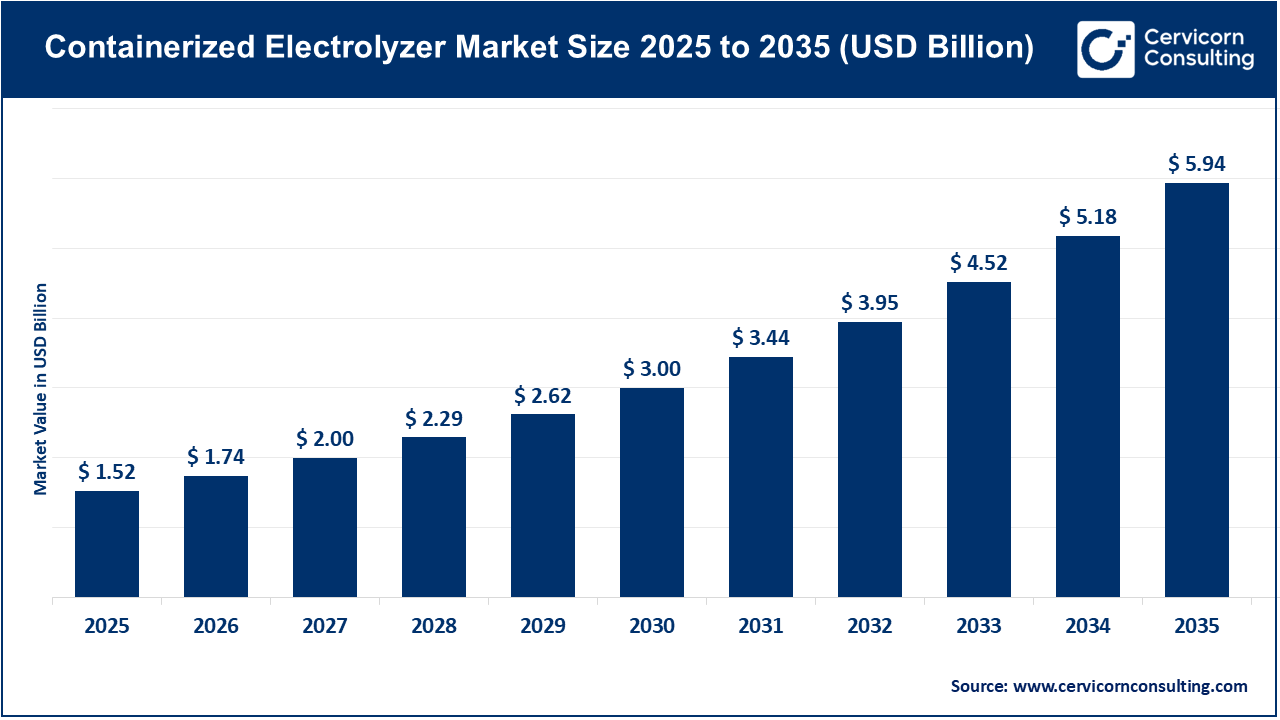

The global containerized electrolyzer market size was estimated at USD 1.52 billion in 2025 and is expected to be worth around USD 5.94 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 14.6% over the forecast period 2026 to 2035. The containerized electrolyzer market is being propelled by the world-wide momentum towards clean hydrogen production and a demand for flexible, deployable energy alternatives. The use of green hydrogen as a decarbonization solution in hard-to-abate sectors (such as steel, ammonia, and transport) is increasingly moving from rhetoric to reality as governments and industry make investments. Containerized electrolyzers provide an attractive solution, as they can be quickly installed, scaled, and relocated, thereby eliminating the high infrastructure and commissioning costs of traditional, large stationary plants. In March 2024, the Larsen & Toubro Group in India commissioned its first 1 MW hydrogen electrolyzer in Hazira, Gujarat, which is notable for both the maturity of its local manufacturing and for the plug-and-play potential of such modular systems.

Additionally, the rapid development of electrolyzer technology and the falling cost of renewable electricity are driving the growth of containerized electrolyzer market. As the prices of solar and wind energy go down, it becomes more cost-effective to create hydrogen by electrolysis, especially in distributed, modular systems like containerized systems. In addition, increasing public and private investment, government policy support such as the EU Hydrogen Strategy and U.S. Inflation Reduction Act, and growing interest from energy developers sides in demand. Together, these influences could be shifting containerized electrolyzers from niche solutions into core enablers of a green hydrogen economy.

What is a containerized electrolyzer?

A containerized electrolyzer is a modular hydrogen production solution that incorporates an entire electrolyzer system with auxiliary components (power electronics, cooling, water purification, and control systems) into a shipping/containerized or skid-mounted container. The system can then arrive on location and be operational in a "plug-and-play" manner without needing foundational civil or infrastructure work and is therefore compact, transportable, and deployable.

Key Applications of containerized electrolyzer

Rising Global Investments in Hydrogen Fueling the Growth of Containerized Electrolyzer Market

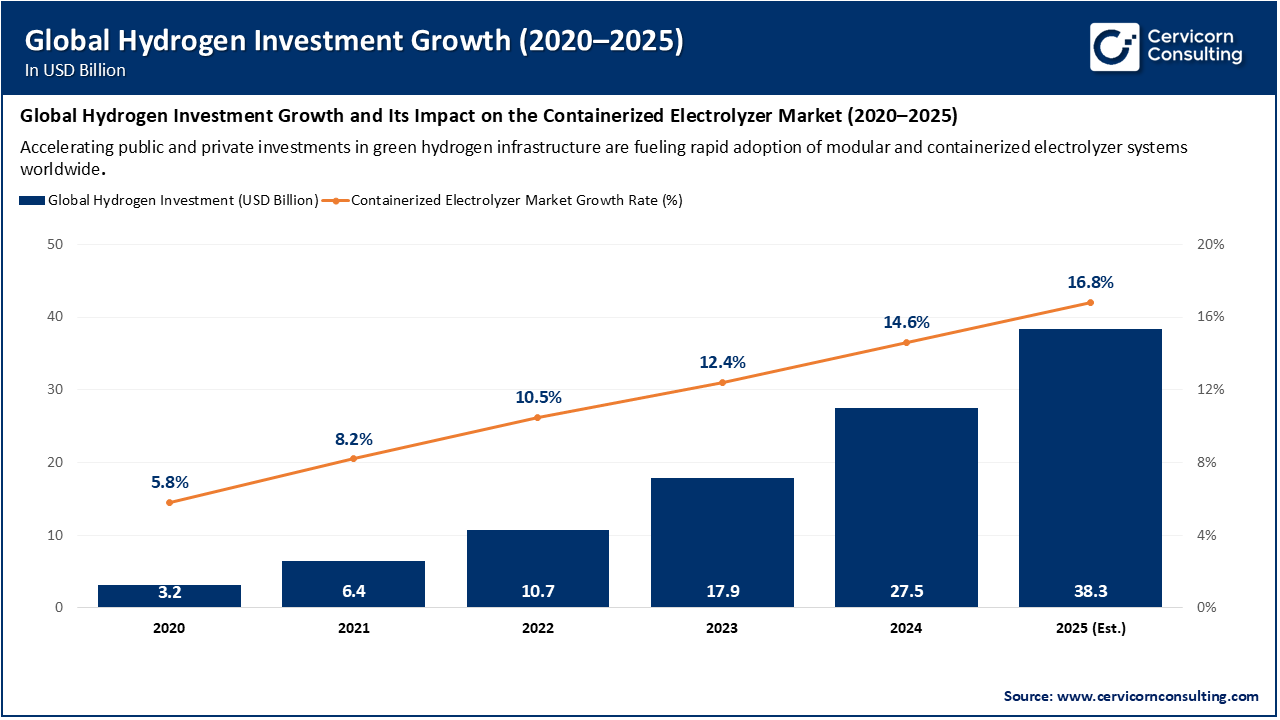

The increase in international investments in green hydrogen is one of the most significant catalysts accelerating the containerized electrolyzer market. Within this burgeoning sector, governments, energy suppliers, and industrial entities are allocating billions of dollars towards hydrogen infrastructure to achieve decarbonization benchmarks and energy security aspirations. Containerized electrolyzers with a modular and mobile design will be the favored option for early-stage and distributed hydrogen projects because they can be deployed quickly and flexibly scaled. Initiatives to fund and generate demand for on-site hydrogen generation systems, such as the EU’s EUR 45 billion Hydrogen Bank, production tax credits in the U.S. Inflation Reduction Act, and Japan’s USD 107 billion hydrogen roadmap, will strengthen demand for electrolyzers. Several funding initiatives, in addition to enhancing on-shore manufacturing capacity, are also incentivizing manufacturing costs and technological advancements of compact, plug-and-play electrolyzer solutions. As a result of these investments, containerized electrolyzers are positioned to be a key enabler for the global hydrogen transition.

The chart clearly shows that global hydrogen investments, which grew by USD 3.2 billion in 2020 up to USD 38.3 billion in 2025, produced a steadily increasing rate of growth of the containerized electrolyzer market from a rate of 5.8% to 16.8%. This relationship indicates how increasing capital inflows cause direct stimulation of growth of the market for containerized electrolyzers resulting in an increased number of applications in green hydrogen production, industrial decarbonization and renewable integration.

Global Hydrogen Investment Initiatives and Their Impact on the Containerized Electrolyzer Market (2023–2025)

| Region | Key Hydrogen Investment (2023–2025) | Impact on Containerized Electrolyzer Market |

| European Union | EUR 45 billion Hydrogen Bank initiative | Stimulates demand for modular electrolyzers in pilot and distributed hydrogen hubs. |

| United States | USD 9.5 billion hydrogen funding under Inflation Reduction Act | Encourages local containerized electrolyzer deployment for clean hydrogen hubs. |

| Japan | USD 107 billion national hydrogen roadmap (2023–2040) | Expands adoption of compact systems for mobility and industrial applications. |

| India | INR 19,744 crore (≈USD 2.4 billion) National Green Hydrogen Mission | Drives on-site production using containerized systems in industrial zones. |

| Middle East (Saudi Arabia, UAE) | Over USD 10 billion in green hydrogen megaprojects | Integration of containerized systems for early-stage and test-phase operations. |

Policy & Clean-Hydrogen Targets Driving Demand

Renewable Energy Expansion & Flexibility Needs

High Initial Capital Cost

Infrastructure & Supply-Chain Limitations

Industrial Decarbonisation & On-Site Hydrogen Production

Remote, Off-Grid, and Hybrid Renewable Applications

Technology Maturity, Efficiency & Durability Issues

Reliable Access to Cheap Renewable Electricity

The containerized electrolyzer market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

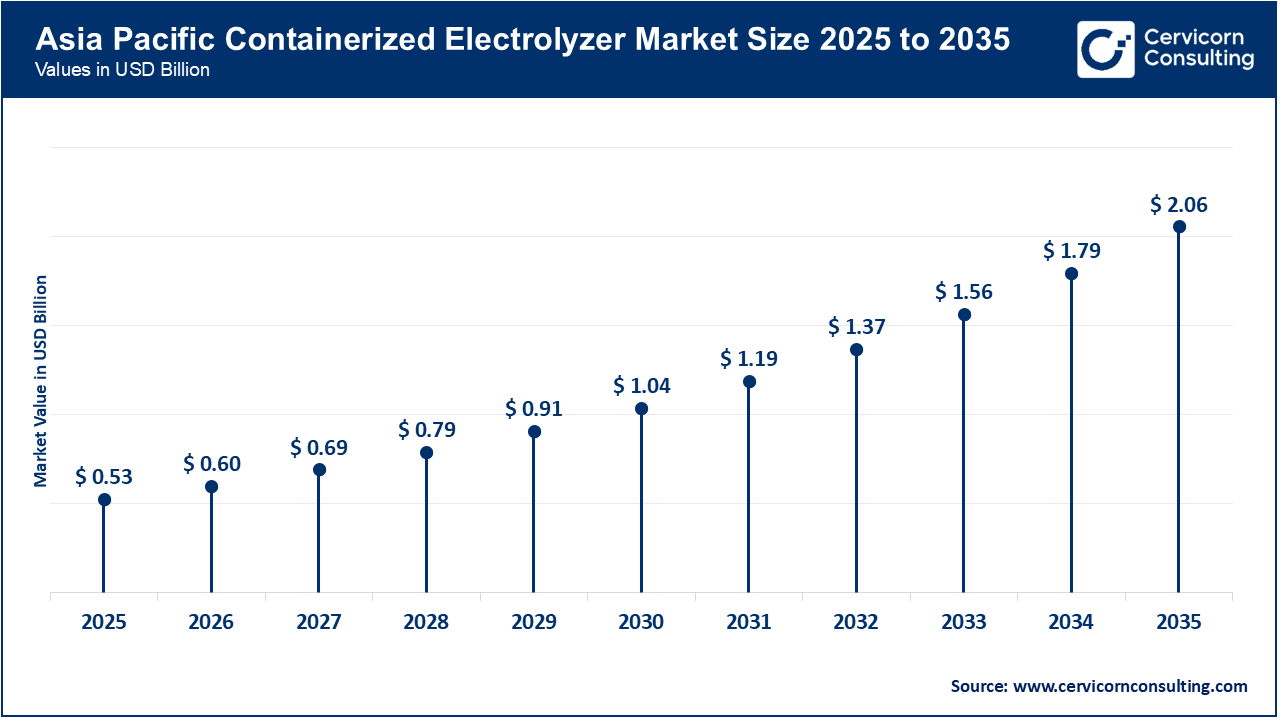

The Asia-Pacific region holds the largest share of the containerized electrolyzer market, as it is led by ambitious hydrogen strategies and rapid scale-up of renewable energy. Countries like India, China, Japan, South Korea and Australia are leading the transformation in the region based on national hydrogen missions aimed at energy independence and decarbonizing industries. India’s (INR 19,744 crore) National Green Hydrogen Mission and Japan’s hydrogen roadmap worth USD 107 billion are key enablers of the demand for containerized electrolyzers being deployed for small and mid-scale projects. The flexibility of containerized systems is perfectly matched to Asia-Pacific’s distributed renewable architecture for the generation of hydrogen in locations suited for consumption in transportation, energy storage and industrial processes. In addition, the rapidly growing manufacturing ecosystem in the region is leading to lower pricing for manufacturing and scaling technologies.

Recent Developments

North America is experiencing a boost in growth of the containerized electrolyzer market due to the large federal incentives and development of regional hydrogen hubs. The incentives in the U.S. Inflation Reduction Act (IRA), which provides up to USD 3 per kilo tax credits for the production of clean hydrogen in the country, have greatly helped domestic electrolyzer deployment, notably modular and containerized applications for distributed projects. This is increasingly the case with the installation of seven regional hydrogen hubs under the U.S. Department of Energy’s USD 7 billion Hydrogen Hub Program which is pulling growth in demand for portable and scalable systems. In Canada, the development of provincial hydrogen roadmaps combined with investments in the various renewable infrastructures are spurring on the growth of containerized systems for use in mobility applications and off-grid industrial applications. The region’s promotion of decentralized hydrogen generation for clean transport and grid resilience will continue to place containerized electrolyzer systems in the frame as a strategic technology for achieving commercial timely deployment objectives.

Recent Developments

Europe remains the technological and policy leader in the global containerized electrolyzer market. The Hydrogen Strategy of the European Union, along with a Hydrogen Bank of EUR 45 billion, has created a favorable political environment for international deployment of modular electrolyzer systems. Europe’s focus on energy security after the energy crisis of 2022 has accelerated the development of decentralized, containerized hydrogen production. Several European nations (of which Germany, the Netherlands, Norway and France are the most notable) are innovating large-scale green hydrogen hubs using containerized units for pilot and distributed applications. Also, the severe carbon-neutral targets for the years 2030 and 2050 which have been adopted by this region of the world continue to create demand in the industrial community for flexible and mobile electrolysis technology.

Recent Developments

Containerized Electrolyzer Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 29.80% |

| Europe | 25.70% |

| Asia-Pacific | 34.60% |

| LAMEA | 9.90% |

The LAMEA region represents a commercial opportunity for containerized electrolyzers with a growing market associated with the potential vast natural resources and a move to create green hydrogen export opportunities. Countries such as Saudi Arabia, UAE, Chile and South Africa are currently converting solar and wind resources to produce green hydrogen for the international market. The containerized electrolyzer systems are seen as the optimum technology to power pilot and demonstration projects because they offer flexibility, mobility and are easy to deploy in isolated desert views or coastal areas. Governments have signed MoUs with electrolyzer manufacturers so they can set up local production facilities and green hydrogen corridors for export to Europe and Asia. The rapid developments in large scale renewable projects in conjunction with foreign investment will position LAMEA as a hotspot for modular hydrogen production in the future.

Recent Developments

The containerized electrolyzer market is segmented into product, capacity, application, end-user, and region.

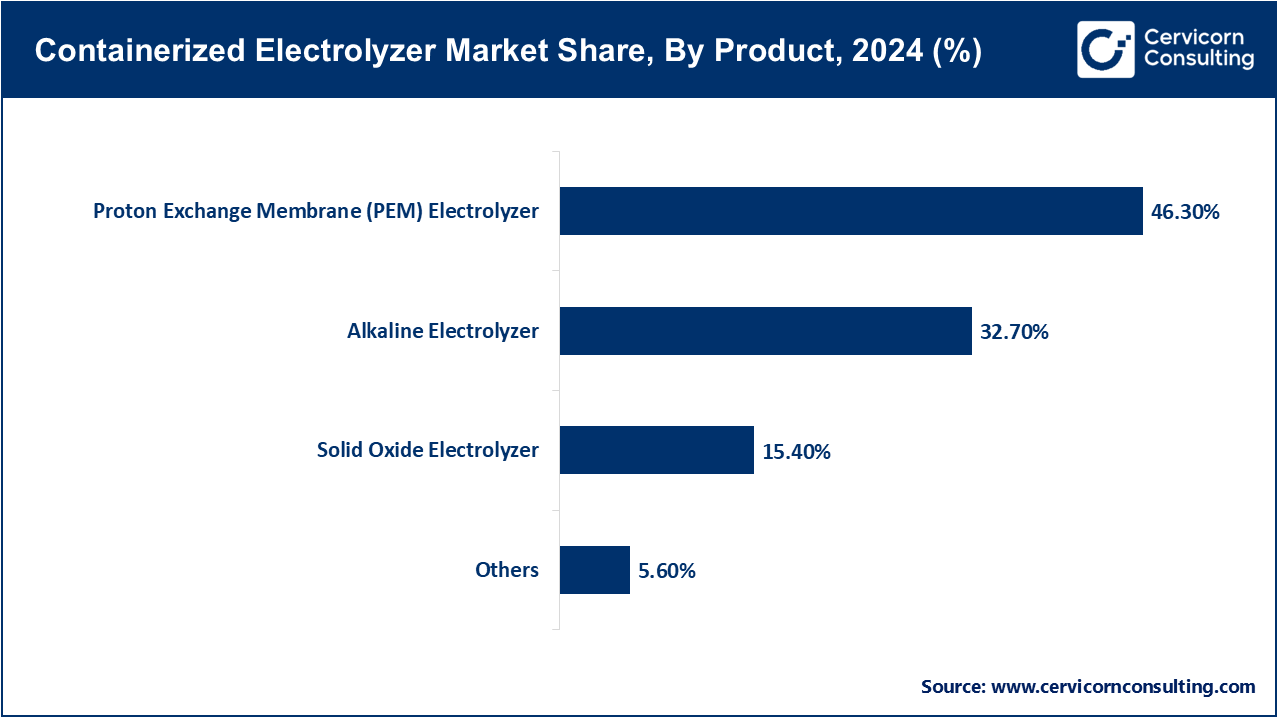

In 2025, Proton Exchange Membrane (PEM) electrolyzers are expected to be the largest technology segment by revenue in the containerized electrolyzer sector. The PEM electrolyzer's small modular design, high hydrogen purity, fast start-up and shut-down speed, and capability to use intermittent renewable power make it the most viable option in a containerized system. They offer a decentralized green hydrogen generation option for mobile hydrogen fueling stations as well. Companies such as Nel ASA, Enapter, and Siemens Energy have been scaling PEM electrolyzer containerized modules to meet the anticipated demand in North America and Europe.

The Solid Oxide Electrolyzer (SOE) technology segment is expected to be the fastest growing. The advantages of SOEs are high energy efficiency (greater than 90%) while using waste heat from industrial processes or high-temperature energy sources to reduce overall energy consumption in the hydrogen production process. Recent pilot projects in Germany, Japan, and South Korea that focus on combining SOEs and systems using industrial waste heat, are furthering the commercial viability of SOEs. Alkaline electrolyzers remain a less expensive option for large industrial hydrogen production users, but the slower dynamic response limits their use in intermittent renewable energy systems. The Others segment, including Anion Exchange Membrane (AEM) technology, is being propelled forward largely through research and development (R&D) for a cost-efficient option closer to PEM cost and flexibility.

Medium-Scale Systems Dominating While Large-Scale Modules Lead Future Growth

The 1–5 MW (medium-scale) segment maintains a strong position in the containerized electrolyzer market due to its balance of mobility and operational scalability. These systems are popular in pilot hydrogen hubs, refueling stations, and industrial clusters that need moderate hydrogen outputs and do not wish to commit to a static installation. Expanding developer partnerships with electrolyzer manufacturers, such as Ohmium’s 1 MW–5 MW systems, which are being deployed in India and Spain, demonstrate the popularity of this size application.

Containerized Electrolyzer Market Share, By Capacity, 2024 (%)

| Capacity | Revenue Share, 2025 (%) |

| Below 1 MW (Small Scale) | 18.20% |

| 1–5 MW (Medium Scale) | 44.80% |

| Above 5 MW (Large Scale) | 37% |

The above 5 MW (large-scale) segment is witnessing the fastest growth rate. As global hydrogen demand increases, multi-megawatt containerized solutions are being used in grid-scale green hydrogen projects. These can be scaled up easily by combining multiple containers into a modular cluster, accumulating tens or hundreds of megawatts. For example, large-scale initiatives like the NEOM Green Hydrogen Project (Saudi Arabia) and the European Hydrogen Backbone involve the integration of multi-megawatt modular systems. The Below 1 MW (small-scale) segment continues to serve niche applications such as research, pilot and remote applications that require small, portable hydrogen production.

Hydrogen Production Leading with Energy Storage Emerging as the Fastest-Growing Use Case

The hydrogen production segment is the clear market leader because containerized electrolyzers are primarily used for green hydrogen production at distributed locations. The speed of installation and ability to be easily relocated is conducive to on-site hydrogen production at refineries, mobility hubs, and small-scale industrials. This application is rapidly gaining traction across Europe and Asia, supported by decarbonization mandates and hydrogen blending initiatives that are extending the market dimensions.

Containerized Electrolyzer Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2025 (%) |

| Hydrogen Production | 48.90% |

| Energy Storage | 22.60% |

| Power-to-Gas | 14.10% |

| Industrial Applications | 10.80% |

| Others | 3.60% |

Simultaneously, the energy storage segment is also becoming the fastest growing, driven by the significantly increasing demand for flexible energy storage for the stability of renewable-heavy grids. Containerized electrolyzers convert excess solar or wind power into hydrogen that can be repurposed for energy and at some point in time for industrial activities. For example, Hystar’s HyPilot in Norway and Siemens Energy’s Silyzer containerized systems are leading the development of modular hydrogen storage with renewables. The Power-to-Gas and Industrial Application segments are also growing at a steady pace as utilities and factory clients are beginning to utilize containerized systems for decentralized clean energy supply and the decarbonization of processes.

Industrial Adoption Leading the Market with Transportation Fueling Rapid Expansion

The industrial segment dominates the containerized electrolyzer market, as green hydrogen uptake to decarbonize process heating is increasing in the industrial sector. Industries such as glass making, metallurgy, chemical production, and fertilizer are using containerized electrolyzers to replace fossil-based hydrogen with renewable hydrogen sources. These units provide the flexibility to produce hydrogen on-site, thereby reducing reliance on traditionally centralized hydrogen delivery supply chains. Industrial businesses, such as L&T's deployment of a 1 MW containerized electrolyzer in India (2024) and Thyssenkrupp's pilot modular systems in Germany, are examples of the current forward momentum.

Containerized Electrolyzer Market Share, By End-User, 2024 (%)

| End-User | Revenue Share, 2025 (%) |

| Industrial | 41.70% |

| Power Generation / Utilities | 28.90% |

| Transportation | 23.50% |

| Others | 5.90% |

The transportation segment is the fastest-growing segment, benefitting from rapid advances in hydrogen mobility infrastructure. Containerized electrolyzers are being utilized to power hydrogen refueling stations for trucks, buses and trains, benefiting from a scalable (modular) and simple (containerized) fuel solution deployment. Areas such as Europe, Japan and California have seen many installations spur under the umbrella of public-private partnerships. The Power Generation & Utilities segment is also expanding, as containerized systems are being deployed in renewable energy microgrids and backup power systems for increased grid resiliency. The Other segment (off-grid, military, and emergency energy applications) will represent a growing niche market especially in areas where traditional energy access is lessened or not possible.

Industry Leaders’ Perspectives

1. Enapter – Giulio Telleschi, VP Engineering

In an interview, Mr Telleschi stressed how Enapter utilizes digitization and cloud-based data to scale modular electrolyzer solutions.

He states, “We have gathered over 2 million operating hours on cloud-based monitoring systems … this data shows our reliability in real world applications, which is what distinguishes us from our competitors.”

He also explained how their “containerised plug-and-play approach ensures easy integration into existing energy systems … The obvious limits of systems and the standard format of interfaces simplify deployment and helps to make big hydrogen projects accessible.”

This view illustrates the importance of modularity, digital monitoring and scalability all of which are required of containerized electrolyzers before they can move from pilot to commercial deployment.

2. LONGi Hydrogen – Wang Yingge, Vice President

In a December 2023 interview, LONGI Hydrogen’s Mr. Yingge elaborated on how LONGI, which is known for PV manufacturing, is now entering the electrolyzer business.

He stated that “hydrogen is a feasible means of energy storage,” especially with the irregularities of renewables and that the company’s strategy began in early 2018 with an annual production capability of electrolyzers by the end of 2022 of 1.5 GW and aiming for 5 GW by 2025.

He added that “whilst cost is a barrier, with wider and more reliable supply-chains with declining components, we see that green hydrogen will be around USD 2.00 per kg in the next 5-10 years.”

That shows how large renewables OEMs expect containerized electrolyzers to be part of the wider energy/storage transition and how they have ambitions to scale manufacturing for modular hydrogen systems.

Market Segmentation

By Product

By Capacity

By Application

By End-User

By Region