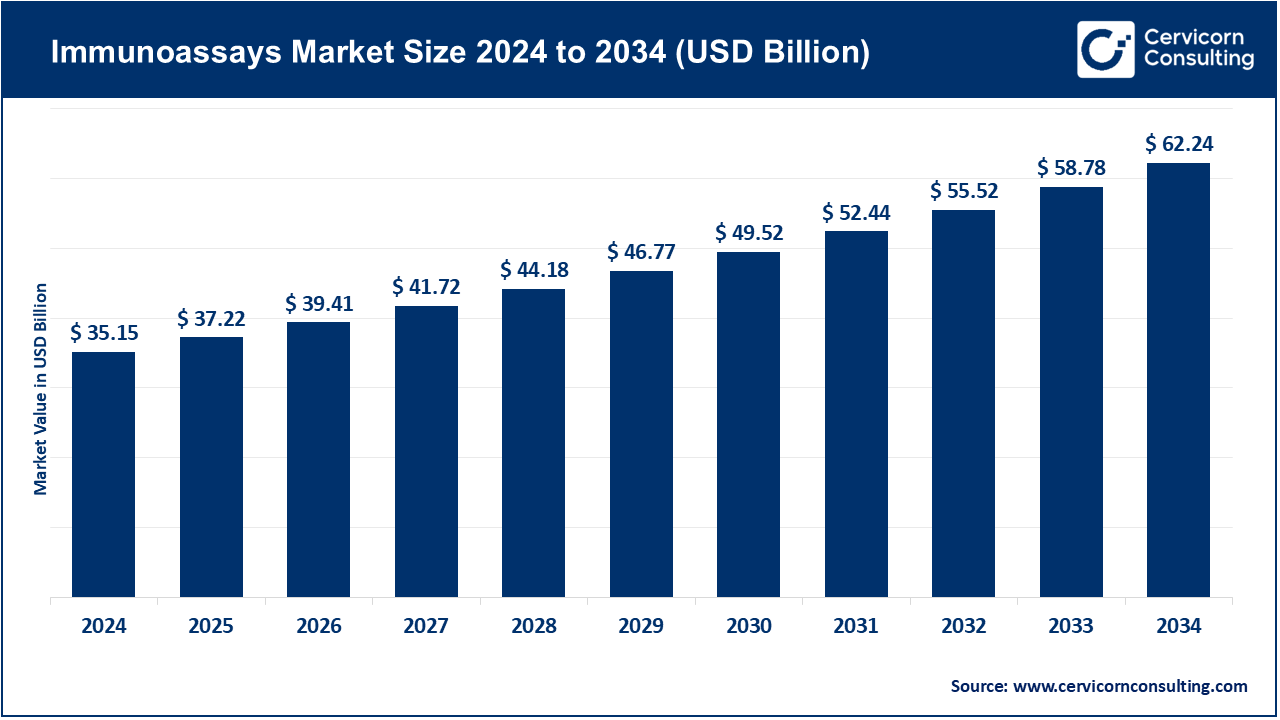

The global immunoassays market size was valued at USD 35.15 billion in 2024 and is expected to be worth around USD 62.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.88% over the forecast period 2025 to 2034. The immunoassays market is growing at an impressive rate due to the increased demands of the accurate, fast, and scalable diagnostic solutions in a healthcare setting. In contrast to the conventional approaches to testing, immunoassays have to strike the right balance between accuracy and sensitivity, on the one hand, and accessibility and speed, on the other, which cannot be done without in the context of the management of infectious diseases, chronic illnesses, and personalized medicine. Manufacturers are also embracing sustainable and patient-centered findings, including environmentally friendly assay kits, automation-compatible systems, and point-of-care directions, which are convenient but, at the same time, do not affect the accuracy.

Simultaneously, the digitalization of healthcare ecosystems is turning immunoassays into interconnected applications, which provide real-time analytics, cloud-based data sharing and even predictive analytics generated by AI. As telemedicine, home diagnostics, and the availability of the market are growing concurrently, immunoassays are becoming smart, sustainable, and interactive. At the time when the level of competition is high, the development of such technologies will support the effectiveness, improve patient outcomes, and solidify the transition to a more aware and resilient global healthcare sector.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 37.22 Billion |

| Expected Market Size in 2034 | USD 62.24 Billion |

| Projected CAGR 2025 to 2034 | 5.88% |

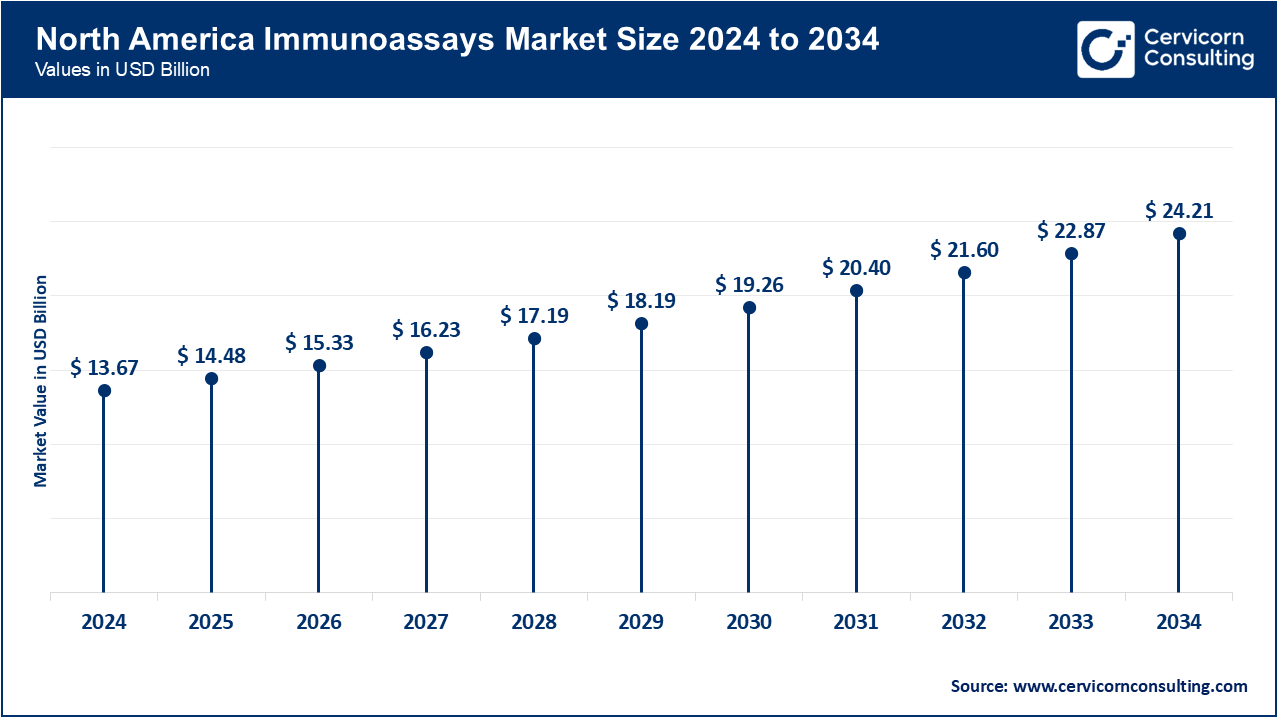

| Leading Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Products, Technology, Specimen, Application, End Users, Region |

| Key Companies | Abbott, BD, Beckman Coulter, Inc., BIOMÉRIEUX, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, QuidelOrtho Corporation, Siemens Healthiness AG, Sysmex Corporation, Thermo Fisher Scientific Inc. |

The immunoassays market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America leads in adopting immunoassays thanks to sophisticated healthcare systems, rigid policies, and attention to detail in health care. Hospitals and diagnostic facilities automate oncology and cardiology immunoassays rapidly. In August 2025, to boost turnaround times and broaden test capabilities, the Cleveland Clinic modernized its labs with next-gen CLIA-based analyzers. This region enjoys high R&D spending, government disease prevention policies, and the growing role of immunoassays in personalized medicine.

In Europe, the formulation of healthcare policies and practices funnel attention to standardization, adherence to EU-approved green lab practices, and other sustainable policies. This region pioneered chemiluminescence and multiplex immunoassays in oncology and attended disease research. At Interpack 2025, Hinojosa Packaging Group exhibited its FSC-certified eco-friendly Halopack and Sumbox systems. Such packaging, which conforms to the EU's emphasis on technical validation, `certified, eco-friendly, and improved technologies, builds on the Europe-wide trend of diagnostics technology certification. Europe's expansion of CLIA and AI-enhanced immunoassays is further evidence of its dominance in precision diagnostics.

The Asia-Pacific region is accelerating growth due to high levels of urban migration, growing investment in healthcare, and diagnostic expansion to tier II, III, and IV cities in China and India. Due to the sheer size of the population and the necessity for inexpensive healthcare solutions, rapid and point of care immunoassays are in high demand. QuidelOrtho launched rapid immunoassay kits for the Asia region in July 2025 for use in the quick diagnosis of respiratory infections. This was an innovative response to the problem of seasonal outbreaks and is an example of the localization of design. The region’s enthusiasm for the digitization of healthcare and precision diagnostics also encourages rapid adoption.

Immunoassays Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38.90% |

| Europe | 27.20% |

| Asia-Pacific | 23.60% |

| LAMEA | 10.30% |

The LAMEA region is an advancing market due to the growth of pilot programs and increased awareness and diagnostic capabilities in Brazil, South Africa, and the Gulf regions. Although adoption is much slower in comparison to North America and Europe, the modernization of healthcare systems is increasing the demand for effective diagnostic tools. In June 2025, South African researchers validated community health program dedicated immunoassay kits for HIV and hepatitis diagnostic testing. LAMEA is burdened with many infectious diseases and is slowly improving its laboratory facilities, therefore there is much untapped growth in this region.

Reagents & Kits: The consumables of any immunoassay are reagents and kits such as antibodies, detection substrates, conjugates, standards, and ready to use diagnostic kits. They are consumable yet a necessity in all tests hence the greatest source of recurrent revenue in this market. They have wide usage in the hospital diagnostics, point-of-care testing and research laboratories. Here innovation is directed towards enhancing the sensitivity, stability of the assays and environmental friendliness by designing the kits in an environmentally friendly manner. A good example of how reagent innovation is directly related to life-saving diagnostics is the release, in July 2025, of new high-sensitivity cardiac troponin reagent kits that are designed to be able to detect heart attack signs earlier to prevent more lives.

Immunoassays Market Share, By Product, 2024 (%)

| Product | Revenue Share, 2024 (%) |

| Reagents & Kits | 56.60% |

| Analyzers/Instruments | 32.30% |

| Software & Services | 11.10% |

Analyzers/Instruments: All the hardware platforms where immunoassays are executed are analyzers and instruments. These are the fully automated systems that can operate high volumes of samples, semi-automated products that can be used in the middle-sized laboratories, and portable devices that can be used in the near-patient testing. They lower the number of human errors, increase throughput and can be integrated with laboratory information systems. Their significance is increasing with the need to have a faster turnaround in large diagnostics centers and hospitals. Abbott has been expanding its Alinity i analyzer family in Europe in June 2025, with new features of advanced automation, easy-to-use workflows, and connectivity to digital labs, demonstrating how analyzers are becoming the focal point of any diagnostic lab.

Software & Services: As labs move to digital-first operation, software and services are becoming more important. These solutions take care of the interpretation of results, quality monitoring, connectivity of instruments and cloud databases, and incorporation of AI-based analytics. Training and maintenance, and support in assay optimization are usually included as services. They assist labs in being in compliance with the regulatory requirements and enhancing the accuracy of the diagnosis. In May 2025, Siemens Healthineers announced an AI-based immunoassay software package to minimize false positives and automate the calibration process and become connected to hospital EMRs to demonstrate that software is now just as significant as the assays.

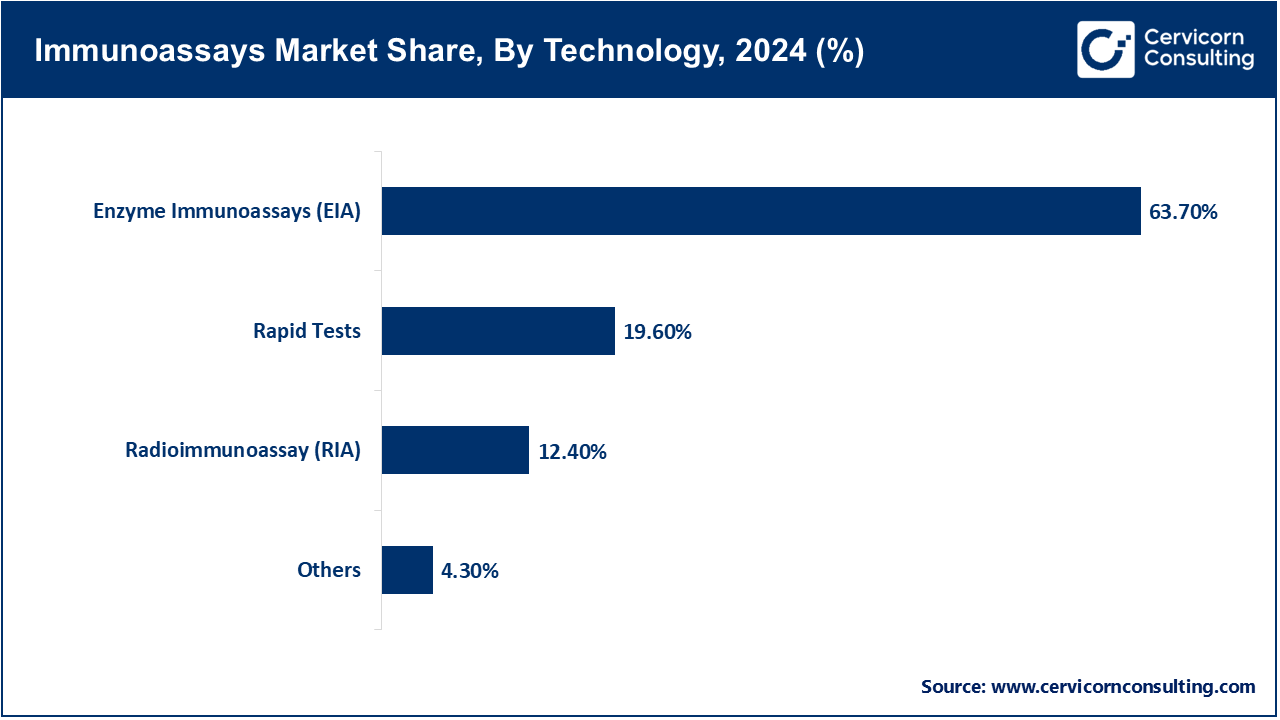

Radioimmunoassay (RIA): Radioimmunoassays are sophisticated analytical techniques used to quantify extremely minute amounts of hormones and drugs and these assays employ antibodies and antigens of known (radio)active isotopes and are able to obtain reliable attenuation data. Although its implementation is waning due to the health ramifications associated with the isotopic radiation used in the procedure, it is unsurpassed in the domain of endocrinology and pharmacology within research settings. This is precisely the case even today in the scenarios where ultra high sensitivity is necessary. In March 2025, a group of Japanese researchers modernized the practices of RIA for the analysis of thyroid hormones in order to have maximal precision with optimal radiation, which has further demonstrated the clinical relevance of RIA within a certain domain of the clinical setting.

Enzyme Immunoassay (EIA): EIA is one of the more commonly used forms of immunoassay technology and entails ELISAs as well. It concentrates on the calculating the amount of optical density produced in the reaction whereby a substrate is acted upon enzymatically after a primary and then a secondary antibody is added. EIA in the context of RIA is used particularly for its economic, scalable, and multifaceted aspects regarding the diagnosis and or disgnostic research within infectious diseases, hormones and autoimmunity. EIA is deeply embedded in research laboratories for the validation and ascertainment of certain biomarkers as well. In April 2025, Bio-Rad Laboratories issued innovative EIA kits for the purpose of monitoring Hepatitis patiennts which has demonstrated and marked the importance of EIA for monitoring and surveillance of global programs related to infectious diseases and has also further demonstrated the importance of enzyme based immunological techniques in mass screening.

Chemiluminescence Immunoassays (CLIA): An attachment to Chemiluminescence Immunoassays (CLIA) has clinical significance and a benchmark which provides value for sensitive high scales monitoring of luminescent signals. Its efficiency and accuracy makes it a dominant choice for hospitals and laboratories processing huge amounts of patients. Mindray launched its new CLIA analyzer in August 2025 for the Asia-Pacific region, it provided oncology biomarker systems for more precise and earlier cancer detecting & diagnostics, suggesting the growing role of CLIA in cancer diagnostics.

Fluorescence Immunoassays (FIA): FIA utilizes fluorescent-labeled antibodies and detection systems, which allow for parallel processing of more samples. FIA is particularly useful in the diagnostics of infectious diseases and in respiration, where a timely and precise result is essential at the point of need. Its major advantage is at the point of need, when rapid and precise results are required in small or moderate sized laboratories. With the introduction of rapid diagnostic kits targeted at the detection of respiratory viruses, QuidelOrtho also expanded its FIA portfolio. These kits provided point-of-care diagnostics during peak flu periods, which reinforced FIA’s significance in respiratory care.

Rapid Tests: Rapid tests serve as innovative immunoassays that are meant for real-time diagnostics, portable, and designed to generate results within a short timeframe and independently of laboratory operations. Such tests are critical for home testing, urgent care, and remote healthcare services. Tests of this kind gained popularity for their role in the COVID-19 pandemic and are now in demand for diagnosing other infectious diseases. In June 2025, BD confirmed the addition of RSV antigen rapid test kits to their respiratory test lineup, enabling more rapid RSV testing and diagnosis to complement respiratory testing for warmer months.

Others: This encompasses more current technologies like multiplex bead-based assays and electrochemiluminescence that enable the simultaneous detection of multiple analytes and are more frequently applied in research, oncology, and infectious disease diagnostics requiring high throughput. In April 2025, Meso Scale Diagnostics brought additional workflow efficiency and testing time reduction in busy laboratories by extending the range of its multiplex electrochemiluminescence assay platform to detect multiple infectious disease biomarkers in a single run.

Blood: Blood spans many proteins and disease biomarkers, and retains the most substantial value in diagnostics because of its comprehensiveness across diverse observable parameters. Virtually every hospital in the world operates using blood as the default sample in immunoassays. Blood as a specimen entered a new epoch in August 2025, when Abbott’s new expansion for CLIA oncology panel approvals significantly aided in earlier cancer detection, and proved blood’s seamless value in clinical examinations.

Saliva: Saliva as a specimen has also seen an increase in usage, slower than blood but noticeable nonetheless. Bloodless testing, especially immunochemistry, is becoming more popular as a result of the specimen’s simple collection and less invasive nature. Saliva is used for the diagnosis of fever, hormonal changes, and increasingly in mental illness. One of the biggest advancements in mental health diagnostics came in July 2025 when a group of researchers from the UK developed stress management systems aided by real time monitoring of cortisol levels using saliva, effectively replacing more invasive methods.

Immunoassays Market Share, By Specimen, 2024 (%)

| Specimen | Revenue Share, 2024 (%) |

| Blood | 67.30% |

| Saliva | 11.10% |

| Urine | 16.40% |

| Others | 5.20% |

Urine: Urine has been used for other limbs of medicine, but its use in urine sample collection for an immunoassays is primary for the diagnosis of: drugs, pregnancies, and some infectious diseases. Immunoassays using urine are in wide use especially as specimen for monitoring therapeutic drugs. We also saw another leap in practice in medicine with bioMerieux’s new kits that had been on the market for a long time in May 2025. Clinicians could help patients more with the new kits that had a reduced time for results and more accurate diagnoses for urinary tract infections.

Others: Specialized diagnostics utilize other materials such as cerebrospinal fluid, various tissues, and different types of swabs. These are important for neurology, oncology, and even the tracking and surveillance of infectious diseases. In June of 2025, some researchers in Germany presented the use of immunoassays based on cerebrospinal fluid for the early detection of Alzheimer‘s disease, which serves as an example of the expansion of diagnostics for neurodegenerative diseases.

Therapeutic Drug Monitoring: It is vital to avoid toxicity or under-dosing, and this application keeps the drugs within therapeutic levels. Oncology, transplant, and certain antibiotics are other areas where this application is overly crucial. In April 2025, Thermo Fisher continued to support precision medicine by broadening the scope of its immunoassay-based therapeutic drug monitoring solutions to biologic drugs.

Oncology: Oncology-focused immunoassays to assess disease progression, personalize treatment, and detect tumor markers are crucial for precision oncology. They continue to gain more utility value in early cancer screening. In August 2025, the role of immunoassays in oncology deepened when Roche introduced a new CLIA-based PSA immunoassay to support screening for prostate cancer.

Cardiology: Cardiology applications focus on diagnosing heart disease, heart failure, or myocardial infraction by detecting certain troponins and BNP. In July 2025, Beckman Coulter improved the outcomes of critical care by launching high-sensitivity troponin immunoassays that enabled emergency rooms to more rapidly identify heart attack patients.

Endocrinology: Endocrinology disorders are often diagnosed and managed through the measurement of certain hormones by immunoassays, including thyroid, insulin and cortisol. In May 2025, DiaSorin further advanced the precision of endocrinology testing solutions by introducing new thyroid hormone EIA kits.

Infectious Diseases Testing: This segment is among the largest consumers of immunoassays, and applies them to HIV and hepatitis, respiratory illnesses, and other infectious diseases threats. Abbott extended its HIV and hepatitis assay portfolio in Africa in June 2025, reinforcing the global health programs’ reliance on immunoassays.

Autoimmune Diseases: Autoimmune disorders such as lupus, celiac disease, and rheumatoid arthritis are associated with the production of aberrant autoantibodies which can be used as markers for diagnosis. These tests are crucial for disease diagnosis and management. In March 2025, Werfen launched an autoimmune immunoassay panel in Europe for primary rheumatology care, widening the market for rheumatology specialists.

Others: This includes allergy testing, monitoring of ovulation and other aspects of fertility, assessments for certain neurological disorders, and some veterinary applications. In April 2025, Euroimmun launched multiplex allergy immunoassay systems to the market, which can resolve the diagnostics of multiple allergens to be tested at once, significantly improving the efficiency of allergy diagnostics.

Hospitals: The application of immunoassays in the departments of emergency care and routine diagnostics in addition to the continuous monitoring of patients, secures hospitals as the primary customers of the technology. Automated immunoassay analyzers are rapidly adopted for their need of high volume, high accuracy testing. In August 2025, the addition of CLIA-based analyzers at the Cleveland Clinic’s diagnostic labs streamlined turnaround times and broadened testing capabilities, servicing their newly adopted model of diagnostic CLIA-based analyzers ultrasound.

Immunoassays Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Hospitals | 50.20% |

| Laboratories | 44.10% |

| Others | 5.70% |

Laboratories: High volume immunoassay testing in diagnostic chains and reference laboratories serves multiple fields such as oncology, infectious disease, and endocrinology. They are sustained by automated and scalable solutions. In June 2025, Quest Diagnostics expanded their immunoassay capacity to address demand, using automated analyzers to manage the increased volume of infectious disease testing.

Others: Academic institutions, Point of care (POC) settings, and Contract Research Organizations (CRO) employing immunoassays for non-hospital diagnostics and clinical trials are pioneers in this field. As an example, in July 2025 Stanford University purchased saliva-based immunoassay technology to detect mental health biomarkers for clinical trials, demonstrating how immunoassays are crossing the boundaries of traditional clinical usage and diving into pioneering domains of healthcare.

Market Segmentation

By Products

By Technology

By Specimen

By Application

By End Users

By Region