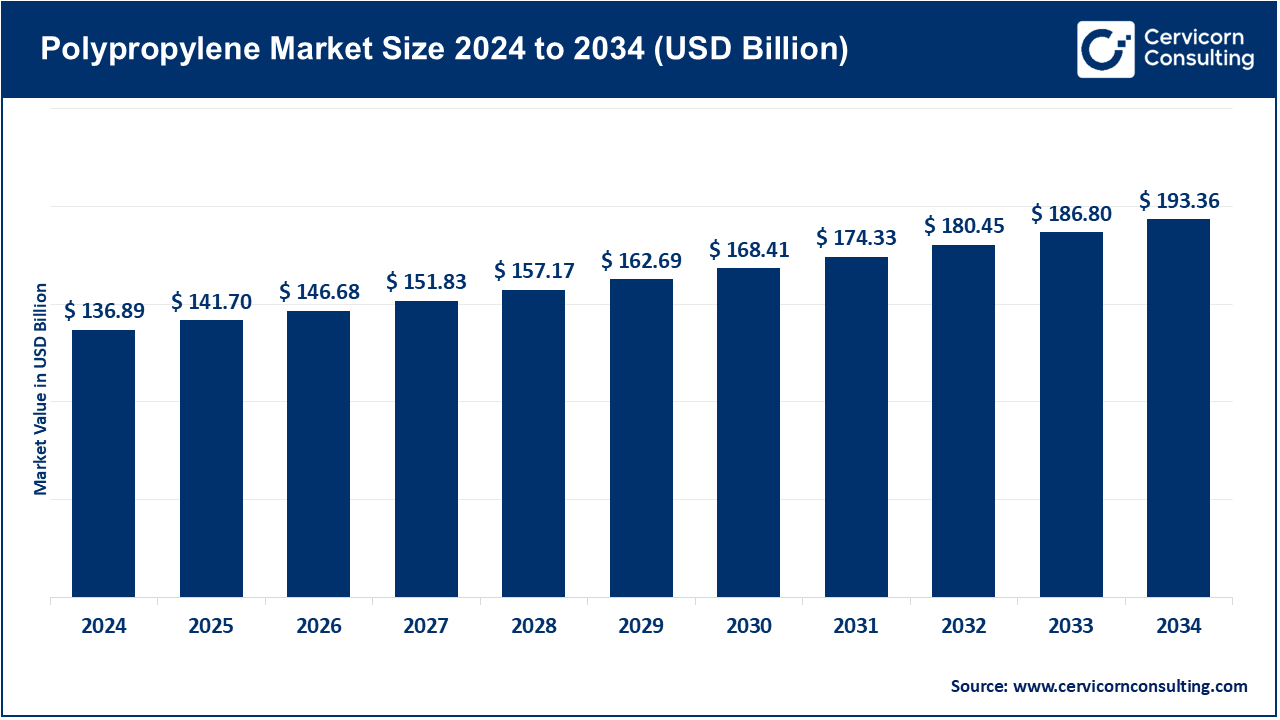

The global polypropylene market size was estimated at USD 136.89 billion in 2024 and is expected to be worth around USD 193.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.6% over the forecast period from 2025 to 2034. The polypropylene market is expected to grow significantly owing to its widespread applicability, cost-effectiveness, and excellent balance of mechanical, thermal, and chemical resistance properties. As industries increasingly demand lightweight and durable materials, polypropylene finds expanding use in packaging, automotive components, textiles, and consumer goods. The surge in e-commerce and FMCG sectors is further driving demand for flexible and rigid packaging solutions made from polypropylene. Additionally, the transition toward sustainable and recyclable materials is favoring polypropylene due to its high recyclability and low environmental impact compared to alternatives like PVC. Growth is also being propelled by advancements in polypropylene processing technologies, rising infrastructure projects in emerging markets, and the material's increasing role in medical and food-grade applications under stringent regulatory frameworks.

The increased usage of polypropylene in the packaging, automotive, construction and healthcare sectors are driving its market growth. It can be used widely due to its lightweight, versatility as well as being easily recyclable - from food containers to automotive components. Growth is driven by greater advances in copolymer blend innovations, fiber grade polypropylene and sustainable production processes. Increased support for eco-friendly plastics and circular economy initiatives are also additional factors positively affecting adoption. Leading companies making targeted investments in sophisticated manufacturing technologies and expanding into new areas are influencing strategic shifts in the market. Because of this, Polypropylene is changing materials efficiency, sustainability and performance engineering across industries worldwide.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 141.70 Billion |

| Expected Market Size in 2034 | USD 193.36 Billion |

| Projected Market CAGR from 2025 to 2034 | 4.6% |

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Application, End-Use, Processing Technology, Grade, Region |

| Key Companies | SABIC, Exxon Mobil Corporation, Borealis AG, BASF SE, INEOS Group, Reliance Industries Limited, LG Chem, LyondellBasell Industries Holdings B.V., DuPont, Braskem |

Homopolymer Polypropylene: One of the simplest types of polypropylene is manufactured from propylene monomers only. It possesses a superior combination tensile strength, rigidity, and a measure of chemical resistance which makes it acceptable for use in packaging that is rigid and automobile parts. In 2024, a new production facility came online in Texas for the large scale manufacture of homopolymer polypropylene. This new plant also launched eco-friendly grades with recycled content. The project was aimed at catering to increasing supply needs in the U.S. and global markets. It enhanced supply reliability for packaging and automotive requiremnets. The company also earned certification for sustainable production which aligned with green goals.

Polypropylene Market Revenue Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Homopolymer Polypropylene | 57.85% |

| Copolymer Polypropylene | 42.15% |

Copolymer Polypropylene: Ethylene is added to this type in order to increase flexibility, impact strength, or clarity photoclear grade. Medical devices, piping systems, and some automobile parts make use of this material. In 2024, the same plant that produced homopolymer started producing random and impact copolymers as well. These were designed to fulfill more demanding performance requirements in automobiles and medical instruments. New grades were created containing 20% recycled material that are now used by manufacturers for drug packaging and durable plastic products. The plant received environmental certification for sustainable copolymer production.

Film & Sheet: Used as packaging materials for food items, labeling stickers and in agriculture; the Flexible or semi rigid films and sheets made out of PP are grouped into two categories: film and sheet. Their strength, clarity and recyclability makes them compete with other materials. ClariPPil — a recyclable PP film and bottle was launched in October 2024 by one of the biggest packaging companies. With more than seventy percent COâ‚‚ emission reduction compared to PET produced equivalents , these products gained instant popularity. The solution underwent important showcase events where its certification results as a recyclable product were revealed on major industry platforms The solution attracted attention from key players in the food sector nutraceuticals as well as healthcare industries.”

Fabric: Hygiene products, carpets, and textiles are made from polypropylene fibers which can be processed using the meltblown or spunbond techniques. The softness and strength combined with chemical resistance make these fibers incredibly versatile. In March 2023, European and Asian producers increased the output of PP meltblown fibers. These fibers were mostly used in face masks alongside wipes and surgical gowns during the pandemic. Even in the post-pandemic world, there remained a sustained period of strong demand for these products in the healthcare and hygiene sectors. Additional investment directed toward improved softness and filtration efficiency continued to sustain polypropylene’s dominance in nonwoven fabric markets.

Blow Molding: Items like plastic bottles and drums are made through blow molding using pressurized air to shape them into hollow objects. The toughness of polypropylene makes it one of few polymers that can endure high temperatures. In January 2023, global resin manufacturers rolled out new grades of PP blow moldings. These products targeted the detergent, shampoo, and pharmaceutical bottle markets intending to replace multi-layered package designs with mono-material blow molded versions. Many brands adopted these materials to meet their targets on recyclability which drove demand for blow-molded PP in packaging industries.

Others: This category incorporates specialized PP applications including thermoforming and rotational molding as well as extrusion coating. These are for trays, lids, liners and insulation panels. In June 2024 Europe adopted PP thermoforming for eco-friendly food trays. Labeled as no-frills packaging, the sheets could be used for fast food and deli meals. Thermoformed PP was also used in airline meal containers. Using these substitutes helped eliminate the use of polystyrene and lower plastic waste. The advancement contributed to the industry's transition towards circular economy principles.

Packaging: The largest end-use sector of polypropylene is packaging films, containers, caps and wraps. Polypropylene (PP) has good sealing properties as well as flexibility and moisture resistance. As of November 2023, major retailers such as Walmart and Tesco have switched to mono-material PP trays. The new trays enhanced recyclability while maintaining food protection goals. In addition to these changes, packaging companies started producing transparent PP lids and added tamper-evident seals. Eco-conscious labeling along with lightweight design were incorporated to minimize carbon footprint.

Automotive: In the automotive industry, polypropylene is used in bumpers interior trims battery cases and air ducts. It helps reduce weight and fuel consumption. In February 2025, new grades of impact copolymers designed for electric vehicles were introduced. These were implemented in lightweight dashboards and under-the-hood parts. Car makers adopted PP to meet new emissions and fuel standards.

Polypropylene Market Revenue Share, By End-Use, 2024 (%)

| End-Use | Revenue Share, 2024 (%) |

| Packaging | 38.40% |

| Automotive | 20.50% |

| Building & Construction | 12.80% |

| Healthcare | 9.40% |

| Electrical & Electronics | 6.30% |

| Textile | 12.60% |

Enhanced colder durability was offered by improved grades ensuring backbone support for the use of the polypropylene in future mobility solutions. Building & Construction: In construction, PP is used in pipes and fittings, panels or insulation due to its toughness, thermal resistance, and lack of corrosion. Some Asian markets issued higher demand for PP insulation and plumbing materials in August 2024. Local suppliers boosted the production of housing project plumbing accessories such as PP pipes. Prefabricated structures also utilized lightweight panels. These constructions supported energy-efficient buildings with lower maintenance needs. Also, construction codes started accepting plastic components made from recyclable materials.

Healthcare: Polypropylene (PP) is utilized in the manufacture of medical containers, syringes, vials as well as other diagnostic devices due to their safety during sterilization and compliance to stringent hygienic standards. There was an introduction of reusable pill bottles made out of polypropylene ecofriendly recyclable materials catered towards healthcare packaging in late October 2024. They were advertised at CPHI Milan claiming to provide advanced moisture protection which drove up their popularity among hospitals, pharmacies and the OTC medicine market. Compared to standard PET bottles these new versions reduced COâ‚‚ emissions by over seventy percent winning them approval from healthcare stakeholders trying to adopt greener alternatives.

Electrical & Electronics: Balancing heat resistance and dielectric strength, PP finds application in cable insulating, housing capacitors, and in electronic packaging. In April 2023, newer grades of flame retarded PP came out for use in consumer gadgets and automotive electronics. The materials provided halogen-free safety which is increasingly required by electronics firms adopting stricter fire safety regulations. This broadened the applicability of PP in safe electrical design.

Textile: In addition to carpets and upholstery, ropes, and nonwoven fabrics like spun-bonded textiles, PP is light hence easy to handle as well as durable and resistant to moisture. Also In July 2023, the nonwovens market experienced an increase in demand for pp fibers based on hygiene and home furnishing ends uses. Asian production units started utilizing Spunbond pp fabrics for furniture linings as well as filters and floor coverings. Textile brands enjoyed the low cost of synthesizing pp fibers while providing good recyclability which kept demand high from domestic and commercial sectors.

Injection Molding: This technique involves producing plastic components by injecting molten polypropylene (PP) into predetermined molds. It is widely used in the automotive industry, food packaging, and household appliances because it guarantees accuracy and efficiency. In May 2024, new injection-molding PP grades were released that increased their impact resistance and recycled content to 20%. Companies integrated these materials into food packaging tubs and auto interiors as brands shifted towards eco-friendly replacements for traditional plastics. The balance of strength and sustainability provided by the new grades supported initiatives to adopt a circular economy.

Blow Molding: Through blow molding, hollow parts such as bottles and containers made from PP can be produced at large scales for packaging or industrial purposes. In March 2023, resin suppliers launched mono-material PP designed for blow-molded packs which replaced cleaning product containers, healthcare liquids, and personal care bottles. These grades provided lightweight packaging while improving recyclability which multiple companies streamlined to minimize plastic composition complexity. This increase the adoption of PP in mass-market bottles significantly.

Extrusion: In polymer (PP) extrusion, the process of pushing extruded material through a die to create pipes, films or sheets is termed PP extrusion. This method is suitable for continuous production lines. In June 2024, pipe producers upgraded PP extrusion systems to meet infrastructure needs. These systems manufactured pressure-resistant pipes for both hot and cold water applications. Moreover, polysulfone semi capsules were supplied to automotive industries while extruded polypropene sheets were used in other branches as well. The technology permitted greater throughput while still maintaining improved characteristics of the materials processed. This improvement allowed greater market share for PP in technical extrusion markets.

Thermoforming: Thermoforming utilizes heat and pressure to generate trays, lids and food containers from PP sheets. It finds applications in food service and fresh cut disposable products. In September 2023, fast food restaurants adopted thermoformed PP trays made out of recyclable polymer sheets. Suppliers introduced lighter PP trays with improved sealing abilities that better maintained seals. They replaced polystyrene in numerous countries around the world. The development enhanced sustainable single-material options for packaging and increased demand for quick service packaged by polypropylene cling film septum free bag type sealable pouches sachets structures wrappers boxes dip tubes containers pop tops cigaret filters mouthpieces masks stuffing fillers sticks stirrer sticks scotch tape which was grown heretofore.

Fiber Spinning: PP fibers are produced through the spinning of molten resin used in nonwovens, textiles and carpets. They have good strength, absorbed moisture, and were cost-effective. In February 2023, additional meltblown lines were installed in India and Europe to increase output of PP fiber. These lines supported production of face masks, diapers, and wet wipes. The new technology enhanced softness and filtration performance. Nonwoven producers noted an increase in demand for hygiene products during the post pandemic period.

Food Grade Polypropylene: Items such as food containers and trays, as well as PP (polypropylene) bottles, serve food-grade purposes because of their moisture resistance and heat protective properties. Major retailers adopted mono-material PP food trays towards late November 2023 which improved recyclability and ensured safety. Following this development, packaging companies manufactured transparent microwaveable lids which greatly increased international demand in the retail sector and for food delivery services while supporting the transition to circular packaging systems.

Medical Grade Polypropylene: The material’s biocompatibility along with its heat resistance makes medical-grade polypropylene ideal for ensuring sterilization of syringes and diagnostic instruments storage and shipping. A refillable pill bottle made of recyclable polypropylene was introduced for prescription medications as well as OTCs (Over the Counter drugs) in October 2024. These bottles outperformed previous standards by providing 71% emissions reduction compared to PET pill bottles used in hospitals and clinics. At PharmaPack and CPHI events, the design received high praise from clinicians for swiftly adoptable eco-innovation recognized for its sustainable design-shared protective features

Industrial-grade: Polypropylene is used for bulletproof safes and construction products, automotive parts, industrial PP containers requiring impact damage toughness, weather, chemical conditions. In April 2024, some manufacturers targeted automotive and construction component parts with new grades of PP industrials that possessed enhanced impact resistance and UV stability. They were absorbed into under-the-hood components and battery housings by Automotive OEMs while outdoor fittings and panels were utilized by construction companies. The enhancements aimed at meeting the demands for lightweight durable recyclable plastic materials consistently rose.

The polypropylene market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

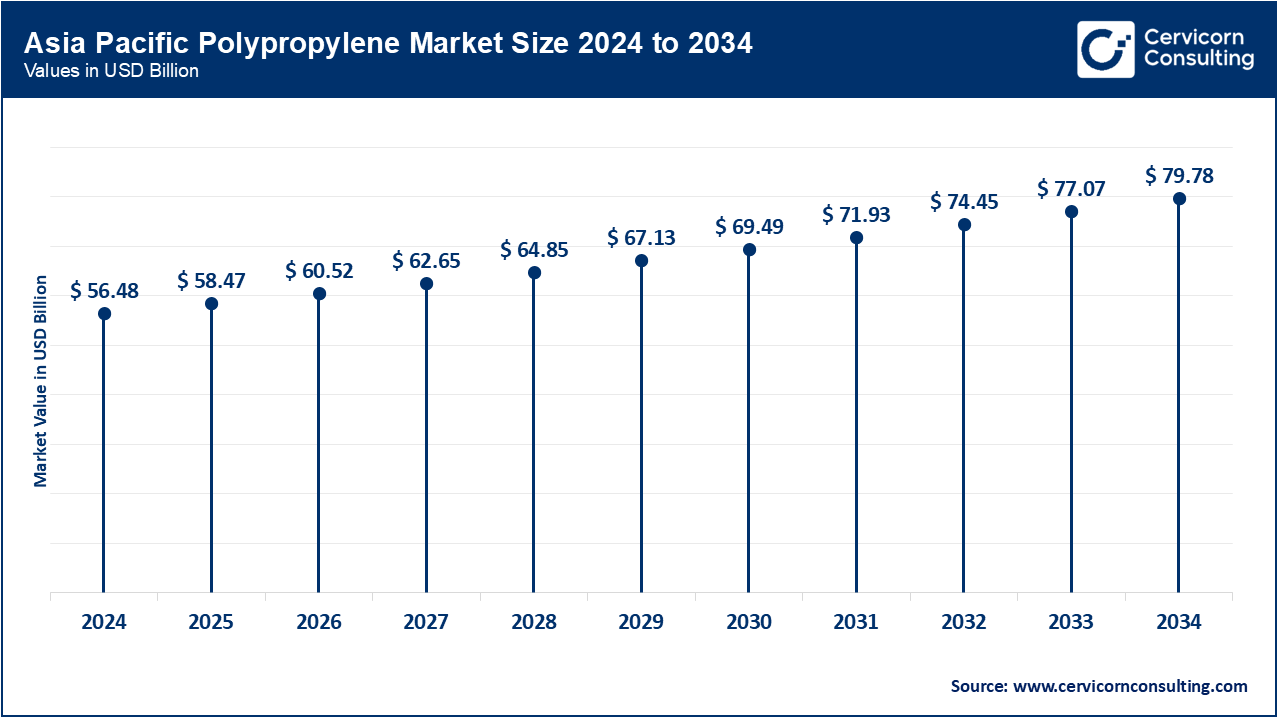

Along with China, India, Japan and others, Asia swiftest expanding region for for its demand for polypropylene fuelled by consumer goods as well as construction and manufacturing industries expansion. Increased manufacturing focused shifted towards high purity fibers and films in China from 2022 onward while India opened new factories focused on textiles, hygiene nonwovens and pp blades by the end of 2023. Pharma sector saw innovation with food grade pp used for packaging medicines in Japan along with supply to electrovehiles from Korea. Medical grade PP saw heightened demand driven from Australia and New Zealand while automotive needs helped push Japan’s infrastructure durable recyclable PP production boosting economy until circa 2025; On this basis region holds epoch making significance in plastic propylene nebula.

The U.S., Canada, and Mexico comprise a saturated polypropylene market focused on packaging, automotive, and healthcare industries. As the leading producer and consumer, the U.S. prioritizes recyclable and food-grade materials. A major polypropylene plant commenced operations in Texas in May 2024, producing homopolymer and copolymer resins containing up to twenty percent recycled content. In 2023, Canada and Mexico enhanced their packaging capabilities to support the food and pharmaceutical industries; there is also an increased use of PP for EV components. By 2025, more PP received environmental certifications for sustainability. These changes advance North America’s circular economy as well as their use of advanced plastics.

The European regional market for polypropylene is marked with stringent regulations and high focus on sustainability. Regionally covering Germany, France, the UK, Italy among others, mono-material PP solutions are rampant due to the strong recycling demands of the EU. Newly launched medical-or film-grade PP lines based in Germany and France are set to be adopted by Italy and Spain in 2024 alongside recyclable PP trays for food services while UKg sprints towards advanced packing technologies. The Netherlands advocated use of PP in agriculture whilst Russia increased domestic production. In 2025 Europe becomes a leader in adoption of food safe and biodegradable PP blend materials showcasing their advancements into sustainable eco-conscious initiatives.

Polypropylene Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 21.80% |

| Europe | 24.94% |

| Asia-Pacific | 41.26% |

| LAMEA | 12% |

The regions of LAMEA are characterized by expanding applications for polypropylene, with Brazil leading in agricultural and packaging uses, and the Middle East dominating production. Africa’s demand is growing in construction and healthcare services. In 2022, Brazil localized PP production to reduce imports while boosting food and industrial packaging opportunities. Gulf nations increased high-value advanced PP output during 2023 and 2024 with global export objectives. Egypt and South Africa are heavily investing in recycling before flexible packaging lines upstream. The UAE and Saudi Arabia will produce medical grade impact copolymers by 2025 alongside industrial grades of the same material. The role of LAMEA in the global polypropylene landscape is steadily strengthening.

The polypropylene industry is led by industry giants such as LyondellBasell, ExxonMobil Chemical, SABIC, and Borealis AG, who are redefining material innovation across packaging, automotive, healthcare, and construction sectors. These companies are advancing sustainable polypropylene solutions through circular economy models, chemical recycling, and low-carbon production. In May 2024, LyondellBasell expanded its mechanical recycling capacity in the U.S., while SABIC launched certified circular PP grades using advanced feedstock recycling. ExxonMobil is focusing on lightweight automotive PP for EVs, and Borealis is driving innovation in mono-material packaging to meet EU recyclability standards. Recent partnerships with startups and research institutes are enhancing biopolymer performance, recyclability, and process efficiency. Through investments in closed-loop systems and specialty PP grades, these leaders are shaping a future of high-performance, sustainable polypropylene for global industries.

Recent partnerships in the polypropylene industry are accelerating progress in sustainability, advanced manufacturing, and circular economy practices. In 2023, Borealis extended its collaboration with Tomra and Zimmerman Recycling to boost closed-loop PP systems across Europe. In January 2024, SABIC partnered with Plastic Energy and Intraplás to scale up certified circular polypropylene in food-grade applications. ExxonMobil joined hands with Cyclyx in late 2022 to improve feedstock collection for advanced recycling. In 2025, LyondellBasell launched a strategic venture with EEW Energy to create high-quality recycled PP from mixed plastic waste. TotalEnergies and Honeywell announced a joint development in March 2024 to commercialize pyrolysis-based PP recycling. These alliances are redefining innovation pipelines in polypropylene, focusing on efficiency, circularity, and carbon footprint reduction.

Market Segmentation

By Type

By Application

By End-Use Industry

By Processing Technology

By Grade

By Region