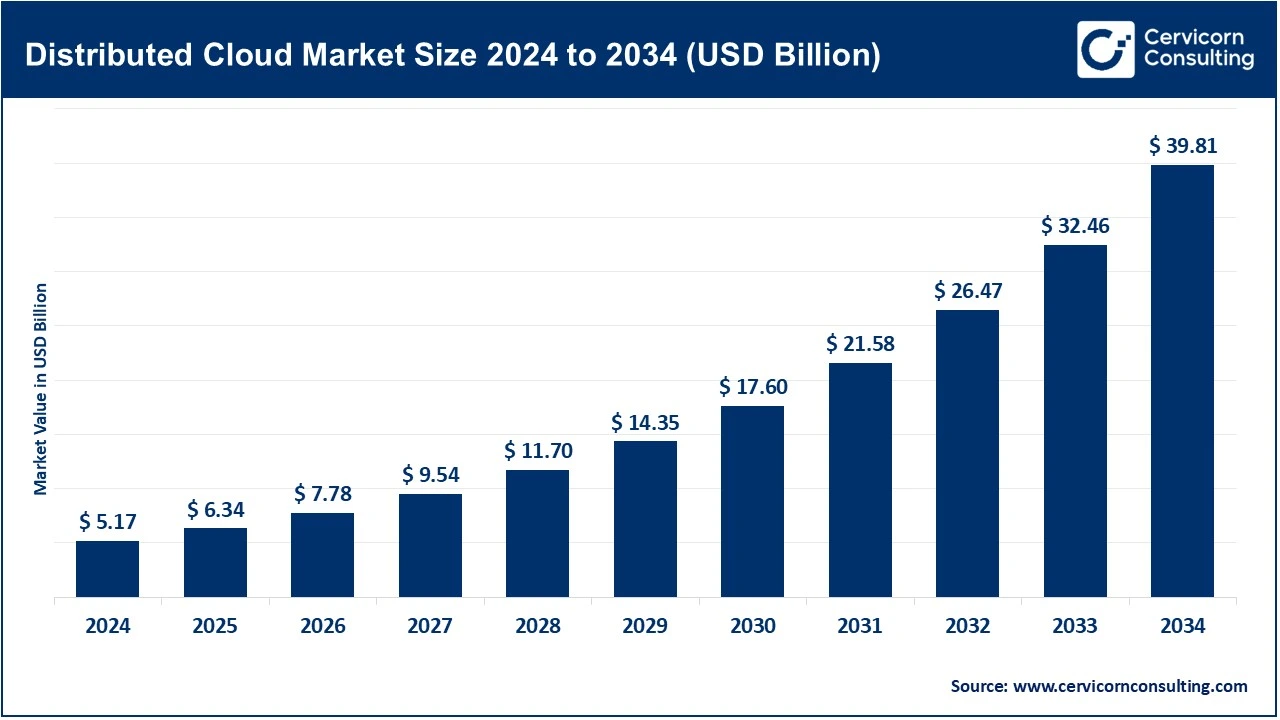

The global distributed cloud market size was estimated at USD 5.17 billion in 2025 and is expected to be worth around USD 39.81 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 22.6% over the forecast period from 2026 to 2035. The distributed cloud market is growing due to the rising demand for cloud solutions that enable organizations to scale, be flexible, and provide secure cloud computing services and the ability to process data closer to the point of use. Organizations are adopting distributed cloud because it reduces latency, enhances performance, and meets local data residency and regulatory compliance. The healthcare, financial services, and government sectors are particularly focused on distributed cloud adoption. The rapid adoption of edge computing and Internet of Things (IoT) technologies will accelerate the demand for distributed cloud due to the ability of distributed cloud architecture to provide real-time processing and analytics via the proximity of computing resources to where data is created. All these factors contribute to a highly positive growth forecast for the distributed cloud market over the next decade.

Recent developments will help support market growth and indicate the emergence of new growth opportunities in the distributed cloud. Major cloud providers are enhancing their data sovereignty and hybrid deployment capabilities by offering new products that will meet the high level of security and governance associated with their customers' business requirements. The strategic partnerships and product innovations, including sovereign cloud solutions that are tailored for specific regions and use cases, indicate how the market for distributed cloud is adapting to the complexity of the enterprise environment. The ongoing investment in 5G, artificial intelligence, and multicloud interconnectivity will continue to generate demand for distributed cloud and expand the role of distributed cloud in the digital transformation process around the world.

Impact of Latency-Sensitive Edge Workloads on the Distributed Cloud Market

The growth of distributed clouds can be attributed to the rise of edge applications that require low latency, which is being driven by the increased use of the Internet of Things (IoT) and 5G networks. There are many examples of edge devices used within IoT, including autonomous vehicles, smart factories, remote health monitoring and digital shipping. These devices require real-time or near real-time processing of their data. When using a traditional centralized cloud model, the transmission distance of the device's data to the centralized location creates latency on the public internet. By contrast, a distributed cloud model eliminates this latency by allowing processing and storage of the device's data to occur at a location that is physically closer to the device itself, which results in considerably reduced latencies when compared to a traditional centralized cloud architecture. The surge in data being generated at the edge of 5G networks is also pushing up the demand for lower latencies for processing. Consequently, enterprises are increasingly turning to a distributed cloud model to build out scalable edge computing services, which will drive rapid growth in the distributed cloud market.

1. Launch of Industrial Distributed Cloud by Aramco Digital, Armada, and Microsoft

Aramco Digital, Armada, and Microsoft have created a joint venture to implement an industrial distributed cloud infrastructure solution for edge AI and digital transformation in industrial environments. Utilizing distributed cloud infrastructure, this joint venture exemplifies how distributed cloud systems can be applied to real-life applications outside conventional IT environments and enable a direct application of AI to the manufacturing and operational aspects of production. Through advancements made possible through edge processing in heavy industry, this project will create greater awareness of the value of distributed cloud technology and facilitate more business enterprises utilizing distributed cloud technologies on a broader scale.

2. Nutanix Enhances Sovereign and Distributed Cloud Capabilities

Nutanix has expanded its existing platform with additional support for regional sovereignty and enhanced security certifications from major public cloud vendors. This development enables Nutanix to offer an improved widespread distributed cloud service that meets the needs of enterprises that are subject to regulation, while also addressing the need for improved governance, availability, resiliency and multi-cloud management, which are all top priorities for enterprises in regulated environments. With greater control over distributed cloud service providers, enterprises are better able to build market confidence and promote greater adoption of distributed cloud services based on their ability to maintain compliance and provide for the deployment of hybrid technologies.

3. Release of StarlingX Version 11.0 for Distributed Cloud Infrastructure

The release of StarlingX 11.0 is a notable development in the realm of distributed cloud infrastructure solutions, through which the primary target audience is telecommunications service providers and giant edge deployments. This hardened solution, deployed by some of the largest Telco's in the world, enables low latency scalable services, which are critical enablers for IoT & 5G applications. In addition, the release of StarlingX 11.0 assists customers in streamlining their deployment of distributed cloud solutions at the edge of the network, enabling them to more rapidly integrate cloud service offerings into their larger enterprise & carrier ecosystems.

4. Recognition of Google Cloud’s AI and Distributed Cloud Capabilities

Google Cloud has been recognized as a top provider of AI Infrastructure. This recognition highlights the continued investment and commitment by Google Cloud to build industry-leading scalable distributed systems that enable and support advanced analyses, machine learning workloads, and other similar neural network applications on cloud and edge devices. Additionally, this recognition indicates that larger cloud providers continue to experience the need to embed innovative concepts to address the needs of customers for performance, latency, and other performance-related issues. As distributed cloud technology is validated by industry leaders, the amount of confidence that enterprises have in these solutions will greatly increase the likelihood of widespread adoption of this technology across all major enterprise applications.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 6.34 Billion |

| Estimated Market Size in 2035 | USD 39.81 Billion |

| Projected CAGR 2026 to 2035 | 22.60% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Deployment Model, Organization Size, Service Type, Industry Vertical, Region |

| Key Companies | AWS, Microsoft Corporation, Cisco Systems Inc., IBM Corporation, HPE, Dell Technologies, Google LLC, Intel Corporation, NVIDIA Corporation, Huawei Technologies, Siemens AG, Schneider Electric, Nokia Corporation, Juniper Networks, Advantech Co., Ltd. |

The distributed cloud market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

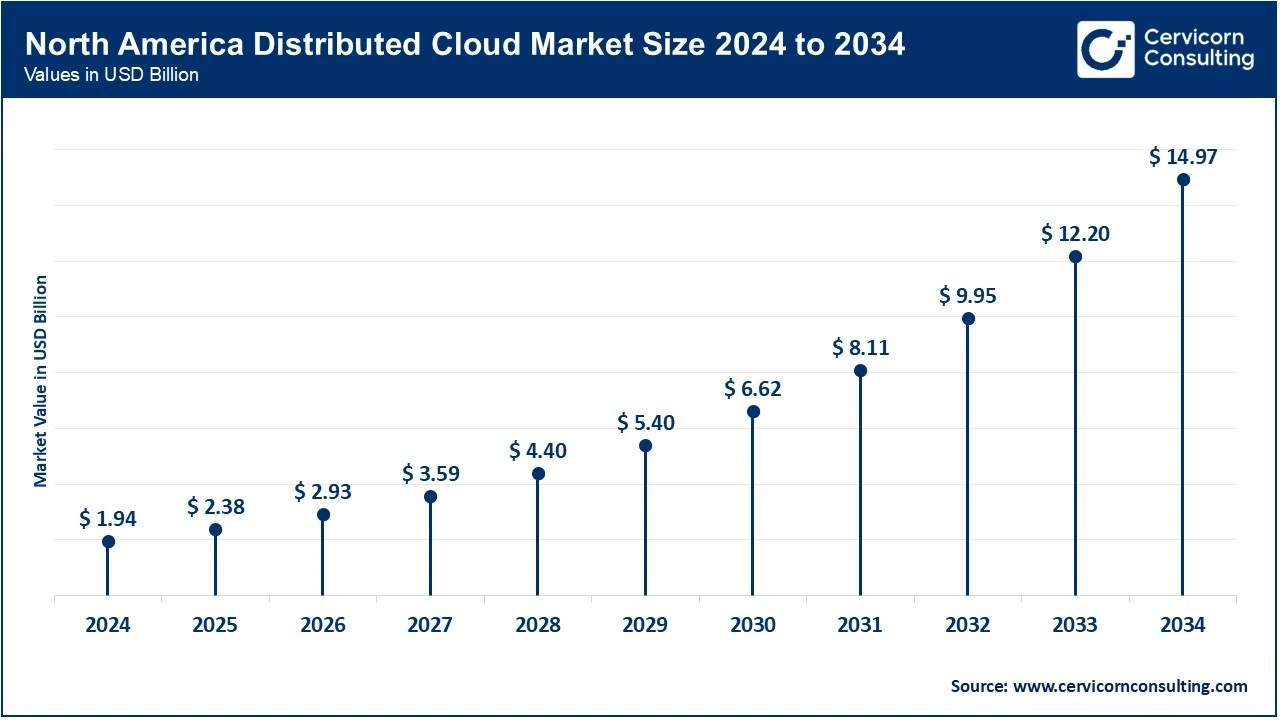

The North America distributed cloud market size was estimated at USD 1.94 billion in 2025 and is projected to reach around USD 14.97 billion by 2035. North America is leading in its infrastructure investment, as well as its customer base’s need for on-premises control solutions. Big organizations and hyperscalers are investing in large amounts into computational resources and services combined with AI workloads and local control capabilities. This trend is driving the development of the distributed cloud market to create products that will provide data sovereignty, hybrid operations and high-performance AI inference capabilities at the edge. Consequently, regulated industries are increasingly accepting and speeding up the development of managed distributed cloud services.

Recent Developments:

The Asia-Pacific distributed cloud market size was valued at USD 1.58 billion in 2025 and is forecasted to surpass around USD 12.14 billion by 2035. The rising digital adoption across Asia Pacific, together with the deployment of Telco 5G networks and significant expansion by hyperscalers within the region, are significant factors driving the market. In addition, local government investment in either their respective geographic area or edge platforms, by hyperscalers, is necessary for achieving lower latency, attaining greater levels of localised content and enhancing the delivery of artificial intelligence (AI) capabilities. The telecommunications operators and cloud vendors also contribute to the acceleration of enterprise and government usage through the drive towards standardisation and the introduction of edge computing capabilities that will be utilised in distributed cloud deployments across manufacturing, smart cities, and mobile services.

Recent Developments:

The Europe distributed cloud market size was reached at USD 1.39 billion in 2025 and is predicted to hit around USD 10.67 billion by 2035. The need for data sovereignty is driving strong demand from businesses and policymakers for cloud services in Europe. Both governments and large corporations seek cloud solutions that ensure their customers' most sensitive information is governed by local laws. This demand necessitates provider-managed distributed cloud solutions that are managed regionally, offer sovereign capabilities, and ensure interoperability with customers' existing enterprise infrastructures. The focus from regulators and the amount of investment in large data centres place Europe at the centre of the market for sovereign and hybrid distributed cloud use cases.

Recent Developments:

Distributed Cloud Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 37.60% |

| Asia-Pacific | 30.50% |

| Europe | 26.80% |

| LAMEA (Latin America, Middle East & Africa) | 5.10% |

The LAMEA distributed cloud market was valued at USD 0.26 billion in 2025 and is anticipated to reach around USD 2.03 billion by 2035. The growth of the LAMEA region is supported by the construction of data centres at a rapid pace, as well as by government-supported cloud initiatives (Sovereign Cloud) and national digitization policies. Examples include the emphasis placed by governments in the Middle East and Latin America on the use of sovereign and AI-ready cloud solutions and on countries in Africa having a strong demand for local interconnection/colocation services that reduce latency and enable regional digital-service support. These infrastructure and policy factors create an opportunity for distributed cloud adoption throughout the LAMEA regions.

Recent Developments:

The distributed cloud market is segmented into deployment model, organization size, service type, industry vertical, and region.

Provider-managed distributed cloud dominates the distributed cloud market due to the large number of enterprise customers seeking an easy way to manage their operations from a single centralised location. The Provider-managed Model is a model used by Cloud Service Providers to manage infrastructure, Security, Updates, and Compliance for users, thereby eliminating operational burden. This Model is also very reliable, extremely scalable and has guaranteed Service Levels, making it the ideal solution for Mission-Critical Workloads where the user is located in a Regulated Industry.

Distributed Cloud Market Share, By Deployment Model, 2025 (%)

| Deployment Model | Revenue Share, 2025 (%) |

| Self-Managed Distributed Cloud | 28.40% |

| Provider-Managed Distributed Cloud | 46.80% |

| Edge-Managed Distributed Cloud | 24.80% |

Edge-managed distributed cloud is the fastest-growing segment in the distributed cloud market, which is driven by the increasing demand for ultra-low-latency applications. The growth of the Edge-managed distributed model is driven by the proliferation of IoT devices, 5G technology, autonomous devices and real-time analytics. The trend towards deploying edge-managed distributed models is a result of organizations wanting to process data locally, decrease network congestion and provide support for time-sensitive workloads.

Large enterprises dominate the market due to their larger IT budgets and more complex operational requirements. Large enterprises require advanced solutions to manage the large volume of data they maintain across multiple geographic locations and to provide the high level of availability and compliance that is expected by all businesses today. The distributed cloud model provides centralized governance, while allowing for operations to be located in multiple locations around the world.

Distributed Cloud Market Share, By Organization Size, 2025 (%)

| Organization Size | Revenue Share, 2025 (%) |

| Large Enterprises | 68.20% |

| Small and Medium Enterprises (SMEs) | 31.80% |

SMEs represent the fastest-growing segment in the market. This growth is due to solutions becoming more cost-effective and easier to implement than ever before. Many SMEs are using distributed cloud to improve their performance and enhance their security, as well as to facilitate digital transformation initiatives. The growth of managed services and pay-as-you-go models is also helping to drive adoption among small businesses.

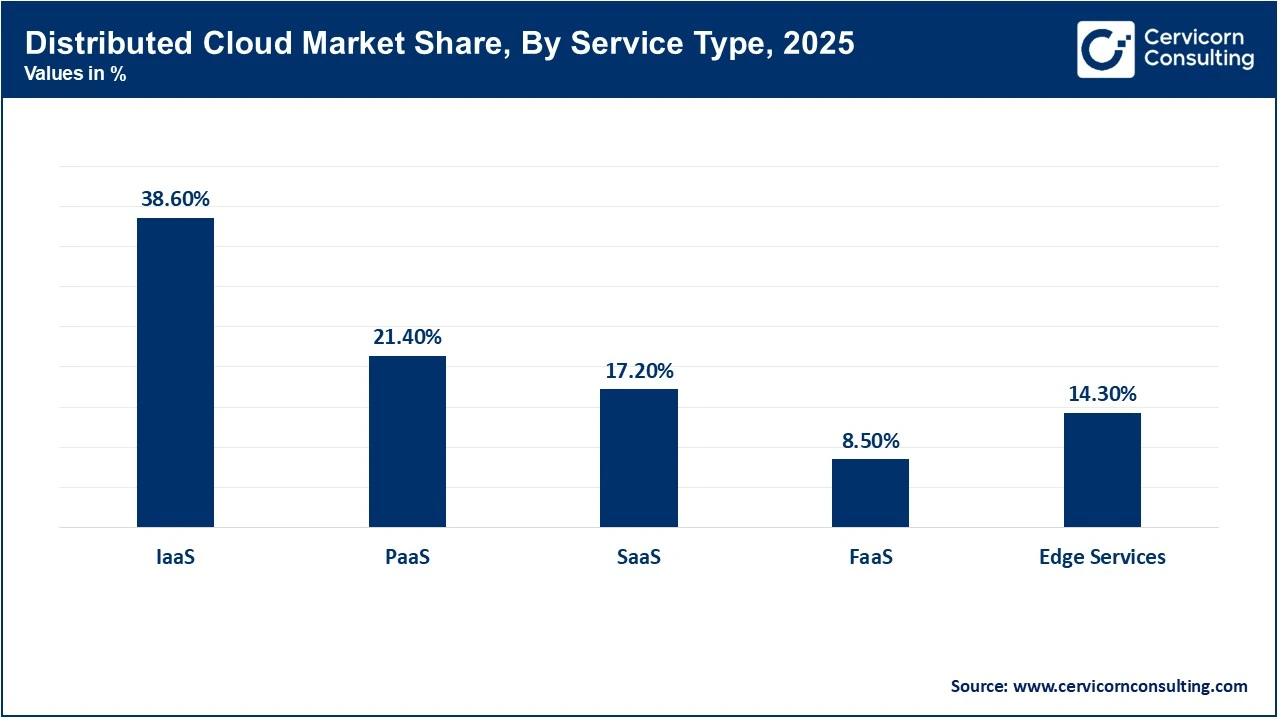

Infrastructure-as-a-Service (IaaS) holds the largest share of the market as it provides an organization’s basic computing, storage, and networking needs. The flexibility of IaaS solutions, as well as enterprises wanting complete control over their own infrastructure resources, has made IaaS the preferred service type for most enterprises. Additionally, IaaS solutions can host a wide variety of workloads and provide the ability to deploy workloads across hybrid and edge environments.

Edge services represent the fastest-growing segment of distributed cloud service offerings. The rapid rate of growth in this segment of the distributed cloud market is due to the growing number of businesses deploying edge computing architectures. Edge computing services allow organizations to perform real-time data processing and analytics near where the data is generated. The expanding number of use cases—smart cities, industrial automation, and connected devices—has also been a critical driver of growth for edge computing services.

The IT and telecom sectors utilize the majority of distributed cloud because they were among the first to fully implement edge technology and cloud-native applications. Telecommunications companies are able to use distributed clouds to create 5G networks, content delivery systems, and virtualised networks. Extreme amounts of data traffic coupled with the ever-increasing need for low latency are the driving force behind continued investments in distributed architectures.

Distributed Cloud Market Share, By Industry Vertical, 2025 (%)

| Industry Vertical | Revenue Share, 2025 (%) |

| IT and Telecom | 27.9% |

| Banking, Financial Services & Insurance (BFSI) | 18.6% |

| Healthcare & Life Sciences | 14.2% |

| Manufacturing | 13.1% |

| Retail and eCommerce | 10.4% |

| Government and Public Sector | 9.3% |

| Others | 6.5% |

Healthcare and life sciences represent the fastest-growing segment in market. The digitization of healthcare services led to the need for distributed cloud within this industry. By utilizing the distributed cloud, real-time patient monitoring, telemedicine, and localized data processing can be provided while complying with healthcare regulations. Demand continues to grow for secure, low-latency healthcare applications, further contributing to the acceleration of the market growth in this vertical.

Amazon Web Services (AWS)

Microsoft Corporation

Cisco Systems Inc

By Deployment Model

By Organization Size

By Service Type

By Industry Vertical

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Distributed Cloud

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Deployment Model Overview

2.2.2 By Organization Size Overview

2.2.3 By Service Type Overview

2.2.4 By Industry Vertical Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Demand for Low-Latency and Real-Time Processing

4.1.1.2 Rising Data Sovereignty and Regulatory Requirements

4.1.2 Market Restraints

4.1.2.1 High Implementation and Operational Complexity

4.1.2.2 Security and Data Management Concerns

4.1.3 Market Challenges

4.1.3.1 Lack of Skilled Workforce and Technical Expertise

4.1.3.2 Interoperability and Standardization Issues

4.1.4 Market Opportunities

4.1.4.1 Expansion of Edge Computing and Smart Infrastructure

4.1.4.2 Growth of Hybrid and Multicloud Strategies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Distributed Cloud Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Distributed Cloud Market, By Deployment Model

6.1 Global Distributed Cloud Market Snapshot, By Deployment Model

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Self-Managed Distributed Cloud

6.1.1.2 Provider-Managed Distributed Cloud

6.1.1.3 Edge-Managed Distributed Cloud

Chapter 7. Distributed Cloud Market, By Organization Size

7.1 Global Distributed Cloud Market Snapshot, By Organization Size

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Large Enterprises

7.1.1.2 Small and Medium Enterprises (SMEs)

Chapter 8. Distributed Cloud Market, By Service Type

8.1 Global Distributed Cloud Market Snapshot, By Service Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Infrastructure-as-a-Service (IaaS)

8.1.1.2 Platform-as-a-Service (PaaS)

8.1.1.3 Software-as-a-Service (SaaS)

8.1.1.4 Function-as-a-Service (FaaS)

8.1.1.5 Edge Services

Chapter 9. Distributed Cloud Market, By Industry Vertical

9.1 Global Distributed Cloud Market Snapshot, By Industry Vertical

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 IT and Telecom

9.1.1.2 Banking, Financial Services & Insurance (BFSI)

9.1.1.3 Healthcare & Life Sciences

9.1.1.4 Manufacturing

9.1.1.5 Retail and eCommerce

9.1.1.6 Government and Public Sector

9.1.1.7 Others

Chapter 10. Distributed Cloud Market, By Region

10.1 Overview

10.2 Distributed Cloud Market Revenue Share, By Region 2024 (%)

10.3 Global Distributed Cloud Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Distributed Cloud Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Distributed Cloud Market, By Country

10.5.4 UK

10.5.4.1 UK Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Distributed Cloud Market, By Country

10.6.4 China

10.6.4.1 China Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Distributed Cloud Market, By Country

10.7.4 GCC

10.7.4.1 GCC Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Distributed Cloud Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Amazon Web Services (AWS)

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Microsoft Corporation

12.3 Cisco Systems Inc.

12.4 IBM Corporation

12.5 Hewlett Packard Enterprise (HPE)

12.6 Dell Technologies

12.7 Google LLC

12.8 Intel Corporation

12.9 NVIDIA Corporation

12.10 Huawei Technologies

12.11 Siemens AG

12.12 Schneider Electric

12.13 Nokia Corporation

12.14 Juniper Networks

12.15 Advantech Co., Ltd.