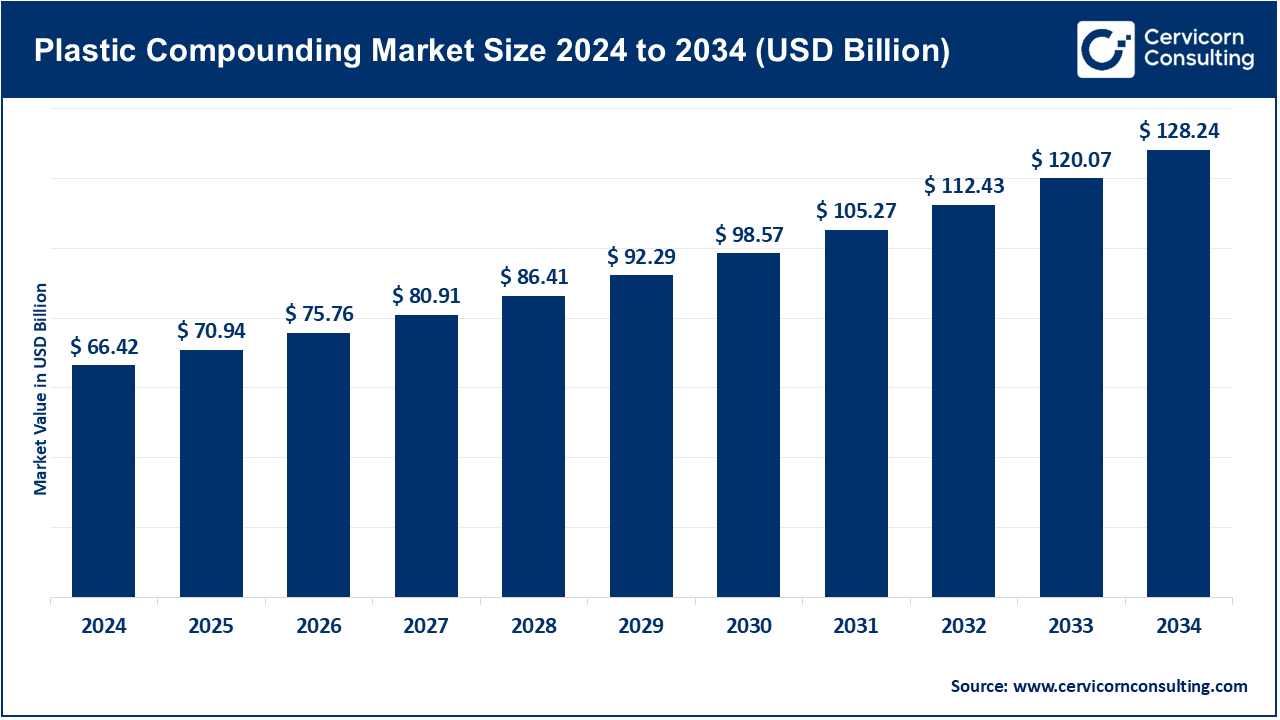

The global plastic compounding market size was estimated at USD 66.42 billion in 2024 and is expected to be worth around USD 128.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.8% over the forecast period from 2025 to 2034.

Plastic compounding basically means mixing polymers with additives to improve or modify the physical, thermal, electrical, or aesthetic properties of a base material. These compounds apply to automotive parts, construction materials, electrical and electronics, medical, and packaging. Thus, the process enables manufacturers to make sure materials are specific to a given application by incorporating fillers, reinforcements, colorants, flame retardants, stabilizers, and other performance enhancing agents.

The global plastic compounding market growth is driven by an increasing applications and growing requirements related to high-performance, lightweight, and tough material. It works in fulfilment of industry demands, mainly in the domains of product customization, cost-effectiveness, and eco-friendly solutions. The market has varied compounded types of plastics such as polyethylene, polypropylene, polyvinyl chloride, polycarbonate, and many more, catering to different end-use sectors. The technological and process evolutions have also resulted in the growth of specialty plastic compounds with improved mechanical strength, UV stability, and thermal stability.

The automotive industry is one of the larger consumers of plastic compounds. Increasing emphasis on vehicle weight reduction to improve fuel efficiency and conform to stricter emission norms has augmented the use of lightweight polymer compounds. In the construction industry, plastic compounds are employed for applications where properties such as corrosion resistance and durability are required for pipes, fittings, and insulation materials. In addition, the fast growth characterizing the electrical and electronics sector and the demand for smaller and efficient consumer appliances promote the use of engineered plastics with better electrical properties.

Another major driver of the market is the shift toward sustainability and recycling. As an increased consciousness for the environment grows amongst industries and consumers, the demand for bio-based and recycled plastic compounds is growing. Manufacturers are increasingly investing in the development of green solutions conforming to the circular economy concept. Also, this trend is creating an increasing demand for other aspects of the market stimulated by urbanization, infrastructure development, and technological innovation in various end-user industries. The ongoing demand for plastic compounds specialized for electric vehicles, smart electronics, and green buildings will thus probably gain more momentum in the forthcoming years.

Top Country Level Production Shares in the Plastic Compounding Market (2024)

| Country | Production Shares, 2024 |

| China | 32% |

| United States | 17% |

| Europe | 14% |

| India | 9% |

| Others | 28% |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 70.94 Billion |

| Expected Market Size in 2034 | USD 128.24 Billion |

| Projected CAGR 2025 to 2034 | 6.8% |

| Dominant Region | Asia-Pacific |

| Key Segments | Source, Polymer Type, Additive Type, Manufacturing Process, End-Use Industry, Region |

| Key Companies | Asahi Kasei Corporation, BASF SE, DuPont, Celanese Corporation NORTH AMERICA, Covestro AG, LANXESS A.G., LyondellBasell, SABIC, KURARAY CO., LTD., Arkema, TEIJIN LIMITED, Solvay S.A. |

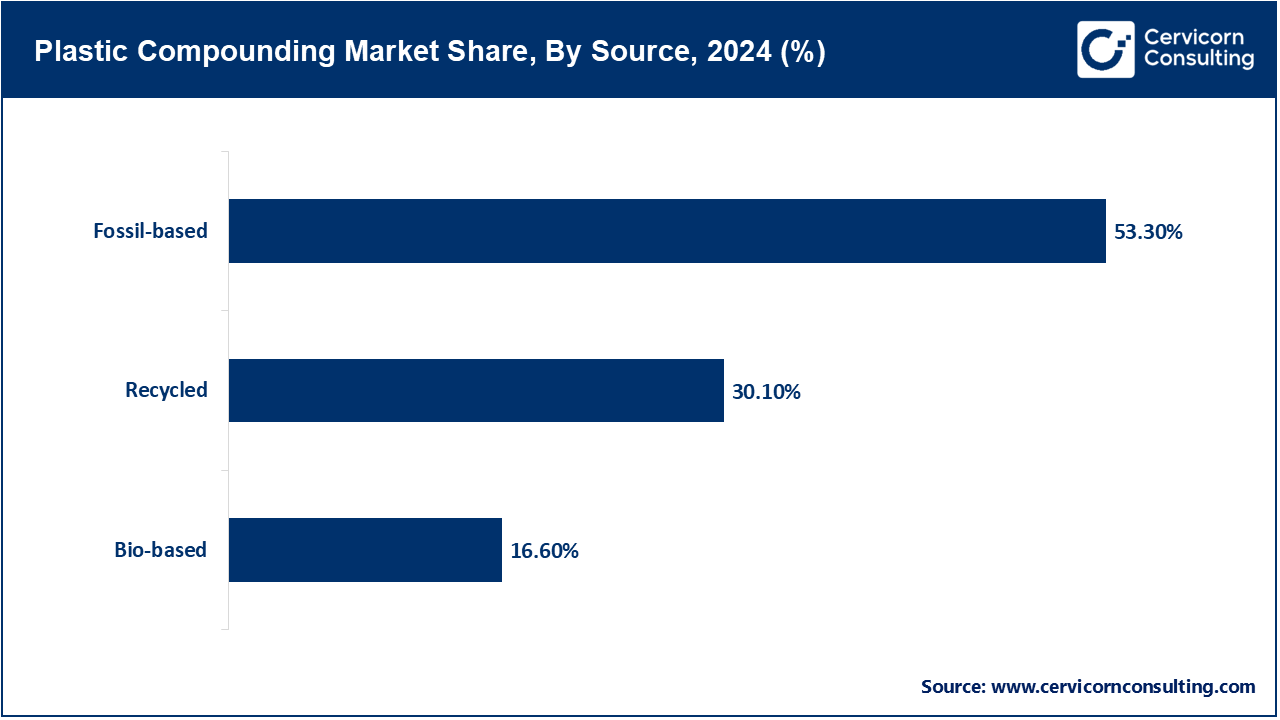

Fossil-based: Fossil-based plastics use petrochemical feedstock which includes natural gas and crude oil. This segment commands the highest share in the market of the world, mainly due to the established infrastructure that manufacturing facilities worldwide enjoy, acceptable performance of the product, and cost efficiency. Common fossil-based polymers such as polypropylene (PP), polyethylene (PE), polystyrene (PS), and polyvinyl chloride (PVC) are generally used in automotive, consumer goods, packaging, electronics, and construction sectors. These materials are preferred for their properties like thermal stability, strength, and moulding capabilities. Moreover, such fossil-based compounds work well with most additives, fillers, and reinforcements, allowing custom formulations. Due to environmental concerns and regulatory initiatives on carbon emissions, industries are now exploring sustainable options, while their technical advantage and deep penetration in global supply chains are expected to keep fossil-based plastics in the limelight for a while.

Recycled: Recycling aims to convert plastic wastes into useful compounds. This industry is steadily growing with increasing environment awareness, legislative requirements, and push to a circular economy. Mostly, compounded recycled plastics find use in packaging, nonlife-critical applications, building products, and household items. While these materials reduce waste deposited in landfills, as well as keep virgin resins at bay to some extent, inconsistent quality, contamination, and the availability of high-performance applications limit their wider acceptance. Developments in recycling technologies, such as chemical recycling and improved sorting systems, are assisting in enhancing the quality and applications of recycled compounds.

Bio-Based: Plastics prepared from bio-based raw materials are created from renewable biological resources such as corn starch, sugarcane, or cellulose. They are becoming more popular as sustainable alternatives to fossil-based plastics, particularly in packaging and agriculture applications or medical applications. Bio-based compounds may be either biodegradable or non-biodegradable, often used in reducing the carbon footprint for end products wherein polylactic acid (PLA), polyhydroxyalkanoates (PHA), and bio-based PE are the typical examples. These types of plastics suffer from high production costs, limited processing infrastructure, and competition with food crops. That having been said, bio-based plastic compounding is inferred to grow gradually owing to a favourable policy and green branding along with technological advancement.

Polypropylene (PP): The polypropylene (PP) is the most dominant polymer in the market as it provides an excellent balance of light weight, chemical resistance, and cost. Its usage is widespread across the sectors of automotive, consumer goods, packaging, textiles, and medical devices. Typically, in compounding, PP is mixed in with impact modifiers, UV stabilizers, fillers like talc, or glass fibres, flame retardants, etc. to tailor properties such as stiffness, heat resistance, or flexibility, while other compounding processes offer other options for thermal, mechanical, or chemical resistance. Compound PP is used in the automotive sector for interior trim, dashboards, bumpers, and battery cases because it helps to reduce the overall weight of the vehicle and hence improve fuel efficiency. Also, being recyclable, it is usually preferred in the design of environmentally friendly products. The major factors that are driving growth for polypropylene are broad processability, low cost, and its ability to be tailor-made for performance applications. As industries demand lightweight and high-strength plastics for various uses, particularly for transportation and packaging, the compounded PP segment is further growing at a considerable pace. Innovation-related activities on bio-based and recycled PP compounds are also receiving huge traction, lending a further push to the market potential.

Polyethylene (PE): The word "polyethylene" stands for all general Types of PE (HDPE, LDPE, and LLDPE). This polymer finds its application in many areas depending upon the situation, e.g., packing, agriculture, construction, and some instances of electrical insulation. PE used in compounding can be modified for UV-resistance, flame-retardancy, stiffness, and impact strength. Due to their specific gravity, HDPE competes to offer hard and rigid goods like plumbing for water, fuel tanks, and domestic containers. LDPE and LLDPE types of polyethylene are softer and used for stretch films, agricultural mulching, and flexible tubing. The additives used in compounded PE include antioxidants, antistatic, and colorants. Increased demand for protective films in packaging, and durable piping in construction and agriculture drives compounded PE. It is also well-known for its dielectric properties and is used for insulation and jacketing of wire and cable. PE ranks among materials used extensively for sustainable packaging because of its recyclability and cost efficiency. Due to the increasing demand for green products and high-performance films, the compound PE market has been experiencing good growth.

Polyvinyl Chloride (PVC): Given the way PVC can be easily modified, the compound material is highly flexible. It can be rigid or flexible depending on the usage of respective additives and thus finds a variety of applications: pipes, window profiles, flooring, cables, and even medical devices. Rigid PVC, also called unplasticized PVC or uPVC, is mainly utilized in construction applications, like pipes, doors, and windows, while flexible PVC, with plasticizer added, is employed for hoses, cables, and so on. In manufacturing, other additives are employed to enhance the relevant and important properties: stabilizers, impact modifiers, fillers, lubricants and pigments, etc., making it flame retardant, weatherable, durable, and able to hold colour. PVC is non-flammable and has very good insulation resistance; hence, it finds a preference with electrical wiring. However, because of chlorine content and phthalates in plasticizers, this leads to environmental concerns, but the development is towards non-phthalate and environmentally friendly PVC compounds. Further, the durability factor, coupled with cost-effectiveness and versatility, continues to draw demand to it. As worldwide construction and infrastructure development gears up, compounded PVC continues to hold centre stage for long-life-high-strength applications.

Polyethylene Terephthalate (PET): PET is a thermoplastic that offers truly high performance, with applications in packaging, textiles, automotive, and electronics. In the compounding industry, PET is typically glass fibre-reinforced and modified with an impact modifier and flame retardant to impart thermal stability, stiffness, and strength. Compounded PET exhibits excellent dimensional stability, chemical resistance, and barrier properties to gases and moisture and thus is preferred for food and beverage containers, especially for bottles. This is a highly valued engineering plastic used in automotive and electrical applications for housings, as well as for under-the-hood components that require a high melting point and structural integrity. With all the environmental concerns, the compounding of recycled PET (rPET) has found increasing demand in sustainable packaging and fibre applications. Through the sort of circular economy model and ever-increasing mandates for recycling of plastics, the rPET compounded form has seen a boom in its acceptance. In consideration of their light weight, strength, and easy recyclability, along with being amenable to modern compounding processes, PET finds Favor in both consumer and industrial applications.

Polystyrene (PS): A readily available thermoplastic, polystyrene is used in compounding due to factors such as affordability, rigidity, and ease of processing. PS are widely used for packaging materials, disposable cutlery, appliances, and insulation. Different types of PSs exist, with General-Purpose PS (GPPS) being transparent and rigid, whereas High Impact PS (HIPS), which is rubber-modified, imparts toughness to TV cabinets, toys, and refrigerator liners. Comprising EPS and XPS foam, it is highly sought for thermal insulation and protective packaging. In compounding, PS may be blended with impact modifiers, flame retardants, and other fillers to satisfy the demands of different applications. However, due to poor biodegradability and difficulties associated with recycling, among other environmental concerns, increasing scrutiny is intensifying against PS on all fronts. Still, it remains in high demand owing to its cheapness and ease of moldability, especially in developing countries. Further highlighted are efforts towards improving its recyclability and at the same time searching for biodegradable alternatives, which probably would determine the future course of PS compounding in the long run. At present, the vast area of utilization provides some block in the path of it venturing into extinction.

Others: This segment includes engineering plastics like Acrylonitrile Butadiene Styrene (ABS), Polyamide (PA), Polycarbonate (PC), Polyoxymethylene (POM), and others, which are used in high-performance applications mostly. These polymers are compounded with reinforcements, impact modifiers, flame-retardants, and colorants suited to their respective industrial specifications, namely aerospace, automotive, consumer electronics, healthcare, and machinery. Highest on the strength scale is ABS, also having charisma, laudable traits that compliment electronics housings and automotive interiors. PA and nylon find application in resisting the forces of heat and strength, placing them in engines and machinery. They're great safety come-under impact-resistant lens for electronics. These plastic resins are priced higher for overcoming mechanical, thermal, and electrical constraints. With industries moving toward light-weight, durable, and miniaturized products, the compounded engineering plastic market has found increased demand. Innovations in bio-based engineering plastics as well as recycled grades widen the attractiveness for sustainability-driven markets. This segment, though smaller in volume, stands high in value in the compounding space.

Fillers: The fillers segment has generated highest revenue share in the market. Fillers-the most frequently used additives for plastic compounding-generally act to lower raw material costs and to improve one or another physical property of the final product. Among these are calcium carbonate, talc, glass fibres, clays, and silica. They impart rigidity, dimensional stability, thermal conductivity, and impact resistance when dispersed in polymer matrices. In operations such as automotive parts, electrical enclosures, and construction materials, these materials assist in ensuring reduced weight so that structural properties are not compromised- properties being energy that need to be prioritized. Moreover, fillers allow plastic compounders to create compounds that meet exact application requirements without substantially increasing the price of production. They further improve sustainability options, allowing either recycled or bio-based resins to be used and enhancing their properties. Advancing reinforced plastics for light weight and high strength need in the automotive and construction sectors, keep the fillers dominant in plastic compounding additives.

Antioxidants: Antioxidants serve as vital additives in plastic compounding as they make sure the polymers are not degraded by heat, oxygen, and light during processing and through the lifetime of the product. Thermoplastic materials, if exposed to high temperatures during manufacturing or in their end use, undergo oxidative degradation resulting in discoloration, brittleness, and reduced mechanical properties. Antioxidants are mainly categorized into primary (chain-breaking) and secondary (peroxide-decomposing). They become more necessary in polyolefins such as polypropylene (PP) and polyethylene (PE), which are highly prone to oxidation. Antioxidants help with their long-term performance and stability in automotive components, packaging films, and wire and cable insulation. With the new laws that demand faster-attacking porous construction with durable plastic, the need fulfilled by a high-performance antioxidant system has become paramount. Having cemented their role in prolonging the service life of plastic products and reducing wastage of materials, antioxidants have carved a niche for being essential towards sustainable plastic compounding across sectors.

Colorants: Colorants make an interesting plastic compounding process as these are mainly responsible for imparting aesthetic and functional features into the finished products. Additives could be pigments or dyes that furnish a colour change according to whether opacity is needed or transparency, or all depending on their end-use requirement. Hence, colorants become essential for a wide variety of consumer items, automotive interiors, electronic casings, and packaging-all places where colour matches and brand differentiation are of paramount importance. Colorants have ancillary uses; for example, they indicate certain physical and chemical properties or grant UV resistance when used with stabilizers. Usually, synthetic or inorganic pigments are the choice colorants along with masterbatches. Careful selection relating to colorants must take into consideration being compatible with the base resin, resisting processing temperatures, and bearing the durability exposure to light and chemicals. The innovation in colorant technology, custom, and biodegradable will enhance the demand for new-age and eco-friendly plastic products. With the increasing demand for customization and branding, plastisol colorants are now witnessing ever-expanding scope.

UV Stabilizers: They are important for UV stabilizers in guarding plastic products against degradation from prolonged exposure to ultraviolet radiation. Devoid of stabilization, UV light tends to photodegrade polymers leading to discoloration, cracking, loss of mechanical strength, and hence failure of plastic materials. UV stabilizers absorb the dangerous radiation and dissipate it as heat or molecularly scavenge free radicals formed during the degradation process. These additives are an important consideration for outdoor applications such as agricultural films, outdoor furniture, automotive parts, and building construction. They mostly include HALS, UV absorbers, and quenchers. HALS is majorly used for the protection of polyolefins because they provide longer life. As durability, product life cycle, as well as weather resistance, are being given importance all over the world, demand for UV stabilizers is also burgeoning. They keep the product from going away in aesthetic appeal and functionality over time, more so in an environment where the sun rays are very strong or crazy weather takes over.

Flame Retardants: Flame retardants are an essential category of additives, which are added to give fire resistance to plastic compounds. One interference mechanism commonly employed in the combustion process is of a flame retardant creating a thin white char layer on the surface of the plastic, releasing gases that inhibit flames, or chemically modifying the polymer decomposition reaction. Their applications have important implications in electrical and electronic components, automotive interiors, construction and building materials, and for public transport systems where fire safety is critical. Normally, flame retardants are halogenated or non-halogenated compounds. Halogenated ones consist of brominated compounds, while non-halogenated types include phosphorus-based, nitrogen-based, and inorganic hydrates such as aluminium hydroxide. A newer, growing emphasis is on finding halogen-free and sustainable flame-retardant options as environmental and health issues are brought up against halogenated flame retardants. The regulations REACH and RoHS have, indeed, served as an impetus. By allowing the plastics industry to meet tough fire standards, flame retardants play a pivotal role in the compounding of plastics, making them a balanced performance option considered safe for use in high-risk industries.

Others: The others category in plastic compounding additives refers to numerous specialized agents that contribute to the performance, processing, and usability of plastics. These include plasticizers, impact modifiers, lubricants, coupling agents, anti-static agents, anti-fogging agents, and processing aids. Each of these additives has a different role to play plasticizers add flexibility and softness (particularly in PVC), impact modifiers impart toughness, and lubricants facilitate processing by reducing friction in either extrusion or moulding. Coupling agents allow better bonding between the polymer matrix and fillers or reinforcements, mainly when composites are involved. Anti-static and anti-fog agents are generally used in packaging and electronics applications to increase product performance and shelf appeal. The whole niche of these additives is expanding as end-use industries are increasingly demanding more tailor-made plastic solutions. Other innovations that contribute to the growth of this segment include additive technologies that consider bio-based or multifunctional concepts, sustenance advanced material formulations, and enhanced product performance across industries.

Injection Molding: Injection molding is the prime compounding method used since it allows to manufacture complex shapes with tight tolerances and repeatability. In this method, the plastic matter melts and is forced into the mold; the matter is then cooled down to give a set solid shape. The process is useful for the automotive, consumer, electronics, and medical industries. It is very efficient with little waste generated, making it perfect for bulk manufacture. Injection moulding gives maximum freedom to engineers in the design of parts of fine detail and high-precision tolerances. Initial Mold costs are high but become cheaper on a per-unit basis through massive production. Injection moulding also supports nearly all thermoplastic and compound formulations, affording manufacturers the freedom to meet varying end-use requirements. New techniques in multi-component moulding and compounding of lightweight materials open newer avenues in their applications. The ability to fabricate high-strength, precision parts ensures that industries requiring functional as well as aesthetic consistency will keep it on demand.

Extrusion: The highest revenue share in the market was captured by the extrusion segment. The most major process in the plastics compounding market is extrusion; mainly due to advantages offered by this process. It is a continuous process by which molten plastic is forced through a die to yield long shapes of various kinds such as pipes, sheets, films, and profiles. The industry prefers extrusion in construction, automotive, packaging, and electrical fields. The major value offered to extrusion is its ability to produce high-volume, consistent products with comparative ease of manual labour. The extrusion process is very much compatible with the addition of any additive such as fillers, flame retardants, and stabilizers that are necessary for enhancing performance characteristics. These extruders provide better mixing and greater control over mixing characteristics resulting in a better dispersion of compounds in twin-screw extrusion. Also, the process can easily accommodate co-extrusion, in which two or more materials are extruded simultaneously to form a multilayered product. From an industrial viewpoint, recent progress toward automation, process monitoring, and energy efficiency has greatly improved its productivity. Its capability to handle recycled and bio-based polymers makes the extrusion process more interesting in a sustainability-defined market.

Blow Molding: A blowing process is a plastic compounding process for hollows and plastic nascent items like bottles, containers, tanks, and drums. It involves extruding or injection-moulding a molten compound onto the die, then inflating it with pressurized air against the walls of the die. It finds greater use in the packaging, automobile, and consumer industries. Blow moulding offers the best combination of lightness, strength, and durability along with cheap costs of manufacture. It is certainly the finest process in large-volume manufacturing of identical hollow items. The compounding supports a variety of materials such as polyethylene, polypropylene, and PVC, sometimes coupled with UV stabilizers or barrier additives. Depending upon the application and desired product properties, different types of moulding processes are used: extrusion blow moulding, injection blow moulding, and stretch blow moulding. The demand for eco-friendly solutions in packing and long-lasting containers instigates further innovation and growth in blow moulding within the compounding industry.

Melt Kneading: Melt kneading is an extremely important compounding process for engineering and special plastics. The mixing process applies mechanical shear forces to polymer materials at elevated temperatures until filler particles, fibres, stabilizers, and other types of additives are dispersed uniformly. Usually, melt kneading occurs in batch or continuous mixers, considered highly effective after degrading thermoplastic elastomers, engineering plastics, and composites. The term melt-kneading emphasizes one of the processing steps that will govern the material properties of strength, rigidity, and thermal stability to chemical resistance. It is more prevalent in situations where one must customize special performances, be it aerospace, electronics, or automotive components. It imparts excellent homogeneity, especially when the materials are of high viscosity or somewhat sensitive to heat. It may take less time to extrude and Mold injection materials end masse, but the craft and control that go into melt kneading make it an absolute must where elaborately functionally compound plastics are concerned.

Internal Mixing: Internal mixing is a batch mixing method applied just for rubber compounding and high-performance polymers. It makes use of internal mixers such as a Banbury or an Intermix to combine polymer and additives under specific pressure, temperature, and shear conditions. It causes a very intense mixing action to have the best dispersion and homogenization of fillers, plasticizers, pigments, or any other functional additive. Internal mixing finds applications when materials having very consistent quality need to be produced-with tire manufacture, industrial rubber goods, and certain engineering plastics being the chief areas. However, it can be more time-consuming and labour-intensive as compared to continuous mixing methods. Still, it can work with highly viscous materials and offer very precise formulations, thus an advantage. It offers pathways for a wide array of compound customizations, including the addition of heat-sensitive or reactive components. Because the mixing parameters can be closely monitored and controlled, there is no question as to the reproducibility and consistency of the material, making it essential for use under quality-compound environments.

Others: The others category in plastic compounding includes processes of various niche and emerging manufacture that are complementary to the main methods. This segment covers techniques such as calendaring, rotational moulding, compression moulding, and reactive extrusion. These processes serve niche markets to cater to unique material or design requirements. Calendaring, for instance, is used to make vinyl sheets and films with a very superior surface quality, while rotational moulding is used for large hollow products to be seamless and devoid of any welds, such as tanks and playground equipment. Compression moulding dominates thermoset plastics and composite materials wherein high strength, and uniformity are desired. Reactive extrusion could allow polymerization to occur in-situ during the compounding, useful for the synthesis of advanced materials. Despite enjoying smaller market shares, these methods are very important for the applications that main methods would otherwise not be able to handle. Their importance is ever increasing with more technological advancements and specialization-based demand for plastics from aerospace, healthcare, electronics, and renewable power industries.

Automotive & Transportation: The automotive & transportation segment accounted for the highest portion of the market's revenue. The automotive and transportation sector is main consumers of plastic compounds, owing to weight reduction, fuel efficiency, and enhanced performance. When it comes to these plastics, commonly compounded are polypropylene and polyamide, including ABS, for use on various exterior and interior components, under-the-hood areas, and safety components. These provide corrosion resistance, design versatility, and an option for low-cost manufacturing. With every shift to electric and hybrid vehicles, demand for specialty compounds for flame retardant and thermal management properties grows. As vehicle manufacture surges up globally, especially at the Asia-Pacific, the demand remains strong and continues to grow.

Building & Construction: The building and construction industry uses plastic compounds extensively for piping, insulation, roofing, cladding, and flooring applications, while PVC, polyethylene, and polypropylene are highly preferred for their durability and weather resistance and ease of installation. Plastic compounds would increase structural strength directly, keeping costs and construction time down. Urbanization and the growth of infrastructure projects in the emerging countries are said to have increased demand for this sector. Increased use of advanced plastic compounds for windows, doors, and thermal insulation has come into the picture with the push for green and energy-efficient buildings. Also, because of their capabilities, these plastic compounds remain indispensable in modern construction activities.

Electrical & Electronics: Plastic compounding provides enormous significance in an industry where insulators exhibit high qualities of flame retardance, stability at temperature, and resistance to impacts. Such plastics are preferred for various compounding applications like polycarbonate, polyamide, and high-performance thermoplastics used in connectors, circuit breakers, switchgear, and housings. Miniaturization of devices, in conjunction with the demand for smart electronics and electric components, is driving the growth of the compounded materials industry. Further expansion of the market is contributed to by 5G infrastructure, consumer electronics, and renewable energy systems. The segment evolves at a rapid pace and, in doing so, requires new formulations that comply with safety regulations as well as high standards of performance.

Packaging: Usually, the packaging industry is one large user of plastic compounds for packaging of food and beverages, such as drinks, pharmaceuticals, and consumer goods. These compounded materials enjoy barrier properties, flexibility, lightweighting, and aesthetic appeal. Polyethylene, polypropylene, and PET are used for both rigid and flexible packaging solutions. Increased inclination for sustainable packaging pushes the demand behind bio-and recyclable compounds. Rising e-commerce, groceries online, and home delivery services would enhance the use of plastic for protective and functional packaging types. In brief, the demand in this segment for cost-effective and high-quality materials hence places the compounding market in prime demand.

Others: Plastics find use in consumer goods, medical, textile, and agricultural industries. Medical-grade compounds find use in devices, tubing, and packaging since they were biocompatible and sterilizable. Agriculture uses UV-stabilized and weather-resistant materials for equipment components, films, and irrigation pipes. Commercial plastic compounds also find use in consumer goods, toys, furniture, and appliances where aesthetics and longevity buy. Demand for specialty and high-performance plastic compounds in the other industries will likely grow slowly as they further diversify their material needs and bring added product lines to the market.

The plastic compounding market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

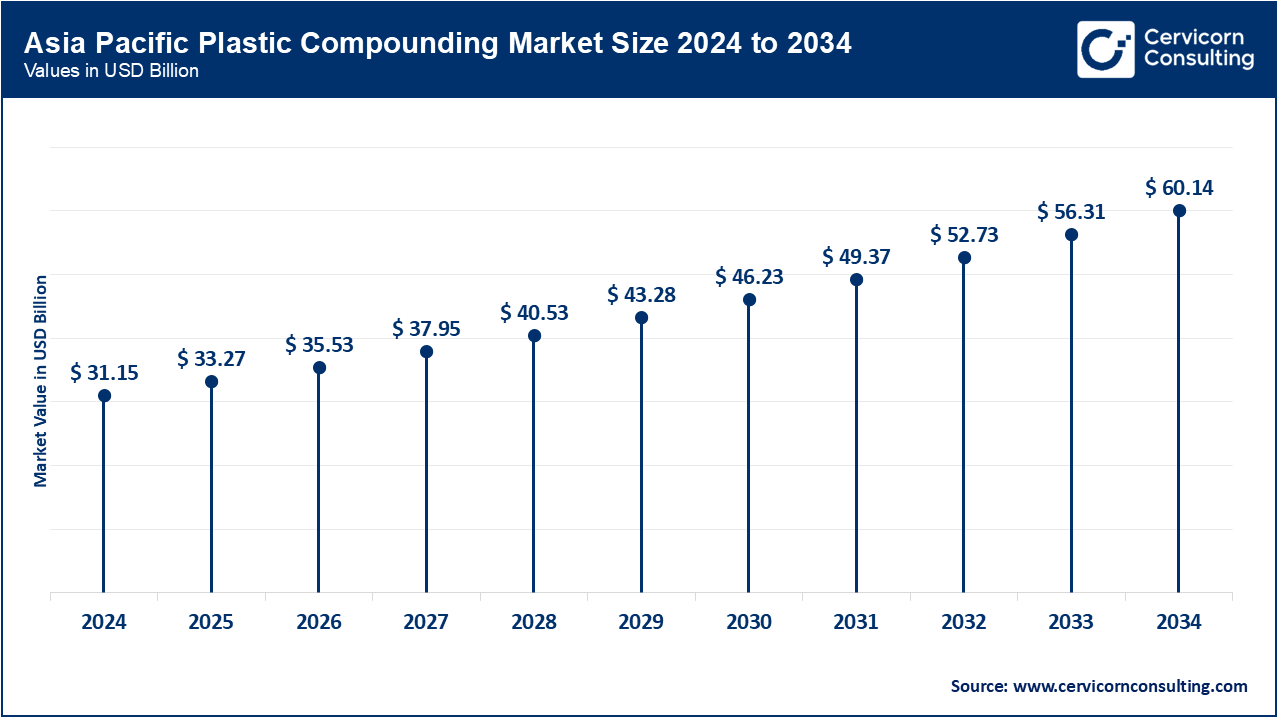

Rapid industrialization associated with an increase in economy and huge manufacturing bases in China, India, Japan, and Southeast Asian countries situate the Asia-Pacific region on a higher scale in the global market. It has cheap labour, adequate raw materials, and expanding domestic consumption in automotive, packaging, construction, and electronics industries. It is driving the demand on account of favourable government policies, increasing middle class, and export markets for sustainable and advanced polymer technologies. China follows India, with the former being the leading producer of automotive and infrastructure materials. An increase in demand has also encouraged further investments in the field of sustainable and advanced polymer technology, both for the application of domestic laws and international requirements.

North America region is mainly steered by the matured industries of automotive, aerospace, electronics, and healthcare sectors. Growth in the U.S. is led by advanced manufacturing capabilities, high R&D spending, and stringent environmental legislation that champion sustainable and high-performance plastic compounds. Another driver for the regional growth is the demand for lightweight materials in automotive and packaging sectors, and growth further is pushed by the incorporation of recycled and bio-based plastics. Canada and Mexico are also principal contributors to the market in the precincts of automotive and packaging industries. Though matured, there has been stable demand for engineered plastic compounds owing to innovations, circular economy initiatives, and infrastructure upgrading.

Europe has been placing an enormous share, because of the strong industrial and regulatory scheme there. Germany, France, and Italy hold strong as primary contributors by their advanced automotive, construction, and electrical industries. Europe leads the sustainability initiatives and development of circular economy practice, thus paving the way for recycled and bio-based plastic compounds. Strictly put in place by the European Union are environmental policies, thus demanding the use of halogen-free flame retardants, biodegradable plastics, and lightweight composites. High-level technology combined with the synergies created among global manufacturers ensures steady growth despite economic slowdowns and soaring energy prices.

Plastic Compounding Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 20.20% |

| Europe | 24.40% |

| Asia-Pacific | 46.90% |

| LAMEA | 8.50% |

LAMEA is an emerging market, and potential for development in automotive, construction, packaging, and consumer goods industries is ever growing. Latin America is witnessing moderate growth, headed by Brazil and Mexico, due to urbanization and infrastructure expansion. On the other hand, the Middle East, having ample petrochemical resources, supports the production of low-cost polymers and their subsequent exports. Africa is a gradual-progress situation because of industrialization along with demands for durable plastic products that are cheap. However, growth is somewhat restrained by political instability, economic problems, and lack of availability of large-scale manufacturing infrastructure. With LAMEA opening their trade relations and focusing on regional development, steady growth can be expected for the future.

Market Segmentation

By Source

By Polymer Type

By Additive Type

By Manufacturing Process

By End-Use Industry

By Region