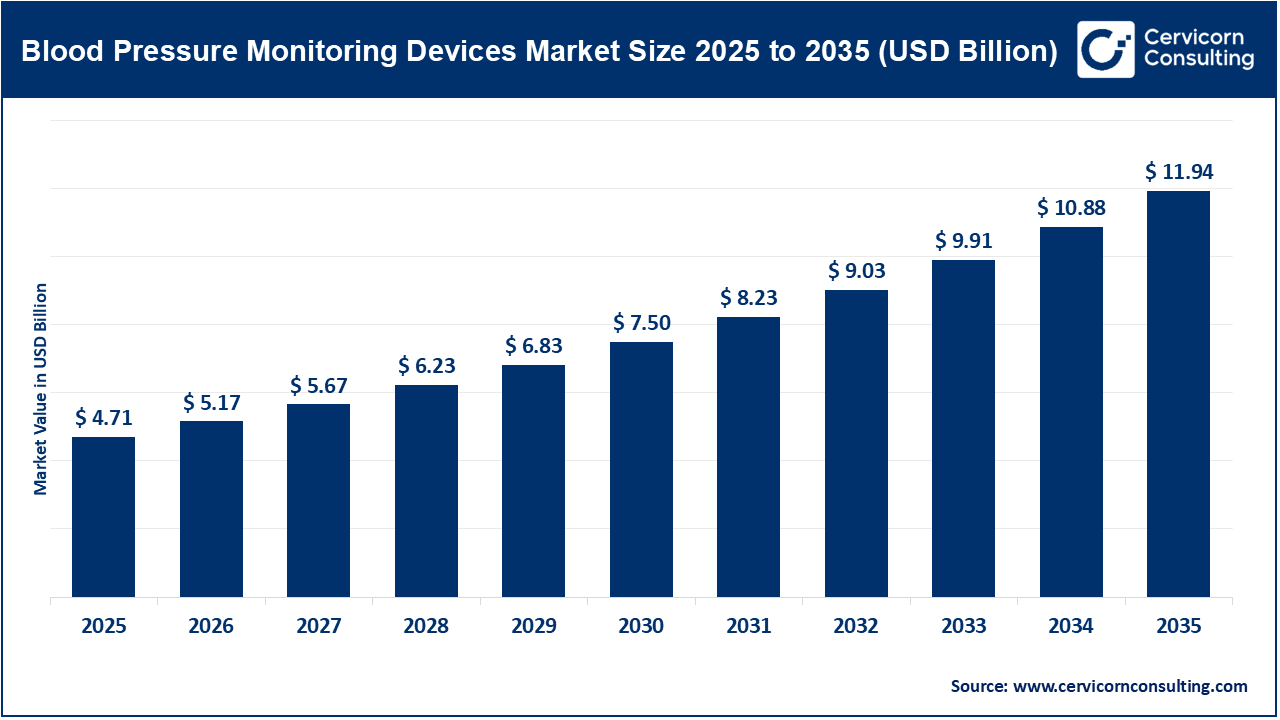

The global blood pressure monitoring devices market size was valued at USD 4.71 billion in 2025 and is expected to be worth around USD 11.94 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.7% over the forecast period from 2026 to 2035. The blood pressure monitoring devices market is expanding rapidly as more people focus on heart health and cases of hypertension continue to increase. Both hospitals and home users are driving demand, especially with the shift toward remote patient monitoring. New wearable and wireless devices, often powered by AI and connected to mobile apps, are gaining popularity because they’re easy to use and offer accurate, real-time readings. This trend is also supported by improved healthcare infrastructure, the rise of telemedicine, and government programs promoting preventive care.

At the same time, healthcare systems worldwide face a shortage of skilled workers, especially nurses and technicians trained to operate modern monitoring equipment. This gap is expected to widen through 2030, particularly in aging countries with fewer healthcare professionals available. Despite these staffing challenges, the demand for reliable blood pressure monitoring devices will continue to grow. Lifestyle-related illnesses, increased use of digital health tools, and the expansion of remote monitoring programs will keep driving demand, likely outpacing the supply of skilled workers capable of managing the data.

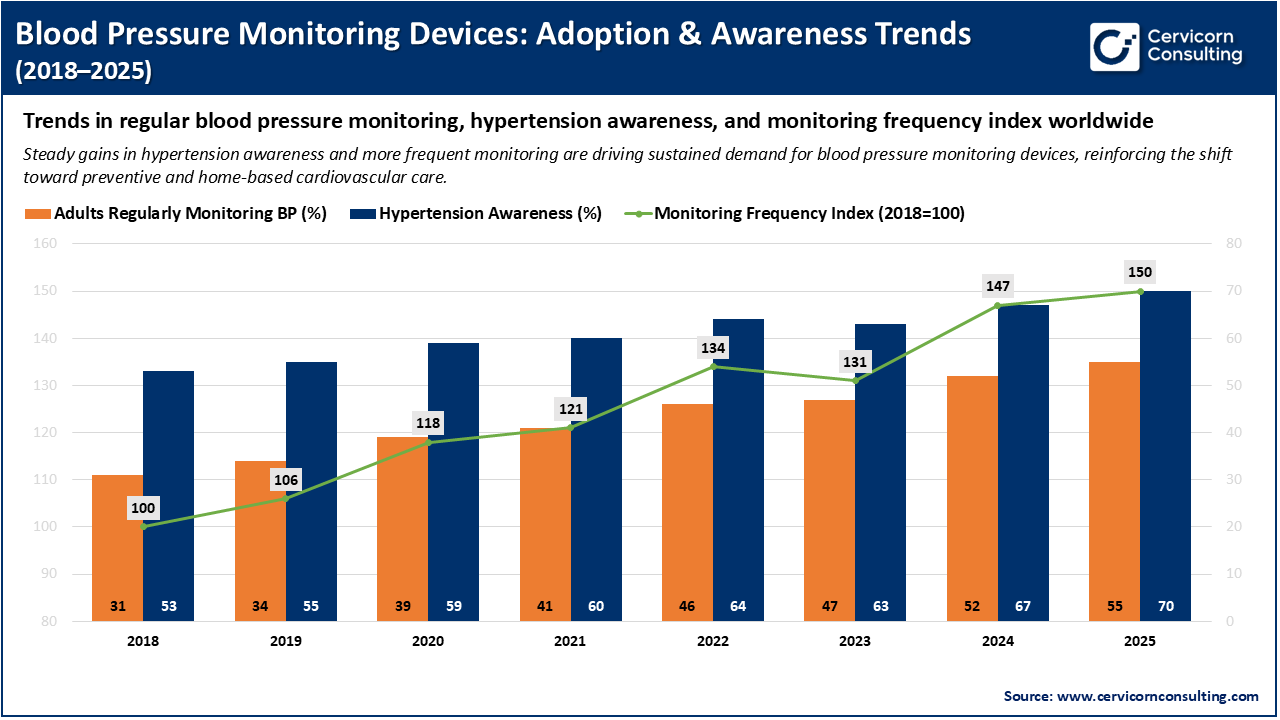

Blood Pressure Monitoring Devices: Adoption and Awareness Trends (2018–2025)

The adoption of blood pressure monitoring devices has shown a steady increase from 2018 to 2025, primarily due to rising awareness of hypertension and a notable shift toward more frequent monitoring practices. The proportion of adults who regularly monitor their blood pressure continues to grow, accompanied by improved awareness levels, which reflects a greater emphasis on preventive healthcare. Furthermore, the significant rise in the monitoring frequency index suggests that users are not only acquiring these devices but are also utilizing them more frequently. These factors together are expected to drive sustained demand for blood pressure monitoring devices in the global market.

Recent Developments of Market

1. Wearable & Connected Devices Transform Home Healthcare Monitoring

The shift toward connected home devices and remote patient monitoring is expected to speed up in 2025 with the launch of cuffless and wearable blood pressure (BP) monitors. These devices utilise mobile connectivity along with flexible, lightweight sensors to continuously and accurately measure BP in real time as people go about their daily routines, adjusting readings based on activity level. Increasing adoption of wearable BP monitors across Asia, Europe, and the U.S. has resulted in the development of devices capable of providing highly accurate measurements during almost any activity. Consequently, they are viewed as one of the most important technological advances in BP monitoring so far.

2. AI-Enabled Predictive Analytics Enhances Clinical Decision-Making

The use of AI-powered algorithms in blood pressure monitoring devices expanded considerably in 2025 and now provides predictive analytics that assist healthcare providers in managing hypertension and detecting cardiovascular risks. Connected home-care devices have been widely adopted by healthcare organizations, creating more opportunities to enhance patient compliance and reduce hospital readmission rates. The combination of machine learning–based analytics and highly accurate monitoring hardware is one of the fastest-growing segments in the market and is projected to grow steadily through 2035.

3. Telemedicine and Remote Monitoring Drive Device Standardization

The rapid growth of telehealth services has led manufacturers to create interoperable, cloud-ready blood pressure monitors that easily connect with major telehealth platforms. These standardized connectivity protocols have enhanced device communication with electronic health records (EHRs), allowing for a smooth consultation experience between patients and clinicians and supporting the shift toward preventive healthcare. This trend is likely to remain a key driver of the global market over the next decade.

4. Sustainability and Eco-Friendly Device Manufacturing Gain Traction

Manufacturers are increasingly adopting eco-friendly production methods, including recyclable plastics, low-power components, and environmentally conscious packaging. During 2025–2026, several major companies publicly committed to reducing their products’ carbon footprint and electronic waste. Organizations that meet these sustainability standards are likely to benefit from regulatory incentives in regions like the EU and North America, providing them with a competitive advantage.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 5.17 Billion |

| Market Size in 2035 | USD 11.94 Billion |

| CAGR form 2026 to 2035 | 9.70% |

| Dominant Region | Asia-Pacific |

| Key Segments | Product Type, Technology, Distribution Channel, Application, End User, Region |

| Key Companies | Omron Healthcare, Inc., Koninklijke Philips N.V., A&D Company, Limited, Welch Allyn, Microlife Corporation, GE HealthCare, Beurer GmbH, SunTech Medical, Withings, iHealth Labs Inc. |

The blood pressure monitoring devices market is segmented by region into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

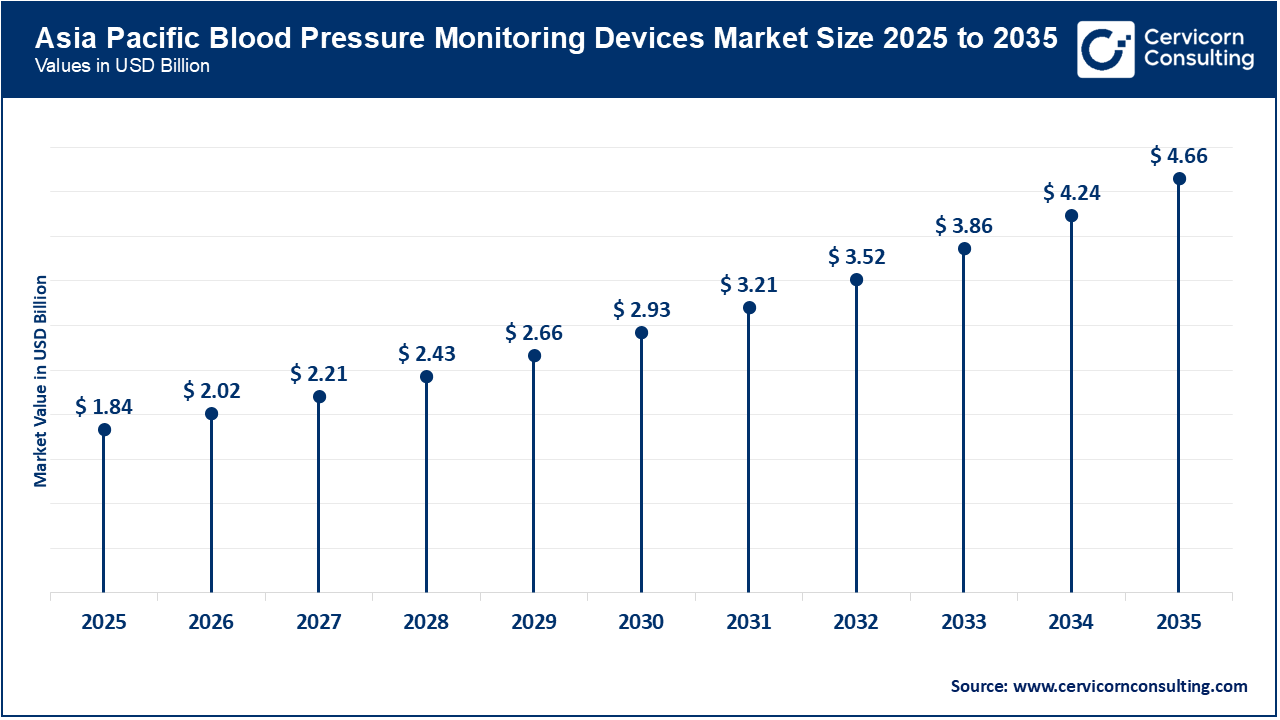

The Asia-Pacific blood pressure monitoring devices market size was valued at USD 1.84 billion in 2025 and is expected to hit around USD 4.66 billion by 2035. Asia Pacific is the largest and fastest-growing region due to rising rates of hypertension and the adoption of digital health care solutions. The region is projected to be the largest market and the fastest growing in blood pressure monitoring devices worldwide by revenue in 2025, based on available data. This growth is driven by aging populations, increasing numbers of people developing hypertension, the emergence of a middle-class, and improvements in healthcare accessibility.

Countries such as China, India, Japan, and South Korea currently have high demand for both clinical and home-based blood pressure monitoring systems. The region continues to see rapid growth in the adoption of wearable and connected blood pressure monitors due to increased smartphone use and government digital health initiatives. Additionally, ongoing investments in healthcare infrastructure and greater awareness of preventive health measures are key factors fueling market growth.

Recent Developments:

The North America blood pressure monitoring devices market size was estimated at USD 1.32 billion in 2025 and is predicted to hit around USD 3.34 billion by 2035. The North American market is the largest globally for blood pressure monitors. This is because North America has a well-developed healthcare system, high health awareness, and a strong acceptance of new technology in healthcare. The USA leads this region with the highest rates of hypertension and heart disease.

Connected and smart blood pressure monitors used in maternal/childcare and remote monitoring markets are gaining popularity in North America. Growth is supported by factors such as favourable reimbursement policies for second opinions, widespread telehealth services, and a dense presence of major medical device companies.

Recent Developments:

The Europe blood pressure monitoring devices market size was reached at USD 1.04 billion in 2025 and is projected to surpass around USD 2.63 billion by 2035. In Europe, the market for blood pressure monitors is still expanding but at a much slower pace. This is mainly because Europe has a higher proportion of older adults than any other region in the world and places a strong emphasis on disease prevention and the use of preventive healthcare services. The countries that drive demand for blood pressure monitors in Europe are Germany, France, the United Kingdom, and Italy. Due to the high incidence of hypertension and cardiovascular disease, these countries are at the forefront of diagnosing these conditions.

Recent Developments:

Blood Pressure Monitoring Devices Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 39% |

| North America | 28% |

| Europe | 22% |

| LAMEA | 11% |

The LAMEA blood pressure monitoring devices market was valued at USD 0.52 billion in 2025 and is anticipated to reach around USD 1.31 billion by 2035. The Latin American sector shows modest growth due to improvements in its healthcare system, increased awareness of heart health, and ongoing urbanization in the region. The largest markets for this product in Latin America are in Brazil and Mexico, where expanding hospital networks are boosting the use of home healthcare devices. The overall Latin American market is much smaller than those of other developed regions. However, recent increases in government healthcare spending, along with growing demand for affordable, automatic blood pressure monitors, are likely to sustain growth in this sector.

Furthermore, the Middle East and African sectors are also expanding thanks to increased government investments to strengthen healthcare systems. The rising prevalence of lifestyle-related diseases, such as hypertension, has further contributed to this trend. In particular, Saudi Arabia, the United Arab Emirates, and South Africa currently experience high demand for this product due to expanding hospitals serving their populations and the implementation of various national health screening programs.

Recent Developments:

The blood pressure monitoring devices market is segmented into product type, technology, distribution channel, application, end user, and geography.

Automated devices that measure blood pressure hold the largest share of the global market due to their reliability, speed, and ease of use. These machines are commonly found in hospitals, clinics, and home settings, making them popular among caregivers and individual consumers alike. These technologies support self-monitoring, reducing opportunities for human error and establishing clear patterns of hypertension.

Blood Pressure Monitoring Devices Market Share, By Product Type, 2025 (%)

| Product Type | Revenue Share, 2025 (%) |

| Automated Blood Pressure Monitors | 55% |

| Manual Blood Pressure Monitors | 26% |

| Wearable Blood Pressure Monitors | 19% |

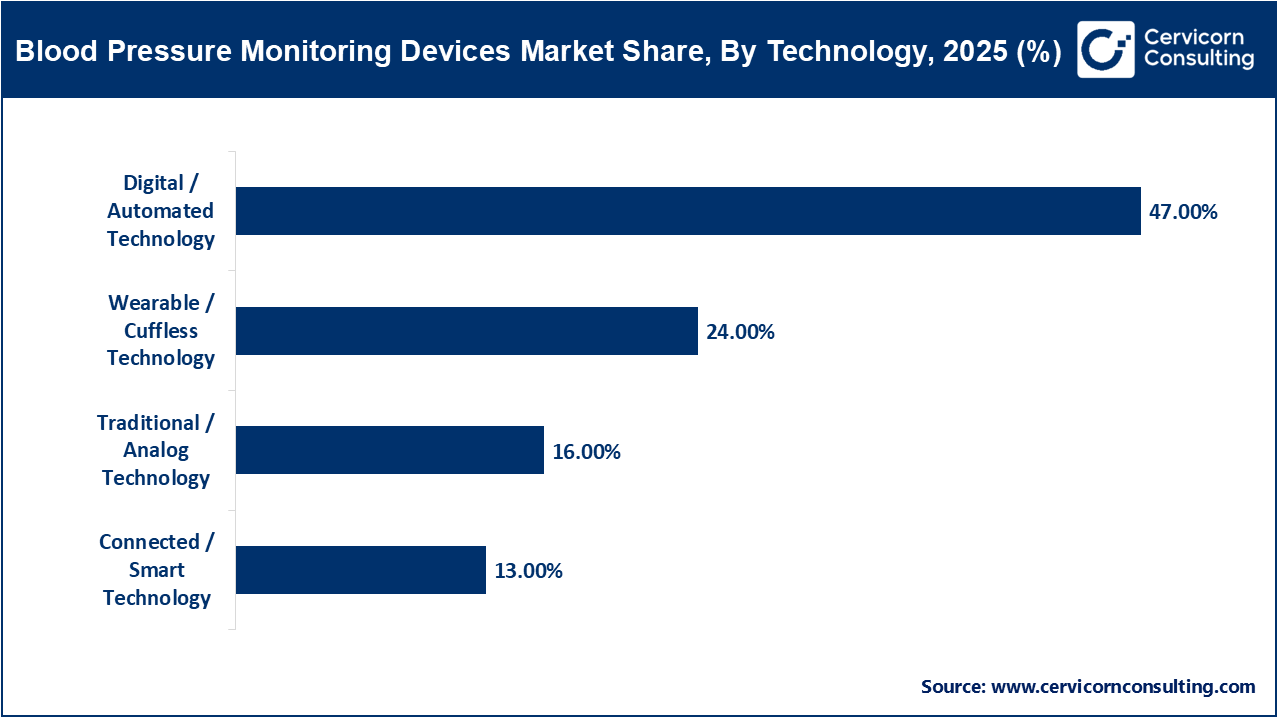

Wearable devices that measure blood pressure are currently the fastest-growing segment, driven by increased use of smartwatches and fitness trackers, as well as consumer demand for continuous personal healthcare monitoring. Additional factors contributing to the rapid growth of this segment include new technological developments in cuffless blood pressure measurement techniques.

Digital and automated blood pressure monitors are the dominant segments, generating the most revenue. Their widespread use has created demand both clinically and at home. Digital/Automated Blood Pressure monitors provide clearly displayed results, high accuracy, memory storage capacity, and ease of use; therefore, they are well suited for long-term management of elevated blood pressure (hypertension).

Connected Smart technology is a rapidly expanding segment of blood pressure monitors, primarily driven by the growth of telehealth, remote patient monitoring, and smartphone-integrated healthcare solutions. Connected & smart blood pressure monitors enable real-time communication between healthcare providers and patients, improving patients' ability to manage their health and overall disease management outcomes.

Retail pharmacies hold the largest market share due to their widespread presence, consumer trust, and immediate product availability. Pharmacist recommendations and over-the-counter access also boost sales through this channel.

Blood Pressure Monitoring Devices Market, By Distribution Channel, 2025 (%)

| Distribution Channel | Revenue Share, 2025 (%) |

| Retail Pharmacies | 40% |

| Online Platforms / E-commerce | 27% |

| Hospital Pharmacies & Institutional Sales | 21% |

| Direct Sales | 8% |

| Others | 4% |

Online platforms and e-commerce are the fastest-growing segments, driven by increased digital adoption, broader product selection, competitive prices, and the convenience of home delivery. The rise of direct-to-consumer medical device brands has further sped up this growth.

The clinical monitoring segment is the largest application market because taking a patient's blood pressure is a common diagnostic test in hospitals, clinics, and other locations. The large number of patients and the need for accurate, validated blood pressure readings contribute to significant ongoing demand from clinicians.

Blood Pressure Monitoring Devices Market, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Clinical Monitoring | 42% |

| Home Monitoring | 35% |

| Remote Patient Monitoring | 14% |

| Preventive Health Screening | 6% |

| Others | 3% |

The home monitoring application segment is growing at the fastest rate due to factors like the high prevalence of hypertension, the aging population, rising healthcare costs, and increasing awareness of preventive health care among patients. More patients want to monitor their chronic conditions from home to reduce hospital visits.

Hospitals and clinics comprise the largest part of the end-user segment due to the ongoing need to measure patients' blood pressure throughout the entire patient experience; from diagnosis to treatment and recovery. When using professional-grade BP monitoring devices, hospitals and clinics must ensure their devices meet accuracy and compliance standards, which drives the continued demand for clinical-grade BP monitors.

Blood Pressure Monitoring Devices Market, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Hospitals & Clinics | 45% |

| Home Healthcare / Home Use | 33% |

| Diagnostic Centers | 11% |

| Ambulatory Surgical Centers & Outpatient Clinics | 7% |

| Telehealth / Remote Monitoring Providers | 3% |

| Others | 1% |

The home healthcare and home use segment is the fastest-growing segment, fueled by the rising preference for self-monitoring, the availability of affordable BP monitoring devices, and the expanding remote healthcare services.

Omron Healthcare

Philips Healthcare

Welch Allyn (Hillrom / Baxter)

Microlife Corporation

By Product Type

By Technology

By Distribution Channel

By Application

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Blood Pressure Monitoring Devices

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.2.5 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand for High-Precision and Connected Blood Pressure Devices

4.1.1.2 Rapid Expansion of Telehealth and Remote Patient Monitoring

4.1.2 Market Restraints

4.1.2.1 High Costs of Advanced Devices and Technological Infrastructure

4.1.2.2 Regulatory Compliance and Standardization Challenges

4.1.3 Market Opportunities

4.1.3.1 Integration of IoT, AI, and Predictive Health Monitoring

4.1.3.2 Growing Demand in Emerging Healthcare Markets

4.1.4 Market Challenges

4.1.4.1 Shortage of Skilled Healthcare Professionals for Device Management

4.1.4.2 Supply Chain Constraints and Data Reliability Concerns

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Blood Pressure Monitoring Devices Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Blood Pressure Monitoring Devices Market, By Product Type

6.1 Global Blood Pressure Monitoring Devices Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

6.1.1.1 Automated Blood Pressure Monitors

6.1.1.2 Manual Blood Pressure Monitors

6.1.1.3 Wearable Blood Pressure Monitors

Chapter 7. Blood Pressure Monitoring Devices Market, By Technology

7.1 Global Blood Pressure Monitoring Devices Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

7.1.1.1 Digital / Automated Technology

7.1.1.2 Wearable / Cuffless Technology

7.1.1.3 Traditional / Analog Technology

7.1.1.4 Connected / Smart Technology

Chapter 8. Blood Pressure Monitoring Devices Market, By Distribution Channel

8.1 Global Blood Pressure Monitoring Devices Market Snapshot, By Distribution Channel

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

8.1.1.1 Retail Pharmacies

8.1.1.2 Online Platforms / E-commerce

8.1.1.3 Hospital Pharmacies & Institutional Sales

8.1.1.4 Direct Sales

8.1.1.5 Others

Chapter 9. Blood Pressure Monitoring Devices Market, By Application

9.1 Global Blood Pressure Monitoring Devices Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

9.1.1.1 Clinical Monitoring

9.1.1.2 Home Monitoring

9.1.1.3 Remote Patient Monitoring

9.1.1.4 Preventive Health Screening

9.1.1.5 Others

Chapter 10. Blood Pressure Monitoring Devices Market, By End User

10.1 Global Blood Pressure Monitoring Devices Market Snapshot, By End User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2035

10.1.1.1 Hospitals & Clinics

10.1.1.2 Home Healthcare / Home Use

10.1.1.3 Diagnostic Centers

10.1.1.4 Ambulatory Surgical Centers & Outpatient Clinics

10.1.1.5 Telehealth / Remote Monitoring Providers

10.1.1.6 Others

Chapter 11. Blood Pressure Monitoring Devices Market, By Region

11.1 Overview

11.2 Blood Pressure Monitoring Devices Market Revenue Share, By Region 2024 (%)

11.3 Global Blood Pressure Monitoring Devices Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Blood Pressure Monitoring Devices Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Blood Pressure Monitoring Devices Market, By Country

11.5.4 UK

11.5.4.1 UK Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Blood Pressure Monitoring Devices Market, By Country

11.6.4 China

11.6.4.1 China Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Blood Pressure Monitoring Devices Market, By Country

11.7.4 GCC

11.7.4.1 GCC Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Blood Pressure Monitoring Devices Market Revenue, 2022-2035 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Omron Healthcare, Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Koninklijke Philips N.V.

13.3 A&D Company, Limited

13.4 Welch Allyn

13.5 Microlife Corporation

13.6 GE HealthCare

13.7 Beurer GmbH

13.8 SunTech Medical

13.9 Withings

13.10 iHealth Labs Inc.