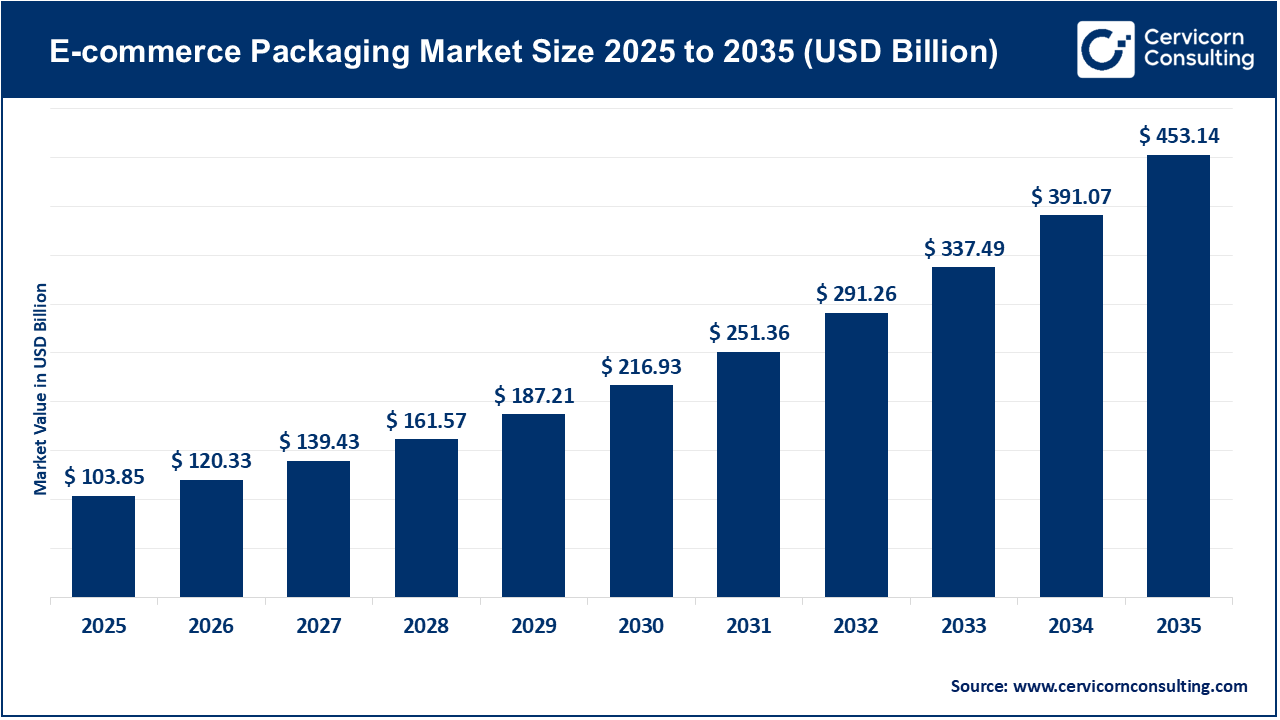

The global e-commerce packaging market size reached at USD 103.85 billion in 2025 and is expected to be worth around USD 453.14 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 15.9% over the forecast period 2026 to 2035. The growth of the e-commerce packaging market is primarily attributed to the ongoing expansion of online shopping and the resulting increase in shipment volumes. Currently, global e-commerce sales represent over 20% of total retail sales, which has led to a notable rise in parcel shipments each year. This trend has significantly increased the demand for durable and protective packaging, particularly in sectors such as electronics, cosmetics, and food, where preventing product damage is essential. Recent studies indicate that product damage and returns may account for as much as 10–15% of the total order value for online retailers, highlighting the importance of optimized packaging solutions.

Additionally, there is a marked shift toward sustainable and lightweight packaging, as more than 60% of consumers now prefer brands that utilize recyclable or eco-friendly materials. This has encouraged companies to adopt paper-based and biodegradable packaging options. Corrugated boxes continue to dominate the market due to their recyclability and cost-effectiveness, making them the preferred choice for most e-commerce shipments. At the same time, the demand for customized and branded packaging is rising, with nearly 40% of consumers reporting that premium packaging influences their decision to make repeat purchases and shapes their perception of the brand. It can be deduced that these evolving consumer preferences and operational requirements are set to further drive the growth of the e-commerce packaging market.

Explosive Growth of Online Retail GMV Driving the Market

The rapid increase in online retail Gross Merchandise Value (GMV) is a major factor driving the e-commerce packaging market. As online sales grow, each transaction results in more parcels that require protective and delivery-ready packaging. Global e-commerce GMV is rising at double-digit rates each year, and international markets are handling millions of packages daily. The expansion of online transactions across various product categories, including electronics and groceries, is increasing the consumption of packaging materials worldwide. This growth in order volumes is directly raising the demand for corrugated boxes, mailers, and protective wraps. As a result, the need for innovative and efficient packaging solutions is expected to grow along with the continued rise in e-retail activity.

Rising E-commerce Penetration Fueling Sustained Growth in the E-commerce Packaging Market

The steady increase in global retail e-commerce sales is significantly contributing to the growth of the e-commerce packaging market. As recent data shows, the share of e-commerce in total retail is expected to rise from approximately 18.8% to 22.6% between 2021 and 2027. This ongoing expansion results in a greater number of individual shipments, even as growth rates stabilize. Consequently, there is a rising demand for corrugated boxes, protective packaging, mailers, and tapes to accommodate frequent and smaller-sized deliveries. The increasing penetration of online retail is also encouraging companies to adopt right-sized, automated, and sustainable packaging solutions. This trend is likely to strengthen long-term demand for advanced packaging across fulfillment and logistics sectors.

1. L’Oréal’s EUR 100 Mn Sustainability Accelerator for Packaging Innovation

In early 2026, L’Oréal introduced its first accelerator program focused on sustainability, committing EUR 100 million over five years to support startups working on recyclable, biodegradable, and circular packaging solutions. These include fiber-based caps, materials derived from seaweed, and biodegradable wood packaging alternatives. The program is designed to speed up the development and market entry of advanced sustainable packaging technologies. As a result, innovation is being integrated into e-commerce supply chains, where environmental performance and brand differentiation are increasingly important for purchasing decisions.

2. China’s National Green Packaging Mandate for E-Commerce

China’s government has launched a Green Packaging Initiative that requires major online retailers to switch to recyclable, reusable, or compostable packaging formats and to report on material use and recovery by 2030. Since China’s e-commerce platforms process over 100 billion parcels each year, this policy is changing how packaging materials are chosen, recovered, and reused throughout the logistics chain. This is expected to drive widespread adoption of sustainable solutions and increase demand for packaging technologies that meet these requirements.

3. EU Packaging and Packaging Waste Regulation (PPWR) Implementation

The European Union adopted the Packaging and Packaging Waste Regulation (PPWR) in late 2024, with important provisions starting in 2025. This regulation sets consistent packaging sustainability requirements across member states and focuses on reuse, recyclability, and reducing waste. For e-commerce brands selling in the EU, these rules provide a strong reason to redesign packaging portfolios. This is likely to encourage innovation, support the use of circular materials, and lead to more investment in recyclable and lightweight packaging that meets regulatory standards.

4. CMC Packaging Automation’s Advanced Automated Systems Rollout

CMC Packaging Automation, a leading packaging technology provider, introduced several advancements at industry events in 2024 and 2025, such as the CartonWrap DUO and the AI-enabled Genesys Prima system. These solutions optimize right-sized box production, reducing material usage by up to 50% and adhesive use by up to 70%. As a result, e-commerce fulfillment centers are able to reduce waste, increase throughput, and lower operational costs. These developments are expected to strengthen the case for automated, sustainable packaging and support wider adoption across logistics networks.

The e-commerce packaging market is segmented into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America e-commerce packaging market size was valued at USD 28.45 billion in 2025 and is predicted to grow around USD 124.16 billion by 2035. The North America is experiencing significant growth due to the widespread adoption of online retail, advanced logistics infrastructure, and an increasing focus among companies on sustainability and packaging efficiency. Major e-commerce platforms, including Amazon, are implementing right-sizing technologies and working to reduce single-use plastics. For example, Amazon has reported a 16% reduction in plastic packaging use by expanding the use of paper and recyclable materials. Rising consumer expectations for sustainability and convenience are further driving the adoption of recyclable boxes, mailers, and automated fulfillment systems across the region.

Recent Developments:

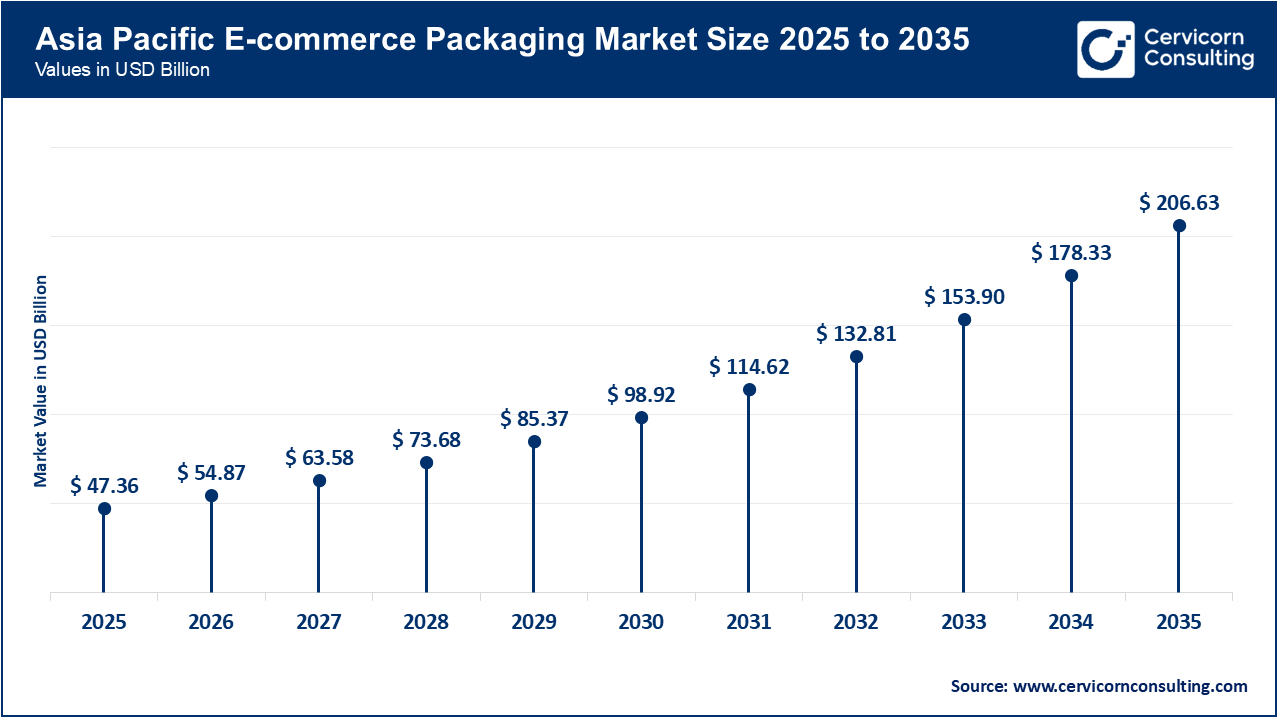

The Asia-Pacific e-commerce packaging market size was estimated at USD 47.36 billion in 2025 and is forecasted to surpass around USD 206.63 billion by 2035. The Asia-Pacific region is witnessing rapid expansion in the market, driven by strong growth in online retail, rising internet and smartphone usage, and a growing middle-class population in countries such as China, India, and those in Southeast Asia. Moreover, the regional growth is also supported by increasing demand for protective, branded, and sustainable delivery solutions. Regulatory measures encouraging the use of eco-friendly materials, along with significant investments in logistics and fulfillment infrastructure, are further supporting the market’s development.

Recent Developments:

The Europe e-commerce packaging market size was reached at USD 22.02 billion in 2025 and is projected to hit around USD 96.07 billion by 2035. Europe is being shaped by strict environmental regulations and a high level of consumer demand for sustainable packaging solutions. The EU Packaging and Packaging Waste Regulation, which will take effect in August 2026, sets higher standards for recyclability, requires minimum recycled content, and introduces harmonized sustainability requirements across EU member states. These regulations are directly influencing the design and materials used in e-commerce packaging. With packaging recycling rates reaching 75% in Europe, regulatory and consumer pressures are accelerating the shift toward circular and lighter packaging formats.

Recent Developments:

E-commerce Packaging Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 45.6% |

| North America | 27.4% |

| Europe | 21.2% |

| LAMEA | 5.8% |

The LAMEA e-commerce packaging market was valued at USD 6.02 billion in 2025 and is anticipated to reach around USD 26.28 billion by 2035. LAMEA region is expanding as a result of increased online shopping, higher internet penetration, and ongoing improvements in logistics and warehousing infrastructure. While the market size remains smaller compared to Western regions, countries such as Brazil, Mexico, and those in the Gulf are experiencing rapid growth as more consumers turn to digital retail platforms. There is a rising investment in secure and lightweight packaging solutions to ensure product protection during longer and more complex delivery routes. Modernization of infrastructure and growing competition are encouraging local packaging providers to adopt more efficient materials and designs.

Recent Developments:

The e-commerce packaging market is segmented into product, material, application, and region.

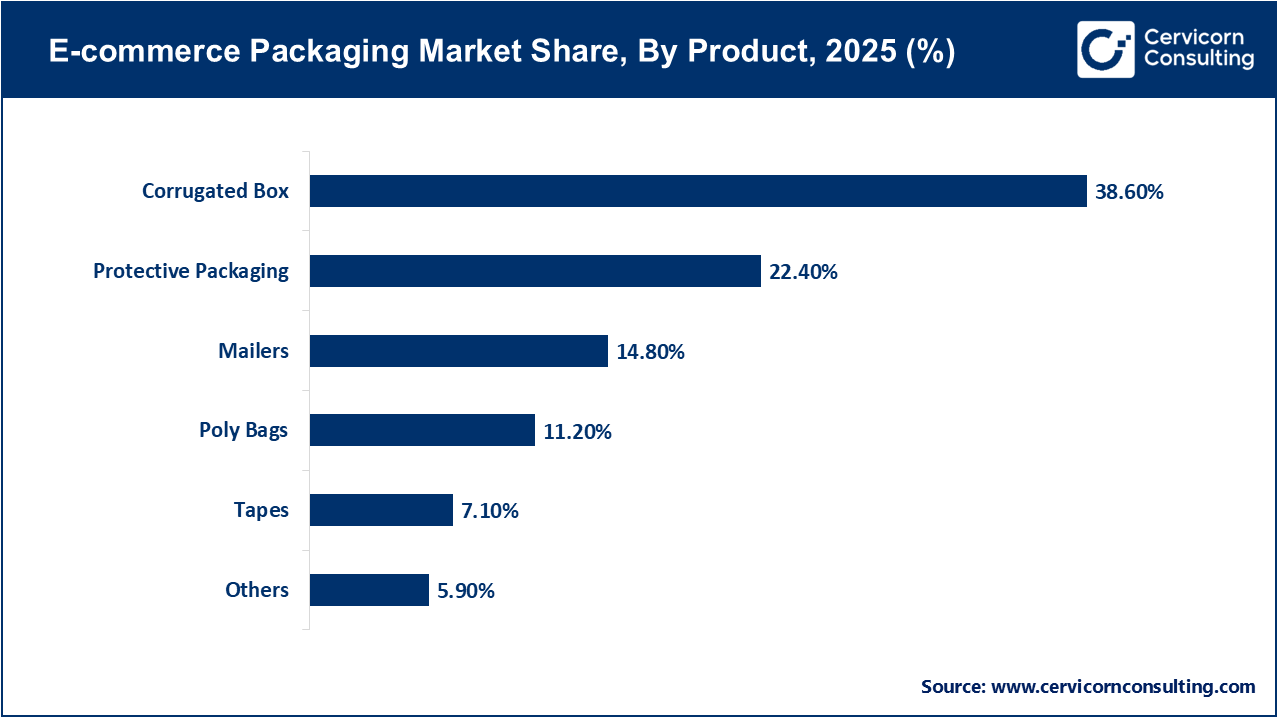

The e-commerce packaging market is largely driven by the widespread adoption of corrugated boxes, which are favored for their strength, versatility, and cost efficiency. These boxes are extensively utilized across various product categories, including electronics, apparel, household goods, and food, as they provide reliable protection during extended shipping processes. The integration of automation, along with the ease of customization and high recyclability, has further contributed to the increased use of corrugated boxes. Moreover, the ability of these boxes to support right-sizing technologies enables e-commerce companies to minimize void fill and reduce logistics costs. As a result, corrugated boxes have become the preferred packaging solution for high-volume online shipments.

Protective packaging has emerged as the fastest-growing segment. This growth is primarily driven by the increasing volume of shipments containing fragile, high-value, and sensitive products such as electronics, cosmetics, and pharmaceuticals. As return rates due to transit damage continue to rise, there is a greater need for advanced cushioning solutions, including air pillows, molded pulp, bubble wraps, and paper-based fillers. Ongoing innovation in lightweight and sustainable materials is also contributing to the segment's expansion, as these materials help reduce product damage while addressing environmental concerns. As a result, protective packaging is becoming an essential part of e-commerce fulfillment strategies, enabling companies to ensure product safety and meet sustainability goals.

Corrugated board is the leading material in the e-commerce packaging market due to its durability, lightweight properties, and high recyclability. This material provides a balance between protection and cost, which makes it suitable for various e-commerce uses. The widespread availability of raw materials, established recycling systems, and regulatory encouragement for paper-based packaging further strengthen its position. Corrugated board also supports sustainability initiatives, allowing brands to reduce plastic consumption and meet the growing demand for environmentally friendly packaging.

E-commerce Packaging Market Share, By Material, 2025 (%)

| Material | Revenue Share, 2025 (%) |

| Corrugated Board | 52.3% |

| Paper and Paperboard | 21.6% |

| Plastic | 23.1% |

| Woods | 3.0% |

Paper and paperboard represent the fastest-growing segment in e-commerce packaging, mainly because of increasing awareness about sustainability and regulations aimed at reducing plastic waste. These materials are now widely used in mailers, void fillers, and secondary packaging, as their biodegradability and recyclability make them attractive options. Many brands are shifting to paper-based protective packaging to address consumer demand for environmentally responsible solutions. Recent improvements in paper strength and coating technologies are also contributing to the rapid adoption of these materials across e-commerce platforms.

The apparel and accessories segment holds a leading position in the market, mainly because of the high frequency of online purchases and rapid inventory turnover. Clothing items are typically shipped in lightweight, flexible, and cost-effective packaging materials, including poly bags, mailers, and corrugated boxes, which are suitable for handling large shipment volumes. The ongoing growth of global fashion e-commerce, along with frequent promotional campaigns and easy return policies, continues to drive steady demand for packaging solutions. Furthermore, the importance of branding and the unboxing experience has led to a greater use of customized and premium packaging formats in this segment.

E-commerce Packaging Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Apparels and Accessories | 26.9% |

| Electronics and Electrical | 18.7% |

| Food and Beverages | 16.4% |

| Personal Care | 12.1% |

| Household | 10.3% |

| Pharmaceutical | 7.6% |

| Pet Food | 4.2% |

| Others | 3.8% |

Electronics and electrical products represent the fastest-growing segment, primarily due to increasing online sales of smartphones, consumer electronics, and smart devices. These products require strong, multi-layer protective packaging to ensure safe delivery, which has led to higher demand for specialized materials and cushioning solutions. The segment's growth is also supported by higher average order values, the expansion of cross-border e-commerce, and the growing preference of consumers to purchase electronics online. As a result, packaging performance and reliability have become essential considerations for this market.

By Product

By Material

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of E-commerce Packaging

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Material Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Online Order Volumes and Parcel Shipments

4.1.1.2 Demand for Product Protection and Brand Experience

4.1.2 Market Restraints

4.1.2.1 Volatility in Raw Material Prices

4.1.2.2 High Cost of Sustainable Packaging Alternatives

4.1.3 Market Challenges

4.1.3.1 Balancing Sustainability with Cost Efficiency

4.1.3.2 Complex Regulatory and Compliance Requirements

4.1.4 Market Opportunities

4.1.4.1 Growth of Sustainable and Circular Packaging Solutions

4.1.4.2 Advancements in Packaging Automation and Right-Sizing

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global E-commerce Packaging Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. E-commerce Packaging Market, By Product

6.1 Global E-commerce Packaging Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Protective Packaging

6.1.1.2 Tapes

6.1.1.3 Poly Bags

6.1.1.4 Mailers

6.1.1.5 Corrugated Box

6.1.1.6 Others

Chapter 7. E-commerce Packaging Market, By Material

7.1 Global E-commerce Packaging Market Snapshot, By Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Corrugated Board

7.1.1.2 Paper And Paperboard

7.1.1.3 Plastic

7.1.1.4 Woods

Chapter 8. E-commerce Packaging Market, By Application

8.1 Global E-commerce Packaging Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Food And Beverages

8.1.1.2 Personal Care

8.1.1.3 Apparels And Accessories

8.1.1.4 Pharmaceutical

8.1.1.5 Household

8.1.1.6 Pet Food

8.1.1.7 Electronics And Electrical

8.1.1.8 Others

Chapter 9. E-commerce Packaging Market, By Region

9.1 Overview

9.2 E-commerce Packaging Market Revenue Share, By Region 2024 (%)

9.3 Global E-commerce Packaging Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America E-commerce Packaging Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe E-commerce Packaging Market, By Country

9.5.4 UK

9.5.4.1 UK E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific E-commerce Packaging Market, By Country

9.6.4 China

9.6.4.1 China E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA E-commerce Packaging Market, By Country

9.7.4 GCC

9.7.4.1 GCC E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA E-commerce Packaging Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Amcor plc

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Sealed Air

11.3 Berry Global, Inc.

11.4 Alpha Packaging

11.5 CCL Industries

11.6 Gerresheimer AG

11.7 Coveris

11.8 Sonoco Products Company

11.9 Greif

11.10 WINPAK Ltd.

11.11 Constantia Flexibles

11.12 Transcontinental Inc.

11.13 Mondi

11.14 Silver Spur Corp.