Polyvinyl Chloride Market Size and Growth 2025 to 2034

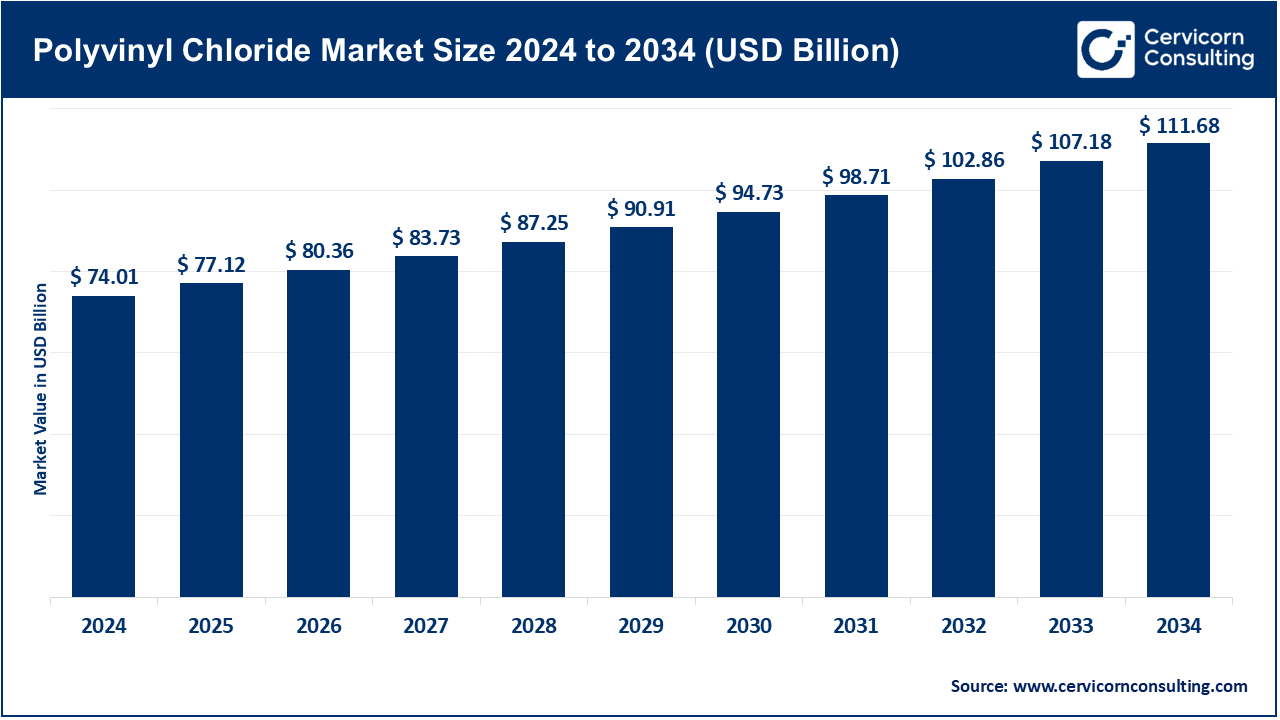

The global polyvinyl chloride market size was estimated at USD 74.01 billion in 2024 and is expected to be worth around USD 111.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.2% over the forecast period from 2025 to 2034.

The global polyvinyl chloride market talks about the production, distribution, and applications concerning this plastic polymer widely applied across various industries. PVC enjoys preference for its durability, chemical resistance, low cost, and versatility, which cost-benefit applications in construction materials, medical devices, automotive components, and consumer goods. Two basic forms exist: rigid and flexible; each type has different applications such as rigid PVC for piping, profiles, and flexible PVC for flooring, cables, and packaging.

Several primary factors are fuelling the growth of the PVC market globally. One prominent factor is the rapid urbanization and infrastructure development taking place across the world, notably within emergent countries. PVC is extremely common across pipes, window frames, doors, and sidings and thus, making it an indispensable material for construction and real estate sectors. The automotive and electrical industries have increased demand for the materials to be light yet strong. Being resistant to corrosion and good insulation properties, this PVC is in enhanced demand in the electrical cable industry. Furthermore, its biocompatibility and sterilization compatibility offered additional growth in the medical application for making IV bags, tubing, and blood containers. The growing trend of replacing traditional materials such as metals and wood with PVC for economic and ease-of-locking-of-maintenance purposes will further strengthen worldwide demand for it.

The focus for opportunities also lies in guiding the market towards tremendous growth via innovation in areas related to bio-based and recyclable PVC materials. Being the matter of utmost concern today, manufacturers are looking for eco-friendly alternatives and closed recycling systems to solve the present environmental issues. With Asia-Pacific and Africa witnessing tremendous opportunities due to the growth of the construction industry, PVC finds a huge demand for government infrastructure projects and population growth. Further penetration of PVC into smart cities, water management systems, and green building would carve out other application avenues. Furthermore, ongoing improvements in manufacturing technologies, including automation and precision compounding, could outweigh opportunities to enhance product quality and reduce production costs. All these factors signal that the global PVC market is on an upward trajectory, having the scope for innovation, regional expansion, and adaption to sustainable development trends.

Polyvinyl Chloride Market Report Highlights

- By Region, Asia-Pacific has accounted highest revenue share of around 50.9% in 2024.

- By Type, By 2024, rigid PVC (uPVC) about 42.80% revenue share. The Rigid PVC (uPVC) segment experiences dominance due to its wide-range applications in the construction, automotive, and packaging industries. uPVC, being highly strong, durable, and resistant to weathering and chemical hazards, finds the greatest use in the manufacturing of pipes, window frames, doors, and profiles. The development of infrastructure, especially in emerging countries, further adds to the demand for rigid PVC. Its ability to be recycled, which makes it cheap, ensures its more preference against metals and wood alternatives. All these factors together enable rigid PVC to be the leading segment bordering in global PVC markets.

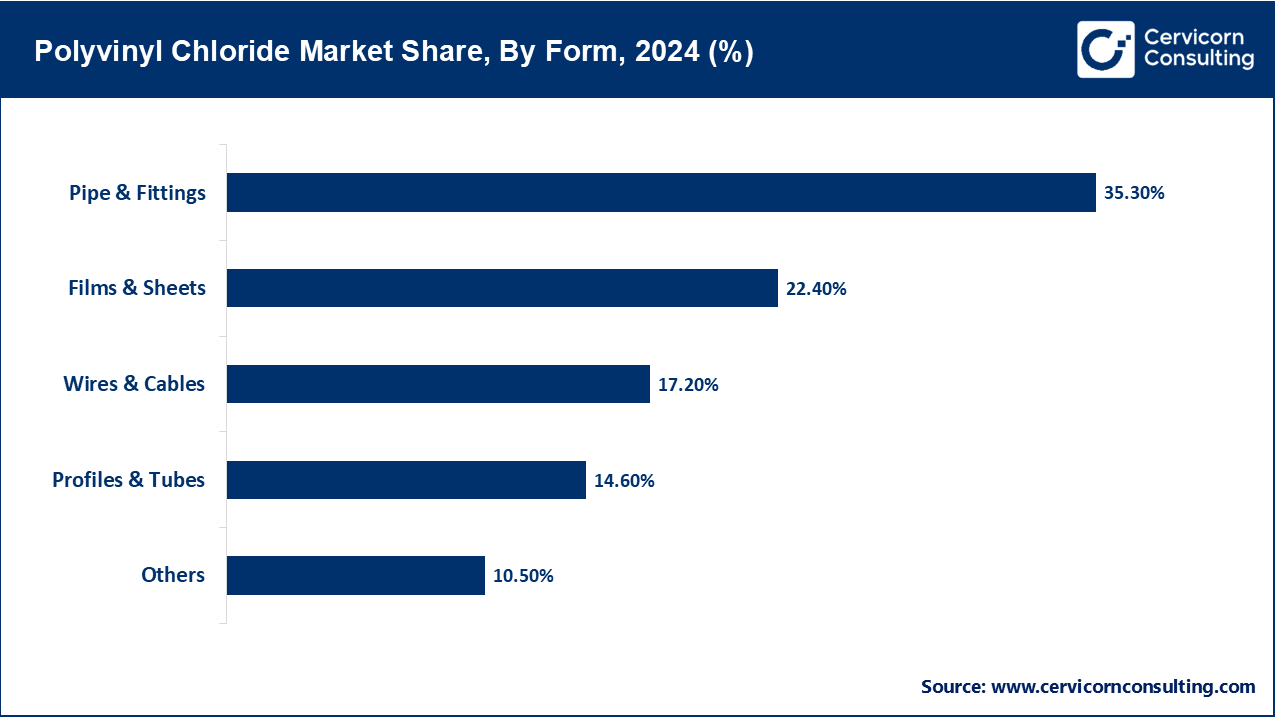

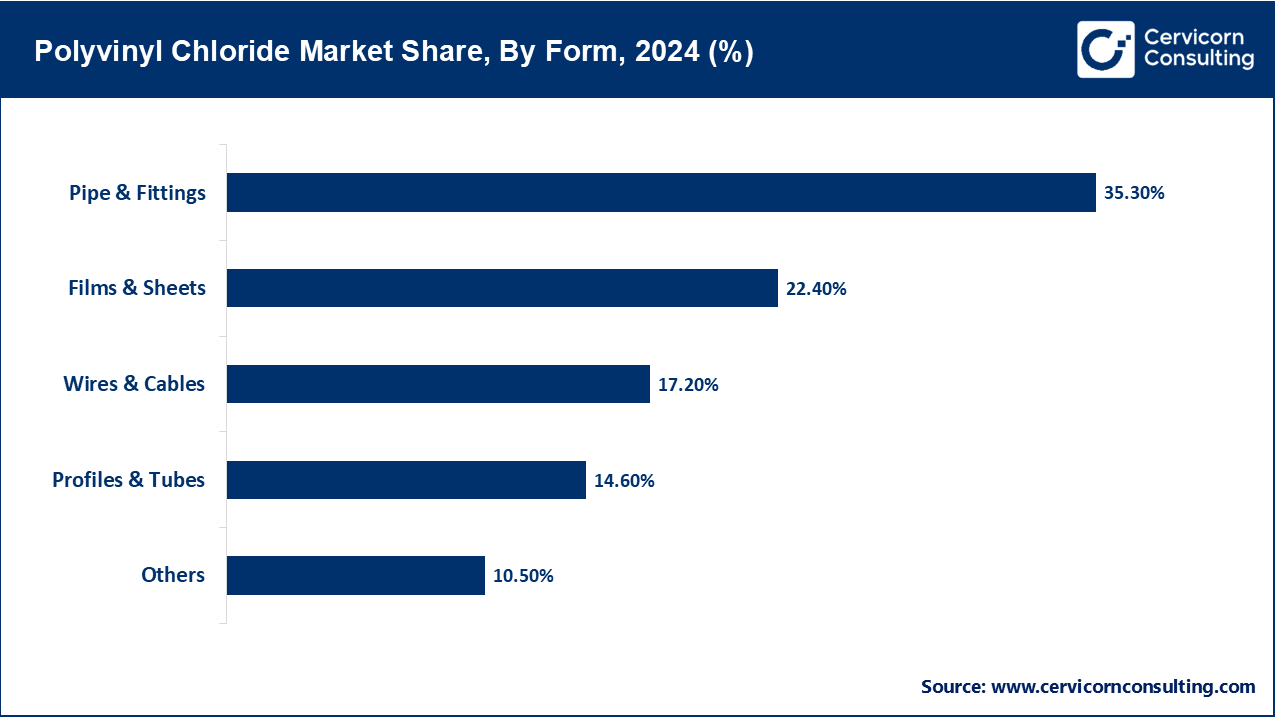

- By Form, the pipes and fittings brought an estimated 35.30% of the total revenue. Key for this domination are the superior properties of PVC, including corrosion resistance, economic price, lighter weight, and easy installation. Heavy uses of pipes and fittings are in the construction, water supply, sewage system, and irrigation sectors. Infrastructure development demand, especially from emerging economies, drives forth the growth of the segment. Also, longer life and less maintenance required for PVC than conventional substances, such as metal, increase pipe and fitting market share within the whole PVC market.

- By End-Use Industry, in 2024, the building & construction segment generated revenue amounting to 37.40%. It is largely because PVC is all-pervasive as it is used in pipes, fittings, profiles, windows, doors, and flooring-as-per its being of serviceable and durable nature, cheap, resistant to chemicals, and weathering-agent. Alongside these, the rapid urbanization and infrastructural development in emerging economies along with the demand for housing has greatly contributed toward building the demand for PVC in construction. With little maintenance and a long life, PVC is noted as an excellent material for contemporary construction in the west. The PVC building market today is still at the rise of green building trends and smart infrastructure.

Top Countries Dominating the Asia-Pacific PVC Market

| Countries |

Share, 2024 (%) |

| China |

58% |

| India |

18% |

| Japan |

10% |

| South Korea |

7% |

| Indonesia |

4% |

| Vietnam |

3% |

Polyvinyl Chloride Market Growth Factors

- Rising Demand from Construction and Infrastructure Sector: The construction sector is one of the major consumers of PVC, owing to its durability, low cost, and resistance to corrosion and chemicals. PVC is widely used in manufacture of pipes, window frames, flooring, roofing sheets, and insulated cables. Because of the universal thrust for urban development, a huge investment is flowing into infrastructure development in emerging economies such as India, China, Brazil, and various African countries with major thrust on housing, water supply, and sanitation projects. Besides this, there are further demands for PVC arising from government schemes advocating affordable housing and smart cities. The light weight and easy installation attributes of PVC make it suitable for the new age construction methods that focus more on efficiency and sustainability. As green building practices come into vogue, increasingly, recyclable and energy-efficient materials such as PVC are in demand. Hence, any growth in construction and infrastructure would inevitably fuel the PVC market globally.

- Expanding Applications in Automotive and Electrical Industries: PVC has become ever more valuable as industries due to its versatility and applications in automotive and electrical fields. In automobile manufacturing, it finds use in making dashboards, door panels, and wire insulation, as well as underbody coatings-from its virtues of strength, flexibility, and resistance to oil and chemicals. With the ever-growing demand for wire coatings that are durable and flame-retardant, the demand for PVC has increased on acceptance bases for electric vehicles (EVs) and hybrids. After all, in the electric industry, it acts as an insulator for electric wires, cables, and conduits, given that it has commendable insulation properties and is low cost. The global wave of electrification, which is being manifested through renewable energy projects and grid upgrades, is pushing the implementation of PVC-based products. On top of this, innovations that make flame-retardant and lead-free PVC compounds greener have further facilitated its application into many new areas. New applications in several high-growth industries together fuel the global PVC market.

- Growth in Packaging Industry: On huge packaging orders, major considerations are placed on PVC clarity, barrier properties, and ability to be moulded into just about any shape. Therefore, it finds common usage in blister packs for pharmaceutical medicines, shrink wrapping of bottles, and containers for food. Increasing demand for secure and tamper-evident packaging in the pharmaceutical industry, particularly after the COVID-19 pandemic, is yet another reason for excessive use of PVC. The ability of PVC to enhance the preservation of freshness and thereby increase shelf life for food and beverage packaging gives much impetus for its application. Moreover, the rising e] commerce and home-delivery activities are creating demand for flexible and secure packaging platforms that find PVC films and wraps as integral components. Innovations in bio-based PVC and recyclable alternatives to finally deal with environmental concerns maintain the material on the commercial front notwithstanding mounting sustainability legislations. Perhaps, thus the global packaging sector's quick expansion realizes for huge opportunities for PVC manufacturers.

- Increasing Use in Medical and Healthcare Products: PVC is utilized mostly in the medical industry in applications like IV bags, tubing, blood bags, catheter, and medical packaging. Its application is favoured in hospitals due to biocompatibility, transparency, chemical resistance, and ease of sterilization. With an improved environment for hospitals operating through Third World Countries, demand for disposable medical products, many of them made of PVC, is rising. The aging population and increasing incidences of chronic ailments have also generated more hospital admissions and demand for higher forms of medical care. Due to a sudden increase in demand for PPE kits, ventilator parts, and diagnostic equipment, the COVID-19 pandemic has equally provided a decent jump in consumption of PVC for medical uses. Coupled with the development of non-phthalate plasticizers and DEHP-free PVC formulations, the material continues to evolve safer for use in medicine, hence aligning with health and safety standards around the globe. Sustaining the medical field's dependence on PVC has furthered the strong expansion history exhibited by this market.

Polyvinyl Chloride Market Trends

- Growing Demand for PVC in Sustainable Building Materials: The PVC material is gaining application in green construction for three reasons. These include durability for a long time, low maintenance, and energy efficiency. Since green building rating systems such as LEED and BREEAM are increasingly being recognized worldwide, architects and builders are also increasingly using various PVC building products, such as windows, pipes, roof membranes, and flooring, that combine for long-term environmental stewardship. Polyvinyl chloride (or PVC) products resist corrosion and weathering by moisture or chemicals, making them appropriate for infrastructure installation where life and durability are paramount. Being lightweight, PVC-based products locally reduce the energy cost and emission of transportation. Manufacturers are also working on alternate formulations with a better environmental profile such as low-VOC PVC products. The rise of this trend is presumed to be further hastened given the fast-growing global regulations around sustainable construction and environmentally conscious consumers. The ever-increasing construction activities in emerging economies have given a further fillip to the demand, positioning PVC-dependent construction as one of the front-runners in green and efficient constructions soon.

- Increased Use of Recycled PVC in Manufacturing: In this global movement toward a circular economy, many industries have come to use recycled PVC materials. Growing environmental awareness along with the worry that plastic waste needs to be monitored have placed recycled PVC products squarely into generation from mainly post-consumer and post-industrial recycled sources. Uses of recycled PVC include flooring, cables, pipes, and profiles that require no trade-off in performance. Due to continuing development in mechanical and chemical recycling technologies, PVC recycling is increasingly feasible with consistent specifications of quality and safety. The use of recycled PVC allows diversion from virgin fossil-based materials and the reduction of carbon footprints in this regard. Particularly in Europe, Vinyl Plus has enabled promotion of PVC recycling, placing the continent ahead in this trend. Moreover, companies increasingly use recycled content as a competitive edge with consumers and stakeholders demanding sustainable products. The trend supports environmental objectives while enabling manufacturing processes to be less costly.

- Technological Advancements in Bio-Based PVC Production: innovations in bio-PVC production stand as mainstream trends: fuelled by the need to lessen dependence on fossil fuels, with an emphasis on setting greener plastics alternatives. Bio-based PVC means to treat the renewable feedstocks such as sugarcane or corn, weathering the petrochemical feedstocks such as ethylene used in conventional synthesis. These alternatives may aid during the production process in diminishing the effects of greenhouse gas emissions while keeping the same performance characteristics of usual PVC. Efforts are on to maximize the production scale of bio-PVC and to reduce costs through R&D. A further step towards increasing sustainability is through the incorporating of bio-based plasticizers into the final product. Hence, sustainability is witnessing paramount importance in packaging, medical devices, and consumer goods industries where it acts as a tool for conscious customer branding and conscious compliance. While still in its infancy, the bio-based PVC market is predicted to grow at a fast pace as supply chains go green and customer demand for low-impact materials increases.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 77.12 Billion |

| Expected Market Size in 2034 |

USD 111.68 Billion |

| Projected CAGR 2025 to 2034 |

4.2% |

| Dominant Region |

Asia-Pacific |

| Key Segments |

Type, Form, End Use, Region |

| Key Companies |

Hanwha Group, Ineos, Ercros, Occidental Petroleum Corporation, Orbia, Formosa Plastics Corporation, KEM ONE, Shin-Etsu Chemical Co., Ltd., Vynova, Westlake Corporation, Others |

Polyvinyl Chloride Market Dynamics

Market Drivers

- Expansion of Water Supply and Irrigation Projects: Large-scale water-hostel irrigation infrastructure construction stimulates PVC pipe and fitting demand, more so in developing countries. PVC is mainly preferred for water systems as it resists corrosion, costs less, lasts long, and is easy to install. High investments in water management systems for treating potable water and sanitation requirements are coming from government-rich countries in Asia, Africa, and Latin America. At the same time, agricultural modernization projects validate the use of PVC pipes in irrigation to boost farm production and water conservation. Unlike traditional materials, for instance, metal or concrete, PVC is more efficient and more long-lasting, which benefits sustainability. Ever-increasing demand for better water transportation and storage systems coupled with infrastructure development works all over the world continue to fuel growth in demand for PVC in this segment.

- Rising Urbanization and Industrialization in Emerging Economies: Polyvinyl Chloride is witnessing increased demand in various end-use industries as rapid urbanization and industrialization take place, chiefly in developing economies like India, China, Brazil, and Southeast Asian countries. With the cities expanding and populations increasing, the demand for infrastructure about edifices, transport systems, sanitation, and utilities is altogether growing higher. Since PVC forms an integral part of construction works-casting pipes, wiring cables, windows, doors, flooring, insulation, etc., it holds great potential in development. Also, with increased manufacturing activities and industrial growth needing strong yet economically feasible packaging, containment, and safety materials, PVC is paving its way as the solution. Age is also in Favor of these fast-growing markets, with PVC being inexpensive, chemically resistant, and needing hardly any maintenance. Government incentives directed toward industrial infrastructure and housing will also galvanize a continuous demand for PVC, making it an essential input for the modernization-urbanization drive in developing nations.

- Growing Use of PVC in Medical Devices and Packaging: Due to its high elasticity, PVC is considered suitable for many medical applications. The PVC package is recognized for its good biocompatibility and transparency. Increasing orders are being put by the healthcare sectors for a wide array of medical devices and packaging solutions. They find extensive use in hospitals for various medical purposes, the structure comprises blood bags, IV containers, tubing, catheters, oxygen masks, etc. Its usefulness in the medical field lies in it offering strength and transparency while being chemically resistant and comes handy as it is sterilizable. Disposable medical products of this nature have been witnessing a surge in demand on the global front, especially after the COVID-19 pandemic, which brought expanding healthcare awareness and infrastructure along with it. On the other hand, the pharmaceutical and food industries also make use of PVC films and sheets for blister packaging and flexible wrapping, respectively, owing to their barrier properties and cost-effectiveness. Since healthcare expenditure is continuously rising across the globe, the healthcare system gradually depends on single-use, hygienic products; hence, PVC as a reliable and scalable material finds even greater importance in the medical and packaging industry.

Market Restraints

- Environmental and Health Concerns Related to PVC Production: The manufacture of PVC involves chlorination and the use of hazardous chemicals such as vinyl chloride monomer (VCM), which is listed as a carcinogen. The manufacturing activities involving PVC are known to pollute dioxins into the atmosphere—highly toxic pollutants posing long-term environmental and health hazards. These emissions leave the air, soil, and water contaminated, threatening the workers and communities around. Incineration or disposal of PVC products in an inappropriate manner may generate harmful by-products that are hazardous to the environment. All these concerns have drawn attention from governments, NGOs, and policymakers alike. Therefore, there is now higher pressure on PVC manufacturers to stay clean or enter possible bans and the glare of public attention. These environmental threats became hurdles for PVC development, especially in developed regions where sustainability legislation is in place, hence some users opting for other more eco-friendly materials.

- Volatility in Raw Material Prices (Especially Crude Oil and Ethylene): PVC is a petrochemical plastic and is therefore dependent on raw materials such as crude oil and ethylene. As a result, any fluctuation in crude oil prices will directly affect the cost structure of PVC manufacturing. Oil prices will increase if the so-called geopolitical tensions arise among oil-exporting countries or divert attention to production or supply-chain disruptions worldwide, thus making PVC costly to produce. Ethylene priced in an up and down manner with respect to feedstock availability while considering refining capacity is another factor for such uncertainty. This kind of an unpredictable environment holds financial hazards for PVC producers and their downstream users as neither can effectively forecast their costs or manage their budgets. Where prices go up for raw material inputs, profit margins for product manufacturers can shrink, inhibiting competitiveness from creating any incentive for increasing investments into PVC capacity expansion. On the other hand, industries that consume PVC in a price-sensitive manner may tend to look for alternatives going for price stability in construction and packaging. Such resources with alternative applications during price instability will deprive PVC of an altogether bigger market distort.

- Stringent Regulatory Restrictions on Plastic Usage and Waste Disposal: Trying to reduce plastic pollution, all countries impose strong legislation, PVC being of great concern as non-biodegradable and difficult to recycle. As such, the pressure from regulations is seen mounting across Europe under REACH and in the United States. PA regulations, and various national bans on single-use plastics such as in India. These restrictions often limit PVC uses in packaging, construction, and consumer products, coupled with provisions on waste management and recycling targets. These rules set upon manufacturers the options of a costly compliance course or redesigning the product to suit the given standards. Moreover, issues faced with PVC disposal, such as the generation of toxins when the polymer degrades or is incinerated, draw greater attention from regulators. Such restrictions limit the uses of PVC, slow down product approvals, and hamper market growth through outright bans in sensitive areas such as health care and food packaging.

Market Opportunities

- Increased Infrastructure Development in Asia and Africa: As fast urbanization and industrialization in the two continents of Asia and Africa continue, there lies huge potential for the PVC market to grow. Developing countries are focusing on infrastructure development to include water supply systems, sewage networks, residential buildings, and transport since PVC can be versatile in applications. It is used in pipes, window frames, and roofing based on its resistance toward corrosion, durability, and cost-effectiveness. Besides, affordable housing projects and smart city projects provide long-term avenues for growth. As infrastructure quality improves in these regions, the usage of PVC-based products will significantly increase, marking these markets as vital growth zones for global manufacturers.

- Technological Advancements in PVC Processing and Additives: Processing technologies are being innovated while additives are being developed to widen the scope of applications for PVC. Industry experts now put their focus on developing new and improved formulations with enhanced thermal stability, flexibility, and environmental performance to better accommodate increasingly stringent regulatory and consumer standards to put PVC on a true competitive footing. Innovations such as nanotech-enhanced PVC, lead-free stabilizers, and other alternatives to plasticizers have been providing diversification in its applications throughout the automotive, construction, consumer goods, etc. Besides advanced manufacturing processes such as 3D printing and extrusion, which also enhance customization of products with minimum waste of material, make PVC competitive. Besides upgrading the quality and performance of the products, these innovations also allow manufacturers entry into a narrow, high-value market. As industries increasingly demand smart and efficient materials, advanced PVC solutions will meet both design and functional application needs, leaving a lucrative opportunity open for manufacturers investing in R&D and proprietary technologies.

- Increasing Use of PVC in 3D Printing and Additive Manufacturing: The increasing use of 3D printing and additive manufacturing technologies provides a good opportunity for the market. It is seen mostly in windows, doors, binders, and flooring lines for buildings; now, manufacturers are looking into using PVC as an inexpensive and durable lightweight thermoplastic-engineered for 3D printing. These qualities have empowered PVC to impart mechanical strength as well as flame resistance and chemical inertness, thus making it a suitable candidate for construction, automotive, or healthcare industries whenever needed for prototyping or end-use parts. Ulterior developments in printer technology and material formulation posited better PVC processing so as to overcome difficulties posed by that high melting point and chlorine emission upon heating. Then, recycled PVC is headed for adaptation in 3D printing, also aligning with global sustainability efforts. Growing industries using 3D printing for fast and tailor-made production will thus find demand for new forms of PVC filament and powders, which will proficiently create a whole new income stream for PVC manufacturers.

Market Challenges

- Competition from Alternative Eco-Friendly Materials: With increase in environmental consciousness, the PVC market is facing huge competition from products considered environmentally friendly. There being emphasis on sustainability across industries, manufacturers are slowly turning to the use of bioplastics, recycled polymers, and alternatives such as polyethylene or polypropylene. These alternatives claim their right to compete with PVC about performance attributes but have less environmental concerns with respect to PVC, especially those attributed to chlorine content and possible dioxin emissions during incineration. Simultaneously, public perception and regulatory threats are pushing industries like packaging, construction, and automotive towards green solutions. These can be observed in the trend of Europe's and North America's regulations and consumption favouring low-impact materials. Finally, with the upsurge in the preference for the circular economy, biodegradable and recyclable materials would only serve to enhance this challenge to PVC's demand and its market share-growing further in the long run if the industry-side fails to present sustainable PVC alternatives or improve its own recycling infrastructure.

- Limited Recycling Infrastructure for PVC Waste: One hurdle facing the PVC industry is the lack of sufficient infrastructure worldwide with recycling facilities for PVC waste. Unlike other thermoplastics, PVC has several additives and stabilizers that present hindrance in the straightforward reprocessing and recycling of PVC. In many cases, mechanical recycling will usually lower the quality of the material, whereas chemical recycling remains prohibitively expensive and under-developed. Most countries simply do not possess the appropriate processing plants to safely handle the PVC waste, hence having a high chance of waste would be sent for incineration or landfilling. This greatly leads to pollution of the environment and questions the industry on its sustainability claim. As more stringent measures are placed by the various governments on managing waste, the absence of viable recycling schemes contributes to risk and concern for PVC producers and users. Also, the lack of closed-loop schemes discourages investment by industries into PVC products, pushing them to invest into products made from materials that are easy to recycle. Enhancements to recycling technologies and infrastructure will thus be one of the major ways to ensure that the PVC market sustains itself."

- Volatility in Global Supply Chains and Trade Restrictions: The PVC market faces new fragilities as global supply chains suffer a hit from political clashes, trade disputes, and logistics bottlenecks. PVC production requires an ample number of raw materials, mostly ethylene and chlorine, which are imported. Any disruption in the availability and price of these raw materials would stem from natural calamities, bona fide export bans, or energy crises and would adversely affect production capacity and profitability. Trade restrictions like tariffs or sanctions or sometimes environmental regulations might restrain the free flow of goods, hence causing an imbalanced situation concerning supply and demand in some regions. The whole situation was exacerbated during the COVID-19 pandemic; shutdowns and transport delays engendered serious price volatility and delivery lags in many different markets. Such issues have been aggravated further by an upsurge in protectionist policies within major economies, compelling manufacturers, and suppliers to diversify supply chains or localize operations. Therefore, the uncertainty, in turn, works against strategic planning while increasing the operational risks borne by the market players across the globe in the PVC industry.

Polyvinyl Chloride Market Segmental Analysis

Type Analysis

Rigid PVC (uPVC): The rigid PVC segment has held leading position in the market. This rigid PVC, also called unplasticized PVC or uPVC, is very durable and stiff—with a wide application in construction and infrastructure-related works. It resists chemicals, weather, and UV rays. Hence, applications such as pipes, window frames, doors, and profiles would always lean heavily on uPVC. Unlike the flexible one, it does not incorporate plasticizers and possesses greater rigidity and environmental resistance. Long in-use duration and almost negligible maintenance needs place it well with the architectural community for use in homes and commercial buildings. Being flame resistant and moisture resistant, rigid PVC finds utilization for cladding and cable insulation and an industrial equipment. Recycling possibilities of the material are a further plus for its eventual use in green buildings. Rise in construction activity all over the world, especially in emerging economies, is a good sign for the buoyant demand for uPVC.

Polyvinyl Chloride Market Revenue Share, By Type, 2024 (%)

| Type |

Revenue Share, 2024 (%) |

| Rigid PVC (uPVC) |

42.80% |

| Flexible PVC |

36.30% |

| Others |

20.90% |

Flexible PVC: Flexible PVC is prepared by the addition of plasticizers, such as phthalates, which soften the rigid polymer and allow for greater flexibility and elasticity. This flexible PVC finds its greatest use in applications where could be bending and movements, such as electrical cable insulation, medical tubing, inflatable products, and automotive interiors. This adaptability, ease of processing, and cost-effectiveness become a crucial competitor in materials especially in consumer goods and industrial applications. Nonetheless, safety concerns of environmental and health impacts of some plasticizers have aroused considerable regulatory quality and call for non-phthalate alternatives. Despite these challenges, technological developments in bio-based and safer plasticizers are sustaining the demand. It provides excellent resistance to water, chemicals, and abrasion and thus, also strengthens its importance in the sectors where both durability and flexibility are required, in the packaging, footwear, and textile industries alike.

Low-smoke PVC: Low-smoke PVC is a special type of PVC designed to keep smoke and toxic gas release to a minimum during combustion. Being low in halogens and containing flame-retardant additives, it is used in those areas where fire safety imposes utmost consideration about being confined or heavily populated. In emergencies, such PVC increases visibility and reduces health risks. The promulgation and enforcement of multiple regulatory frameworks, which gave fire safety utmost emphasis in construction and infrastructure, therefore ultimately led to widespread adoption of low-smoke PVC across geographies. Low-smoke PVC also retains most of the core properties of regular PVC, such as durability, corrosion resistance, and processability. With an increasing consciousness of fire hazards and environmental impact, a growth in demand for low-smoke halogen-free alternatives can be witnessed. This demand is thus pressuring manufacturers to engage in R&D and realize sustainable and safer flame-retardant solutions based on low-smoke PVC formulations.

Chlorinated PVC (C-PVC): Being produced by chlorinating standard PVC resin, chlorinated PVC increases its chlorine content and greatly improves its heat and chemical resistances. It is used largely for hot and cold-water pipes and fire sprinkler systems as well as for chemical handling applications where temperatures and corrosive substances are higher. It offers higher mechanical strength, better thermal stability, and superior flame resistance than regular PVC, thus being fit for both plumbing systems industrially and residentially. Increased demand for efficient, durable piping systems in the construction and chemical industries is, in fact, driving the adoption of C-PVC. Moreover, since it can also withstand a higher range of pressures and temperatures, it turns to be a cheaper alternative to metal pipes. Easy to install, long life, and low maintenance requirements are further contributing an advantage to C-PVC's enlarging market share worldwide, especially in regions which struggle to keep up with rapid urbanization and infrastructure development.

Form Analysis

Pipe & Fittings: This segment stands as the dominant form segment in the PVC market, comprising construction, plumbing, water distribution, sewage, and irrigation systems. The rigid PVC properties that make it suitable to be used as pipes and fittings are great durability and corrosion resistance, coupled with affordability and ease of installation. This material finds applications in both pressure and non-pressure industrial uses for potable water supply and drainage systems. The increase in urbanization, infrastructure development, and agricultural modernization all fuels the demand for PVC piping systems across the globe. Innovations like molecular-oriented PVC (PVC-O) are further strengthening and lengthening the life of these systems. Additionally, the replacement of the old and rusting cast and ductile iron pipes with corrosion-resistant PVC pipes in developed countries further boosts this segment. Favourable regulations for lead-free pipes and increased smart city projects are other factors contributing to the growth of the market.

Films & Sheets: PVC films and sheets are considered flexible or semi-rigid and are used mainly for packaging, signage, medical, construction, and automotive applications. These qualities include excellent clarity, chemical resistance, and ease of thermoforming for blister packaging, food wraps, and shrink films. Rigid PVC sheets find application in wall cladding and roofing membranes. In the medical field, PVC films are used for manufacturing IV bags, blood bags, and pharmaceutical blister packs that require hygiene and sterilizability. Growth in the packaging and healthcare sector, particularly in emerging economies, accelerate demand. Also, the sustainability trend will foster manufacturers in producing recyclable and bio-based PVC films.

Wires & Cables: In the insulation and sheathing of cables, PVC proves to be major application. It is flame-retardant and flexible, resistant to chemicals, and cheap, so it is applied to insulation for electrical wiring in household, commercial, and industrial sectors. It includes applications of power, telecommunication, and automotive wiring. However, the growth in renewable energy installations, electric vehicles, and infrastructure modernization has been giving impetus to the demand for PVC-insulated cables. Besides installation growth, engineering developments in the formulations of fire-retardant PVC have been able to satisfy stricter safety codes in the construction and transportation sectors. Also, in respect of outdoor and underground cable applications, it must resist environmental stressors like moisture and sunlight.

Profiles & Tubes: PVC profiles and tubes are used extensively for window and door frames, curtain rails, cable trunking, and furniture edging. The segment is enriched by PVC's good structural strength, low thermal conductivity, and resistance against moisture and termite attacks. In buildings, uPVC profiles are preferred for energy-efficient and weather-resistant window systems. PVC pipes find application in air conditioning, chemical transportation, and medical devices. Demand in facilities for residential and commercial building applications is high. It is through green building trends and growing DIY home improvement projects that demand for lightweight and customizable PVC profiles and tubes is increasing across the globe.

Others: It basically captures a whole array of specialized PVC applications that include PVC-coated fabric, inflatable structures, toys, footwear soles, medical tubes, credit cards, and consumer items. These niche applications make use of the flexible nature, durability, and economy of PVC. One prominent building uses of PVC plus PU synthetic leather in fashion upholstery, flooring, and wall coverings. It is also used industrially in conveyors and tank linings. Since it responds well to different additives that allow manufacturers to produce materials with specific levels of flexibility, colour, texture, and resistance properties, the industry is very dynamic. As the manufacturing industries become diversified and are always evolving, there is continuous evolution in the others segment too as it sees applications in 3D printing, smart textiles, and biodegradable PVC blends.

End-Use Industry Analysis

Building & Construction: The building & construction segment stands as the dominant in the PVC market. Great builders use the sector to consume PVC in large quantities, further asserting PVC's qualities of durability, weathering capability, and cheapness. It can be found in pipes and fittings, window profiles, and doors. With rigid PVC (uPVC) offering the necessary strength and fire resistance needed in structural works-Less corrosion and deterioration are guaranteed in plumbing and drainage systems-from chemicals and moisture, respectively. Development in residential and commercial infrastructures in emerging economies hence gives rise to the flood of energy-efficient PVC materials and solutions for green building. Consequently, being lightweight and easy to install act as a great driver for PVC in prefabricated construction.

Automotive: PVC finds huge applications in the automotive business for interior and exterior considerations. It is valued for its flexibility and interesting aesthetics together with good cost performance: dashboards, door panels, underbody coatings, wiring insulation, floor mats are just some of the numerous applications of PVC. Flexible PVC is great at minimizing vibration to enhance the passengers' comfort. It also meets stricter regulatory requirements for fire resistance and mechanical durability. PVC is also employed for lightweight components, promoting fuel efficiency by enabling an overall reduction in vehicle weight. An increase in demand for flame-retardant, special performance materials like PVC is going together with the production of electric vehicles (EVs). Additionally, the packaging aligns itself with automotive sustainability goals, further encouraging its popularity.

Electrical & Electronics: PVC conversely has a balanced, multifaceted application profile with its major specifications that include the electrical and electronics field for insulation of wires, cables, or connectors. It has good dielectric strength, being flame retardant, and it can resist chemical attacks and moisture, thus making it suitable for electrical insulation. Besides, it gives flexibility and discretion to the installers, ensuring that it will provide good service even under harsh environmental conditions. PVC compounds and formulations can be adjusted for a specified voltage or temperature range, thus making them suitable for use in consumer electronics, industrial machinery, and power distribution systems. In this section, demand for PVC continues to increase with respect to investments being made in telecommunications and electrification, particularly in developing areas. On the other hand, the introduction of smart gadgets for energy saving and energy-efficient home appliances requires materials that can be relied upon and certified to be safe.

Healthcare: PVC is of medical importance in the making of IV bags, tubing, blood bags, catheters, etc., because of its biocompatibility, clarity, and sterility. Flexible PVC allows the safe transfer of fluids, while rigid PVC is used to make containers and several components for diagnostic equipment. It can be easily sterilized through a variety of processes including gamma radiation and ethylene oxide gas. PVC remains a mainstay in disposable and reusable medical items owing to its cost-effectiveness and ready availability. In tandem with phthalate-free PVC developments, which allay safety concerns, there is an increase in applications of this medical-grade material in sensitive applications such as neonatal and dialysis care. The growth of global healthcare infrastructure and increasing demand for single-use medical supplies will further drive the growth.

Packaging: In general, PVC finds its application in rigid and flexible packaging because of its characteristics of clarity, barrier properties, and sealing properties. In blister packs, clamshell containers, shrink wraps, and labels are some of the packaging applications it finds. In pharma packaging, it is used for the safe packaging of tablets and capsules. In food packaging, it helps in enhancing shelf-life by protecting its contents against oxygen and moisture. Rigid PVC helps in giving strength and tamper resistance, while the flexible one is used in wraps and films. It is considered one of the most versatile materials since it can be moulded into almost any shape commonly needed in consumer and industrial products. PVC becomes more essential with rising consumer demands for hygienic and tamper-proof packaging, especially after the COVID crisis. Relevant to sustainability concerns is the innovation of recyclable and bio-based PVC packaging.

Consumer Goods: It is used in various consumer products such as furniture, footwear, toys, stationery, sports gear, and even home décor products. Lightweight, durable, waterproof, and inexpensive are the attributes of PVC that accord it precedence among materials used for mass-produced articles. In footwear, for instance, flexible PVC is used in manufacturing soles and sandals. In furniture, it is used in faux leather upholstery and wall coverings. That moldability and the safety features of PVC make it attractive for toys and household tools. Customized colours, finishes, and appearances further increase consumer interest. Also, the prevailing trend for affordable and durable home-related products in emerging markets will continue to lift the growth of the segment. Recent developments of non-toxic PVC formulations will go a long way in easing safety and environmental concerns in consumer use.

Others: Industrial applications, agriculture, signage, and marine constitute the other segment. Some agricultural uses include irrigation pipes, greenhouse films, and water storage systems, where PVC is preferred for its resistance to chemicals and UV. The rigid PVC sheets are used in the signage and advertising industry for their longevity and ability to accept print. Because of its ability to resist salt water and corrosion, marine applications grade PVC is used in the manufacturing of boat fittings and flotation devices. Industrial uses include its application for factory flooring, wall cladding, and chemical handling systems. Inability to develop in terrible and varied environments is due to the adaptability and service life. As emerging applications such as back sheets for solar panels and composite materials develop, this segment will develop with new things.

Polyvinyl Chloride Market Regional Analysis

The PVC market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

Why does North America hold a significant share in the polyvinyl chloride market?

- The North America polyvinyl chloride market size was valued at USD 18.35 billion in 2024 and is expected to reach around USD 27.70 billion by 2034.

North America holds a significant share in the global PVC market on account of demand from matured construction and renovation industries in the USA and Canada. Due to its durability, water resistance, and cost-effectiveness, the region highly utilizes PVC in construction materials such as pipes, siding, and flooring. Moreover, the demand gets further enhanced with a growing focus on modernizing infrastructure and water management systems. Healthcare is another industrial sector that is of importance as PVC finds wide application in medical devices and packaging. Strict environmental regulations have brought with them innovations in sustainable PVC formulations and recycling initiatives. Hence, the regional market landscape also gets shaped by technological advancements in bio-attributed and non-phthalates plasticizers. Relative to emerging markets, growth is moderate, but region still holds importance because of applications towards high-value products and industrial standards.

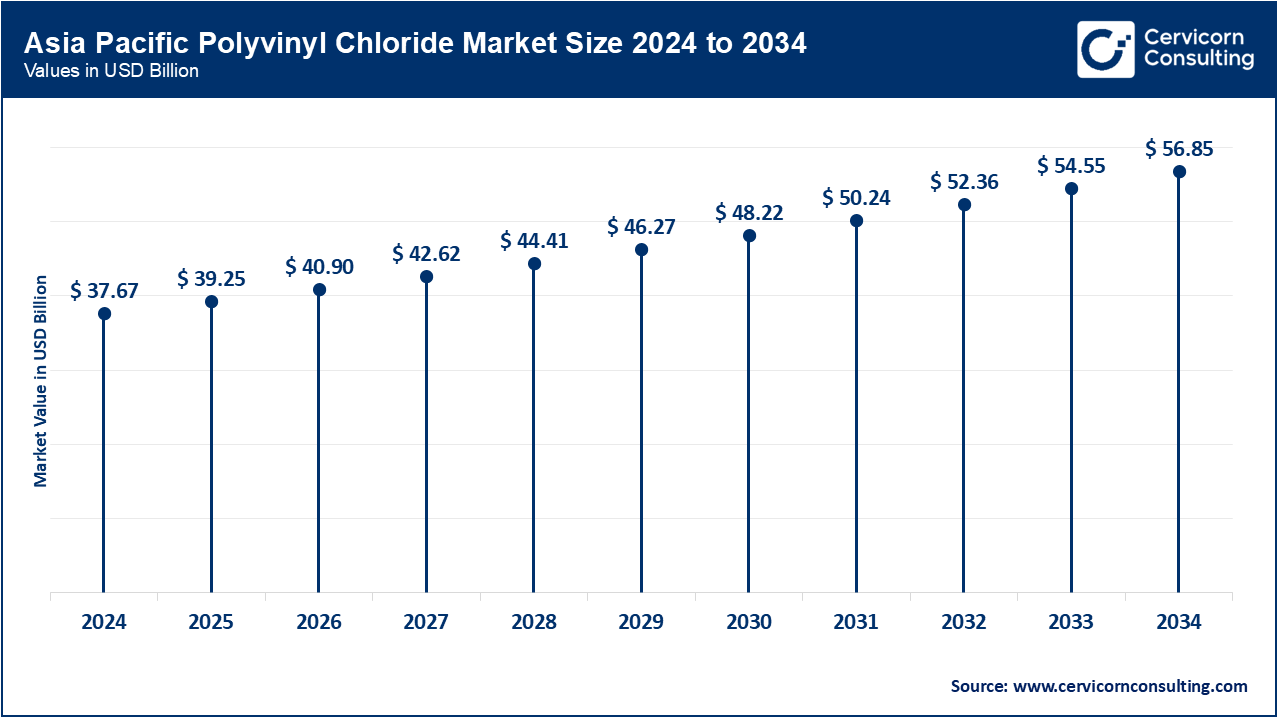

Why does Asia Pacific dominate the polyvinyl chloride market?

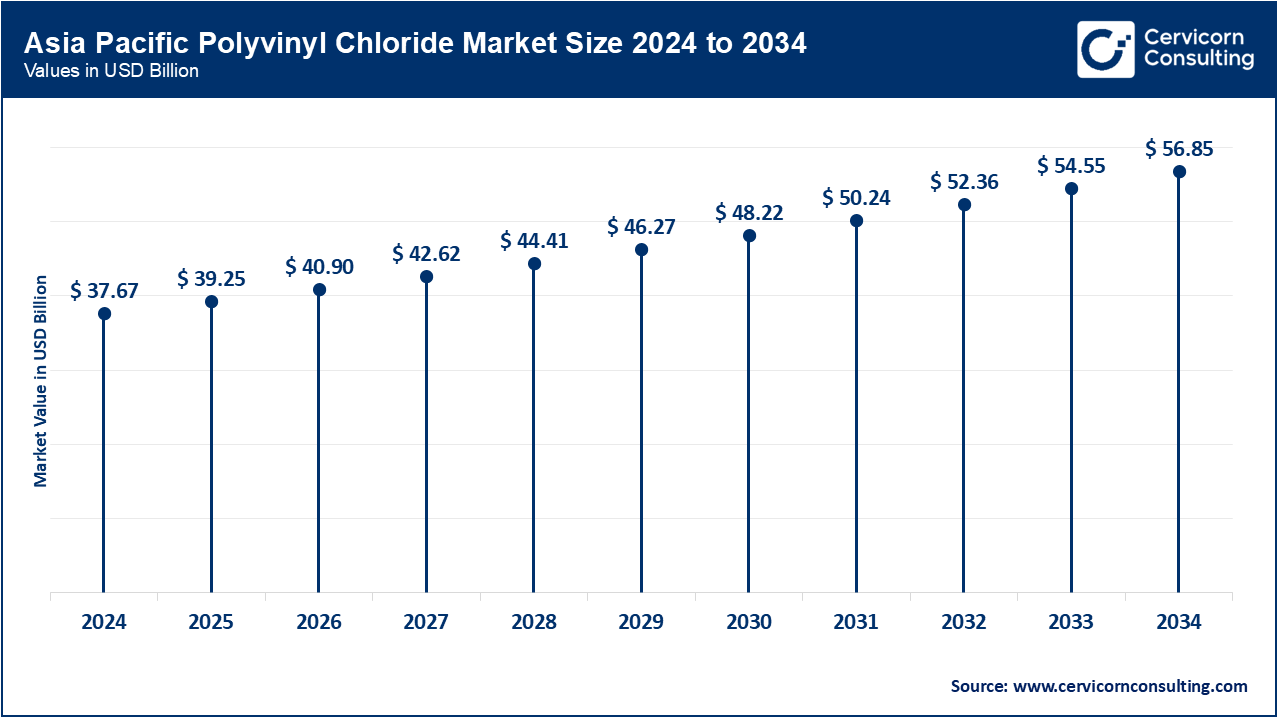

- The Asia-Pacific polyvinyl chloride market size was reached at USD 37.67 billion in 2024 and is forecasted to surpass around USD 56.85 billion by 2034.

The Asia Pacific dominates the global PVC market, with solid demand from major end-use areas like building & construction, automotive, packaging, and electrical & electronics. China, India, Japan, and South Korea are the prominent supply regions. Considerable weightage is given to China for the construction and infrastructure projects being huge, and due to rapid urbanization and government investments in smart cities. India also witnesses healthy growth with rising demand for affordable housing and water supply systems through PVC pipes, along with the growth of the automobile sector. Besides, many PVC producers in the region and cheap production along with promotion through trade policies contribute to enhancing the regional production capacities. Because of sustainability concerns, along with recycling technologies, market dynamics are further enhanced. Backed by fast industrial growth, the region has an enormous population along with demand for urban infrastructure, thereby making the Asia Pacific region the largest influencer in the global PVC landscape.

What are the growth factors of the Europe polyvinyl chloride market?

- The Europe polyvinyl chloride market size was estimated at USD 14.21 billion in 2024 and is expected to hit around USD 21.44 billion by 2034.

The Europe is characterized by strict environmental regulations, advanced recycling initiatives, and a high focus on sustainable construction practices. Countries like Germany, France, Italy, and the UK contribute majorly and use PVC in making energy-efficient buildings, automobile constructions, and medical requirements. The region further promotes the circular economy wherein companies engage in mechanical and chemical recycling of PVC products. In addition, Europe's mature automotive sector applies PVC in interior trims, low underbody coatings, and cable insulation, valuing flexibility and low cost from the value proposition. Construction also benefits from PVC's thermal efficiency and corrosion resistance, in line with requirements for green building standards. Regulatory framework, such as the REACH, with activities like Vinyl Plus, lead the market into the emerging development of low-emission and recyclable PVC grades. Although growth here is less compared to Asia-Pacific, it leads in sustainable innovation and quality PVC applications.

Polyvinyl Chloride Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

24.80% |

| Europe |

19.20% |

| Asia-Pacific |

50.90% |

| LAMEA |

5.10% |

What are the emerging trends in the LAMEA PVC market?

- The LAMEA polyvinyl chloride market size was valued at USD 3.77 billion in 2024 and is anticipated to reach around USD 5.70 billion by 2034.

LAMEA provides an opportunity in the global PVC market as infrastructure development, urbanization, and investments in water and sanitation intensify. Latin America hosts huge markets in Brazil and Mexico, wherein construction, packaging, and agriculture demand PVC. On the other hand, the Middle East, with countries like Saudi Arabia and the UAE, heavily invests in mega infrastructure and smart city projects that aid PVC consumption for pipes, profiles, and fittings. In Africa, developmental projects require inexpensive yet durable construction materials, and PVC meets this criterion. However, economic volatility, low local production, and heavy dependency on imports pose hindrances to the market. Still, government-supported housing schemes, water distribution improvements, and rising population are creating long-term demand potential in this region.

Polyvinyl Chloride Market Top Companies

Recent Developments

- In Sept 2024, NEOVYNTM offers a much-reduced carbon footprint: 37% less than the European average for suspension PVC, down to 1.3 kg of CO_2 per kg of PVC. Therefore, their customers are certainly going to be able to reduce scope 3 emissions to produce sustainable downstream products.

- In May 2023, it has been planned for construction of a second PVC plant in Mahshahr by Arvand Petrochemical of Iran, with roughly equivalent production capacity and technology to that of 320,000 tons/year Khuzestan region PVC plant.

- In April, 2022, Formosa Plastics Corp. announced the production of PVC at the enlarged Formosa Baton Rouge, Louisiana, plant.

Market Segmentation

By Type

- Rigid PVC (uPVC)

- Flexible PVC

- Low-smoke PVC

- Chlorinated PVC (C-PVC)

By Form

- Pipe & Fittings

- Films & Sheets

- Wires & Cables

- Profiles & Tubes

- Others

By End-Use Industry

- Building & Construction

- Automotive

- Electrical & Electronics

- Healthcare

- Packaging

- Consumer Goods

- Others

By Region

- North America

- APAC

- Europe

- LAMEA