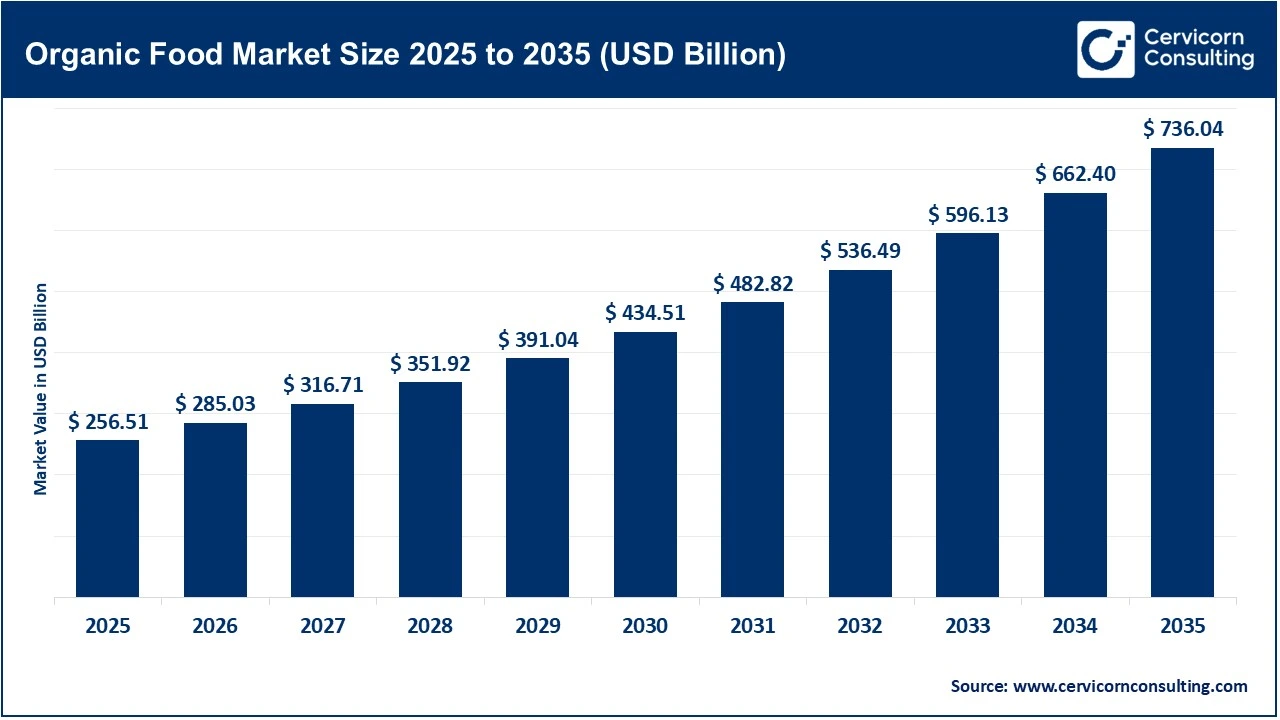

The global organic food market size was valued at USD 256.51 billion in 2025 and is expected to be worth around USD 736.04 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 11.14% over the forecast period from 2026 to 2035. The organic food market is continuously growing because of increased demand created by consumers due to concerns about their health, nutrition, and the safety of their food. The increase in consumer concerns regarding synthetic pesticides, chemicals, antibiotics, and genetically modified organisms (GMOs) will drive many consumers toward organic foods as the primary means of purchasing these types of food products compared to non-organic foods. Consumers perceive that organic foods are safer, cleaner, and more nutritious than conventional foods. Urbanites, millennials, and other health-conscious consumers will experience significant effects from the rising prevalence of lifestyle-related health problems such as obesity, diabetes, and cardiovascular disease that have contributed to increased demand for all-natural, minimally processed food products. Lastly, the rise in consumer incomes and interest in premium-quality, sustainable food products will further contribute to the growth of the organic food market across the globe.

Additionally, another most significant factor contributing to the continual growth of the organic food industry is the increasing amount of access to organic products that are available to consumers through modern retail and online shopping. As a result of being able to find and learn about organic products at supermarkets, specialty organic food stores, and the use of e-commerce websites, it has become much easier for consumers to access organic products. The continuation of supportive government proceedings, such as subsidies for farmers that produce organic products and the availability of certification programs and regulated labeling for organic producers, has also encouraged farmers and companies to participate in growing the organic sector. All of these factors contribute to greater awareness of and access to organic products, as well as the establishment of a new consumer space created by the organic industry.

Evolving Agricultural Practices Accelerating Organic Food Market Growth

Agricultural farming is constantly evolving, creating opportunities for the development of a robust organic food industry through more efficient production methods, the adoption of sustainable practices, and increased consistency in the availability of organic products. New technology available to organic farmers now enables them to utilize advanced production methods, such as precision farming, crop rotation, biological pest management, and improving the health of the soil. Using technology and data to make informed decisions on their farms allows organic farmers to produce increased yields and protect the quality of their finished products. Farmers today are also taking advantage of data-based tools, which allow them to produce higher yields. Additionally, climate-smart practices are helping farmers conserve water and become more effective in managing their resources. Government programs and technological training initiatives will expedite the transition of many farmers from conventional agriculture to organic agriculture, thereby increasing the total amount of certified organic land and enhancing the overall strength of the organic food supply chain worldwide.

Recent Developments & Investments in Organic Food

| Company | Value | Development Details |

| Two Brothers Organic Farms | INR 110 crore (USD 13.2 Mn) | Raised Series B funding to expand organic food processing capacity, strengthen direct farmer partnerships, scale pan-India distribution, and invest in branding for traditionally processed organic staples such as grains, oils, and sweeteners. |

| Ripple Foods | USD 17 M | Secured growth funding to expand production of plant-based organic milk alternatives, improve supply-chain efficiency, invest in product innovation (high-protein formulations), and support leadership transition to accelerate scale-up in retail and foodservice channels. |

| Alimento Agro Foods | INR 50 crore (USD 5.5 Mn) | Raised venture capital to grow its ready-to-eat organic and ethnic food portfolio, enhance cold-chain logistics, expand manufacturing, and strengthen online and modern retail presence. |

1. European Union Expands Organic Farming Targets under the EU Green Deal

Recently, the European Union has reaffirmed its commitment to organic agriculture through the EU Green Deal and the EU Farm to Fork strategy. The EU Green Deal and the EU Farm to Fork strategy are focused on increasing the amount of land that will be grown organically (25%) by the year 2030. This target will have a direct impact on the global market for organic foods due to the addition of certified organic farmland, an increase in the consistency of organic food products available to consumers, and the transition of vast numbers of farmers away from using chemicals in farming. Additionally, government-provided subsidies, technical support, and the creation of a unified system for labeling organic products will continue to spur the growth of organic food production in Europe. By doing this, these programs will build trust in organic food, create sustainable food systems, and position Europe as the world's primary producer and consumer of organic food products.

2. U.S. Government Increases Funding for Organic Certification and Climate-Smart Agriculture

The US Department of Agriculture (USDA) is expanding funding programs to support organic certification, climate-smart farming, and regenerative agriculture. Cost-share assistance programs that reduce costs associated with obtaining organic certification and also provide incentives to improve soil health help break down entry barriers for farmers and enhance long-term productivity. This milestone strengthens a major market driver because of an increased supply of certified organic products, while aligning with the goals of sustainability and food safety. The increase in government support for domestic organic food production will improve traceability of products and create more consumer trust in the organic industry; as a result, there will be accelerated growth in all elements of the market for the retail, foodservice, and wholesale distribution channels.

3. India Strengthens National Organic Farming Programs to Boost Domestic and Export Deman

The Indian government has developed initiatives such as the Paramparagat Krishi Vikas Yojana (PKVY) and Organic Cluster Development Programmes (OCDPs) in Ghana to support chemical-free farming and increase farmer income. These initiatives provide training, certification, and support for the export of organic produce out of India, which has helped establish India as a leading supplier of organic grains, spices, fruits, and processed foods around the world. This accomplishment is a result of increased domestic health awareness and demand for exports and has enhanced the ability for producers around the globe to access the organic market. Governmental assistance is improving scalability for organic food producers, reducing production costs, and placing them in a stronger position to compete as exporters of organic food from India.

4. Leading Food Companies Commit to Long-Term Organic and Regenerative Sourcing

The major food companies, such as Danone, Nestlé, and General Mills, have all declared a commitment to sourcing organic and regenerative materials. The companies’ long-term focus on partnerships with governments and cooperative farmers will focus on developing soil health, decreasing GHG emissions, and providing a reliable supply of organic raw materials. The alignment of corporate sustainability with governmental climate change and food security issues supports the development of the organic food marketplace. This support will enable sustainable, affordable, and innovative organic processed foods to continue to lead to a growing market for organic foods and a greater likelihood of consumer acceptance.

The organic food market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

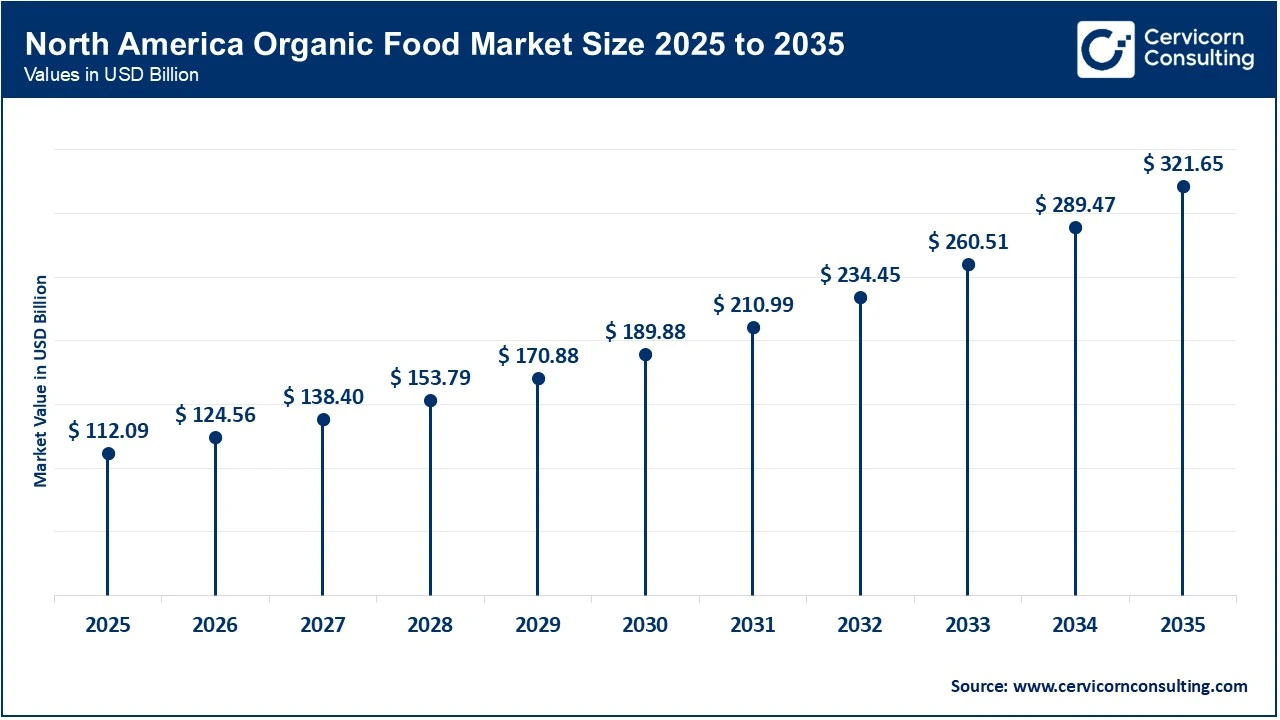

The North America organic food market size was reached at USD 112.09 billion in 2025 and is predicted to surpass around USD 321.65 billion by 2035. North America leads the market due to increased consumer awareness of health, nutrition, and food safety, as well as increased consumer purchasing power and established organic certification standards. Consumers in both the U.S. and Canada prefer to purchase clean-label, non-GMO products and pesticide-free fruits and vegetables. The steady growth of organic fruits, vegetables, dairy products, and packaged foods in both countries has supported this sector's continued growth. Additionally, significant government incentives, transparent product labeling, and increased consumer demand for environmentally sustainable and ethically produced products have further supported growth in the organic foods market.

Recent Developments:

The Asia-Pacific organic food market size was accounted for USD 49.51 billion in 2025 and is projected to hit around USD 142.06 billion by 2035. Asia Pacific is the fastest-growing region in the organic foods market, due to rapid urbanization, increased disposable incomes, and growing concern about food safety and nutrition. The increasing shift of consumers in China, India, Japan, and Australia towards purchasing organic fruits and vegetables, cereals, and packaged goods has come as a result of the increased use of pesticides and food contamination. Moreover, the growth of e-commerce and modern retail channels is facilitating much greater access to organic food products. The Asia Pacific Region will see continued expansion as various government initiatives support the growth of organic farms and certifications, as well as the growing consumer demand for clean-label and plant-based food products.

Recent Developments:

The Europe organic food market size was estimated at USD 81.06 billion in 2025 and is forecasted to grow around USD 232.59 billion by 2035. Europe's organic foods market is heavily influenced by high environmental awareness, strict adherence to food safety guidelines, and a high level of confidence among consumers in the organic designation on labels. Germany, France, the United Kingdom, and Italy are four of several countries within Europe that are experiencing the growth of organic diets among their respective populations. Supporting this growth is considerable government support, including subsidies for organic farming, the European Union Green Deal, and agricultural policies that promote sustainable practices. Additionally, consumers' growing preferences for locally grown, ethically produced, and environmentally sustainable food products contribute to the continued growth of organic food sales within Europe.

Recent Developments

Organic Food Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 43.7% |

| Europe | 31.6% |

| Asia-Pacific | 19.3% |

| LAMEA (Latin America, Middle East & Africa) | 5.4% |

The LAMEA organic food market was valued at USD 13.85 billion in 2025 and is anticipated to reach around USD 39.75 billion by 2035. The LAMEA region is experiencing steady growth driven by strong agricultural production and export demand in Latin America and an increase in premium food usage throughout the Middle East and Africa. There are several factors contributing to supply growth for these products, such as favourable farming conditions, increased access to organic certifications, and increased export activity. There are several key factors driving local demand for these products, such as increased public awareness of health issues, growth of urban centers, and premium retail expansion. Moreover, government policies and initiatives related to sustainability and the rapid expansion of modern and digital retail platforms are contributing to the robust growth of the regional market.

Recent Developments:

The organic food market is segmented into category, product type, distribution channel, and region.

Fruits and vegetables dominate the organic foods market because they are the most commonly consumed items made from organic ingredients and have the strongest association with organic and chemical-free eating. Consumers have significant concerns regarding pesticide residue on their fresh produce, which consistently drives an increase in organic fruit and vegetable purchases within households and foodservice. Their wide distribution and consistent purchase pattern, combined with their high level of consumer trust regarding organic labeling, continue to support this category of organic foods in maintaining its dominant share of overall organic sales.

Organic Food Market Share, By Category, 2025 (%)

| Category | Revenue Share, 2025 (%) |

| Fruits & Vegetables | 31.2% |

| Frozen & Processed Foods | 18.1% |

| Meat, Fish, & Poultry | 14.2% |

| Dairy | 12.0% |

| Beverages | 9.4% |

| Cereals & Grains | 9.3% |

| Others | 5.8% |

Frozen and processed organic foods are the fastest-growing category due to provide convenience, health, and sustainability all rolled into one. Urbanization, the increasing number of busy professionals, and the demand for quick and convenient meals (ready-to-eat) and easy storage (frozen) are driving consumers to choose frozen and processed organic meal options. Furthermore, ongoing innovation in product offerings for organic frozen meals, snacks, and packaged foods is supporting the rapid expansion of this category.

Unprocessed organic foods dominate the market because consumers view it as the most authentic and purest way to consume organic products. Consumers prefer to eat fruit and vegetables, whole grains, and raw agricultural products in their unprocessed state. Fresh vegetable and fruit consumption has a significant role in the diets of all consumers, and there is a strong connection with nutritional value and the promise of reducing processing.

Organic Food Market Share, By Product Type, 2025 (%)

| Product Type | Revenue Share, 2025 (%) |

| Unprocessed | 54.2% |

| Processed | 45.8% |

Processed organic foods are the fastest-growing product type due to evolving lifestyles and increased demand for convenient forms of nutrition. Consumers who have busy schedules, especially those living in cities, are more likely than ever before to purchase packaged or canned organic foods, organic beverages, and ready-to-eat meals in order to save time while also eating healthier. This growth trajectory is attributable to multiple factors, including longer shelf lives, improved flavor profiles, and an ever-increasing selection of product types in this category.

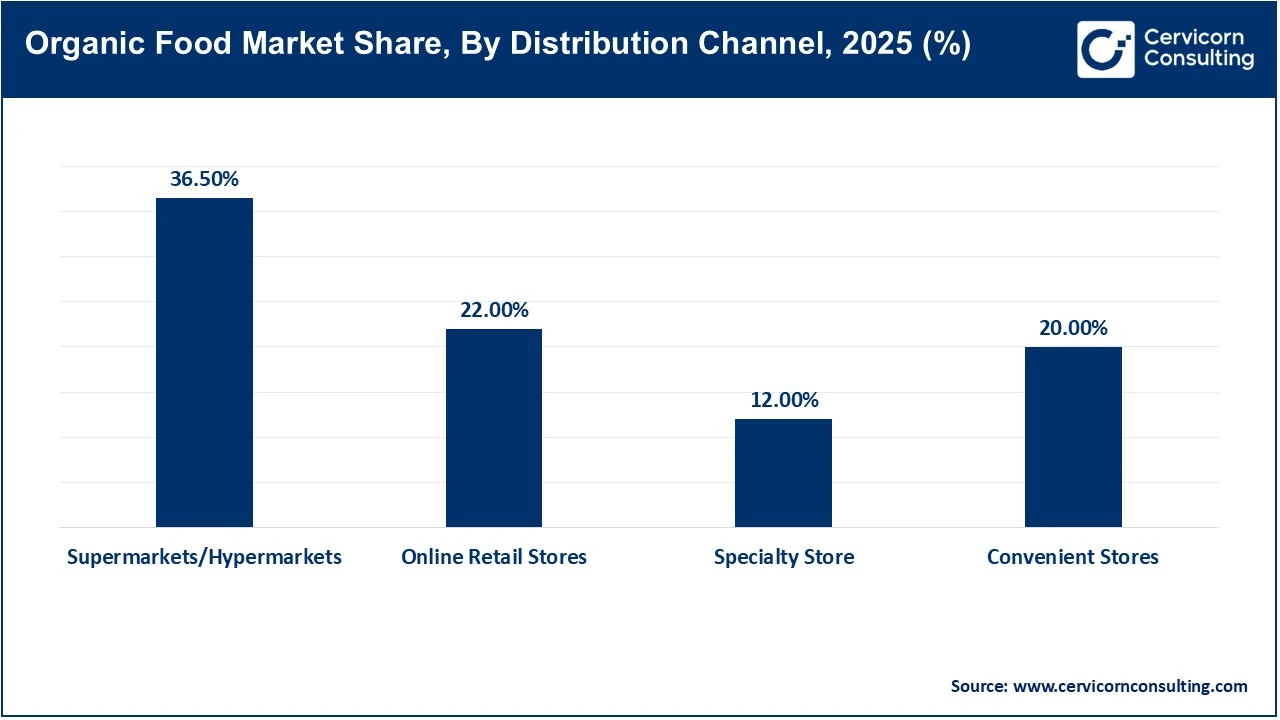

Supermarkets and hypermarkets dominate the organic foods market because of the wide range of products, efficient supply chain, and competitive prices available in one location. The ability to sell their organic label products and have them readily accessible to consumers makes it the most convenient place for the majority of consumers to purchase organic food products. In addition, high levels of consumer trust and consistent in-store sales promotions strengthen their dominance in this market.

Online retail stores are the fastest-growing distribution channel, due to the rapid growth of e-commerce and digital grocery platforms. Customers are favoring home delivery, convenient subscription models, and an increased variety of organic brand products found only online. Additionally, customers are choosing the convenience of comparing prices, flexible delivery, and the increasing use of digital services to help them make their purchasing decisions, which has led to an unprecedented level of growth for online channels.

Danone S.A.

General Mills, Inc.

Nestlé S.A.

By Category

By Product Type

By Distribution Channel

By Region