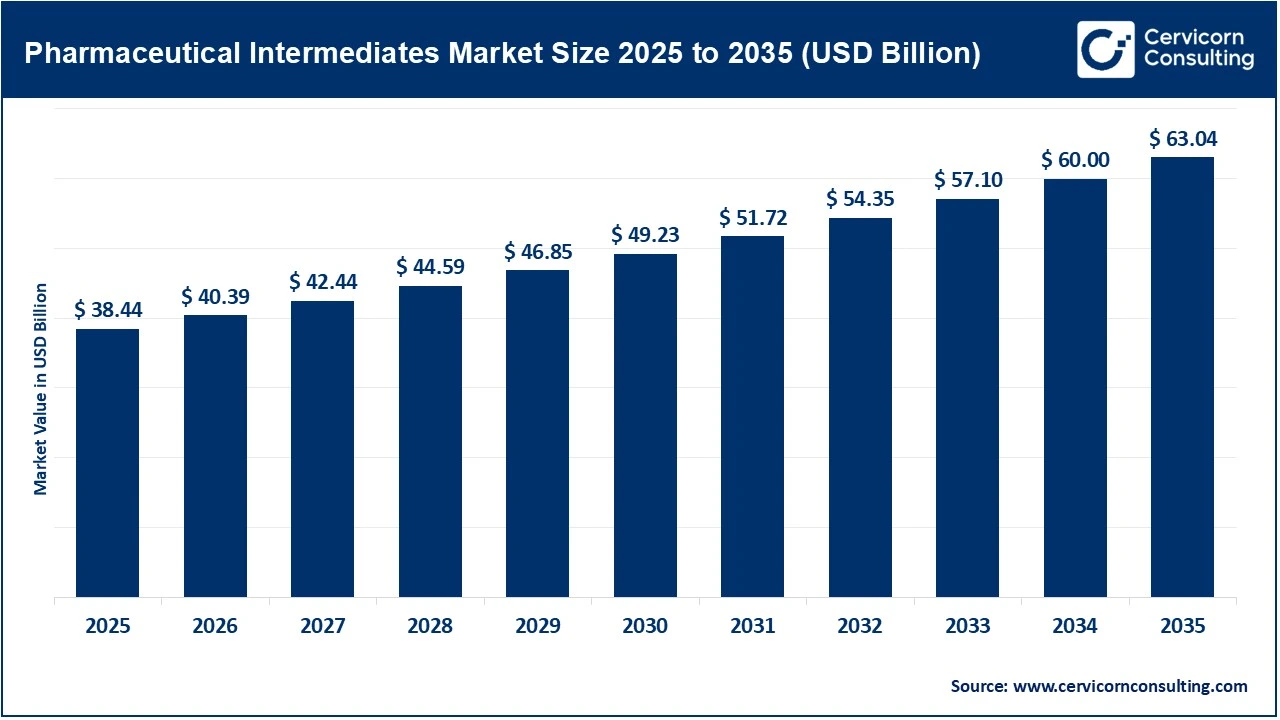

The global pharmaceutical intermediates market size was valued at USD 38.44 billion in 2025 and is expected to surpass around USD 63.04 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.1% over the forecast period from 2026 to 2035. The pharmaceutical intermediates market is driven primarily by the steady rise in global pharmaceutical production, fueled by the increasing prevalence of chronic diseases, an aging population, and expanding access to healthcare in emerging economies. Pharmaceutical intermediates are critical inputs in the synthesis of active pharmaceutical ingredients (APIs), so growth in generic drugs, branded formulations, and specialty medicines directly boosts demand. In addition, pharmaceutical companies are increasingly outsourcing intermediate and API manufacturing to contract development and manufacturing organizations (CDMOs) to reduce costs, improve scalability, and focus on core R&D activities. This outsourcing trend, combined with advances in synthetic chemistry, biocatalysis, and process optimization, continues to strengthen market growth.

Another important growth factor is the global focus on supply chain security and regional self-reliance in pharmaceutical manufacturing. Governments and industry players are investing in domestic production capabilities to reduce dependence on a limited number of sourcing regions for key intermediates. Asia-Pacific, particularly India and China, remains a major growth hub due to cost advantages, skilled labor, and strong chemical manufacturing ecosystems, while North America and Europe are seeing renewed investments in high-value and complex intermediates.

Accelerating Shift Toward Outsourced Manufacturing Driving the Pharmaceutical Intermediates Market

The accelerating shift toward outsourced manufacturing is significantly driving pharmaceutical intermediates market growth across both developed and emerging economies. Pharmaceutical companies increasingly rely on external manufacturers to reduce capital expenditure, accelerate time-to-market, and manage complex production requirements efficiently. Outsourcing allows drug developers to focus on core competencies such as research, clinical development, and regulatory strategy execution. Contract manufacturing organizations provide specialized expertise, regulatory compliance, scalable capacity, and cost advantages for intermediate production activities. This trend is further supported by rising drug complexity, stricter quality standards, and growing demand for customized and high-purity intermediates. As a result, long-term partnerships between pharmaceutical companies and outsourcing providers are strengthening global supply chains and sustaining market expansion.

Recent Developments in the Pharmaceutical Intermediates Market (2025)

| Company | Recent Development (2025) | Details |

| Divi’s Laboratories Ltd. (India) | Stronger quarterly profit driven by API & chemical compounds segment | Reported second-quarter profit above analyst estimates, helped by its business focused on customised chemical compound production for drugs, reflecting robust demand in its API/intermediate portfolio. |

| Aarti Industries Ltd. (India) | Secured long-term feedstock supply contracts | Entered into multiple long-term agreements for key commodities (e.g., methanol, toluene) with suppliers in GCC and Southeast Asia, reinforcing supply-chain resilience for its chemical/intermediate operations. |

| Thermo Fisher Scientific | Significant investments in Indian biopharma manufacturing | Announced plans for major investments in India’s biopharma infrastructure at Biopharma Conclave 2025 to strengthen local manufacturing capabilities. |

| Divi’s Laboratories - Capacity & Growth | New unit / backward integration efforts | Commenced commercial operations of Unit-III project to reduce supply chain risk, increase capacity, and enhance API/intermediate CDMO output. |

1. Cambrex’s U.S. API and Intermediates Capacity Expansion

Cambrex’s recent investment to expand its API and pharmaceutical intermediates manufacturing capacity in the United States represents a significant company-led milestone that is strengthening domestic drug supply chains. By increasing localized production of critical intermediates, Cambrex is reducing dependence on overseas suppliers while improving lead times, quality control, and regulatory alignment for pharmaceutical customers. This expansion supports growing demand from innovator and generic drug manufacturers seeking reliable, compliant sourcing partners, thereby directly accelerating demand for intermediates and reinforcing long-term market growth through enhanced capacity and supply resilience.

2. India’s Production-Linked Incentive (PLI) Scheme for Bulk Drugs

The Indian government’s continued rollout and progress of the PLI scheme for bulk drugs, including pharmaceutical intermediates and key starting materials, is a major policy milestone driving market expansion. The initiative incentivizes domestic production through financial support linked to output, encouraging companies to invest in new plants, backward integration, and scale-up of intermediate manufacturing. This government-backed push reduces import dependency, strengthens supply security, and positions India as a global manufacturing hub, significantly boosting both domestic consumption and export-oriented growth in the pharmaceutical intermediates market.

3. Accelerated Expansion of the Global CDMO Sector

The rapid expansion of contract development and manufacturing organizations (CDMOs), particularly in Asia, marks a critical structural milestone for the pharmaceutical intermediates market. As pharmaceutical companies increasingly outsource development and manufacturing to control costs and focus on core R&D, CDMOs are scaling up facilities and technology platforms that require large and consistent volumes of intermediates. This shift is creating sustained upstream demand, longer-term supply contracts, and higher utilization of intermediate manufacturing assets, thereby driving steady market growth and encouraging further investments across the value chain.

4. Strategic Supply Chain Localization Initiatives by Governments

Recent government-led initiatives across the U.S., Europe, and Asia aimed at supply chain localization and resilience have emerged as an important milestone influencing the pharmaceutical intermediates market. Policies encouraging reshoring, near-shoring, and diversification of pharmaceutical raw material supply are prompting manufacturers to establish regional intermediate production facilities. These initiatives reduce vulnerability to global disruptions, stimulate capital investment, and expand regional manufacturing ecosystems, collectively driving higher demand for pharmaceutical intermediates and supporting sustainable, geographically balanced market growth.

Market Opportunities

The pharmaceutical intermediates market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

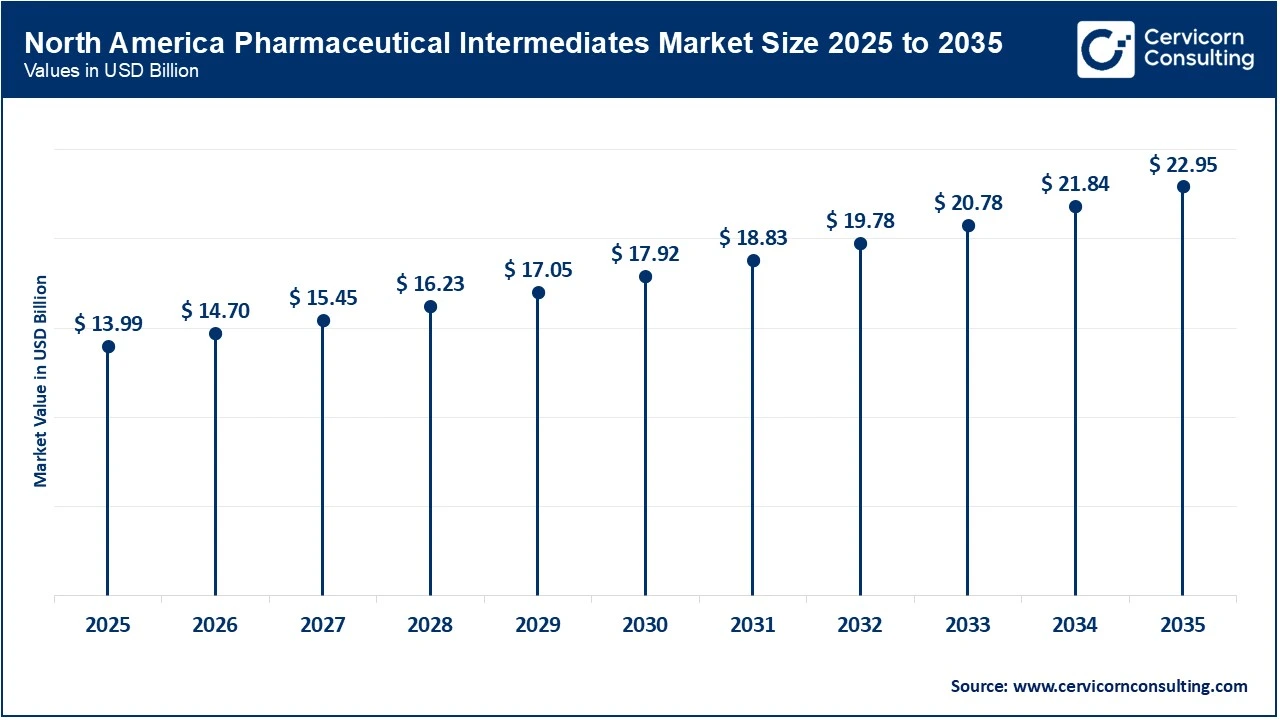

The North America pharmaceutical intermediates market size was estimated at USD 13.99 billion in 2025 and is expected to reach around USD 22.95 billion by 2035. North America market is being driven by large on-shore investments from CDMOs and pharma majors that aim to shorten supply chains and secure critical drug inputs. Significant capital projects and acquisitions, including major CDMO expansions and biomanufacturing investments, are raising local capacity for intermediates and APIs, improving lead times and regulatory alignment for U.S. and Canadian drugmakers. This reshoring momentum makes domestic sourcing more attractive to global customers and increases demand for higher-margin, specialty intermediate services across the region.

Recent Developments:

The Asia-Pacific pharmaceutical intermediates market size was accounted for USD 12.34 billion in 2025 and is forecasted to grow around USD 20.24 billion by 2035. Asia-Pacific market growth is driven by strong public incentives and rapid CDMO capacity expansion, particularly in India and China. Schemes that promote domestic manufacture of KSMs, intermediates, and APIs combined with private sector scaling (new plants, technology upgrades, and contract manufacturing wins) are attracting global sourcing and long-term contracts. Cost competitiveness plus improving regulatory compliance mean more global pharma companies use Asia-Pacific CDMOs for both commodity and complex intermediates, lifting overall regional demand.

Recent Developments:

The Europe pharmaceutical intermediates market size was reached at USD 7.69 billion in 2025 and is projected to hit around USD 12.617 billion by 2035. European markets are increasingly shaped by policy and funding efforts to re-regionalize API and intermediate production to reduce import dependence. EU and national initiatives to support local API and finished-medicine manufacturing are encouraging investments, joint ventures, and capacity upgrades across incumbent manufacturers and specialist CDMOs. Regulatory alignment and public support for resilient supply chains spur near-term capex and longer-term development of higher-value intermediate production, especially for regulated, high-quality chemistries destined for EU markets.

Recent Developments:

Pharmaceutical Intermediates Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 36.4% |

| Asia-Pacific | 32.1% |

| Europe | 20.0% |

| LAMEA | 11.5% |

The LAMEA pharmaceutical intermediates market was valued at USD 4.42 billion in 2025 and is anticipated to reach around USD 7.25 billion by 2035. The LAMEA market is propelled by national policies and international partnerships that prioritize local medicine production to improve access and manage risk. Governments and multilateral agencies are offering incentives and forging public-private collaborations to develop API and intermediate capabilities, while multinational firms are investing in regional plants to serve local and export markets. As healthcare demand rises, these localization efforts increase procurement of intermediates regionally and create growth opportunities for local CDMOs and chemical suppliers.

Recent Developments:

The pharmaceutical intermediates market is segmented into product, application, end user, and region.

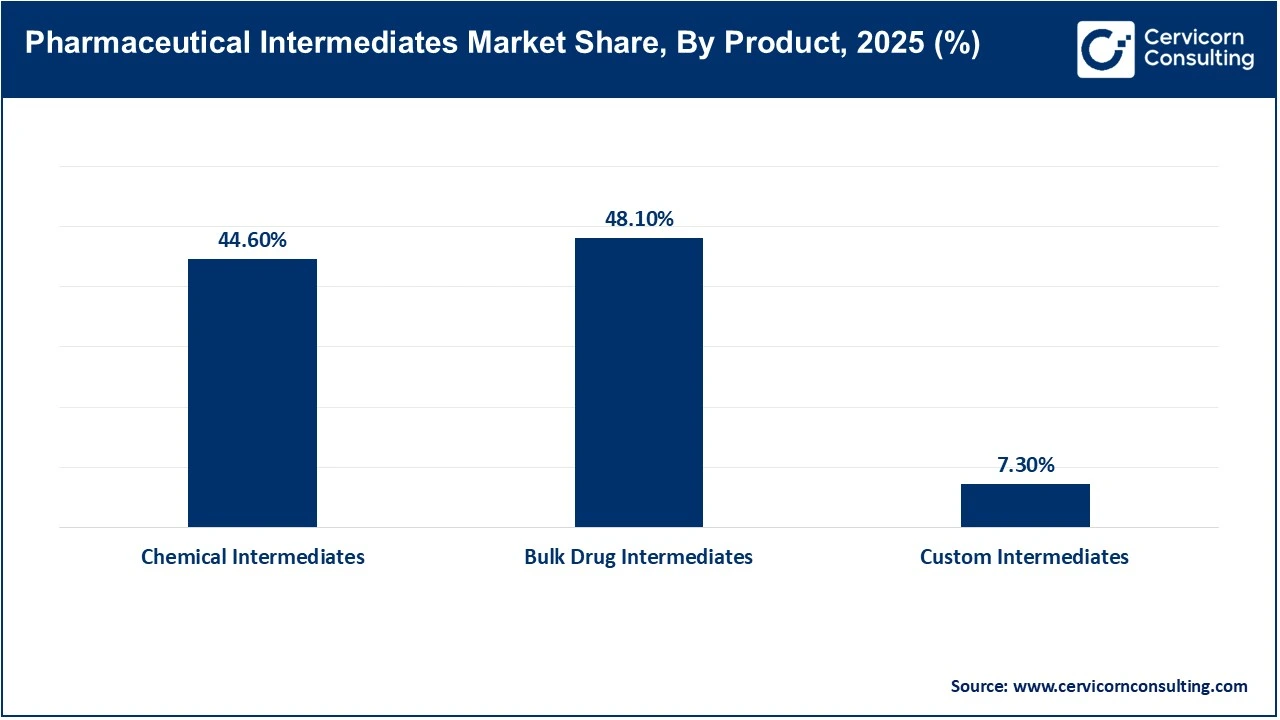

Bulk drug intermediates dominate the market due to their extensive use in large-scale production of generic and branded active pharmaceutical ingredients. High and consistent demand for essential medicines, including cardiovascular, analgesic, and anti-infective drugs, sustains large-volume consumption of bulk intermediates. Their cost efficiency, standardized production processes, and strong presence in emerging manufacturing hubs such as India and China further reinforce their dominance across global pharmaceutical supply chains.

Custom intermediates represent the fastest-growing product segment, driven by rising demand for complex molecules, high-potency APIs, and specialty drugs. Pharmaceutical companies increasingly outsource tailored intermediate synthesis to specialized manufacturers to reduce development timelines and manage costs. Growth in innovative therapies, including oncology and biologics-adjacent small molecules, is accelerating demand for customized, low-volume, high-value intermediates produced under stringent regulatory standards.

Analgesics holding the highest application share, reflects the sustained and widespread demand for chronic pain management therapies across global healthcare systems. The rising prevalence of conditions such as arthritis, musculoskeletal disorders, cancer-related pain, and post-surgical pain has significantly increased the consumption of analgesic drugs, thereby driving strong demand for their pharmaceutical intermediates. Additionally, the ageing population, growing self-medication trends, and easy availability of over-the-counter pain relief products further support consistent production volumes.

Pharmaceutical Intermediates Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Analgesics | 29.8% |

| Anti-Inflammatory Drugs | 18.2% |

| Cardiovascular Drugs | 16.1% |

| Anti-Diabetic Drugs | 11.7% |

| Anti-Cancer Drugs | 14.4% |

| Others | 9.8% |

The anti-cancer drugs segment is the fastest growing application area due to increasing cancer incidence, expanding oncology pipelines, and rapid innovation in targeted therapies. These treatments often require highly specialized and complex intermediates, boosting demand for advanced synthesis capabilities. Rising healthcare spending, improved diagnostics, and strong investment in oncology research are collectively accelerating intermediate consumption in this segment.

Biotech and pharmaceutical companies remain the dominant end users, as they are directly involved in API and finished drug manufacturing. Large production volumes, continuous drug portfolio expansion, and strong regulatory compliance capabilities drive consistent intermediate demand. Established pharma players also maintain long-term supply agreements with intermediates manufacturers, reinforcing this segment's leading market share.

Pharmaceutical Intermediates Market Share, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Biotech & Pharma Companies | 41.3% |

| Research Laboratories | 23.9% |

| CMO/CRO | 34.8% |

Contract manufacturing organizations and contract research organizations are the fastest-growing end-user segment, fueled by the accelerating shift toward outsourced drug development and manufacturing. Pharmaceutical companies increasingly rely on CMOs and CROs to improve flexibility, reduce capital expenditure, and accelerate time-to-market. As outsourcing expands across development stages, these organizations are becoming major consumers of both bulk and custom pharmaceutical intermediates.

Recent Developments by Major Companies

Lonza Group AG

WuXi AppTec Co., Ltd.

Thermo Fisher Scientific Inc.

Market Segmentation

By Product

By Category

By Application

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Pharmaceutical Intermediates

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Category Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand for APIs and Finished Pharmaceuticals

4.1.1.2 Accelerating Shift Toward Outsourced Manufacturing

4.1.2 Market Restraints

4.1.2.1 Volatility in Raw Material Prices

4.1.2.2 Stringent Regulatory and Environmental Compliance

4.1.3 Market Challenges

4.1.3.1 Supply Chain Concentration and Geopolitical Risks

4.1.3.2 Increasing Competition and Margin Pressure

4.1.4 Market Opportunities

4.1.4.1 Government Incentives for Domestic Manufacturing

4.1.4.2 Growth of High-Value and Specialty Intermediates

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Pharmaceutical Intermediates Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Pharmaceutical Intermediates Market, By Product

6.1 Global Pharmaceutical Intermediates Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Chemical Intermediates

6.1.1.2 Bulk Drug Intermediates

6.1.1.3 Custom Intermediates

Chapter 7. Pharmaceutical Intermediates Market, By Category

7.1 Global Pharmaceutical Intermediates Market Snapshot, By Category

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Branded Drug Intermediates

7.1.1.2 Generic Drug Intermediates

Chapter 8. Pharmaceutical Intermediates Market, By Application

8.1 Global Pharmaceutical Intermediates Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Analgesics

8.1.1.2 Anti-Inflammatory Drug

8.1.1.3 Cardiovascular Drugs

8.1.1.4 Anti-Diabetic Drugs

8.1.1.5 Anti-Cancer Drugs

8.1.1.6 Others

Chapter 9. Pharmaceutical Intermediates Market, By End-User

9.1 Global Pharmaceutical Intermediates Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Biotech and Pharma Companies

9.1.1.2 Research Laboratory

9.1.1.3 CMO/CRO

Chapter 10. Pharmaceutical Intermediates Market, By Region

10.1 Overview

10.2 Pharmaceutical Intermediates Market Revenue Share, By Region 2024 (%)

10.3 Global Pharmaceutical Intermediates Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Pharmaceutical Intermediates Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Pharmaceutical Intermediates Market, By Country

10.5.4 UK

10.5.4.1 UK Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Pharmaceutical Intermediates Market, By Country

10.6.4 China

10.6.4.1 China Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Pharmaceutical Intermediates Market, By Country

10.7.4 GCC

10.7.4.1 GCC Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Pharmaceutical Intermediates Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Lonza Group AG

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 WuXi AppTec Co., Ltd.

12.3 Thermo Fisher Scientific Inc.

12.4 Cambrex Corporation

12.5 Siegfried Holding AG

12.6 Divi’s Laboratories Ltd.

12.7 Aarti Industries Limited

12.8 Curia Global, Inc.

12.9 Dishman Carbogen Amcis Ltd.

12.10 Jubilant Pharmova Limited

12.11 Sanofi S.A.

12.12 Merck KGaA

12.13 BASF SE

12.14 Hetero Labs Limited

12.15 Pfizer Inc.