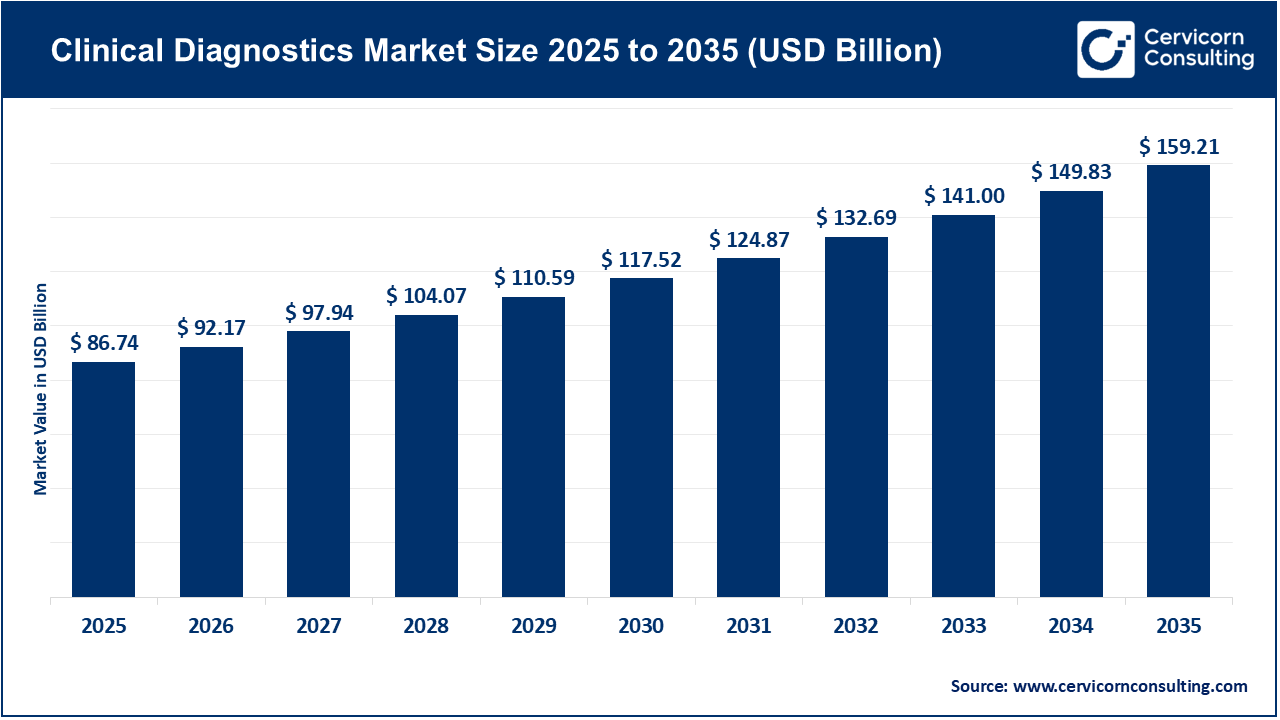

The global clinical diagnostics market size was valued at USD 86.74 billion in 2025 and is expected to be worth around USD 159.21 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.3% over the forecast period 2026 to 2035. The clinical diagnostics market is primarily driven by the rising global burden of chronic and infectious diseases, such as diabetes, cardiovascular disorders, cancer, and respiratory infections. Aging populations, especially in developed economies, have significantly increased the demand for routine diagnostic testing and early disease detection. Additionally, the growing emphasis on preventive healthcare, regular health check-ups, and early diagnosis has accelerated test volumes across hospitals and diagnostic laboratories. The expansion of healthcare infrastructure in emerging economies and improved access to diagnostic services are further supporting market growth.

Another major growth factor is technological advancement in diagnostic platforms, including molecular diagnostics, automation, immunoassays, and point-of-care (POC) testing. Innovations such as high-throughput analyzers, rapid diagnostic kits, companion diagnostics, and AI-enabled laboratory software have improved accuracy, speed, and efficiency of testing. Increased adoption of personalized medicine, rising investments in R&D by key players, and favorable government initiatives for disease screening programs are also fueling market expansion. Together, these drivers are transforming clinical diagnostics into a critical pillar of modern healthcare delivery worldwide.

Expansion of Decentralized Point-of-Care (POC) Testing in Emerging Markets

The expansion of decentralized point-of-care (POC) testing in emerging markets is a significant driver of growth in the clinical diagnostics market, primarily due to gaps in centralized laboratory infrastructure and limited access to healthcare facilities. In many low- and middle-income countries, a large proportion of the population lives in rural or semi-urban areas where access to fully equipped diagnostic laboratories is limited. According to global health estimates, nearly 45–50% of the world’s population lacks access to essential diagnostic services, creating strong demand for portable, rapid, and easy-to-use diagnostic solutions. POC testing enables faster clinical decision-making by delivering results within minutes to hours, reducing patient follow-up loss and improving disease management, particularly for infectious diseases such as HIV, malaria, tuberculosis, and COVID-19, which remain highly prevalent in emerging regions.

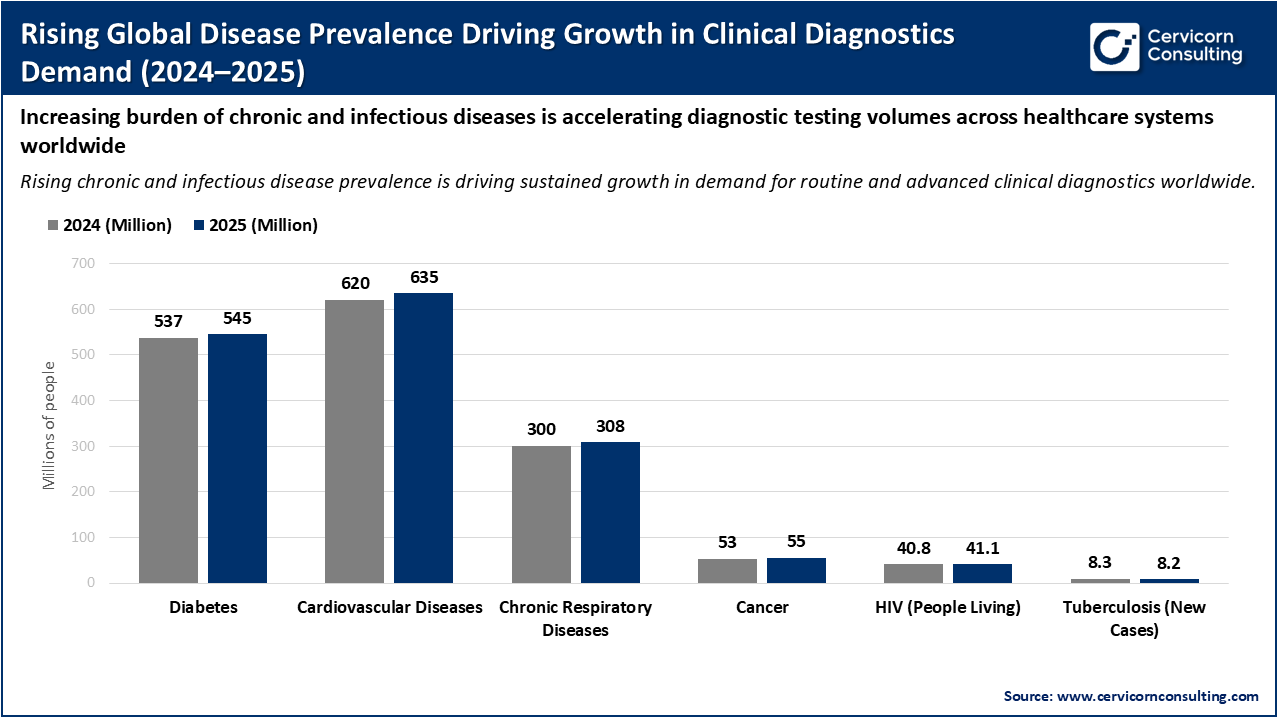

Rising Global Disease Prevalence as a Key Driver of the Clinical Diagnostics Market

The chart illustrates the growing global prevalence of major chronic and infectious diseases between 2024 and 2025, highlighting a steady increase in conditions such as diabetes, cardiovascular diseases, chronic respiratory diseases, cancer, and HIV. These conditions affect hundreds of millions of people worldwide and typically require continuous monitoring, routine laboratory testing, and early detection to manage disease progression effectively. As patient populations expand, healthcare systems must perform a higher volume of diagnostic tests, directly increasing demand for reagents, kits, instruments, and laboratory services.

This rising disease burden is a strong growth driver for the clinical diagnostics market, as it fuels demand across multiple testing categories including blood chemistry, hematology, molecular diagnostics, and infectious disease testing. Chronic diseases drive recurring diagnostic needs over a patient’s lifetime, while infectious diseases necessitate large-scale screening and surveillance. Together, these trends lead to higher test volumes, expanded laboratory infrastructure, and increased adoption of advanced diagnostic technologies, reinforcing sustained market growth globally.

1. BGI and Roche Launch Alzheimer’s Diagnostic Tests in China

BGI Genomics and Roche Diagnostics have introduced new blood-based diagnostic tests for Alzheimer’s disease in cities across China, offering less invasive and more accessible options compared to traditional procedures such as PET scans or spinal taps. This development expands access to early Alzheimer’s screening in a large and aging population, improving early disease detection and patient management. By simplifying testing and enabling broader clinical use, these diagnostics help boost overall test volumes and increase demand for advanced biomarkers, particularly in Asia-Pacific markets where healthcare access is rapidly evolving.

2. Danaher and AstraZeneca Partner to Scale Precision Diagnostics

Danaher Corporation announced a strategic partnership with AstraZeneca to co-develop and commercialize next-generation diagnostic tools aimed at precision medicine applications. This collaboration fosters innovation in diagnostics by combining Danaher’s technical expertise with AstraZeneca’s clinical insights, accelerating the development of tests that help tailor treatments to individual patients. The partnership supports the integration of advanced diagnostics into personalized care pathways, driving increased adoption of precision testing across healthcare systems and strengthening market demand for sophisticated clinical solutions.

3. UK–Singapore Regulatory Innovation Corridor for Health Technologies

The governments of the United Kingdom and Singapore launched a regulatory innovation corridor to expedite access to breakthrough health technologies, including diagnostics. Regulatory collaborations like this reduce barriers to market entry for innovative diagnostic products by streamlining approval processes across jurisdictions. Faster regulatory pathways encourage investment and commercialization of cutting-edge diagnostic tools, particularly in digital health and molecular diagnostics, enhancing global market growth and helping patients access new technologies more quickly.

4. Aiforia’s Next-Gen AI Platform and Clinical Deployments

Aiforia Technologies expanded its AI-powered clinical diagnostics platform with next-generation technology and secured new regulatory approvals and deployments in 2025. AI technologies in diagnostics significantly improve efficiency and accuracy in areas such as pathology image analysis. Aiforia’s advancements help laboratories process large data volumes faster, support better clinical decision-making, and reduce turnaround times for diagnostic results. Widespread adoption of AI platforms accelerates digital transformation in diagnostics, increasing throughput and enabling labs to handle growing test demands more effectively.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 92.17 Billion |

| Market Size in 2035 | USD 159.21 Billion |

| Market CAGR 2026 to 2035 | 6.30% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Test Type, Product, Technology, Sample Type, End User, Region |

| Key Companies | Bio-Rad Laboratories Inc., Abbott Laboratories, Danaher Corporation, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche AG, Illumina Inc., bioMérieux SA, Qiagen N.V., Siemens Healthineers AG, Becton, Dickinson and Company, Sysmex Corporation, Hologic Inc., Quest Diagnostics Inc., Sonic Healthcare Ltd |

Expansion of Point-of-Care and Home-Based Diagnostics

Growth of Personalized and Precision Medicine

Shortage of Skilled Laboratory Professionals

Data Management and Integration Issues

The clinical diagnostics market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

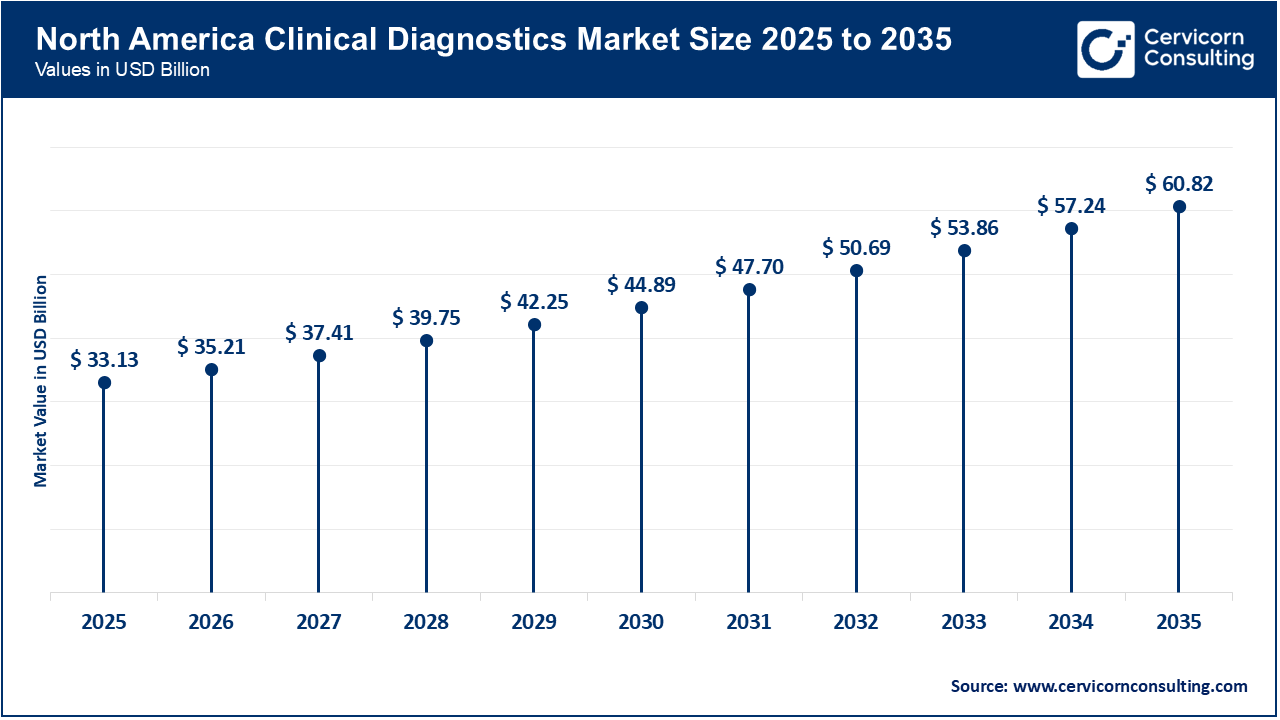

The North America clinical diagnostics market size was valued at USD 33.13 billion in 2025 and is forecasted to hit around USD 60.82 billion by 2035. North America remains the largest and most mature clinical diagnostics market globally, driven by high healthcare expenditure, advanced healthcare infrastructure, and widespread adoption of cutting-edge diagnostic technologies. The region benefits from strong research and development ecosystems, rapid integration of digital health tools, and significant investments in early disease detection programs. Major healthcare systems and laboratories in the U.S. and Canada adopt high-throughput laboratory automation, molecular diagnostics, and AI-enabled diagnostic platforms ahead of other regions, supporting consistent market growth. North America’s dominance is also supported by routine screening programs and high awareness of preventive care among both providers and patients, sustaining high testing volumes across hospital and independent laboratory settings. As a result, this region contributes a substantial share of global clinical diagnostics revenue and sets technological benchmarks for other markets.

Recent Developments:

The Asia-Pacific Clinical diagnostics market size was accounted for USD 19.17 billion in 2025 and is predicted to surge around USD 35.19 billion by 2035. Asia-Pacific is one of the fastest-growing regions in the clinical diagnostics market, driven by expanding healthcare infrastructure, rising disease burden, and growing demand for accessible and cost-effective diagnostic testing. Economic growth in countries such as China, India, and Southeast Asian markets has led to increased healthcare spending and investments in modern laboratory facilities, improving access to both routine and advanced diagnostics. Rising prevalence of chronic conditions and infectious diseases fuels demand for broader screening and monitoring services, while government health initiatives aim to enhance early detection and reduce disease-related mortality. Additionally, emerging markets are adopting decentralized and point-of-care testing models to serve rural and underserved populations, further expanding diagnostic penetration beyond major urban centers.

Recent Developments:

The Europe clinical diagnostics market size was estimated at USD 24.81 billion in 2025 and is projected to surpass around USD 45.53 billion by 2035. Europe’s clinical diagnostics market is propelled by strong regulatory frameworks, emphasis on personalized medicine, and high adoption of advanced testing technologies. Countries like Germany, the United Kingdom, and France have well-established public health systems that prioritize early disease screening and chronic disease monitoring, supporting high utilization of diagnostic services. European laboratories and healthcare providers benefit from coordinated standards and guidelines that promote the uptake of molecular diagnostics and digital solutions, while increasing healthcare expenditure continues to uplift diagnostic testing capabilities across both public and private sectors. Furthermore, Europe’s aging population and government advocacy for preventive healthcare contribute to sustained demand for routine and specialized diagnostic tests. The region’s regulatory environment also encourages quality and safety in diagnostics, fostering innovation and adoption of next-generation assays across disease areas.

Recent Developments:

Clinical Diagnostics Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38.2% |

| Europe | 28.6% |

| Asia-Pacific | 22.1% |

| LAMEA (Latin America, Middle East & Africa) | 11.1% |

The LAMEA clinical diagnostics market was valued at USD 9.63 billion in 2025 and is anticipated to reach around USD 17.67 billion by 2035. The LAMEA region is increasingly important for clinical diagnostics growth, driven by rising healthcare investment, expanding diagnostic infrastructure, and a growing focus on early disease detection and chronic disease management. Latin American countries such as Brazil and Mexico are upgrading laboratory capabilities and expanding preventive healthcare programs, increasing demand for diagnostic services. In the Middle East and Africa, government initiatives and private healthcare expansion support adoption of advanced diagnostics, particularly in urban centers where larger hospitals and reference labs are emerging. While the region still faces challenges related to healthcare access and reimbursement systems, rising awareness of the importance of diagnostics and increasing partnerships with global diagnostic suppliers are improving market prospects. Technological adoption is gradually increasing, especially in point-of-care and rapid testing formats that can serve diverse healthcare settings across LAMEA.

Recent Developments:

The clinical diagnostics market is segmented into test type, product, technology, sample type, end user, and region.

Complete Blood Count (CBC) remains the dominant test type in the clinical diagnostics market due to its universal application across nearly all healthcare settings. CBC tests are routinely prescribed for general health checkups, infection detection, anemia diagnosis, immune system evaluation, and monitoring of chronic diseases. Their widespread use in hospitals, independent laboratories, and physician offices ensures consistently high test volumes. CBC tests are cost-effective, quick to perform, and supported by well-established automated hematology analyzers, making them a cornerstone of routine diagnostics. The rising aging population and increased prevalence of chronic conditions further reinforce the dominance of CBC testing, as these patients require frequent monitoring through basic hematological parameters.

Clinical Diagnostics Market Share, By Test Type, 2025 (%)

| Test Type | Revenue Share, 2025 (%) |

| Complete Blood Count (CBC) | 21.4% |

| Infectious Disease Testing | 18.6% |

| Lipid Panel | 10.2% |

| Renal Panel | 9.1% |

| Liver Panel | 8.4% |

| Electrolyte Testing | 7.9% |

| Oncology & Tumor Marker Testing | 13.3% |

| Companion Diagnostics | 6.5% |

| Others | 4.6% |

Infectious disease testing is the fastest-growing test type segment, driven by rising global awareness of disease surveillance and outbreak preparedness. The demand for rapid, accurate detection of viral and bacterial infections has increased significantly, supported by advancements in molecular diagnostics and rapid antigen testing. Expanding screening programs, growing adoption of point-of-care tests, and government-led initiatives to control infectious diseases are accelerating growth. Additionally, emerging markets are increasingly investing in decentralized infectious disease testing, further boosting this segment’s expansion.

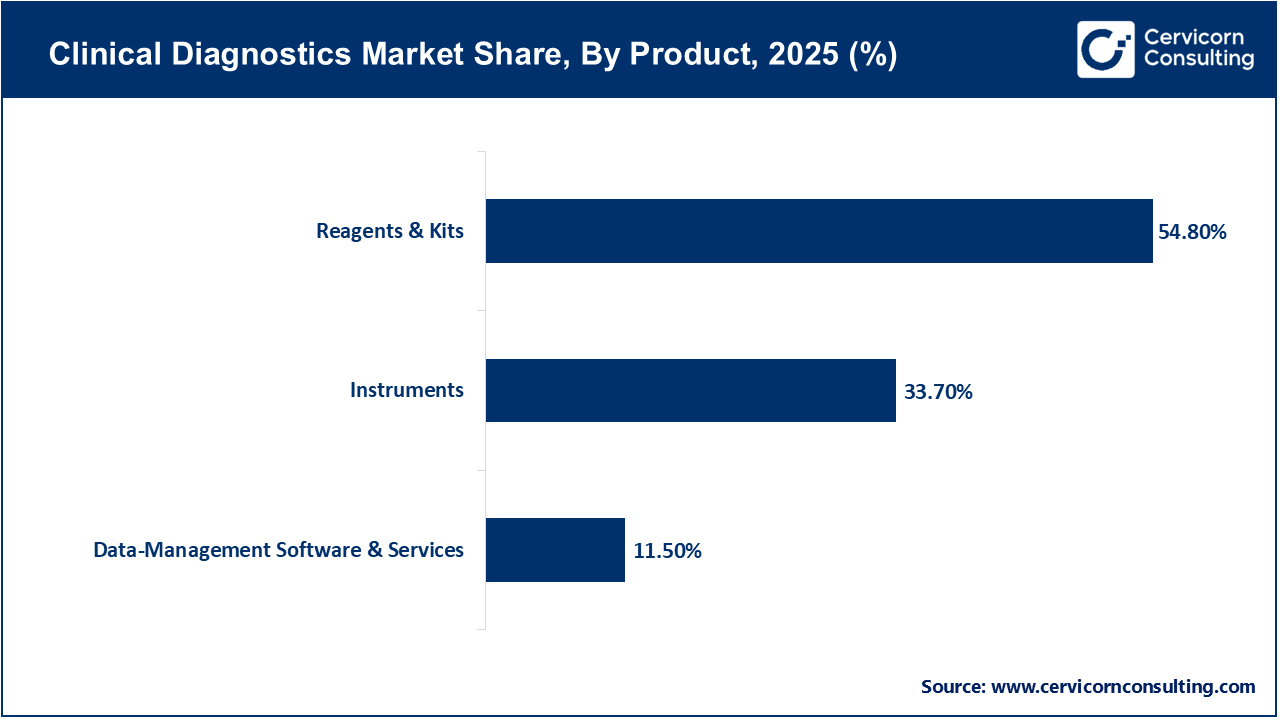

Reagents and kits dominate the product segment due to their recurring usage across all diagnostic tests. Unlike instruments, which are capital purchases, reagents are consumables required for every test performed, ensuring continuous demand. High testing volumes in clinical chemistry, immunoassays, and hematology directly translate into sustained reagent consumption. Manufacturers benefit from long-term reagent contracts with laboratories, creating stable revenue streams. The increasing number of routine and specialized tests being conducted globally continues to reinforce the dominance of this segment.

Data-management software and services represent the fastest-growing product segment as laboratories increasingly digitize operations. The growing need for efficient data handling, regulatory compliance, interoperability with electronic health records, and AI-enabled diagnostics is driving adoption. Cloud-based laboratory information systems and analytics platforms improve workflow efficiency, reduce errors, and support remote diagnostics. As diagnostic data volumes increase, demand for advanced software solutions continues to rise rapidly.

Clinical chemistry dominates the technology segment due to its extensive application in routine diagnostic testing, including liver panels, renal panels, lipid profiles, and electrolyte testing. High automation, scalability, and cost efficiency make clinical chemistry analyzers essential in high-throughput laboratories. These systems are widely deployed across hospitals and diagnostic centers, supporting consistent test volumes. Their reliability and standardized workflows ensure continued dominance in both developed and emerging healthcare markets.

Clinical Diagnostics Market Share, By Technology, 2025 (%)

| Technology | Revenue Share, 2025 (%) |

| Clinical Chemistry | 29.6% |

| Immunoassay & Immunochemistry | 21.8% |

| Hematology | 15.2% |

| Molecular Diagnostics | 14.9% |

| Microbiology | 8.1% |

| Urinalysis | 4.7% |

| Coagulation & Hemostasis | 3.9% |

| Others | 1.8% |

Molecular diagnostics is the fastest-growing technology segment, driven by its superior sensitivity and specificity. Its expanding use in infectious disease detection, oncology, and genetic testing is transforming diagnostic practices. The increasing focus on early disease detection and personalized medicine is accelerating adoption. Technological advancements such as PCR automation and multiplex testing are further enhancing accessibility and scalability.

Blood-based samples dominate the sample type segment as they are essential for a wide range of diagnostic tests, including hematology, immunoassays, and clinical chemistry. Established collection protocols, broad test compatibility, and high diagnostic reliability support their dominance. Most routine and specialized diagnostics rely on blood samples, making them indispensable in clinical settings. Increasing chronic disease prevalence further strengthens demand for blood-based diagnostics.

Clinical Diagnostics Market Share, By Sample Type, 2025 (%)

| Sample Type | Revenue Share, 2025 (%) |

| Blood / Plasma / Serum | 69.4% |

| Urine | 14.8% |

| Tissue / Biopsy | 7.3% |

| Saliva | 5.6% |

| Others | 2.9% |

Saliva is the fastest-growing sample type due to its non-invasive nature and ease of collection. It is increasingly used in infectious disease testing, hormonal analysis, and genetic screening. Saliva-based diagnostics are particularly attractive for point-of-care and home-based testing, improving patient compliance. Advances in assay sensitivity are expanding its clinical applications, driving rapid adoption.

Hospital laboratories dominate the end-user segment due to high patient volumes and access to advanced diagnostic infrastructure. Hospitals handle complex and emergency cases that require comprehensive diagnostic testing, supporting high utilization of clinical diagnostics. Integrated workflows and specialized staff further enhance diagnostic efficiency. The growing burden of chronic diseases and hospital admissions sustains this dominance.

Clinical Diagnostics Market Share, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Hospital Laboratories | 42.1% |

| Independent Diagnostic Laboratories | 31.4% |

| Point-of-Care Settings | 15.8% |

| Physician Office Laboratories | 7.2% |

| Others | 3.5% |

Point-of-care settings are the fastest-growing end-user segment, driven by demand for rapid diagnostics and decentralized healthcare delivery. POC testing enables immediate clinical decisions, particularly in emergency rooms, clinics, and remote areas. Government support, technological advancements, and growing home-care trends are accelerating adoption. As healthcare shifts toward convenience and accessibility, POC diagnostics continue to expand rapidly.

Bio-Rad Laboratories Inc.

Danaher Corporation

F. Hoffmann-La Roche AG

By Test Type

By Product

By Technology

By Sample Type

By End User

By Region