electronics. The development of the electric and autonomous vehicle has increased the necessity of the use of sensors, microcontrollers and embedded software in the design of vehicles. Automobiles electronics assist in controlling things like fuel injection, braking, navigation and connectivity. Their increasing popularity helps to achieve compliance with rules and regulations, control of emissions, and digital disruption in the automobile industry, and so they are important in automobile architecture and customer experience.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 317.33 Billion |

| Market Size in 2034 | USD 653.12 Billion |

| Projected CAGR 2025 to 2034 | 9.20% |

| Dominant Region | Asia-Pacific |

| Key Segments | Component, Vehicle Type, Point of Sale, Application, Propulsion, Region |

| Key Companies | Aisin Corporation, Altera Corporation, American Axle & Manufacturing, Inc., Atmel Corporation, Autoliv, Inc., Bosch Group, Broadcom, Inc., Continental AG, Delphi Technologies, Denso Corporation, Faurecia, Hitachi Automotive Systems, Ltd., Hyundai Mobis, Infineon Technologies, Lear Corporation, Magna International, Inc., Panasonic Corporation, Texas Instruments Incorporated, The Dow Chemical Company, VALEO, Voxx International Corporation, ZF Friedrichshafen AG |

The automotive electronics market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

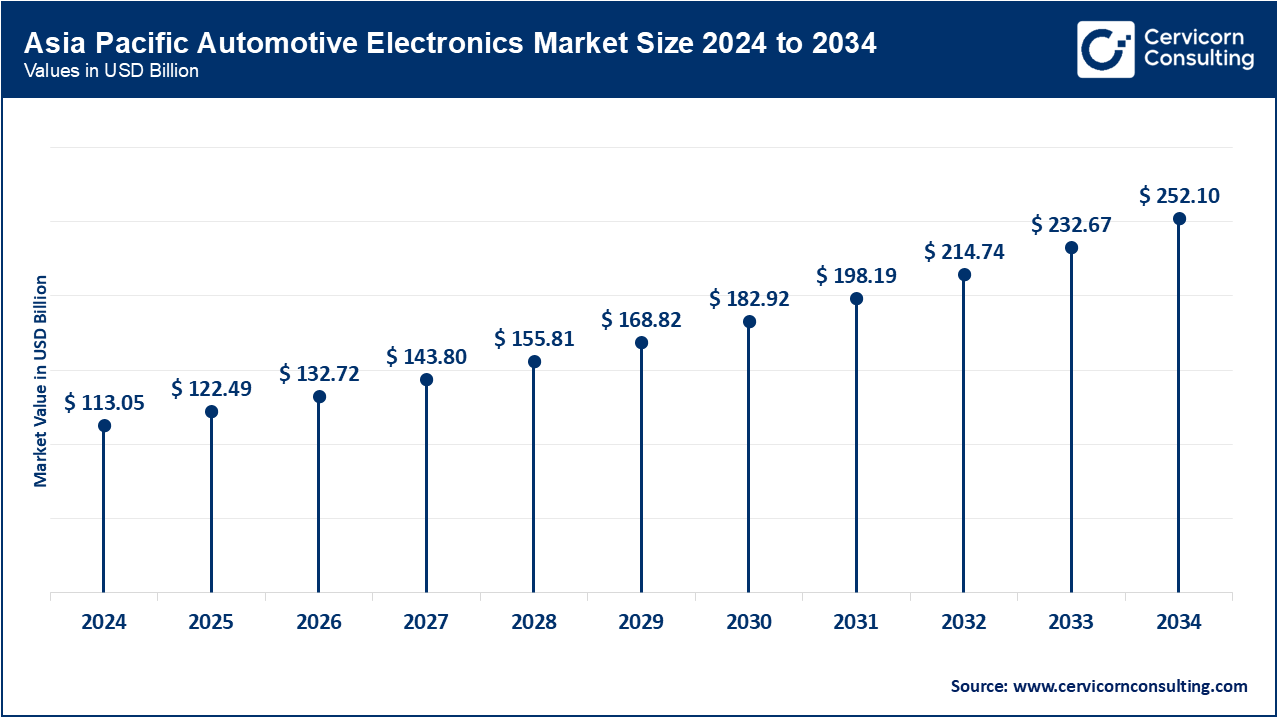

The Asia-Pacific region is the fastest expanding area due to the rapid automobile production in China, Japan, South Korea, and India. The government initiative towards EVs, as well as digital infrastructure and local manufacturing, is improving the incorporation of ADAS, body electronics, and infotainment systems. Local Chinese innovation and scale are being spurred by the entry of Chinese tech companies into the auto-electronics value chain. Upper-tier disposable incomes, urban migration, and consumer preference for advanced vehicles further increase electronics penetration. Semiconductors also have a strong position in Taiwan and South Korea, improving the region’s supply chain resilience.

This region is proactive and more developed, due to established automotive OEMs, high demand for electric and connected vehicles, and rigorous safety policies. The U.S. and Canada has ADAS, autonomous driving, and V2X communication systems investments. There is also strong synergy of the automotive industry with technology companies Intel, NVIDIA, and Apple. Government policies on EVs and smart mobility fuel even further the adoption of advanced electronics in vehicles. Furthermore, Tesla and GM are geographically located in this region which strengthens the leadership in high-performance vehicle electronics.

Europe is the global leader for the adoption of automotive electronics because of the stringent emission policies as well as the existing EV charging infrastructure and advanced safety requirements. Countries like Germany, France, and Netherlands are ADAS and electrification technolgies frontrunners. BMW, Volkswagen, and Daimler are active European OEMs investing into software-defined vehicles with modern infotainment systems featuring real-time diagnostics and embedded deeper vehicle software. The European Union’s active legislation for carbon neutral goals and the digital transformation of mobility encourage the integration of advanced electronics in passenger and commercial vehicles in this heavily regulated innovative region.

Automotive Electronics Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 25.20% |

| Europe | 21.50% |

| Asia-Pacific | 38.60% |

| LAMEA | 14.70% |

The LAMEA region exhibits steady growth aided by expanding vehicle ownership, construction activities, and adopting electric mobility. Telemetry, safety systems, and infotainment are emerging in these countries: Brazil, UAE, and South Africa. Large-scale adoption is still constrained by high price sensitivity and lack of infrastructure. Nonetheless, OEMs are expanding in the region and customizing electronics integration to suit climatic conditions, road conditions, and local drives. There is visible growth with global tier-1 suppliers and localized partnerships, alongside government digitization efforts, signaling long-term demand for vehicle embedded electronics.

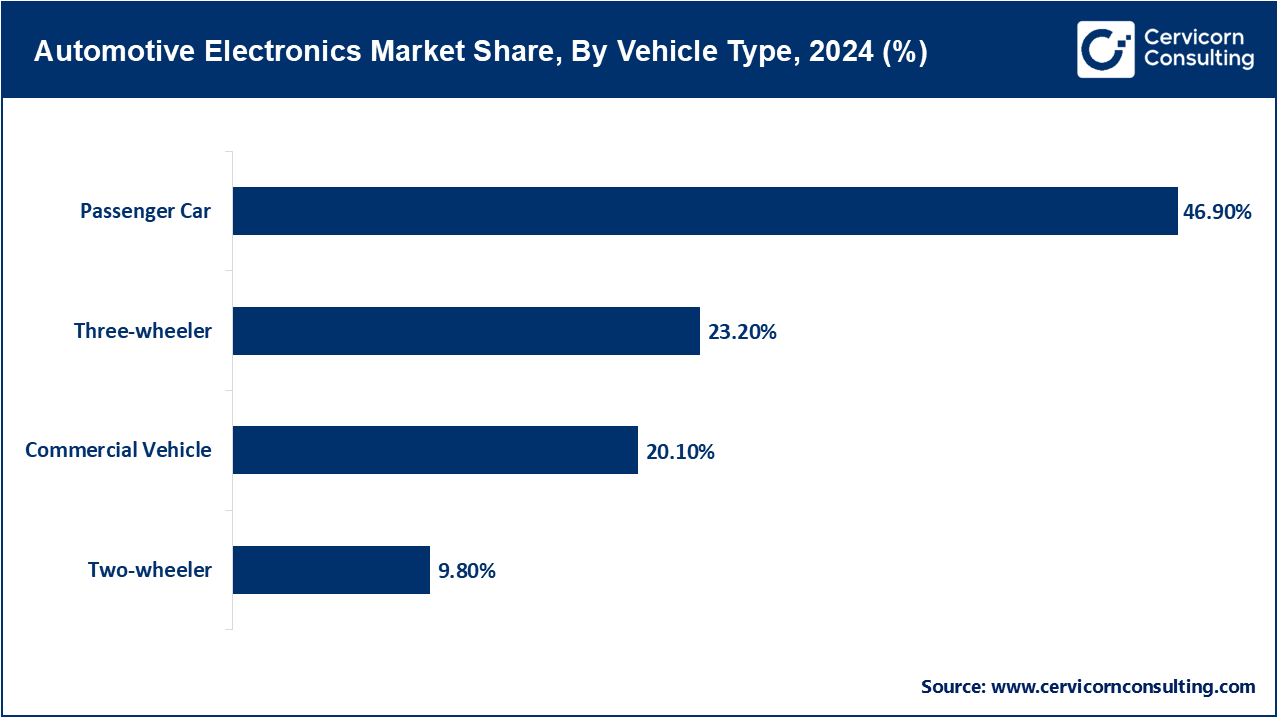

Passenger Car: The demand for advanced automotive electronics in passenger vehicles is the highest. Major systems are: ADAS, infotainment, electronic control units (ECUs), telematics, and digital cockpits. Original Equipment Manufacturers (OEMs) are adding to the vehicles smart driver assistance, autonomous capabilities, over-the-air updates, V2X communication, and more. Over 35% of the cost of a car, is its electronics and the direction the market is moving towards is software defined vehicles. Sustained demand to systems that are electrified, connected, and intelligent in this section will continue to drive global revenues.

Two-Wheeler: The adoption of ABS coupled with GPS tracking, digital gauges, EFI, and automotive electronics is advancing more rapidly for two-wheelers. Also, the Asia-Pacific region has concentrated more on the development of electric scooters and smart bikes which has led to greater demand for BMS as well as IoT-based diagnostics. Coupled with the increase in urban mobility solutions, two-wheeler manufacturers are focusing on more economical electronics that provide enhanced safety and fuel efficiency. This sector stands to gain significant traction, especially with the rise of e-mobility.

Three-Wheeler: In India and Southeast Asia, the three-wheeler segment is rapidly adopting electrification in last mile logistics and ride-hailing services. Notable electronic upgrades include telematics and digital displays, battery management systems, as well as control units for electric drive motors. Basic body electronics are improving as well, standardizing on LED lights and safety indicators. Stricter regulations for emissions and safety standards will impose the need for electronic control units (ECUs) to optimize three-wheeler performance for fleet and urban transport system monitoring and tracking.

Commercial Vehicles: From light duty trucks to heavy duty buses, commercial vehicles owe greatly to electronics for fleet management, telematics, ADAS, and powertrain optimization. Digital tachographs, route monitoring, predictive maintenance, and driver fatigue detection systems are widely used. Emphasis on logistics and emissions are driving the need for electronics in fleet operations, real time diagnostics, autonomous driving assistance, and connected platforms. This section serves the logistics, mining, and agriculture sectors and presents great potential for advanced automation.

Original Equipment Manufacturer (OEM): The OEM segment accounted for a highest revenue share. OEM manufacturers still supply Vehicle-Mounted Electronic Systems such as ADAS modules, infotainment systems, power management units, and even safety control modules, which means they still tightly control the automotive electronics market. Something like ADAS and infotainment systems functions as safety control modules for vehicles are provided by these manufacturers too. The way OEMs approach integrated electronics is advantageuous if they provide integration, warranty repair, and compliance with legal necessities. Added features in vehicles such as connected systems and autonomous driving are made available through smarter, carrier-installed systems which require collaboration with software and chip manufacturers. OEM sales ensure high-quality standards and offers long-term growth through integration of scalable and upgradable platforms.

Automotive Electronics Market Revenue Share, By Point of Sale, 2024 (%)

| Point of Sale | Revenue Share, 2024 (%) |

| OEM | 61.30% |

| Aftermarket | 38.70% |

Aftermarket: Opportunities for infotainment enhancements and parking assists, reverse cameras, digital instrument clusters, and tracking systems are expanded under this segment. Retrofitting older vehicles with advanced driver assistance, lighting, and connectivity tools is a growing trend, especially in emerging markets. The segment benefits from increasing consumer awareness and demand for personalized driving experiences. While OEM dominance persists, aftermarket sales enable technology penetration into mid-range and budget vehicle categories, boosting accessibility and lifecycle extension for vehicles.

Advanced Driver Assistance Systems (ADAS): The ADAS segment has captured highest revenue share in the market. Technologies included are adaptive cruise control, emergency brakes, lane departure warning, and blind spot monitoring. ADAS automates vehicle safety with the use of safety and automation cameras, radar, software, and safety sensors. There is a rising regulatory framework that enforces the mandatory adoption of collision avoidance technologies and provides smooth interactions of advanced driving automation which accelerates the adoption of ADAS. It is still vital for range automotive electronics for level 2 and level 3 automation, and is becoming standard for both mass-market and high-end vehicles rapidly.

Body Electronics: Body electronics includes modules controlling lighting, windows, seat adjustment, HVAC and central locking systems. The vehicle user experience is enhanced with the emergence of digital cockpits, ambient lighting, and smart key systems. Automakers are implementing microcontrollers and smart switches for comfort, convenience, and customization. With consumer demand for luxury features on the rise, so is the need for lightweight, compact, and efficient components. This segment epitomizes the intersection of vehicle comfort, functional electronics, and convenience.

Infotainment & Communication: The infotainment and communication systems comprises voice recognition, bluetooth, smartphone integration, navigation, and in-car connectivity and more. These systems sharpen interactions and enhance entertainment between the driver and passenger. At the same time drivers are demanding a more user friendly system, 5G, cloud computing, and over-the-air updates are revolutionizing the industry. Collaborations between automakers and tech companies for AI-powered virtual assistants and infotainment services are becoming increasingly common, thus infotainment is becoming increasingly essential for markup difference and profit.

Powertrain: Components of a powertrain’s electronics comprises of engine control units (ECUs), electric motor controllers, transmission bidirectional interfaces, and a battery management system. Within electric vehicles, this domain crucially augments energy efficiency, torque control, thermal management, and reliability systemically. This domain is experiencing a surge due to the electric vehicles market, alongside hybrid drivetrains and alternative fuel powered technologies. Target lightweight control modules with extremely durable environmental reliability in real time, and user adaptability over time are the focus for the OEMs.

Safety Systems: A systems safety identification includes airbags, anti-lock braking systems, electronic stability control, tire pressure monitoring systems and other collision sensors. Regulatory requirements in the U.S., EU, and Japan have enforced these features to be a standard. Current safety technologies use AI and sensor fusion to prevent crashes and protect occupants in advance. With the growth of autonomous driving, safety systems now interconnect with ADAS which forms a comprehensive safety architecture crucial for safeguarding the driver, passengers, and pedestrians.

Key players in the automotive electronics industry—such as Bosch, Continental, Denso, and Infineon Technologies—are driving forward the next wave of automotive innovation through integration of intelligent systems, domain control architectures, and AI-enhanced functionalities. These firms are focusing on centralizing vehicle electronic controls, enabling zonal architectures and seamless over-the-air updates. Bosch is advancing embedded control units for ADAS, while Continental focuses on software-defined mobility platforms. Denso is pushing electrification components with advanced thermal management systems, and Infineon is strengthening cybersecurity features in vehicle semiconductors. Together, these developments reflect a shift toward connected, autonomous, and software-centric vehicles tailored for next-generation mobility ecosystems.

Market Segmentation

By Vehicle Type

By Point of Sale

By Component

By Propulsion

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Automotive Electronics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Vehicle Type Overview

2.2.2 By Point-of-Sale Overview

2.2.3 By Application Overview

2.2.4 By Propulsion Overview

2.2.5 By Component Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Consumer Demand for Infotainment & Comfort

4.1.1.2 Government Mandates on Safety & Emissions

4.1.1.3 Collaborations And Semiconductor Investment

4.1.2 Market Restraints

4.1.2.1 Increased Electronic System Costs

4.1.2.2 Disruption of the Supply Chain and Shortages of Supply Parts

4.1.3 Market Challenges

4.1.3.1 Data Integrity and Cybersecurity

4.1.3.2 Regulatory Complexity and Standardization

4.1.4 Market Opportunities

4.1.4.1 Advancement in EV Power Electronics

4.1.4.2 V2X and Smart Mobility Expansion

4.1.4.3 Automotive Aftermarket ADAS

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Automotive Electronics Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Automotive Electronics Market, By Vehicle Type

6.1 Global Automotive Electronics Market Snapshot, By Vehicle Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Two-wheeler

6.1.1.2 Three-wheeler

6.1.1.3 Passenger car

6.1.1.4 Commercial Vehicle

Chapter 7. Automotive Electronics Market, By Point of Sale

7.1 Global Automotive Electronics Market Snapshot, By Point of Sale

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Original Equipment Manufacturer (OEM)

7.1.1.2 Aftermarket

Chapter 8. Automotive Electronics Market, By Component

8.1 Global Automotive Electronics Market Snapshot, By Component

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Electronic Control Unit

8.1.1.2 Sensors

8.1.1.3 Current Carrying Devices

8.1.1.4 Others

Chapter 9. Automotive Electronics Market, By Application

9.1 Global Automotive Electronics Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Advanced Driver Assistance Systems (ADAS)

9.1.1.2 Body electronics

9.1.1.3 Infotainment & communication

9.1.1.4 Powertrain

9.1.1.5 Safety Systems

Chapter 10. Automotive Electronics Market, By Propulsion

10.1 Global Automotive Electronics Market Snapshot, By Propulsion

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 ICE

10.1.1.2 Electric

Chapter 11. Automotive Electronics Market, By Region

11.1 Overview

11.2 Automotive Electronics Market Revenue Share, By Region 2024 (%)

11.3 Global Automotive Electronics Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Automotive Electronics Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Automotive Electronics Market, By Country

11.5.4 UK

11.5.4.1 UK Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Automotive Electronics Market, By Country

11.6.4 China

11.6.4.1 China Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Automotive Electronics Market, By Country

11.7.4 GCC

11.7.4.1 GCC Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Automotive Electronics Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Aisin Corporation

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Altera Corporation

13.3 American Axle & Manufacturing, Inc.

13.4 Atmel Corporation

13.5 Autoliv, Inc.

13.6 Bosch Group

13.7 Broadcom, Inc.

13.8 Continental AG

13.9 Delphi Technologies

13.10 Denso Corporation

13.11 Faurecia

13.12 Hitachi Automotive Systems, Ltd.

13.13 Hyundai Mobis

13.14 Infineon Technologies

13.15 Lear Corporation

13.16 Magna International, Inc.

13.17 Panasonic Corporation

13.18 Texas Instruments Incorporated

13.19 The Dow Chemical Company

13.20 VALEO

13.21 Voxx International Corporation

13.22 ZF Friedrichshafen AG