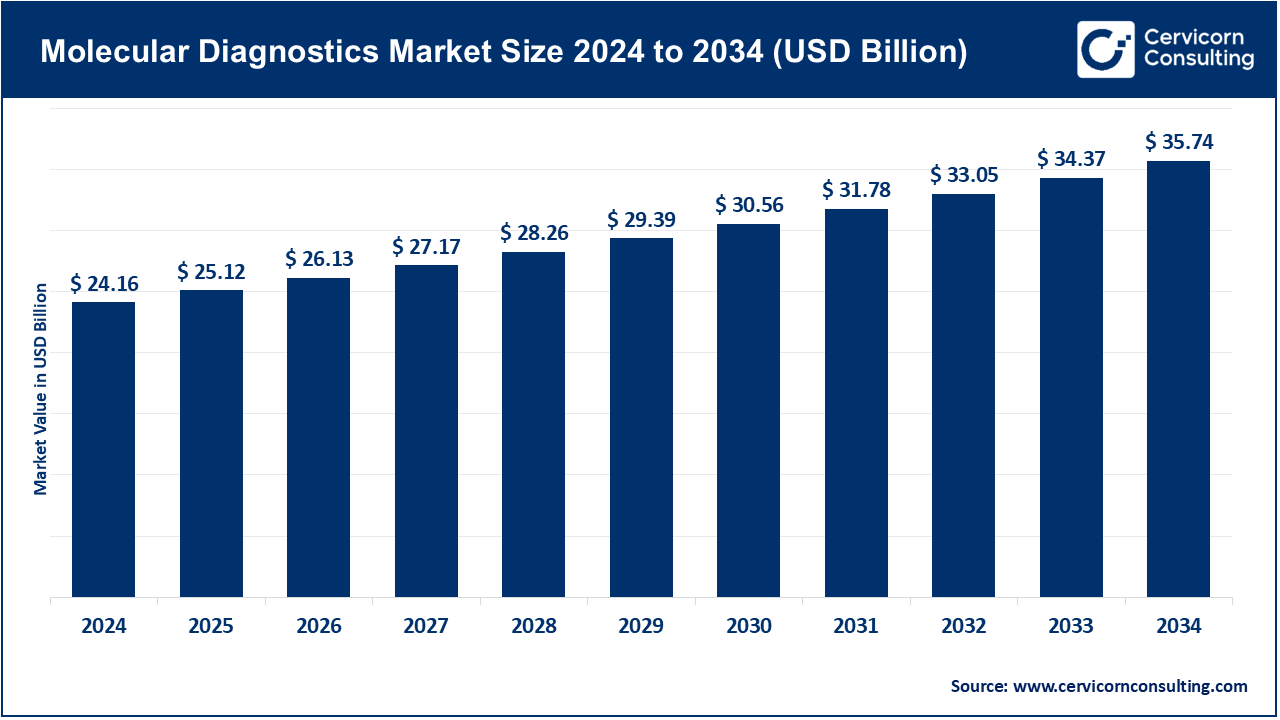

The global molecular diagnostics market size was accounted for USD 24.16 billion in 2024 and is expected to be worth around USD 35.74 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.99% over the forecast period from 2025 to 2034. The healthcare industry has been shifting towards early detection of diseases, customized therapy, and improvement of chronic and infectious disease management, which has resulted in a growing interest in molecular diagnostics. New advancements in ts been driven by improvements in genomics and proteomics, which provide sensitive and specific diagnosed tools for cancer, genetic diseases and viral infections. The combination of AI, machine learning, IoT, and other technologies has also increased the accuracy and efficiency of diagnostic tests, giving healthcare professionals more evidence-based tools to help patients and lower the cost of healthcare.

The expansion of rapid diagnostics, which will be available to more hospitals, clinics, and remote areas, has been made possible by the adoption of real-time molecular assays, lab-on-a-chip devices, and high-throughout sequencing. Innovative next-generation technologies like CRISPR-based assays and digital PCR platforms, in addition to government support, regulations, and initiatives centered on rapid diagnostics, have also stimulated innovation. Due to the high demand for personalized medicine, decentralized testing, and predictive diagnostics, the molecular diagnostics market will likely continue technologically driven rapid expansion.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 25.12 Billion |

| Estimated Market Size in 2034 | USD 35.74 Billion |

| Projected CAGR 2025 to 2034 | 3.99% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Technology, Product & Service, Test Location, Application, End User, Region |

| Key Companies | Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Qiagen N.V., BioMérieux S.A., Hologic, Inc., F. Hoffmann-La Roche Ltd., Danaher Corporation (Cepheid), Becton, Dickinson and Company (BD Diagnostics), Siemens Healthineers |

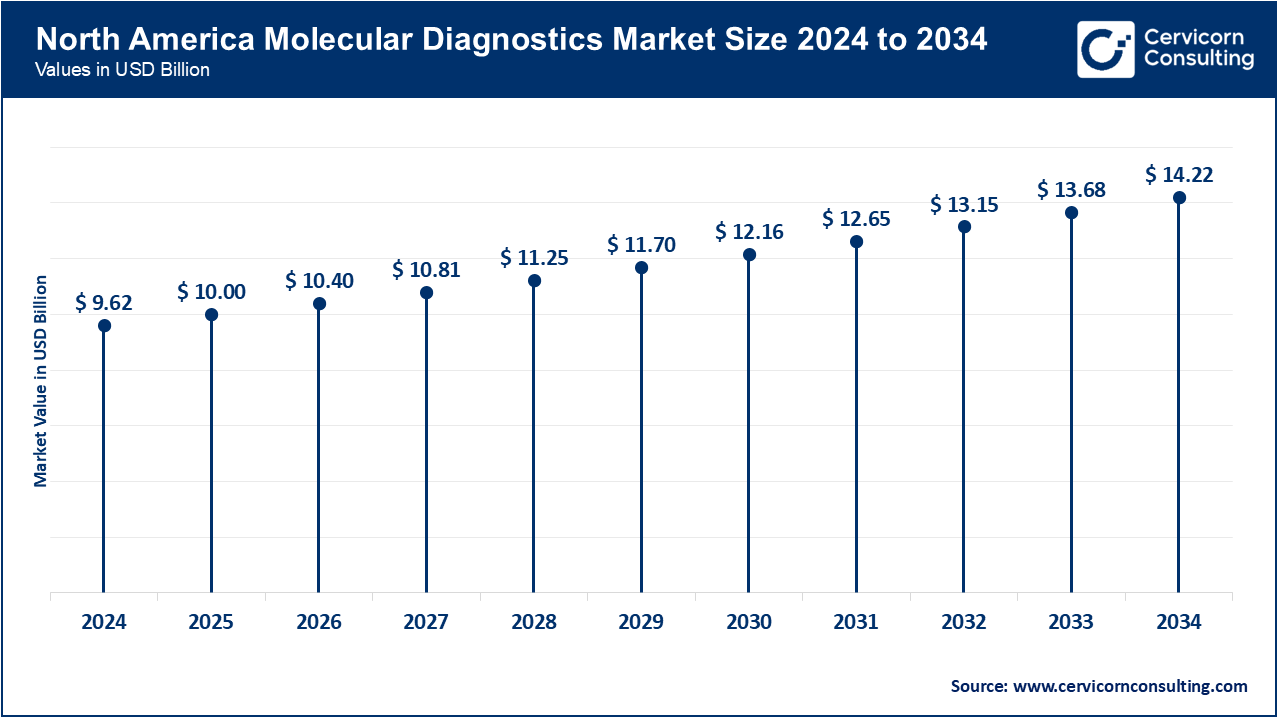

The molecular diagnostics market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The North America market is foremost thanks to innovative healthcare frameworks and early tech adoptions. More than 65% of U.S. Diagnostic Laboratories adopting AI and Robotics by March 2025 to streamline precision and mitigate turnaround time. Since early 2025, healthcare funding and governmental support has been expanded, resulting in greater access to AI-enhanced Molecular Care in Hospitals and Clinics. Industry leaders including Roche, Abbott, and Thermo Fisher have augmented their positions by focusing their investments on NGS and PCR platforms. Expansion in precision diagnostics and point-of-care testing have been the pillars for sustained growth.

Europe is the second-largest market thanks to investments in healthcare policies and frameworks on collaborative healthcare research and integrations. Many Laboratories adopting AI-assisted data analytics and automation tech between 2020 and 2025 to speed-up the processes of infectious and genetic disease testing. Healthcare infrastructure, particularly high-throughput labs and precision medicine programs, in Germany, France, and the U.K. has been the backbone of Europe’s advanced healthcare research. Prolific partners such as Qiagen, BioMérieux, and Siemens Healthineers have built collaborative efforts with healthcare research centers. The heightened emphasis surveillance, preparedness on diseases, technology, and outbreak integrations enables Europe to retain its marketplace strength.

Strong collaboration with global diagnostic companies is becoming a conduit for accelerating innovation in the region. The seamless diffusion of cutting-edge advancements in automated testing systems and AI-assisted diagnostics s readily available in the region. As demonstrated in the development of molecular diagnostics in China and the 3 million annual diagnostic tests milestone, flagship integration of diagnostic tests in hospitals, point-of-care facilities, and reference labs underscores the dramatic increases in testing. The rapid uptake of public and private healthcare sector automated systems and Eastern Government mpg AI systems is rage with strong regulatory support and financial incentives.

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 39.80% |

| Europe | 27.20% |

| Asia-Pacific | 24.30% |

| LAMEA | 8.70% |

The integration of healthcare smart cities and the establishment of modern diagnostic and tissue labs continue to support infrastructure development in LAMEA. The incorporation of point-of-care diagnostics and AI assisted testing is pioneering for LAMEA. Countries within the region, especially Brazil, Mexico, and the Gulf Countries, LAMEA has become a test bed where diagnostic networks are liberalizing and the enhancement of the proactive training of healthcare workers supports the provisioning of health service. The shift of global diagnostic companies to LAMEA where the expected growth 2026-2028 is driven by the disease burden, and the copious health driven technologies of the region will guarantee the establishment of diagnostic services.

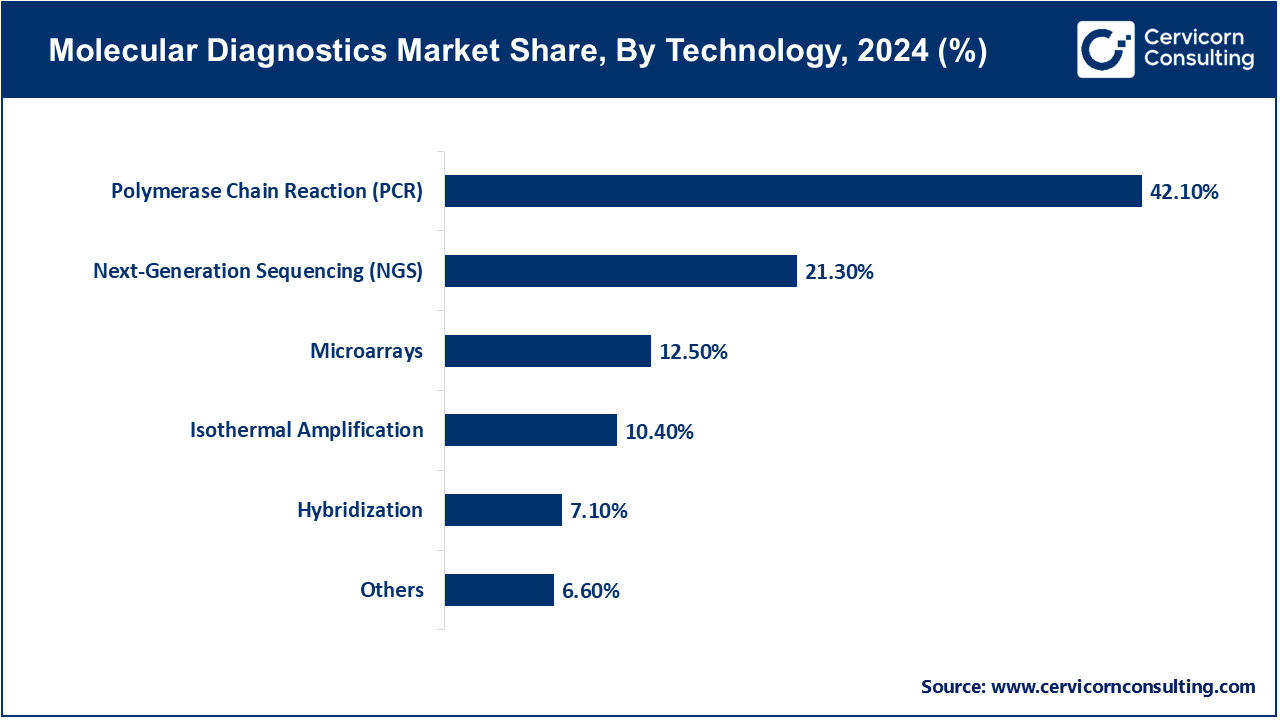

Polymerase Chain Reaction (PCR): PCR is the main backbone of molecular diagnostics, and it is extensively used in the detection of infectious diseases, cancer biomarkers, and hereditary diseases. The high sensitivity and specificity of the technology has seen it become an option of choice by hospitals and labs across the globe. By January 2025, several U.S. and European hospitals stated they were turning around COVID-19, influenza, and TB tests at higher rates following more complex real-time and multiplex PCR systems. By March 2025 Roche and Bio-Rad introduced updated PCR platforms, which allowed the company to deliver higher throughput and simplified workflows to both clinical and research applications.

Next-Generation Sequencing (NGS): NGS has enhanced the accuracy of medicine, providing an in-depth genomic profile in oncology, detection of rare diseases, and tracking of pathogens. As of June 2025, a number of NGS panel-based laboratories in North America and Europe were incorporated in personalized cancer therapies. Illumina and Thermo Fisher scientific companies implemented rapid sequencing workflows faster in May 2025, which enhance test accuracy and allow earlier treatment decisions. The adoption of NGS is also increasing in emerging markets, which helps to cover a larger area of molecular diagnostics.

Microarrays: Microarrays are commonly used in gene expression study, detection of mutations and chromosomal abnormalities. As of April 2025, high-density microarrays were reportedly used in academic and research institutes around the world to identify biomarkers and to use them in cancer diagnostics. In early 2025, Agilent Technologies and Affymetrix reported new microarray systems that have enhanced the sensitivity and density of the probe arrays, this boosted the detection of low-abundance targets in both research and clinical laboratories.

Isothermal Amplification: LAMP (Loop-Mediated Isothermal Amplification) and related techniques do not require thermocycling, so they are suitable as point-of-care and field diagnostics. In February 2025, a number of South-Eastern Asian and African clinics announced the successful implementation of isothermal amplification tests of malaria, dengue and COVID-19, shortening time-to-diagnosis and allowing faster treatment decisions. These assays remain low-cost and simple, thus remaining in use in the decentralized healthcare context.

Hybridization: Assays with hybridization identify specific sequences of DNA or RNA with labeled probes and are applied in cytogenetics, cancer research and in the study of infectious diseases. By March 2025, a number of laboratories in Europe and North America had adopted sophisticated hybridization applications to identify low-abundance genetic targets, to help diagnose or plan treatments earlier. New continuous innovations in the design of probes and augmentation of signals have attained test accuracy.

Other Technologies: New molecular diagnostics technologies, including CRISPR-based detection, digital PCR, and biosensors, are under consideration to provide the rapid highly precise testing. In May 2025, pilot tests in Europe and the Asia-Pacific region showed how CRISPR diagnostics could be used to detect pathogens at the point of care especially in areas with low lab capacity. Such technologies are slowly broadening the horizons of molecular diagnostics to the conventional ones.

Instruments: Diagnostic instruments are essential for molecular testing. Hospitals and labs have increasingly invested in compact, high-throughput instruments. In 2025, Roche and Thermo Fisher Scientific launched new rapid-testing platforms that improved accessibility and efficiency within clinical and decentralized settings. By the end of 2025, Roche and Thermo Fisher Scientific introduced new rapid testing platforms that improved accessibility and efficiency and could be used in decentralized clinical settings.

Market Share, By Product & Service, 2024 (%)

| Product & Service | Revenue Share, 2024 (%) |

| Instruments | 24.30% |

| Reagents & Kits | 60.50% |

| Software & Services | 15.20% |

Reagents & Kits: In molecular diagnostics, reagents and kits are crucial since they provide the necessary components for tests. By April 2025, companies introduced pre-validated kits for infectious diseases, oncology, and genetic testing. By simplifying the setup process, these kits decreased the potential for human error which, in turn, enhanced workflow and spurred adoption in hospitals and point-of-care facilities.

Software & Services: Software solutions, particularly those that focus on AI-assisted diagnostics and laboratory information management systems (LIMS), provide automated workflow systems that help test interpretation and reporting. By June 2025, many AI-enabled platforms that improved precision, reduced error margins, and refined clinical decision-making were adopted in healthcare systems across Europe and North America.

Infectious Disease Testing: Clinical settings are increasingly using molecular diagnostics to help with rapid identification of viruses, other pathogens, and bacteria. By March 2025, the most recent PCR and isothermal amplification systems were used in hospitals and remote clinics to identify COVID-19 variants, influenza, and tuberculosis. This rapid identification preformed proactive responses to treatment, and it improved treatment outcomes and outbreak management.

Oncology: As of mid-2025, there has been a substantial increase in the use of oncology diagnostic testing across Europe and North America, fueled by the adoption of NGS and PCR-based technologies. Labs began using comprehensive multi-gene panels on a routine basis, which, alongside other precision medicine components such as targeted therapies and monitoring, greatly increased the demand.

Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Infectious Disease Testing | 45.30% |

| Oncology | 22.60% |

| Genetic Testing | 14.20% |

| Pharmacogenomics | 10.50% |

| Others | 7.40% |

Genetic Testing: Genetic testing can identify hereditable conditions as well as rare diseases, and facilitate prenatal screening. By April 2025, a number of diagnostic centers in India and Southeast Asia began to increase the scope of their prenatal and pediatric genetic testing. This was supported by the use of NGS and microarrays, which improved turnaround times and allowed clinicians to make timely interventions.

Pharmacogenomics: In the field of molecular diagnostics, pharmacogenomics analyzes genetic variations that determine a person's response to drugs. This is used to formulate a personalized treatment plan. As of May 2025, there has been a growth in the adoption of pharmacogenomics in oncology, cardiology, and psychiatry, with clinicians customizing treatments using lab results integrated with EHRs.

Others: Things such as testing for autoimmune diseases, checking organ transplant compatibility, and profiling for antimicrobial resistance are also uses. By June 2025, these expanded the reach of molecular diagnostics as specialized labs around the world added these tests into their regular workflows.

Hospitals & Clinics: Hospitals and clinics implement molecular diagnostics to facilitate rapid and accurate diagnoses, ongoing monitoring, and personalized treatment plans. These facilities increasingly utilize point-of-care (POC) molecular testing, which enables physicians to make clinical decisions in real time. By March 2025, many hospitals across North America, Europe, and parts of Asia will have made significant investments in advanced POC instruments and expanded laboratory infrastructure. These advancements have increased access to molecular diagnostics in both urban centers and rural healthcare settings, allowing for the rapid identification of infectious diseases, cancer markers, and genetic disorders.

Diagnostic Laboratories: Standalone diagnostic laboratories that focus on high-volume testing play a significant role in detecting diseases, including infectious diseases, cancer, and genetic disorders. By May 2025, numerous labs in Europe and North America will have expanded their facilities with high-throughput automation and AI-assisted molecular diagnostics. The combination of these technologies will optimize workflows, minimize human error, and improve turnaround time, enabling the laboratory to process higher volumes of samples. In addition, these laboratories are increasingly providing specialized testing services to support external hospitals and clinics, which promotes broader use of molecular diagnostics.

Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Hospitals & Clinics | 40.20% |

| Diagnostic Laboratories | 34.60% |

| Academic & Research Institutes | 14.70% |

| Others | 10.50% |

Academic & Research Institutes: Institutes use molecular diagnostics for advanced studies in genomics, epidemiology, and biomarker detection. As of April 2025, research facilities, including those in Europe, North America, and the Asia-Pacific regions, adopted NGS and microarray technologies for studies in clinical research and experimental studies. This use deepens the understanding of disease mechanisms, uncovers new therapeutic targets, and helps create new diagnostic tools. Joint research between universities and healthcare providers has also enhanced translational research which is the conversion of research into real-world medicine.

Other: Molecular diagnostics is also used by government health agencies, the pharmaceutical industry, and biotechnological companies for public health surveillance, R&D, and the management of clinical trials. Implementation of large-scale disease monitoring, outbreak detection, and real-time epidemiological studies using molecular diagnostics was adopted by several agencies within Asia and Europe by June 2025. Pharma and biotech companies primarily focus on patient stratification, monitoring therapeutic efficacy, and streamlining clinical trial processes. Molecular diagnostics has become more intertwined with clinical and biotech research proving its value in innovative drug development.

Market Segmentation

By Technology

By Product & Service

By Test Location

By Application

By End User

By Region