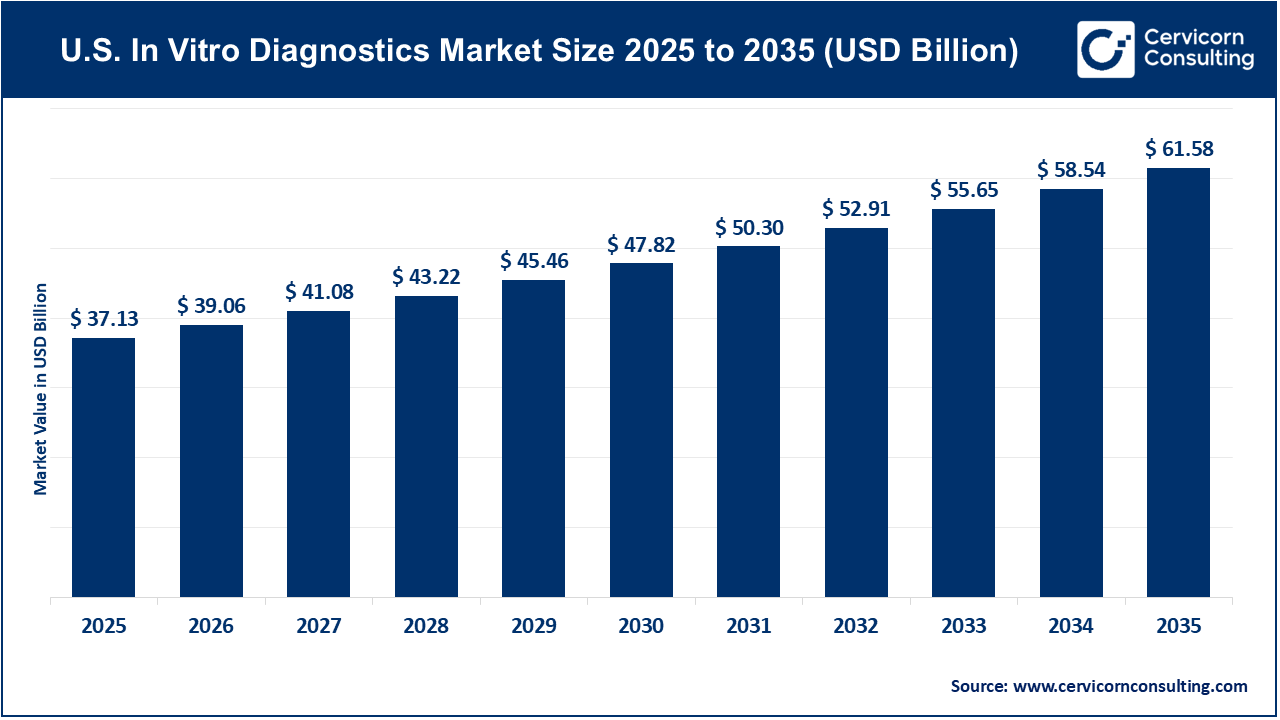

The U.S. in vitro diagnostics market size was reached at USD 37.13 billion in 2025 and is expected to be worth around USD 61.58 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.2% over the forecast period 2026 to 2035. The U.S. In Vitro Diagnostics (IVD) market is experiencing significant changes as molecular biology, digital health, and decentralized care models become more integrated. As the largest segment in the medical device industry, the IVD sector plays a crucial role in clinical decision-making and is estimated to impact more than 70% of healthcare outcomes.

The In vitro diagnostics market is the largest and most active part of the medical device industry in the United States. IVD technologies provide essential information for disease prevention, diagnosis, and monitoring. These include a range of reagents, instruments, and systems used to examine blood, urine, or tissue samples. In 2024, the global medical technology industry was valued at over 567 billion dollars, and the IVD sector continues to be a major source of revenue because of its important role in healthcare. The U.S. market benefits from strong clinical laboratory infrastructure and a high adoption rate of new diagnostic technologies. This has helped IVD move from a supporting laboratory tool to a key part of personalized medicine and population health management.

Transition Toward Decentralized Point-of-Care Testing Driving the IVD Market

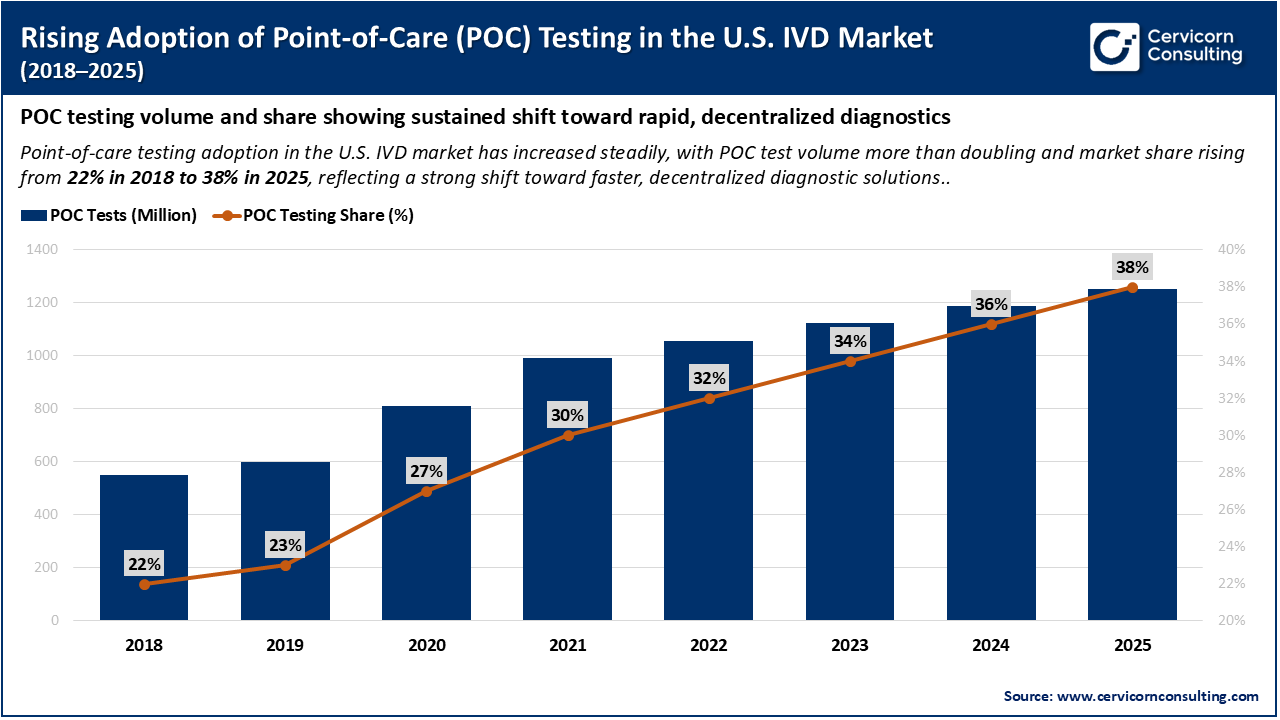

The U.S. healthcare system is currently experiencing a significant transformation, as there is a shift from centralized laboratory testing towards decentralized Point-of-Care Testing (POCT). This change is largely driven by the increasing need for rapid clinical decision-making. The trend is especially noticeable in the management of infectious diseases and chronic conditions such as diabetes, where immediate test results are essential for improving patient outcomes and reducing hospital readmission rates. Recent technological advancements have made it possible to miniaturize complex assays, which allows healthcare providers to obtain laboratory-quality results in physician offices, urgent care centers, and retail clinics. The adoption of POCT aligns with the broader movement towards consumer-focused healthcare, as patients seek faster, more accessible diagnostic services. As a result, this decentralization is reducing the logistical challenges faced by centralized facilities and is expanding access to diagnostic interventions, particularly for underserved populations.

The introduction of new molecular POCT devices utilizing rapid nucleic acid detection methods, such as isothermal amplification, is further accelerating the movement toward decentralized testing. These platforms can deliver results more quickly than traditional PCR, and as their costs decrease and usability improves, they are increasingly incorporated into routine clinical workflows. This development reduces dependence on specialized laboratory personnel and allows resources to be redirected toward more efficient care delivery. As a result, healthcare providers are better positioned to address acute diagnostic needs in real time and to respond more effectively to patient demand.

The chart illustrates the steady rise in Point-of-Care (POC) testing adoption in the U.S. IVD market from 2018 to 2025. POC test volumes increased from approximately 550 million tests in 2018 to about 1.25 billion tests in 2025, reflecting strong growth in decentralized diagnostics. Over the same period, POC testing’s share of total IVD tests expanded from 22% in 2018 to 38% in 2025, highlighting a clear market shift toward faster, near-patient testing and reduced reliance on centralized laboratory settings.

1. Breakthroughs in Rapid Molecular Diagnostic Platforms

From 2023 to 2025, the IVD sector has made considerable progress in developing rapid molecular diagnostic platforms with syndromic testing capabilities. These platforms enable clinicians to test for a wide range of pathogens, including various respiratory and gastrointestinal viruses, using a single patient sample. The FDA has cleared several high-sensitivity multiplex PCR systems for use in near-patient settings, which has significantly reduced the time required to obtain results from several days to less than an hour. This advancement is important for managing seasonal outbreaks and helps prevent the overuse of antibiotics by providing clear viral identification at the point of care. As a result, these rapid platforms support a more targeted approach to infectious disease management, helping to maintain the effectiveness of current treatments and improve patient recovery times.

2. Government Initiatives for Early Cancer Detection and Screening

The U.S. government has increased its efforts in early cancer detection through the Cancer Moonshot initiative, which has allocated significant funding for the development of multi-cancer early detection (MCED) tests. These liquid biopsy technologies, designed to detect circulating tumor DNA (ctDNA) from a simple blood sample, are moving from experimental stages into clinical practice. In 2024, several important pilot programs began to assess how these tests can be used in routine screenings for high-risk groups. These efforts are expected to change the approach to oncology by focusing on early intervention, allowing cancer to be found when it is most treatable. As a result, government support is speeding up the commercialization and reimbursement of advanced genomic screening tools, which could lead to earlier diagnoses and save many lives each year.

3. Strategic Corporate Mergers Enhancing Testing Portfolios

The in vitro diagnostics (IVD) market is currently seeing a notable rise in mergers and acquisitions. Leading companies are acquiring specialized biotechnology firms to strengthen their positions in fast-growing areas like Next-Generation Sequencing (NGS) and digital pathology. This trend is mainly driven by the increasing need for comprehensive laboratory solutions that cover the entire diagnostic process, from sample preparation to data analysis using artificial intelligence. By acquiring these firms, established players can bring new technologies to market more quickly, avoiding long research and development periods. As a result, the IVD sector is becoming more concentrated, with integrated diagnostic platforms that improve efficiency and expand the range of available diagnostic tools.

4. FDA Clearances for Next-Generation Sequencing Technologies

The FDA has reached an important milestone by approving a record number of next-generation sequencing (NGS)-based companion diagnostics, which play a key role in personalized therapies. This development reflects a change in regulatory strategy, as large-panel genomic tests that can detect hundreds of genetic variants in a single assay are now being accepted. By the end of 2024, the FDA had approved almost 950 artificial intelligence (AI)-enabled medical devices, many of which process the large datasets produced by NGS platforms. These regulatory advancements provide a clearer route for developers to introduce complex genomic tests to the market. As a result, precision medicine is becoming more accessible, and advanced genetic profiling is now a standard part of diagnostic procedures for cancer and rare genetic disorders in the United States.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 39.06 Billion |

| Market Size in 2035 | USD 61.58 Billion |

| Market CAGR 2026 to 2035 | 5.20% |

| Key Segments | Product, Technology, Application, Test Location, End-use |

| Key Companies | Abbott Laboratories, Thermo Fisher Scientific, Danaher Corporation, Quest Diagnostics, Becton, Dickinson and Company, Bio-Rad Laboratories, Illumina, QuidelOrtho Corporation, Exact Sciences Corporation, Natera, Siemens Healthineers, Beckman Coulter Diagnostics |

The U.S. in vitro diagnostics market is segmented into product, technology, application, test location, and end-use.

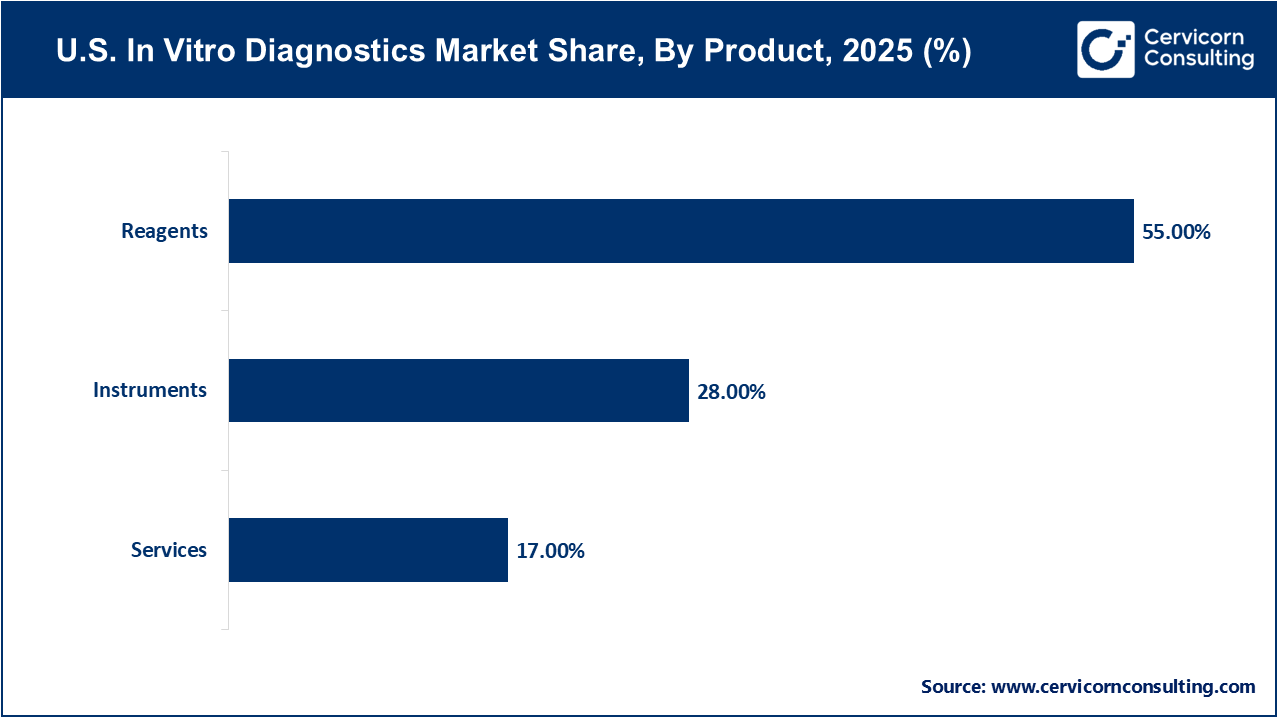

Reagents represent the dominant product segment in the IVD market due to their recurring usage across routine and specialized diagnostic tests. Unlike instruments, reagents are consumables that must be replenished regularly, generating continuous revenue for manufacturers. High testing volumes for infectious diseases, diabetes, oncology, and chronic disorders across hospitals and laboratories sustain strong demand. Additionally, advancements in assay sensitivity and specificity further support widespread reagent adoption, reinforcing this segment’s leading market position.

The services segment is the fastest growing, driven by increasing reliance on outsourced diagnostic testing, laboratory management, and maintenance services. Rising complexity of diagnostic procedures, particularly molecular and genetic testing, has increased demand for specialized service providers. Workforce shortages in clinical laboratories and the need for cost-efficient operations are encouraging healthcare providers to outsource diagnostics. Growth in reference laboratories and data-driven diagnostic solutions is further accelerating expansion of the services segment.

Immunoassay technology holds the dominant share in the IVD market due to its broad application in infectious disease detection, hormone analysis, oncology screening, and therapeutic drug monitoring. Its high sensitivity, specificity, and compatibility with automated platforms make it a preferred choice for high-volume testing in hospitals and laboratories. The continued use of immunoassays in routine and specialty diagnostics, along with innovation in multiplex testing formats, sustains its leadership across the U.S. diagnostic landscape.

U.S. In Vitro Diagnostics Market Share, By Technology, 2025 (%)

| Technology | Revenue Share, 2025 (%) |

| Immunoassay | 34% |

| Hematology | 12% |

| Clinical Chemistry | 28% |

| Molecular Diagnostics | 18% |

| Coagulation | 4% |

| Microbiology | 3% |

| Others | 1% |

Molecular diagnostics is the fastest-growing technology segment, driven by increasing adoption of PCR, real-time PCR, and next-generation sequencing. These technologies enable early disease detection, genetic profiling, and precision medicine applications, particularly in oncology and infectious diseases. Growing demand for companion diagnostics and personalized treatment strategies further supports growth. Continuous advancements in speed, accuracy, and cost-effectiveness are accelerating adoption across clinical laboratories.

Infectious diseases account for the largest share of the IVD application segment due to the high frequency of diagnostic testing for viral, bacterial, and fungal infections. Routine screening for respiratory infections, sexually transmitted diseases, and hospital-acquired infections drives consistent demand. Public health surveillance programs and preventive healthcare initiatives further support testing volumes. The need for rapid, accurate diagnostics ensures infectious disease testing remains a core application area.

U.S. In Vitro Diagnostics Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Infectious Diseases | 30% |

| Diabetes | 18% |

| Oncology | 15% |

| Cardiology | 10% |

| Nephrology | 8% |

| Autoimmune Diseases | 7% |

| Drug Testing | 6% |

| Others | 6% |

Oncology is the fastest-growing application segment, driven by increasing cancer incidence and the growing emphasis on early diagnosis. The shift toward precision oncology has increased demand for molecular and genetic tests that guide targeted therapies. Companion diagnostics, biomarker testing, and liquid biopsy technologies are gaining traction. Advancements in cancer screening and personalized treatment approaches are significantly expanding the role of IVD solutions in oncology care.

Diagnostic laboratories dominate the end-use segment due to their central role in processing the majority of IVD tests. Independent, reference, and hospital-based laboratories perform large volumes of routine and specialized diagnostics. Availability of advanced instruments, trained personnel, and automated systems enables high-throughput testing. Laboratories remain the preferred setting for complex assays, molecular diagnostics, and confirmatory testing, maintaining their dominant position in the market.

U.S. In Vitro Diagnostics Market Share, By End-use, 2025 (%)

| End-use | Revenue Share, 2025 (%) |

| Hospitals | 38% |

| Laboratory | 45% |

| Home-care | 12% |

| Others | 5% |

Home-care is the fastest-growing end-use segment, supported by rising adoption of self-testing and remote monitoring solutions. Increased prevalence of chronic diseases, aging population, and demand for convenient healthcare options are key growth drivers. Home-based glucose monitoring, infectious disease tests, and rapid diagnostic kits are gaining popularity. Technological innovation and digital health integration are further expanding the role of home-care diagnostics.

Abbott Laboratories Expands Global POCT Footprint

Abbott continues to lead the decentralized testing market with the 2024 expansion of its "i-STAT" and "BinaxNOW" platforms. The company recently secured additional FDA clearances for rapid panels that can detect multiple respiratory viruses in under 15 minutes, directly targeting the urgent care and retail pharmacy markets. This move strengthens Abbott's position as a provider of immediate, actionable health data. The impact of this expansion is a more dominant presence in the consumer-facing diagnostic space, reinforcing the trend of healthcare moving closer to the patient.

Roche Diagnostics Launches Next-Generation Digital Pathology Suite

Roche has announced the rollout of a comprehensive AI-driven digital pathology platform designed to integrate seamlessly with existing hospital laboratory information systems. This suite utilizes advanced algorithms to assist in the grading of breast and prostate cancers, aiming to reduce inter-pathologist variability. By combining high-resolution imaging with cloud-based data management, Roche is addressing the global shortage of pathology expertise. The impact of this launch is a significant step forward in the digitalization of the diagnostic workflow, setting a new standard for precision in oncology.

By Product

By Technology

By Application

By Test Location

By End-use